- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 18-11-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | RBA Meeting's Minutes | |||

| 07:00 | Switzerland | Trade Balance | October | 2.9 | |

| 09:00 | Eurozone | Current account, unadjusted, bln | September | 25.7 | 23.4 |

| 10:00 | Eurozone | Construction Output, y/y | September | 1.2% | 2.7% |

| 11:00 | United Kingdom | CBI industrial order books balance | November | -37 | -32 |

| 13:30 | Canada | Manufacturing Shipments (MoM) | September | 0.8% | 0.6% |

| 13:30 | U.S. | Housing Starts | October | 1.256 | 1.32 |

| 13:30 | U.S. | Building Permits | October | 1.387 | 1.387 |

| 14:00 | U.S. | FOMC Member Williams Speaks | |||

| 18:00 | Canada | Gov Council Member Wilkins Speaks | |||

| 23:50 | Japan | Trade Balance Total, bln | October | -123 | 301 |

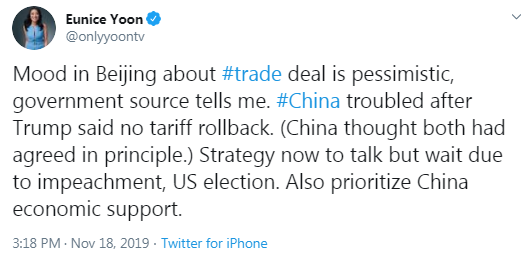

Major US stock indexes rose slightly, as investors focused on conflicting reports about US-China trade negotiations.

CNBC Beijing correspondent Eunice Yun wrote on Twitter today that Chinese officials are pessimistic about the prospects for a deal between the US and China. According to a government source, China is worried about President Trump’s statements that the US will not abolish tariffs, as they believed that both sides had already agreed on this. Beijing's current strategy is to negotiate, but to wait in view of events such as impeachment and US elections. This message runs counter to Chinese state media reporting this weekend that China and the United States are engaged in “constructive” trade negotiations. They also noted that US Trade Representative Robert Lighthizer and Secretary of the Treasury Steven Mnuchin discussed with the Chinese Deputy Prime Minister Liu He key issues of the first phase of the trade agreement.

Market participants also drew attention to data from the National Association of Homebuilders (NAHB), which indicated that the confidence of American homebuilders fell slightly in November. According to the data, the NAHB / Wells Fargo Housing Market Index fell to 70 in November after rising to 71 in October. Economists had expected the index to rise to 72. A modest decline occurred after the housing market index rose for four consecutive months and was at the highest level since reaching the corresponding value in February 2018.

Most DOW components completed trading mixed (15 in the black, 15 in the black). The outsider was Chevron Corp. (CVX; -1.87%). The biggest gainers were The Walt Disney Co. (DIS; + 1.89%).

Most S&P sectors recorded a decline. The largest decline was shown in the base materials sector (-1.2%). The consumer goods sector grew the most (+ 0.2%).

At the time of closing:

Dow 28,036.15 +31.26 + 0.11%

S&P 500 3,122.01 +1.55 + 0.05%

Nasdaq 100 8,549.94 +9.11 + 0.11%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | RBA Meeting's Minutes | |||

| 07:00 | Switzerland | Trade Balance | October | 2.9 | |

| 09:00 | Eurozone | Current account, unadjusted, bln | September | 25.7 | 23.4 |

| 10:00 | Eurozone | Construction Output, y/y | September | 1.2% | 2.7% |

| 11:00 | United Kingdom | CBI industrial order books balance | November | -37 | -32 |

| 13:30 | Canada | Manufacturing Shipments (MoM) | September | 0.8% | 0.6% |

| 13:30 | U.S. | Housing Starts | October | 1.256 | 1.32 |

| 13:30 | U.S. | Building Permits | October | 1.387 | 1.387 |

| 14:00 | U.S. | FOMC Member Williams Speaks | |||

| 18:00 | Canada | Gov Council Member Wilkins Speaks | |||

| 23:50 | Japan | Trade Balance Total, bln | October | -123 | 301 |

Analysts at TD Securities are exppecting the Bank of Canada (BoC) to cut rates by 50bps over 2020, with 25bp cuts in January and April.

