- Аналітика

- Новини та інструменти

- Новини ринків

- Federal Reserve Preview: Dot plot set to determine the US Dollar’s dramatic moves

Federal Reserve Preview: Dot plot set to determine the US Dollar’s dramatic moves

- The Federal Reserve is set to leave interest rates unchanged but signal its next moves via its dot plot.

- New forecasts for peak borrowing costs in 2023 and 2024 are set to trigger an instant reaction.

- Markets tend to reverse some moves after the dot plot is out.

Markets are always looking to the future – and the Federal Reserve’s (Fed) dot plot is something investors can cling to foresee its next moves. In addition, the Fed’s figures can be read by algorithms, triggering a response that is fast and furious. For retail traders who fear missing out, the counter-reaction to this initial response to the dots provides a trading opportunity.

Here is a preview of the Fed decision and the dot plot, due out on Wednesday at 18:00 GMT.

Federal Reserve Chair Jerome Powell and his colleagues prefer pre-announcing the rate decision. Senior officials signalled an upcoming pause in the interest-rate hiking cycle, the first breather the bank takes in over a year. Nevertheless, several members of the Federal Open Markets Committee (FOMC) have stressed that this may merely be a “skip” decision – leaving rates unchanged now only to resume raising them in July.

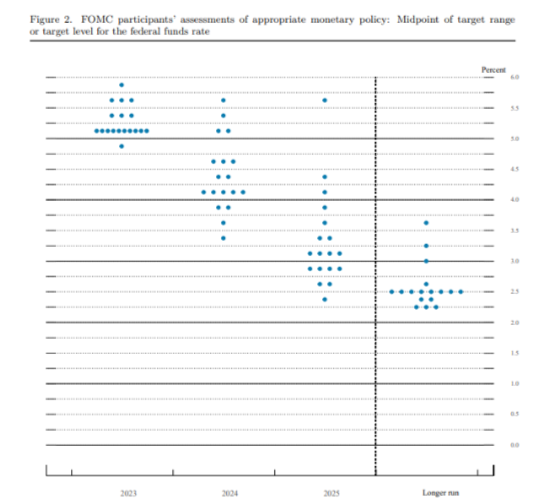

How will markets quickly assess what lies ahead? That is where the dot plot comes in handy. Every three months, the Fed publishes a Summary of Economic Projections. Initially, this document only consisted of a chart plotting the projections of various Fed members, each represented by a dot – hence the name: dot plot.

What the Federal Reserve dot plot looks like:

Source: Federal Reserve

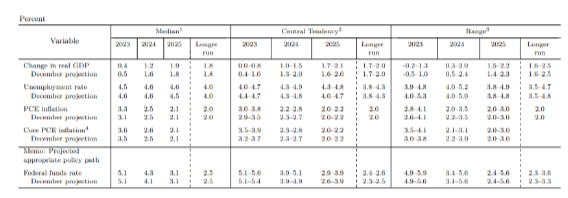

The bank later added a handy table summarizing the range of forecasts and, most importantly, the median. The Fed releases forecasts for economic growth, the unemployment rate, and inflation as reflected in the Personal Consumption Expenditure (PCE) gauge as well as the Core PCE measure, and the cherry on the cake – the interest rate.

These dot plot documents are released only once every other meeting, giving them more impact. In March, the Fed left its end-2023 interest rate median projection at 5.1% but raised the forecast for end-2024 to 4.3% from 4.1%, in a sign that policymakers expected rates to remain higher for longer.

How the dot plot looks in its table format. The numbers at the bottom left are what matter most: the updated projection for the interest rate at the end of this year and the next:

Source: Federal Reserve

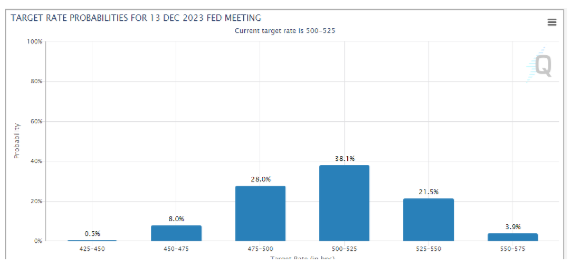

The current Federal Funds rate is at a range of 5.00-5.25%, at what the Fed projected for year-end. Officials insisted that no rate cuts are planned for 2023. Markets initially priced looser monetary policy for later in the year but reluctantly aligned to the Fed’s view after several hawkish comments from officials.

Bond markets expect rates to end the year at current levels after potentially rising in July. Nevertheless, uncertainty is sky-high, and that means high volatility.

Source: CME Group

How to trade the Fed dot plot – three scenarios

The Fed would likely want to leave the door open to a rate hike in July while continuing to refrain from rate cuts this year. This view implies a bump in the dot plot, resulting in an interest rate median forecast of 5.3% or 5.4% at the end of 2023.

I see such a scenario as the most probable one, resulting in a knee-jerk reaction favouring the US Dollar and sinking stocks. But, as mentioned earlier, the moves may quickly reverse in anticipation of Fed Chair Powell’s press conference 30 minutes after the release.

And for a good reason – Powell may smooth out any hawkish perception by reiterating the bank is data-dependent. Signs of a slowdown in the US economy may continue accumulating between the Fed’s meetings.

In this mainstream scenario, the dot plot would provide an opportunity to go against the US Dollar.

The second scenario is a hawkish outcome – the dot plot showing the Fed raising its forecast to 5.5% by the end of 2023. Such an outcome would spook markets, sending the Greenback higher.

A reversal will only come if Powell contrasts or substantially softens the message afterwards. Investors are unlikely to send the US Dollar down before hearing from Powell.

The third scenario, a highly unlikely dovish outcome, is for the dot plot to remain unchanged for 2023. If the Fed refuses to indicate net higher borrowing costs by year-end, the US Dollar will plunge. Similar to the expected behaviour in response to the hawkish outcome, there is room for reversal only when Powell talks.

He could say that if inflation rises, the Fed could still raise rates. Nevertheless, I do not expect an instant correction but for markets to move only upon confirmation from the Fed Chair.

Final thoughts

The Federal Reserve’s dot plot is critical to the market’s instant reaction – and the counter-trend. I suggest trading carefully as markets tend to move choppily around the event.

Fed FAQs

What does the Federal Reserve do, how does it impact the US Dollar?

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

How often does the Fed hold monetary policy meetings?

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

What is Quantitative Easing (QE) and how does it impact USD?

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

What is Quantitative Tightening (QT) and how does it impact the US Dollar?

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.