- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 28-11-2024

The European Central Bank (ECB) policymaker Francois Villeroy de Galhau said on Thursday that the central bank should keep its options open for a bigger rate cut next month and its policy rate could eventually fall to a level that once again boots growth, per Reuters.

Key quotes

Seen from today, there is every reason to cut on December 12. Optionality should remain open on the size of the cut, depending on incoming data, economic projections and our risk assessment.

Victory against inflation is in sight.

The inflation target may be reached in early 2025.

Our interest rates should clearly go to the neutral rate.

We still have significant room to remove the restrictive stance of our monetary policy.

I wouldn't exclude going below the neutral rate in the future.

There is every reason to cut on December 12th, optionality should remain open on the size.

For the following meetings, we shouldn't exclude any of them for possible cuts.

Market reaction

At the time of writing, the EUR/USD pair is trading 0.04% higher on the day to trade at 1.0559.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

The headline Tokyo Consumer Price Index (CPI) for November rose 2.6% YoY as compared to 1.8% in the previous month, the Statistics Bureau of Japan showed on Friday. Meanwhile, the Tokyo CPI ex Fresh Food, Energy came in at 2.2% in November vs. 1.8% in October.

Additionally, Tokyo CPI ex Fresh Food rose 2.2% in November against 2.1% expected and up from 1.8% in the prior month.

Market reaction to the Tokyo Consumer Price Index

As of writing, the USD/JPY pair was down 0.18% on the day at 151.21.

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

Reserve Bank of Australia (RBA) Governor Michele Bullock said on Thursday that Australia’s core inflation is “too high” to consider interest-rate cuts in the near term. Bullock reiterated that there’s still some way to go before prices return sustainably to target, per Bloomberg.

Key quotes

Policy will need to remain restrictive until there is more confidence in inflation.

There is still some way to go in returning inflation sustainably to target band.

Our forecasts suggest a sustainable return to target will occur in 2026.

The word ‘sustainably’ is important because it recognizes that we need to look through temporary factors that influence the headline inflation rate.

Given the tightness in Australia’s labor market, along with our assessment that the level of demand still exceeds supply in the broader economy, we expect it will take a little longer for inflation to settle at target.

If the data that we’re seeing and the information we’re getting from our liaison and so on suggests that inflation is picking up again, it’s not going to follow that trajectory, it’s going in another direction, then that would be a very big red flag for us.

Market reaction

At the time of writing, the AUD/USD pair is trading 0.02% lower on the day to trade at 0.6499.

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

- Gold price remains steady at $2,637 amid thin Thanksgiving trading.

- Trump's tariff threats weigh on Gold, but easing rhetoric towards Canada and Mexico offers some relief.

- Market eyes 70% chance of a 25 bps Fed rate cut, supporting gold as Treasury yields stay subdued.

Gold price consolidated around $2,630 on Thursday amid thin liquidity trading as US markets are closed for Thanksgiving. Geopolitics continued to drive the price of non-yielding metal, which dwindled during the last three trading days. The XAU/USD trades at $2,637, virtually unchanged.

Market mood improved on Thursday, partly due to Israel and Lebanon's 60-day ceasefire. However, the escalation of the Russia-Ukraine conflict could keep Bullion prices firmly above $2,600.

US President-elect Donald Trump's tariff threats on China, Canada, and Mexico limited the advance of the golden metal, with traders flying towards the safety of the Greenback. Sources cited by Reuters said, “It did increase a bit of concern about the possible repercussions from these two countries. So that continues to remain an important support factor for gold.”

Following Trump’s remarks, Gold tumbled due to risks linked to his threats. However, recent developments suggest that the US President-elect has eased his rhetoric to Canada and Mexico.

Gold recovered after the report and as market participants eyed another 25 basis point interest rate cut by the Federal Reserve at the upcoming December meeting.

The swaps market sees a probability of 70% of such a decision, according to the CME FedWatch Tool, as the odds improved from around 55% at the beginning of the week.

This would keep US Treasury bond yields depressed, which could undermine the Greenback.

Ahead this week, the US economic docket is absent, barring a surprise of a Federal Reserve speaker in the media. Next Monday, the schedule will be busy with the release of S&P Global and ISM Manufacturing PMI, and Fed Governor Christopher Waller crossing the wires.

Daily digest market movers: Gold prices fluctuate near $2,630

- Gold prices recovered as US real yields remained unchanged at 1.9906%.

- US data released on Wednesday showed the economy growing 2.8% in Q3, below estimates but unchanged from the preliminary estimate.

- This, along with the latest Core PCE Price for October coming at 2.8% YoY up from estimates of 2.7%, suggests the disinflation process has stalled and that the Fed might begin to pause cutting rates.

- Data from the Chicago Board of Trade, via the December fed funds rate futures contract, shows investors estimate 24 bps of Fed easing by the end of 2024.

Technical outlook: Gold price advances modestly, clings to $2,630

Gold price is consolidated within the 50 and 100-day Simple Moving Averages (SMAs), each at $2,668 and $2,572, respectively. Nevertheless, some upside in the short term is seen due to Gold’s being slightly pressed toward the former, but buyers need to clear key resistance levels.

If Gold clears the 50-day SMA, the next stop would be the $2,700 figure. A breach of the latter will expose the psychological $2,750, and the all-time high at $2,790.

Conversely, If bears push prices below $2,600, it will open the door to testing the 100-day SMA of $2,572, immediately followed by the November 14 swing low of $2,536.

