- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 18-10-2019

- U.S. economy is sending mixed signals

- Consumers are strong, but businesses appear to be nervous, pulling back on spending and hiring

- Europe, Germany, China are slowing, and U.S. will feel that

- Yield curve is signalling the Fed policy may be slightly contractionary

- Monetary policy should be somewhat accommodative in light of the risks we are seeing

- I expect the inflation to undershoot 2%-target for the foreseeable future

- U.S. economy is generally performing well

- Moderation in economy this year is in line with outlook

- She is mindful that rate cuts could increase financial instability which Fed has limited ability to counteract

- Corporate debt continues to rise to high levels and lower capital levels at largest banks could be costly to employment and growth

- She will remain attentive to incoming data for signs of downside risks to the US economy

- ECB continues to stand ready to adjust all of its instruments

- There are mild signs of overstretched valuations in eurozone in some riskier segments of financial markets

- Monetary policy can and should be enhanced by other policies

The Conference

Board announced on Friday its Leading Economic Index (LEI) for the U.S. edged

down 0.1 in September to 111.9 (2016 = 100), following a revised 0.2 percent decrease

in August (originally a 0.3 percent m-o-m drop).

Economists had

forecast an advance of 0.1 percent.

Ataman

Ozyildirim, Senior Director of Economic Research at The Conference Board, said “The

US LEI declined in September because of weaknesses in the manufacturing sector

and the interest rate spread which were only partially offset by rising stock

prices and a positive contribution from the Leading Credit Index. The LEI

reflects uncertainty in the outlook and falling business expectations, brought

on by the downturn in the industrial sector and trade disputes. Looking ahead,

the LEI is consistent with an economy that is still growing, albeit more

slowly, through the end of the year and into 2020.”

The report also

revealed the Conference Board Coincident Economic Index (CEI) for the U.S. was

unchanged in September, remaining at 106.4, following a 0.3 percent advance in

August. Meanwhile, its Lagging Economic Index (LAG) for the U.S. rose 0.1

percent in September to 108.3, following a 0.4 percent drop in August.

Analysts at TD Securities offered a brief preview of next week's important European event risk, the latest monetary policy update by the European Central Bank (ECB).

- "Draghi's final ECB meeting is likely to be a dovish one. Inflation expectations are likely still at record lows, inflation has disappointed, and GDP growth will need to be revised lower again in December. We think that markets are being complacent about the odds of another rate cut this year, even if they won't be able to price that in until after we get a better idea of Lagarde's view on monetary policy.

- The ECB looks unlikely to provide EURUSD with a strong directional cue. A lack of fresh policy initiatives keeps attention elsewhere. A dovish message could temper recent gains, but EUR should remain more sensitive to Brexit developments and broader risk appetite.

- The market reaction should be relatively muted at the next week's meeting. The key driver for risk sentiment will be the developments on the Brexit front in the coming week. With respect to monetary policy, market focus does turn to the implementation of the ECB's tiered deposit system on October 30 as well as the start of the new QE purchases from November 1."

- Global growth is decelerating, cites trade tension

- Expect consumer spending to be strong, but it is fragile

U.S. stock-index futures were flat on Friday, as investors digested mixed macroeconomic data out of China and good earnings reports from Coca-Cola (KO; +1.9%) and American Express (AXP; +0.8%).

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 22,492.68 | +40.82 | +0.18% |

Hang Seng | 26,719.58 | -128.91 | -0.48% |

Shanghai | 2,938.14 | -39.19 | -1.32% |

S&P/ASX | 6,649.70 | -35.00 | -0.52% |

FTSE | 7,179.00 | -3.32 | -0.05% |

CAC | 5,647.22 | -25.85 | -0.46% |

DAX | 12,654.84 | -0.11 | 0.00% |

Crude oil | $54.49 | +1.04% | |

Gold | $1,494.40 | -0.26% |

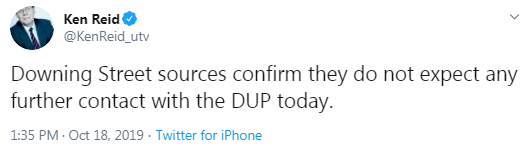

James Smith, a developed market economist at ING, reckons that the British government may be just two votes short of winning – although there are of course several moving parts.

