- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 22-01-2018

(raw materials / closing price /% change)

Oil 63.83 +0.82%

Gold 1,332.90 -0.02%

(index / closing price / change items /% change)

Nikkei +8.27 23816.33 +0.03%

TOPIX +2.18 1891.92 +0.12%

Hang Seng +138.52 32393.41 +0.43%

CSI 300 +51.20 4336.60 +1.19%

Euro Stoxx 50 +16.21 3665.28 +0.44%

FTSE 100 -15.35 7715.44 -0.20%

DAX +29.24 13463.69 +0.22%

CAC 40 +15.48 5541.99 +0.28%

DJIA +142.88 26214.60 +0.55%

S&P 500 +22.67 2832.97 +0.81%

NASDAQ +71.65 7408.03 +0.98%

S&P/TSX -5.48 16347.98 -0.03%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2261 +0,33%

GBP/USD $1,3887 +0,19%

USD/CHF Chf0,9619 -0,10%

USD/JPY Y110,93 +0,17%

EUR/JPY Y136,02 +0,49%

GBP/JPY Y155,157 -0,23%

AUD/USD $0,8017 +0,29%

NZD/USD $0,7326 +0,73%

USD/CAD C$1,24427 -0,50%

03:00 Japan BoJ Interest Rate Decision -0.1% -0.1%

03:00 Japan BoJ Monetary Policy Statement

03:00 Japan BOJ Outlook Report

04:30 Japan All Industry Activity Index, m/m November 0.3% 0.9%

06:30 Japan BOJ Press Conference

09:30 United Kingdom PSNB, bln December -8.12

10:00 Eurozone ZEW Economic Sentiment January 29 30

10:00 Germany ZEW Survey - Economic Sentiment January 17.4 17.9

11:00 United Kingdom CBI industrial order books balance January 17 12

15:00 Eurozone Consumer Confidence (Preliminary) January 0.5 0.6

15:00 U.S. Richmond Fed Manufacturing Index January 20 18

23:30 Australia Leading Index December 0.1%

23:50 Japan Trade Balance Total, bln December 113 530

Major US stock indices rose significantly on Monday, as investors bet on US lawmakers who must strike a deal to stop the closure of the federal government. At the same time, the market is supported by a flurry of M & A deals, which inspired investors.

In addition, as a result of improved production-related indicators, the Chicago Fed's economic activity index (CFNAI) rose to +0.27 in December from +0.11 in November. Two of the four broad categories of indicators that make up the index have increased since November, and three of the four categories made a positive contribution to the index in December. The three-month moving average of the index, CFNAI-MA3, fell to +0.42 in December from +0.43 in November.

The cost of oil increased by about 1%, supported by weakness of the US dollar, comments from Saudi Arabia, as well as strong economic growth, which helped to strengthen the demand for petroleum products. Saudi Energy Minister Khalid al-Falih said that OPEC and other producers will continue to cooperate on reducing oil production after 2018.

Most components of the DOW index finished trading in positive territory (20 out of 30). Leader of growth were shares of Verizon Communications Inc. (VZ, + 2.87%). Outsider - NIKE, Inc. (NKE, -1.25%).

Almost all sectors of the S & P index finished trading in positive territory. The base materials sector grew most (+ 1.2%). The sector of industrial goods decreased only (-0.1%).

At closing:

DJIA + 0.55% 26,214.60 +142.88

Nasdaq + 0.98% 7,408.03 +71.65

S & P + 0.81% 2,832.97 +22.67

-

Says China needs to take further steps to open its economy to imports

-

More can be done on EU's banking union project, notably on common deposit insurance

-

Without policy action next economic downturn will come sooner and be harder to fight

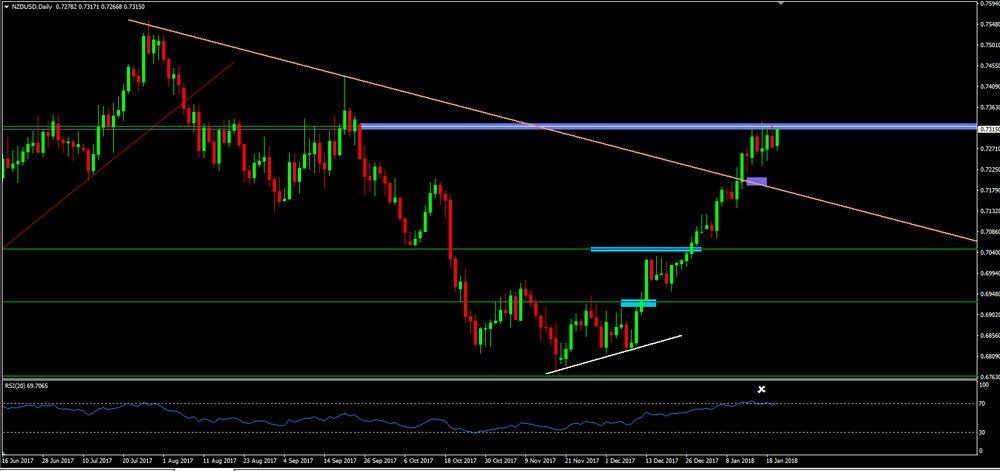

On daily time frame chart, we can see that NZD/USD has been follwing a strong bullish trend on the last few weeks.

