- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 27-11-2020

On Monday, at 00:00 GMT, New Zealand will release ANZ's business confidence indicator for November. Also at this time, Australia will present inflation data from MI for November. At 00:30 GMT, Australia will announce changes in the volume of operating profit of companies for the 3rd quarter and the volume of lending to the private sector for October. At 01:00 GMT, China will publish the PMI for the manufacturing sector and the non-manufacturing activity index for November. At 05:00 GMT, Japan will report a change in the construction orders for October. At 07:30 GMT, Switzerland will announce changes in retail trade volume for October, and at 08:00 GMT, it will release the KOF index of leading economic indicators for November. At 09:30 GMT, Britain will announce changes in the volume of the M4 money supply aggregate, the number of approved mortgage applications and the volume of net loans to individuals for October. At 10:30 GMT ECB chief Lagarde will deliver a speech. At 13:00 GMT, Germany will present the consumer price index for November. At 13:30 GMT, Canada will report changes in the volume of construction permits for October and the balance of payments for the 3rd quarter, as well as release the producer price index for October. At 14:45 GMT, the US will publish the Chicago purchasing managers ' index for November. At 15:00 GMT, the US will announce a change in the volume of pending home sales for October. Also on Monday, there will be a OPEC meeting and a meeting of the Eurogroup. At 21:30 GMT, Australia will release the AIG manufacturing activity index for November. At 23:30 GMT, Japan will report a change in the unemployment rate for October, and at 23:50 GMT, it will report a change in the volume of capital expenditures for the 3rd quarter.

On Tuesday, at 00:30 GMT, Japan will publish the manufacturing PMI for November. Also at 00:30 GMT, Australia will report changes in the volume of construction permits for October and the balance of payments for the 3rd quarter. At 01:45 GMT China will introduce the PMI index for the manufacturing sector from Caixin for November. At 03:30 GMT in Australia, RBA's interest rate decision will be announced and the RBA statement will be released. At 06:45 GMT, Switzerland will announce changes in GDP for the 3rd quarter, and at 08:30 GMT it will release the PMI for the manufacturing sector for November. At 08:50 GMT, France will present the index of business activity in the manufacturing sector for November. At 08:55 GMT, Germany will report changes in the unemployment rate and the number of unemployed for November, as well as release the index of business activity in the manufacturing sector for November. At 09:00 GMT, the Euro zone will publish the index of business activity in the manufacturing sector for November. At 09:30 GMT, Britain will present the PMI for the manufacturing sector for November. At 10:00 GMT, the Eurozone will release the consumer price index for November. At 13:30 GMT, Canada will report changes in GDP for September. At 14:45, the US will publish the index of business activity in the manufacturing sector for November, and 15:00 GMT - the ISM manufacturing index for November. Also at 15:00 GMT, the US will announce a change in the construction spending for October. In addition, at 15:00 GMT, the head of the Fed Powell will make a speech. At 17:00 GMT ECB chief Lagarde will deliver a speech. At 23:50 GMT, Japan will announce a change in the monetary base for November.

On Wednesday, at 00:30 GMT, Australia will report changes in GDP for the 3rd quarter. At 05:00 GMT, Japan will release a consumer confidence indicator for November. At 07:00 GMT Germany will report the change of volume of retail sales in October. At 07:30 GMT, Switzerland will publish the consumer price index for November. At 10:00 GMT, the Euro zone will present the producer price index for October, and report changes in the unemployment rate for October. At 13:15 GMT, the US will announce a change in the number of employees from ADP for November. At 13:30 GMT, Canada will announce a change in the level of labor productivity for the 3rd quarter. At 15:00 GMT, the head of the Fed Powell will make a speech. At 15:30 GMT, the US will report changes in oil reserves according to the Ministry of energy. At 19:00 GMT in the US, the Fed "Beige Book" will be presented. At 21:30 GMT, Australia will release the AIG construction activity index for November. At 21:45 GMT, New Zealand will announce a change in the volume of construction permits for October.

On Thursday, at 00:00 GMT, New Zealand will release the ANZ commodity price index for November. At 00:30 GMT, Australia will report a change in the foreign trade balance for October. Also at 00:30 GMT, Japan will present the index of business activity in the service sector for November. At 01:45 GMT China will publish the index of business activity in the services sector from Caixin for November. Then the focus will be on business activity indices in the services sector for November: at 08:50 GMT, France will report, at 08:55 GMT - Germany, at 09:00 GMT - the Eurozone, and at 09:30 GMT - Britain. At 10:00 GMT, the Euro zone will announce a change in retail trade volume for October. At 13:30 GMT, the US will announce a change in the number of initial applications for unemployment benefits for November. At 14:45 GMT, the US will release the PMI for the services sector for November, and at 15:00 GMT - the ISM index for the non-manufacturing sector for November.