- "We know the Democratic Unionist Party (DUP) will not vote for the deal, at least as things stand. And conventional wisdom suggests that without the DUP, many pro-Brexit Conservative MPs (from the European Research Group, or ERG) won't back the deal either.

- But that no longer appears to be the case. Buzzfeed reckons 10 out of 28 ERG MPs would not vote for the deal, although many others are keeping their cards close to their chest – former Conservative leader Ian Duncan-Smith has signalled concerns.

- But there is a chance that when push comes to shove, all of these 28 MPs back Johnson’s revised agreement. After all, there is a lot to like for them in this agreement - the UK (with the exception of Northern Ireland) is no longer tied into the single market and customs union.

- It also looks like the anti-‘no deal’ MPs who were ousted from the Conservative Party a few weeks ago - with the exception of those that didn’t vote for Mrs May’s deal - will also back the agreement.

- That probably means everything will hinge on Labour. Five of their MPs voted for Mrs May’s deal back in March, and it looks like they will be joined by a sixth. But that would still leave the government a few votes short – and more opposition lawmakers will be needed to get the deal over the line.

- That could be challenging. Johnson’s deal is economically-harsher than the previous agreement, mainly by virtue of the fact that the UK (excl NI to an extent) is outside of the EU’s customs union. But the clincher might be the so-called level playing field commitments.

- That’s a worry for Labour MPs, not just in terms of the direct impact of watering down these rules, but it could also make Brussels less inclined to negotiate a wide-ranging EU free trade deal in future.

- In the end though, the revised deal is a fudge. The level playing field commitments have been removed from the legally-binding withdrawal agreement, but there is still an aspiration to keeping them, contained within the non-binding political declaration.

- Many Labour MPs will still be wary – and if nothing else, voting for the deal could theoretically help hand Johnson a better election victory."

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC. | MO | 44.5 | 0.22(0.50%) | 26205 |

Amazon.com Inc., NASDAQ | AMZN | 1,789.83 | 2.35(0.13%) | 11784 |

American Express Co | AXP | 120.99 | 1.89(1.59%) | 133064 |

Apple Inc. | AAPL | 235.21 | -0.07(-0.03%) | 47914 |

AT&T Inc | T | 38 | 0.19(0.50%) | 50829 |

Boeing Co | BA | 370 | 0.94(0.25%) | 1792 |

Caterpillar Inc | CAT | 129.67 | -1.37(-1.05%) | 18262 |

Chevron Corp | CVX | 115.4 | 0.05(0.04%) | 665 |

Cisco Systems Inc | CSCO | 47.09 | 0.06(0.13%) | 7512 |

Exxon Mobil Corp | XOM | 68.43 | 0.29(0.43%) | 2863 |

Facebook, Inc. | FB | 190.51 | 0.12(0.06%) | 17519 |

Ford Motor Co. | F | 9.12 | 0.01(0.11%) | 10191 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.5 | 0.06(0.64%) | 5601 |

