- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 26-01-2018

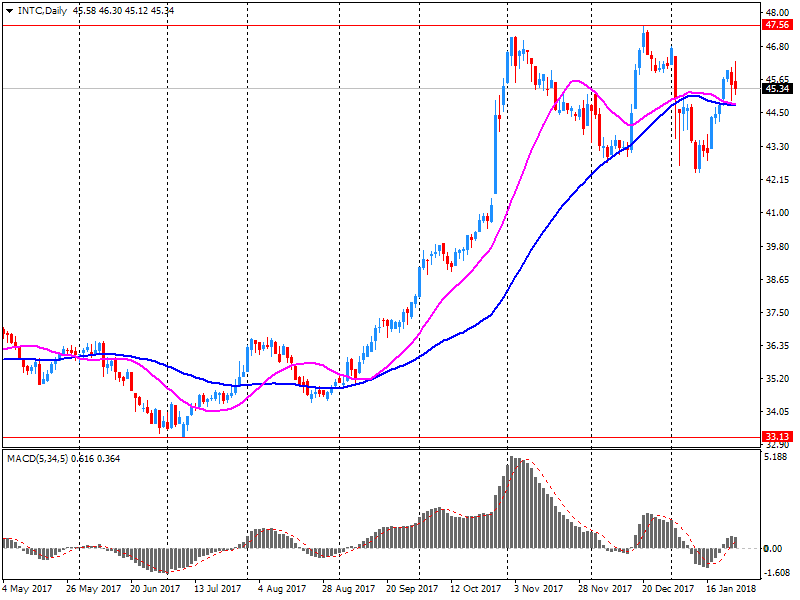

Major US stock indices rose strongly, reaching new record levels, supported by high incomes from Intel (INTC) and the pharmacist AbbVie (ABBV), as well as the weakness of the US dollar.

The focus was also on the United States. The Commerce Department reported that the US economy continued to grow in the fourth quarter, losing a little momentum from the summer, but gained enough strength to extend one of its best periods in recent years. Gross domestic product - the cost of all goods and services produced in the US - adjusted for inflation, from October to December increased by 2.6% on an annualized basis. Economists had expected growth of 2.9%. In the second and third quarters the output slightly exceeded 3%. The last growth, caused by a significant increase in the costs of US consumers and enterprises, has limited the best year of the economy since 2014. In the fourth quarter, the volume of output increased by 2.5% compared to the previous year. It grew by 1.8% in 2016 and by 2% in 2015. Last year was the fourth best calendar year of growth since expansion began in mid-2009.

Most components of the DOW index recorded a rise (24 out of 30). The leader of growth was shares of Intel Corporation (INTC, + 10.23%). Outsider were shares of Caterpillar Inc. (CAT, -1.43%).

All sectors of S & P finished trading in positive territory. The healthcare sector grew most (+ 1.7%).

At closing:

Dow + 0.85% 26.616.71 +223.92

Nasdaq + 1.28% 7.505.77 +94.61

S & P + 1.18% 2.872.87 +33.62

-

Extending article 50 would not solve legal problems of ratifying withdrawal

-

UK and EU agree on need to have strict time limit for implementation period

-

UK and EU must follow same rules for implementation period to work

-

We agree on need for continued access to each others markets on current terms

U.S. stock-index futures rose on Friday as investors assessed a raft of corporate earnings and economic data.

Global Stocks:

Nikkei 23,631.88 -37.61 -0.16%

Hang Seng 33,154.12 +499.67 +1.53%

Shanghai 3,559.09 +10.78 +0.30%

S&P/ASX -

FTSE 7,648.16 +32.32 +0.42%

CAC 5,537.59 +56.38 +1.03%

DAX 13,325.26 +26.90 +0.20%

Crude $65.57 (+0.09%)

Gold $1,351.30 (-0.86%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 255.5 | 7.81(3.15%) | 33227 |

| ALCOA INC. | AA | 53.47 | 0.17(0.32%) | 772 |

| Amazon.com Inc., NASDAQ | AMZN | 1,370.00 | 12.49(0.92%) | 49029 |

| American Express Co | AXP | 99.5 | 0.20(0.20%) | 681 |

| Apple Inc. | AAPL | 174.77 | 0.55(0.32%) | 127730 |

| AT&T Inc | T | 37.1 | 0.08(0.22%) | 12815 |

| Barrick Gold Corporation, NYSE | ABX | 15.2 | 0.15(1.00%) | 35172 |

| Boeing Co | BA | 336.35 | 1.66(0.50%) | 10210 |

| Caterpillar Inc | CAT | 174.65 | 6.31(3.75%) | 476858 |

| Cisco Systems Inc | CSCO | 42.36 | 0.19(0.45%) | 4510 |

| Citigroup Inc., NYSE | C | 79.98 | 0.53(0.67%) | 10054 |

| Deere & Company, NYSE | DE | 171.9 | 2.30(1.36%) | 6185 |

| Exxon Mobil Corp | XOM | 88.61 | 0.08(0.09%) | 1495 |

| Facebook, Inc. | FB | 188 | 1.45(0.78%) | 82917 |

| FedEx Corporation, NYSE | FDX | 270.99 | 0.58(0.21%) | 300 |

| Ford Motor Co. | F | 11.92 | -0.13(-1.08%) | 197291 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 20.55 | 0.95(4.85%) | 273237 |

