- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 30-01-2018

(raw materials / closing price /% change)

Oil 63.99 -2.39%

Gold 1,337.50 -0.21%

(index / closing price / change items /% change)

Nikkei -337.37 23291.97 -1.43%

TOPIX -22.32 1858.13 -1.19%

Hang Seng -359.60 32607.29 -1.09%

CSI 300 -45.92 4256.10 -1.07%

Euro Stoxx 50 -36.29 3606.75 -1.00%

FTSE 100 -83.55 7587.98 -1.09%

DAX -126.77 13197.71 -0.95%

CAC 40 -47.81 5473.78 -0.87%

DJIA -362.59 26076.89 -1.37%

S&P 500 -31.10 2822.43 -1.09%

NASDAQ -64.02 7402.48 -0.86%

S&P/TSX -139.21 15955.51 -0.86%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2401 +0,15%

GBP/USD $1,4148 +0,51%

USD/CHF Chf0,93398 -0,37%

USD/JPY Y108,77 -0,16%

EUR/JPY Y134,90 -0,01%

GBP/JPY Y153,898 +0,35%

AUD/USD $0,8084 -0,13%

NZD/USD $0,7330 +0,12%

USD/CAD C$1,23375 0,00%

00:01 United Kingdom Gfk Consumer Confidence January -13 -13

00:30 Australia Private Sector Credit, m/m December 0.5% 0.5%

00:30 Australia Private Sector Credit, y/y December 5.4%

00:30 Australia Trimmed Mean CPI y/y Quarter IV 1.8% 1.9%

00:30 Australia CPI, y/y Quarter IV 1.8% 2%

00:30 Australia CPI, q/q Quarter IV 0.6% 0.7%

00:30 Australia Trimmed Mean CPI q/q Quarter IV 0.4% 0.5%

01:00 China Non-Manufacturing PMI January 55.0 55.0

01:00 China Manufacturing PMI January 51.6 51.5

02:00 U.S. President Trump Speaks

05:00 Japan Construction Orders, y/y December 20.5%

05:00 Japan Housing Starts, y/y December -0.4% 1.2%

05:00 Japan Consumer Confidence January 44.7 44.9

07:00 Germany Retail sales, real adjusted December 2.3% -0.4%

07:00 Germany Retail sales, real unadjusted, y/y December 4.4% 2.8%

07:00 Switzerland UBS Consumption Indicator December 1.67

07:45 France CPI, m/m (Preliminary) January 0.3% -0.3%

07:45 France CPI, y/y (Preliminary) January 1.2%

08:55 Germany Unemployment Rate s.a. January 5.5% 5.5%

08:55 Germany Unemployment Change January -29 -17

09:00 Switzerland Credit Suisse ZEW Survey(Expectations) January 52.0

09:50 Eurozone ECB's Benoit Coeure Speaks

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) January 0.9%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) January 1.4% 1.3%

10:00 Eurozone Unemployment Rate December 8.7% 8.7%

13:15 U.S. ADP Employment Report January 250 185

13:30 Canada Industrial Product Price Index, m/m December 1.4% -0.1%

13:30 Canada Industrial Product Price Index, y/y December 2.7%

13:30 Canada GDP (m/m) November 0.0% 0.4%

14:45 U.S. Chicago Purchasing Managers' Index January 67.6 64.1

15:00 U.S. Pending Home Sales (MoM) December 0.2% 0.4%

15:30 U.S. Crude Oil Inventories January -1.071 0.1

19:00 U.S. Fed Interest Rate Decision 1.5% 1.5%

19:00 U.S. FOMC Statement

22:30 Australia AIG Manufacturing Index January 56.2

Major US stock indexes finished the session in negative territory, while the Dow Jones Industrial Average and S & P indexes fell by more than 1%, as bond yields increased and companies' shares in the healthcare sector declined.

In addition, as it became known today, the housing price index from S & P / Case-Shiller for 20 cities increased seasonally by 0.7% over the three-month period ending in November, compared with the same period that ended in October , and grew by 6.4% compared to a year earlier. The national index grew seasonally adjusted by 0.7% MoM and 6.2% YoY.

At the same time, the index of consumer confidence from the Conference Board grew in January after a decline in December. The index is now 125.4, compared with 123.1 in December. The index of the current situation slightly decreased - from 156.5 to 155.3, and the index of expectations rose from 100.8 last month to 105.5 this month.