General Electric Co | GE | 9.06 | 0.02(0.22%) | 11571 |

General Motors Company, NYSE | GM | 36.21 | 0.02(0.06%) | 421 |

Goldman Sachs | GS | 206.8 | 0.34(0.16%) | 451 |

Google Inc. | GOOG | 1,253.98 | 0.91(0.07%) | 2081 |

Home Depot Inc | HD | 236.5 | -0.27(-0.11%) | 1370 |

Intel Corp | INTC | 51.68 | -0.18(-0.35%) | 608 |

International Business Machines Co... | IBM | 134.68 | 0.42(0.31%) | 5629 |

Johnson & Johnson | JNJ | 132.77 | -3.40(-2.50%) | 41574 |

JPMorgan Chase and Co | JPM | 120.55 | 0.20(0.17%) | 2307 |

McDonald's Corp | MCD | 207.38 | 0.53(0.26%) | 1122 |

Merck & Co Inc | MRK | 83.96 | 0.16(0.19%) | 1853 |

Microsoft Corp | MSFT | 140.08 | 0.39(0.28%) | 82020 |

Nike | NKE | 95 | -0.56(-0.59%) | 7496 |

Procter & Gamble Co | PG | 116.92 | 0.29(0.25%) | 2296 |

Starbucks Corporation, NASDAQ | SBUX | 86.25 | -0.04(-0.05%) | 650 |

Tesla Motors, Inc., NASDAQ | TSLA | 260.71 | -1.26(-0.48%) | 18297 |

The Coca-Cola Co | KO | 54.95 | 1.16(2.16%) | 585757 |

Twitter, Inc., NYSE | TWTR | 39.72 | 0.11(0.28%) | 10241 |

UnitedHealth Group Inc | UNH | 244.5 | 0.83(0.34%) | 1494 |

Verizon Communications Inc | VZ | 60.49 | 0.08(0.13%) | 1303 |

Visa | V | 178.38 | 0.44(0.25%) | 3255 |

Wal-Mart Stores Inc | WMT | 119.44 | -0.40(-0.33%) | 2572 |

Walt Disney Co | DIS | 132.75 | 0.38(0.29%) | 4262 |

Yandex N.V., NASDAQ | YNDX | 30.59 | 0.30(0.99%) | 13967 |

UnitedHealth (UNH) initiated with a Buy at Mizuho; target $270

Microsoft (MSFT) resumed with an Outperform at RBC Capital Mkts; target $160

Twitter (TWTR) resumed with a Neutral at MKM Partners

Caterpillar (CAT) downgraded to Equal-Weight from Overweight at Morgan Stanley; target lowered to $145

Altria (MO) upgraded to Neutral from Sell at Citigroup; target raised to $46

Snap (SNAP) upgraded to Buy from Neutral at BofA/Merrill; target $18

Barrick (GOLD) upgraded to Outperform from Mkt Perform at Raymond James

- Sees the Brexit deal between UK and EU as significant progress

- Hopes UK parliament to approve deal on Saturday

- We're on the glide path to Chile and the meeting of the two presidents mid-November

- The plan there is to have an agreement, so we'll see what happens

The NZD/USD pair built on Thursday's gains and climbed to its highest level since mid-September at 0.6377 on Friday. As of writing, the pair was trading at 0.6370, adding 0.4% on a daily basis. Unless the pair makes a sharp U-turn and erases more than 50 pips in the remainder of the day, it will close the week in the positive territory for the fourth straight week.

Earlier in the day, the data from China showed that the Chinese economy expanded by 1.5% on a quarterly basis in the third quarter to match the market consensus. Additionally, industrial production in China in September rose by 5.8% on a yearly basis following August's reading of 4.4% and beat analysts' estimate of 5% to provide a boost to antipodeans.

On the other hand, the selling pressure surrounding the Greenback remained intact on Friday and helped the pair stretch higher. The upbeat market sentiment dampened the demand for the USD throughout the week and the disappointing macroeconomic data releases from the US put additional weight on the currency's shoulders.

Ahead of Kansas City Fed President Esther George, Dallas Fed President Robert Kaplan, and Federal Reserve Vice-Chair Richard Clarida's speeches later in the session, the US Dollar Index is at its lowest level since August 23 at 97.47, losing 0.1% and 0.9% on a daily and weekly basis, respectively.

American Express (AXP) reported Q3 FY 2019 earnings of $2.08 per share (versus $1.88 in Q3 FY 2018), beating analysts’ consensus estimate of $2.02.

The company’s quarterly revenues amounted to $10.989 bln (+8.3% y/y), generally in line with analysts’ consensus estimate of $10.938 bln.

The company also issues in-line guidance for Q4, projecting revenues of +8-10% y/y to ~$11.31-11.52 bln versus analysts’ consensus estimate of $11.39 bln.

It reaffirmed guidance for FY 2019, projecting EPS of $7.85-8.35 versus analysts’ consensus estimate of $8.10.

AXP rose to $121.60 (+2.10%) in pre-market trading.

Coca-Cola (KO) reported Q3 FY 2019 earnings of $0.56 per share (versus $0.57 in Q3 FY 2018), in line with analysts’ consensus estimate.

The company’s quarterly revenues amounted to $9.507 bln (+8.3% y/y), slightly beating analysts’ consensus estimate of $9.424 bln.

KO rose to $54.52 (+1.36%) in pre-market trading.

