- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 25-04-2018

| raw materials | closing price | % change |

| Oil | 68.01 | +0.46% |

| Gold | 1,324.40 | -0.65% |

| index | closing price | change items | % change |

| Nikkei | -62.80 | 22215.32 | -0.28% |

| TOPIX | -2.02 | 1767.73 | -0.11% |

| Hang Seng | -308.09 | 30328.15 | -1.01% |

| CSI 300 | -14.79 | 3828.70 | -0.38% |

| Euro Stoxx 50 | -25.05 | 3485.83 | -0.71% |

| FTSE 100 | -46.08 | 7379.32 | -0.62% |

| DAX | -128.52 | 12422.30 | -1.02% |

| CAC 40 | -30.86 | 5413.30 | -0.57% |

| DJIA | +59.70 | 24083.83 | +0.25% |

| S&P 500 | +4.84 | 2639.40 | +0.18% |

| NASDAQ | -3.61 | 7003.74 | -0.05% |

| S&P/TSX | +32.75 | 15509.75 | +0.21% |

| Pare | Closed | % change |

| EUR/USD | $1,2162 | -0,59% |

| GBP/USD | $1,3932 | -0,34% |

| USD/CHF | Chf0,98303 | +0,44% |

| USD/JPY | Y109,39 | +0,52% |

| EUR/JPY | Y133,04 | -0,06% |

| GBP/JPY | Y152,42 | +0,19% |

| AUD/USD | $0,7566 | -0,49% |

| NZD/USD | $0,7066 | -0,68% |

| USD/CAD | C$1,28396 | +0,12% |

| Time | Region | Event | Period | Previous | Forecast |

| 04:30 | Australia | Export Price Index, q/q | I quarter | 2.8% | 4.1% |

| 04:30 | Australia | Import Price Index, q/q | I quarter | 2% | 1.3% |

| 09:00 | Germany | Gfk Consumer Confidence Survey | May | 10.9 | 10.8 |

| 11:30 | United Kingdom | BBA Mortgage Approvals | March | 38.1 | 37.1 |

| 13:00 | United Kingdom | CBI retail sales volume balance | April | -8 | 5 |

| 14:45 | Eurozone | ECB Interest Rate Decision | | 0.0% | 0% |

| 15:30 | Eurozone | ECB Press Conference | | | |

| 15:30 | USA | Continuing Jobless Claims | April | 1863 | 1850 |

| 15:30 | USA | Goods Trade Balance, $ bln. | March | -75.35 | -74.8 |

| 15:30 | USA | Initial Jobless Claims | April | 232 | 230 |

| 15:30 | USA | Durable Goods Orders | March | 3.1% | 1.6% |

| 15:30 | USA | Durable Goods Orders ex Transportation | March | 1.2% | 0.5% |

| 15:30 | USA | Durable goods orders ex defense | March | 2.5% | 1.1% |

The major US stock indexes ended the trading mixed, as the Boeing rally after optimistic results and forecasts was offset by a decline in shares of technology companies and an increase in the yield of US government bonds.

Before the start of the trading session, Boeing (BA), Twitter (TWTR) and Yandex N.V. reported their activity reports in the first quarter of this year. (YNDX). The first two companies reported higher than expected quarterly earnings and revenue. In addition, Boeing improved its earnings forecast for the full year 2018.

According to FactSet, the results demonstrated by US companies during the reporting season were relatively good, but the stock growth was more restrained compared to previous quarters. According to some analysts, strong indicators could already be taken into account in prices

Most components of the DOW index finished trading in the red (20 of 30). Outsider were shares of General Electric Company (GE, -4.60%). The leader of growth was the shares of The Boeing Company (BA, + 4.00%).

Almost all S & P sectors recorded a decline. The largest drop was shown by the sector of conglomerates (-0.8%). Only the consumer goods sector grew (+ 0.1%).

At closing:

Dow 24,083.14 +59.01 +0.25%

S&P 500 2,639.37 +4.81 +0.18%

Nasdaq 100 7,003.74 -3.61 -0.05%

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.2 million barrels from the previous week. At 429.7 million barrels, U.S. crude oil inventories are in the lower half of the average range for this time of year.

Total motor gasoline inventories increased by 0.8 million barrels last week, and are in the upper half of the average range. Both finished gasoline inventories and blending components inventories increased last week.

