- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 17-06-2024

- As rate cut hopes persist, EUR/USD recovers from a near-term swing low near 1.0670.

- Investors shrug off cautious Fed tones to bet on September rate cut.

- EU economic data thin this week with mid-tier events, Friday’s global PMIs loom.

EUR/USD recovered to 1.0740 on Monday as market sentiment shifts back into rate cut hopes to kick off the new trading week, with investors shrugging off cautionary statements from Federal Reserve (Fed) officials that warned rate cuts may not materialize at a pace investors are happy with. US data will dominate financial headlines with Retail Sales slated for Tuesday, leaving markets shuffling in place until Friday’s global Purchasing Managers Index (PMI) figures update.

Pan-European economic figures are limited to mid-tier prints this week, leaving markets to focus on Tuesday’s upcoming US Retail Sales print. In May, US Retail Sales are expected to increase to 0.2% month-over-month after remaining flat at 0.0% in the previous month. Core Retail Sales, excluding automobile sales, are also anticipated to remain steady at 0.2%.

Read more: Fed policymakers warns that rates set to hold as the wait for more cooling inflation data continues

Throughout the week’s upcoming economic calendar, various Federal Reserve (Fed) officials are scheduled to make appearances, with a number of policymakers expressing a notably cautious stance on Monday. Although recent inflation data has shown a faster-than-expected decline, the Fed has emphasized a reluctance to implement premature rate cuts, emphasizing the need for further data before making any decisions.

Later in the week, EU and US PMI)figures scheduled for Friday are expected to split results, with market forecasts expecting a slight uptick in pan-EU activity and a slight decrease expected in US PMI figures.

EUR/USD technical outlook

EUR/USD recovered its footing on Monday, extending last Friday’s recovery from a near-term low around 1.0670. Despite intraday recovery, the Fiber remains on the low side, trading south of the 200-hour Exponential Moving Average (EMA) at 1.0770. A pattern of lower highs leaves EUR/USD at risk for a continued bearish slide.

Daily candlesticks remain firmly planted in bear country after tumbling back from the 200-day EMA at 1.0803. Bullish momentum is on pace to build a firmer bounce from recent lows below the 1.0700 handle, but pressure is mounting with a pattern of lower highs weighing on price action from December’s peak near 1.1140.

EUR/USD hourly chart

EUR/USD daily chart

- USD/CAD trades in negative territory near 1.3720 on the softer US Dollar on Tuesday.

- Fed’s Harker said it is appropriate to keep rates on hold and wait for more data.

- Higher crude oil prices lift the commodity-linked Loonie and weigh on the pair.

The USD/CAD pair extends downside around 1.3720 during the early Asian session on Tuesday. The decline of the USD Index (DXY) and the rebound of crude oil prices weigh on the pair. The US Retail Sales and Industrial Production are due later in the day. Also, the Fed Lisa Cook, Thomas Barkin, Adriana Kugler, Lorie Logan, Alberto Musalem, and Austan Goolsbee are set to speak.

The US Federal Reserve (Fed) officials have maintained a cautious stance, noting that the Fed may need to keep rates for longer than markets expected for more cooling inflation data. Philadelphia Fed President Patrick Harker said that if the US economy behaved as he expected, one rate cut would be “appropriate” by the end of 2024, adding that it is fine to keep rates on hold and wait for more data.

Earlier, Cleveland Fed President Loretta Mester stated that she would like to see good-looking inflation data, while Minneapolis Fed President Neel Kashkari said that it would be a “reasonable prediction” that the Fed will wait until December to cut interest rates. Market expectations for rate cuts have clashed with the Fed's rate cut predictions through 2024. According to the CME's FedWatch Tool, financial markets see nearly 60% odds of at least 25 basis points (bps) of rate cuts at the September meeting.

On the Loonie front, crude oil prices edge higher as investors expect an increase in summer fuel demand due to a hotter-than-average season. This, in turn, boosts the commodity-linked Canadian Dollar (CAD) as Canada is the largest Oil exporter to the United States (US).

- Interest rate in Australia is set to stay steady at 4.35% for the fifth consecutive meeting in May.

- Reserve Bank of Australia Governor Michele Bullock will hold a press conference at 05:30 GMT.

- The Australian Dollar could see a big reaction to RBA’s policy statement and Bullock’s words.

The Reserve Bank of Australia (RBA) is unlikely to give into the pressure of a dovish policy pivot, as adopted by the Bank of Canada (BoC) and the European Central Bank (ECB) when it concludes its policy meeting on Tuesday.

The RBA is set to keep the Official Cash Rate (OCR) unchanged at 4.35% for the fifth meeting in a row in June. The decision will be announced at 04:30 GMT, while Governor Michele Bullock’s press conference will follow at 05:30 GMT.

Reserve Bank of Australia expected to extend the pause, but what’s next?

Economists are widely expecting the RBA to hold its borrowing rate at a 12-year high at yet another policy meeting, with Governor Michele Bullock likely to retain her hawkish rhetoric during the press conference.

In lieu of the stickier nature of inflation, the Australian central bank could leave the door ajar for a rate hike this year, especially after the Minutes of the RBA’s May meeting showed that the board members considered increasing interest rates.

However, the RBA could refrain from explicitly signaling a policy pivot in the upcoming meetings, maintaining a ‘higher rates for longer’ view.

The May policy statement read, “recent data have demonstrated that the process of returning inflation to target is unlikely to be smooth. Persistence of services inflation is a key uncertainty.”

Therefore, “not ruling anything in or out on future decisions,” the statement added.

The trimmed mean Consumer Price Index (CPI), the RBA’s measure of underlying inflation, ticked lower from 4.2% YoY to 4.0% year-over-year in the three months to March, but at a slower pace than expected. Meanwhile, The first quarter headline inflation rate was 1%, compared with the 0.6% pace in the December quarter. Economists had tipped it would rise to 0.8%. The main reason behind the slower-than-expected decline in inflation was the elevated services inflation alongside a tight labor market. This remains a major cause of concern for the central bank.

The recent labor market data published by the Australian Bureau of Statistics (ABS) showed that the Australian economy added 39,700 jobs in May, driven by full-time employment, compared to an expected 30,000 gain. The Unemployment Rate dipped to 4% in May from 4.1% in April.

Against this economic backdrop, the RBA is likely to remain in a wait-and-see mode until the release of the second quarter inflation data due on July 31. Another unwelcome surprise on the inflation front could warrant the RBA’s action.

Previewing the RBA policy decision, analysts at TD Securities (TDS) explained, “the Board is likely to reiterate that it "...will remain vigilant to upside risks." However we are not expecting the Board to shift its tone, comfortable for now that a higher for longer cash rate will do its job of getting on top of inflation. The Bank has indicated it's reluctant to 'fine tune' policy but if the Bank mentions Q2 CPI as a risk, this would be considered hawkish.”

How will the RBA interest rate decision impact AUD/USD?