Oscillators like the Relative Strength Index (RSI) have shifted bearishly, indicating sellers are in charge.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

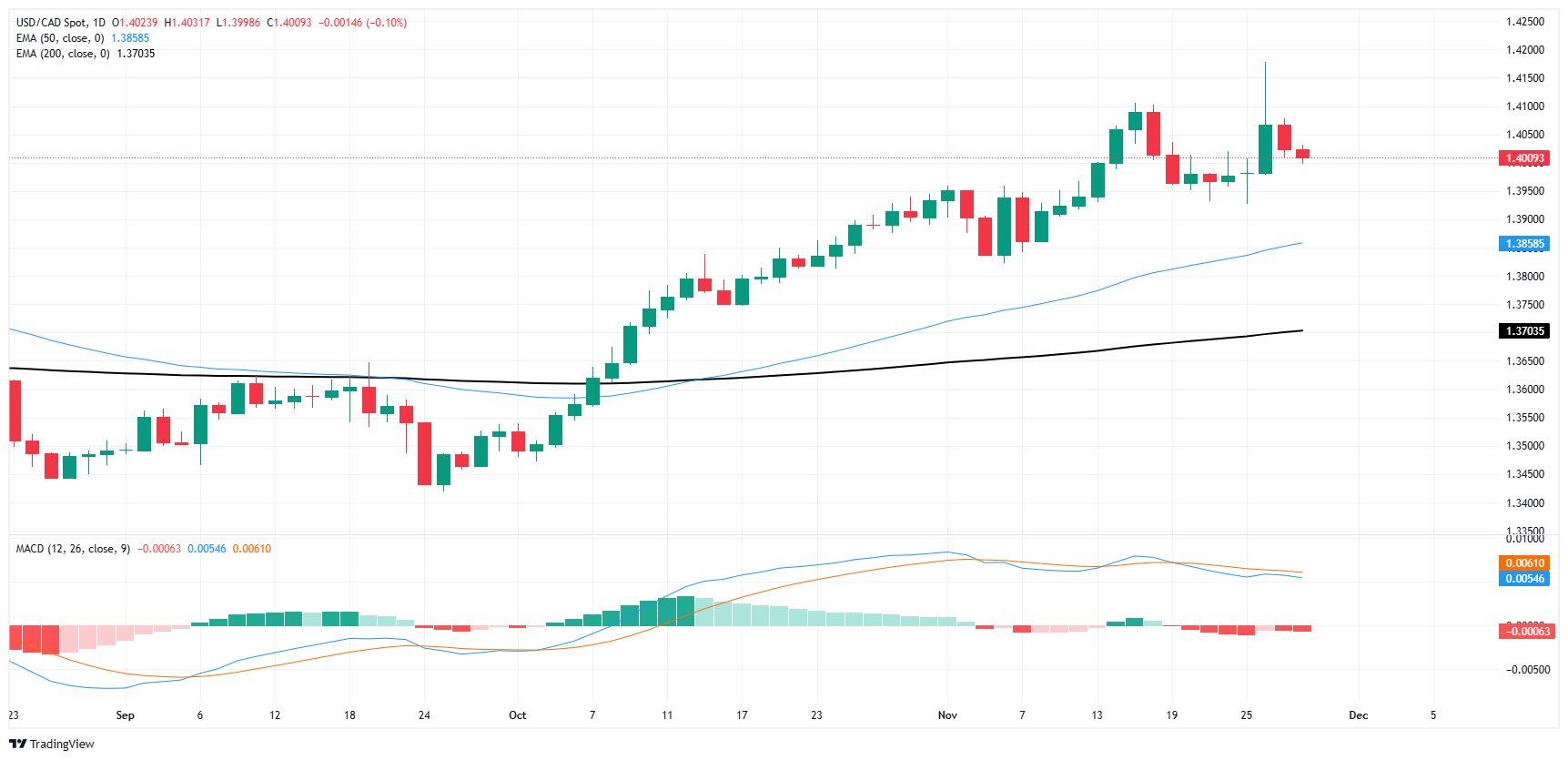

- USD/CAD trades in negative territory for the third consecutive day around 1.4010 in Friday’s early Asian session.

- The weakness in the US Dollar (USD) weighs on the pair, but potential downside seems limited.

- Canada’s Q3 GDP growth report will be in the spotlight on Friday.

The USD/CAD pair extends its downside to near 1.4010 during the early Asian session on Friday, pressured by the weakening of the US Dollar (USD) after the holiday-thinned market. All eyes will be on Canada’s Gross Domestic Product (GDP) growth number for the third quarter (Q3), which is due later on Friday.

The Greenback edges lower due to the month-end flows and some profit-taking for the US long weekend. Nonetheless, the cautious stance of the US Federal Reserve (Fed) might help limit the USD’s losses. The FOMC Minutes released on Tuesday showed that Fed officials see interest rate cuts ahead but at a gradual pace as inflation eases and the labor market remains strong.

On the Loonie front, traders brace for Canada’s third-quarter GDP growth, which is expected to grow 1.0% on an annualized basis in Q3, compared to the previous reading of 2.1%. On a monthly basis, Canadian GDP is estimated to expand 0.3% MoM in September, compared to August’s flat 0.0% print.

Any signs of slower growth in the Canadian economy might push the Bank of Canada (BoC) to deliver a second consecutive 50 basis points (bps) rate cut at the upcoming next rate decision on December 11. This, in turn, could drag the Canadian Dollar (CAD) lower and act as a tailwind for USD/CAD.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- EUR/USD failed to make any progress toward 1.0600, but is still holding steady.

