- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 17-04-2024

Federal Reserve (Fed) Governor Michelle Bowman said Wednesday that inflation progress slows and possibly halts. Bowman further stated that monetary policy is currently restrictive and time will tell if it is "sufficiently" restrictive.

Key quotes

“Inflation progress slows and possibly halts.”

“Strength of consumer spending tied to ongoing job growth.”

“Monetary policy currently restrictive; time will tell if it is "sufficiently" restrictive.”

“Consumers are turning to cheaper goods, but still spending heavily on travel for eclipse viewing.”

Market reaction

The US Dollar Index (DXY) is trading 0.01% higher on the day at 105.95, as of writing.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- EUR/USD posts modest gains near 1.0672 on the softer USD on Thursday.

- Fed’s Powell said the central bank might take longer than expected to achieve the 2% target.

- ECB policymaker said a rate cut looks increasingly likely in its June meeting.

The EUR/USD pair edges higher to 1.0672 on Thursday during the early Asian session. The recovery of that major pair is bolstered by renewed selling pressure in the US Dollar (USD) and a risk-friendly environment. Investors will monitor the usual weekly Initial Jobless Claims, the Philly Fed Manufacturing Index, the CB Leading Index, and Existing Home Sales, due later on Thursday.

The Federal Reserve's (Fed) rate cut hopes were faded. Fed Chairman Jerome Powell commented on Tuesday that the recent data have clearly not given Fed greater confidence and indicate that it's likely to take longer than expected to achieve the central bank's 2% target. The hawkish comments from the Fed’s Powell might provide some support to the Greenback and cap the upside of the EUR/USD in the near term. Investors see a nearly 71% chance that the Fed will cut interest rates in September, according to the CME FedWatch Tool.

On the other hand, investors increase their bets that the European Central Bank (ECB) will cut the interest rate in June. The ECB policymaker Joachim Nagel said on Wednesday that a rate cut looks increasingly likely for June, but certain parts of the incoming inflation data still look higher than desired. Meanwhile, ECB policymaker Bostjan Vasle said that the deposit rate should be lower to 3% by the end of the year from a record high of 4% currently if disinflation continues as expected. Interest rate differentials have been a primary driver of the major pair. The dovish stance from the ECB drags the Euro (EUR) lower and creates a headwind for the EUR/USD pair.

- GBP/JPY remains confined between 191.60 and 192.80, unable to break through key resistance at 193.00.

- Technical analysis highlights potential decline towards strong support at 190.00, with key indicators aligning.

- Immediate technical supports to watch include the Tenkan-Sen at 191.46 and the Kijun-Sen at 191.06.

The GBP/JPY consolidates at around current exchange rates, unable to break above/below the 191.60/192.80 range, following an inflation report in the UK that sparked a rally in the GBP/USD pair. Therefore, after finishing Wednesday's session around familiar levels, the cross-currency pair trades at 192.22, virtually unchanged.

GBP/JPY Price Analysis: Technical outlook

The daily chart shows the pair has peaked, as buyers remained unable to crack the 193.00 figure to challenge the year-to-date (YTD) high of 193.53. That opened the door for a dip toward the 190.00 mark, a strong support level, as key technical indicators converged around that area. The April 2 low of 190.03, the 50-day moving average (DMA), and the top of the Ichimoku Cloud (Kumo).

Since then, the GBP/JPY remains subdued. The first resistance would be 193.00, followed by the YTD high. On the flip side, the first support would be 190.00, followed by key support levels. Up next would be the Tenkan-Sen at 191.46, the Senkou Span A at 191.26, and the Kijun-Sen at 191.06.

GBP/JPY Price Action – Daily Chart

The European Central Bank (ECB) policymaker Bostjan Vasle said on Wednesday that the deposit rate should be "much closer" to 3% by the end of the year from a record high of 4% currently if disinflation continues as expected.

Key quotes

"We should be much closer to 3% towards the end of the year if everything goes according to plan.”

"Some worrying developments in the Middle East.”

Market reaction

These comments have little to no market reaction to the Euro. The EUR/USD pair is trading at 1.0672, unchanged on the day.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Federal Reserve Bank of Cleveland President Loretta Mester spoke on "An update from the Federal Reserve” on Wednesday. Mester said that inflation is higher than expected and the US Fed needs more confidence in trajectory.

Key quotes

“More information needed before confirming 2% inflation sustainability.”

“Inflation slightly higher than anticipated this year.”

“Confidence needed that inflation is decreasing.”

“Strong labor markets, solid economic growth.”

“Watching and gathering more information before taking action.”

“Monetary policy well-positioned.”

“Possible rate cut if labor markets worsen.”

“Anticipates a shift to eased policy.”

“Watching risks to both mandates.”

Market reaction

The US Dollar Index (DXY) is trading 0.02% lower on the day at 105.92, as of writing.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- The RSI on the daily chart lies deep in negative terrain but recovered.

- The hourly RSI paints a growing buying momentum, trending the positive territory.

- The MACD on both charts signals a less intense selling momentum.

The NZD/USD stands recovered to 0.5919, it seeing 0.60% gains. The dominant sentiment remains bearish, subtly dominated by sellers due to the consistent positioning beneath key Simple Moving Averages (SMAs). However, indicators on the daily and hourly charts seem to be recovering.

On the daily chart, the Relative Strength Index (RSI) demonstrates a negative sentiment as it continues an under-50 trend. Although there was a slight uptick from the recent low point seen on Monday, the RSI remains in deep in negative territory. Moreover, the Moving Average Convergence Divergence (MACD) displays falling red bars, reinforcing a weakening bearish momentum.

NZD/USD daily chart

The hourly chart presents an interesting contrast. Here, recent RSI readings consistently float above 50, marking a positive territory. The latest reading is 57, revealing that buyers are taking the reins on the hourly scale. The MACD histogram echoes the buying momentum printing rising green bars.

NZD/USD hourly chart

Upon examining the long-term trend, it becomes apparent that the NZD/USD exhibits bearish momentum as it slots below the 20-day, 100-day, and 200-day Simple Moving Average (SMA) indicators. So any movements which keeps the pair beneath these levels shouldn't be considered as a clear buying signal.

