- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 29-11-2024

- Silver posts a 1.33% gain on Friday, yet records a weekly loss of 2.30%.

- Technical outlook neutral with a potential bullish pivot if Silver clears $31.00 resistance.

- Downward risk persists if Silver falls below $30.35, targeting next support at $30.00.

Silver price advanced on Friday and finished the session with gains of over 1.33%, yet printed losses of 2.30% in the week. A weak US Dollar sponsored a leg up in the grey metal, which has cleared the 100-day Simple Moving Average (SMA) of $30.35. At the time of writing, the XAG/USD trades at $30.60.

XAG/USD Price Forecast: Technical outlook

The grey metal is neutral to downward biased, consolidated, and fluctuated around the 100-day SMA. Neither buyers nor sellers have been able to move Silver’s price outside of the $29.64-$31.52 range.

Oscillators such as the Relative Strength Index (RSI) remain bearish, though there have been signs that buyers are gathering steam.

Hence, for a bullish continuation, buyers must clear the $31.00. Once cleared, the next stop would be the top of the range at $31.52 before buyers could target the 50-day SMA at $31.74, ahead of the $32.00 figure.

On the other hand, if XAG/USD drops below the 100-day SMA of $30.35, the next support would be the $30.00 mark. On further weakness, sellers could aim to the 200-day SMA at $29.10.

XAG/USD Price Chart – Daily

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

- Friday's session saw NZD/USD rally 0.61% to trade around 0.5930.

- Price action shows recent gains and a recovery to the 20-day SMA, indicating potential for a reversal.

- Indicators look promising and approaching positive areas so the pair may see further upside.

The NZD/USD pair surged by 0.61% on Friday's session, continuing the recovery from last week's lows and reaching 0.5930.

The pair has resumed its upward trajectory, fueled by positive technical indicators. The Relative Strength Index (RSI) has moved near positive territory at around 49, signaling increasing buying pressure and bullish sentiment. Moreover, the Moving Average Convergence Divergence (MACD) indicator displays a rising green histogram, further confirming the bullish momentum.

The Kiwi's pair's recent rally has seen it conquer the 20-day Simple Moving Average (SMA) of 0.5905, signaling potential for a bullish reversal. However, the lingering bearish crossover between the 100-day and 200-day SMAs at 0.6060 raises concerns about the sustainability of the gains. Positive technical indicators, including the RSI and MACD, suggest buying pressure is rising and support bullish momentum..

NZD/USD daily chart

- Gold gains 0.67% in late session, but geopolitical strife keeps it above $2,600 despite monthly losses.

- Escalation in Russia-Ukraine conflict and Middle East tensions underline Gold's safe-haven appeal.

- Market optimism grows for a 25 bps Fed rate cut in December, bolstering Bullion’s short-term prospects.

Gold's price advanced late during the North American session on Friday, up by 0.67%, yet it remains set to print monthly losses of over 3%. Geopolitical risks continue to drive price action with the non-yielding metal fluctuating at around $2,600. The XAU/USD trades at $2,652 after hitting a daily low of $2,634.

Geopolitical tensions eased in the Middle East after Israel and Lebanon agreed to a ceasefire. Nevertheless, both countries accused each other of violating the agreement.

Recently, Sky News Arabia revealed that the Israeli Army announced the bombing of a mobile rocket platform belonging to Hezbollah in southern Lebanon in an air strike.

Gold prices could remain bid after the escalation of the Russia-Ukraine conflict. During the week, Russia attacked Ukraine’s energy infrastructure and threatened to attack with ballistic missiles. Russia’s response is a retaliation to the US and UK authorizing the deployment of missiles manufactured in both countries inside Russia.

In November, Bullion prices were hampered by US President-elect Donald Trump's victory on November 5. Some of his proposals are inflation-prone, like imposing tariffs and cutting taxes.

This bolstered the Greenback, which is set to end November with gains of over 2%, according to the US Dollar Index (DXY). Speculation that the new US administration's fiscal policy is expansionary might prevent the Federal Reserve (Fed) from continuing to lower interest rates.

The choice of Scott Bessent as Treasury Secretary for the upcoming Trump administration calmed the markets and bolstered Gold prices last week. Investors see Bessent as market-friendly, which could moderate harsh Trump trade policies.

Consequently, market participants are optimistic that the Fed will cut rates by 25 basis points at the December meeting. According to the CME FedWatch Tool, the swaps market sees a probability of 66% of such a decision.

Daily digest market movers: Gold price underpinned by lower US real yields

- Gold prices recovered as US real yields dropped seven basis points to 1.92%.

- The US 10-year Treasury bond yield falls six basis points to 4.182%.

- The US Dollar Index (DXY), which tracks the performance of the buck against six currencies, edged down 0.37% at 105.75 on the day. However, it is set to print gains of over 1.79% for the month.

- The latest US GDP figures and the Core Personal Consumption Expenditures (PCE) Price Index hint that the US economy remains robust and that easing policy could need to be paused.

- However, Fed officials seemed convinced that further easing is needed and may cut rates at the December meeting. However, they adopted a more cautious stance, opening the door to pause the easing cycle.

- Data from the Chicago Board of Trade, via the December fed funds rate futures contract, shows investors estimate 24 bps of Fed easing by the end of 2024.

Technical outlook: Gold price climbs but remains below 50-day SMA

Gold prices remain upwardly biased yet contained within the 50 and 100-day Simple Moving Averages (SMAs), each at $2,668 and $2,572, respectively. Buyers need to clear the 50-day SMA so they can test $2,700. On further strength, XAU/USD's next resistance level would be the psychological $2,750 and the all-time high at $2,790.

On the other hand, if sellers drag the non-yielding metal below $2,600, they could target the 100-day SMA, ahead of the November 14 swing low of $2,536.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- Aussie mildly rose to 0.6510 in Friday's session.

