- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 26-12-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 09:00 | Switzerland | Credit Suisse ZEW Survey (Expectations) | December | -3.9 | -8.5 |

| 09:00 | Eurozone | ECB Economic Bulletin | |||

| 09:30 | United Kingdom | Mortgage Approvals | November | 41.219 | |

| 16:00 | U.S. | Crude Oil Inventories | December | -1.085 | -1.833 |

| 18:00 | U.S. | Baker Hughes Oil Rig Count | December | 685 |

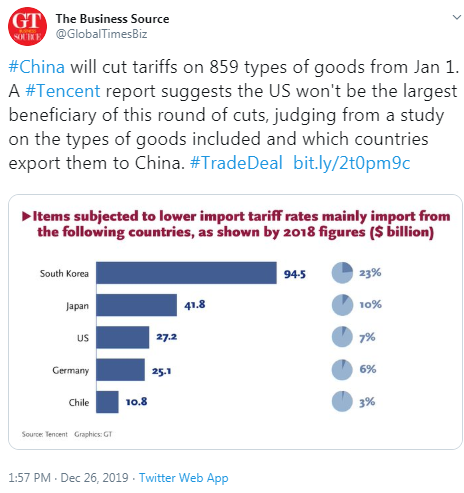

Major US stock indexes rose significantly amid continued optimism that the first phase of a trade agreement between the US and China would be signed in the near future.

Traders returned from the Christmas holidays and saw confirmation of the expectations of an imminent trade deal: China's Commerce Department said today that it is in close contact with the United States about the agreement. Last week, US Treasury Secretary Stephen Mnuchin said the first phase of the trade agreement would be signed in early January. US President Donald Trump said Tuesday that the United States and China will hold a ceremony to sign a trade agreement, but did not specify the date or place of the event.

The Mastercard report, which showed that consumers increased their online purchases during the holiday shopping season this year, also boosted optimism, with Internet sales reaching a record high.

Hopes for a breakthrough in a protracted trade war, coupled with a weakening Fed monetary policy and strong U.S. economic data, allowed US stock markets to update record highs over the past few weeks and provided an opportunity for the S&P 500 to record its best results since 2013.

Market participants also received a report from the Department of Labor, which showed that the number of Americans applying for unemployment benefits fell last week in a sign of continued strength in the labor market. According to the report, the number of initial applications for unemployment benefits fell by 13,000 to 222,000, seasonally adjusted for the week ending December 21. Economists predicted that the number of hits would fall to 224,000.

Most DOW components completed trading in positive territory (21 out of 30). The biggest gainers were Apple Inc. (AAPL; + 1.86%). Outsider were the shares of The Boeing Co. (BA; -0.90%).

Almost all S&P sectors recorded an increase. The services sector grew the most (+ 0.7%). Only the health sector showed a decrease (-0.3%).

At the time of closing:

Dow 28,621.59 +106.14 + 0.37%

S&P 500 3,239.92 +16.54 + 0.51%

Nasdaq 100 9,022.39 +69.51 + 0.78%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 09:00 | Switzerland | Credit Suisse ZEW Survey (Expectations) | December | -3.9 | -8.5 |

| 09:00 | Eurozone | ECB Economic Bulletin | |||

| 09:30 | United Kingdom | Mortgage Approvals | November | 41.219 | |

| 16:00 | U.S. | Crude Oil Inventories | December | -1.085 | -1.833 |

| 18:00 | U.S. | Baker Hughes Oil Rig Count | December | 685 |

The Chinese banking and insurance regulator - China Banking and Insurance Regulatory Commission (CBIRC) - has tightened the operating rules for smaller banks in villages and towns as part of efforts to reduce financial risks caused by mismanagement in a weak area of the banking sector.

"A few banks in villages and townships have deviated from their original mission of serving rural and smaller firms," China Banking and Insurance Regulatory Commission (CBIRC) stated in a notice on Thursday.

"They need to focus back on the credit business in rural areas and enhance financial support for rural rejuvenation."

Banks in villages and townships will be banned from cross-regional credit granting and bill financing, and the majority of new loans must be lent to local farmers, communities and smaller firms, the CBIRC added.

The regulator may suspend business at high-risk institutions and those that have deviated far from their original purpose, and limit their market access or reshuffle their management teams, according to the notice.