The cost of oil declined significantly on Tuesday, continuing yesterday's trend, which was caused by evidence of rising oil production in the US. In addition, cautious investors sold stocks, bonds and commodities.

Most components of the DOW index recorded a decline (27 of 30). Outsider were shares UnitedHealth Group Incorporated (UNH, -4.04%). The growth leader was the shares of Caterpillar Inc. (CAT, + 1.13%).

Almost all sectors of S & P finished trading in the red. The health sector showed the greatest decline (-1.7%). Only the utilities sector grew (+ 0.1%).

At closing:

DJIA -1.37% 26,076.89 -362.59

Nasdaq -0.86% 7.402.48 -64.02

S & P -1.09% 2,822.43 -31.10

The Conference Board Consumer Confidence Index increased in January, following a decline in December. The Index now stands at 125.4 (1985=100), up from 123.1 in December. The Present Situation Index decreased slightly, from 156.5 to 155.3, while the Expectations Index increased from 100.8 last month to 105.5 this month.

"Consumer confidence improved in January after declining in December," said Lynn Franco, Director of Economic Indicators at The Conference Board. "Consumers' assessment of current conditions decreased slightly, but remains at historically strong levels. Expectations improved, though consumers were somewhat ambivalent about their income prospects over the coming months, perhaps the result of some uncertainty regarding the impact of the tax plan. Overall, however, consumers remain quite confident that the solid pace of growth seen in late 2017 will continue into 2018."

U.S. stock-index futures fell on Tuesday, signaling the equities' readiness to extend losses into a second session. There is not one specific reason for the selling; rather, it is the result of some profit-taking following a strong start to 2018.

Global Stocks:

Nikkei 23,291.97 -337.37 -1.43%

Hang Seng 32,607.29 -359.60 -1.09%

Shanghai 3,488.19 -34.81 -0.99%

S&P/ASX 6,022.80 -52.60 -0.87%

FTSE 7,619.89 -51.64 -0.67%

CAC 5,494.30 -27.29 -0.49%

DAX 13,254.91 -69.57 -0.52%

Crude $64.97 (-0.90%)

Gold $1,343.80 (+0.26%)

The inflation rate in Germany as measured by the consumer price index is expected to be 1.6% in January 2018. Based on the results available so far, the Federal Statistical Office (Destatis) also reports that consumer prices are expected to decline by 0.7% compared with December 2017.

In January 2018, the harmonised index of consumer prices for Germany, which is calculated for European purposes, is expected to increase by 1.4% year on year and to decrease by 1.0% on December 2017.

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 255.8 | -0.21(-0.08%) | 4369 |

| ALCOA INC. | AA | 53.84 | -0.65(-1.19%) | 911 |

| ALTRIA GROUP INC. | MO | 69.09 | -0.74(-1.06%) | 1164 |

| Amazon.com Inc., NASDAQ | AMZN | 1,410.00 | -7.68(-0.54%) | 107277 |

| American Express Co | AXP | 99.29 | -0.12(-0.12%) | 7471 |

| Apple Inc. | AAPL | 166.21 | -1.75(-1.04%) | 442963 |

| AT&T Inc | T | 37.1 | -0.16(-0.43%) | 11793 |

| Barrick Gold Corporation, NYSE | ABX | 14.45 | 0.10(0.70%) | 21730 |

| Boeing Co | BA | 338.75 | -2.07(-0.61%) | 13183 |

| Caterpillar Inc | CAT | 160.38 | -2.20(-1.35%) | 29656 |

| Chevron Corp | CVX | 128 | -0.48(-0.37%) | 3750 |

| Cisco Systems Inc | CSCO | 42.7 | -0.15(-0.35%) | 46389 |

| Citigroup Inc., NYSE | C | 79.4 | -0.56(-0.70%) | 42669 |

| Exxon Mobil Corp | XOM | 87.5 | -0.51(-0.58%) | 10394 |

| Facebook, Inc. | FB | 184.05 | -1.93(-1.04%) | 151878 |

| Ford Motor Co. | F | 11.08 | -0.04(-0.36%) | 122178 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.5 | -0.13(-0.66%) | 19016 |