Distillate fuel inventories decreased by 2.6 million barrels last week and are in the lower half of the average range for this time of year. Propane/propylene inventories decreased by 0.2 million barrels last week, and are in the lower half of the average range. Total commercial petroleum inventories increased by 1.4 million barrels last week.

U.S. stock-index futures fell on Wednesday, as the 10-year U.S. Treasury yield held above 3-percent level, while investors awaited Q1 earnings from a number of big companies, including AT&T (T), Facebook (FB), Ford Motor (F), Visa (V), etc. All these names are set to report after today's closing bell.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,215.32 | -62.80 | -0.28% |

| Hang Seng | 30,328.15 | -308.09 | -1.01% |

| Shanghai | 30,328.15 | -308.09 | -1.01% |

| S&P/ASX | - | - | - |

| FTSE | 7,370.51 | -54.89 | -0.74% |

| CAC | 5,408.39 | -35.77 | -0.66% |

| DAX | 12,384.75 | -166.07 | -1.32% |

| Crude | $67.45 | | -0.37% |

| Gold | $1,321.80 | | -0.84% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 200.25 | -0.88(-0.44%) | 4294 |

| ALCOA INC. | AA | 50.26 | -0.56(-1.10%) | 1585 |

| Amazon.com Inc., NASDAQ | AMZN | 1,460.00 | -0.09(-0.01%) | 52901 |

| Apple Inc. | AAPL | 162.6 | -0.34(-0.21%) | 128326 |

| AT&T Inc | T | 35.07 | 0.07(0.20%) | 22913 |

| Barrick Gold Corporation, NYSE | ABX | 13.12 | -0.26(-1.94%) | 4525 |

| Boeing Co | BA | 336.7 | 7.64(2.32%) | 282743 |

| Caterpillar Inc | CAT | 145.76 | 1.32(0.91%) | 49160 |

| Cisco Systems Inc | CSCO | 43.79 | 0.05(0.11%) | 18664 |

| Citigroup Inc., NYSE | C | 69.2 | 0.08(0.12%) | 8992 |

| Deere & Company, NYSE | DE | 138.1 | -0.01(-0.01%) | 906 |

| Exxon Mobil Corp | XOM | 78.06 | -0.29(-0.37%) | 2496 |

| Facebook, Inc. | FB | 160.3 | 0.61(0.38%) | 244857 |

| Ford Motor Co. | F | 11.02 | 0.06(0.55%) | 26201 |

| General Electric Co | GE | 14.63 | -0.05(-0.34%) | 150949 |

| General Motors Company, NYSE | GM | 37.8 | -0.13(-0.34%) | 12738 |

| Goldman Sachs | GS | 243.45 | 0.96(0.40%) | 4862 |

| Google Inc. | GOOG | 1,027.00 | 7.02(0.69%) | 19338 |

| Home Depot Inc | HD | 175.97 | -0.29(-0.16%) | 2616 |

| HONEYWELL INTERNATIONAL INC. | HON | 146.5 | -0.72(-0.49%) | 130 |