- Gains in the Aussie pair are influenced by broad-based US Dollar weakness.

- Aussie finds support but faces pressure from trade war concerns between China and the US.

The AUD/USD pair extends gains for the third straight day on Friday, although it has trimmed a portion of its intraday gains and holds above the 0.6500 psychological threshold. The pair recently reached a multi-day high before retracing some of its intraday gains. The positive momentum in the pair is influenced mainly by broad-based US Dollar weakness.

Despite showing signs of resilience and gaining, the US Dollar remains under pressure against most major currencies. The weakness in the US Dollar is primarily due to dovish comments from Federal Reserve Chairman Jerome Powell, who hinted at a pause in the US interest rate hiking cycle. This has led market participants to speculate that the Fed may not raise interest rates as aggressively as previously anticipated.

Daily digest market movers: Australian Dollar mixed, trade war concerns limit the upside

- AUD/USD is maintaining its upward trend for the third consecutive day despite a slight pullback in intraday gains.

- The AUD/USD pair reversed early gains and trades mixed around 0.6500 amid concerns over the US-China trade war.

- The US is set to unveil further AI chip sanctions against China as early as Monday, which is weighing on the AUD/USD due to risk-off market sentiment.

- This week, the AUD has gained support due to weakness in the USD, despite mixed Australian economic data and a hawkish Reserve Bank of Australia.

AUD/USD technical outlook: Outlook improves as bulls gain momentum, indicators signal further gains ahead

The AUD/USD pair continued to gain ground and approached the 20-day Simple Moving Average (SMA) but faced rejection. However, the outlook remains positive as bullish momentum continues to build.

The AUD/USD pair is likely to find support at the 20-day SMA and the ascending trendline from the August low. On the upside, immediate resistance is at the 50-day SMA and the 0.6600 round figure. A break above this resistance area could lead to further gains toward the 0.6700 mark.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- The Dow Jones finds room to move higher on thin Friday.

- November set to close as the Dow Jones’ best-performing month of the year.

- Another data-laden NFP week looms ahead over the horizon.

The Dow Jones Industrial Average (DJIA) explored territory north of the 45,000 handle for the second time this week. With little on the data docket and Friday’s Post-Thanksgiving holiday trading hours cut short, investors scrambled to push equities into record territory before closing up shop for the weekend.

Tech stocks, specifically chipmakers, are helping to bolster stock indexes after it was revealed that additional restrictions on the sale of semiconductor goods to China being considered by the Biden administration may not be as stiff as many investors had originally feared. Lacking any other fundamental reasons to sell short, traders are bidding stocks higher for the day as markets continue to brush off renewed threats of wide-reaching tariffs set to be imposed by incoming President-elect Donald Trump in January.

Next week will see a fresh round of employment and labor figures that will draw eyes from all corners of the market. This will culminate in another print of monthly Nonfarm Payrolls (NFP) numbers next Friday.

Dow Jones news

Equities broadly found higher ground on holiday-shortened Friday, with two-thirds of the Dow Jones printing in the green from the day’s opening bids at the closing bell. Nvidia (NVDA) rallied over 2%, closing north of $138 per share as the chipmaker recovers from a recent downturn. Investors soured on NVDA after it was revealed that the major tech sector player, which is expected to see revenues soar by another 100% YoY in 2025, may see extended gross inflows shrink to a paltry 50% YoY in 2026. NVDA has fallen over 7% from its all-time high of $148.88 set earlier this month, but still up over 1,000% from 2022’s lows near $12.

Dow Jones price forecast

The DJIA continues to find higher ground, vexing traders looking to amass short positions as price action shows little disregard for any precise definition of overbought conditions. The Dow Jones is up nearly 20% YTD, and has closed in the green for all but two of the last 11 consecutive months.

Traders looking to get into an exhaustion play will be looking for an eventual decline to the 50-day Exponential Moving Average (EMA) rising through 43,000, but a long-running pattern of bouncing from the key moving average means they should just get out of the way and follow the crowd into a fresh leg higher.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- US Dollar Index falls near 106.00 on a quiet Friday.

- DXY stands soft as US markets open on Black Friday after remaining closed on Thursday.

- The hawkish Fed and strong economic outlook from the US might limit the downside.

The US Dollar Index (DXY), which measures the value of the USD against a basket of currencies, trades near 106.10 with mild losses but trimmed most of its daily losses, which saw the index below 106.00.

Overall, the US Dollar maintains a bullish outlook, supported by strong economic data and a hawkish Federal Reserve (Fed) stance. Despite profit-taking and geopolitical uncertainty, the uptrend remains intact.

This week, thin liquidity and market holidays have resulted in reduced trading activity, but the DXY is expected to continue its upward trajectory due to robust US economic growth.

Daily digest market movers: US Dollar stabilises on Friday ahead of the weekend

- The US Dollar Index is currently trading near 106.00 with slight losses.

- The Greenback has recovered since the reopening of US markets on Black Friday.

- The Euro's rally, which pressured the USD, has subsided, influencing the DXY's behavior.

- The Fed’s hawkish stance might continue pushing the index higher.

- This week’s Federal Open Market Committee Minutes suggested that the Fed is in no rush to cut rates.

- Some participants cautioned that disinflation could take longer than expected. Officials discussed a "technical adjustment" to money market operations.

- According to the CME FedWatch Tool, the odds of a December rate cut have risen to around 66%.

DXY technical outlook: Despite profit-taking, outlook remains bullish

Technical indicators for the DXY suggest a period of consolidation with the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators hovering around neutral levels.

Despite a recent dip below the 20-day Simple Moving Average (SMA), the index has quickly recovered, indicating that the uptrend remains intact. Key support is found at 106.00-106.50, while resistance is at 108.00. The overall bullish momentum suggests that the uptrend is likely to continue in the medium term as the US economy remains robust and the Fed is expected to cool down rate cut bets. Traders should monitor the 106.00 level closely as a break below this level could trigger further downside.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Mexican Peso appreciates 0.59% against US Dollar, poised for strong weekly performance.