On Friday, at 00:30 GMT Australia will report the change of volume of retail sales for October. At 07:00 GMT Germany will report the change in the factory orders for October. At 07:45 GMT, France will announce a change in the state budget balance for October. At 09:30 GMT, Britain will release the PMI for the construction sector for November. At 13:30 GMT, the US will report changes in the unemployment rate and the nonfarm payrolls for November, as well as the foreign trade balance for October. At 13:30 GMT, Canada will announce changes in the unemployment rate and the number of employees for November, as well as the balance of foreign trade for October. At 15:00 GMT, the US will announce changes in the volume of production orders for October. At 18:00 GMT, in the United States, the Baker Hughes report on the number of active oil drilling rigs will be released.

FXStreet notes that this week the markets were buoyed by the news that President-elect Joe Biden intends to nominate Janet Yellen to be Treasury secretary but, economists at Capital Economics suggest that, while she is eminently qualified, her lack of political deal-making experience could be an Achilles heel.

“Without question, Janet Yellen, the ex-Fed Chair and academic economist, will have a very close working relationship with current Fed Chair Jerome Powell, which will presumably include trying to revive the Fed’s emergency lending facilities that Mnuchin will allow to expire at the end of this year. But as an ardent defender of the Fed’s independence and inflation-fighting mandate, she would seem to be the last person who would put pressure on the Fed to fund additional government spending via any MMT-style monetary financing by the Fed."

“The big question is whether she will be able to sell Biden’s economic plans to a split Congress. At first glance, her quiet and deliberate demeanour suggests she might struggle. But we definitely wouldn’t underestimate her and, besides, unlike the many State Governors who have little Washington experience when they become President, Biden knows Congress inside-out and can do his own deal-making. In which case, the only possible drawback to Yellen’s nomination may not matter that much in practice.”

FXStreet notes that the loonie continues to be pushed and pulled by currencies moving versus the USD, leaving the CAD stronger against the greenback over the past month. According to economists at CIBC, the USD/CAD pair is likely rangebound until it becomes clear that the Bank of Canada (BoC) will lag the Fed on hikes.

“A generally range-bound US dollar in the next couple of quarters will remove one impetus for loonie appreciation. Both Canada and the US will be dealing with second waves of COVID-19, but there are now some questions emerging on whether Canada will have a longer wait for mass vaccination, given its lack of domestic vaccine manufacturing capacity. If the vaccine timeline in Canada lags materially behind its peers, that could compound C$ weakness.”

“Over the medium-term, we look for the loonie to soften, once trade fundamentals are no longer being offset, as they are today, by overnight rates above the US dollar and other majors.”

“Note that markets have been assuming that the BoC will lead the way on rate hikes, which runs counter to the fact that Canada’s GDP will have suffered a larger drop in 2020. As the BoC signals it can be very patient, we look for USD/CAD to end 2021 at 1.36.”

NFXStreet reports that the EU leaders are scheduled to meet on December 10-11 and economists at Raobank remain of the view that tensions between Hungary/Poland and the rest of the EU may escalate in the coming weeks.

“Hungarian PM Orban and his Polish counterpart Morawiecki aligned and solidified objections to the rule of mechanism during their meeting in Budapest on Thursday."

“We do see a risk of a brief spike higher in EUR/PLN and EUR/HUF amid growing market realisation that it may take much longer to solve this dispute and the redistribution of EU funds could be substantially delayed which would be negative for European assets in the short-term.”

“The price action in EUR/PLN has started to look more bullish as the downside trendline - which capped gains since the middle of November – has been cleared. A close above the 4.50 pivot would be another indication that the short-term bias has shifted to the upside.”

“A period of consolidation in EUR/HUF should be followed by another leg higher towards the October high at 369.25.”

