- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 25-02-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Construction Work Done | Quarter IV | -0.4% | -1% |

| 07:45 | France | Consumer confidence | February | 104 | 103 |

| 09:00 | Switzerland | Credit Suisse ZEW Survey (Expectations) | February | 8.3 | |

| 13:30 | Eurozone | ECB President Lagarde Speaks | |||

| 14:35 | U.S. | FOMC Member Kaplan Speak | |||

| 15:00 | U.S. | New Home Sales | January | 0.694 | 0.715 |

| 15:30 | U.S. | Crude Oil Inventories | February | 0.414 | |

| 18:00 | U.S. | FOMC Member Kashkari Speaks | |||

| 21:45 | New Zealand | Trade Balance, mln | January | 547 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Construction Work Done | Quarter IV | -0.4% | -1% |

| 07:45 | France | Consumer confidence | February | 104 | 103 |

| 09:00 | Switzerland | Credit Suisse ZEW Survey (Expectations) | February | 8.3 | |

| 13:30 | Eurozone | ECB President Lagarde Speaks | |||

| 14:35 | U.S. | FOMC Member Kaplan Speak | |||

| 15:00 | U.S. | New Home Sales | January | 0.694 | 0.715 |

| 15:30 | U.S. | Crude Oil Inventories | February | 0.414 | |

| 18:00 | U.S. | FOMC Member Kashkari Speaks | |||

| 21:45 | New Zealand | Trade Balance, mln | January | 547 |

- Coronavirus is a negative supply-side shock, hence one shouldn't overstate adequacy of monetary policy response

- Bank of France will likely revise slightly downward 2020 French growth forecast (which is currently at 1.1 percent)

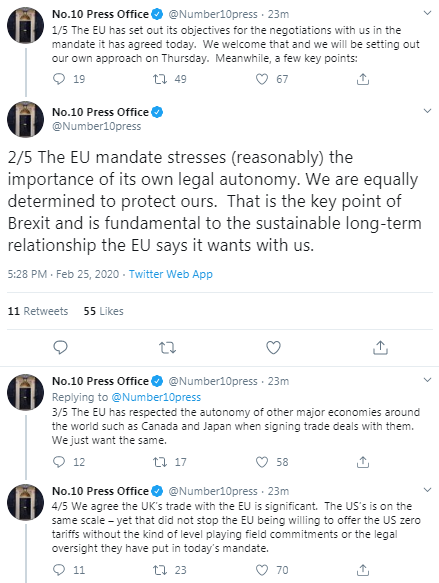

- EU is ready to open some ten negotiating tables at the same time

- These will be complex, demanding negotiations

- EU won't conclude talks at any price

The latest survey from the Federal Reserve Bank of Richmond revealed on Tuesday that the U.S. fifth district's manufacturing softened in February.

According to the report, the composite manufacturing index dropped from 20 in January to -2 in February, as its three major components - shipments (to 1 in February from 29 in January), new orders (to -10 from 13), and employment (to 8 from 20) - declined. In addition, backlog of orders also decreased (to -6 from 9). Still, the index for local business conditions remained positive, and manufacturers were optimistic that activity would improve in the coming months, the Richmond Fed noted.

Economists had expected a reading of 13. A reading above 0 signals expansion, while a reading below 0 indicates contraction.

The Conference Board announced on Tuesday its U.S. consumer confidence gauge rose 0.3 points to 130.7 in February from a 130.4 in January.

Economists had expected consumer confidence to come in at 132.0.

January's consumer confidence reading was revised down from originally estimated 131.6.

The survey showed that the expectations index rose from 101.4 last month to 107.8 this month, while the present situation index fell from 173.9 to 165.1.

Lynn Franco, Senior Director of Economic Indicators at The Conference Board, noted: "Consumer confidence improved slightly in February, following an increase in January. Despite the decline in the Present Situation Index, consumers continue to view current conditions quite favorably. Consumers' short-term expectations improved, and when coupled with solid employment growth, should be enough to continue to support spending and economic growth in the near term."

S&P reported on Tuesday its Case-Shiller Home Price Index, which tracks home prices in 20 U.S. metropolitan areas, rose 2.9 percent y-o-y in December, following a revised 2.5 percent y-o-y increase in November (originally a 2.6 percent y-o-y climb).

