- Аналітика

- Новини та інструменти

- Новини ринків

- Euro comes under some pressure following recent tops near 1.0970

Euro comes under some pressure following recent tops near 1.0970

- Euro gives away part of Friday’s gains vs. the US Dollar.

- Stocks in Europe opens the week in a mixed tone.

- EUR/USD meets initial resistance around 1.0970.

- EMU Business Climate surprised to the downside in July.

- Fedspeak will grab all the attention later in the session.

After the release of the June Nonfarm Payrolls, the Euro (EUR) faced some selling pressure, causing EUR/USD to retreat towards 1.0950 at the beginning of the week.

On this, the June employment figures catered to various interests. Individuals focused on growth would emphasize the lowest monthly job gain in 30 months (209K) and the downward adjustment of 110K for the previous two months. On the other hand, those optimistic about the resilient economy would highlight the strong hiring indicated by the household survey, a decrease in the unemployment rate, and notable growth in wages. Considering all factors, the report likely favours a 25 basis points increase in July.

Meanwhile, the US dollar (USD) is attempting a bounce after Friday's drop to 2-week lows in the 102.20 zone, as measured by the USD Index (DXY). This is occurring against the backdrop of further weakness in yields in the short end of the curve and extra gains in the belly and the long end.

The potential future actions of the Federal Reserve and the European Central Bank (ECB) in normalizing their monetary policies continue to be a topic of discussion, especially with increasing concerns about an economic slowdown on both sides of the Atlantic.

The recent robust results from key US fundamentals have reinforced the likelihood of a 25 basis point rate hike by the Fed at its July meeting. These results have continued to show a resilient US economy and a tight labour market.

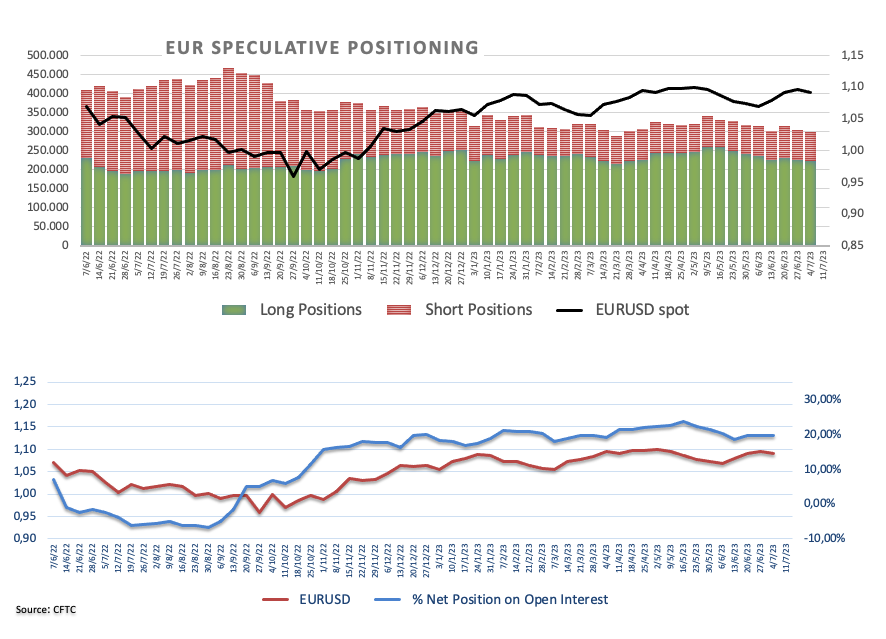

On another front, data from the CFTC Positioning report for the week ended on July 3 saw the speculative community trimming their EUR net longs to levels last seen in mid-March near 143K contracts, as the single currency continued to correct lower from peaks past the key 1.1000 the figure (June 22).

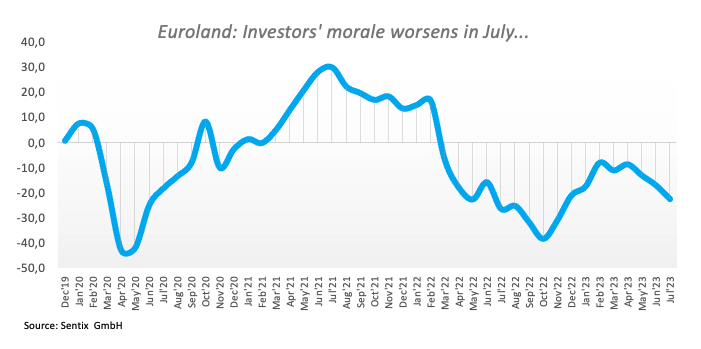

In the euro docket, Investor Confidence tracked by the Sentix Index in the euro area weakened to -22.5 in Jul in what was the sole release at the beginning of the week.

Across the ocean, Wholesale Inventories is only due along with speeches from FOMC Michael Barr (permanent voter, centrist), San Francisco Fed Mary Daly (2024 voter, hawk), Cleveland Fed Loretta Mester (2024 voter, hawk), and Atlanta Fed Raphael Bostic (2024 voter, hawk).

Daily digest market movers: Euro appears cautious ahead Fedspeak, CPI

- The EUR faces some tepid downward sentiment on Monday.

- The EMU Sentix Index deteriorated further in July.

- Chinese inflation figures came in short of estimates in June.

- Bets for a 25 bps rate hike by the Fed, ECB in July remain steady.

- Fed speakers will take centre stage later on Monday.

Technical Analysis: Euro now shifts the attention to 1.1000 and above

The recent price action in EUR/USD allows for extra gains in the short-term horizon.

The continuation of the uptrend should rapidly clear the July top at 1.0973 (July 7) prior to the psychological 1.1000 hurdle. North from here emerges the June peak of 1.1012 (June 22) ahead of the 2023 high of 1.1095 (April 26), which is closely followed by the round level of 1.1100. Further up comes the weekly top of 1.1184 (March 31, 2022), which is supported by the 200-week SMA at 1.1180, just before another round level at 1.1200.

On the downside, the weekly low at 1.0833 (July 6) appears reinforced by the provisional 100-day SMA. The breakdown of this region should meet the next contention area not before the May low of 1.0635 (May 31) ahead of the crucial 200-day SMA at 1.0624, which is followed by the March low of 1.0516 (March 15) and the 2023 low of 1.0481 (January 6).

Looking at the broader picture, the constructive view of EUR/USD appears unchanged as long as the pair trades above the key 200-day SMA.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.