The WSJ reports the Fed over the last three months has flooded money markets with hundreds of billions of dollars in cash to avoid a repeat of volatility that roiled cash markets in September.

The success of the moves, which reversed roughly half of the Fed's shrinkage of its asset portfolio over the prior two years, will encounter a test around December 31, when some financial institutions could face incentives from regulations to limit their lending, which could cause supply and demand imbalances for cash.

Fed officials have said they believe deposits by banks held at the Fed, called reserves, grew scarce enough in mid-September to put pressure on an obscure but important lending rate in the market for repurchase agreements, or repos. Banks and other firms use repos as a way to borrow cash for short periods, pledging government securities as collateral.

To prevent a squeeze from happening again, Fed officials have been buying short-term Treasury bills from financial institutions to put more reserves back into the financial system. They also have conducted daily injections of liquidity into markets.

Altogether, those operations could add nearly $500 billion in net liquidity to markets around December 31.

The end of the year is an important date because large banks could limit lending activities in derivatives and repo markets to guard against extra regulatory burdens. For these banks, their lending profile on December 31 is used to determine how much equity capital they must raise against their liabilities.

In the last few years, repo rates have typically been no more than a 10th of a percentage point above or below the Fed's benchmark rate, but on December 31, 2018, they widened by 2.75 percentage points.

U.S. stock-index futures rose slightly on Thursday, on persisting optimism that an initial U.S.-China trade deal would be signed soon

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 23,924.92 | +142.05 | +0.60% |

| Hang Seng | - | - | - |

| Shanghai | 3,007.35 | +25.47 | +0.85% |

| S&P/ASX | - | - | - |

| FTSE | - | - | - |

| CAC | - | - | - |

| DAX | - | - | - |

| Crude oil | $61.48 | | +0.61% |

| Gold | $1,513.40 | | +0.57% |

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 50.4 | 0.12(0.24%) | 11782 |

| Amazon.com Inc., NASDAQ | AMZN | 1,797.50 | 8.29(0.46%) | 17791 |

| Apple Inc. | AAPL | 284.68 | 0.41(0.14%) | 67649 |

| AT&T Inc | T | 39 | 0.04(0.10%) | 6154 |

| Boeing Co | BA | 331.8 | -1.20(-0.36%) | 45745 |

| Caterpillar Inc | CAT | 147.65 | 0.17(0.12%) | 107 |

| Cisco Systems Inc | CSCO | 47.87 | 0.09(0.19%) | 4520 |

| Citigroup Inc., NYSE | C | 78.77 | 0.18(0.23%) | 4246 |

| Exxon Mobil Corp | XOM | 70.11 | 0.09(0.13%) | 6132 |

| Facebook, Inc. | FB | 205.7 | 0.58(0.28%) | 11489 |

| FedEx Corporation, NYSE | FDX | 151.05 | 0.27(0.18%) | 1018 |

| Ford Motor Co. | F | 9.5 | 0.03(0.32%) | 2542 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.09 | 0.10(0.77%) | 34479 |

| General Electric Co | GE | 11.18 | -0.01(-0.09%) | 33908 |

| General Motors Company, NYSE | GM | 36.55 | -0.03(-0.08%) | 1077 |

| Goldman Sachs | GS | 230.09 | 0.18(0.08%) | 1971 |

| Intel Corp | INTC | 59.47 | 0.06(0.10%) | 705 |

| JPMorgan Chase and Co | JPM | 137.75 | 0.17(0.12%) | 1478 |

| McDonald's Corp | MCD | 197.1 | 0.43(0.22%) | 595 |

| Microsoft Corp | MSFT | 157.6 | 0.22(0.14%) | 18637 |

| Pfizer Inc | PFE | 39.38 | 0.09(0.23%) | 5535 |

| Tesla Motors, Inc., NASDAQ | TSLA | 428.25 | 3.00(0.71%) | 129360 |

| The Coca-Cola Co | KO | 54.72 | 0.01(0.02%) | 1642 |

| Twitter, Inc., NYSE | TWTR | 32.63 | 0.13(0.40%) | 11430 |

| Verizon Communications Inc | VZ | 61.32 | 0.04(0.07%) | 2188 |

| Visa | V | 187.65 | 0.08(0.04%) | 2458 |

| Wal-Mart Stores Inc | WMT | 119.78 | 0.27(0.23%) | 2442 |

| Walt Disney Co | DIS | 145.63 | 0.34(0.23%) | 8185 |

| Yandex N.V., NASDAQ | YNDX | 43.52 | -0.15(-0.34%) | 1701 |

Tesla (TSLA) target raised to $370 from $270 at Wedbush; Neutral

The data from the Labor Department revealed on Thursday the number of applications for unemployment benefits fell slightly more than expected last week, pointing to ongoing labor market strength.