- The Australian Unemployment Rate is expected to have ticked higher in March.

- Employment Change is foreseen losing momentum after the outstanding February figure.

- AUD/USD corrective advance may provide bears the chance to sell at higher levels.

Australia will publish its monthly employment report first thing Thursday. The Australian Bureau of Statistics (ABS) is expected to announce the country added measly 7.2K new positions in March after the outstanding 116.5K jobs created in February. The Unemployment Rate is foreseen at 3.9% after dropping to a six-month low of 3.7% in the previous month. In February, the trend unemployment rate remained at 3.8% for the sixth month in a row.

Australia reports the monthly Employment Change split into full-time and part-time positions. Generally speaking, full-time jobs imply working 38 hours per week or more and usually include additional benefits, but they mostly represent consistent income. On the other hand, part-time employment generally means higher hourly rates but lacks consistency and benefits. That’s why the economy prefers full-time jobs.

Scrutinizing the impressive February headline, Australia created 38.3K part-time roles and added a whopping 78.2K full-time ones. “The large increase in employment in February followed larger-than-usual numbers of people in December and January who had a job that they were waiting to start or to return to. This translated into a larger-than-usual flow of people into employment in February and even more so than February last year,” according to the official ABS report.

Australian unemployment rate expected to bounce back in March

Market analysts anticipate the Australian Unemployment Rate increased to 3.9% in March after declining to 3.7% in February. As mentioned before, the country is expected to have added 7.2K new jobs following 116.5K positions added in February.

The labor sector in Australia has remained relatively strong over the past few months, although, opposite to other major counterparts, the Reserve Bank of Australia (RBA) does not seem to care about whether the job market remains tight.

As widely anticipated, the RBA kept its policy rate unchanged for the third straight meeting at 4.35% when it met in March. For a change, policymakers scrapped any reference to possible further increases, pushing AUD/USD lower.

“If our forecasts come true, and I really hope we’re on that narrow path that Phil (Lowe - former RBA Governor) used to talk about, then we can slow the economy enough that it preserves a lot of the gains in employment and brings inflation down,” Governor Michele Bullock noted, following the central bank meeting. The Board is hopeful they will head into a soft landing as long as inflation remains subdued.

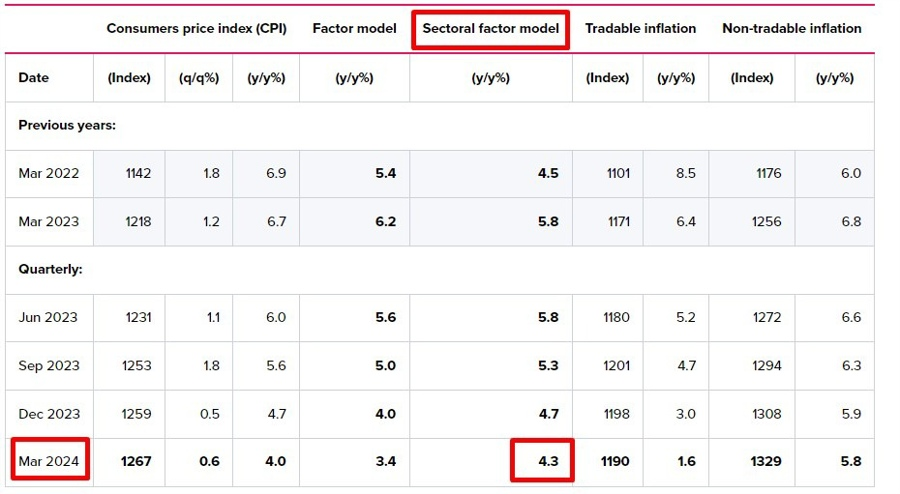

The Australian Bureau of Statistics (ABS) publishes the Consumer Price Index (CPI) quarterly. According to the latest release, the CPI rose 0.6% in the last quarter of 2023 and 4.1% in the 12 months to December 2023. The RBA’s inflation goal is between 2% and 3%.

It is worth mentioning that wage growth is reported separately. The ABS also offers a quarterly report, with the latest showing the seasonally adjusted Wage Price Index (WPI) rose 0.9% in the last quarter of 2023 and 4.2% over the year. At this point, wage growth continues to outstrip inflation, but it's not something to care about today.

When will the Australian employment report be released, and how could it affect AUD/USD?

The ABS will publish the February employment report on Thursday. As previously stated, Australia is expected to have created 7.2K new jobs in March, while the Unemployment Rate is foreseen at 3.9%. The Participation Rate was reported at 66.7% in February.

The tepid job creation and the modest uptick in the Unemployment Rate should not be a problem for the RBA. A much stronger than-anticipated report, however, may be read as a delay in rate cuts. The market isn’t rushing to bet on it, which means the Aussie will likely take advantage against the US Dollar in such a scenario.

A poor outcome on the contrary, and given broad USD strength, AUD/USD may fall to fresh 2024 lows.