- Holiday-thinned US markets kneecapped market volumes on Thursday.

- Shortened US hours will also trim volumes on Friday, but EU HICP inflation could spark a move.

EUR/USD churned chart paper just south of the 1.0600 handle on Thursday, failing to extend Fiber’s recent bullish recovery but not losing any ground either. Market volumes were constrained on Thursday with US markets dark for the Thanksgiving holiday, and Friday will likewise see crimped liquidity during the US session to wrap up the trading week.

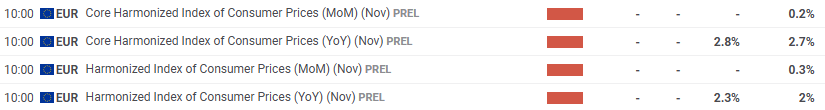

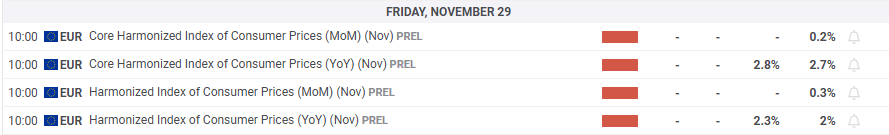

A fresh batch of pan-EU inflation figures are due on Friday, which could see the Euro take a leg higher rounding the corner into the weekend, however Fiber traders have had little reason to bid EUR/USD as of late. The key figures for Fiber will be pan-EU Harmonized Index of Consumer Prices (HICP) inflation. Core HICP inflation is forecast to tick upwards to 2.8% YoY in November from the previous 2.7%, which will throw a wrench in the works for several European Central Bank (ECB) officials who have hit newswires this week trying to soothe investors with promises of further rate cuts in December and heading into 2025.

On the Greenback side, next Friday’s US Nonfarm Payrolls (NFP) jobs report, scheduled for December 6, will be the big figure to watch. Next week’s NFP will take on renewed importance for traders now that watching for signs of rate cuts from the Federal Reserve (Fed) has taken a backseat as of late. However, a large move in either direction in NFP figures could jolt Treasury rates, sparking fresh fears of either too many or too few rate cuts heading into 2025.

EUR/USD price forecast

The Euro’s much-needed bullish reprieve on Wednesday gave Fiber bulls a chance to put more distance between themselves and the pair’s latest swing low below the 1.0400, but not by much. EUR/USD is poised for a battle with the 1.0600 handle, and even a victory on the key technical level still sees further topside momentum running aground of a quickly-descending 50-day Exponential Moving Average (EMA) falling through 1.0750.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- GBP/USD is treading water near 1.2700 with a quiet Friday on the docket.

- Data is thin on both sides of the Atlantic to wrap up the trading week.

- BoE”s FSR is unlikely to move the needle on Friday, markets await next week’s NFP.

GBP/USD saw a quiet Thursday session, trading on the thin side and holding on near the 1.2700 handle. US markets were dark on Thursday for the Thanksgiving holiday, and Friday will also see shortened US trading hours, keeping the back half of the trading week on the low end of volumes overall.

The Bank of England’s (BoE) latest Financial Stability Report will drop on markets early during Friday’s upcoming US market session. The release is overwhelmingly unlikely to drive much momentum in Cable markets. However, traders should still be on the lookout for low-volume volatility spikes. With the US slated to have shortened trading hours on Friday, overall market liquidity will be even lower than usual, making it easier for outsized orders to shock bids.

Next week’s economic data docket bodes just as poorly for the Pound Sterling. Very little data of note is slated for release next week on the UK side, while traders will be hunkering down to wait for next Friday’s US Nonfarm Payrolls (NFP) jobs report, scheduled for December 6. Next week’s NFP will take on renewed importance for traders now that watching for signs of rate cuts from the Federal Reserve (Fed) has taken a backseat as of late. However, a large move in either direction in NFP figures could jolt Treasury rates, sparking fresh fears of either too many or too few rate cuts heading into 2025.

GBP/USD price forecast

The GBP/USD trend is downward biased, though the British Pound has made some recovery. For buyers to regain control, they need to break above 1.2714, the November 20 high, and the 200-day Simple Moving Average (SMA) at 1.2818. If these levels are surpassed, moving towards 1.3000 will be challenging due to a recent 'death cross' formation between the 50-day and 100-day SMAs.

Sellers must close below 1.2600 for a bearish continuation, which would expose the November 26 low at 1.2506, followed by last week's low of 1.2486. Overall, while the GBP/USD has a slight short-term upside, significant downside risks persist.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- NZD/USD declined to 0.5895 on Thursday.

- Pair rejected at 20-day SMA and indicators lost some steam, but may have momentum to conquer the SMA.

- As long as the pair holds below the 20-day SMA, the outlook for the short-term will be negative.

The NZD/USD declined slightly in Thursday's session, reaching a low of 0.5895, before recovering some ground. Overall, the momentum seems to be mixed. The pair has been in a downtrend since late September, and the short-term outlook remains negative as long as it remains below the 20-day Simple Moving Average (SMA).

The technical indicators present conflicting signals. The Relative Strength Index (RSI) is currently at 47, indicating that it is in negative territory and suggests that selling pressure is present. On the other hand, the Moving Average Convergence Divergence (MACD) histogram is green and rising, indicating that buying pressure is rising. This divergence suggests that while there may be some selling pressure, there is also significant buying interest in the market.