U.S. stock-index futures rose on Friday, as optimism around an economic recovery next year outweighed concerns around an expected spike of coronavirus cases after gatherings for the Thanksgiving holiday and concerns over doubts around the effectiveness of AstraZeneca/Oxford University’s COVID-19 vaccine candidate.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 26,644.71 | +107.40 | +0.40% |

Hang Seng | 26,894.68 | +75.23 | +0.28% |

Shanghai | 3,408.31 | +38.57 | +1.14% |

S&P/ASX | 6,601.10 | -35.30 | -0.53% |

FTSE | 6,329.79 | -33.14 | -0.52% |

CAC | 5,596.63 | +29.84 | +0.54% |

DAX | 13,304.18 | +17.61 | +0.13% |

Crude oil | $45.25 | -1.01% | |

Gold | $1,778.50 | -1.81% |

FXStreet reports that Senior Economist at UOB Group Alvin Liew assessed the latest publication of the FOMC Minutes.

“There was an in-depth discussion about the FOMC’s asset purchase program in the November FOMC minutes which detailed that shifting circumstances could lead to adjustments to the pace and composition of asset purchases so as to provide more accommodation if the need arises.”

“Participants discussed plans to provide more concrete guidance on their asset purchases by linking the time frame for the program to economic conditions and that the Committee ‘might want to enhance its guidance for asset purchases fairly soon’. Most Fed officials were of the view to taper the asset buying program before raising rates (which is unlikely to happen until end of 2023).”

“We now expect more monetary easing/accommodation by the Fed from its existing tool kits, and the first in line will be the asset purchase program. As was highlighted in the minutes, we think it may come in the form of either 1) shifting its UST purchases to those with longer-maturities (without increasing the size of the overall purchases) or 2) keeping the current purchase composition but over a longer period. We expect the Fed to keep its near zero percent policy rate until at least 2023 but the Fed will not lower rates beyond zero, into negative territory. Re-visiting yield curve control is also a possibility but not in the immediate future.”

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 177.4 | 0.28(0.16%) | 541 |

ALCOA INC. | AA | 20.83 | 0.46(2.26%) | 1191558 |

ALTRIA GROUP INC. | MO | 40.69 | 0.31(0.77%) | 12291 |

Amazon.com Inc., NASDAQ | AMZN | 3,217.90 | 32.83(1.03%) | 60142 |

American Express Co | AXP | 120 | -0.58(-0.48%) | 4200 |

Apple Inc. | AAPL | 116.93 | 0.90(0.78%) | 500903 |

AT&T Inc | T | 29.08 | 0.09(0.31%) | 71808 |

Boeing Co | BA | 218.91 | 1.30(0.60%) | 127603 |

Chevron Corp | CVX | 91.71 | -0.43(-0.47%) | 10087 |

Cisco Systems Inc | CSCO | 42.76 | 0.26(0.61%) | 24106 |

Citigroup Inc., NYSE | C | 56.9 | -0.16(-0.28%) | 29007 |

Deere & Company, NYSE | DE | 257.66 | 1.23(0.48%) | 4172 |

E. I. du Pont de Nemours and Co | DD | 64.9 | 0.31(0.48%) | 454 |

Exxon Mobil Corp | XOM | 40.67 | -0.14(-0.34%) | 68441 |

Facebook, Inc. | FB | 277.97 | 2.38(0.86%) | 86229 |

FedEx Corporation, NYSE | FDX | 290.2 | 1.90(0.66%) | 5675 |

Ford Motor Co. | F | 9.13 | 0.05(0.55%) | 270088 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 24.21 | 0.67(2.85%) | 189289 |