| General Electric Co | GE | 16.58 | 0.14(0.85%) | 288290 |

| General Motors Company, NYSE | GM | 44.13 | -0.03(-0.07%) | 3914 |

| Goldman Sachs | GS | 266.9 | 1.22(0.46%) | 4486 |

| Google Inc. | GOOG | 1,174.88 | 10.64(0.91%) | 9232 |

| Hewlett-Packard Co. | HPQ | 23.7 | 0.04(0.17%) | 2673 |

| Home Depot Inc | HD | 206.85 | 0.63(0.31%) | 1234 |

| HONEYWELL INTERNATIONAL INC. | HON | 161.87 | 1.90(1.19%) | 939 |

| Intel Corp | INTC | 45.88 | 0.37(0.81%) | 56288 |

| International Business Machines Co... | IBM | 166 | 0.63(0.38%) | 3458 |

| Johnson & Johnson | JNJ | 142.5 | 0.43(0.30%) | 6874 |

| JPMorgan Chase and Co | JPM | 116.35 | 0.68(0.59%) | 13552 |

| McDonald's Corp | MCD | 176.6 | 0.48(0.27%) | 750 |

| Merck & Co Inc | MRK | 61.49 | 0.31(0.51%) | 854 |

| Microsoft Corp | MSFT | 92.58 | 0.76(0.83%) | 36849 |

| Nike | NKE | 68.03 | 0.03(0.04%) | 929 |

| Pfizer Inc | PFE | 37.08 | 0.15(0.41%) | 4145 |

| Procter & Gamble Co | PG | 88.66 | 0.35(0.40%) | 10374 |

| Starbucks Corporation, NASDAQ | SBUX | 61.07 | 0.24(0.39%) | 8008 |

| Tesla Motors, Inc., NASDAQ | TSLA | 348.11 | 2.22(0.64%) | 20781 |

| The Coca-Cola Co | KO | 47.85 | 0.02(0.04%) | 649 |

| Twitter, Inc., NYSE | TWTR | 22.62 | 0.25(1.12%) | 61746 |

| United Technologies Corp | UTX | 135.43 | -0.25(-0.18%) | 1608 |

| UnitedHealth Group Inc | UNH | 245.95 | 1.10(0.45%) | 659 |

| Verizon Communications Inc | VZ | 54.39 | 0.17(0.31%) | 334 |

| Visa | V | 124.8 | 0.25(0.20%) | 4129 |

| Wal-Mart Stores Inc | WMT | 106 | 0.21(0.20%) | 2449 |

| Yandex N.V., NASDAQ | YNDX | 38.39 | 0.52(1.37%) | 2450 |

Intel (INTC) target raised to $52 from $47 at Mizuho

Intel (INTC) target raised to $55 from $53 at FB Riley

United Tech (UTX) target raised to $146 from $124 at Stifel

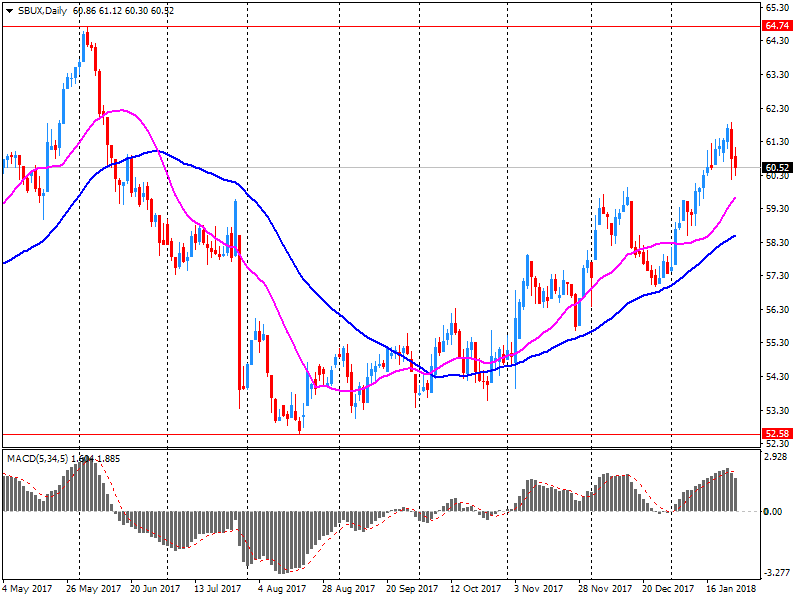

Starbucks (SBUX) removed from Conviction Buy List at Goldman

Travelers (TRV) upgraded to Neutral at Atlantic Equities

Intel (INTC) upgraded to Outperform from Neutral at Credit Suisse

The Consumer Price Index (CPI) increased 1.9% on a year-over-year basis in December, following a 2.1% gain in November. The all-items excluding gasoline index rose 1.5% year over year in December, matching the increase in November.

Prices were up in seven of the eight major CPI components in the 12 months to December, with the transportation and shelter indexes contributing the most to the increase. The household operations, furnishings and equipment index declined 0.3% on a year-over-year basis.