Despite facing resistance at the 20-day SMA, NZD/USD maintains momentum from recent gains, with indicators suggesting both buying and selling pressure present. However, the downward trend continues as long as the pair remains below the mentioned SMA. When American traders return from Thanksgiving’s holiday, the pair may see further volatility which might set the direction of the pair.

NZD/USD daily chart

- AUD/USD stands neutral around 0.6490 on Thursday.

- US-China trade war concerns and upcoming AI chip sanctions weigh on AUD/USD.

- Greenback's weakness continues to support the Australian Dollar.

The AUD/USD stands mixed around 0.6495 in Thursday's session, reversing early gains. The recent weakness in the US Dollar (USD) has helped keep the Aussie afloat. However, buyers have turned cautious amid the United States (US)-China trade war. The US is set to unveil further Artificial Intelligence (AI) chip sanctions against China on Monday, which is weighing on the AUD/USD, due to the risk-off market sentiment that has been triggered.

The Australian Dollar (AUD) has gained support due to weakness in the US Dollar, despite mixed Australian economic data and a hawkish Reserve Bank of Australia (RBA).

Daily digest market movers: Australian dollar pressured as US-China trade concerns linger.

- The AUD/USD benefited lately from the USD softness which seems to be in a consolidation period.

- The Greenback fundamentals remain, with markets pricing a less dovish Federal Reserve (Fed) and strong economic data limiting the USD’s losses.

- On the other side, the Aussie could see some gains by the RBA’s hawkishness but Australia’s mixed economic outlook might limit the upside.

- The markets are seeing the RBA’s first rate cut to come in Q2 of 2025, while continuing to be confident of a Fed cut in December.

- In addition, trade wards fears between the US and China might also affect the Aussie as China is one of its largest trade partners.

AUD/USD technical outlook: Outlook is negative in the short term despite signs of mild recovery

The AUD/USD pair remains under pressure as technical indicators continue to point to a bearish bias, with the Relative Strength Index (RSI) hovering below the 50 mark but the Moving Average Convergence Divergence (MACD) is showing some signs of bullish presence.However, for the short term, the outlook remains negative unless the pair manages to recover above the 20-day SMA. Should this level be breached, it could signal a potential trend reversal and open the door for further gains in the AUD/USD.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

US markets took Thursday off for the Thanksgiving holiday, keeping the Greenback at bay and setting up European-session traders for a fresh round of preliminary pan-European HICP inflation figures for November.

Here’s what you need to know on Friday, November 29th:

The US Dollar Index (DXY) slumped into a flat day on Thursday, trading flatly near the 106.00 handle as holiday-thinned market volumes took the wind out of US market session sails. The Greenback’s broad-market index has eased from year-plus highs set late last week, but rushing too quickly into a bearish USD stance could catch short-term traders off-guard with a snap back into the high side.

EUR/USD also traded flat through most of Thursday’s market action, hobbled just south of the 1.0600 handle. Euro traders will be looking ahead to Friday’s wide docket of European economic data, but the key figures for Fiber will be pan-EU Harmonized Index of Consumer Prices (HICP) inflation. Core HICP inflation is forecast to tick upwards to 2.8% YoY in November from the previous 2.7%, which will throw a wrench in the works for several European Central Bank (ECB) officials who have hit newswires this week trying to soothe investors with promises of further rate cuts in December and heading into 2025.

GBP/USD struggled to make much progress in either direction, but Cable still managed to inch closer to the 1.2700 handle on Thursday. The UK has a clean data docket on Friday, although the Bank of England (BoE) is expected to release its latest Financial Stability Report.

USD/JPY reclaimed some lost ground on Thursday after a clean bounce off of the 200-day Exponential Moving Average (EMA) near 150.50 during the mid-week market session. However, bullish momentum remains absent as Yen traders gear up for Japanese inflation figures early Friday. Core Tokyo Consumer Price Index (CPI) inflation is expected to tick higher to 2.1% for the year ended in November, compared to the previous period’s 1.8%. While rising inflation will help push the Bank of Japan (BoJ) closer to increasing rock-bottom interest rates, investors have noted that Japan’s Unemployment Rate is also expected to tick up to 2.5% in November from 2.4%, a move that will give permadove BoJ policymakers all the fuel they need to continue holding rates in the basement for an undefined period.

AUD/USD remained stuck near the 0.6500 level, and a quiet data docket for the Antipodeans means the Aussie is likely to remain stuck near recent lows. AUD/USD fell over 7% top-to-bottom from September’s highs near 0.6940, and Aussie bulls are struggling to develop meaningful momentum.

- EUR/AUD falls 0.20%, influenced by expectations of ECB policy easing.

- Technical indicators show a shift to neutral as EUR/AUD invalidates head-and-shoulders pattern.

- Key resistances await at 1.6254 (50-day SMA) and 1.6300; supports positioned at 1.6168 and 1.6003.

- Support level are seen at 1.6200, 1.6168 and 1.6003.

The Euro took a hit and dived against the Australian Dollar as traders seemed convinced that the European Central Bank (ECB) would lower borrowing costs at the upcoming meeting. The chances of the ECB cutting 50 basis points remain, as most Eurozone economies remain subdued. At the time of writing, the EUR/AUD trades were at 1.6231, down 0.20%.

EUR/AUD Price Forecast: Technical outlook

The EUR/AUD shifted from a downward to a neutral bias. Once prices cleared the head-and-shoulders (H&S) chart pattern’s neckline, the H&S was invalidated, indicating that buyers' bulls were gathering momentum.

On its way north, the EUR/AUD found acceptance at 1.6200 before extending its gains, but bulls must reclaim the 50-day Simple Moving Average (SMA) at 1.6254 to keep their hopes of testing 1.6300.