- Banxico minutes suggest potential for 50 bps rate cut in December, boosting Peso's outlook.

- President Sheinbaum optimistic about averting Trump's proposed 25% tariffs, bolstering MXN stability.

The Mexican Peso appreciated against the US Dollar during the North American session as the Greenback extended its downfall and is about to hit its most significant weekly loss in three months. Speculation that US President-elect Donald Trump may moderate his trade rhetoric weighed on the American currency. Therefore, the USD/MXN trades at 20.29, down 0.59%.

Mexico’s economic docket was light on Friday, but the Bank of Mexico (Banxico) revealed its November 14 monetary policy meeting minutes on Thursday.

Banxico’s board members voted unanimously to lower rates, and according to the minutes, members agreed that the rate cut cycle “should continue.” Nevertheless, one of the officials suggested “a larger rate adjustment” at the December meeting in light of expectations that core inflation would continue to trend lower.

Even though this opens the door for a 50 bps rate cut at the next meeting, the USD/MXN trended lower after Mexican President Claudia Sheinbaum and US President-elect Donald Trump sustained conversations on Wednesday, calming fears and underpinning the emerging market currency.

Earlier on Friday, President Sheinbaum said she is convinced that she would reach a deal with the US to avoid President-elect Trump's threat of 25% tariffs, according to Bloomberg. She added, “I’m convinced we’re going to reach an agreement while defending our sovereignty, with respect for Mexicans and respect for Mexico, with the collaboration that one government should have with another.”

Meanwhile, US data suggests the economy might be slowing faster than expected. Earlier, the Chicago Purchasing Managers Index (PMI) for November tumbled. It was the second monthly decline from September levels.

Daily digest market movers: Mexican Peso appreciates during the week

- Banxico’s board members noted that the Mexican Peso traded broadly, depreciating markedly and exhibiting volatility mainly due to uncertainty about the US election.

- They added that inflation risks are tilted to the upside, mentioning a greater exchange rate depreciation. They acknowledged the inflation outlook still calls for a generally restrictive policy stance.

- Banxico’s members “agreed that Mexico's inflation outlook has been improving, after the significant global shocks of previous years. However, they forewarned that it still faces challenges.”

- In the bank's quarterly report, Banxico Governor Victoria Rodriguez commented that they monitored the recent Peso volatility and added that there has not been a need to intervene in the forex market.

- The quarterly report revealed that Banxico updated its projection for the Mexican economy to grow 1.8% in 2024, up from 1.5%. Nevertheless, the central bank kept its 2025 Gross Domestic Product (GDP) projection at 1.2%.

- The CME FedWatch Tool suggests that investors see a 66% chance of a 25-basis-point (bps) rate cut at the Federal Reserve’s December meeting, up from 59% a day ago.

- Data from the Chicago Board of Trade, via the December Fed funds rate futures contract, shows investors estimate 24 bps of Fed easing by the end of 2024.

Technical outlook: Mexican Peso recovers as USD/MXN falls below 20.40

The USD/MXN remains upwardly biased despite being set to finish the week with losses. Nevertheless, the pair carved a successive series of higher highs and higher lows, suggesting buyers are in charge. If buyers keep the exchange rate above the November 19 swing low of 20.06, this could pave the way for further upside.

The first resistance would be 20.50, followed by the year-to-date (YTD) peak at 20.82. If surpassed, the next stop would be 21.00, ahead of March 8, 2022 peak at 21.46, followed by the November 26, 2021 high at 22.15.

Conversely, if bears drag the exchange rate below 20.06, the next support would be 20.00. On further weakness, bears could challenge the 50-day Simple Moving Average (SMA) at 19.92. Key support levels lie beneath the latter with the 100-day SMA at 19.48 before the psychological 19.00 figure.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- EUR/USD started Friday with hopeful gains, but slumped back into the low side.

- European inflation figures showed contraction on the near end of the curve.

- Core monthly HICP inflation dipped to its lowest level since February.

EUR/USD kicked Friday off with a mild rally into the 1.0600 handle as broader markets took advantage of the US holiday session to sell off the Greenback and bid up riskier assets, but another contraction in key pan-European inflation figures pulled the plug on Fiber bulls. Despite an intraday softening of the Euro’s stance, EUR/USD is poised for its first weekly gain in a month.

According to the Harmonized Index of Consumer Prices (HICP), headline European inflation sank to -0.3% in November, falling from the previous month’s 0.3%. Core HICP inflation also declined to -0.6% MoM compared to the previous print of 0.2%, sending core monthly inflation measures into contraction territory for the third time this year and the lowest print since February.

Annualized HICP inflation ticked higher, with core HICP rising to 2.8% YoY from the previous 2.7%, but the bump in yearly inflation is likely due to previous bumps in the road as the European Central Bank (ECB) grapples with whipsaw inflation prints. ECB officials noted that still-declining inflation metrics bode well for further rate cuts. Still, too-steep of an inflation easing curve is raising investor concerns of a deepening slowdown within the broader European economy.

EUR/USD price forecast

The Euro’s bullish turnaround from two-year lows is already running into trouble as intraday bidding runs aground of the 1.0600 handle. Bullish momentum has achieved a moderate 2.5% recovery from November’s bottom bids near 1.0330, but momentum remains limited. Looking higher up, a rapidly-descending 50-day Exponential Moving Average (EMA) falling through 1.0750 while the 200-day EMA rolls over into bear country near 1.0840.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- EUR/CAD rose by 0.26% on Friday.

- A break and close below 1.4800 could signal further bearish momentum in the short term.