General Electric Co | GE | 10.6 | 0.10(0.95%) | 616018 |

General Motors Company, NYSE | GM | 45.55 | 0.09(0.20%) | 39554 |

Goldman Sachs | GS | 236 | -0.54(-0.23%) | 1057 |

Google Inc. | GOOG | 1,781.87 | 10.44(0.59%) | 2295 |

Hewlett-Packard Co. | HPQ | 22.15 | -0.10(-0.45%) | 11230 |

Home Depot Inc | HD | 275 | 1.04(0.38%) | 7712 |

Intel Corp | INTC | 47.33 | 0.28(0.60%) | 73764 |

International Business Machines Co... | IBM | 124.47 | 0.27(0.22%) | 11474 |

International Paper Company | IP | 51.39 | 0.32(0.63%) | 629 |

Johnson & Johnson | JNJ | 144.5 | 0.82(0.57%) | 34634 |

JPMorgan Chase and Co | JPM | 121.7 | -0.33(-0.27%) | 9784 |

McDonald's Corp | MCD | 219.45 | 0.11(0.05%) | 1895 |

Merck & Co Inc | MRK | 80.3 | 0.24(0.30%) | 7292 |

Microsoft Corp | MSFT | 215.11 | 1.24(0.58%) | 67484 |

Nike | NKE | 136 | 0.46(0.34%) | 4871 |

Pfizer Inc | PFE | 36.71 | 0.18(0.49%) | 437535 |

Procter & Gamble Co | PG | 139.38 | 0.70(0.50%) | 5389 |

Starbucks Corporation, NASDAQ | SBUX | 98.48 | 0.28(0.29%) | 4750 |

Tesla Motors, Inc., NASDAQ | TSLA | 583.23 | 9.23(1.61%) | 1621396 |

The Coca-Cola Co | KO | 53.11 | 0.18(0.34%) | 11118 |

Twitter, Inc., NYSE | TWTR | 46.69 | 0.26(0.56%) | 43427 |

UnitedHealth Group Inc | UNH | 336 | 2.81(0.84%) | 2796 |

Verizon Communications Inc | VZ | 60.55 | 0.14(0.23%) | 1506 |

Visa | V | 211.99 | 1.10(0.52%) | 7173 |

Wal-Mart Stores Inc | WMT | 152.98 | 1.15(0.76%) | 21489 |

Walt Disney Co | DIS | 148.51 | -0.58(-0.39%) | 20563 |

Yandex N.V., NASDAQ | YNDX | 66.5 | 0.88(1.34%) | 4923 |

- Coronavirus aid for companies will amount to EUR4.5 billion a week in December

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 07:45 | France | Consumer spending | October | -4.4% | 2.9% | 3.7% |

| 07:45 | France | CPI, m/m | November | 0% | 0.1% | 0.2% |

| 07:45 | France | CPI, y/y | November | 0% | 0.1% | 0.2% |

| 07:45 | France | GDP, q/q | Quarter III | -13.8% | 18.2% | 18.7% |

| 08:10 | Germany | German Buba President Weidmann Speaks | ||||

| 10:00 | Eurozone | Industrial confidence | November | -9.2 | -10.5 | -10.1 |

| 10:00 | Eurozone | Consumer Confidence | November | -15.5 | -17.6 | -17.6 |

| 10:00 | Eurozone | Economic sentiment index | November | 91.1 | 86.5 | 87.6 |

GBP fell against its major rivals in the European session on Friday as the outcome of the UK-EU talks on a post-Brexit trade deal remained uncertain.

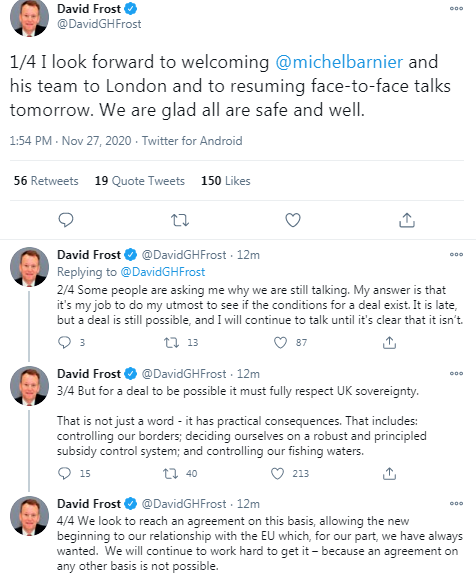

The UK and the EU's trade negotiators are still trying to finalize the post-Brexit trade deal. However, the stumbling blocks to an agreement still remain. The media reported that the EU's chief negotiator Michel Barnier told EU envoys he cannot say at this stage if a deal with the UK is possible. Barnier announced he will be traveling to London this evening to continue talks, as he and his team are no longer in quarantine. He also acknowledged that "same significant divergences persist". Meanwhile, the UK's Prime Minister Boris Johnson noted that substantial and important differences remain to be bridged in negotiations with the EU and added that the UK can prosper mightily with or without the trade deal. The UK's chief Brexit negotiator David Frost tweeted that for a deal to be possible it must fully respect the UK's sovereignty. "That is not just a word - it has practical consequences. That includes: controlling our borders; deciding ourselves on a robust and principled subsidy control system; and controlling our fishing waters," he wrote.

Renewed talk of a Scottish independence referendum added to pressure on the pound. Scottish leader Nicola Sturgeon said she wants a second referendum on Scottish independence to take place in the "earlier part" of the next parliamentary term, which begins next year. The first independence referendum was held in 2014, when 55% of Scots rejected leaving the UK.