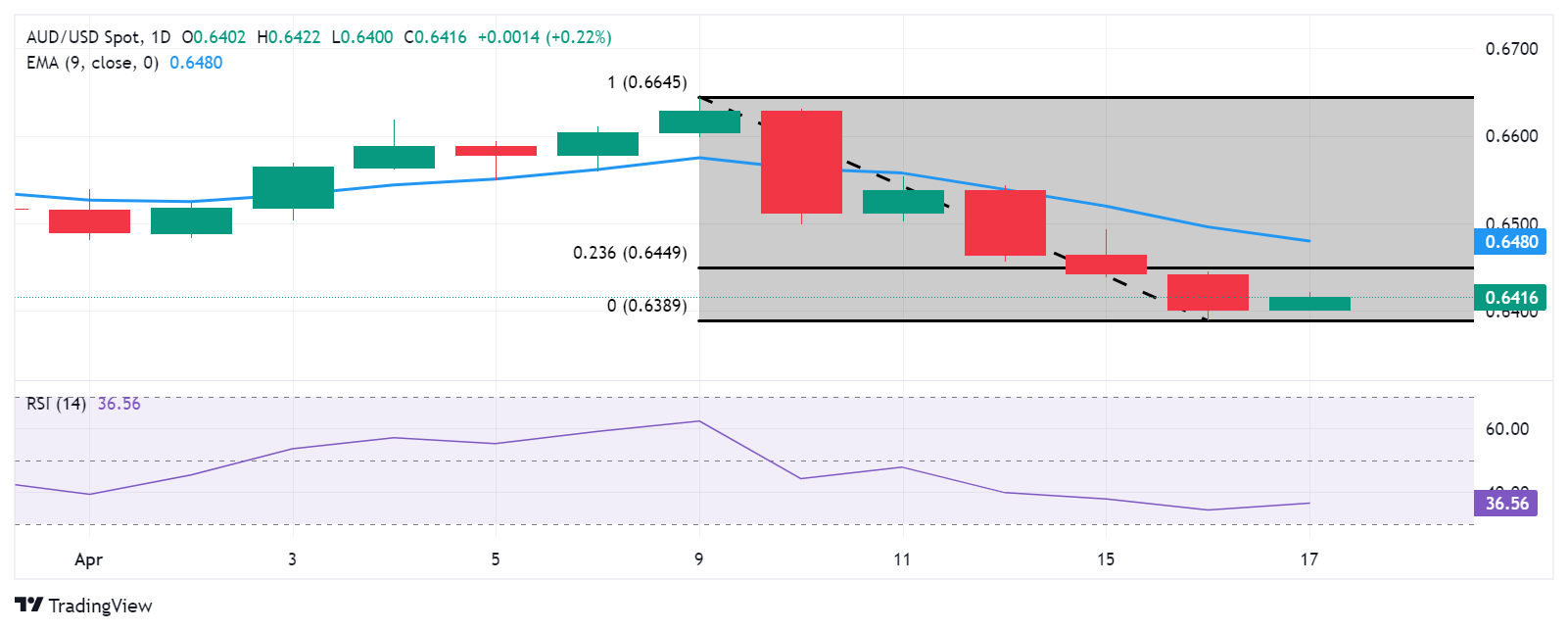

From a technical perspective, Valeria Bednarik, Chief Analyst at FXStreet, notes: “The AUD/USD pair set a fresh 2024 low on Tuesday at 0.6388, as broad US Dollar demand in a risk-averse environment dominates financial boards. The pair is up ahead of the announcement, but the advance seems corrective. Speculative interest is adjusting rate-cut expectations while digesting the latest Middle East developments. The modest improvement in sentiment is short of confirming fears are gone, which means the case for a lower low is alive and kicking.”

Bednarik adds: “AUD/USD is bearish, given that it is developing below all its moving averages in the daily chart. The 20 Simple Moving Average (SMA) heads firmly south below the 100 and 200 SMAs and over 100 pips above the current level, reflecting bears’ strength. Technical indicators recovered modestly from oversold readings but lack momentum enough to confirm an interim bottom. AUD/USD has near-term support at 0.6410, followed by the aforementioned 2024 low. Once below the latter, the slide could extend initially towards 0.6350, en route to 0.6315. On the contrary, immediate resistance can be found at 0.6470, followed by the 0.6530 pierce zone. It is worth adding that, once the dust settles and in the case of a bullish run, sellers may take their chances to keep the pair in the bearish path.”

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Economic Indicator

Unemployment Rate s.a.

The Unemployment Rate, released by the Australian Bureau of Statistics, is the number of unemployed workers divided by the total civilian labor force, expressed as a percentage. If the rate increases, it indicates a lack of expansion within the Australian labor market and a weakness within the Australian economy. A decrease in the figure is seen as bullish for the Australian Dollar (AUD), while an increase is seen as bearish.

Read more.Next release: Thu Apr 18, 2024 01:30

Frequency: Monthly

Consensus: 3.9%

Previous: 3.7%

Source: Australian Bureau of Statistics

The Australian Bureau of Statistics (ABS) publishes an overview of trends in the Australian labour market, with unemployment rate a closely watched indicator. It is released about 15 days after the month end and throws light on the overall economic conditions, as it is highly correlated to consumer spending and inflation. Despite the lagging nature of the indicator, it affects the Reserve Bank of Australia’s (RBA) interest rate decisions, in turn, moving the Australian dollar. Upbeat figure tends to be AUD positive.

- Silver edges higher, showing resilience with a 0.50% gain, yet faces tough resistance near $28.74.

- Technical analysis suggests potential pullback risks with $28.00 as a pivotal level; further support at $27.59 and $27.00.

- Upside momentum could resume if prices surpass $28.28, targeting higher resistance points at $28.74 and potentially $29.00.

Silver’s prices remain in positive territory but continued to register higher tails in the daily chart, signaling buyers' failure to commit to higher prices above the May 18, 2021, high of $28.74. At the time of writing, XAG/USD trades at $28.21 and gains 0.50%.

XAG/USD Price Analysis: Technical outlook

The daily chart depicts the grey metal as upward biased even though it’s retreating below the crucial resistance level, exposing the significant $28.00 figure. Once that level is cleared, it could potentially lead to a significant shift in the market dynamics. Silver’s next support would be the April 15 low of $27.59 ahead of $27.00. Once that level is taken out, the next demand zone would be the December 4, 2023, high turned support at $25.91.

On the other hand, if buyers lift XAG/USD prices back above June 10, 2021, high at $28.28, it could clear the path to test $28.74. A breach of the latter will expose $29.00, followed by the year-to-date (YTD) high at $29.79.

XAG/USD Price Action – Daily Chart

- Markets are pushing the start of the easing cycle from the BoE to September.

- Fed Chair Powell's hawkish stance on Tuesday strengthened the US Dollar.

- As the BoE and Fed’s policies align, the Pound may see additional gains.

The GBP/USD pair is currently trading slightly higher at 1.2448, tallying daily gains. Meanwhile, the USD’s rally was halted due to US Treasury yields declining, but the Greenback’s outlook is bright as the US economy remains strong and markets bet on a more aggressive Federal Reserve (Fed).

Earlier in the session, the UK's Consumer Price Index (CPI) for March reported a slight increase, indicating ongoing inflationary pressures. As a reaction, markets readjusted their expectations on the next decisions from the British bank, and the initial cut is now anticipated for September, a delay from previously expected August. Furthermore, the likelihood of a second reduction in December has decreased to 60% from being fully anticipated earlier in the week. This recalibration of expectations has benefited the Pound on Wednesday.