Economists had expected an advance of 2.8 percent y-o-y.

Phoenix (+6.5 percent y-o-y), Charlotte (+5.3 percent y-o-y) and Tampa (+5.2 percent y-o-y) recorded the highest y-o-y advances in December. Overall, twelve of the 20 cities reported greater price gains in the year ending December versus the year ending November.

Meanwhile, the S&P/Case-Shiller U.S. National Home Price Index, which measures all nine U.S. census divisions, surged 3.8 percent y-o-y in December, up from 3.5 percent y-o-y in the previous month.

"The U.S. housing market continued its trend of stable growth in December," noted Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. "December's results bring the National Composite Index to a 3.8% increase for calendar 2019. This marks eight consecutive years of increasing housing prices (an increase which is echoed in our 10- and 20-City Composites). At the national level, home prices are 59% above the trough reached in February 2012, and 15% above their pre-financial crisis peak. Results for 2019 were broad-based, with gains in every city in our 20-City Composite."

U.S. stock-index futures rose on Tuesday, helped by upbeat earnings reports from Home Depot (HD; +3.1%) and HP Inc. (HPQ; +2.7%), a day after the market recorded its worst decline in two years on concerns the coronavirus outbreak would dent global economic growth.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,605.41 | -781.33 | -3.34% |

| Hang Seng | 26,893.23 | +72.35 | +0.27% |

| Shanghai | 3,013.05 | -18.18 | -0.60% |

| S&P/ASX | 6,866.60 | -111.70 | -1.60% |

| FTSE | 7,102.91 | -53.92 | -0.75% |

| CAC | 5,760.39 | -31.48 | -0.54% |

| DAX | 12,987.66 | -47.58 | -0.37% |

| Crude oil | $51.39 | | -0.08% |

| Gold | $1,653.00 | | -1.41% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 152.8 | 0.25(0.16%) | 5067 |

| ALCOA INC. | AA | 15.5 | 0.14(0.91%) | 6721 |

| ALTRIA GROUP INC. | MO | 44.15 | 0.35(0.80%) | 7090 |

| Amazon.com Inc., NASDAQ | AMZN | 2,030.00 | 20.71(1.03%) | 66858 |

| American Express Co | AXP | 128.8 | 0.61(0.48%) | 4803 |

| AMERICAN INTERNATIONAL GROUP | AIG | 46.12 | 0.42(0.92%) | 360 |

| Apple Inc. | AAPL | 301.52 | 3.34(1.12%) | 461778 |

| AT&T Inc | T | 38.2 | 0.15(0.39%) | 37332 |

| Boeing Co | BA | 318.85 | 0.95(0.30%) | 41853 |

| Caterpillar Inc | CAT | 133.02 | 0.85(0.64%) | 2486 |

| Chevron Corp | CVX | 105 | 0.29(0.28%) | 1758 |

| Cisco Systems Inc | CSCO | 44.18 | 0.18(0.41%) | 59665 |

| Citigroup Inc., NYSE | C | 73 | 0.47(0.65%) | 15788 |

| Deere & Company, NYSE | DE | 173.7 | 1.84(1.07%) | 520 |

| E. I. du Pont de Nemours and Co | DD | 50.8 | 0.35(0.69%) | 923 |

| Exxon Mobil Corp | XOM | 56.55 | 0.19(0.34%) | 40208 |

| Facebook, Inc. | FB | 202.13 | 1.41(0.70%) | 114368 |

| FedEx Corporation, NYSE | FDX | 155.9 | 1.05(0.68%) | 1880 |

| Ford Motor Co. | F | 7.69 | 0.12(1.59%) | 201760 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.3 | 0.06(0.53%) | 12380 |