Meanwhile, the reports about a mistake in trials of AstraZeneca (AZN) and Oxford University's coronavirus vaccine candidate weighed on market sentiment. The companies acknowledged that an error in the dosage was made in testing the coronavirus vaccine, developed by them. This raised questions about the reliability of the promising results of the trials that were released at the beginning of the week. On Monday, AstraZeneca and the University of Oxford announced that their coronavirus vaccine candidate appeared to be either 90 percent or 62 percent effective, depending on dosing regimens. On average, vaccine efficacy was 70 percent. AstraZeneca’s executives said that the company wanted the new test to confirm the 90 percent efficacy rate.

FXStreet notes that an unsurprisingly quiet session for the S&P 500 ahead of Thanksgiving on Wednesday leaves the immediate outlook unchanged. Support at 3595/78 now ideally holds for a break to a new high above 3646 to retest trend resistance from February, now at 3677, the Credit Suisse analyst team reports.

“With the market holding support from its rising 13-day average, now at 3568 and having cleared resistance at 3629 this in our view marks a bullish ‘pennant’ continuation pattern to reinforce the existing and larger bull ‘triangle’.

“Whilst we do still have concerns (daily RSI momentum is not yet confirming the break higher and the market is above what we see as its ‘typical’ extreme) our bias though remains to continue to give the upside the benefit of the doubt still, looking for a break above 3646 for a retest of trend resistance from February, today seen at 3677, but with fresh sellers still expected here for now. Through here remains needed to inject momentum to the rally with resistance then seen at 3700 next, then 3720.”

FXStreet reports that according to UOB Group’s FX Strategists, USD/CNH is seen keeping the 6.5400-6.6200 range in the next weeks.

24-hour view: “USD traded in a quiet manner between 6.5567 and 6.5732. The quiet price actions offer no fresh clues and USD could continue to consolidate, expected to be within a 6.5550/6.5780 range.”

Next 1-3 weeks: “There is not much to add to our update from Tuesday (24 Nov, spot at 6.5710). As highlighted, the recent weak phase in USD has ended and the current movement is viewed as part of a consolidation phase. From here, USD is expected to trade between 6.5400 and 6.6200 for a period of time.”

FXStreet reports that EUR/USD continues to push higher after negating Monday’s bearish session to leave the market back above key downtrend and price resistance at 1.1900/20. Analysts at Credit Suisse continue to look for a clear and sustained break above here to confirm a resumption of the core uptrend. The pair would then see resistance back at the 1.2011 September high.

“We continue to look for (finally) a clear and sustained break above the key resistance at 1.1920 and a weekly close today to confirm we are finally seeing the consolidation from September at an end for a resumption of the core uptrend, as well as seeing a bullish ‘outside week’ complete.

“We see resistance at 1.1962/66 next, then the 1.2011 September high and eventually our 1.2145/55 first upside objective – the ‘neckline’ to the early 2018 top and 78.6% retracement of the 2018/2020 bear trend. Whilst we would look for a fresh phase of consolidation to emerge here, big picture, we continue to look for an eventual move above 1.2500.”

FXStreet notes that with the hard deadline of the end of the transition period just one month away on 31 December, the coming days truly are crucial to reach a Brexit deal. ABN Amro’s base case continues to be that a free trade agreement will be signed. However, even with a deal, Brexit has already been and will continue to be significantly economically damaging – primarily for the UK, and to a much lesser degree for its closest European trading partners.

“Estimates from both official and independent institutions suggest that, even with a free trade agreement (FTA) that involves zero tariffs and zero quotas, Brexit will – over time – reduce UK GDP by around 5% compared to a scenario of continued EU membership.”

“With regard to the impact on growth in the remaining EU countries, most estimates suggest that the impact on aggregate GDP growth in the short term will be around a fifth to a quarter of the impact on the UK economy, while the longer-term impact is expected to be negligible. The impact will be largest on the UK’s main trading partners – Ireland, the Netherlands and Belgium.”

“Estimates both by the UK government and the LSE suggests a no-deal Brexit would lead to an additional 2.5% long-term fall in GDP relative to a FTA deal. The UK and EU’s regulatory regimes are likely to see an even sharper divergence in a no-deal scenario. However, in either scenario the effect of both border checks and nontariff barriers is significant, and moreover, it is much bigger than the effects of former PM Theresa May’s proposed hypothetical deal."

“Finally, note that even according to the UK government’s own analysis, the potential mitigating effect of new trade deals with non-EU trading partners is tiny – in the order of 0.2-0.3% at most, which does not even remotely offset the negative effects of Brexit.”