According to the report, the initial claims for unemployment benefits decreased by 13,000 to a seasonally adjusted 222,000 for the week ended December 21.

Economists had expected 224,000 new claims last week.

Claims for the prior week were revised upwardly to 235,000 from the initial estimate of 234,000.

Meanwhile, the four-week moving average of claims edged up 2,250 to 228,000, the highest level since mid-February.

According to Mastercard SpendingPulse, U.S. holiday retail sales rose 3.4 percent (excl. auto) with online sales climbing 18.8 percent compared to 2018.

Key findings of the report indicate that this was a winning holiday season for retail, especially for e-commerce:

- Total Apparel recorded a 1 percent growth year over year. The category also experienced stronger than expected e-commerce advance, up 17 percent compared to 2018.

- The Jewelry sector showed a 1.8 percent gain in total retail sales, with online sales surging 8.8 percent and supporting eCommerce strength. This trend started before the holiday season and helped the sector power through to its finish.

- Department stores saw overall sales drop of 1.8 percent and online sales growth of 6.9 percent, emphasizing the importance of omnichannel offerings.

- Electronics and appliances rose 4.6 percent, while the home furniture and furnishings category increased 1.3 percent.

Reuters reports, China's Ministry of Agriculture and Rural Affairs said that the countries large pig farms were lining up with small, family-based farms in a state-initiated investment of nearly 50 billion yuan ($7 billion) to boost hog productions hit hard by a deadly swine disease.

According to the agriculture ministry, fifteen leading pig farms in Beijing on Thursday signed 19 agreements with local governments in 16 Chinese cities such as Liangzhou of western Sichuan province and Engshi in central Hubei, to raise pigs together.

These projects are expected to produce more than 22 million hogs for slaughter annually and involve 33,000 poor rural families, the ministry said, without giving a timeline.

China's pig herd is about 40% smaller than a year ago, after deadly African swine fever swept through the country in the year following its discovery in mid-2018, the ministry noted.

Says BoJ will not hesitate to ease its monetary policy further if there is a greater possibility that momentum towards achieving 2-percent inflation target is lost

When BoJ pursues monetary easing, economic stimulus adopted by the government can exert significant effects to maintain the expanding trend in the economy

Cooperation between monetary and fiscal authorities entails difficulties in terms of ensuring public confidence toward macroeconomic policy

Hopes that firms' stance will continue to shift toward further raising wages and prices under favorable economic environment, and that a virtuous cycle of wages and prices will gain further strength

Notes that firms need to continue with positive investment

BoJ will continue to firmly fulfill its responsibility as central bank of achieving price stability target so that Japan's economy will grow in a sustainable manner under the virtuous cycle of the economy

Japan's Ministry of Land, Infrastructure, Transport and Tourism reported on Thursday that the country's housing starts recorded a double-digit decline in November.

According to the report, housing starts tumbled 12.7 percent on a yearly basis, following a 7.4 percent decline in October. That marked the fifth consecutive decrease in housing starts. Economists had forecast an 8.1 percent fall.

Annualized housing starts fell to 834,000 in November from 879,000 in October. Economists had expected 882,000.

Data also revealed that construction orders received by big 50 contractors reduced 1.2 percent on year in November, in contrast to an advance of 6.4 percent in October.

Global stock markets have been on a torrid run in 2019, adding more than $17 trillion in total value, according to Deutsche Bank calculations.

The value of global equities began the year just under $70 trillion but has now surpassed $85 trillion, according to a chart from Deutsche Bank's Torsten Slok.

The banner year for equities has been helped by easier monetary policy and political developments around the globe.

Central banks around the world have taken a more dovish approach, boosting markets. The Fed has cut its benchmark interest rate three times this year, and the ECB cut its already negative rates even further. The global trade outlook - in turmoil since the election of Donald Trump and the vote for Brexit in the United Kingdom - also became more clear during the year.