Having faced rejection once again at the 0.6700 level, the Australian Dollar (AUD) has turned south against the US Dollar (USD). If RBA Governor Bullock explicitly signals a rate hike in the upcoming meetings this year, AUD/USD could see a fresh upswing toward the abovementioned key resistance.

On the other hand, AUD/USD could extend the ongoing downtrend to test 0.6500 on the RBA’s failure to affirm the hawkish expectations. Therefore, the language in the policy statement and Bullock’s comments are likely to determine the next directional move in the AUD/USD pair.

In the lead-up to the RBA showdown, big banks, including Australia and New Zealand Banking Group (ANZ) and Societe Generale, have pushed back the likely timing of the RBA's first interest rate cut to early 2025 from November this year.

Dhwani Mehta, Asian Session Lead Analyst at FXStreet, notes key technicals to trade AUD/USD on the policy outcome. “AUD/USD is on track to challenge a critical demand area near 0.6650, where the 100-day and 200-day Simple Moving Averages (SMA) hang around. The 14-day Relative Strength Index (RSI) points lower below the 50 level, indicating a clear downside path for the pair heading into the RBA interest rate decision.”

“Aussie buyers need to defend the abovementioned key support near 0.6550 on a daily closing basis to attempt a rebound toward the 21-day SMA at 0.6635. The next upside barrier is seen at the critical 0.6700 threshold. Conversely, a downside break of the 0.6550 support zone could trigger a fresh downtrend toward the 0.6500 level. The last line of defense for buyers is seen at 0.6477, the March 5 low,” Dhwani adds.

Economic Indicator

RBA Interest Rate Decision

The Reserve Bank of Australia (RBA) announces its interest rate decision at the end of its eight scheduled meetings per year. If the RBA is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Australian Dollar (AUD). Likewise, if the RBA has a dovish view on the Australian economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for AUD.

Read more.Next release: Tue Jun 18, 2024 04:30

Frequency: Irregular

Consensus: 4.35%

Previous: 4.35%

Source: Reserve Bank of Australia

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

- Silver's price drops to $29.49, posting minimal losses of 0.38%.

- First support level at the 50-day moving average near $29.01.

- If Silver buyers clear $30.00, a re-test of the YTD high of $32.51 is possible.

Silver's price edged lower and posted minimal losses of 0.38% on Monday. Elevated US Treasury bond yields amid Fed hawkish commentary undermined the grey metal. Therefore, the XAG/USD trades at $29.49 at the time of writing.

XAG/USD Price Analysis: Technical outlook

The grey metal is neutral to downward biased after hitting an eleven-year high of 32.51. Since then, the pair retreated towards an area near the 50-day moving average (DMA) at around $29.01, which is the first support level.

Momentum turned bearish, with the Relative Strength Index (RSI) standing below the 50-midline.

Therefore, the first support level for XAG/USD would be the 50-DMA. If the Silver price dives below that level, the next support level will be the 100-DMA at $26.40, ahead of the May 2 low of $26.02.

On the other hand, if Silver buyers conquer $29.00, they must clear the $30.00 handle if they want to re-test the year-to-date (YTD) high of $32.51.

XAG/USD Price Action – Daily Chart

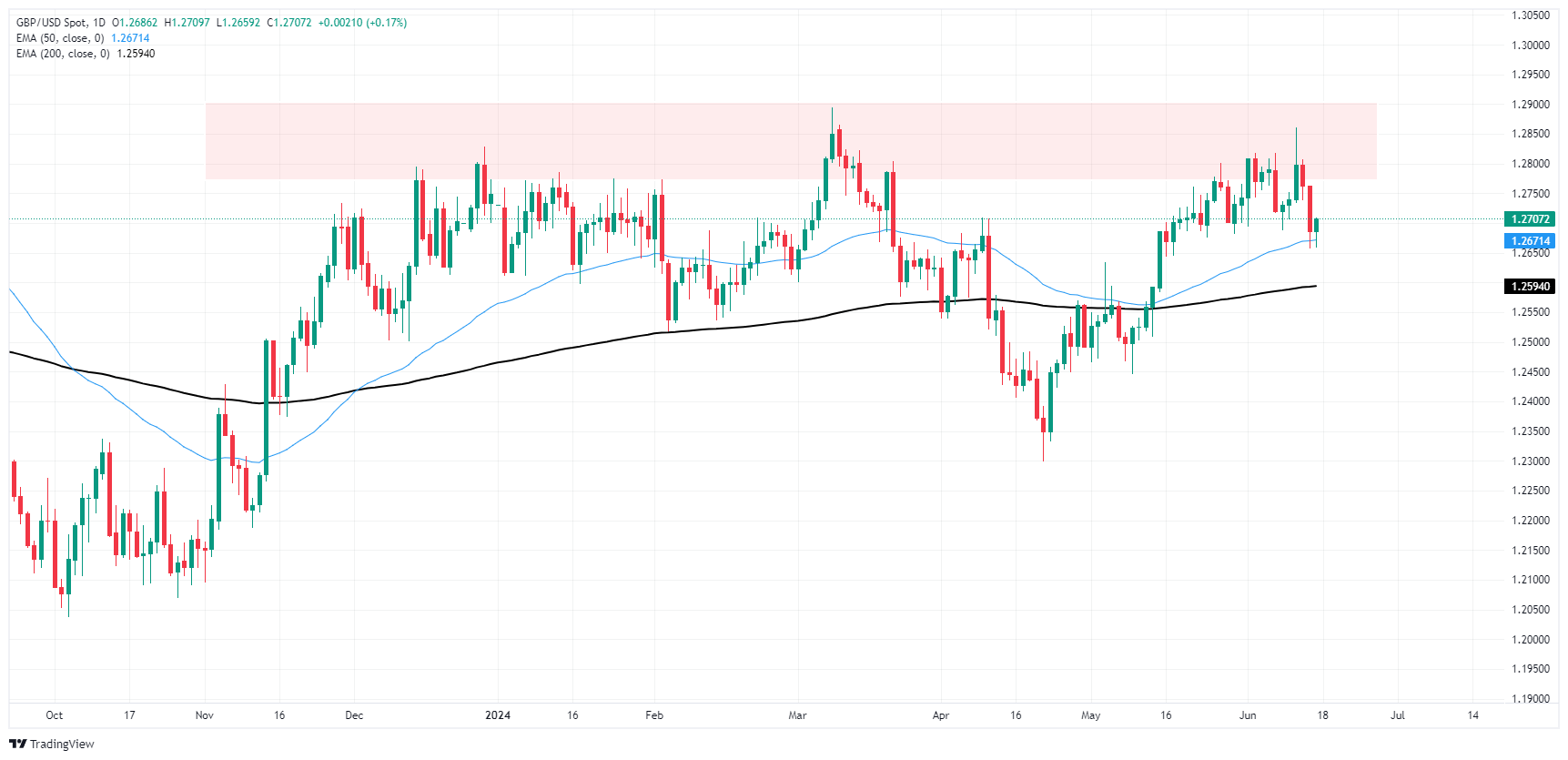

- GBP/USD bounced back to 1.2700 after a hard drop to 1.2660.