The Australia and New Zealand Bank’s (ANZ) Brian Martin said early on Friday that Brexit deal faces significant parliamentary skepticism.

- “The EU and UK have reached agreement on replacing the Irish backstop, but the deal now faces intense parliamentary debate.

- The deal delivers Brexit and allows the UK to negotiate free trade agreements. UK politics is never easy, however, and the agreement is not without costs. Will Scotland now want similar arrangements to Northern Ireland?

- Many MPs welcome a deal but feel its implications need to be put to the public in a referendum. The DUP, which has supported the government, says that under no circumstances will it support the deal.

- The government needs 320 votes to pass the agreement. Johnson’s Conservative Party has 287 MPs.

- The European Research Group, the hard Brexiteers of the Conservatives, has around 35 MPs. Some may not support Johnson, given the DUP’s position.

- Johnson expelled 21 Conservative MPs from the parliamentary party in September, because they did not support a no-deal Brexit. They are not showing a sudden willingness to rush to his aide, although some probably will.

- Up to 20 Labour ‘leave’ MPs could support the bill, but that won’t cover the gap. Early calculations from various political analysts suggest the government is short a handful of votes.

- The outcome will be very close. Interestingly, the former leader of the Liberal Democrats has urged the LDP to support the deal with a referendum.”

Han de Jong, the chief economist at ABN AMRO Bank, offered his views on the latest Brexit developments.

- "UK Prime Minister Boris Johnson reached a deal with the EU on Brexit. The deal takes the "backstop" out of the equation, but puts an economic border in the Irish Sea. At the time of writing European leaders still have to agree to the deal, but there is no reason to think they will not.

- A much higher hurdle for the deal is the UK parliament which is meant to vote on the deal on Saturday. My colleague Bill Diviney has set out the various options here. The government does not have a majority in parliament so things are complicated. But it is far from impossible that the deal passes as some MPs may prefer this deal over taking the risk of a hard(er) Brexit.

- It is also possible that the deal is passed on the condition that it is put to a new referendum. Should the deal get rejected new elections look inevitable and it then all depends on what platforms the various parties will campaign on. So, there is still uncertainty, but the good thing is that a hard Brexit has become a lot less likely. We should know a lot more after the weekend."

- PM will hold a cabinet meeting at 15:00 GMT in Downing Street

- PM and his team will be speaking to lawmakers from across parliament today

- Tells EU leaders they can't pretend an extension will not be offered to the UK if it is requested

- Frames Brexit as a historic issue weighing on EU

- Says EU leaders have a responsibility not to push UK out if there is a request for further delay

European Union leaders will discuss a new budget plan on Friday that could allow the bloc to spend up to 1.1 trillion euros in the 2021-2027 period, but deep divisions among governments could block a deal for months.

Under a proposal prepared by Finland, which holds the EU’s rotating presidency, the next long-term budget should have a financial capacity between 1.03% and 1.08% of the bloc’s gross national income (GNI), a measure of output.

That would allow the EU to spend between 1 and 1.1 trillion euros for seven years with its first budget after the exit from the club of Britain, one of the top contributors to EU coffers.

The document, is less ambitious than proposals put forward by the European Commission, the EU executive, which is seeking a budget worth 1.1% of GNI. The EU parliament called for an even higher budget at 1.3% of GNI. But the Finnish proposal moves beyond a 1% cap set by Germany, the bloc’s largest economy.

Finland’s midway solution has displeased most of the 27 EU states, EU officials said, anticipating long negotiations before a compromise can be reached.

China's economy grew at the target rate of 6% in the third quarter, and despite uncertainty over the trade war, we are raising our forecast for fourth-quarter growth, Iris Pang – Economist Greater China at ING – wrote in a note.