| General Electric Co | GE | 11.98 | 0.12(1.01%) | 330342 |

| General Motors Company, NYSE | GM | 33.3 | 0.21(0.63%) | 10941 |

| Goldman Sachs | GS | 225.25 | 0.71(0.32%) | 2298 |

| Google Inc. | GOOG | 1,432.99 | 11.40(0.80%) | 12592 |

| Hewlett-Packard Co. | HPQ | 22.85 | 0.75(3.39%) | 582725 |

| Home Depot Inc | HD | 246.75 | 7.05(2.94%) | 91420 |

| HONEYWELL INTERNATIONAL INC. | HON | 176.4 | 1.13(0.64%) | 220 |

| Intel Corp | INTC | 62.31 | 0.55(0.89%) | 81669 |

| International Business Machines Co... | IBM | 147.15 | 0.72(0.49%) | 4637 |

| Johnson & Johnson | JNJ | 146.26 | 0.35(0.24%) | 4400 |

| JPMorgan Chase and Co | JPM | 133.4 | 1.24(0.94%) | 35833 |

| McDonald's Corp | MCD | 213.53 | 0.01(0.00%) | 4028 |

| Merck & Co Inc | MRK | 81.4 | 0.07(0.09%) | 5273 |

| Microsoft Corp | MSFT | 173.9 | 3.01(1.76%) | 445886 |

| Nike | NKE | 96.52 | 0.61(0.64%) | 6179 |

| Pfizer Inc | PFE | 34.88 | 0.21(0.61%) | 26197 |

| Procter & Gamble Co | PG | 123.6 | 0.30(0.24%) | 3045 |

| Starbucks Corporation, NASDAQ | SBUX | 84.9 | 0.38(0.45%) | 7431 |

| Tesla Motors, Inc., NASDAQ | TSLA | 846.5 | 12.71(1.52%) | 294818 |

| The Coca-Cola Co | KO | 58.6 | -0.05(-0.09%) | 5786 |

| Travelers Companies Inc | TRV | 134.01 | -0.11(-0.08%) | 673 |

| Twitter, Inc., NYSE | TWTR | 36.3 | 0.41(1.14%) | 90044 |

| United Technologies Corp | UTX | 147.94 | 1.36(0.93%) | 892 |

| UnitedHealth Group Inc | UNH | 278.53 | 0.74(0.27%) | 18068 |

| Verizon Communications Inc | VZ | 58.1 | 0.11(0.19%) | 1988 |

| Visa | V | 198.39 | -0.40(-0.20%) | 73432 |

| Wal-Mart Stores Inc | WMT | 116.75 | 0.43(0.37%) | 5867 |

| Walt Disney Co | DIS | 133.8 | 0.79(0.59%) | 25492 |

| Yandex N.V., NASDAQ | YNDX | 42.8 | 0.78(1.86%) | 230831 |

Tesla (TSLA) downgraded to Hold from Buy at Jefferies; target raised to $800

NVIDIA (NVDA) downgraded to Reduce from Neutral at Nomura; target lowered to $230

Micron (MU) downgraded to Underperform from Buy at BofA/Merrill; target $50

- Adds tariff rates with India are unacceptable

- Says India will invest $3 bln in defense and will also purchase energy products from U.S.

- Says he was happy when he heard World Health Organization's (WHO) statement that coronavirus infections are going down in China

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 07:00 | Germany | GDP (YoY) | Quarter IV | 0.6% | 0.4% | 0.4% |

| 07:00 | Germany | GDP (QoQ) | Quarter IV | 0.2% | 0% | 0% |

| 11:00 | United Kingdom | CBI retail sales volume balance | February | 4 | 1 |

USD traded lower against most other major currencies in the European session on Tuesday as investors expect that global coronavirus outbreak could prompt the U.S. Federal Reserve to cut interest rates to curb potential economic fallout from the virus.

The dollar index edged down by 0.1% to 99.31.

Fed officials flagged coronavirus risk at their January meeting but noted it was too early to say whether the virus effects on the U.S. economy would be material.

Anyway, market participants have been placing increasing bets on rate cuts later this year in interest-rate futures markets. According to the CME FedWatch Tool, traders are now pricing in a 52% chance of an interest rate cut at the Fed’s April meeting. They also assign a 37% chance of three cuts by the end of the year.

- Austria confirms first two cases of COVID-19, governor of Tyrol province Günther Platter told Austrian Press Agency (APA)

- Croatia confirms first coronavirus case, Prime Minister Andrej Plenković announced

Home Depot (HD) reported Q4 FY 2019 earnings of $2.28 per share (versus $2.25 per share in Q4 FY 2018), beating analysts' consensus estimate of $2.11 per share.