The large climb for world markets has been largely dominated by the U.S. markets. The rally in the U.S. has been broad, with the S&P 500, Dow Jones Industrial Average and Russell 2000 all rising more than 20% this year. Big years for some of the world's most valuable companies, such as an 80% gain for Apple and a 57% gain for Facebook, have helped fuel the rise.

Italian Education Minister Lorenzo Fioramonti told he had resigned after failing to obtain from the government billions of euros he said were needed to improve the country's schools and universities.

The resignation is a blow to the embattled government, whose ruling parties are at odds on issues ranging from euro zone reform to migrant rights.

It also underscores the problems of the anti-establishment 5-Star Movement, Fioramonti's party, which is trying to reorganize amid widespread internal dissatisfaction with its leader Luigi Di Maio.

Fioramonti said shortly after the government of 5-Star and the center-left Democratic Party was formed in September that he would quit unless education spending was raised by 3 billion euros ($3.3 billion) in the 2020 budget.

Few believed him, even as the budget continued its passage through parliament and it became clear the government had little intention of hiking taxes or cutting spending to find the funds he demanded. The budget was approved on Monday ahead of a Dec. 31 deadline.

"It shouldn't be a surprise to anyone that a minister keeps his word," Fioramonti told.

Fioramonti said he would still support the government in parliament, where he is a lower house deputy.

Japanese Prime Minister Shinzo Abe and Chinese Premier Li Keqiang agreed on the need to create a new era for the two countries as they step up preparations for Chinese President Xi Jinping's state visit to Japan next spring.

Abe told Li that he wants to make the recent improvement in ties sustainable and promote "constant" high-level exchanges and dialogue, according to the Japanese Foreign Ministry.

Li was quoted as saying that momentum has been maintained for improving Sino-Japanese ties, adding that they are now back on a "normal track."

The meeting took place during Abe's three-day visit to China through Wednesday where he held a trilateral meeting with Li and South Korean President Moon Jae In.

Data from Bank of Japan showed that Japan's services producer prices increased at a steady pace in November.

Services producer prices increased 2.1 percent year-on-year in November, the same rate of increase as seen in October.

On a monthly basis, inflation eased to 0.2 percent from 1.9 percent in October. Nonetheless, prices have increased for the second straight month after staying flat in September.

Excluding international transportation, services producer prices grew 0.2 percent on month, taking the annual growth to 2.1 percent in November.

China's November soybean purchases from the United States surged from a year earlier, data showed on Wednesday, as cargoes booked by importers with tariff-free quotas cleared customs.

China brought in 2.56 million tonnes of U.S. soybeans, up from zero a year ago and 1.147 million tonnes in October, after Beijing issued waivers to exempt importers from hefty tariffs for some American cargoes.

Shipments of U.S. soybeans plunged in the same month last year as buyers stayed clear of the U.S. market after Beijing slapped hefty tariffs on a list of American goods including soybeans in a tit-for-tat trade war.

China resumed buying U.S. cargoes after the countries agreed to a truce in their trade war in December last year.

Crushers have made more rounds of purchases of U.S. beans in recent months after Beijing issued tariff-free quotas in a goodwill gesture to Washington.

Also in November, China brought in 3.86 million tonnes of soybeans from Brazil, down 24% from 5.07 million tonnes in the same month last year.

China will curb financial risks in the rental housing market by tightening lending to rental housing companies and capping the ratio of their rental income from loans taken by tenants at 30%, the housing ministry said.

The Chinese government has vigorously promoted the rental housing market since 2017 to address housing affordability as home prices skyrocketed across the country. But rapid growth in the sector with little regulatory control has created unexpected financial risks.

The ministry described the sector's development as "chaotic", saying it had been filled with false listing information and malicious practices such as misuse of loans, illegal withholding of security deposits and forced evictions.

The ministry will work with five other government entities, including the banking and insurance regulator and the state administration for market regulation, to better police rental companies, real estate agencies and online platforms, according to a guidance published on its website.

China's banking and insurance regulator on Thursday issued guidelines to push financial institutions to improve their services for foreign trade firms.

China will encourage banks and insurers to maintain financial support for companies in the commodities, electronic equipment, and processing trade sectors, while step up their services for cross-border e-commerce and manufacturing upgrade, the Banking and Insurance Regulatory Commission said in a document on its website.