- US Retail Sales in the barrel for Tuesday, UK CPI inflation slated for Wednesday.

- Fed rate cut hopes continue to drive market flows despite cautious rhetoric.

GBP/USD halted a recent slide on Monday, recovering 1.2700 after bottoming out near 1.2660 last week. Broader market sentiment recovered to kick off the new week as investors shrug off cautionary tones from Federal Reserve (Fed) officials to continue hoping for a September rate cut as US economic data softens.

Tuesday’s upcoming US Retail Sales will draw the market’s outlook sharply into focus. US Retail Sales in May are expected to tick back up to 0.2% MoM after the previous month’s 0.0% flat print. Core Retail Sales excluding automobiles in May are also expected to hold steady at 0.2%. Later in the week, US Purchasing Managers Index (PMI) figures scheduled for Friday are expected to ease slightly.

Read more: Fed policymakers warns that rates set to hold as the wait for more cooling inflation data continues

Fed official appearances are muttered throughout the week’s economic calendar, with several policymakers striking a notably cautious tone on Monday. Recent inflation data has cooled faster than expected, but the Fed remains in no rush to cut too early, cautioning that more data is needed before making a decision on rates.

UK CPI inflation is due Wednesday, forecast to tick upwards to 0.4% MoM in May, rising from the previous month’s 0.3%. The Bank of England (BoE) also gathers for a fresh vote on interest rates. The UK central bank is broadly expected to hold interest rates at 5.25% in June, with the Monetary Policy Committee (MPC) forecast to vote seven-to-two on keeping rates unchanged, inline with the BoE’s previous meeting.

GBP/USD technical outlook

GBP/USD rose back into the 1.2700 handle on Monday, but bullish momentum remains limited and the pair will need a fresh push to reclaim chart territory north of the 200-hour Exponential Moving Average (EMA) at 1.2734. The pair remains steeply off of last week’s peak bids near 1.2860, and near-term volatility has pushed the technical boundaries wider, leaving the pair to waffle in congestion.

A long-term supply zone beyond the 1.2800 handle continues to crimp bullish momentum on daily candlesticks despite Monday’s bounce from the 50-day EMA at 1.2671. The pair is holding on the north side of technical support from the 200-day EMA at 1.2593, but bidders are struggling to gather the needed momentum to break back into 2024’s peak bids near 1.2900.

GBP/USD hourly chart

GBP/USD daily chart

- The NZD/USD slips further below the 20-day SMA as bears reinforce their strength.

- Daily chart indicators suggest an ongoing consolidation phase, marked by a slight negative momentum following last Wednesday’s push.

- The pair fell to a low of 0.6105 but bulls managed to clear most of its losses.

The NZD/USD continued its descent on Monday, moving below the 20-day Simple Moving Average (SMA) of 0.6140 the buyers managed to clear most of its daily losses. The pair seems to be stuck in a state of consolidation following the sharp surge last week to 0.6220. Despite buyers' attempts, the 20-day SMA could not be sustained, and losses could potentially extend if this trend continues.

Meanwhile, on the daily chart, the Relative Strength Index (RSI) has maintained its negative momentum, suggesting a faltering buying pressure. The downward orientation of the RSI is consistent with the flat red bars displayed by the Moving Average Convergence Divergence (MACD), further emphasizing the ongoing consolidation narrative.

NZD/USD daily chart

The NZD/USD's immediate resistance level stands at the 20-day SMA of 0.6140. Simultaneously, the convergence of the 100 and 200-day SMAs in the 0.6050-0.6060 region builds a sturdy support base for the pair, which is likely to aid in correction should the bears seize control. Movements below this convergence point could indicate sell conditions.

Furthermore, the main resistance continues to stand at the 0.6200 level. A breach at this point could be viewed as a buy signal, signaling an overturn of the bearish sentiment.

- USD/JPY hits a daily low of 156.81, currently trading at 157.43.

- Major trading above 50, 100, and 200-day moving averages, confirming upward bias.

- Key resistance levels: 158.25 (June 17 high) and 158.44 (April 26 peak), with YTD high at 160.32 in sight.

The USD/JPY climbed for the second straight day, up 0.27% after hitting a daily low of 156.81, as US Treasury bond yields climbed six basis points on speculation that the Federal Reserve will keep interest rates unchanged. At the time of writing, the pair trades at 157.43.

USD/JPY Price Analysis: Technical outlook

The uptrend in the USD/JPY remains, though Monday’s price action suggests that buyers remain cautious amid fears of Japanese authority's intervention. The major is trading above the 50, 100, and 200-day moving averages (DMAs), further confirming the upward bias supported by the Relatives Strength Index (RSI), which shows momentum is bullish.

If USD/JPY climbs above 157.00, the next resistance level would be the 158.25 high hit on June 17, followed by the April 26 peak at 158.44. If those levels are cleared, up next would be the year-to-date (YTD) high of 160.32.

Conversely, if USD/JPY drops below 157.00, sellers can challenge key support levels. The first one would be the Senkou Span A at 156.16, followed by the Kijun-Sen at 155.93. The next demand area would be the Senkou Span B at 155.52.

USD/JPY Price Action – Daily Chart

- The AUD/JPY showed tepid losses on Monday and then recovered, focusing on building support around the 20-day SMA regained last week.

- Given continued side-ways trading, the pair might move in the 104.00 - 105.00 range.

In Monday's session, the AUD/JPY pair experienced limited losses and then recovered to trade with gains, with attention focused on reinforcing the support at the 20-day Simple Moving Average (SMA), after dipping briefly below 103.60 and then recovering it back. The price recovery above the 104.00 level indicates the robust supportive role played by this SMA, which once served as a barrier to the bulls.

On a daily scale, the Relative Strength Index (RSI) stands flat at 57. This neutral stance indicates a weak buying pressure and that the overall technical outlook remains balanced. Likewise, the Moving Average Convergence Divergence (MACD) continues to show flat red bars, indicating a steady selling momentum.

AUD/JPY daily chart

Summing up, ongoing consolidation is the trend for the AUD/JPY pair, despite a small loss on Monday, with trading activity focused around the 20-day SMA. This situation leads to an expectation of continued sideways trading within the 104.00-105.00 range for the forthcoming sessions, as bulls are consolidating the gains from May's rally that took the pair near the 105.00 level.

However, the periods of consolidation suggest a prep phase for bulls aiming for the 104.50-105.00 range once again. On the other hand, a breach below the 20-day SMA could tempt the sellers, with support lining up at 103.60, just below the mentioned SMA. Further supports exist at 102.60, and long-term at the 100 and 200-day SMAs, situated in the 100.00 to 98.00 bracket.

- WTI climbs to $80 per barrel as energy markets hope for summer demand uptick.