Consumer prices for transportation rose 4.9% on a year-over-year basis in December, following a 5.9% increase in November. The movement in transportation prices was led by gasoline, which rose 12.2% year over year in December, after increasing 19.6% the previous month. The purchase of passenger vehicles index increased 3.7% in the 12-month period ending in December.

New orders for manufactured durable goods in December increased $7.0 billion or 2.9 percent to $249.4 billion, the U.S. Census Bureau announced today. This increase, up four of the last five months, followed a 1.7 percent November increase. Excluding transportation, new orders increased 0.6 percent. Excluding defense, new orders increased 2.2 percent. Transportation equipment, also up four of the last five months, led the increase, $6.0 billion or 7.4 percent to $87.2 billion.

Shipments of manufactured durable goods in December, up seven of the last eight months, increased $1.5 billion or 0.6 percent to $246.8 billion. This followed a 1.3 percent November increase. Fabricated metal products, also up seven of the last eight months, led the increase, $0.5 billion or 1.5 percent to $33.5 billion.

Real gross domestic product (GDP) increased at an annual rate of 2.6 percent in the fourth quarter of 2017, according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent.

The increase in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, residential fixed investment, state and local government spending, and federal government spending that were partly offset by a negative contribution from private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased

The price index for gross domestic purchases increased 2.5 percent in the fourth quarter, compared with an increase of 1.7 percent in the third quarter The PCE price index increased 2.8 percent, compared with an increase of 1.5 percent. Excluding food and energy prices, the PCE price index increased 1.9 percent, compared with an increase of 1.3 percent

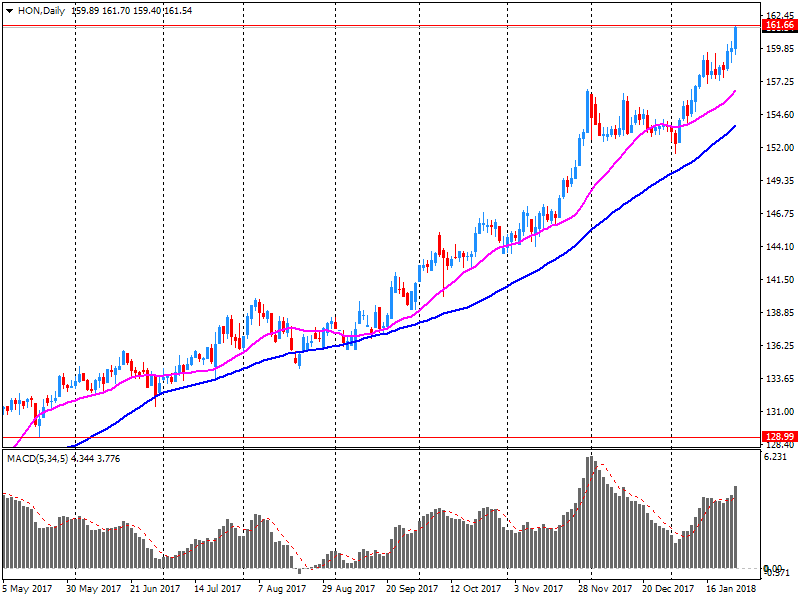

Honeywell (HON) reported Q4 FY 2017 earnings of $1.85 per share (versus $1.74 in Q4 FY 2016), beating analysts' consensus estimate of $1.84.

The company's quarterly revenues amounted to $10.843 bln (+8.6% y/y), generally in-line with analysts' consensus estimate of $10.796 bln.

The company also issued updated guidance for FY 2018, projecting EPS of $7.75-8.00 (compared to its prior guidance of $7.55-7.80 and analysts' consensus estimate of $7.84) and revenues of $41.8-42.5 bln (versus analysts' consensus estimate of $42.23 bln).