However, now the price is showing some difficults in break through the purple box (resistance level) and the indicator - RSI - is showing a "overbought" which it may give some indications of a reversal trend.

Therefore, we can expect a further bearish movement soon.

U.S. stock-index futures fell slightly on Monday, as investors assessed the impact of the government's ongoing partial shutdown in the U.S. At the same time, the further decline was limited by the expectations of broadening global economic growth and the profit expansion.

Global Stocks:

Nikkei 23,816.33 +8.27 +0.03%

Hang Seng 32,393.41 +138.52 +0.43%

Shanghai 3,501.36 +13.50 +0.39%

S&P/ASX 5,991.90 -13.90 -0.23%

FTSE 7,736.92 +6.13 +0.08%

CAC 5,541.48 +14.97 +0.27%

DAX 13,452.63 +18.18 +0.14%

Crude $63.29 (-0.03%)

Gold $1,333.10 (0%)

-

Revises up growth forecasts for euro area, including Germany, Italy, cuts forecast for Spain

-

Maintains growth forecast for emerging markets and developing countries

-

Sees U.S. growth slowing from 2022 as impact from tax package starts to wane

-

Revision to its outlook reflects global growth momentum, expected impact of U.S. tax cuts

Sales were up in six of seven subsectors, representing 99% of wholesale sales. The food, beverage and tobacco subsector and the motor vehicle and parts subsector led the gains.

In volume terms, wholesale sales increased 0.5%.

The food, beverage and tobacco subsector posted the largest increase in dollar terms in November, rising 1.9% to $12.2 billion. Higher sales in the food industry, up 2.2% to $11.1 billion, contributed the most to the gain. This was the highest level on record for both the subsector and the industry.

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 53 | -0.10(-0.19%) | 400 |

| ALTRIA GROUP INC. | MO | 71.13 | 0.01(0.01%) | 295 |

| Amazon.com Inc., NASDAQ | AMZN | 1,295.25 | 0.67(0.05%) | 16405 |

| American Express Co | AXP | 97.23 | -0.80(-0.82%) | 8601 |

| AMERICAN INTERNATIONAL GROUP | AIG | 61.2 | -0.35(-0.57%) | 8704 |

| Apple Inc. | AAPL | 177.47 | -0.99(-0.55%) | 187149 |

| Barrick Gold Corporation, NYSE | ABX | 14.42 | 0.05(0.35%) | 7700 |

| Boeing Co | BA | 337 | -0.73(-0.22%) | 10272 |

| Caterpillar Inc | CAT | 170 | -0.41(-0.24%) | 4313 |

| Cisco Systems Inc | CSCO | 41.4 | 0.11(0.27%) | 4967 |

| Citigroup Inc., NYSE | C | 78.05 | -0.25(-0.32%) | 9989 |

| Facebook, Inc. | FB | 181.24 | -0.05(-0.03%) | 58864 |

| FedEx Corporation, NYSE | FDX | 274.02 | -0.30(-0.11%) | 134 |

| Ford Motor Co. | F | 12.02 | 0.02(0.17%) | 42999 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.78 | -0.18(-0.90%) | 49575 |