- Crude Oil markets shrug off disappointment Chinese demand figures.

- OPEC+ production limits set to expire, could swamp out Crude supplies.

West Texas Intermediate (WTI) US Crude Oil shrugged off recent bearish pressures to climb back towards the $80.00 handle on Monday. Energy markets are shrugging off the planned end of voluntary production cuts from the Organization of the Petroleum Exporting Countries (OPEC) and a miss from updated Chinese demand figures. Barrel traders continue to hope for an expected uptick in summer Crude Oil demand to stop up a possible oversupply wave that could hit barrel stocks as production continues to outpace projections.

A planned phasing out of voluntary production cuts for OPEC ally member states, OPEC+, is expected to begin later in the year as OPEC+ begins to crack under the financial pressure of trying to prop up global Crude Oil prices. Chinese production figures also missed the mark over the weekend, threatening future hopes of an uptick in industrial fuels production. Despite headwinds on multiple fronts, Crude Oil markets are grinding out higher ground to kick off the new trading week as investors expect an uptick in summer fuel demand with a hotter-than-average summer season expected.

Crude Oil technical outlook

WTI US Crude Oil climbed back over the 200-day Exponential Moving Average (EMA) at $78.81, tipping into the touch range of the $80.00 handle as it continues an extended recovery from the recent multi-month swing low at $72.45.

A short-side play could be on the cards if bullish exhaustion runs out of gas near $80.00, but bidders could find technical support as WTI cracks above a descending trendline drawn from 2024’s peak bids above $86.00.

WTI hourly chart

WTI daily chart

- Polls commissioned by MORENA indicate 80% support for judicial reform and 70% for electing Supreme Court judges.

- Nearly 90% favor an independent judicial watchdog; around 40% believe many judges and magistrates are corrupt.

Mexico’s President-Elect Claudia Sheinbaum revealed that polls commissioned by the ruling party, Morena, supported the popular election of Supreme Court judges.

Claudia Sheinbaum said, “These polls are information, they don't have another objective,” and added, “This is just information to be considered in the discussions that will start in the coming days.”

Sheinbaum commented that she would hold talks with elected senators and deputies on Tuesday and compromised public forums to discuss the plan.

According to Reuters,” Some 70% backed the popular election of Supreme Court judges, and nearly 90% supported an independent judicial watchdog to probe possible misdeeds or corruption. Around 40% said they believed most judges, magistrates and ministers were corrupt.”

The polls jointly surveyed some 3,855 people between June 14-16 with margins of error of just under 3%.

USD/MXN Reaction

The pair trades at around 18.53, slightly above the 18.50 figure, consolidated. A daily close above the latter could pave the way for further gains. Otherwise, the USD/MXN would likely remain at around 18.35-19.00.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- The consolidation phase extends as the Kiwi witnesses difficulty against the Yen.

- Indicators on the daily chart trend downwards, indicating potential for further consolidation in the upcoming sessions.

- Retesting the 97.00 level could be on the cards, but a break above this resistance appears unlikely due to weak buying traction.

On Monday, the NZD/JPY pair extended its consolidation phase after hitting a multi-year high last week. The technical landscape suggests that sellers may have their chance as consolidation continues, potentially limiting the pair's upward movement under the key resistance level of 97.00. However, the 20-day Simple Moving Average (SMA) is holding as strong support and bulls continue to defend it.

The daily Relative Strength Index (RSI) for NZD/JPY now stands at 60, indicating a slight retracement downwards and a decrease in the bullish momentum. The Moving Average Convergence Divergence (MACD) continues to print rising red bars, indicating an ongoing consolidation phase.

NZD/JPY daily chart

Buyers continue to maintain their stand above the 20-day Simple Moving Average (SMA), demonstrating an effort to uphold the bullish trend. Regardless, the downturn observed in the daily technical indicators points towards the market's need for further consolidation after the significant leap to nearly 96.00 since May.

The upcoming trading sessions might witness the pair movings between the support level of 95.00 and the resistance level of 97.00 as this pair remains among the tallest since June 2007. Notably, the bears have struggled twice consecutively to breach the 20-day SMA at 96.20, making it unlikely for the downtrend to continue The longer-term 100-day and 200-day Simple Moving Averages (SMAs), established roughly around 90.00 - 92.00, continue to protect the overall bullish aspect of the pair. The area around 95.30 also offers substantial support against potential losses.

- Gold price starts week on back foot as high US yields dent appetite for the non-yielding metal.

- Fed officials signal only one rate cut in 2024 via Minneapolis Fed's Neel Kashkari.

- Upcoming US economic data releases, including Retail Sales and Industrial Production, to influence Gold price.

- Precious metals traders await US Retail Sales and Industrial Production on June 18.

Gold prices retreated on Monday due to rising US Treasury bond yields after Federal Reserve (Fed) officials decided to keep rates unchanged and revised their expectations on rate cuts from three to one later in the year. Therefore, the XAU/USD trades at $2,317, down 0.63%, after retreating from the daily high of $2,332.

The golden metal is on the defensive as US Treasury bond yields advance after Fed officials remained hawkish. Despite that, the Greenback failed to gain traction and remains one of the laggards in the FX space.

Over the weekend, the Minneapolis Fed’s Neel Kashkari discussed monetary policy, saying that “it’s a reasonable prediction” that the Fed will ease policy by just 25 basis points (bps) in 2024. This would keep US bond yields high, making it less appealing to hold bullion as the fed funds rate remains lofty.

Earlier, Philadelphia Fed President Patrick Harker said that if the economy evolves as expected, one rate cut in 2024 is expected. He said the policy is restrictive and positioned to bring inflation to 2%.

Gold traders will watch the release of Retail Sales, Industrial Production, Initial Jobless Claims, and the S&P Global Purchasing Managers Index (PMI) figures.

Data from the Chicago Board of Trade (CBOT) shows traders expect 35 bps of easing during the year via December’s 2024 fed funds rate contract.

News that the People’s Bank of China has paused its 18-month bullion buying spree has weighed on the precious metal. PBOC holdings held steady at 72.80 million troy ounces of Gold in May.

Daily digest market movers: Gold price flops on higher US yields

- Rising US Treasury yields remained high, capping Gold’s advance. The US 10-year T-yield is up almost six bps to 4.281%.

- US Dollar Index (DXY) decreased by 0.18% to 105.34, putting a lid on Gold price.

- Despite US CPI report showing disinflation process continuing, Fed Chair Jerome Powell commented that they remain “less confident” about the progress on inflation.

Technical analysis: Gold price sellers regain control as prices are headed toward $2,300

Gold price is neutral to downwardly biased as the Head-and-Shoulders chart pattern remains intact, hinting that the golden metal could dip below the $2,200 mark. Momentum shows that sellers are gathering steam with the Relative Strength Index (RSI) diving further into bearish territory, opening the door for further losses.