The EUR/CAD pair saw a slight uptick in Friday's session, climbing by 0.26% to reach 1.4825. However, despite this modest gain, the pair remains below its 20-day Simple Moving Average (SMA), having recently completed a bearish crossover between the 20 and 200-day SMAs. While buyers attempt to reclaim the 20-day SMA, indicators suggest a struggle, with the Relative Strength Index (RSI) recovering buying pressure and the Moving Average Convergence Divergence (MACD) indicating rising buying pressure and overall bullish momentum.

However, until the pair breaks above 1.4800, the short-term outlook remains negative. The mentioned crossover, combined with momentum not being entirely recovered, suggests that further gains may be limited.

EUR/CAD daily chart

- GBP/USD sees over 1.2% weekly gain but faces resistance near 1.2700, risking pullback to 1.2600.

- Oscillators like RSI suggest growing buyer momentum yet remain below the neutral threshold.

- Break above 1.2700 could target 200-day SMA at 1.2818, with this week’s high at 1.2749 as immediate hurdle.

The Pound Sterling clings to earlier gains yet trades off the weekly highs, which reached around 1.2749 during the European session. At the time of writing, the GBP/USD trades at 1.2684, virtually unchanged.

GBP/USD Price Forecast: Technical outlook

Although the GBP/USD is set for weekly gains of over 1.2%, price action suggests Cable didn’t find acceptance above 1.2700, which could exacerbate a pullback toward the 1.2600 figure. In that outcome, the pair’s next support would be the November 27 daily low of 1.2564, followed by the November 26 low of 1.2506. On further weakness, the November 22 pivot low of 1.2486 is on the cards.

Conversely, if GBP/USD finishes the week above 1.2700, this could pave the way for testing the 200-day Simple Moving Average (SMA) at 1.2818. However, buyers must clear the current week’s peak of 1.2749.

Oscillators such as the Relative Strength Index (RSI) hint that buyers are gathering momentum, even though the RSI remains below its neutral line.

Therefore, in the short-term, the GBP/USD upside is seen if it clears at 1.2700.

GBP/USD Price Chart – Daily

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.06% | -0.01% | -0.93% | 0.07% | -0.12% | -0.44% | -0.08% | |

| EUR | -0.06% | -0.06% | -1.01% | 0.01% | -0.18% | -0.50% | -0.14% | |

| GBP | 0.00% | 0.06% | -0.97% | 0.07% | -0.12% | -0.44% | -0.08% | |

| JPY | 0.93% | 1.01% | 0.97% | 1.02% | 0.81% | 0.48% | 0.86% | |

| CAD | -0.07% | -0.01% | -0.07% | -1.02% | -0.20% | -0.51% | -0.15% | |

| AUD | 0.12% | 0.18% | 0.12% | -0.81% | 0.20% | -0.32% | 0.04% | |

| NZD | 0.44% | 0.50% | 0.44% | -0.48% | 0.51% | 0.32% | 0.36% | |

| CHF | 0.08% | 0.14% | 0.08% | -0.86% | 0.15% | -0.04% | -0.36% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

- GBP/JPY has fallen to a trendline for the August rally.

- The pair is in a downtrend with odds favoring an extension lower.

GBP/JPY is trying to pierce the trendline for the uptrend since the August lows. If it is successful and decisively breaches the trendline, it will suggest a follow-through lower to a fresh downside target at 186.20, the 61.8% Fibonacci of the down move prior to the trendline (blue rectangle on chart).

The pair is now in a short and probably medium-term downtrend (since the October 31 high) and according to technical analysis lore trends have a tendency to extend, suggesting the odds favor even more downside to come.

GBP/JPY Daily Chart

GBP/JPY is making its way down to the next target for the pair at around 189.56, the low of the Right-Angled triangle that formed in late September and early October.

It is also possible it could bounce from the current level at the trendline which is a support level.

The Relative Strength Index (RSI) is not yet oversold which indicates the pair could still have further to fall before it gets oversold.

A decisive breach of the trendline would be one accompanied by a long red candlestick that closed near its lows and well clear of the trendline, or three consecutive red candles that breached the level.

- Silver price extends its recovery to near $31.00 as demand for safe-haven asset improves.

- Russia threatens to attack Ukraine with nuclear-capable ballistic missiles.

- The US Dollar recovers with investors focusing on a slew of US economic data.

Silver price (XAG/USD) recovers further to near $31.00 in North American session on Friday. The white metal bounced back on Thursday after posting a fresh 11-week low near $29.60. The asset strengthens as investors fear that Russia could launch a nuclear attack on Ukraine.

Russia threatens a possible nuclear-capable ballistic missile strike on Ukraine, followed by firing a series of Intermediate Range Ballistic Missiles (IRBM) on 17 targets, including defense and energy facilities. The prevailing war between Russia and Ukraine keeps the demand for safe-haven assets intact. This was the second-largest Russian attack on Ukraine, according to Ukraine's energy ministry. Historically, the safe-haven appeal of precious metals such as Silver increases at times of global market uncertainty or heightened geopolitical risks.

In the Middle East, tensions between Israel and Iran have eased, with a ceasefire coming into effect early this week.

Meanwhile, the US Dollar (USD) rebounds strongly as investors shift focus to the United States (US) labor market and business activity data, which will be released next week. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, bounces back after posting a fresh two-week low near 105.60.

Silver technical analysis

Silver price rebounds strongly after sliding to near the upward-sloping trendline around $29.50, which is plotted from the February 29 low of $22.30 on a daily timeframe. Still, the outlook of the Silver price is bearish as a bear cross, represented by 20 and 50-day Exponential Moving Average (EMA) around $31.30, points to an escalation in the downside trend.

The white metal weakened after the breakdown of the horizontal support plotted from the May 21 high of $32.50.

The 14-day Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, suggesting a sideways trend.

Silver daily chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

- EUR/JPY is falling to a key support level after tumbling further on Friday.

- It could bounce once it touches the level and the RSI is oversold on an intraday basis, cautioning aggressive short-sellers.