- Likelihood of trade deal will be determined by friends in EU

- Substantial and important differences still to be bridged

- If we leave on Australian terms, we will make a great success of it

FXStreet reports that FX Strategists at UOB Group said that USD/JPY is expected to keep the 103.70-105.00 range unchanged for the time being.

Next 1-3 weeks: “We highlighted on Tuesday that the current movement in USD is viewed as the early stages of a consolidation phase and we expected USD to trade between 103.70 and 105.30. There is no change in our view but the decrease in volatility suggests that a 103.70/105.00 range is likely enough to contain the price actions in USD, at least for a few more days.”

FXStreet reports that economists at Credit Suisse said that NZD/USD remains in a clear uptrend.

“Although daily RSI is still in heavily overbought territory and momentum might slow down, allowing the market to unwind its overbought condition, with a major base in place though, as well as the recently completed bull ‘triangle’, we stay biased higher with resistance initially at the June 2018 high at 0.7054/60.

“Removal of the 0.7060 June 2018 high would subsequently open the door to the 78.6% retracement of the 2017/2020 fall at 0.7111, where we would expect to see a first attempt to cap.”

According to the report from European Commission, after the partial recovery of sentiment between May and September and the broad sideways movement in October, the drop is the first one since sentiment fell sharply in the first COVID-19 wave. The Employment Expectations Indicator (EEI) posted the second monthly decline in a row (down by 3.3 points in both regions to 86.6 in the euro area and 87.2 in the EU).

In the euro area, the ESI’s decline was fuelled by diving confidence in retail trade, services and among consumers. Sentiment in industry and construction held up rather well, posting comparatively mild deteriorations. Industry confidence edged down (-0.9), ending its six months rally which had brought the indicator almost back to its level prior to the outbreak of COVID-19 in Europe. Services confidence took a hit (-5.2), sealing the end of its recovery, for which October’s broadly flat readings had already provided some indication. Consumer confidence posted the second monthly decline (-2.1), as households reported growing concerns about the expected general economic situation and their expected financial situation, which were matched by more cautious intentions to make major purchases. Retail trade confidence saw an abrupt end to its six-months recovery (-5.8), as retailers’ expected business situation nosedived and their appraisals of the present business situation and the adequacy of the volume of stocks got more tepid. Construction confidence eased moderately (-1.0), due to worsened appraisals of the level of order books and, to a lesser extent, more cautious employment expectations. Finally, last month’s decline in financial services confidence (not included in the ESI) intensified (-10.9), reflecting deteriorations in all its components (past business situation, past demand and, particularly, demand expectations).

Reuters reports that EU's chief negotiator Michel Barnier said that significant differences remain between the European Union and Britain on fisheries, state aid and future dispute resolution in talks on a trade agreement.

The trade deal is to replace from Jan. 1, 2021 the current transition period after Britain left the European Union at the end of last January to avoid tariffs and quotas on goods.

"Same significant divergences persist. Traveling to London this evening to continue EU-UK talks with (Britain's chief negotiator) David Frost and his team," Barnier said.

FXStreet reports that according to economists at MUFG Bank, further restrictions under a Biden presidency are on the cards.

“Risks remain elevated and news that Astra Zeneca will run an additional trial to try and validate the 90% efficacy rate in results from a portion of its trial is concerning. Clearly, the biggest single risk for financial markets now is the failure of vaccines being rolled out smoothly in Q1 2021.”

“On three days over the past week, the US has reported a daily death total over the 2,000 level. On average over the past week, the US has recorded 175K new cases per day”

“The latest available data is to Wednesday and the mobility figures were the highest for a Wednesday since 14th October. So the next few weeks could see the consequences of Thanksgiving in a further escalation of infections and deaths.”

“There are certainly increasing calls for a national strategy to tackle the virus and it seems likely with COVID-19 figures set to be elevated when Joe Biden becomes president in January that greater restrictions are on the way. If the rest of the world is recovering by then, it could result in further reason to sell the dollar.”

CNBC reports that according to Bank of Communications International’s Hao Hong, the People’s Bank of China (PBOC) could step in following a number of recent bond defaults by Chinese state-linked firms.

“In the past couple of weeks the default situation is somehow getting glaring,” Hong, managing director and head of research at the firm, told.

“I wouldn’t be surprised to see the PBOC intervene from here,” he said.

Hong said it’s in the Chinese central bank’s “best interest” to maintain sufficient liquidity to avoid “systemic risk.”

The PBOC previously warned in its financial stability report that factors such as a reliance on borrowing to make debt repayments by some large firms could present a risk to the entire economy.