If XAU/USD drops below $2,300, the first support would be the May 3 low of $2,277, followed by the March 21 high of $2,222. Further losses lie beneath, as sellers would eye the Head-and-Shoulders chart pattern objective from $2,170 to $2,160.

Otherwise, if Gold extends its gains past the June 7 cycle high of $2,387, it will be ready to test the $2,400 figure.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

The Greenback gave away part of its recent advance despite the rebound in US yields in response to an improvement in the broad risk appetite trends and somewhat easing political jitters in Europe.

Here is what you need to know on Tuesday, June 18:

The USD Index (DXY) left behind two strong daily advances in a row amidst investors’ speculation of two interest rate cuts by the Fed in 2024. A busy calendar on June 18 will see Retail Sales, Industrial Production, Business Inventories and TIC Flows. In addition, Fed’s Cook, Barkin, Collins, Kugler, Logan, Musalem and Goolsbee are all due to speak.

EUR/USD showed some signs of life after Friday’s multi-week lows well south of the 1.0700 support. The final Inflation Rate in the euro zone, and the Economic Sentiment in both Germany and the Euroland are expected on June 18.

GBP/USD regained composure, set aside two straight sessions of losses and reclaimed the area beyond 1.2700 the figure. Next on tap in the UK calendar will be the release of the Inflation Rate on June 19.

USD/JPY maintained the bullish trade well in place and flirted with the 158.00 barrier once again in quite an auspicious start to the week. The Japanese docket will be empty on June 18.

AUD/USD alternated gains and losses around the 0.6600 neighbourhood ahead of the key interest rate decision by the RBA. On June 18, the RBA will decide on interest rates.

Prices of WTI added to Friday’s advance and challenged the key 200-day SMA above the $79.00 mark per barrel.

The rebound in US yields and some incipient risk-on trade weighed on Gold prices and sparked modest losses on Monday. By the same token, Silver partially faded Friday’s advance and revisited the low-$29.00s.

- AUD/USD extended its decline in Monday's session as market gears up for RBA decision.

- Federal Reserve's projection of higher interest rates continues to bolster the USD.

- Australian and American economic calendars remain empty on Monday.

The Australian Dollar (AUD) experienced additional losses against the US Dollar (USD) on Monday as markets gear up for Tuesday’s Reserve Bank of Australia (RBA) decision.

The Australian economy shows some signs of weakness, but stubbornly high inflation is prompting the RBA to delay cuts, which may limit its decline. The RBA's meeting concludes on Tuesday when investors will look for further clues. Markets are pricing in the first rate cut only for May 2025.

Daily digest market movers: Australian Dollar sustains sell-off, markets await RBA's decision

- No significant highlights were detected from the Australian economy on Friday.

- Reserve Bank of Australia meets on Tuesday and is expected to keep rates steady at 4.35%.

- The RBA is expected to stick to its neutral policy guidance that the bank is not ruling anything in or out.

- Following the May 7 meeting, Governor Bullock confirmed that the board discussed the option of raising rates. This option will likely remain on the table as inflation doesn’t show signs of easing.

- Market fully projects in a cut at the February meeting.

- Market hopes for rate cuts have persistently clashed with the Fed’s rate cut expectations through 2024, and according to the CME’s FedWatch Tool, rate markets maintain over 60% odds of at least a 25 basis-point rate trim on September 18.

Technical analysis: Sellers persist as Aussie approaches key level

The Relative Strength Index (RSI) now sits below 50 and points downwards, indicating negative momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) prints steady rising red bars hinting at persistent selling pressure.

The short-term outlook has turned negative as the pair fell below the 20-day Simple Moving Average (SMA) toward 0.6613, indicating a loss in buying steam. As sellers continue to advance, the area of 0.6560-0.6550 where the 100 and 200-day Simple Moving Averages (SMAs) converge might be retested.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- Dow Jones clips into higher ground as investors look to claw back territory.

- US Retail Sales to be the early week’s key data print.

- Investors shrug off increasing warnings from Fed policymakers to hope for cuts.

The Dow Jones Industrial Average (DJIA) found thin gains on Monday, climbing four-tenths of a percent as investors recover balance and resume the long wait for rate cuts from the Federal Reserve (Fed). The “bad news is good news” narrative that has fueled investor sentiment seeking an accelerated pace of rate cuts from the Fed still exists in broader market flows, but has begun to destabilize as US economic data begins to cool faster than expected.

The Fed is still firmly entrenched in a holding pattern as policymakers seek firmer signs of cooling inflation within the US’ domestic economy as shelter and services inflation thumbs the nose at market expectations. Despite repetition of the need for patience from Fed officials, markets continue to hope for a quarter-point cut from the Fed at the September 18 policy meeting. According to the CME’s FedWatch tool, rate traders are pricing in over 60% odds of at least a 25 basis point rate trim from the Fed in September.

Read more: Fed policymakers warn that rates set to hold as the wait for more cooling inflation data continues

US Retail Sales slated for Tuesday will be the early week’s key data print, with Housing Starts on Thursday and a fresh round of the S&P Global Purchasing Managers Indexes (PMI) slated for Friday. Tuesday’s headline Retail Sales are expected to recover to 0.2% MoM in May after the previous month’s flat 0.0%.

Dow Jones news

Over two-thirds of the DJIA’s constituent securities are in the green on Monday as investors lean into a risk-on mood to kick off the new trading week. Despite the upbeat sentiment, Unitedhealth Group Inc. (UNH) still full over a full percent to $489.60 per share. Unitedhealth is ex-dividend on Monday, having paid the latest round of dividends and the company is also in the process of notifying users of a recent data breach.

On the upside, Apple Inc. (AAPL) has climbed around three percent on Monday, shouldering its way into $218.54 per share as investors flaunt a recent demotion in Apple’s volume weighting in the Technology Select Sector SPRDR ETF Fund (XLK). The ETF reduced Apple’s volume share in the ETF to just 4.5% as investors continue to scoop up Nvidia Corp. (NVDA), whose share in the same ETF rose to 21% to match Microsoft’s weighting within the fund. Apple’s battery supplier also unveiled new battery tech that promises significantly higher energy density on a per-unit basis, but how the technology will be applied to Apple devices remains to be seen.

Dow Jones technical outlook

The Dow Jones Industrial Average is snapping a near-term losing streak, on pace to close in the green for the first time in five trading days after closing lower for four straight sessions. The Index remains steeply off of recent all-time highs above the 40,000.00 major handle, but further declines are set to get mired in technical congestion at the 50-day Exponential Moving Average (EMA) at 38,809.34.

The Dow Jones is still trading well above the 200-day EMA at 37,396.04, and downside pressure has thus far failed to extend a push back down to the last swing low at the 38,000.00 handle. The level to beat for bulls will be last week’s peak bids at 39,136.56.

Dow Jones five minute chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- Mexican Peso down 0.29% amid risk aversion on weak China data and European political uncertainty.

- Banxico's verbal intervention last week stabilized the Peso, central bank remains vigilant on currency volatility.