- “While the Canadian economy has thus far been resilient to global headwinds, we do not believe recent actions taken by the US and China to enough to meaningfully resolve the elevated level of trade uncertainty. This should prompt the BoC to provide more stimulus to offset the impact of global headwinds, although recent messaging suggests there is a very high bar to do so by the end of 2019.

- Underscoring the BoC's (relatively) constructive outlook is a healthy starting point; Q2 GDP was stronger than expected at 3.7%, and even with an undesirable.”

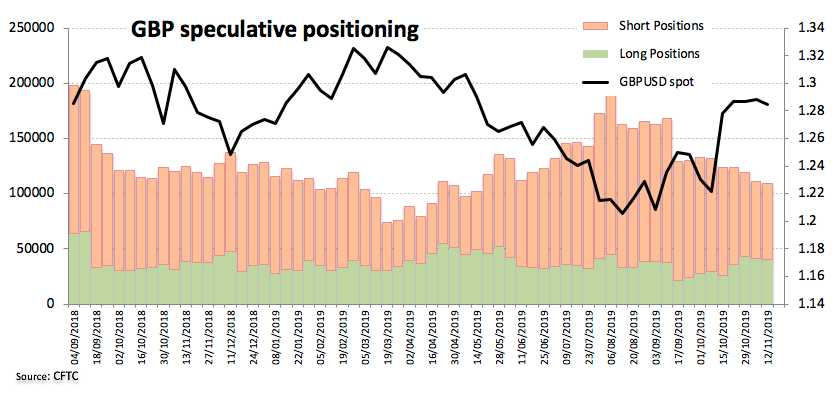

Analysts at Rabobank note the latest CFTC Commitment of Traders Report showed USD net longs slipped for a sixth consecutive week.

“Expectations that a phase 1 trade deal between the US and China could be close to being achieved coupled with another Fed rate cut in October had boosted risk appetite. This had encouraged flows out of the USD into higher-yielding currencies. That said doubts about the trade deal have crept in during the past couple of weeks and this has created some support for the USD in the spot market.

Net EUR short positions edged lower but there has been no strong direction in recent weeks.

Net short GBP positions dropped back for a ninth consecutive week and are at their lowest level since May.

JPY net positions held in negative ground for a fifth consecutive week and shorts rose to their largest level since June.

CHF net shorts increased for a third week consistent with a drop in demand for safe-haven assets.

CAD net long positions dropped back after their recent surge. BoC Governor Poloz last week reiterated the case for keeping the door open for further policy easing.

AUD net shorts bounced back as hopes for a US/China trade faded. The AUD’s role as a proxy for confidence in China suggests that trade talks remain very much in view.”

The National

Association of Homebuilders (NAHB) announced on Monday its housing market index

(HMI) fell one point to 70 in November from an unrevised October reading of 71.

Economists had

forecast the HMI to stay at 71.

A reading over

50 indicates more builders view conditions as good than poor.

Two out of the

three HMI components were lower this month. The indicator gauging current sales

conditions decreased two points to 77, while the component measuring traffic of

prospective buyers fell one point to 53. At the same time, the measure charting

sales expectations in the next six months rose one point to 77.

NAHB Chairman

Greg Ugalde noted: “Single-family builders are currently reporting ongoing

positive conditions, spurred in part by low mortgage rates and continued job

growth. In a further sign of solid demand, this is the fourth consecutive month

where at least half of all builders surveyed have reported positive buyer

traffic conditions.”

Meanwhile, NAHB

Chief Economist Robert Dietz said: “We have seen substantial year-over-year

improvement following the housing affordability crunch of late 2018, when the

HMI stood at 60. However, lot shortages remain a serious problem, particularly

among custom builders. Builders also continue to grapple with other

affordability headwinds, including a lack of labor and regulatory constraints.”

Analysts at TD Securities are expecting Canada’s retail sales to remain subdued with a 0.3% decline in September as softer motor-vehicle sales add to a more subdued 0.1% decline in the ex-autos measure.

- “On a brighter note, the pickup in consumer goods imports does suggest some upside for clothing and other textiles, and the continued recovery in the housing market should support retail sales of furniture and home furnishings.

- Real retail sales should come in below the headline print, providing a poor handoff to Q4 consumption; even though September CPI fell by 0.4% m/m, weakness was concentrated in services, and consumer goods prices rose by 0.2% m/m.”

Analysts at the Royal Bank of Scotland (RBS) note that the U.S. retail sales, excluding volatile items like autos and petrol, rose a modest 0.1% in October after a 0.1% decline the previous month.