In line with that, the US continues to see robust inflation and economic figures, underpinning the Fed’s decision to maintain a restrictive policy stance longer than initially expected. So as both bank's policies align, the GBP may see further gains or the pace of the pair may be dictated by how wide the US and GBP’s yield spreads get.

GBP/USD technical analysis

On the daily chart, the Relative Strength Index (RSI) is edging towards oversold territory. On Wednesday, there was a positive movement from 31 to 34 which suggests that the market is currently dominated by sellers, and the pair might be due for a price correction or reversal as sellers take a breather.

When assessing the wider scenario, it's noticeable that the GBP/USD has been trading below the Simple Moving Averages (SMAs) for 20-day, 100-day, and 200-day periods which suggests that the overall trend remains bearish. That being said, traders should pay close attention to an impending bearish crossover at 1.2570 between the 20 and 200-day SMA, which could add further downside pressure on the GBP/USD.

- Gold price drops from daily highs as better global risk sentiment diminishes safe-haven demand.

- A dip in US Treasury yields places additional pressure on the US Dollar amidst hawkish Fed remarks.

- Easing Middle East tensions sway Gold market, forthcoming US sanctions on Iran could influence future precious metal prices.

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve (Fed) officials. US Treasury bond yields dropped and undermined the Greenback, capping Gold’s plunge.

XAU/USD trades at $2,375, down 0.34%, after hitting a daily high of $2,395, just shy of surpassing $2,400. Tensions in the Middle East had subsided after Israeli officials commented that they considered striking Iran on Monday but decided to wait, according to Axios. In the meantime, the US will impose new sanctions on Iran in the upcoming days, said Jake Sullivan, the White House National Security Advisor.

Back to economic themes, Fed Chair Jerome Powell said the US economy has performed quite strongly while acknowledging that recent data shows the lack of further progress on inflation.

Daily digest market movers: Gold slides amid falling US yields, soft US Dollar

- Powell added, "The recent data have clearly not given us greater confidence and instead indicate that it is likely to take longer than expected to achieve that confidence,” that inflation is on the path to 2%. He said, “Given the strength of the labor market and progress on inflation so far, it is appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us.”

- Recent US economic data indicates a robust economy, highlighted by February's Retail Sales, which outperformed expectations, and steady Industrial Production figures. These positive indicators have helped to mitigate concerns raised by weaker-than-anticipated housing data released on Wednesday.

- In the meantime, the CME FedWatch Tool shows the first rate cut could happen in September, with odds for a quarter percentage point cut standing at 71%.

- Despite decent US economic data, market participants seem to be focused on geopolitical risks. Sources cited by The Jerusalem Post revealed that Israel has reportedly finalized plans for a counter strike against Iran.

- US Dollar Index (DXY), which tracks the buck’s performance against a basket of six other currencies, loses 0.15% to 105.96.

- Gross Domestic Product (GDP) estimates for Q1 2024 show that the US economy is expected to grow 2.9%, up from 2.8% estimated on April 15, according to the Atlanta GDPNow model.

Technical analysis: Gold dives as RSI nearly exits overbought levels

Gold’s daily chart depicts the yellow metal as upwardly biased despite retreating toward the $2,370 region. The formation of a Doji on Tuesday suggests that buyers lack the momentum to extend the precious metal's gains, opening the door for a pullback.

In addition, the Relative Strength Index (RSI has fallen below the 80 level and hasn’t looked back, as it is nearly crossing below the 70 level, suggesting that buying pressure is fading.

That said, XAU/USD is headed for a correction. The first support would be the $2,350 mark, followed by the April 15 daily low of $2,324. Once surpassed, Gold might test $2,300.

On the other hand, if buyers drag prices toward $2,400, a test of the all-time high of $2,431 is on the cards.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

The Greenback saw its recent rally run out of steam, prompting a corrective move in the USD Index (DXY) and some recovery in the risk-linked galaxy amidst persistent geopolitical concerns and a firm conviction of an ECB rate cut in the summer.

Here is what you need to know on Thursday, April 18:

The Greenback came under pressure and forced the USD Index (DXY) to retreat from recent peaks. On April 18, the usual weekly Initial Jobless Claims are due along with the Philly Fed Manufacturing Index, the CB Leading Index and Existing Home Sales. In addition, Fed’s Bowman, Bostic and Williams are also due to speak.

EUR/USD rose to three-day highs on the back of the renewed selling pressure in the greenback and a risk-friendly environment in the global markets.

GBP/USD regained the smile and revisited the upper 1.2400s on risk-on sentiment and following expectations of a BoE’s rate cut later in the year.

USD/JPY traded on the defensive after two consecutive sessions of gains, although managing well to keep the trade north of 154.00. In Japan, the weekly Foreign Bond Investment and the speech by BoJ Noguchi are scheduled for April 18.

AUD/USD set aside a three-session negative streak and rebounded from recent yearly lows in the sub-0.6400 area. The release of the Australian labour market report takes centre stage on April 18.

WTI dropped markedly and flirted with the $82.00 mark per barrel on easing geopolitical concerns and a larger-than-estimated weekly build in US crude oil inventories.

Gold prices retreated modestly below the $2,400 mark per troy ounce pari passu with shrinking geopolitical jitters. Silver prices left behind Tuesday’s strong decline and rebounded past the $28.00 mark per ounce.

European Central Bank’s President Christine Lagarde speaks in Washington, DC.

Key Quotes

Growth in Europe is mediocre, much slower than in the US

We’re clearly seeing timid signs of recovery

The game (of fighting inflation) is not over

Market Reaction

A firmer upside momentum now lifts EUR/USD to the area of daily highs near 1.0680.

- The daily RSI for the AUD/JPY demonstrates a modest uptrend, maintaining above the middle ground.

- The Hourly chart reveals mixed sentiment, with frequent RSI changes and negative momentum portrayed by the MACD bars.

- The 20-day SMA at 99.30 is the main target for the bulls.