- Upcoming economic data from Mexico expected to show economic slowdown.

The Mexican Peso traded with minuscule losses against the US Dollar on Monday and is down 0.29% as risk appetite deteriorates based on weak China data and political uncertainty in Europe. The emerging market currency would remain volatile as traders digest the incumbent judiciary reform in September, presented by current President Andres Manuel Lopez Obrador and approved by upcoming President Claudia Sheinbaum. The USD/MXN trades at 18.51, gaining 0.34%

The Mexican currency stabilized last week after verbal intervention by Bank of Mexico (Banxico) Governor Victoria Rodriguez Ceja last Wednesday, who said the central bank is attentive to volatility in the Mexican currency exchange rate and could act to restore “order” in markets.

Last week, Claudia Sheinbaum tried to calm investors and told them not to be concerned about the reforms. She said, “Mexico’s economy is healthy and strong, and [there is] nothing to worry about.”

The economic docket in Mexico will feature the announcement of Aggregate Demand, Private Spending, Retail Sales, and Economic Activity data. The data is expected to show that the economy is slowing down due to higher interest rates set by Banxico at 11%, which are expected to be lowered in the June 27 meeting.

Despite that, the USD/MXN exchange rate continues to be driven by political uncertainty about the changes to the Mexican Constitution that threaten the state of law.

Across the border, the latest Federal Reserve (Fed) decision to keep rates unchanged and the projection of just one interest rate cut in 2024 cushioned the Greenback and boosted the USD/MXN to 14-month highs.

The US economic docket is absent except for Fed officials crossing the newswires. Up next, the Philadelphia Fed’s Patrick Harker will give a speech later on Monday.

Daily digest market movers: Mexican Peso on defensive amid risk-aversion

- In February 2024, AMLO presented several proposals to the Mexican Congress. These include a Supreme Court reform to elect Supreme Court ministers through a popular vote, an electoral reform aimed at electing electoral commission councilors by popular vote and reducing multi-member representation, and a reform of autonomous bodies that proposes dissolving the transparency body.

- Mexican Peso depreciation could weigh on Banxico's decision to ease policy on June 27 despite last month’s dip in core prices. Therefore, keeping interest rates higher could prompt deceleration in the economy and increase the odds of a possible recession.

- Morgan Stanley noted that if Mexico’s upcoming government and Congress adopted an unorthodox agenda, it would undermine Mexican institutions and be bearish for the Mexican Peso, which could weaken to 19.20.

- Latest US inflation report increased the odds of a Fed rate cut in September from 62% to 56.3%, according to CME FedWatch Tool.

- December’s 2024 fed funds futures contract hints that investors expect 35 basis points of rate cuts by the Fed through the end of the year.

Technical analysis: Mexican Peso registers losses as USD/MXN climbs above 18.50

The USD/MXN uptrend remains intact, even though it has hovered near 18.50 for the last three trading days. Momentum supports buyers as the Relative Strength Index (RSI) remains bullish after exiting overbought territory. That said, if buyers achieve a daily close above 18.50, that could pave the way for further upside.

Once buyers reclaim 18.50, the next resistance level would be the year-to-date high of 18.99, followed by the March 20, 2023, high of 19.23. A breach of the latter will sponsor an uptick to 19.50, ahead of the psychological 20.00 mark.

Conversely, if sellers push prices below the April 19 high of 18.15, that would keep the exotic pair trading within the 18.00-18.15 range.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Canadian Dollar treads lightly amidst quiet Monday markets.

- Canada Housing Starts rise faster than expected in May, but sales and prices are down.

- US NY Empire Manufacturing recovered, but Tuesday’s Retail Sales loom ahead.

The Canadian Dollar (CAD) is trading tightly on Monday, with gains and losses mixed across the board and within a quarter of a percent against most of its major currency peers. Canadian Housing Starts came in better than expected, but prices and activity remain lower in May. US manufacturing figures improved more than expected but still remain in contraction territory.

Canada saw Housing Starts rise more than expected for the year ending in May, but according to the Canadian Real Estate Association (CREA), both housing prices and buying activity declined in May. The US New York Empire Manufacturing Index rose faster than expected in June but still remains mired in contraction territory. Markets will shift into wait-and-see mode as investors look out for US Retail Sales figures due on Tuesday.

Daily digest market movers: Canadian Dollar finds tepid Monday markets and a limited data docket

- Canadian Housing Starts rose to 264.5K YoY in May, above the forecast for 247K and rising from the previous period’s revised 241.1K.

- However, the CREA’s Canadian Home Price Index fell 0.2% MoM in May and fell 2.4% YoY. The CREA also noted that home sales declined 0.6% MoM in May as activity remains constrained.

- The US NY Empire State Manufacturing Index recovered to a four-month high of -6.0 in June, higher than the forecast of -9.0 and well above the previous -15.6. Despite the recovery, the NY Empire index has remained in contraction territory since November of last year.

- Tuesday’s US Retail Sales will be the key data release of the early week, and investors will be keeping one eye turned to the news feeds. A slew of policymakers from the Federal Reserve are expected to appear this week.

- Wednesday’s Juneteenth US holiday will see a lull in the midweek market flow.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.21% | -0.08% | 0.24% | -0.02% | 0.13% | 0.17% | 0.05% | |

| EUR | 0.21% | 0.14% | 0.47% | 0.20% | 0.24% | 0.42% | 0.26% | |

| GBP | 0.08% | -0.14% | 0.40% | 0.05% | 0.08% | 0.24% | 0.13% | |

| JPY | -0.24% | -0.47% | -0.40% | -0.15% | -0.11% | 0.08% | -0.14% | |

| CAD | 0.02% | -0.20% | -0.05% | 0.15% | 0.08% | 0.19% | 0.07% | |

| AUD | -0.13% | -0.24% | -0.08% | 0.11% | -0.08% | 0.24% | 0.05% | |

| NZD | -0.17% | -0.42% | -0.24% | -0.08% | -0.19% | -0.24% | -0.12% | |

| CHF | -0.05% | -0.26% | -0.13% | 0.14% | -0.07% | -0.05% | 0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Technical analysis: Canadian Dollar churns in the midrange on Monday

The Canadian Dollar (CAD) is comfortably splashing around in the shallow end on Monday, trading within a quarter of one percent across the board as markets kick off the new trading week on a notably tepid note. USD/CAD briefly found an intraday high above 1.3760 before pulling back into a familiar midrange near 1.3740.

Intraday price action remains mired on the low side of a heavy supply zone above 1.3760, but long-term momentum still leans into the bullish side as the pair holds north of the 50-day Exponential Moving Average (EMA) at 1.3673. USD/CAD has been grinding higher on a rising trendline, climbing from December’s swing low below 1.3200, but the pair has failed to etch in a fresh high since peaking at 1.3846 in mid-April.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- DXY rally sees minor pullback on Monday but is set to continue its upward journey this week.