| General Electric Co | GE | 16.13 | -0.15(-0.92%) | 224186 |

| General Motors Company, NYSE | GM | 42.61 | -0.41(-0.95%) | 1916 |

| Goldman Sachs | GS | 271.1 | -1.38(-0.51%) | 6693 |

| Google Inc. | GOOG | 1,169.99 | -5.59(-0.48%) | 4491 |

| Hewlett-Packard Co. | HPQ | 23.7 | -0.11(-0.46%) | 464 |

| Home Depot Inc | HD | 202.7 | -2.22(-1.08%) | 11635 |

| HONEYWELL INTERNATIONAL INC. | HON | 160.1 | -1.37(-0.85%) | 793 |

| Intel Corp | INTC | 49.62 | -0.36(-0.72%) | 82415 |

| International Business Machines Co... | IBM | 165.75 | -1.05(-0.63%) | 10248 |

| International Paper Company | IP | 63.67 | -1.41(-2.17%) | 125 |

| Johnson & Johnson | JNJ | 143.14 | -0.54(-0.38%) | 7572 |

| JPMorgan Chase and Co | JPM | 115.41 | -0.79(-0.68%) | 43776 |

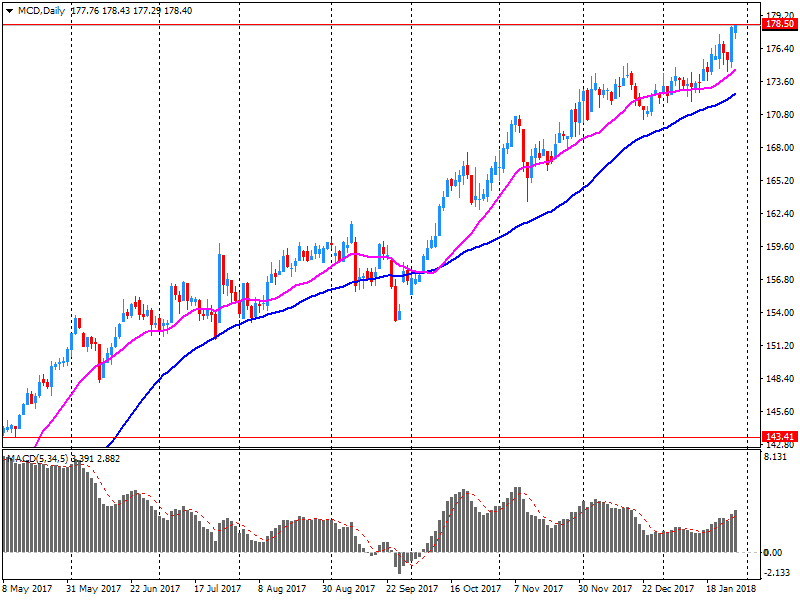

| McDonald's Corp | MCD | 176.27 | -1.50(-0.84%) | 181413 |

| Merck & Co Inc | MRK | 60.95 | -0.68(-1.10%) | 19973 |

| Microsoft Corp | MSFT | 93.6 | -0.32(-0.34%) | 133774 |

| Nike | NKE | 67.33 | -0.25(-0.37%) | 6860 |

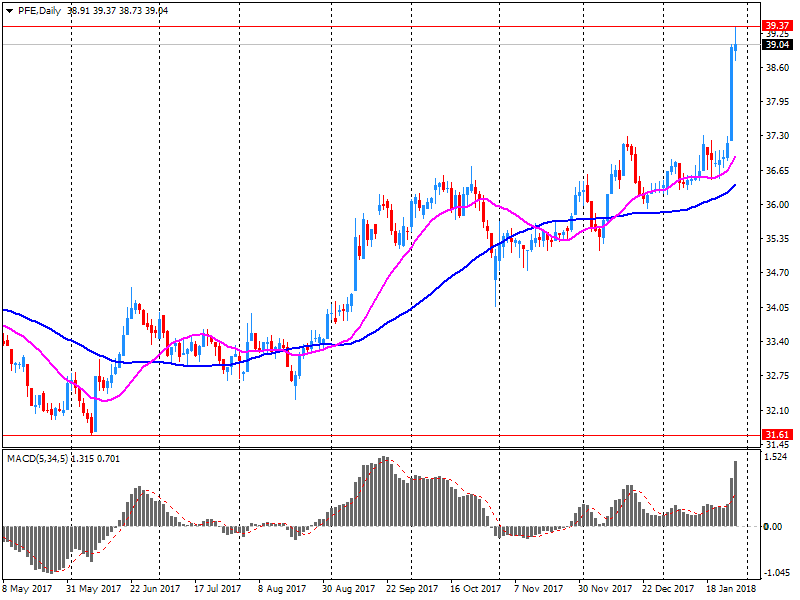

| Pfizer Inc | PFE | 38.4 | -0.62(-1.59%) | 384041 |

| Procter & Gamble Co | PG | 86.71 | -0.15(-0.17%) | 11332 |

| Starbucks Corporation, NASDAQ | SBUX | 56.75 | -0.27(-0.47%) | 19753 |

| Tesla Motors, Inc., NASDAQ | TSLA | 345.8 | -3.73(-1.07%) | 23251 |

| The Coca-Cola Co | KO | 47.62 | -0.08(-0.17%) | 4712 |

| Travelers Companies Inc | TRV | 148.5 | -0.46(-0.31%) | 1008 |

| Twitter, Inc., NYSE | TWTR | 25.04 | -0.14(-0.56%) | 271018 |

| United Technologies Corp | UTX | 136.2 | -0.47(-0.34%) | 3939 |

| UnitedHealth Group Inc | UNH | 233.6 | -13.81(-5.58%) | 653491 |

| Verizon Communications Inc | VZ | 53.85 | -0.28(-0.52%) | 8681 |

| Visa | V | 124.49 | -0.35(-0.28%) | 7958 |

| Wal-Mart Stores Inc | WMT | 109.46 | -0.09(-0.08%) | 9041 |

| Walt Disney Co | DIS | 111.21 | -0.33(-0.30%) | 7070 |

| Yandex N.V., NASDAQ | YNDX | 38.2 | -0.30(-0.78%) | 2460 |

Cisco Systems (CSCO) initiated with Hold at Loop Capital

Intel (INTC) resumed with a Buy at Citigroup; target $58