Conversely, if bears move in and push the EUR/AUD below the H&S neckline below 1.6200, this could pave the way for further downside. On that outcome, the first support would be the November 27 low of 1.6168, followed by the November 25 daily low at 1.6003.

EUR/AUD Price Chart – Daly

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- The Canadian Dollar is mostly flat near familiar territory on Thursday.

- Canada GDP figures due Friday to draw some attention from Loonie traders.

- Market volumes are notably thin with US markets shuttered for Thanksgiving.

The Canadian Dollar (CAD) traded thinly on Thursday, sticking to the 1.4000 handle against the Greenback as global markets grind into slow gear in the latter half of the trading week with overall market volumes crimped by a lack of flow from US institutions. US markets are shuttered in observation of the Thanksgiving holiday today, and a shortened day for American markets on Friday also bodes poorly for consistent market moves to wrap up the week.

Canada will be printing updates to Gross Domestic Product (GDP) growth figures on Friday, leaving Loonie traders in the lurch for Thursday. Still, Canadian Current Account figures came in better than expected, helping to muscle the CAD into a slightly higher stance on the day.

Daily digest market movers: Canadian Dollar propped up by holiday markets

- The Canadian Dollar gains a scant tenth of a percent on Thanksgiving Thursday.

- Market flows have dried up with the US on holiday. Friday volumes will likely be constrained as well.

- Canada’s Current Account came in at -3.23 billion in the third quarter, better than the expected -9.3 billion and rebounding from the previous quarter’s revised -4.7 billion, which was initially released at -8.4 billion.

- On Friday, Canada’s third quarter GDP growth is expected to ease to just 1.0% on an annualized basis, down from the previous 2.1%.

- On a month-on-month basis, Canadian GDP is forecast to swing up to 0.3% MoM in September compared to August’s flat 0.0% print.

Canadian Dollar price forecast

The Canadian Dollar’s (CAD) is seeing a tepid rebound after tapping a 55-month low this week. The CAD has gained an intraday foothold against the US Dollar, dragging the USD/CAD pair back into the 1.4000 handle. The pair is still caught on the high end following a broad-market bull run in the Greenback. Still, technical traders will have an increasingly difficult time ignoring the growing potential for a cyclical turnaround in the long-term charts.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- The US Dollar Index trades near 106.00 neutral.

- US markets remain closed on Thursday forThanksgiving celebrations.

- Economic data may push the Fed not to hurry to cut rates.

The US Dollar Index (DXY), which measures the value of the USD against a basket of currencies, trades near 106.00 on Thursday, tilted higher by the US Dollar (USD) strength.

Thin liquidity is expected as most major trading floors will be closed across the United States, with Thanksgiving and Black Friday taking place, resulting in a very calm remaining two trading days for the week.

The US Dollar Index (DXY) remains bullish, supported by robust economic data and a hawkish Federal Reserve (Fed) stance. Despite recent profit-taking and geopolitical uncertainty, the uptrend is intact.

Daily digest market movers: US Dollar holds steady, calm end of the week ahead

- Thanksgiving and Black Friday holidays in the US have led to thin liquidity and a lull in trading activity.

- With only two trading days remaining this week, market movements are expected to be subdued.

- This week, November’s Federal Open Market Committee (FOMC) minutes suggested a cautious Fed with no rush to cut rates.

- Robust economic growth, resilient household spending and strong consumer confidence support a cautious Fed easing cycle.

- October’s Personal Consumption Expenditures (PCE) underscored persistent inflation and the need for caution which may push the Fed to consider less cuts.

- In the meantime, the odds of a cut in December by the Fed remain high but subdued.

DXY technical outlook: Outlook remains bullish despite consolidation

Despite temporary setbacks due to profit-taking and global uncertainty, the uptrend remains intact. Technical indicators, including the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), suggest consolidation, as they struggle to gain traction. However, the DXY remains supported by the 106.00-106.50 area, which has proven resilient and could prevent further losses. On the upside, key resistance is encountered at 107.00.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Mexican Peso strengthened after Trump – Sheinbaum’s call, reversing some of the losses spurred by Trump's earlier threats.

- Banxico minutes reflect a possibility of further interest rate adjustments based on the inflation outlook.

- Fed’s favorite inflation gauge suggests prices remain high, justifying its gradual approach.

The Mexican Peso rallied against the US Dollar on Thursday after being pressured by Trump’s tariff threats. Upbeat news related to a call between the United States (US) President-elect and Mexico’s President Claudia Sheinbaum weighed on the exotic pair as the Peso recovered and trimmed weekly losses. The USD/MXN trades at 20.41,down 0.72%.

The call betweenSheinbaum and Trump revealed that both countries found common ground to fix issues involving them. In his Truth Social network, Trump indicated that he “had a wonderful conversation with the new President of Mexico, Claudia Sheinbaum Pardo. She has agreed to stop migration through Mexico.” He added they discussed how they could work “to stop the massive drug inflow to the US.”

Following the post, the USD/MXN began to slide after hitting a new year-to-date (YTD) high of 20.82 on Monday.

On the monetary policy front, the Bank of Mexico (Banxico) revealed in its minutes that the inflationary scenario will allow for further adjustments to interest rates.

Across the north of the border, the Federal Reserve’s (Fed) preferred gauge for inflation, the Core Personal Consumption Expenditures (PCE) Price Index, increased 2.8% YoY in October, up from 2.7% in September and in line with analysts’ estimates.. This justifies the Fed’s policymakers' gradual approach to monetary policy, adopted since the latest meeting in early November.