- “The softness was broad-based - seven out of thirteen categories fell, hinting at softer activity in Q4. Weakness was most evident in clothing and furniture sales.

- Throw car sales into the mix, which fell 3.7%, and the picture looks even weaker. Could US demand for big-ticket items be cooling? Still, despite the weaker readings the household sector looks set to remain the main source of growth for the US economy, keeping the Federal Reserve on the sidelines, at least near-term. Retailers will be hoping for a Black Friday blowout.

U.S. stock-index futures edged down on Monday amid mixed signals on U.S.-China trade deal.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 23,416.76 | +113.44 | +0.49% |

Hang Seng | 26,681.09 | +354.43 | +1.35% |

Shanghai | 2,909.20 | +17.86 | +0.62% |

S&P/ASX | 6,766.80 | -26.90 | -0.40% |

FTSE | 7,311.76 | +8.82 | +0.12% |

CAC | 5,913.92 | -25.35 | -0.43% |

DAX | 13,163.14 | -78.61 | -0.59% |

Crude oil | $57.19 | -0.92% | |

Gold | $1,465.80 | -0.18% |

The CFTC Positioning Report for the week ended on November 12 reveals the following:

- "Speculators kept scaling back their gross longs in USD, taking the net longs to the lowest level since mid-July. Rising hopes on the U.S.-China trade deal lifted US yields and collaborated with the increasing selling pressure in the safe havens, in turn morphing into extra upside in the buck.

- By the same tocken, JPY net shorts increased to the highest level since early June, as market participants kept dumping their positions in the safe haven universe.

- GBP net shorts retreated to the lowest level since May 21. Indeed, the sterling extended its up move in tandem with riding speculations that Tories could win the December elections with majority.

- Net shorts in VIX (aka ‘the panic index’) increased to multi-year highs. The index has been losing ground for the last seven straight weeks."

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 172.29 | 0.41(0.24%) | 7534 |

ALCOA INC. | AA | 20.9 | 0.01(0.05%) | 4742 |

ALTRIA GROUP INC. | MO | 47.95 | -0.02(-0.04%) | 18755 |

Amazon.com Inc., NASDAQ | AMZN | 1,737.10 | -2.39(-0.14%) | 13313 |

American Express Co | AXP | 120.7 | -0.06(-0.05%) | 204 |

AMERICAN INTERNATIONAL GROUP | AIG | 53.95 | 0.02(0.04%) | 1526 |

Apple Inc. | AAPL | 265.96 | 0.20(0.08%) | 399358 |

AT&T Inc | T | 39.4 | -0.10(-0.25%) | 16928 |

Boeing Co | BA | 372.87 | 1.19(0.32%) | 33480 |

Caterpillar Inc | CAT | 145 | -0.31(-0.21%) | 6366 |

Cisco Systems Inc | CSCO | 44.97 | -0.12(-0.27%) | 79631 |

Citigroup Inc., NYSE | C | 74.38 | -0.02(-0.03%) | 9661 |

E. I. du Pont de Nemours and Co | DD | 67.65 | 0.01(0.01%) | 1468 |

Exxon Mobil Corp | XOM | 69.05 | -0.14(-0.20%) | 18390 |

Facebook, Inc. | FB | 195.04 | -0.06(-0.03%) | 96602 |

FedEx Corporation, NYSE | FDX | 158.4 | 0.07(0.04%) | 1434 |

Ford Motor Co. | F | 9.05 | 0.10(1.12%) | 348323 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.25 | 0.09(0.81%) | 67540 |