The AUD/JPY showed a stronger stance by posting a gain of 0.27% and settling at 99.24 in Wednesday’s session. Despite the recent downside, the pair indicates a dominant bullish outlook, firmly standing above the key Simple Moving Averages (SMAs). However, the recent dip below the 20-day SMA brightened the outlook for the bears for the short term.

On the daily chart, the Relative Strength Index (RSI) pair indicates a slight positive trend. Despite dipping close to the 50 level, it recovered and retained its position in positive territory, hovering around 52. Meanwhile, the Moving Average Convergence Divergence (MACD) shows rising red bars, signaling a potential shift in momentum.

AUD/JPY daily chart

The hourly RSI reveals a mixed trend. The latest reading was 53, indicating a positive trend, while previous readings varied between positive and negative territories, revealing fluctuating market momentum. The hourly MACD shows flat red bars, signifying a steady negative momentum.

AUD/JPY hourly chart

Observing the broader prospect, the AUD/JPY's position above the 100-day and 200-day SMA reveals a robust long-term bullish trend. Any significant movements today that keep the cross above these levels won’t threaten the positive outlook, but as the bears gather momentum, some downside in the short term should be expected.

- Mexican Peso regains ground, trading at 16.98 against the US Dollar following Banxico Deputy Governor's comments on maintaining high rates.

- Banxico Deputy Governor Jonathan Heath indicates possible "fine adjustments" to interest rates to combat persistent inflation.

- Fed Chair Jerome Powell hinting at prolonged high US rates due to stagnant inflation progress.

The Mexican Peso trims some of its losses against the US Dollar, but it’s not out of the woods despite remarks from Bank of Mexico (Banxico) Deputy Governor Jonathan Heath suggesting that rates would likely need to remain higher.

That and an improvement in risk appetite was a relief for the Mexican currency, which weakened to levels last seen in February 2024. The USD/MXN trades at 16.99, down 0.47%.

During an interview with Banorte’s Podcast, Heath said the central bank would likely make “fine adjustments” to the main reference rate to ensure “that the restrictive monetary stance remains at these levels for as long as necessary until we see progress on inflation.”

He added that although inflation’s downward trajectory remains in place, it stalled near the 4.4% threshold for five months. Heath added that “prices of services” are to blame for inflation's stickiness.

Across the border, Heath’s colleague, Fed Chair Jerome Powell, said rates could remain higher for longer in remarks at the Wilson Center on Tuesday. Powell said that the lack of progress on inflation would likely require keeping rates steady for “as long as needed.”

Daily digest market movers: Mexican Peso underpinned by Heath comments

- Mexico’s economic docket remains absent, though February’s Retail Sales report for February is scheduled for April 19.

- On Tuesday, the International Monetary Fund (IMF) updated its expectations for economic growth in Mexico, from 2.7% to 2.4% in 2024 and from 1.5% to 1.4% in 2025. The IMF reduced its 2025 forecast, arguing that the fiscal expansion that will drive progress this year will be reversed in the next year because the new administration will have to tighten its belt, reversing existing spending policy.

- US economic data revealed during the week suggests the economy remains solid. A better-than-expected Retail Sales report for February, along with firm Industrial Production, overshadowed weaker-than-expected housing figures on Wednesday.

- Powell added, “Given the strength of the labor market and progress on inflation so far, it is appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us.”

- Geopolitical tensions in the Middle East would likely weigh on the Mexican currency. USD/MXN traders must be aware that any escalation could prompt traders to ditch the Mexican Peso and buy US Dollars.

- US Treasury yields are sliding close to eight basis points (bps) in the belly and long end of the yield curve. That underpins the Greenback, which is up a modest 0.09% at 106.17 on the DXY.

- Data from the Chicago Board of Trade (CBOT) suggests that traders expect the Fed funds rate to finish 2024 at 4.95%, down from 4.97% a day ago.

Technical analysis: Mexican Peso cuts some losses but remains pressured

The USD/MXN daily chart suggests the pair shifted to a neutral/upward bias as the Mexican currency tumbles and depreciates past the 17.00 figure. However, buyers must keep the pair above the 100-day Simple Moving Average (SMA) at 16.97, to remain hopeful of higher prices. That would the 17.00 figure in sight, followed by the current weekly high of 17.08. Once surpassed, the next stop would be the 200-day SMA at 17.16, followed by the January 17 high at 17.38, before testing the 17.50 psychological level.

On the other hand, if USD/MXN slides below 16.97, look for a pullback toward last year’s low of 16.62, followed by the April 12 low of 16.40.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Oil prices accelerate their reversal as US stocks increase beyond expectations

- The outlook of higher rates for a longer time is increasing concerns about a lower demand for oil

- These fears have offset the impact of geopolitical risks.

Oil prices are going through a sharp reversal on Wednesday, to pare some of the gains taken over the last tree months. WTI crude futures broke lower on Wednesday after a period of hesitation hammered by the higher-for-longer Fed outlook coupled with larger-than-expected US oil stocks.

The weekly EIA report revealed that US Oil stocks increased by 2.735 million barrels. in the week of April 12, against expectations of 1.65 million, and from the 5,841 million barrels reported in the previous week.

This increase in crude stocks comes after Fed Chair, Jerome Powell, warned that the bank might still have work to do to bring inflation to the 2% target. These comments suggest that interest rates will remain at restrictive levels for a longer time, which is expected to depress economic growth and weigh on demand for Oil.

This has offset the positive impact on Crude from the increasing geopolitical risks and from news reporting a US threat to reimpose the ban on Venezuelan Oil if President Maduro fails to meet his commitment to fair elections this year.

The broader trend remains bullish although today’s bearish reaction is suggesting a deeper correction. A confirmation below previous highs at $82.85 puts the $80.50 area on the bears’ focus. On the upside, bulls should regain the $84.90 level to shift the focus back toward the YTD high, at $87.60.

- Dow Jones index dips into losses following positive market opening.

- Investors’ concerns about the Fed’s “higher for longer” stance are weighing on risk appetite.

- Technical picture remains bearish with DJIA retreating from historic highs reached in March.

The Dow Jones Industrial Average (DJIA) is posting losses after a positive opening on Wednesday. Investors’ concerns about the hawkish comments by Federal Reserve (Fed) Chair Jerome Powell on Tuesday and a string of downbeat quarterly earrings have soured market sentiment.