"The main growth driver was still infrastructure projects. These projects have moved from the investment stage to the production stage. We expect infrastructure projects to continue to be the central pillar of growth in the fourth quarter. There is another CNY1 trillion yuan from the local government special bond quota, borrowed from next year, to be used until the end of 2019. These bonds are the source of financing for infrastructure projects. As such, both investment and industrial production will continue to rely on infrastructure. This will mark even bigger differences between private and public sector growth. The private sector will continue to suffer from the scaling down of factory activity due to the US tariffs. This will add even more uncertainty in terms of job security and salary growth which, in turn, will put pressure on consumption, even if substantial public sector growth acts to counter these negative pressures. The good news is that we expect 5G infrastructure, production and services to start to make a visible contribution to the economy from the fourth quarter. Although it is still uncertain how much 5G can help China's exports, domestic usage of 5G alone should offer good support to the economy. We are raising our forecast for 4Q19 GDP growth from 5.8% to 6.0%. As such, our GDP growth forecast for the whole of 2019 will be 6.15%."

Goldman Sachs said it had raised its estimate on the probability of a Brexit deal to 65% from 60% after Britain struck a new divorce agreement with the European Union that still needs British parliamentary backing.

The bank lowered its odds on “no deal” to 10% from 15% and left its odds of no Brexit happening at all unchanged at 25%, it said, adding that it maintained its base case that Britain will leave the EU with a deal by Oct. 31.

European Union leaders unanimously backed a new Brexit deal with Britain on Thursday, leaving Prime Minister Boris Johnson facing a battle to secure parliament’s support for the agreement if he is to take Britain out of Europe on Oct. 31.

Hedge fund owner Ray Dalio said the global business cycle is in a “great sag” and the world’s economy holds at least two parallels to the 1930s.

Dalio said it was now too late for central banks to make much difference as economies enter a natural downturn.

“This cycle is fading, we are now in the world in what I would call a ‘great sag’,” said Dalio, adding that monetary policy, and especially interest rate reductions, were unlikely to offer much stimulus.

“Europe is at the limitation of that, Japan is (too) and the U.S. doesn’t have much to go on for that,” he told.

Dalio said the world was also experiencing the biggest wealth gap since the 1930s and that was creating political stress.

“In the United States the top one-tenth of 1% of the population has a net worth that is approximately equal to the bottom 90%,” he said.

Dalio told that China’s new swagger was further evidence that the world now echoes the depression era of the last century. “Also like the 1930s, we have a rising power challenging an existing world power in the form of China-U.S. challenges.”

According to Piotr Matys, Emerging Markets FX Strategist at Rabobank, the Turkish lira might not be completely out of the woods just yet despite the recent recovery.

"The Turkish lira is in a recovery mode after Turkey and the US agreed to a temporary ceasefire to allow Kurdish fighters – who until recently were US allies in the region – to retreat from the area which Turkey intends to use as a safe zone to relocate a few millions Syrian refugees. While the agreement negotiated by Vice President Pence is a step in the right direction, the respite for the lira could be short-lived if the 5-days ceasefire does not lead to a permanent truce. There seems to be – based on comments from various lawmakers – a relatively strong incentive on Capitol Hill to penalise Turkey for its military offensive in northern Syria, even if it is rational and justified from the Turkish perspective due to the overwhelming number of Syrian refugees and Kurdish fighters being a threat to Turkey’s security. The risk of tough economic sanctions hasn’t vanished".

According to the report from European Central Bank, in August 2019 the current account of the euro area recorded a surplus of €27 billion, compared with a surplus of €22 billion in July 2019. Surpluses were recorded for goods (€28 billion), primary income (€7 billion) and services (€5 billion). These were partly offset by a deficit for secondary income (€14 billion).

In the 12 months to August 2019, the current account recorded a surplus of €312 billion (2.7% of euro area GDP), compared with a surplus of €398 billion (3.5% of euro area GDP) in the 12 months to August 2018. All major components contributed to this decline, particularly a smaller surplus for services (down from €119 billion to €73 billion) and a bigger deficit for secondary income (up from €138 billion to €161 billion). Smaller surpluses were also recorded for goods (down from €328 billion to €314 billion) and primary income (down from €89 billion to €86 billion).

In the financial account, euro area residents made net acquisitions of foreign portfolio investment securities totalling €153 billion in the 12-month period to August 2019 (down from €411 billion in the 12 months to August 2018). Over the same period, non-residents made net acquisitions of euro area portfolio investment securities amounting to €208 billion (up from €153 billion).

Bank of Japan Deputy Governor Masayoshi Amamiya said that the central bank must "patiently continue" its powerful monetary stimulus to maintain momentum towards achieving 2% inflation, as downside risks from overseas economies mount.