General Electric Co | GE | 11.48 | -0.04(-0.35%) | 227057 |

General Motors Company, NYSE | GM | 36.8 | -0.09(-0.24%) | 7342 |

Goldman Sachs | GS | 220.29 | 0.04(0.02%) | 216 |

Google Inc. | GOOG | 1,334.20 | -0.67(-0.05%) | 3160 |

Hewlett-Packard Co. | HPQ | 19.99 | -0.19(-0.94%) | 28146 |

Home Depot Inc | HD | 237.3 | 0.01(0.00%) | 9989 |

Intel Corp | INTC | 57.92 | -0.04(-0.07%) | 11982 |

International Business Machines Co... | IBM | 134.45 | 0.05(0.04%) | 2915 |

International Paper Company | IP | 45.8 | 0.15(0.33%) | 3900 |

Johnson & Johnson | JNJ | 134.8 | -0.14(-0.10%) | 3244 |

JPMorgan Chase and Co | JPM | 129.5 | -0.03(-0.02%) | 9801 |

McDonald's Corp | MCD | 194.3 | 0.33(0.17%) | 4860 |

Merck & Co Inc | MRK | 84.75 | -0.15(-0.18%) | 2060 |

Microsoft Corp | MSFT | 149.96 | -0.01(-0.01%) | 171200 |

Nike | NKE | 93.18 | 0.14(0.15%) | 3015 |

Pfizer Inc | PFE | 37.35 | 0.07(0.19%) | 34013 |

Procter & Gamble Co | PG | 120.55 | 0.01(0.01%) | 2227 |

Starbucks Corporation, NASDAQ | SBUX | 84.15 | -0.06(-0.07%) | 2417 |

Tesla Motors, Inc., NASDAQ | TSLA | 352.7 | 0.53(0.15%) | 50152 |

The Coca-Cola Co | KO | 52.75 | 0.08(0.15%) | 9150 |

Twitter, Inc., NYSE | TWTR | 29.29 | 0.04(0.14%) | 93094 |

United Technologies Corp | UTX | 149.43 | 0.07(0.05%) | 1241 |

UnitedHealth Group Inc | UNH | 269 | -0.40(-0.15%) | 2322 |

Verizon Communications Inc | VZ | 59.55 | 0.04(0.07%) | 2908 |

Wal-Mart Stores Inc | WMT | 119 | 0.13(0.11%) | 22753 |

Walt Disney Co | DIS | 144.65 | -0.02(-0.01%) | 50593 |

Yandex N.V., NASDAQ | YNDX | 37.91 | 2.12(5.92%) | 541481 |

Aanalysts at Deutsche Bank note global financial conditions and growth prospects have been lifted post the Trump Administration announced in early October its intent to seek a phased trade agreement with China.

- “Constructive developments regarding Brexit have added to this positive drift. Our analysis suggests that business sentiment is now forming a bottom on a global scale and is likely to show modest improvement as we move into 2020, with risks of near-term recession declining.

- In the US, our models based on a wide variety of leading indicators tell us that growth is bottoming in the current quarter at a pace well below potential. Recession risks have declined noticeably assuming progress continues on the trade front, and a moderate upturn in growth ahead still seems in train, though election uncertainty should cap the upside.

- In Europe, too, the more cyclical manufacturing sector data have started to improve, helped by export orders, and our euro area data surprise indicator has turned positive for the first time in 20 months. With policy uncertainty diminishing, spillover from weak manufacturing to the rest of the economy should be limited. We continue to expect EA growth to move sideways through the winter and pick up slowly beginning in Q2.

- China's domestic demand growth may have bottomed, and we expect enough recovery in its trade and investment to about offset the secular downtrend in GDP growth. In Japan, external orders have begun to rise again, and the economy should begin to recover by Q2 as the effects of the recent consumption tax hike fade.

- Our call that a global bottoming is near rests importantly on the assumptions that a Phase 1 trade deal with China is signed, auto tariffs are put aside, and hard Brexit risks subside. But the global economic picture remains fragile. Should a deal not be reached and tariffs be raised further on US trade with China and Europe, we would expect the global economy to continue to slide, very possibly into recession in the quarters ahead.

- On the other hand, a surprisingly positive trade agreement, with a significant tariff rollback, would boost our outlook for global growth. Recent official chatter casts doubt on this outcome. While it could be a negotiating tactic, we see risks tilted more to the downside.”

- EU needs a 'big conversation' among fiscal policymakers about how to stimulate economy

- Disorderly Brexit is less likely but if so, the ECB and BoE have worked closely together in last two years

- Brexit is less big deal for eurozone economy than UK

- We are worried about the impact of Brexit on Ireland

FX Strategists at UOB Group see USD/JPY to grind lower and test the 108.00-region in the next weeks.

- "24-hour view: Expectation for USD to “retest 108.25” was incorrect as it rebounded to 108.85. The rapid rebound appears to be running ahead of itself and further USD strength is not expected. For today, USD is likely to trade sideways, expected to be within a 108.50/108.95 range.