| Intel Corp | INTC | 51.9 | 0.45(0.87%) | 53825 |

| International Business Machines Co... | IBM | 145.45 | -0.11(-0.08%) | 2561 |

| Johnson & Johnson | JNJ | 125.77 | -0.42(-0.33%) | 1380 |

| JPMorgan Chase and Co | JPM | 110.6 | 0.19(0.17%) | 6962 |

| McDonald's Corp | MCD | 156.9 | -0.42(-0.27%) | 627 |

| Merck & Co Inc | MRK | 59.9 | -0.19(-0.32%) | 335 |

| Microsoft Corp | MSFT | 93.1 | -0.02(-0.02%) | 65656 |

| Pfizer Inc | PFE | 37.11 | 0.05(0.13%) | 763 |

| Procter & Gamble Co | PG | 72.51 | 0.01(0.01%) | 6023 |

| Starbucks Corporation, NASDAQ | SBUX | 57.48 | -0.33(-0.57%) | 497 |

| Tesla Motors, Inc., NASDAQ | TSLA | 283 | -0.46(-0.16%) | 17385 |

| The Coca-Cola Co | KO | 42.93 | -0.14(-0.32%) | 3144 |

| Twitter, Inc., NYSE | TWTR | 31.54 | 1.07(3.51%) | 7033944 |

| UnitedHealth Group Inc | UNH | 233.9 | -0.32(-0.14%) | 557 |

| Verizon Communications Inc | VZ | 50 | 0.33(0.66%) | 48123 |

| Visa | V | 121.7 | 0.43(0.35%) | 10912 |

| Wal-Mart Stores Inc | WMT | 86.35 | -0.18(-0.21%) | 813 |

| Walt Disney Co | DIS | 99.65 | 0.19(0.19%) | 14659 |

| Yandex N.V., NASDAQ | YNDX | 34 | 0.46(1.37%) | 88029 |

Freeport-McMoRan (FCX) target lowered to $19 from $22 at Cowen

Verizon (VZ) upgraded to Buy from Hold at SunTrust

Verizon (VZ) upgraded to Buy from Neutral at UBS

Walt Disney (DIS) upgraded to Market Perform from Underperform at BMO Capital Markets

Alphabet A (GOOGL) upgraded to Buy at Stifel; target $1,234

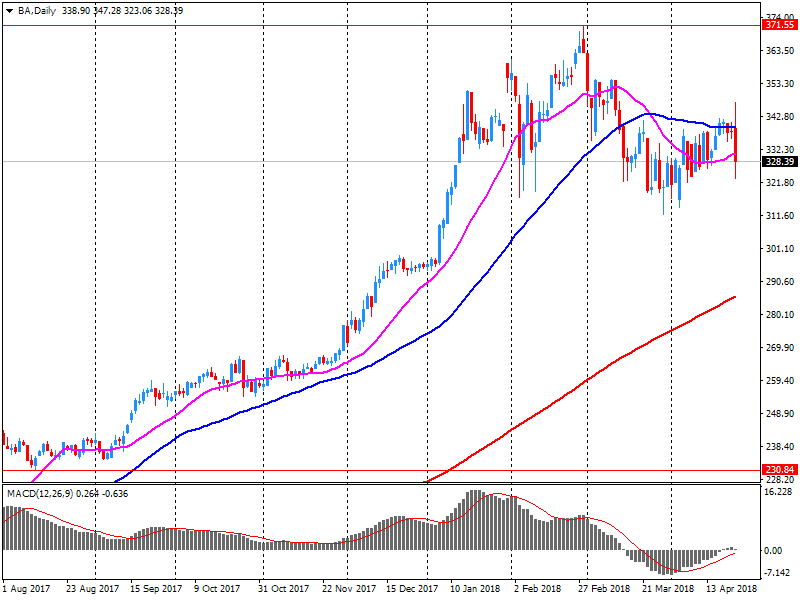

Boeing (BA) reported Q1 FY 2018 earnings of $3.64 per share (versus $2.01 in Q1 FY 2017), beating analysts' consensus estimate of $2.59.

The company's quarterly revenues amounted to $23.382 bln (+6.5% y/y), beating analysts' consensus estimate of $22.221 bln.

The company also raised FY2018 EPS guidance to $14.30-14.50 from $13.80-14.00 (versus analysts' consensus estimate of $14.09) and reaffirmed FY2018 revenues guidance at $96-98 bln (versus analysts' consensus estimate of $97.03 bln).

BA rose to $338.00 (+2.72%) in pre-market trading.

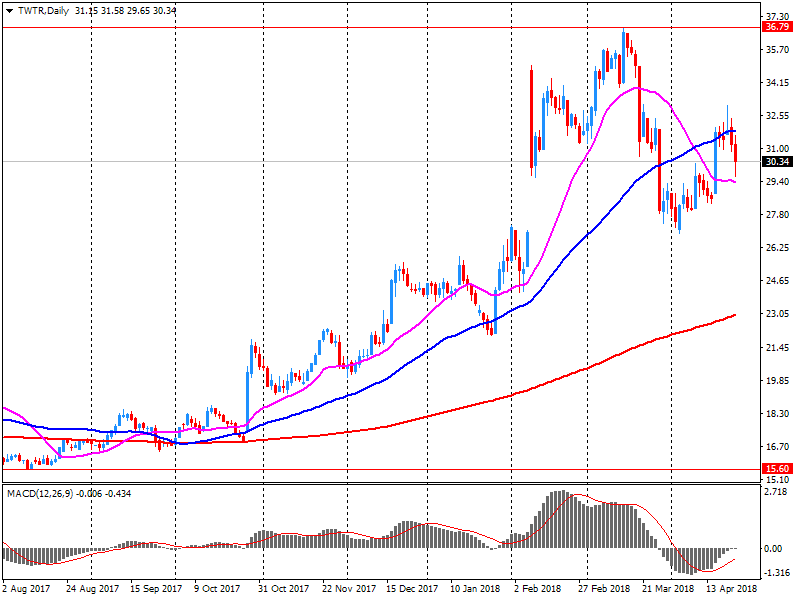

Twitter (TWTR) reported Q1 FY 2018 earnings of $0.16 per share (versus $0.11 in Q1 FY 2017), beating analysts' consensus estimate of $0.11.