"The BOJ will appropriately guide policy without preconception, while monitoring various risks," Amamiya said in a speech at an annual meeting of credit associations.

More attention is needed than before to risks that price momentum will be lost, Amamiya said. With that in mind, the central bank will re-examine the economy and price trends at its policy-setting meeting scheduled for Oct. 30-31, he said.

Bank of England Deputy Governor Dave Ramsden said he still saw a case for a gradual increase in interest rates if Britain manages a smooth departure from the European Union, maintaining a slightly more hawkish tone than some of his colleagues.

Britain's parliament is due to vote on Saturday on a new transition deal Prime Minister Boris Johnson agreed with Brussels, which would maintain existing trade arrangements for more than a year while longer-term trade barriers are discussed.

"The kind of guidance we've been giving - in the world ofa deal it still applies," Ramsden said.

"We're not saying over what timeframe, but limited and gradual (rate increases) is a reasonable qualitative framing," he added, referring to the BoE's longstanding guidance on rates.

Ramsden said he believed a transition deal could create some pick-up in investment and productivity if it brought clarity to businesses.

Economists at the Australia and New Zealand Bank (ANZ) offered their take on Friday's release of the Chinese GDP report, which showed that economic growth eased further to a near 30-year low level of 6.0% during the third quarter of 2019 and marked a further loss of momentum.

"With China’s GDP having expanded 6.2% on a year-to-date basis in Q3, we believe it is likely that the economy will maintain full-year growth at 6.0% in 2019 unless GDP growth falls below 5.5% y/y (or 1.0% q/q) in Q4. In nominal terms, China’s GDP growth has retreated to 7.6% y/y in Q3 from 8.3% in Q2, signalling that the economy is slowing at a quicker pace than what the headline figure indicates. We also notice that China’s industrial production (IP) data tend to rise at quarter-ends in 2019. For instance, the headline growth rates rose 1.4ppt in September, and 1.3ppt in June. The increase in retail sales in September does not point to a broad-based recovery in consumption. To further support economic growth, fiscal policy is the only viable tool. However, Chinese policymakers will also need to address existing funding constraints faced by local governments"

Westpac’s weekly market update highlights the key market drivers at the moment, namely the US-China trade developments and Brexit. The report prepared by Sean Callow highlights various catalysts to help foresee near-term market moves.

The US and China are still talking about a trade deal, which is a positive outcome.

The next key date appears to be the APEC summit in Chile mid- November.

The positive tone from both China and the US on trade relations should continue to support risk appetite.

There may be more lasting support for the Aussie from a change in market expectations for RBA monetary policy.

Pricing for a November cash rate cut was around 45% mid-week but was trimmed to a modest 25% after the unemployment data.

Johnson’s government has suffered several big defeats in parliamentary votes in recent months, so his luck will need to change on Saturday.

Japan can ramp up fiscal stimulus if the hit to the economy from October’s sales tax hike proves bigger than expected, International Monetary Fund (IMF) Deputy Managing Director Mitsuhiro Furusawa said.

Furusawa also said there was no change to the IMF’s long-standing proposal for Japan to continue raising the tax rate in small increments over several years to 15%.

“If downside risks materialize and economic growth slows more than expected, additional fiscal support may be necessary, accompanied by continued easy monetary policy,” Furusawa, a former senior Japanese finance ministry official, told.

Prime Minister Shinzo Abe proceeded with a twice-delayed increase in the sales tax rate to 10% from 8% in October as part of efforts to rein in Japan’s huge public debt. Abe hopes the increased sales tax will support the fast-ageing population and rein in the industrial world’s heaviest public debt burden, more than twice the size of Japan’s $5 trillion economy.

Citi discusses the latest Brexit deal developments.

"Br A big hurdle may be close to being crossed should the EU summit endorse the UK Brexit proposal on Friday but yet another hurdle still remains - UK parliament sitting on October 19 to debate and pass the Brexit deal/ What is needed to pass the deal in the UK parliament? – (1) Boris Johnson will need the support of the DUP, the hard – core Brexiteers within the Tory Party and the 21 rebel Conservatives, dismissed after Theresa May stood down as PM (Boris Johnson has indicated there may be a path back for the ex-Conservatives if they back the Brexit deal). (2) But even if all Conservatives (and ex-Conservatives) plus the DUP vote for the Brexit deal, they would will still likely fall short as Boris Johnson currently rules in a minority government, meaning that he will need at least 10 – 20 members of the opposition to vote for the deal as well," Citi adds.