- Next 1-3 weeks: We cautioned on Wednesday (13 Nov, spot at 109.00) that “risk of a short-term top has increased” and added yesterday (14 Nov, spot at 108.80) that “a short-term top is place and USD is likely to trade sideways for a period”. USD subsequently dropped below the bottom of our expected 108.45/109.30 range (low of 108.23) before recovering. The rapid decline has resulted in an improvement in downward momentum and from here, USD is expected to remain under pressure. Only an unlikely move back above 109.15 (‘strong resistance’ level) would suggest that downward pressure eased. Until then, the bias is for USD to trade lower towards 108.00 followed closely by a strong support at 107.85."

Analysts at TD Securities note that the PBoC has cut its 7 day reverse repo rate to 2.5% from 2.55% and added CNY 180bn of liquidity via open market operations.

“The cut in rates was the first since 2015 and follows the release of the PBoC's quarterly report over the weekend, which warned both about risks to growth and rising inflation. October data was uniformly weak, suggesting that PBoC will maintain its incremental policy of easing.”

Analysts at ANZ note that the RBNZ, RBA, and the U.S. Fed have all now joined Texas Hold’em club, betting – for now – on previous rate cuts doing the job.

- “Most analysts and the market had been expecting one more cut from the RBNZ last week, taking the OCR to an RBA-matching 0.75%. But while the RBNZ did significantly downgrade their near-term outlook, as expected, a lower TWI and a downward revision to their estimate of how fast the economy can grow offset that.

- There are still aspects of their medium-term outlook that we see as too optimistic, and the RBNZ has yet to take into account the bank capital changes, to be announced 5 December.

- We are now forecasting two further cuts in May and August next year, taking the OCR to 0.5%. The risks are tilted towards earlier and/or more cuts, depending partly on the outcome of the RBNZ’s capital proposals, but also global factors.”

- But if situation changes, there is room for lower rates

- No reason now to alter Eurozone growth prospects

- Economy is developing as projected by the ECB

- Industry remains weak but services, labour market more positive

FX Strategists at UOB Group do not rule out the continuation of the rebound in AUD/USD, although the mid-0.6800s looks a tough barrier so far.

- "24-hour view: “Our view for AUD last Friday was that “the rapid decline is severely over-extended and further sustained weakness is not expected for today”. However, instead of consolidating, AUD rebounded strongly and closed right at the high of 0.6822 (+0.54%). While the rebound appears to be running ahead of itself, there is scope to for AUD to extend its advance. That said, the strong 0.6845 resistance could be just out of reach. Support is at 0.6800 but the stronger level is at 0.6785”.

- Next 1-3 weeks: We held the view yesterday (14 Nov, spot at 0.6810) that the “risk is on the downside but any weakness is likely limited to 0.6765”. AUD subsequently extended its decline and plummeted to 0.6770. While the price action has resulted in a rapid improvement in momentum, longer-term conditions are still rather oversold and the prospect for a sustained decline below 0.6765 is still not that high. That said, AUD is expected to remain on the back foot unless it can move back above 0.6845."

Analysts at Deutsche Bank note that this morning in Asia the PBOC has cut the interest rate on its seven-day reverse repurchase agreements to 2.5% from 2.55% for the first time since October 2015.

- “Along with the reduction in interest rates, the PBoC also added CNY 180bn of cash into the financial system via open market operations, helping to alleviate liquidity concerns. Meanwhile, over the weekend the PBOC’s quarterly report warned not only on growth risks but also on rising inflation, highlighting the limited room that monetary policy has to respond.

- The PBoC also said in the report that it will “increase counter-cyclical adjustment” to ward off downward pressure on the economy while adding that monetary policy will “properly handle the short-term pressure,” making sure not to offer excessive funding, while keeping an eye on the risk of expectations that inflation may spread.”

Analysts at the Royal Bank of Scotland (RBS) think there is no recession for the U.K .economy as after contracting by 0.2% in the second quarter, the economy regained enough composure to eke out 0.3% growth in three months to September.

- “There’s not much to celebrate though. Momentum is slowing: GDP growth is the most sluggish since the aftermath of the financial crisis in 2010 (just 1% y/y).

- The manufacturing industry failed to stage any recovery at all, with output flat. Thank goodness for the services sector, especially bright spots like film and TV production, which expanded 22% over the past 12 months and has doubled in size in just five years.”