- Fed maintains that only one rate cut is expected in 2024, conflicting with market expectations.

- US Treasury yields continued rising, gaining more than 1% on Monday.

On Monday, the US Dollar Index (DXY) experienced some pullback but maintained overall strength. Tracking the previous week's performance, the DXY was influenced by the hawkish Federal Reserve (Fed) and the risk-off impulses from Europe. These two driving factors are expected to continue influencing the Index, allowing the US Dollar rally to proceed. It's worth noticing that the Index, on Friday, closed at its highest level since early May and is expected to retest the April-May highs near 106.50.

The US economic outlook persists in a state of ambiguity. The Fed continues to keep its economic indicator projections unchanged but revised its forecast for Personal Consumption Expenditures (PCE) higher. Primarily, soft inflation levels combined with a robust labor market illustrate the mixed dynamic of the US economic landscape.

Daily digest market movers: DXY slightly pulls back after strong week

- Fed perceives only one rate cut in 2024 compared to the market's prediction of two. This discrepancy will be influenced heavily by emerging financial data.

- Investors are awaiting critical reports, namely June's Consumer Price Index (CPI) and PCE, which will be key for timing of interest rate cuts. The odds of a cut at the July meeting remain low at 10%.

- An upcoming cut will also depend on July’s CPI and PCE, ahead of the Fed's meeting on September 17-18. The odds for a rate cut at this meeting are currently near 75%.

- US Treasury yields are following an uptrend, with the 2, 5 and 10-year yields reported at 4.47%, 4.30%, and 4.28%, respectively, with large gains.

DXY technical analysis: Bulls pause, outlook still positive

The technical indicators presented a pause in Monday's session but maintained an overall positive standpoint. The Relative Strength Index (RSI) continues to hold above the 50 level, and the Moving Average Convergence Divergence (MACD) continues to present green bars. This implies that the bulls remain strong, which leaves the door open for additional gains.

Furthermore, the DXY remains above its 20, 100 and 200-day Simple Moving Averages (SMA), which combined with investors taking a breather supports a bullish stance for the DXY.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

The US Dollar (USD) and the Pound Sterling (GBP) gain momentum while the Euro (EUR) and the Japanese Yen (JPY) lose track, strategists at Rabobank note.

US shows the best performance in the FX

“USD net long positions have increased for five consecutive weeks, driven by a decrease in short positions. Labor data came in hot this week with higher-than-expected nonfarm payrolls registering 272 thousand new jobs added to the US economy in May. Investors had priced in a slim-to-none likelihood of a June rate cut going into the June 12th FOMC meeting.”

“EUR net long positions have decreased, driven by an increase in short positions. The ECB released its decision to cut rates 25bps at the June 6th meeting. The market is positioned for a rate pause in July. GBP net long positions increased for the third consecutive week, driven by an increase in long positions. Investors are positioned for a no-change decision from the Bank of England at the June 20th meeting.”

“JPY net short positions have increased, driven by decrease in long positions. PPI registered higher than expected at 0.7% m/m for May versus expectations of 0.5% m/m. Investors were positioned for a no-change decision from the BoJ going into the June 14th meeting.”

- The Japanese Yen weakens against the US Dollar on Monday amid still–elevated US interest-rate projections.

- The Fed’s reluctance to entertain interest-rate cuts until more data assures them inflation is coming down, is a factor.

- The BoJ’s expected bond-taper supports JPY but weak wage data and imported inflation weigh.

The Japanese Yen (JPY) trades lower by about a third of a percent against the US Dollar (USD), in the 157.80s on Monday, as the outlook for interest rates in the US remains elevated despite lower inflation and economic sentiment readings. The expectation of higher interest rates supports the USD by attracting greater inflows of foreign capital.

The Japanese Yen, meanwhile, weakens as despite moderate gains to inflation, Japanese real wages – which are adjusted for inflation – continue to fall, registering the 25th consecutive month of declines in April, data from the Ministry of Health, Labor and Welfare shows. The data suggests much of Japan’s inflation is imported because of a historically weak Yen rather than due to increased consumer spending.

The Yen does however receive a modicum of support from Friday’s Bank of Japan (BoJ) meeting. Although the BoJ did not raise interest rates which languish in a range between 0.0% - 0.1% – the lowest of any developed central bank – it did say it was planning to reduce quantitative easing (QE). Officials announced that at the next meeting in July they would be revealing plans on tapering Japanese Government Bond (JGB) purchases. A reduction in QE is positive for the Japanese Yen as it helps raise interest rates.

USD/JPY remains supported by comments from the Chairman of the Federal Reserve (Fed), Jerome Powell. At the Fed’s June policy meeting Powell said he needed more assurances that inflation was coming down in a sustainable fashion before cutting interest rates.

Future interest rate forecasts from members of the Federal Open Market Committee (FOMC), who are tasked with setting interest rates, were also revised, documents accompanying the June meeting showed. From members forecasting three 0.25% cuts to the Fed Funds Rate in 2024, in March, the June projections showed only one 0.25% cut now penciled in amid stickier-than-expected inflation. The expectation that US interest rates will remain higher for longer was a boost for the US Dollar.

US Consumer Price Index (CPI) data for May, released a few hours before the Fed meeting, showed a lower-than-expected reading suggesting price pressures were dissipating. Chairman Powell, however, dismissed the data as insufficient to force the Fed to lower interest rates from their 5.25% - 5.50% band. More data showing lower inflation would be required, he said, before the Fed could be confident the long-run inflation rate was on its way down.

US Producer Price Index (PPI) data on Thursday showed “factory gate” prices slowly cooling in May, further adding to the picture of a declining US inflationary backdrop.

On Friday the Michigan Consumer Sentiment Index declined for the third straight month in a row to 65.6 in June, from 69.1 in May and well below forecasts of 72, preliminary estimates showed. Year-ahead inflation expectations, however, remained unchanged at 3.3%, but the five-year one edged up to 3.1% from 3.0% in May, data from the University of Michigan showed.

USD/JPY traders will also be wary of the risk of Japanese government direct intervention in the Forex markets after myriad warnings from high-ranking officials and currency czars. Data from the BoJ also revealed it had intervened to make market operations to prop up the Yen when USD/JPY experienced sudden corrections in late April and early May recent records showed.

European Central Bank (ECB) policymakers indicated that the French situation is “contained”, allowing the Euro (EUR) to float above 1.07, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

EUR holds a steady grip over 1.07

“ECB policymakers indicated last week that the risks around French situation were 'contained' while the National Rally’s Le Pen commented that her party would co-operate with President Macron if her group won the election. Soothing comments have allowed the 1-Y OAT/Bund spread to narrow marginally from last week’s peak, allowing the EUR to steady above 1.07.”

“EUR gains from last Friday’s low have developed slowly in overnight trade. The rebound may have some legs in our session but, at the moment, gains look more like a brief consolidation ahead of renewed weakness.”