The company's quarterly revenues amounted to $25.782 bln (-2.7% y/y), in line with analysts' consensus estimate of $25.782 bln.

The company also issued downside guidance for FY 2020, projecting EPS of ~$10.45 (versus analysts' consensus estimate of $10.55) and revenues of +3.5-4.0% y/y to $114.1-114.6 bln (versus analysts' consensus estimate of $114.91 bln).

HD rose to $245.61 (+2.47%) in pre-market trading.

Carsten Brzeski, Chief Economist ING Germany, believes that the German economy remains stuck in stagnation.

"The just-released second estimate of fourth quarter GDP growth revealed that the economy came to a standstill. GDP growth came in at 0.0% quarter-on-quarter, from 0.2% QoQ in 3Q. On the year, the economy had still grown by 0.4%. Private consumption stagnated, investments and exports dropped while construction and government consumption increased. The fact that inventories contributed 0.6 percentage points to quarterly growth, however, does not bode well for the coming quarters."

"Moving closer to recent developments, the German economy has been stuck in a de facto stagnation since mid-2018, with average quarterly growth at a meagre 0.1%. There is no single explanation for the slowdown. In fact, it is a combination of too many one-offs, disruption in key sectors and a lack of new structural reforms and investment, which have turned around the economy’s biggest challenges within less than two years. Back in 2018, the German economy was suffering from supply side constraints, now it is mainly suffering from a lack of demand. Still, let’s not forget that the domestic part of the economy remains solid. The stagnation masks a two-speed economy underneath. Maybe the only common denominator of all the different drivers is the fact that Germany’s strongest trump card has become its biggest vulnerability: its openness and dependence on exports and global trade."

"Looking ahead, recent tentative signs of a bottoming out in the manufacturing sector have been overshadowed by the possible adverse economic impact from the coronavirus, be it directly through weaker demand from Asia, or indirectly through supply chain disruptions. At the same time, some technical factors like the strong growth contribution from inventories in the fourth quarter as well as weather-driven strong activity in construction do not bode well for first quarter growth in 2020, as these factors often reverse on a quarterly basis."

HP (HPQ) reported Q1 FY 2020 earnings of $0.65 per share (versus $0.52 per share in Q1 FY 2019), beating analysts' consensus estimate of $0.54 per share.

The company's quarterly revenues amounted to $14.618 bln (-0.6% y/y), roughly in line with analysts' consensus estimate of $14.637 bln.

The company issued downside guidance for Q2 FY 2020, projecting EPS of $0.49-0.53 versus analysts' consensus estimate of $0.54.

For FY 2020, the company projected EPS of $2.33-2.43 versus analysts' consensus estimate of $2.24.

HPQ rose to $22.90 (+3.62%) in pre-market trading.

- Says will increase yuan re-lending and re-discount quota by 500 billion yuan to support small and medium banks

- Encourages banks to delay interest payment for eligible firms until 30 June

- Encourages commercial banks to step up lending to small firms

- Says will push lending rates significantly lower

- Will lower interest rates for loans to small and agriculture businesses by 0.25%

- Will exempt VAT for small businesses in Hubei from March to end-May

The Confederation of British Industry (CBI) reported on Tuesday its latest survey of retailers showed retail sales volume balance rose to 1 in February from 0 in January. That marked the fourth consecutive month of broadly flat retail sales volume (following a period of falling sales from mid-2019) but represented the highest balance since April 2019.

Economists had forecast the reading to increase to 4.

The report also revealed that retailers expect the retail sales volumes to remain broadly flat in the year to March (-3). Meanwhile, orders placed with suppliers dropped for the tenth consecutive month (balance of -13), with retailers expecting a faster decline next month (-22). Despite this, investment outlook improved noticeably from the previous quarter, with investment intentions seeing the largest swing since the start of the survey in 1983, with the balance reaching its highest since November 2010 (+26, from -38 in November).

Ben Jones, CBI Principal Economist, noted: "The prospects for a recovery in investment in the retail sector are on the up. This is particularly the case among large retailers, driven by shifts online and the trend for re-purposing retail space. But the first months of 2020 haven't brought a tangible change in fortunes on the high street. Conditions remain tough, especially for smaller retailers, and that won't be changing anytime soon. Retailers will be looking to the new Chancellor to recognise the challenges facing the sector in his upcoming Budget."