Japanese Finance Minister Taro Aso said the government was ready to deploy fiscal stimulus steps flexibly if the economy needed fresh support to fend off risks from slumping global demand and the U.S.-China trade war.

But he said Japan’s economy remained on course for a moderate recovery thanks to robust domestic demand, signaling that no immediate, additional measures were necessary to ease the pain from a sales tax hike that kicked off in October.

“Given uncertainty over the global economy, exports are falling and weighing on manufacturers’ output. But the weakness has yet to spread to non-manufacturers or domestic demand,” Aso told.

“If we need to compile some form of an economic stimulus package, we are ready to take various types of fiscal measures flexibly,” he said.

China's third-quarter economic growth slowed more than expected and to its weakest pace in almost three decades as the bruising U.S. trade war hit factory production, boosting the case for Beijing to roll out fresh support.

Gross domestic product (GDP) rose just 6.0% year-on-year, marking a further loss of momentum for the economy from the second quarter's 6.2% growth.

China's trading partners and investors are closely watching the health of the world's second-largest economy as the trade war with the United States fuels fears about a global recession.

Downbeat Chinese data in recent months has highlighted weaker demand at home and abroad. Still, most analysts say the scope for aggressive stimulus is limited in an economy already saddled with piles of debt following previous easing cycles, which have sent housing prices sharply higher.

The third-quarter GDP growth was the slowest since the first quarter of 1992, the earliest quarterly data on record, and missed forecasts for 6.1% growth. It was also at the bottom end of the government's full-year target range of 6.0%-6.5%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1250 (3220)

$1.1203 (3828)

$1.1180 (2237)

Price at time of writing this review: $1.1123

Support levels (open interest**, contracts):

$1.1064 (2427)

$1.1028 (2628)

$1.0987 (3996)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 8 is 70639 contracts (according to data from October, 17) with the maximum number of contracts with strike price $1,1000 (3996);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3041 (1607)

$1.2987 (1785)

$1.2964 (1113)

Price at time of writing this review: $1.2851

Support levels (open interest**, contracts):

$1.2639 (159)

$1.2580 (443)

$1.2514 (245)

Comments:

- Overall open interest on the CALL options with the expiration date November, 8 is 33404 contracts, with the maximum number of contracts with strike price $1,3200 (3667);

- Overall open interest on the PUT options with the expiration date November, 8 is 24638 contracts, with the maximum number of contracts with strike price $1,2100 (2672);

- The ratio of PUT/CALL was 0.74 versus 0.62 from the previous trading day according to data from October, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 59.53 | 1.26 |

| WTI | 54.09 | 2.13 |

| Silver | 17.53 | 0.92 |

| Gold | 1492.121 | 0.17 |

| Palladium | 1756.24 | -0.55 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -21.06 | 22451.86 | -0.09 |

| Hang Seng | 184.21 | 26848.49 | 0.69 |

| KOSPI | -4.89 | 2077.94 | -0.23 |

| ASX 200 | -51.8 | 6684.7 | -0.77 |

| FTSE 100 | 14.37 | 7182.32 | 0.2 |

| DAX | -15.16 | 12654.95 | -0.12 |

| Dow Jones | 23.9 | 27025.88 | 0.09 |

| S&P 500 | 8.26 | 2997.95 | 0.28 |

| NASDAQ Composite | 32.67 | 8156.85 | 0.4 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.68271 | 1.08 |

| EURJPY | 120.855 | 0.4 |

| EURUSD | 1.11261 | 0.49 |

| GBPJPY | 139.989 | 0.47 |

| GBPUSD | 1.28883 | 0.57 |

| NZDUSD | 0.63444 | 0.86 |

| USDCAD | 1.31357 | -0.48 |

| USDCHF | 0.98747 | -0.73 |

| USDJPY | 108.605 | -0.1 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.