EUR/JPY extends its downtrend since the Halloween peak and is within spitting distance of hitting key support at the September 30 swing low of 158.11 (red dashed line on chart).

It is now probably in a short-term downtrend and given it is a principle of technical analysis that trends have a tendency to extend themselves, the odds favor EUR/JPY falling to lower lows.

EUR/JPY Daily Chart

At the September 30 low the pair will probably find its feet and bounce. The Relative Strength Index (RSI) momentum indicator is in the oversold zone (below 30) on an intraday basis. If the pair closes with RSI still in oversold it will be a signal for short-holders not to add to their short positions. The risks of a pullback will also be greater.

A deeper sell-off could take EUR/JPY down to the trendline at around 157.00 or even all the way to 154.00 – 155.00, the August-September lows.

- USD/JPY has broken out of a Broadening Formation pattern and is falling towards its target.

- The pair has probably reversed its short-term trend and risks now lie to the downside, in line with the bearish bias.

USD/JPY has breached the bottom of a bearish Broadening Formation price pattern and is falling toward the first downside target at 148.54, the 61.8% Fibonacci extrapolation of the height of the pattern extrapolated down.

USD/JPY Daily Chart

Further bearishness could carry USD/JPY to the next target at 148.24, the September 2, key swing high.

The (blue) Moving Average Convergence Divergence (MACD) momentum indicator is diverging away from its red signal line – a further bearish sign.

The short-term trend has probably reversed from bullish to bearish after the breakdown. Given it is a principle of technical analysis that trends have a tendency to extend, the odds now favor more weakness in the short-term.

- EUR/CHF mildly falls on Friday as markets digest Eurozone HICP inflation data for November.

- The Euro weakens as it does little to change the outlook for interest rates , a key driver of FX valuations.

- CHF gains marginally on stronger GDP growth data but hamstrung by comments for the SNB’s President Schlegel.

EUR/CHF edges lower to trade on the 0.9300 handle on Friday after the release of Eurozone inflation data continues to suggest European Central Bank (ECB) members will cut interest rates at their December meeting despite the figures meeting economists’ expectations. Lower interest rates are negative for the Euro (EUR) since they decrease net capital inflows, and this puts pressure on the pair.

The Swiss Franc (CHF) meanwhile, gains a mild tailwind after the release of Swiss Gross Domestic Product (GDP) data shows Swiss economic growth outstripped expectations, and accelerated in Q3 on a year-over-year basis. The effect is likely to be blunted, however, with comments from the President of the Swiss National Bank Martin Schlegel, last week, still fresh in traders' minds. Schlegel said that interest rates in Switzerland might fall below zero. Still, EUR/CHF has fallen into negative territory after both sets of data on the back of Swiss Franc outperformance.

Eurozone inflation data decpetively high

The preliminary Eurozone Harmonized Index of Consumer Prices (HICP) rose 2.3% YoY in November in line with expectations and above the 2.0% of the previous month, according to data released Friday from Eurostat. Core HICP rose by 2.8%, which was also in line with expectations.

Despite appearing like inflation was rising, several analysts said the elevated November figures were almost entirely due to “base effects”. A base effect relates to the corresponding month of the previous year, if inflation was too low in that month it only requires a small rise for the data to show a large percentage increase in the current year.

“The increase in headline inflation from 2.0% in October to 2.3% in November was in line with expectations and was almost entirely caused by a base-effects driven by an increase in energy inflation,” said Jack Allen-Reynolds, deputy chief Eurozone economist at Capital Economics.