-

The market will crash "like you have never seen before" if he loses the election

-

The market will go up if he wins the election this year

-

US is spending a tremendous amount on coronavirus efforts

CNBC reports that U.S. government debt prices changed course to climb on Tuesday as markets continue to rattle amid global coronavirus fears.

The yield on the benchmark 10-year Treasury note, which moves inversely to price, was down at 1.363% having hit its lowest intraday level in over three years on Monday. The yield on the 30-year Treasury bond was also lower at 1.822% but remained above the all-time lows notched on Monday.

A sharp rise in cases of the new coronavirus in Italy, South Korea and the Middle East sparked fears of a global pandemic which will slow the world economy, sending investors running for cover on Monday.

Markets remain attuned to coronavirus developments, with South Korea now reporting 60 new cases to bring the country's total to 893 infected, while China's National Health Commission reported 508 new confirmed cases and 71 new deaths as of Monday night.

.

eFXdata reports that Citi discusses EUR/CHF technical outlook and flags a scope for targeting 1.0234-1.0264 on a decisive break below 1.06.

"Intervention watch has become the topic of conversation for CHF/SNB watchers, and we wrote about limited options recently," Citi notes.

"EURCHF continues to sit at significant support around 1.06, and should we break lower, CitiFX Technicals see us visiting 1.0234-1.0264," Citi adds.

CNBC reports that Saudi Energy Minister Prince Abdulaziz bin Salman said that OPEC and its allied oil-producing nations are still working well together and still have options to try to rebalance global crude markets.

"We do communicate with each other, we use every opportunity to talk with each other," he said, speaking to reporters at the ICCUS conference in the Saudi capital of Riyadh.

"We did not run out of ideas, we haven't lost our phones and there are always good ways of communicating through conference calls and technology is very helpful."

His comments came amid speculation that there is tension in the alliance, known as OPEC+, over whether to cut oil production further.

Prince Abdulaziz insisted that the producer countries in the alliance communicate and he was "confident of our partnership," adding that every producer was a "responsible" one.

FXStreet reports that in opinion of FX Strategists at UOB Group, USD/JPY could have charted a temporary top in the 112.20 region (February 20th).

24-hour view: "The sudden and sharp plunge in USD was unexpected as it plunged to an overnight low of 110.32. While the rapid drop appears to be running ahead of itself, the vastly improved downward momentum suggests it is too early to expect a sustained recovery. USD is more likely to consolidate and trade within a relatively broad 110.30/111.30 range."

Next 1-3 weeks: "We highlighted yesterday (24 Feb) that 'if USD were to break 111.20, it would indicate it need more time to muster enough momentum to challenge to the critical 112.40 level'. However, the manner by which USD cracked 111.20 and the subsequent plunge to a low of 110.32 came as a surprise. The price action suggests that last Thursday's (20 Feb) high of 112.21 is a top, albeit likely a temporary one. From here, USD could continue to trade in volatile manner but is expected to stay to within last week's broad 109.64/112.21 for a while."

eFXdata reports that CIBC Research notes the breakdown in the relationship between JPY and Gold prices.

"During the current risk-off sentiment in FX markets, the only source of real solace appears to be the US$. One of the best example of traditional safe havens losing their shine is the relationship between the yen and gold prices. Even before the aforementioned horrid GDP print gave the yen a further kick weaker, that relationship had started to break down," CIBC notes.

"Because the only real risk-off play is the US$ at the moment, this puts the greenback at greater risk when global sentiment improves. Given continuing uncertainty regarding the Chinese economy, this could be more of a story for the second half of the year," CIBC adds.

FXStreet reports that NZD/USD is still seen slipping back to the 0.6270 region in the next weeks, noted FX Strategists at UOB Group.

24-hour view: "We highlighted yesterday that "downward pressure has eased" and expected NZD to 'trade sideways between 0.6305 and 0.6355'. NZD subsequently traded between 0.6304 and 0.6356. The underlying tone has firmed somewhat and from here, there is scope for NZD to probe the 0.6360 resistance. For today, the strong resistance at 0.6380 is not expected to come into the picture. Support is at 0.6325 followed by 0.6305."