The company's quarterly revenues amounted to $0.665 bln (+21.3% y/y), beating analysts' consensus estimate of $0.608 bln.

TWTR rose to $31.69 (+4.00%) in pre-market trading.

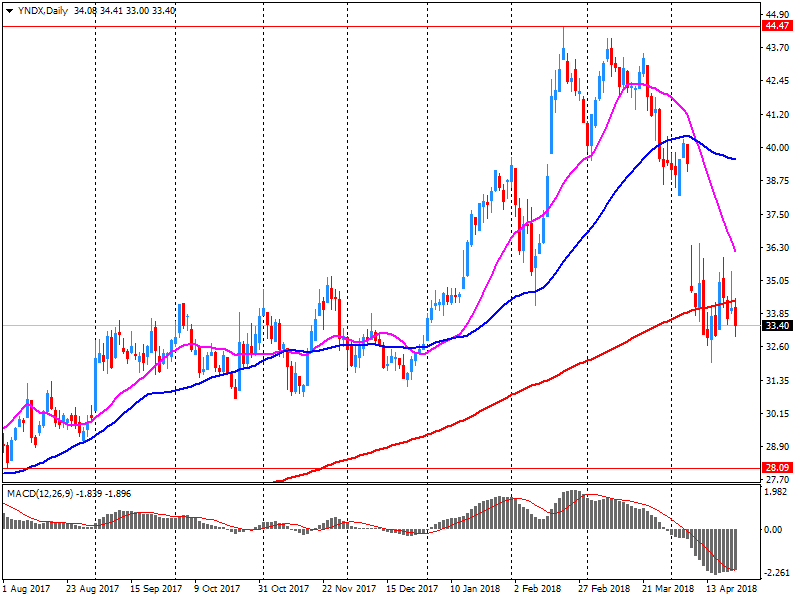

Yandex N.V. (YNDX) reported Q1 FY 2018 earnings of RUB11.96 per share (versus RUB11.41 in Q1 FY 2017), missing analysts' consensus estimate of RUB12.02.

The company's quarterly revenues amounted to RUB26.573 bln (+28.7% y/y), beating analysts' consensus estimate of RUB26.193 bln.

The company also raised its FY 2018 outlook. It expects now its revenue to grow in the range of 28% to 32% y/y this year, up from its prior forecast of +25-30% y/y.

YNDX rose to $34.00 (+1.37%) in pre-market trading.

-

Says the European Commission has taken an open position on how to resolve the customs union issue

EUR/USD

Resistance levels (open interest**, contracts)

$1.2353 (1380)

$1.2331 (277)

$1.2296 (217)

Price at time of writing this review: $1.2216

Support levels (open interest**, contracts):

$1.2171 (3843)

$1.2132 (2427)

$1.2089 (3074)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date May, 4 is 77371 contracts (according to data from April, 24) with the maximum number of contracts with strike price $1,2650 (4233);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4104 (913)

$1.4077 (655)

$1.4039 (414)

Price at time of writing this review: $1.3962

Support levels (open interest**, contracts):

$1.3897 (1185)

$1.3864 (1747)

$1.3826 (2259)

Comments:

- Overall open interest on the CALL options with the expiration date May, 4 is 22480 contracts, with the maximum number of contracts with strike price $1,4400 (3262);

- Overall open interest on the PUT options with the expiration date May, 4 is 24122 contracts, with the maximum number of contracts with strike price $1,3850 (2259);

- The ratio of PUT/CALL was 1.07 versus 1.10 from the previous trading day according to data from April, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Wants to leave a strong and lasting footprint in Syria

-

We have obliterated Isis in Iraq, Syria

-

He and Macron talked about not giving Iran open season in the region

-

Believes autos rules will be "the heart" of NAFTA deal

-

Negotiations are in "very intensive phase", negotiators worked over the weekend and again on monday

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.