Amazon (AMZN) target raised to $1500 at Monness Crespi & Hardt

Alphabet (GOOG) target raised to $1350 at Needham

Alphabet A (GOOGL) target raised to $1375 from $1200 at B. Riley FBR

AT&T (T) target raised to $40 from $36 at Scotia; Sector Perform

McDonald's (MCD) reported Q4 FY 2017 earnings of $1.71 per share (versus $1.44 in Q4 FY 2016), beating analysts' consensus estimate of $1.59.

The company's quarterly revenues amounted to $5.340 bln (-11.4% y/y), beating analysts' consensus estimate of $5.221 bln.

MCD fell to $176.31 (-0.82%) in pre-market trading.

Pfizer (PFE) reported Q4 FY 2017 earnings of $0.62 per share (versus $0.47 in Q4 FY 2016), beating analysts' consensus estimate of $0.56.

The company's quarterly revenues amounted to $13.703 bln (+0.6% y/y), generally in-line with analysts' consensus estimate of $13.675 bln.

The company also issued upside guidance for FY 2018, projecting EPS of $2.90-3.00 (versus analysts' consensus estimate of $2.78) at revenues of $53.5-55.5 bln (versus analysts' consensus estimate of $53.82 bln).

PFE fell to $38.90 (-0.31%) in pre-market trading.

Seasonally adjusted GDP rose by 0.6% in both the euro area (EA19) and in the EU28 during the fourth quarter of 2017, compared with the previous quarter, according to a preliminary flash estimate published by Eurostat, the statistical office of the European Union. In the third quarter of 2017, GDP had grown by 0.7% in both zones. Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 2.7% in the euro area and by 2.6% in the EU28 in the fourth quarter of 2017, after +2.8% in both zones in the previous quarter. Over the whole year 2017, GDP grew by 2.5% in both zones.

GBP/USD on the last weeks has been appreciating and passes the barrier close to the 1.41.

At this moment, we can see that the price is starting a correction its last movements.

However, it can be interesting to trade once the price starts to reject the zone which we mentioned on the chart (green retangle) in order to go long in this pair.