The regulator also asked financial institutions to boost lending to small foreign trade firms.

Danske Bank analysts suggest that they saw the first sign of a turn in the Chinese business cycle in October, but a continued moderate recovery has hinged on a de-escalation of the US-China trade war and this is exactly what we got with the phase-one deal.

"Our GDP forecast for 2020 has been 6.0% for some time based on the assumption of easing trade tensions and increasing effects of the policy stimulus. We stick to this view and now see risks as more balanced after having been mainly to the downside."

China is in close touch with the United States on signing a Phase 1 trade deal, the country's commerce ministry said on Thursday, adding that both sides are still going through necessary procedures before the signing.

Gao Feng, commerce ministry spokesman, made the comments to reporters at a regular briefing.

Analysts at CIBC expect the US Dollar Index (DXY) to move lower over the next quarters. They forecast DXY at 95.5 in Q1 2020 and at 93.4 in Q3 of next year.

"The US dollar has managed to rally in the past year, despite a dose of Fed rate cuts and an adverse current account balance that protectionism has not addressed. After what looks to be a softer Q4 pace, the US looks poised to pick up in early 2020 on improved interest sensitive demand, particularly in housing. That should see the Fed put away the rate cut tool for good, which on its own would be supportive for the dollar. But we see that overridden by a gradual reduction in global uncertainty over the course of the coming year, which will lean towards a partial reversal of some of the flight to safety gains for the dollar. We enter the year with a US-China trade deal waiting to be tested, lingering uncertainties over post-Brexit UK-EU trade talks, and pockets of overseas economic weakness still evident. The lagged impacts of earlier monetary stimulus, clarity on some of the trade files over time, and fiscal stimulus in Japan, and potentially down the road in Europe, could see the world exit 2020 with an improving tone overseas. That risk-on environment should allow recoveries for the euro and Sterling, and superior current account balances in Europe and Japan should also favour their currencies against the dollar."

Bank of Japan Governor Haruhiko Kuroda said on Thursday that the central bank would ease policy further without hesitation if the momentum towards it 2% inflation target came under threat.

He was speaking at an annual meeting of Japan's largest business lobby, Keidanren.

The central bank last week left its target for short-term rates at -0.1% and that for 10-year bond yields around 0%, and it stuck to its assessment that Japan's economy continues to expand moderately as a trend.

Analysts from Rabobank forecast the EUR/USD pair at 1.09 in a three month period and at 1.11 in nine months.

"What is bad for the US economy, however, is enviably sour for the global economy. We expect any USD downside into the end of next year to be moderate as other central banks also provide more stimulative monetary policy conditions. In Australia this could mean that Quantitative Easing is rolled out for the first time. During the past two years the market has underestimated the strength of the USD vs. the EUR. What has changed since the start of that period is that the market is no longer short of USD, meaning it should become more sensitive to any bad news. What remains the same is that the USD is still the only dominant currency on the global payments system and that the US economy continues to perform well relative to other major countries. We see potential for EUR/USD to dip lower into the spring. However, on our view that the Fed will be cutting interest rates aggressively into the end of the year and we see scope for the USD to lose some ground in H2 2020."

EUR/USD

Resistance levels (open interest**, contracts)

$1.1206 (5379)

$1.1172 (2559)

$1.1155 (3731)

Price at time of writing this review: $1.1088

Support levels (open interest**, contracts):

$1.1048 (5225)

$1.0999 (3035)

$1.0950 (2659)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 3 is 54498 contracts (according to data from December, 24) with the maximum number of contracts with strike price $1,1200 (5379);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3208 (3121)

$1.3164 (827)

$1.3123 (1443)

Price at time of writing this review: $1.2988

Support levels (open interest**, contracts):

$1.2879 (1647)

$1.2837 (1388)

$1.2792 (2286)

Comments:

- Overall open interest on the CALL options with the expiration date January, 3 is 24205 contracts, with the maximum number of contracts with strike price $1,3500 (3272);

- Overall open interest on the PUT options with the expiration date January, 3 is 27729 contracts, with the maximum number of contracts with strike price $1,2800 (2286);

- The ratio of PUT/CALL was 1.15 versus 1.11 from the previous trading day according to data from December, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -47.71 | 23782.87 | -0.2 |

© 2000-2024. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.