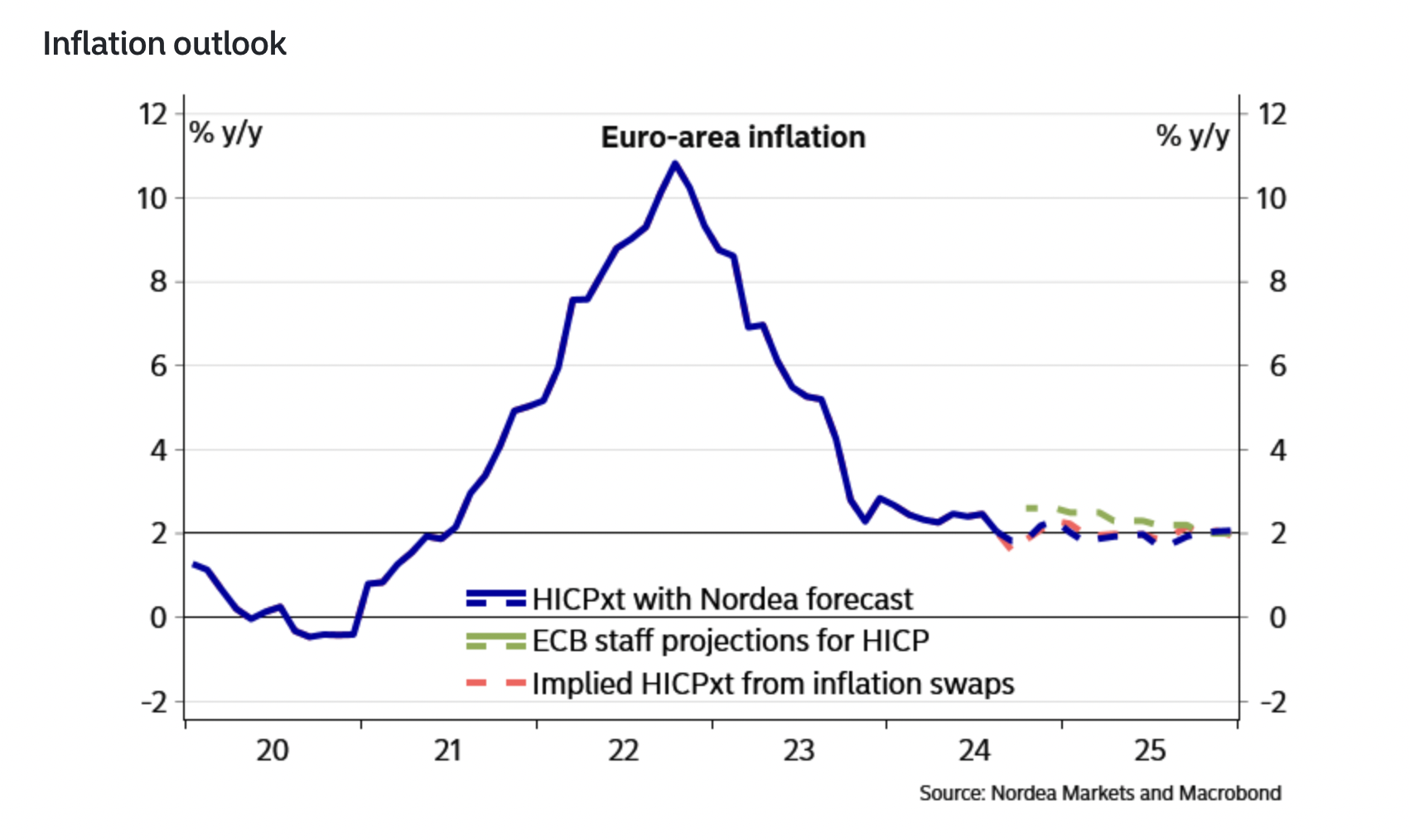

The view was shared by Anders Svendsen, chief analyst at Nordea, who said, “Inflation rises on base effects but remains on track to return to the ECB's inflation target in the first part of 2025, allowing the ECB to continue cutting policy rates towards neutral.”

Svendsen goes further to argue that inflation will likely fall to the European Central Bank’s (ECB) 2.0% target more quickly than the ECB is currently forecasting.

“Markets and the ECB agree that inflation will close in on 2% but disagrees on the timing. We believe the ECB will change its forecast to reflect an earlier return to 2% at its meeting in December. With that outlook, the ECB can continue cutting policy rates to neutral,” he writes.

Capital’s Allen-Reynolds thinks the November data marginally reduces the chance of the ECB making a double-dose 50 basis points (pbs) (0.50%) cut to rates in December, however, in spite of this, there is still a “good chance” of 50 bps reduction nevertheless, as well as lower rates further down the track.

“The continued strength of euro-zone services inflation in November reduces the chance that the ECB will cut interest rates by 50 bps in December,” yet adds, “While we think there is a good case for the ECB to cut interest rates by 50bp in December, several influential members of the Governing Council seem opposed to the idea and the strength of services inflation will arguably bolster their case. But if we’re right that services inflation will decline in December and beyond, and that the economy will remain weak, we think bigger cuts will be on the cards sooner or later.”

France's budget woes a drag

A further drag on the Euro is the political risk around the French budget with Prime Minister Michel Barnier struggling to get stringent budget cuts passed through parliament because of his wafer-slim majority.

The political battle highlights France’s weak fiscal position and has led to the spread in yields between French Government Bonds over German Bunds to widen by 82 bps, indicating outsized risks for French bond-holders.

“French Prime Minister Michel Barnier will have to make more concessions to the budget bill to prevent the government from falling. Far-right National Rally President Bardella stressed yesterday that “other red lines” remained. In the meantime, French political uncertainty is not spreading to the rest of the Eurozone which limits the drag on EUR.”

CHF vulnerable on SNB rhetoric

EUR/CHF saw limited downside pressure after Swiss GDP data, even though it would have been expected to strengthen CHF. Swiss GDP recorded a 2.0% rise in Q3 YoY, above the 1.8% forecast and the 1.8% previously. QoQ GDP rose 0.4%, in line with expectations and below the revised-down 0.6% of Q2.

The effect of the data was muted by growing expectations that the Swiss National Bank (SNB) will slash interest rates by 50 bps at its December meeting following comments from SNB President Schlegel in which he warned that negative interest rates cannot be ruled out.

“The SNB has plenty of room to slash the policy rate as Swiss inflation is tracking below the bank’s Q4 forecast of 1.0%. Market is pricing-in about 60% probability of a 50 bps rate cut to 0.50% at the December 12 meeting,” said Elias Haddad, Senior Markets Strategist at Brown Brothers Harriman (BBH).

- USD/CAD bounces back from 1.3980 after the Canadian GDP data release, which was broadly weaker than expected.

- The Canadian economy grew by 0.1% in September, slower than estimates of 0.3%.

- A slight rebound in the US Dollar has also prompted the Loonie pair’s recovery.

The USD/CAD pair rebounds after posting a fresh three-day low near 1.3980 in Friday’s North American session. The Loonie pair bounces back as Statistics Canada has reported slower-than-expected Gross Domestic Product (GDP) growth in September month. The agency showed that the Canadian economy expanded by 0.1% after remaining flat in August. Economists expected the economy to have risen by 0.3%

The agency also reported that growth in the third quarter of the year was 0.3%, slower than 0.5% in the previous quarter. Meanwhile, in comparison to the third quarter of the previous year, the GDP growth was 1%, as expected, softer than the 2.2% growth in the second quarter of the current year.

Moderate expansion in the Canadian output is expected to boost expectations of more outsized interest rate cuts by the Bank of Canada (BoC). The BoC reduced its key borrowing rates by 50 bps in October.

Meanwhile, a slight recovery in the US Dollar (USD) has also pushed the Loonie pair higher. The USD recovered some of its intraday losses, suggesting that a near-term low has been formed. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, bounces back after registering a fresh two-week low near 105.60.

The correction in the US Dollar started when United States (US) President-elect Donald Trump nominated Scott Bessent to fill the position of Treasury Secretary. Market participants expect Bessent to execute Trump-stated trade policies strategically and gradually that won’t prompt inflationary pressures swiftly.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- Canada's GDP expanded by 1% in Q3, matching analysts' estimate.