Next 1-3 weeks: "NZD tried but failed again to move below 0.6300 as it rebounded from 0.6304 (NZD touched 0.6303 last Friday). For now, there is no change to our view from last Friday (21 Feb, spot 0.6330) wherein we expected further NZD weakness to 0.6270. On the upside, a breach of 0.6380 (no change in 'strong resistance' level) would indicate that the current downward pressure has eased."

According to the business managers surveyed in February 2020, the business climate in industry has remained at 102, two points above its long term average.

n February 2020, the industrialists' balance of opinion on their overall order books has improved for the second month consecutively, after the low point of December. However, the balance on foreign order books has worsened again, after a rebound in January. Both balances stand above their long-term average. The balance of opinion on past production has recovered slightly but stays below its average. The balance on personal production prospects is stable, after a sharp increase in January, and the one on general prospects has recovered sharply. Both balances stand above their long-term average.

Considering employment, the balances of opinion on past and expected variations are practically stable. Both balances stand above their average. The turning point indicator has remained in the area indicating a favourable economic outlook.

Insee also reported that in February 2020 the business climate is stable. At 105, the composite indicator, compiled from the answers of business managers in the main market sectors, is still above its long-term mean (100). Compared to January, the business climate has gained one point in retail trade and in services. It is stable in building construction and in manufacturing. In all sectors, the business climate stands above its long-term average.

eFXdata reports that Danske Research discusses USD/CAD outlook and maintains forecast profile unchanged at 1.32 in 3M, 1.29 in 6M and 1.27 in 12M.

"The CAD is caught between suffering energy (warm weather, virus fears and strong USD) and a global investor preference for US assets, which indirectly has supported the broad CAD. Bank of Canada has turned significantly more dovish in recent months and we keep our baseline call of two 25bp rate cuts over the coming 12M. In comparison, markets price 35bp worth of cuts," Danske notes.

"Fundamentally, we still regard USD/CAD as overvalued, with fair-value estimates in the low 1.20s. According to CFTC IMM data, speculative CAD positioning is neutral but investors have recently added significant amount of shorts," Danske adds.

FXStreet reports that in light of the recent price action, Cable is now expected to remain side-lined in the next weeks, suggested FX Strategists at UOB Group.

24-hour view: "Our expectation for GBP 'to retest last Friday's 1.2980 peak' was incorrect as it dropped to a low of 1.2887 before rebounding quickly. The price action is deemed as a consolidation phase and GBP is expected to trade sideways for now, likely between 1.2885 and 1.2960."

Next 1-3 weeks: "The downward pressure that last Thursday (20 Feb, spot at 1.2920) ended abruptly as GBP rebounded above the 'strong resistance' level of 1.2960 (high of 1.2980). For now, last week's 1.2849 low is viewed as an interim bottom and the current price action is likely part of a consolidation phase. In other words, GBP is expected to trade sideways between 1.2850 and 1.3030."

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 05:00 | Japan | Leading Economic Index | December | 90.8 | 91.6 | 91.6 |

| 05:00 | Japan | Coincident Index | December | 94.7 | 94.7 | 94.1 |

| 07:00 | Germany | GDP (YoY) | Quarter IV | 0.6% | 0.4% | 0.3% |

| 07:00 | Germany | GDP (QoQ) | Quarter IV | 0.2% | 0% | 0% |

During today's Asian trading, the us dollar traded steadily against the Euro, rose slightly against the yen and fell against the pound.

The spread of the Covid-19 coronavirus outside China is causing strong investor concern that the consequences for the global economy will be more dramatic than previously thought. Analysts are starting to think that the Federal reserve may cut interest rates in response. A number of them expect that the rate cut before the end of this year could reach 50 basis points from the current 1.5-1.75% per annum.

DBS analysts predict that the yen may weaken and move into the range of 110-115 yen/$1 after weak statistics on the state of the country's economy. The Japanese economy fell at its fastest pace in 5.5 years in the fourth quarter, following a 6.3% increase in the country's consumption tax compared to the same period in 2018. The reduction in GDP occurred for the first time since the third quarter of 2018. DBS expects that the Japanese economy may show a decline this quarter, resulting in a technical recession for the first time since 2012.