Powell observed the lack of progress on inflation on Tuesday and resumed the “higher for longer” monetary policy outlook, which is acting to dampen investors’ appetite for risk.

Beyond that, quarterly earnings data disappointed on Wednesday with Travelers Companies (TRV) reporting profits below estimates, while US Bancorp’s (USB) net interest income fell by 14% in Q1.

The main Wall Street indices are in the red. The NASDAQ is leading losses with a 0.63% decline to 15,769, followed by the S&P 500, down 0.44% to 5,028, and the Dow Jones, off 0.3% to 37,693.

Dow Jones news

The Technology sector is the worst performer on Wednesday, dropping 1.1%, weighed down by the outlook of high rates for a longer time. Industrials are following on Wednesday with a 0.75% decline. On the positive side, Utilities are up 0.8%, while Materials appreciate 0.2%.

Travelers Companies (TRV) plunges 8.2% to $204.99 following downbeat quarterly earnings. Intel (INTC)l is next with a 1.9% drop to $35.57. United Health is the best performer, with a 2.7% rally to $481.53, followed by Goldman Sachs (GS) with a 1.38% gain to $402.33.

Dow Jones technical outlook

The DJIA index has reversed earlier gains and maintains an overall bearish picture intact. The move below 38,560 has activated a Head & Shoulders pattern that points toward a sharper decline.

Immediate support is 37,586, followed by the measured target of the H&S pattern, which meets the mid-January low and 38.6% Fibonacci retracement at 37,087. A bullish reaction might find resistance at the 38,531 previous support ahead of the 39,000 region (order block).

Dow Jones Index Daily Chart

Nasdaq FAQs

The Nasdaq is a stock exchange based in the US that started out life as an electronic stock quotation machine. At first, the Nasdaq only provided quotations for over-the-counter (OTC) stocks but later it became an exchange too. By 1991, the Nasdaq had grown to account for 46% of the entire US securities’ market. In 1998, it became the first stock exchange in the US to provide online trading. The Nasdaq also produces several indices, the most comprehensive of which is the Nasdaq Composite representing all 2,500-plus stocks on the Nasdaq, and the Nasdaq 100.

The Nasdaq 100 is a large-cap index made up of 100 non-financial companies from the Nasdaq stock exchange. Although it only includes a fraction of the thousands of stocks in the Nasdaq, it accounts for over 90% of the movement. The influence of each company on the index is market-cap weighted. The Nasdaq 100 includes companies with a significant focus on technology although it also encompasses companies from other industries and from outside the US. The average annual return of the Nasdaq 100 has been 17.23% since 1986.

There are a number of ways to trade the Nasdaq 100. Most retail brokers and spread betting platforms offer bets using Contracts for Difference (CFD). For longer-term investors, Exchange-Traded Funds (ETFs) trade like shares that mimic the movement of the index without the investor needing to buy all 100 constituent companies. An example ETF is the Invesco QQQ Trust (QQQ). Nasdaq 100 futures contracts allow traders to speculate on the future direction of the index. Options provide the right, but not the obligation, to buy or sell the Nasdaq 100 at a specific price (strike price) in the future.

Many different factors drive the Nasdaq 100 but mainly it is the aggregate performance of the component companies revealed in their quarterly and annual company earnings reports. US and global macroeconomic data also contributes as it impacts on investor sentiment, which if positive drives gains. The level of interest rates, set by the Federal Reserve (Fed), also influences the Nasdaq 100 as it affects the cost of credit, on which many corporations are heavily reliant. As such the level of inflation can be a major driver too as well as other metrics which impact on the decisions of the Fed.

- The DXY Index is recording mild gains, hitting a high since early November at 106.1.

- Investors are focusing on Fed Chair Powell's hawkish stance and US Treasury yields at multi-month highs.

- The Fed’s Beige books, set to be released later in the session, will be closely watched.

The US Dollar Index (DXY) stands at 106.10, showing mild gains. The shift in the index's trend appears influenced by several factors including strong growth and persistent inflation in the US, as well as increased hawkishness from Federal Reserve (Fed) officials.

The US economy is seeing sticky inflation and robust growth. Fed Chair Powell's hawkish stance shows that instead of another rate hike, the Fed favors market tightening through higher yields and wider spreads, which strengthens the USD. However, with financial conditions still loose, further tightening is required and Powell commented on Tuesday that the monetary policy may need additional time to work.

Daily digest market movers: DXY holds its ground on hawkish Fed bets

- Federal Reserve Chair Powell was seen hawkish on Tuesday and warned that there is little progress on inflation. He also stated that the bank remains data-dependent.

- The possibility of a rate cut in the next meeting in June stands at around 15%, a huge drop compared to the previous week's 60%. Also, the chances for a July rate cut have fallen below 50%.

- The first-rate cut is expected to take place in September with a 95% probability, followed by another in December at a 70% probability.

- The US Treasury yields for the 2-year, 5-year and 10-year Treasury bonds are currently standing at 4.93%, 4.63% and 4.61%, respectively, down on the day. Despite the recent decrease, the 2-year and 10-year yields are at their highest since November.

DXY technical analysis: DXY displays bulls' stronghold despite overbought conditions.

On the daily chart, the Relative Strength Index (RSI) continues exhibiting overbought conditions, hinting at an upcoming correction or consolidation phase. The Moving Average Convergence Divergence (MACD) shows decreasing green bars, implying that the buying momentum is losing steam and that the bears may soon take charge.

However, the pair is comfortably positioned above its 20, 100 and 200-day Simple Moving Averages (SMAs), indicating the bulls' dominance in the current scenario. This suggests a positive medium to long-term outlook, with the bulls defending their ground despite the technical indicators pointing toward a short-term bearish influence.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Bank of England’s Governor Andrew Bailey speaks in the wake of the pick up in UK inflation figures in March.

Key Quotes

We’re pretty much on track for where we thought we would be in february on inflation.

I expect next month's inflation number will show quite a strong drop

Oil prices haven't leaped as much as expected

The effect of middle East conflict is less than feared

Market Reaction

GBP/USD keeps the tight range in the low 1.2400s, fading the initial bullish move to the 1.2480 zone on the back of the ongoing bounce in the Dollar.