Ahead this week, Mexico’s docket remains light, yet it will feature Fiscal Balance figures. However, USD/MXN traders should be aware of political developments, including US President-elect Donald Trump’s posts on social media.

Daily digest market movers: Mexican Peso to remain volatile – Banxico

- Banxico’s board members noted that the Mexican Peso traded broadly, depreciating markedly and exhibiting volatility mainly due to uncertainty about the US election.

- They added that inflation risks are tilted to the upside, mentioning a greater exchange rate depreciation. They acknowledged the outlook for inflation still calls for a restrictive policy stance.

- In the bank's quarterly report, Banxico’s Governor Victoria Rodriguez commented that they monitored the recent peso volatility and added that there has not been a need to intervene in the forex market.

- The quarterly report revealed that Banxico updated the Mexican economy to grow 1.8% in 2024, up from 1.5%. Nevertheless, the central bank kept its 2025 Gross Domestic Product (GDP) projection at 1.2%.

- The CME FedWatch Tool suggests that investors see a 66% chance of a 25-basis-points (bps) rate cut at the US central bank’s December meeting, up from 59% a day ago.

- Data from the Chicago Board of Trade, via the December Fed funds rate futures contract, shows investors estimate 24 bps of Fed easing by the end of 2024.

USD/MXN technical outlook: Mexican Peso recovers as USD/MXN falls below 20.50

The USD/MXN is still upward biased despite hitting a daily low of 20.20. Despite recovering some ground, it remains below the psychological 20.50 figure, meaning that bulls are not out of the woods. If they want to extend the uptrend, they need to reclaim 20.50, followed by the YTD high of 20.83, ahead of the 21.00 mark. Once those levels are cleared, bulls will target the March 8, 2022, peak at 21.46, followed by the November 26, 2021, high at 22.15.

Conversely, if bears drag the exchange rate below 20.00, the next support would be the 50-day Simple Moving Average (SMA) at 19.90. Key support levels lie beneath the latter, with the 100-day SMA at 19.45, before the psychological 19.00 figure.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- EUR/CAD shed 0.30% on Thursday to trade near 1.4770.

- The cross faced rejection at the 20-day and 200-day SMA convergence at around 1.4800, completing a bearish crossover.

- The bearish crossover tends to be bearish sign, hinting at further weakness in the pair.

The EUR/CAD fell by 0.30% on Thursday, reaching approximately 1.4770. The convergence of the 20-day and 200-day Simple Moving Averages (SMAs) around 1.4800 was rejected the cross, which resulted in a bearish crossover. This bearish crossover may suggest more weakness in the pair.

Technical indicators, such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), substantiate the bearish momentum in EUR/CAD's recent price action. The RSI, currently in negative territory, shows increasing selling pressure with a declining slope, suggesting a rise in bearish sentiment. Meanwhile, the MACD, though flat, remains in red, indicating sustained selling pressure.

The EUR/CAD pair has been facing strong resistance at the confluence of its 20-day and 200-day SMAs, leading to a bearish crossover. This signals potential weakness in the pair in the coming sessions as it may invalidate it latest strides to recover.

EUR/CAD daily chart

- GBP/USD maintains a downward trend but shows signs of short-term upward bias.

- Resistance levels to watch include 1.2714 and the 200-day SMA at 1.2818.

- Key supports lie at 1.2600 and further down at the November 26 low of 1.2506.

- Oscillators like the Relative Strength Index (RSI) hint at continued bearish sentiment despite a recent uptick

The GBP/USD consolidates at around weekly highs, posting modest losses of 0.05% at around 1.2670 due to thin liquidity conditions as US markets remain closed for Thanksgiving.

The Greenback has been pressured for the last few days due to month-end flows and rebalancing, noted ING. Although US data was upbeat on Wednesday, market participants digested Trump’s tariff rhetoric.

GBPUSD Price Forecast: Technical outlook

The GBP/USD trend remains downward biased, although the Pound has recovered some ground. If buyers want to regain control, first, they need to clear 1.2714, the November 20 high, followed by the 200-day Simple Moving Average (SMA) at 1.2818, which has turned flat. If those two resistance levels are surpassed, buyers' ride toward 1.3000 would not be easy after the 50-day SMA just crossed below the 100-day SMA and accelerated toward forming a ‘death-cross.’

Conversely, sellers must achieve a daily close below 1.2600 for a bearish continuation. A breach of the latter will expose the November 26 low of 1.2506, ahead of last week's low of 1.2486.

Oscillators such as the Relative Strength Index (RSI) remain bearish-biased despite rising for three straight days. The GBP/USD is tilted to the upside in the short term, but downside risks remain.

GBP/USD Price Chart – Daily

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.11% | -0.01% | 0.23% | -0.04% | 0.03% | 0.19% | 0.13% | |

| EUR | -0.11% | -0.11% | 0.14% | -0.15% | -0.08% | 0.08% | 0.02% | |

| GBP | 0.01% | 0.11% | 0.25% | -0.02% | 0.04% | 0.19% | 0.13% | |

| JPY | -0.23% | -0.14% | -0.25% | -0.28% | -0.20% | -0.09% | -0.12% | |

| CAD | 0.04% | 0.15% | 0.02% | 0.28% | 0.08% | 0.22% | 0.16% | |

| AUD | -0.03% | 0.08% | -0.04% | 0.20% | -0.08% | 0.16% | 0.10% | |

| NZD | -0.19% | -0.08% | -0.19% | 0.09% | -0.22% | -0.16% | -0.07% | |

| CHF | -0.13% | -0.02% | -0.13% | 0.12% | -0.16% | -0.10% | 0.07% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

- USD/CHF has broken below a key level bringing the uptrend into doubt.