“I think recently the corporate default is catching a lot of people’s attention,” the analyst said. “I would say that, you know, it is concerning because it’s coming from (state-owned enterprises) but then at the same time, it’s a relatively small amount in a very large market.”

Reuters reports that ECB policymaker Francois Villeroy de Galhau said that the amount of monetary stimulus is not the only question facing the European Central Bank and it also needs to look at how it is transmitted to the economy.

"In the face of prolonged uncertainty, out first objective must be keeping very favourable financing conditions as long as necessary," Villeroy said.

"To this end, the recalibration of instruments must focus in particular not only on the level of monetary support, but also on the duration, flexibility and efficient targeting, in short, the quality of monetary policy transmission," he added.

FXStreet reports that Axel Rudolph, Senior FICC Technical Analyst at Commerzbank, maintains a bullish outlook while the EUR/USD pair trades aboe the 1.18 level.

“EUR/USD continues to probe the 78.6% retracement at 1.1926. This and yesterday’s high at 1.1941 we need to clear, preferably on a closing basis, to trigger another leg up to the 1.2014 August peak.”

The cross is finding initial support at the 1.1800/1.1786 November 23 low and the 55-day ma. The currently evolving chart pattern is viewed as a bullish consolidation.”

“EUR/USD will remain bid while above the six month support line at 1.1715.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 07:45 | France | Consumer spending | October | -4.4% | 2.9% | 3.7% |

| 07:45 | France | CPI, m/m | November | 0% | 0.1% | 0.2% |

| 07:45 | France | CPI, y/y | November | 0% | 0.1% | 0.2% |

| 07:45 | France | GDP, q/q | Quarter III | -13.8% | 18.2% | 18.7% |

| 08:10 | Germany | German Buba President Weidmann Speaks |

During today's Asian trading, the US dollar declined against the euro and the japanese yen.

The yen also strengthened against other currencies as risk aversion was driven by concerns about the effectiveness of the coronavirus vaccine.

The ICE index, which tracks the dollar's performance against six currencies (the euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), fell 0.13%.

The dollar hit its lowest level in more than 2 years against a basket of currencies this week, with investors and analysts believing that its weakening will continue.

"The dollar appears to be significantly overvalued, with investors primarily invested in us assets," said Goldman Sachs Group strategist Christian Mueller-Glissman. In his opinion, factors such as the high price of US stocks, interest rates that do not keep up with inflation and the global economic recovery should put pressure on the dollar.

The US currency has fallen since the beginning of November on news about the development of COVID-19 vaccines, as well as on the background of reduced uncertainty related to the US presidential election.

According to the report from Insee, in Q3 2020, GDP in volume terms bounced back: +18.7% (revised by +0.4 points compared to the first release) after – 13.8% in Q2 2020. Economists had expected a 18.2% increase. Nevertheless, GDP remained well below the level it had before the health crisis: measured in volume, compared to its level in Q3 2019 (year-on-year change), GDP in Q3 2020 was 3.9% lower (previously estimated at 4.3 % lower). Revisions are mostly due to the integration of new data for September, especially for household consumption and investment in services.

All components of domestic demand rebounded sharply in Q3. Household consumption expenditure increased strongly (+17.9% in Q3, after –11.4%) and approached their pre-crisis level (–1.3% year-on-year), while general government expenditure slightly exceeded it (+0.5% year-on-year). On the other hand, total GFCF remained largely under its pre-crisis level (–4.8% year-on-year), despite its strong rebound in Q3 (+23.9% after –14,5%). Overall, total domestic demand (excluding inventory changes) contributed by +19.5 points to GDP growth this quarter.

Foreign trade also rebounded this quarter, especially exports (+22.1% after –25.1%). Imports on the other hand increased in a less pronounced manner (+16.8% after –16.8%). Overall, foreign trade made a positive contribution to GDP growth: +0.7 points, after –2.3 points in Q2. Finally, changes in inventories contributed negatively to GDP growth (–1.5 points after –0.9 points).

FXStreet reports that FX Strategists at UOB Group said that a move above 1.3400 remains on the cards.

Next 1-3 weeks: “We have held a positive view in GBP since last Tuesday. After GBP retreated from a high of 1.3396, we highlighted on Tuesday (24 Nov) that ‘there is chance, albeit not a high one, for GBP to push above 1.3400’. GBP rose to 1.3394 yesterday before closing at 1.3386 (+0.19%). Momentum is beginning to improve and a break of 1.3400 would shift the focus to the year to-date high at 1.3481 (there is a minor resistance at 1.3440). All in, the outlook for GBP is deemed as positive as long as it does not move below 1.3280 (‘strong support’ level previously at 1.3250).”