- USD/CAD trades modestly higher on the day above 1.4000.

Canada's Gross Domestic Product (GDP) expanded at an annual rate of 1% in the third quarter, Statistics Canada reported on Friday. This reading followed the 2.2% growth recorded in the second quarter and matched the market expectation.

On a quarterly basis, the Canadian economy grew by 0.3%, while expanding by 0.1% on a monthly basis in September.

Market reaction

USD/CAD edged higher with the immediate reaction to this report and was last seen gaining 0.1% on the day at 1.4028.

- The US Dollar extends this week’s decline on Black Friday.

- French budget talks are pushing the Euro higher, weighing on the US Dollar Index

- The US Dollar Index falls below 106.00 and tests the next support level for a rebound.

The US Dollar (USD) trades softer on Friday on the back of concerns over Europe, with the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, extending this week’s decline and falling below the 106.00 level.

France’s budget talks are not going well, with Prime Minister Michel Barnier having to consent to too many demands from the far-right National Rally from Marine Le Pen. The budget concerns are sending French yields higher, to levels matching weaker European peripheral countries such as Greece, fueling a stronger Euro over the US Dollar.

Meanwhile, US financial markets will close early on Friday after Thanksgiving Day. US equity futures are trading flat while the US bond market opens up under thin liquidity.

Daily digest market movers: Europe in the spotlight for all the wrong reasons

- Far-right National Rally leader Marine Le Pen, who holds outsize leverage in France’s split parliament, gave Prime Minister Michel Barnier until Monday to kneel to her budget demands before she decides whether to topple the government, Bloomberg reports.

- Prime Minister Barnier already agreed to abandon plans to raise taxes on electricity on Thursday, Reuters reports.

- Equities are mixed, with European equities marginally in the red, while US futures are flat to a touch higher on the day.

- The CME FedWatch Tool is pricing in another 25 basis points (bps) rate cut by the Fed at the December 18 meeting by 66.3%. A 33.7% chance is for rates to remain unchanged. The Fed Minutes have helped the rate cut odds for December to move higher.

- The US 10-year benchmark rate trades at 4.22%, falling to this week’s low at the start of this Friday after being closed on Thursday.

US Dollar Index Technical Analysis: France, the next sick man in Europe

The US Dollar Index (DXY) faces some more selling pressure on Friday, with one of its main components, the Euro, weighing the Index down. With the uprising in French yields and spreads, the rate gap between the US and Europe gets narrower, with the Euro catching up with the US Dollar. Pivotal support levels need to be identified, with the “Trump trade” set to pick up soon again as President-elect Donald Trump takes office in January.

With this week’s decline in the DXY, former support levels have now turned into resistance. On the upside, 106.52 (April 16 high) is the first level to watch. Should the Dollar bulls reclaim that level, 107.00 (round level) and 107.35 (October 3, 2023, high) are back on target for a retest.

If the DXY correction continues, the pivotal level at 105.53 (April 11 high) comes into play on Friday as the last man standing before heading into the 104-region. Should the DXY fall all the way towards 104.00, the big figure and the 200-day Simple Moving Average at 104.03 should catch any falling knife formation.

US Dollar Index: Daily Chart

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- US markets trade with limited capacity due to the Thanksgiving aftermath on Friday.

- OPEC+ ministers will meet in person before the delayed Output Policy Meeting scheduled on Thursday.

- The US Dollar Index retreats further, with French yields narrowing the rate gap between the US and Europe.

Crude Oil trades in the red and loses around 1% on Friday. However, it is in a continuous tight range with traders on the sidelines awaiting the outcome of the upcoming Organization of the Petroleum Exporting Countries and its allies (OPEC+) meeting on its output policy, which has been delayed to next Thursday. Markets have already priced in a delay in production normalization to the first quarter of 2025.

The US Dollar Index (DXY), which measures the performance of the US Dollar (USD) against a basket of currencies, eases further on Friday with only a handful of US market participants returning to markets after Thanksgiving Thursday. The weakening of the US Dollar comes with the narrowing of the yield gap between the US and Europe due to French yields spiking higher on political uncertainty. French Prime Minister Michel Barnier has until Monday to propose a severely reduced budget, or the far-right National Rally party of Marine Le Pen threatens to topple the French government if demands are unmet.

At the time of writing, Crude Oil (WTI) trades at $68.18 and Brent Crude at $72.03.

Oil news and market movers: What to expect from OPEC+

- Saudi Aramco may reduce the official selling price of Arab Light crude by $0.70 per barrel for January sales to Asia, according to the median estimate from Bloomberg.

- Several OPEC+ ministers will attend the meeting of the Gulf Cooperation Council in Kuwait on Sunday and discuss in person before the Output Policy Meeting scheduled for Thursday.

- The Crude Oil market continues to face uncertainties around weather, demand, and geopolitical developments, said Charu Chanana, chief investment strategist for Saxo Markets Pte in Singapore, Bloomberg reported.

Oil Technical Analysis: The unexpected needs to happen

Crude Oil prices are still dragging, facing selling pressure and the risk of more downsides, with a constant reminder in articles and media outlets that there is a supply glut still at hand in the Oil landscape. Markets are already pricing in a simple delay of the inevitable, that supply normalization will happen at one point. The only game-changer that could push Oil prices higher would be when OPEC+ considers deepening production cuts and/or extending them for even a year.

On the upside, the pivotal level at $71.46 and the 100-day Simple Moving Average (SMA) at $72.13 are the two main resistances. The 200-day SMA at $76.22 is still far off, although it could be tested if tensions intensify further. In its rally towards that 200-day SMA, the pivotal level at $75.27 could still slow down any upticks.

On the other side, traders need to look towards $67.12 – a level that held the price in May and June 2023 – to find the first support. In case that breaks, the 2024 year-to-date low emerges at $64.75, followed by $64.38, the low from 2023.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

- Gold rises on increased haven flows as geopolitical hotspots light up.