Pound Sterling price today

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies today. Pound Sterling was the weakest against the Euro.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.15% | 0.02% | -0.04% | 0.04% | -0.08% | -0.03% | -0.03% | |

| EUR | 0.16% | 0.16% | 0.15% | 0.22% | 0.08% | 0.13% | 0.14% | |

| GBP | -0.04% | -0.19% | -0.04% | 0.02% | -0.12% | -0.07% | -0.07% | |

| CAD | 0.01% | -0.14% | 0.04% | 0.06% | -0.08% | -0.03% | -0.02% | |

| AUD | -0.02% | -0.20% | -0.02% | -0.06% | -0.14% | -0.10% | -0.08% | |

| JPY | 0.09% | -0.07% | 0.11% | 0.06% | 0.11% | 0.04% | 0.06% | |

| NZD | 0.08% | -0.10% | 0.09% | 0.05% | 0.11% | -0.02% | 0.02% | |

| CHF | 0.04% | -0.13% | 0.06% | 0.02% | 0.04% | -0.06% | 0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

- Canadian Dollar advances moderately as market sentiment improves.

- USD/CAD is pulling back despite the Fed’s hawkish stance and lower oil prices.

- Current Canadian Dollar recovery is likely to be short-lived.

The Canadian Dollar (CAD) is trading higher on Wednesday to snap a five-day sell-off that has sent the Loonie 1.7% lower. A positive risk sentiment, coupled with lower US yields, is hurting the safe-haven US Dollar and offsetting the CAD’s adverse fundamental background.

The absence of key US releases in the US of Canada is allowing the Canadian Dollar to regain some of the ground lost over the previous days. Upside attempts, however, are likely to be short-lived. The “higher for longer” Federal Reserve (Fed) stance, in opposition to the Bank of Canada’s (BoC) dovish outlook, is expected to support the US Dollar. Beyond that, the lower Oil prices are an extra weight for the commodity-linked Loonie.

On Wednesday, the release of the Fed’s beige book and speeches from Fed members Mester and Bowman are the only events worth mentioning. After Tuesday’s speech by Fed Chair Jerome Powell, their impact on the pair is limited.

Daily digest market movers: USD/CAD loses steam at five-month highs

Canadian Dollar is trading 0.2% higher on Wednesday after having lost nearly 2% in a five-day sell-off.

The hawkish Fed stance, confirmed on Wednesday by Fed Chair Powell, and the dovish outlook of the BoC, which is expected to start cutting rates in June, are acting as a headwind for the CAD.

On Wednesday, Fed Chair Powell warned about the lack of progress on inflation, suggesting that the bank will have to keep rates at restrictive levels for a longer time.

Bets for a Fed rate cut in July have dropped to 37% from 50% at the beginning of the week. Investors are now pricing in 40 bps of cuts in 2024, down from 150 BP in January.

EIA Crude Oil stocks have increased by 2.735 million barrels. against expectations of 1.65 million. Incrementally, this is weighing further on Crude prices and also on the CAD.

On Tuesday, Canadian inflation data showed mixed figures. Headline CPI accelerated to a 2.9% yearly rate from 2.8% in the previous month. The Core CPI eased to 2%, its lowest level in three years.

These figures endorse the view that the Bank of Canada will be able to cut rates soon, probably in June, and increase negative pressure on the pair.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.15% | 0.01% | -0.05% | 0.05% | -0.09% | -0.02% | -0.03% | |

| EUR | 0.17% | 0.18% | 0.13% | 0.21% | 0.05% | 0.11% | 0.11% | |

| GBP | -0.04% | -0.18% | -0.08% | 0.03% | -0.14% | -0.07% | -0.07% | |

| CAD | 0.02% | -0.13% | 0.03% | 0.08% | -0.08% | -0.02% | -0.01% | |

| AUD | -0.05% | -0.18% | -0.02% | -0.08% | -0.16% | -0.10% | -0.07% | |

| JPY | 0.09% | -0.07% | 0.09% | 0.05% | 0.12% | 0.04% | 0.06% | |

| NZD | 0.05% | -0.13% | 0.03% | 0.01% | 0.09% | -0.07% | -0.01% | |

| CHF | 0.04% | -0.11% | 0.07% | 0.01% | 0.10% | -0.06% | 0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: USD/CAD in corrective pullback with 1.3785 holding bears for now

The broader US Dollar trend remains intact, although the pair is going through a corrective pullback from overbought levels, following a five-day rally.

Bears are expected to be challenged at 1.3785, ahead of the intra-week low at 1.3728. The 38.2% Fibonacci retracement level of April’s rally is at 1.3705. On the upside, the immediate resistance is at 1.3845. Further up, the next target would be November 2023 high at 1.3900.

USD/CAD 4-Hour Chart

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

- AUD/USD is buoyed by an improved risk sentiment and a sluggish US economic calendar.

- Wall Street opens higher, influencing currencies despite a slight increase in the US Dollar Index.

- Upcoming Australian employment data could impact AUD strength, with forecasts suggesting modest job growth.

The Australian Dollar makes a U-turn and rises against the US Dollar in early trading during the North American session, gaining 0.33% amid an improvement in risk appetite. A scarce economic calendar in the United States (US) and hawkish comments from Federal Reserve Chair Jerome Powell failed to boost the Greenback. The AUD/USD trades at 0.6423.

AUD/USD gains despite hawkish Fed comments; focus on Australian jobs data

Wall Street is setting the tone, opening with gains. US Treasury yields tumble but do not undermine the buck, which stays firm, as depicted by the US Dollar Index (DXY). The DXY is up 0.11%, at 106.24.

US data revealed during the week showed that American consumers remain resilient while Industrial Production stands tall. On the negative front, US Building Permits and Housing Starts plunged due to higher mortgage rates. The Mortgage Bankers Association (MBA) revealed that rates for 30-year mortgages edged up from 7.01% to 7.13%.

In addition to the data, Fed Chair Jerome Powell said that the lack of progress on inflation would likely require keeping rates steady for “as long as needed.” The markets perceived Powell as hawkish, though Wednesday’s price action suggests the opposite.