HON fell to $160.00 (-1.14%) in pre-market trading.

Starbucks (SBUX) reported Q4 FY 2017 earnings of $0.58 per share (versus $0.52 in Q4 FY 2016), beating analysts' consensus estimate of $0.57.

The company's quarterly revenues amounted to $6.073 bln (+5.9% y/y), missing analysts' consensus estimate of $6.188 bln.

SBUX fell to $57.36 (-5.27%) in pre-market trading.

Intel (INTC) reported Q4 FY 2017 earnings of $1.08 per share (versus $0.79 in Q4 FY 2016), beating analysts' consensus estimate of $0.87.

The company's quarterly revenues amounted to $17.053 bln (+4.1% y/y), beating analysts' consensus estimate of $16.343 bln.

The company issued in-line guidance for Q1 FY 2018, projecting EPS of $0.65-0.75 (versus analysts' consensus estimate of $0.72) at revenues of $14.5-15.5 bln (versus analysts' consensus estimate of $15.03 bln).

Intel also raised quarterly dividend 10% to $0.30.

INTC rose to $47.63 (+5.14%) in pre-market trading.

-

Says reent statements about currencies have not been helpful

-

We will have to reassess if currency levels continue to shift

-

Whatever happens to the dollar remains very important

UK gross domestic product (GDP) was estimated to have increased by 0.5% in Quarter 4 (Oct to Dec) 2017, compared with 0.4% in Quarter 3 (July to Sept) 2017.

The dominant services sector, driven by business services and finance, increased by 0.6% compared with the previous quarter, although the longer-term trend continues to show a weakening in services growth.

Production industries grew by 0.6%, boosted by the second consecutive quarter of strong growth in manufacturing.

Growth in manufacturing was partially offset in total production by a significant fall in oil and gas extraction, caused by the well-publicised repair work made to the Forties pipeline.

-

2018 gdp growth forecast raised to 2.3 pct vs 1.9 pct

-

2019 gdp growth forecast raised to 1.9 pct from 1.7 pct

-

2019 inflation at 1.7 pct vs 1.6 pct 3 months ago

-

2022 inflation forecast steady at 1.9 pct; initial 2020 estimate at 1.8 pct

-

The annual growth rate of the broad monetary aggregate M3 decreased to 4.6% in December 2017, from 4.9% in November.

-

The annual growth rate of the narrower aggregate M1, which includes currency in circulation and overnight deposits, decreased to 8.6% in December, from 9.1% in November.

-

The annual growth rate of adjusted loans to households stood at 2.8% in December, unchanged from the previous month.

-

The annual growth rate of adjusted loans to non-financial corporations decreased to 2.9% in December, from 3.1% in November.

-

Tells Reuters that Paris could overtake London as Europe's top financial centre within years

EUR/USD

Resistance levels (open interest**, contracts)

$1.2559 (2818)

$1.2529 (1094)

$1.2504 (2284)

Price at time of writing this review: $1.2453

Support levels (open interest**, contracts):

$1.2369 (385)

$1.2349 (554)

$1.2324 (569)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 130495 contracts (according to data from January, 25) with the maximum number of contracts with strike price $1,1850 (7037);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4359 (243)

$1.4325 (242)

$1.4293 (1137)

Price at time of writing this review: $1.4245

Support levels (open interest**, contracts):

$1.4105 (114)

$1.4071 (149)

$1.4034 (333)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 43676 contracts, with the maximum number of contracts with strike price $1,3600 (3468);

- Overall open interest on the PUT options with the expiration date February, 9 is 38543 contracts, with the maximum number of contracts with strike price $1,3400 (3043);

- The ratio of PUT/CALL was 0.88 versus 0.84 from the previous trading day according to data from January, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

We still need accommodative monetary policy

-

Says UK is a bit of an outlier, we do see a bit of a pick-up in growth

-

World economy is accelerating, UK has not seen this yet

-

There is a prospect that UK will be recoupled with global growth later this year

-

UK economic output likely to be tens of billions of pounds lower by the end of this year than if it hadn't voted for brexit

European stock markets erased earlier gains and turned firmly lower on Thursday, yanked lower by a euro rally after the European Central Bank said eurozone growth was surprisingly strong and offered only limited pushback against the Trump administration's embrace of dollar weakness.

The S&P 500 and the Dow Jones Industrial Average logged fresh records on the back of robust earnings but both indexes finished off intraday highs in volatile trading as the buck rebounded following President Donald Trump's dollar-supportive comments.

Asian equities traded mixed Friday, while the dollar steadied after President Donald Trump waded into the unusual public discussion over exchange rates. Trump said that he favored a strong greenback, just a day after his Treasury secretary endorsed a weaker dollar as good for trade, sending the currency down.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.