- Israel breaks its ceasefire agreement by attacking Hezbollah, and Putin threatens to use nuclear-capable missiles on Ukraine.

- XAU/USD is technically crawling up a major trendline but remains vulnerable to breakdowns.

Gold (XAU/USD) stages a bigger rebound on Friday and enters the $2,660s during the European session. A rise in safe-haven flows due to a breakdown in the Israel – Hezbollah ceasefire agreement is one of the catalysts, as is Russian President Vladimir Putin’s warning Russia could launch nuclear-capable missiles at Ukraine.

Gold rallies as safe-haven demand increases

Gold experienced a drop in price of nearly 3.0% Monday on rumors Israel and Hezbollah were close to reaching a ceasefire agreement. An eventual deal emerged with both sides agreeing to a 60-day cessation of hostilities.

Gold is rebounding on Friday, however, after the ceasefire fell apart following a strike by the Israeli airforce on Hezbollah targets in southern Lebanon, who they claim were violating the ceasefire agreement.

Geopolitical risks have further ratcheted up in Ukraine after Russia left over a million inhabitants without electricity following widespread strikes on Wednesday night.

While speaking at a conference in Kazakhstan on Thursday, Putin said “he would consider further launches of Russia’s new Oreshnik medium-range ballistic missile, first fired at Ukraine’s Dnipro region last week,” according to CNN. Oreshnik’s have nuclear capability.

Gold supported by reduced risks of a US-Mexico trade war

Diminishing tariff fears could also be impacting Gold price after reports that US President-elect Donald Trump and Mexican President Claudia Sheinbaum had a constructive phone conversation on Wednesday. This suggests a lower risk of a costly trade war between the two countries.

The implementation of higher tariffs had been viewed as inflationary for the US and expected to keep interest rates elevated. This, in turn, would be negative for non-interest-paying assets like Gold. However, now many commentators are saying that Trump’s threat to put a 25% tariff on Mexican imports is probably more a negotiating tactic than anything else and, therefore, unlikely to materialize.

US Dollar edges lower, aiding Gold

A further factor supporting Gold on Friday is a weaker US Dollar (USD). The Dollar Index (DXY), which measures its value against a trade-weighted index of peers, has edged down during trading on Friday. This is positive for Gold, which is mainly priced and traded in USD.

Gold’s recovery on Thursday was partly spurred by increased bets the Fed would cut interest rates by 25 basis points (bps) at its December meeting, and whilst the expectations remain about the same, odds have not further increased as we draw to the end of the week.

The market-based probability of a rate hike is 66%, according to the CME FedWatch tool. This leaves a 34% chance the Fed will leave interest rates unchanged.

Technical Analysis: XAU/USD recovers along major trendline

Gold extends its recovery along a major trendline and is now entering the fourth day in a row of gains. The trendline reflects the precious metal’s long-term uptrend.

XAU/USD Daily Chart

Gold’s short-term trend is unclear, but it is in a medium and long-term uptrend. Given the maxim that “the trend is your friend,” the odds still favor an eventual continuation higher.

A break above $2,721 (Monday’s high) would be a bullish sign and give the green light to a continuation higher. The next target would be at $2,790, matching the previous record high.

Alternatively, a decisive break below the major trendline would likely lead to further losses, probably to the $2,536 November lows. Such a move would confirm the short-term trend as bearish.

A decisive break would be one accompanied by a long red candlestick that broke cleanly through the trendline and closed near its low – or three red candlesticks in a row that broke below the line.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- NZD/USD clings to recovery above 0.5900 triggered by the US Dollar’s correction.

- Investors await a string of US employment-related economic indicators.

- This week, the RBNZ cut interest rates by 50 bps to 4.25%.

The NZD/USD pair holds gains above the round-level support of 0.5900 in Friday’s European session. The Kiwi pair strengthens as the US Dollar Index (DXY) extends its correction after diving below the key support of 106.00 and posts a fresh two-week low near 105.60. However, it manages to recover some losses but is on track to close the week with an almost 1.5% decline.

The US Dollar (USD) weakens as the investors trim so-called ‘Trump Trades’ after United States (US) President-elect Donald Trump nominated Scott Bessent to fill the position of Treasury Secretary. Market participants expect Bessent to execute Trump-stated trade policies strategically and gradually with an intention to avoid a lethal trade war.

Going forward, investors will focus on a slew of US employment-linked data and the ISM Manufacturing and Services PMI data for November, which will be released next week. The array of economic data will influence market expectations for the Federal Reserve’s (Fed) monetary policy action in December.

According to the CME FedWatch tool, the likelihood for the Fed to cut interest rates by 25 basis points (bps) to 4.25%-4.50% in the December meeting is 66% while the rest supports leaving them unchanged.

Meanwhile, the New Zealand Dollar (NZD) performs strongly even though market participants expect the Reserve Bank of New Zealand (RBNZ) to cut interest rates again by 50 bps in its next monetary policy meeting in February 2025 after reducing by the same margin on Wednesday.

RBNZ Governor Adrian Orr kept doors for an outsize interest rate cut open but the decision will depend on economic conditions. Orr was confident about a further decline in inflationary pressures.

Economic Indicator

RBNZ Interest Rate Decision

The Reserve Bank of New Zealand (RBNZ) announces its interest rate decision after its seven scheduled annual policy meetings. If the RBNZ is hawkish and sees inflationary pressures rising, it raises the Official Cash Rate (OCR) to bring inflation down. This is positive for the New Zealand Dollar (NZD) since higher interest rates attract more capital inflows. Likewise, if it reaches the view that inflation is too low it lowers the OCR, which tends to weaken NZD.

Read more.Last release: Wed Nov 27, 2024 01:00

Frequency: Irregular

Actual: 4.25%

Consensus: 4.25%

Previous: 4.75%

Source: Reserve Bank of New Zealand