- Other band omens are also appearing suggesting the possibility of a bearish shift in the trend.

USD/CHF is at risk of tipping into a downtrend and reversing its short and medium-term bull trend, as it extends its pullback below a key level. Other “bad omens” also make their appearance on the price chart, suggesting a risk of more downside.

USD/CHF Daily Chart

USD/CHF has found support at the (green) 200-day Simple Moving Average (SMA) at 0.8822 and although it could still mount a recovery from its current level and thereby rescue the uptrend, the evidence is building for a possible reversal and start of new downtrend. Given “the trend is your friend” such a reversal would suggest a bearish bias then dominating.

The pair has broken below the key 0.8801 November 9 swing low and although it failed to close below the level, the breach is still a bearish indication.

The pair formed a Two-Bar reversal pattern (red rectangle on chart) at the November 22 and 23 highs which is bearish. This happens when a long green candle that reaches a peak is followed by a long red candle of a similar size. It is a sign of a reversal in sentiment and a signal of more downside to follow.

The Relative Strength Index (RSI) momentum indicator has formed a Double Top pattern (red ellipse) which is bearish for momentum and consequently also price.

A break below the 0.8797 November 27 low would confirm a change in the short-term trend and more downside to targets at 0.8748 (August 14 high), and 0.8615 (November 4 low).

That said, if price remains above the November 27 low and recovers, it could signal a resumption of the uptrend.

If so, a break above the 0.8958 November 22 high would probably confirm a continuation up to the next target at 0.9000 (round number and psychological area), followed by 0.9050 (July 2 swing high).

- EUR/JPY edges higher on a stronger Euro but fails to build on gains due to conflicting data from the Eurozone.

- The Yen benefits from heightened expectations of the BoJ hiking interest rates in December, increasing inflows into the Yen.

- Lawmakers in Japan are debating a supplementary budget which could deliver cash handouts to households and stoke inflation.

EUR/JPY edges higher to just below the 160.00 level on Thursday after survey data released by the European Commission suggested stubborn inflation expectations might keep interest rates more elevated than previously thought in the Eurozone. This supports the Euro (EUR) since higher interest rates support foreign capital inflows. However, weaker German inflation data contradicts the survey’s findings and keeps the Single Currency under pressure.

“The European Commission survey was little changed in November and is still consistent with weak growth at best, while the price components suggest that inflationary pressures remain sticky,” said Elias Hilmer, assistant economist at Capital Economics of the data.

The Japanese Yen (JPY), meanwhile, trades mixed. On the one hand it is pressured by political risk due to the ruling party’s tenuous grip on power, whilst on the other hand it remains underpinned by expectations the BoJ will raise interest rates at the end of the year.

Political risk for the Yen

On Thursday, the Japanese parliament convened an extraordinary session to begin a 24-day deliberation of the supplementary budget as well as laws governing party funding.

The supplementary budget is expected to help inflation-hit households with cash handouts, whilst policymakers will also debate new laws around political party fundraising after a high profile scandal, in which members of Prime Minister Shigeru Ishiba’s ruling LDP party were found to have amassed private slush funds from fundraising activities, according to Kyodo News. His party rules Japan with a tenuous minority alongside its junior partner, the Momeito party.

If the budget is passed it could drive more inflation, increasing the chances of the Bank of Japan (BoJ) raising its permanently ultar-low interest rate of 0.25%. Higher interest rates are positive for the Yen because they increase foreign capital inflows.

BoJ Governor Kazuo Ueda recently repeated that a rate hike in December was still possible, citing concerns over the Yen’s weakness. Markets are now pricing in a roughly 60% chance of a 25 basis point rate hike in Japan next month, up from around 50% just a week ago, according to Trading Economics.

German Inflation undershoots expectations

EUR/JPY sees upside curtailed on Thursday after just-released preliminary German Consumer Price Index (CPI) data for November fell below economists expectations, weighing on the Euro. The data contradicts the earlier European Commission survey data and increases the chances the European Central Bank (ECB) will begin a more aggressive phase of interest rate cuts in the Eurozone.

German headline CPI rose by 2.2% in November, below the 2.3% expected and core CPI remained at 2.4%, falling below the expected 2.6%.

Traders now await Japanese Tokyo CPI data on Friday for fresh clues as to the direction of monetary policy in Japan, with implications for the direction of the Japanese Yen and its pairs.

- Silver price rebounds strongly as a fresh escalation in the war between Russia and Ukraine bolstered its safe-haven demand.

- Russia hit 14 targets in Ukraine, which resulted in a nationwide blackout.

- The US Dollar bounces back as the Fed is expected to cut interest rates cautiously.

Silver price (XAG/USD) recovers its intraday losses and ticks up to nearly $30.15 in the North American session on Thursday after posting a fresh 11-week low around $29.65. The white metal bounces back as a fresh escalation in the war between Russia and Ukraine has improved its safe-haven demand.

Tensions between Ukraine and Russia intensified after Russia launched its Intermediate-range Ballistic Missiles (IRBM) to hit 17 targets in Ukraine including, military facilities, defense industry facilities and their support systems in response to their attack deep inside Russia through the United States (US) ATACMS missiles last week, Russian President Vladimir Putin said at a security summit in Kazakhstan on Thursday.