EUR/USD

Resistance levels (open interest**, contracts)

$1.2020 (5202)

$1.1985 (1412)

$1.1958 (4229)

Price at time of writing this review: $1.1927

Support levels (open interest**, contracts):

$1.1863 (181)

$1.1830 (1096)

$1.1790 (2470)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 4 is 103826 contracts (according to data from November, 26) with the maximum number of contracts with strike price $1,1200 (6560);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3476 (1355)

$1.3453 (1251)

$1.3422 (1635)

Price at time of writing this review: $1.3366

Support levels (open interest**, contracts):

$1.3308 (479)

$1.3281 (1021)

$1.3212 (736)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 23903 contracts, with the maximum number of contracts with strike price $1,3500 (2752);

- Overall open interest on the PUT options with the expiration date December, 4 is 41367 contracts, with the maximum number of contracts with strike price $1,2700 (11992);

- The ratio of PUT/CALL was 1.73 versus 1.70 from the previous trading day according to data from November, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

As reported by the Federal Statistical Office (Destatis), the index of import prices decreased by 3.9% in October 2020 compared with the corresponding month of the preceding year. In September 2020 and in August 2020 the annual rates of change were -4.3% and -4.0%, respectively. From September 2020 to October 2020 the index rose by 0.3%.

The index of import prices, excluding crude oil and mineral oil products, decreased in October 2020 by 1.3% compared with October 2019.

The index of export prices decreased by 1.0% in October 2020 compared with the corresponding month of the preceding year. In September 2020 and in August 2020 the annual rates of change were -1.1%, each. From September 2020 to October 2020 the index slightly rose by 0.1%.

RTTNews reports that survey data from ANZ showed that New Zealand consumer confidence weakened in November after improving last month.

The consumer confidence index fell to 106.9 in November from 108.7 a month ago.

Consumers' perceptions of their current financial situation fell 2 points to +1. A net 27 percent of consumers expect to be better off financially this time next year, down 1.

A net 11 percent think it is a good time to buy a major household item, unchanged from last month.

The indicator measuring perceptions regarding the next year's economic outlook gained 3 points to -18 percent. At the same time, the five-year outlook fell 7 points to +15 percent.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 47.57 | -2.28 |

| Silver | 23.29 | -0.09 |

| Gold | 1808.757 | 0.08 |

| Palladium | 2384.31 | 2.4 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 240.45 | 26537.31 | 0.91 |

| Hang Seng | 149.7 | 26819.45 | 0.56 |

| KOSPI | 24.37 | 2625.91 | 0.94 |

| ASX 200 | -46.9 | 6636.4 | -0.7 |

| FTSE 100 | -28.16 | 6362.93 | -0.44 |

| DAX | -3.23 | 13286.57 | -0.02 |

| CAC 40 | -4.5 | 5566.79 | -0.08 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 07:00 (GMT) | United Kingdom | Nationwide house price index, y/y | November | 5.8% | 5.4% |

| 07:00 (GMT) | United Kingdom | Nationwide house price index | November | 0.8% | 0.3% |

| 07:45 (GMT) | France | Consumer spending | October | -5.1% | 2.9% |

| 07:45 (GMT) | France | CPI, m/m | November | 0% | 0.1% |

| 07:45 (GMT) | France | CPI, y/y | November | 0% | 0.1% |

| 07:45 (GMT) | France | GDP, q/q | Quarter III | -13.7% | 18.2% |

| 08:10 (GMT) | Germany | German Buba President Weidmann Speaks | |||

| 10:00 (GMT) | Eurozone | Industrial confidence | November | -9.6 | -10.5 |

| 10:00 (GMT) | Eurozone | Consumer Confidence | November | -15.5 | -17.6 |

| 10:00 (GMT) | Eurozone | Economic sentiment index | November | 90.9 | 86.5 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.73561 | -0.08 |

| EURJPY | 124.14 | -0.23 |

| EURUSD | 1.19086 | -0.03 |

| GBPJPY | 139.162 | -0.45 |

| GBPUSD | 1.33493 | -0.25 |

| NZDUSD | 0.70014 | -0.04 |

| USDCAD | 1.30147 | 0.09 |

| USDCHF | 0.90627 | -0.21 |

| USDJPY | 104.231 | -0.21 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.