The ICE Dollar index, which shows the value of the dollar against six major world currencies, fell by 0.05% compared to the previous day. For much of last week, it was near a three-year high, but started losing ground on Friday and Monday.

According to the report from Federal Statistical Office (Destatis), the gross domestic product (GDP) did not continue to rise in the fourth quarter of 2019 compared with the third quarter of 2019 after adjustment for price, seasonal and calendar variations. As the Destatis reported in its first release of 14 February 2020, there had been a dynamic start in the first quarter of 2019 (+0.5%), a decline in the second quarter (-0.2%) and a slight recovery in the third quarter of the year (+0.2%). The resulting price-adjusted GDP growth was 0.6% for all of 2019 (also after calendar adjustment).

Compared with the previous quarter, there were mixed signals regarding domestic demand (after price, seasonal and calendar adjustment). Growth of domestic final consumption expenditure, which had often been the main economic driving force lately, slowed markedly after a very strong third quarter. Household final consumption expenditure stagnated in the fourth quarter of 2019 (0.0%) and general government final consumption expenditure rose only slightly by 0.3%. Trends diverged for fixed capital formation. While gross fixed capital formation in construction increased by 0.6% on the third quarter, which was due also to the mild weather, capital formation in machinery and equipment again decreased considerably (-2.0%). Capital formation in other fixed assets was up 1.1% on a quarter earlier.

The development of foreign trade slowed down the economic activity in the fourth quarter. According to provisional calculations, exports were down 0.2% on the third quarter after price, seasonal and calendar adjustment. While exports of services were slightly higher than in the previous quarter (+0.4%), exports of goods decreased by 0.4%. Imports of goods and services, however, rose by 1.3%.

In a year-on-year comparison, economic growth decelerated towards the end of the year. In the fourth quarter of 2019, the price-adjusted GDP rose by 0.3% on the fourth quarter of 2018 (calendar-adjusted: +0.4%). A higher year-on-year increase of 1.1% had been recorded for the third quarter of 2019 (calendar-adjusted: +0.6%).

EUR/USD

Resistance levels (open interest**, contracts)

$1.0927 (2228)

$1.0898 (3593)

$1.0879 (796)

Price at time of writing this review: $1.0854

Support levels (open interest**, contracts):

$1.0829 (2525)

$1.0808 (2559)

$1.0777 (2519)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 6 is 113235 contracts (according to data from February, 24) with the maximum number of contracts with strike price $1,1200 (6367);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3070 (3915)

$1.3032 (2225)

$1.2973 (368)

Price at time of writing this review: $1.2938

Support levels (open interest**, contracts):

$1.2889 (1634)

$1.2872 (2478)

$1.2848 (3592)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 28388 contracts, with the maximum number of contracts with strike price $1,3050 (3915);

- Overall open interest on the PUT options with the expiration date March, 6 is 30651 contracts, with the maximum number of contracts with strike price $1,2800 (3707);

- The ratio of PUT/CALL was 1.08 versus 1.07 from the previous trading day according to data from February, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 55.92 | -1.29 |

| WTI | 51.25 | -2.01 |

| Silver | 18.59 | -0.21 |

| Gold | 1658.352 | -0.07 |

| Palladium | 2636.08 | -2.61 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| Hang Seng | -487.93 | 26820.88 | -1.79 |

| KOSPI | -83.8 | 2079.04 | -3.87 |

| ASX 200 | -160.7 | 6978.3 | -2.25 |

| FTSE 100 | -247.09 | 7156.83 | -3.34 |

| DAX | -544.09 | 13035.24 | -4.01 |

| CAC 40 | -237.85 | 5791.87 | -3.94 |

| Dow Jones | -1031.61 | 27960.8 | -3.56 |

| S&P 500 | -111.86 | 3225.89 | -3.35 |

| NASDAQ Composite | -355.31 | 9221.28 | -3.71 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.66031 | 0.18 |

| EURJPY | 120.148 | -0.38 |

| EURUSD | 1.08516 | 0.23 |

| GBPJPY | 143.126 | -0.74 |

| GBPUSD | 1.29273 | -0.14 |

| NZDUSD | 0.63386 | 0.35 |

| USDCAD | 1.32894 | 0.27 |

| USDCHF | 0.97902 | -0.04 |

| USDJPY | 110.712 | -0.61 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.