According to the energy ministry in Kyiv, this is the 11th large-scale assault by Russia on Ukraine’s energy supplies this year, which caused the nationwide blackout, CNN reported.

Historically, the safe-haven appeal of precious metals such as Silver increases at times of global market uncertainty or heightened geopolitical risks.

Meanwhile, the US Dollar (USD) bounces back in a thin trading volume trading day as United States (US) markets are closed on account of Thanksgiving Day. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, rebounds to near 106.30 after a sharp correction in the last three days. The USD Index rebounds on expectations that projected growth in the Personal Consumption Expenditure (PCE) inflation data for November would force Federal Reserve (Fed) officials to act cautiously on interest rate cuts.

Silver technical analysis

Silver price rebounds strongly after sliding to near the upward-sloping trendline around $29.50, which is plotted from the February 29 low of $22.30 on a daily timeframe. Still, the outlook of the Silver price is bearish as a bear cross, represented by 20 and 50-day Exponential Moving Average (EMA) around $31.30, points to an escalation in the downside trend.

The white metal weakened after the breakdown of the horizontal support plotted from the May 21 high of $32.50.

The 14-day Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, suggesting a sideways trend.

Silver daily chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

- Annual inflation in Germany edged slightly higher in November's flash estimate.

- EUR/USD continues to fluctuate in a tight channel at around 1.0550.

Inflation in Germany, as measured by the change in the Consumer Price Index (CPI), rose to 2.2% on a yearly basis in November from 2% in September, Destatis' flash estimate showed on Thursday. This reading came in below the market expectation of 2.3%.

On a monthly basis, the CPI declined 0.2% as anticipated.

The Harmonized Index of Consumer Prices in Germany, the European Central Bank's preferred gauge of inflation, increased 2.4% on a yearly basis, matching September's reading and falling short of analysts' estimate of 2.6%.

Market reaction

EUR/USD showed no immediate reaction to these figures and was last seen losing 0.25% on the day at 1.0540.

- The US Dollar trades mildly positive against most major currencies.

- With Thanksgiving and Black Friday ahead, US trading activity and volumes will be subdued.

- The US Dollar Index trades back above 106.00 after a brief excursion found support below the level on Wednesday.

The US Dollar (USD) trades overall marginally higher against most major pairs on Thursday, with the US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, bouncing back above 106.00 after a sharp sell-off the prior day, in what is expected to be a very calm remaining two trading days for the week with Thanksgiving and Black Friday taking place. Thin liquidity and most major trading floors will be closed across the United States.

Meanwhile, the focus shifts to Europe, where France is struggling to convince markets it can pass its much-needed budget after France’s Prime Minister, Michel Barnier, warned that mayhem could take place in financial markets if the French parliament does not support the budget bill with the possibility that the French government could fall, Bloomberg reports.

Daily digest market movers: Markets are enjoying Thanksgiving

- The US economic calendar will be empty on Thursday and Friday due to the Thanksgiving holidays.

- Equities are trading in the green overall this Thursday. European indices are up nearly 1%, while US futures are flat to marginally higher on the day.

- The CME FedWatch Tool is pricing in another 25 basis points (bps) rate cut by the Fed at the December 18 meeting by 68.2%. A 31.8% chance is for rates to remain unchanged. The Fed Minutes have helped the rate cut odds for December to move higher.

- The US 10-year benchmark rate trades at 4.26%, and will not move this Thursday with the US bond market being closed.

US Dollar Index Technical Analysis: Risks above Europe

The US Dollar Index (DXY) might be moving in the coming two days due to some outside forces. One driver could come from the Eurozone, where France’s budget hangs in the balance. Should the balance not pass Parliament, France’s yields and spreads with other European countries could get out of control and trigger uncertainty for the Eurozone and the Euro (EUR), thus making the US Dollar (USD) outperform the shared currency.

With the profit taking this week, the pivotal resistance of 107.35 (October 3, 2023, high) became active again. The fresh two-year high at 108.07 reached last Friday is the level to beat further up. A brief spike to the 109.00 big figure level could play out in a volatile moment.

The DXY is bouncing off from 105.89, a pivotal level since May 2, which was held under profit-taking pressure on Wednesday. A touch lower, the pivotal 105.53 (April 11 high) should avoid any downturns towards 104.00. Should the DXY fall all the way towards 104.00, the big figure and the 200-day Simple Moving Average at 104.02 should catch any falling knife formation.

US Dollar Index: Daily Chart

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- AUD/NZD has confirmed a bearish reversal pattern after peaking in late November.

- The MACD has crossed below its signal line providing a sell signal.

AUD/NZD has completed a Three Black Crows candlestick pattern (red rectangle on chart) after peaking at the November 25 multi-month high.

AUD/NZD Daily Chart

The Three Black Crows is a Japanese candlestick pattern which occurs after a market peak, when three red down days occur consecutively. Such a pattern indicates the odds favor AUD/NZD moving to lower lows.

The (blue) Moving Average Convergence Divergence (MACD) has crossed below its red signal line, giving a sell signal and reinforcing the bearish candlestick pattern.

Support lies first at the 200-day Simple Moving Average (SMA) at 1.9029 and then at the trendline for the broader uptrend at around 1.0900.

A break below the low of the Three Black Crows at 1.0992 would confirm a continuation to the above-mentioned targets.

- Gold continues to snake higher on Thursday as markets price in higher probabilities of the Fed cutting interest rates in December.

- A softening of Trump’s rhetoric on tariffs is a possible factor in the falling interest rate expectations.