Therefore, our bias for this pair is long but of the price doesn't respect the fibonnaci levels and the upside trend line we can consider a short entries as well.

The Gross Domestic Product (GDP) generated by the Spanish economy registers a variation of 0.7% in the fourth quarter of 2017 compared to the previous quarter2 , according to advance estimate of the quarterly GDP. This rate is one tenth lower than that registered in the previous quarter. The variation of the GDP in the fourth quarter of 2017 with respect to the same quarter of the year The previous one stands at 3.1%, similar to the rate registered in the third quarter of the year.

In Q4 2017, GDP in volume terms increased again: +0.6%, after +0.5% in Q3. On average over the year, GDP accelerated markedly: +1.9% after +1.1% in 2016.

Total gross fixed capital formation (GFCF) accelerated slightly (+1.1% after +0.9%) while household consumption expenditure slowed down (+0.3% after +0.6%). Overall, final domestic demand excluding inventory changes contributed to GDP growth by +0.5 points in Q4 2017 (after +0.6 points).

Foreign trade balance contributed positively to GDP growth (+0.6 points after −0.5 points): exports accelerated markedly (+2.6% after +1.1%) while imports slowed down sharply (+0.7% after +2.4%). Conversely, changes in inventories contributed negatively (−0.5 points after +0.3 points).

EUR/USD

Resistance levels (open interest**, contracts)

$1.2495 (2302)

$1.2460 (3574)

$1.2432 (5490)

Price at time of writing this review: $1.2362

Support levels (open interest**, contracts):

$1.2301 (1581)

$1.2266 (2261)

$1.2227 (3362)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 132579 contracts (according to data from January, 29) with the maximum number of contracts with strike price $1,1850 (7037);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4171 (1698)

$1.4142 (2243)

$1.4110 (3462)

Price at time of writing this review: $1.4009

Support levels (open interest**, contracts):

$1.3964 (142)

$1.3933 (538)

$1.3899 (550)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 44585 contracts, with the maximum number of contracts with strike price $1,3600 (3462);

- Overall open interest on the PUT options with the expiration date February, 9 is 41004 contracts, with the maximum number of contracts with strike price $1,3400 (3043);

- The ratio of PUT/CALL was 0.92 versus 0.89 from the previous trading day according to data from January, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

The unemployment rate in Japan came in at a seasonally adjusted 2.8 percent in December, the Ministry of Internal Affairs and Communications said on Tuesday, cited by rttnews.

That was above expectations for 2.7 percent, which would have been unchanged.

The job-to-applicant ratio was 1.59, exceeding forecasts for 1.57 and up from 1.56 in the previous month.

The number of employed persons in December was 65.42 million, an increase of 520,000 or 0.8 percent on year.

European stocks ended a volatile session in negative territory on Monday, with losses for banks and commodity companies outweighing a rally for chip makers that came after Apple-supplier AMS AG reported a major jump in revenue and lifted its sales forecasts.

All major U.S. benchmarks closed lower on Monday, with the Dow and the S&P 500 having their worst day this year, as the appetite for equities was dampened by a pickup in borrowing costs.

Asia-Pacific equity markets followed U.S. stock benchmarks lower as global government borrowing costs continued to rise. Indexes in the region hit session lows by midday, with Japan's Nikkei Stock Average NIK, -1.34% falling 1.5%. Benchmarks in Taiwan Y9999, -1.08% , Hong Kong and Australia XJO, -0.82% were each nearly 1% lower in recent trading.

-

Goods exports rose $1.1 billion (26 percent) to $5.6 billion, a new high for monthly total exports. The previous high was $5.0 billion in March 2014.

-

Goods imports rose $494 million (11 percent) to $4.9 billion.

-

The monthly trade balance was a surplus of $640 million (12 percent of exports).

-

In the last five December months, there were two surpluses (in 2012 and 2013), and three deficits (2014, 2015, and 2016).

-

The December 2017 surplus was the largest in a December month, and the largest in any month since March 2015 ($661 million).

-

Praises governor Kuroda's handling of BoJ policy

-

Important that next governor continues "Abenomics" if not Kuroda

-

Reflect country's monetary and fiscal policy flexibility, economic resilience, and public policy stability

-

Stable outlook reflects view that fiscal performance to remain sound with slowly improving net debt ratio during next few years

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.