- No reason to fear that Germany would slide into recession

- Manufacturing downturn could be leveling off

- The slowdown is not likely to intensify markedly

- The slowdown will probably continue in fourth quarter

- The overall economic output could more or less stagnate

The number of properties put up for sale in Britain has fallen by the most in any month in more than 10 years as the combination of Brexit and an election weighs on the market, a survey showed.

There were 14.9% fewer properties put on sale in the four weeks to Nov. 9 than in the same period last year, property website Rightmove said. That was the biggest annual fall since August 2009, shortly after the global financial crisis.

"I've seen lots of unusual events affecting the property market in my 40-year career, but a Brexit deadline followed by a snap general election six weeks later is obviously a new combination," Miles Shipside, Rightmove director, said.

Rightmove said some would-be sellers of property might be waiting to see if Britain's next government reforms the stamp duty tax on property transactions which might reduce the cost of acquiring a new home.

In opinion of Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, EUR/USD could attempt to regain the 1.1080/95 area in the very near term.

“EUR/USD has managed to stabilise around the 61.8% retracement at 1.0994. Thursdays price action constituted a key day reversal and we would allow for a rebound into the 1.1080/1.1095 band very near term. This is the location of the 55 day ma and we will need to regain this for a viable retest of the 1.1180 recent high. While capped by the 55 day ma, the market is regarded as under pressure and capable of extending the decline to the next Fibonacci support at 1.0943. It is possible that we will see one more final leg down to the base of the channel at 1.0865 and the 1.0814 Fibo retracement before a sustained recovery is seen”.

China's central bank on Monday lowered the interest rate on its regular reverse repurchase open market operations for the first time since October 2015, aiming to boost market confidence and prop up slowing growth.

The People's Bank of China said on its website that it cut the seven-day reverse repurchase rate to 2.5% from 2.55%. The central bank also injected a net 180 billion yuan of cash into the monetary system via open market operations.

China's October economic and financial data fell across the board, while food prices continued to rise even as core inflation remained weak. Analysts said that with the downward pressure on the economy, the need to cut interest rates is rising.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1131 (3123)

$1.1104 (2194)

$1.1087 (1591)

Price at time of writing this review: $1.1062

Support levels (open interest**, contracts):

$1.1019 (3916)

$1.0985 (3261)

$1.0944 (2961)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 6 is 100018 contracts (according to data from November, 15) with the maximum number of contracts with strike price $1,1200 (5609);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3014 (1563)

$1.2988 (2535)

$1.2967 (1081)

Price at time of writing this review: $1.2948

Support levels (open interest**, contracts):

$1.2868 (209)

$1.2826 (1645)

$1.2762 (1758)

Comments:

- Overall open interest on the CALL options with the expiration date December, 6 is 30422 contracts, with the maximum number of contracts with strike price $1,3000 (5261);

- Overall open interest on the PUT options with the expiration date December, 6 is 32492 contracts, with the maximum number of contracts with strike price $1,2200 (2316);

- The ratio of PUT/CALL was 1.07 versus 1.05 from the previous trading day according to data from November, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 63.45 | 1.55 |

| WTI | 57.86 | 1.63 |

| Silver | 16.92 | -0.47 |

| Gold | 1466.581 | -0.26 |

| Palladium | 1705.46 | -1.83 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 161.77 | 23303.32 | 0.7 |

| Hang Seng | 2.97 | 26326.66 | 0.01 |

| KOSPI | 22.95 | 2162.18 | 1.07 |

| ASX 200 | 58.6 | 6793.7 | 0.87 |

| FTSE 100 | 10.18 | 7302.94 | 0.14 |

| DAX | 61.52 | 13241.75 | 0.47 |

| CAC 40 | 38.19 | 5939.27 | 0.65 |

| Dow Jones | 222.93 | 28004.89 | 0.8 |

| S&P 500 | 23.83 | 3120.46 | 0.77 |

| NASDAQ Composite | 61.81 | 8540.83 | 0.73 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.68149 | 0.43 |

| EURJPY | 120.28 | 0.68 |

| EURUSD | 1.10539 | 0.31 |

| GBPJPY | 140.397 | 0.55 |

| GBPUSD | 1.2903 | 0.17 |

| NZDUSD | 0.64008 | 0.33 |

| USDCAD | 1.32252 | -0.17 |

| USDCHF | 0.98966 | 0.17 |

| USDJPY | 108.808 | 0.38 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.