“EUR losses did stabilize around the 76.4% retracement of the April/May rally at 1.0675 last week, however, so the potential for a deeper rebound cannot be ignored. But spot remains well below levels that would confer any real technical strength on the EUR I think (above 1.0850 is needed to lift the EUR’s technical prospects at this point).”

Global carry trade withers away leaving markets cling to the US Dollar as the best hedge to rising risks, TDS strategists note.

Global politics reshapes the market risk sentiment

“The grip of the 'doom loop' continues to tighten ever so slightly. Markets are witnessing typical behavior of a complex, adaptive system. What starts with a seemingly idiosyncratic event in a specific country, morphs into a problem for everyone else. The events in South Africa, India, Mexico, and now France are not isolated. They are connected and starting to reshape the market sentiment.”

“This is an outcome we have been recently discussing, especially as FX vols have been lulled into a dreamlike state. Everything is fine — until it's not. The unwinding of the carry trade has been a major talking point with clients recently. A successful carry trade needs two conditions: rate divergence and low volatility. Both are moving against it, leaving the USD as the best hedge to rising risks.”

“We also note that long-term valuations play a critical role in carry unwinds. Our slow-moving composite framework, LFFV, points to overvaluation in most of the popular carry trades like MXN, BRL, COP, HUF. What's more, EUR headwinds keep building, underscoring rising political uncertainty and a jump in OAT-Bund spreads. We continue to expect an H2 break below 1.05 in EUR/USD.”

- GBP/USD prolonged its losses for three straight days amid risk aversion.

- The pair is neutral to downward bias with momentum favoring sellers as RSI turns bearish.

- Key support levels: Last week’s low at 1.2656, 100-DMA at 1.2646, 50-DMA at 1.2612, and 200-DMA at 1.2548.

- For bullish continuation, GBP/USD must break above resistance at 1.2720/40 and test 1.2750.

The Pound Sterling extended its losses versus the Greenback on Monday, losses of some 0.06% as traders remain risk averse due to European political uncertainty. That and a Bank of England’s (BoE) monetary policy decision looming would likely keep the major consolidated. The GBP/USD trades at 1.2675 after hitting a daily high of 1.2688.

GBP/USD Price Analysis: Technical outlook

From a technical standpoint, the GBP/USD is neutral to downward biased, even though price action is above the daily moving averages (DMAs). Momentum shifted in favor of sellers, which according to the Relative Strength Index (RSI) are gathering traction as it turns bearish.

Once the GBP/USD dived below 1.2700 on further weakness, opened the door for additional losses. The next support would be last week’s low of 1.2656, followed by the 100-DMA at 1.2646, ahead of the 50-DMA at 1.2612. A breach of the latter will expose the 200-DMA at 1.2548.

Conversely, if traders want a bullish continuation, they must lift the GBP/USD above a broken support trendline that turned resistance at around 1.2720/40 before testing 1.2750.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.13% | 0.06% | 0.32% | 0.10% | 0.32% | 0.31% | 0.16% | |

| EUR | 0.13% | 0.21% | 0.49% | 0.24% | 0.36% | 0.49% | 0.29% | |

| GBP | -0.06% | -0.21% | 0.36% | 0.03% | 0.14% | 0.25% | 0.11% | |

| JPY | -0.32% | -0.49% | -0.36% | -0.11% | 0.00% | 0.13% | -0.10% | |

| CAD | -0.10% | -0.24% | -0.03% | 0.11% | 0.15% | 0.20% | 0.07% | |

| AUD | -0.32% | -0.36% | -0.14% | -0.01% | -0.15% | 0.19% | -0.02% | |

| NZD | -0.31% | -0.49% | -0.25% | -0.13% | -0.20% | -0.19% | -0.14% | |

| CHF | -0.16% | -0.29% | -0.11% | 0.10% | -0.07% | 0.02% | 0.14% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Global financial markets cheered last week's weaker-than-expected US CPI data for May, with both the headline (+0.0%) and core (+0.2%) measures coming in a tick below consensus expectations, National Bank of Canada (NBC) strategists Stéfane Marion and Jocelyn Paquet note.

Possibility of US disinflation stalling persists

“The real question going forward is whether the ongoing deflation in core goods will be enough to offset the persistent inflationary pressures in core services, where 12-month inflation has been above 5% for 24 consecutive months – the longest such streak since the early 1990s.”

“Note that there is no precedent in modern US history for core services inflation to be above 5% while core goods are deflating. As US tariffs on Chinese goods ramp up, the possibility of disinflation stalling in the coming months remains.”

“Keep in mind that the average base effect on core CPI from now to December will be only +0.17%, which means that, for the 12-month core rate to continue to fall, monthly results from now to the end of the year will have to be consistently below this figure. It’s possible, but it’s a tall order.”

Crude Oil's recovery could start to fade as upside momentum eases, TDS Senior Commodity Strategist Ryan McKay notes.

Markets may halt their Brent and WTI buying program

“In WTI crude, Commodity Trading Advisors (CTAs) will need to see prices breakthrough $80/bbl to see a continuation of the recent buying program, while liquidations appear to be the more likely risk with downside triggers at $78.36/bbl. Brent crude could also see selling on a failure to break through the $83/bbl level.”

“Indeed, while the market has recovered nicely from the OPEC+ driven knee-jerk lower, there is still more relative concern about Q4 balances and beyond, which should serve as a resistance to major upside.”

Gold (XAU/USD) faces some Commodity Trading Advisor (CTA) selling amid the back-and-forth price action, but the latest Federal Reserve (Fed) meeting generated some demand for the Yellow Metal, Ryan McKay, Senior Commodity Strategist, notes.

Gold faces some CTA selling amid price wobbling

“Precious metals are trading weaker to start the week, but back-to-back weaker-than-expected inflation prints, along with the less hawkish details of the Fed meeting, have seen appetite for gold increase.”

“Plenty of uncertainty remains regarding timing of expected cuts, and macro positioning's beta to data surprises will remain elevated in the near term.”

“In this sense, the back-and-forth price action in the Yellow Metal saw some modest selling from CTAs, but these positions could be added back above $2,354/oz.”

- USD/JPY rises to a seven-week high near 158.00 amid multiple tailwinds.

- The US Dollar strengthens as the Fed maintains hawkish guidance on interest rates.

- The Japanese Yen weakens as BoJ pushes plans for a reduction in bond-buying operations.

The USD/JPY pair jumps to near 158.00 in Monday’s American session. The asset extends its upside as Federal Reserve’s (Fed) hawkish narrative on the interest rate outlook has strengthened the US Dollar (USD) and the postponement of taper tantrum plans by the Bank of Japan (BoJ) has weakened the Japanese Yen.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades sideways but clings to gains near 105.56. The Fed sees only one rate cut this year as policymakers want to see inflation declining for months.

Meanwhile, investors shifted focus to the United States (US) Retail Sales data for May, which will be published on Tuesday. Monthly Retail Sales are estimated to have increased by 0.3% after remaining flat in April.