| General Electric Co | GE | 15.99 | -0.27(-1.66%) | 996487 |

| Goldman Sachs | GS | 255.67 | -0.45(-0.18%) | 2922 |

| Google Inc. | GOOG | 1,135.85 | -1.66(-0.15%) | 628 |

| Home Depot Inc | HD | 201.87 | 0.54(0.27%) | 1566 |

| Intel Corp | INTC | 44.84 | 0.02(0.04%) | 12416 |

| International Business Machines Co... | IBM | 161.93 | -0.44(-0.27%) | 14614 |

| JPMorgan Chase and Co | JPM | 112.67 | -0.34(-0.30%) | 4209 |

| Merck & Co Inc | MRK | 61.21 | -0.07(-0.11%) | 4223 |

| Microsoft Corp | MSFT | 89.96 | -0.04(-0.04%) | 6893 |

| Nike | NKE | 66.89 | -0.32(-0.48%) | 9097 |

| Pfizer Inc | PFE | 36.92 | -0.02(-0.05%) | 3870 |

| Procter & Gamble Co | PG | 91.19 | 0.12(0.13%) | 1124 |

| Starbucks Corporation, NASDAQ | SBUX | 61.15 | -0.11(-0.18%) | 2637 |

| Tesla Motors, Inc., NASDAQ | TSLA | 349.25 | -0.77(-0.22%) | 17711 |

| The Coca-Cola Co | KO | 47.07 | -0.09(-0.19%) | 5516 |

| Twitter, Inc., NYSE | TWTR | 23.29 | -0.37(-1.56%) | 177767 |

| United Technologies Corp | UTX | 136.5 | 0.60(0.44%) | 1304 |

| Verizon Communications Inc | VZ | 52.04 | 0.13(0.25%) | 16523 |

| Visa | V | 122.8 | 0.10(0.08%) | 6663 |

| Wal-Mart Stores Inc | WMT | 104.35 | -0.24(-0.23%) | 1085 |

General Electric (GE) downgraded to Neutral from Buy at BofA/Merril

Freeport-McMoRan (FCX) downgraded to Neutral from Outperformer at CIBC

American Express (AXP) downgraded to Neutral from Buy at Guggenheim

Apple (AAPL) downgraded to Neutral from Overweight at Atlantic Equities

Verizon (VZ) upgraded to Sector Outperform from Sector Perform at Scotia Howard Weil

January 23

Before the Open:

Johnson & Johnson (JNJ). Consensus EPS $1.72, Consensus Revenues $20090.28 mln.

Procter & Gamble (PG). Consensus EPS $1.14, Consensus Revenues $17389.73 mln.

Travelers (TRV). Consensus EPS $1.51, Consensus Revenues $6466.20 mln.

Verizon (VZ). Consensus EPS $0.88, Consensus Revenues $33190.02 mln.

January 24

Before the Open:

General Electric (GE). Consensus EPS $0.29, Consensus Revenues $33745.25 mln.

United Tech (UTX). Consensus EPS $1.56, Consensus Revenues $15372.26 mln.

After the Close:

Ford Motor (F). Consensus EPS $0.39, Consensus Revenues $36840.81 mln.

January 25

Before the Open:

3M (MMM). Consensus EPS $2.03, Consensus Revenues $7849.73 mln.

Caterpillar (CAT). Consensus EPS $1.78, Consensus Revenues $12008.13 mln.

Freeport-McMoRan (FCX). Consensus EPS $0.49, Consensus Revenues $4877.28 mln.

After the Close:

Intel (INTC). Consensus EPS $0.87, Consensus Revenues $16341.90 mln.

Starbucks (SBUX). Consensus EPS $0.57, Consensus Revenues $6196.44 mln.

January 26

Before the Open:

Honeywell (HON). Consensus EPS $1.84, Consensus Revenues $10812.87 mln.

-

Says we will discuss all issues again in german coalition negotiations

-

SPD will consider this week how to position itself for coalition negotiations

-

Sight deposits of domestic banks at 468.854 bln chf in week ending january 19 versus 473.922 bln chf a week earlier

-

Senate majority leader Mitch Mcconnell says if DACA isn't resolved by feb. 8th and government is open, he would allow a vote

European stocks rose on Friday, with gains for industrial and tech shares helping the region's benchmark bag a third straight weekly win, as investors appeared to set aside concerns about a possible shutdown of the U.S. government.

It's still early, but so far fourth-quarter earnings season is confirming what most investors had already suspected: a lower corporate tax rate is likely to boost profits and may even percolate into the broader economy.

Most Asian markets traded lower on Monday as investors kept an eye on political developments in the U.S. after a government shutdown began last week. Japan's Nikkei 225 edged down 0.18 percent in afternoon trade. Automakers were mixed: Toyota declined 0.68 percent while Mitsubishi Motors tacked on 1.97 percent.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2338 (4134)

$1.2321 (3106)

$1.2297 (2863)

Price at time of writing this review: $1.2225

Support levels (open interest**, contracts):

$1.2166 (1723)

$1.2137 (1651)

$1.2104 (2330)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 115033 contracts (according to data from January, 19) with the maximum number of contracts with strike price $1,1850 (7013);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3970 (2014)

$1.3953 (2994)

$1.3930 (2366)

Price at time of writing this review: $1.3864

Support levels (open interest**, contracts):

$1.3786 (244)

$1.3760 (328)

$1.3730 (309)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 36758 contracts, with the maximum number of contracts with strike price $1,3600 (3482);

- Overall open interest on the PUT options with the expiration date February, 9 is 29760 contracts, with the maximum number of contracts with strike price $1,3500 (3054);

- The ratio of PUT/CALL was 0.81 versus 0.80 from the previous trading day according to data from January, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.