In December 2023, the Fed revealed in its projections that most officials expected to cut rates three times due to the evolution of the disinflation process. Nevertheless, three months of higher inflation than expected via the Consumer Price Index (CPI) sparked Powell’s tilt and a repricing of fewer rate cuts than foreseen.

On the Australian front, it would feature the release of jobs data. The Employment Change is expected to add 7.2K jobs to the workforce, well below the 116.5K created in February, while the Unemployment Rate is foreseen to edge close to 4%. If the data comes weak, that would warrant a more accommodative policy by the Reserve Bank of Australia. Hence, AUD/USD traders could push the pair lower.

AUD/USD Price Analysis: Technical outlook

Despite recovering, the AUD/USD is bearishly biased, and it would require buyers to achieve a daily close above the February 13 low of 0.6442. Otherwise, the pair's first support would be the 0.6400 mark, followed by the April 16 daily low of 0.6389. The next support would be 0.6350, followed by the 0.6300 mark.

In an interview with WiWo on Wednesday, European Central Bank (ECB) policymaker and Bundesbank Chief Joachim Nagel said that price pressures in the Eurozone could continue for some time, per Reuters.

"It's not completely clear if the inflation rate will reach 2% target next year and stay at this level," Nagel added and noted that he expects a "slight growth" in German economy in 2024.

Market reaction

These comments don't seem to be impacting the Euro's valuation in a noticeable way. At the time of press, EUR/USD was up 0.15% on the day at 1.0635.

- Silver price jumps higher to $28.60, driven by worsening geopolitical tensions.

- Israel’s response to Iran’s attack will escalate fears of Middle East tensions spreading beyond Gaza.

- US bond yields edge down despite Fed lean towards higher interest rates for a longer period.

Silver price (XAG/USD) advances to $28.60 in Wednesday’s early New York session. The white metal witnesses significant buying interest as deepening Middle East tensions keep safe-haven bid firm. Investors are worried that tensions in the Middle East region could spread beyond Gaza as Israel said it will respond to Iran’s attack on their territory.

The Iranian military launched hundreds of missiles and drones on Saturday in retaliation to Israel’s attack on the Iranian embassy near Damascus in Syria in which two high-rank generals were killed. After Iran’s attack on Israel Tehran said, “the matter deemed to be closed.” However, should the Israeli regime make another mistake, Iran’s response will be considerably more severe, Wall Street Journal reported. The appeal for bullions strengthens when investors see geopolitical tensions escalating further.

Meanwhile, 10-year US Treasury yields fall to 4.63% despite Federal Reserve (Fed) sees interest rates remaining higher for a longer period. A decline in yields on interest-bearing assets eases the opportunity cost of holding an investment in non-yielding assets, such as Silver.

The US Dollar Index (DXY) exhibits strength near 106.20 as robust US Retail Sales data for March has improved the economic outlook. Higher spendings by households are done when labor market conditions remain tight, suggest strong economic outlook.

Silver technical analysis

Silver price faces selling pressure while attempting to break above horizontal resistance plotted from 3 August 2020 high at $29.86. The long-term outlook of the white metal is bullish as the 20-week Exponential Moving Average (EMA) at $24.85 is sloping higher.

The 14-period Relative Strength Index (RSI) shifts into the bullish range of 60.00-80.00, suggesting a strong upside momentum.

Silver weekly chart

- USD/CAD slumps to 1.3800 even though the US Dollar exhibits strength.

- Investors see the BoC choosing the June meeting as their earliest point for pivoting to rate cuts.

- Oil prices weaken as Fed Powell’s hawkish guidance raises doubts over global economic outlook.

The USD/CAD pair dipped to round-level support of 1.3800 in Wednesday’s early American session. The Loonie asset faces pressure despite multiple tailwinds, such as higher Bank of Canada (BoC) rate cut hopes, a sharp decline in the Oil price, and hawkish guidance from Federal Reserve (Fed) Chair Jerome Powell.

The S&P 500 opens on a positive note, suggesting an improvement in the risk appetite of the market participants. 10-year US Treasury yields edge down to 4.64% but are still close to a five-month high as Fed Powell supported the argument of keeping interest rates higher for a longer period.

Meanwhile, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, turns sideways above 106.00.

Traders are pricing in a rate cut by the BoC in the June meeting as inflation remains on course towards the required rate of 2%. The BoC’s preferred inflation measure, the Core Consumer Price Index (CPI), which excludes eight volatile items, softened to 2.0% from the prior reading of 2.1%.

Last week, BoC Governor Tiff Macklem acknowledged that a rate cut in June is possible if inflation continues to decelerate sustainably after keeping interest rates unchanged at 5%.

Meanwhile, West Texas Intermediate (WTI), futures on NYMEX, have dropped to $84.00 as the dismal global economic outlook outweighs tight supply fears. Higher prospects for the Fed maintaining the monetary policy framework for a longer period weigh on the Oil price. Investors fear the global oil supply remaining tight amid deepening Middle East tensions.

- USD/JPY extends its uptrend into the 154.00s.

- It may be forming a Measured Move pattern with an end target of 156.11.

- RSI is overbought, however, warning a correction may be on the horizon.

USD/JPY is trading in the upper 154.00s. It has formed what looks like a Measured Move price pattern composed of three waves, commonly labeled A, B and C.

In the case of Measured Moves, the end of wave C can be reliably predicted because it is often at the point where wave C is equal in length to wave A, or a Fibonacci ratio of wave A. At the very least wave C normally extends to a 0.618 ratio of A.

USD/JPY Daily Chart

The end of C if it ends equal to A it will reach roughly 156.11 and there is a chance the rally could extend that high.

However, it is also the case that price has already reached the conservative target for the end of wave C at the Fib. 0.618 extension of A, at 154.20, which means there is a possibility it may have unfolded to its limit.

In addition, the Relative Strength Index (RSI) is well into overbought territory, recommending bullish traders with a medium-term outlook should not increase their long bets. If RSI exits overbought it may be a sign USD/JPY is pulling back.

For USD/JPY bulls the important thing is that price itself continues to rise and as long as it does the uptrend is likely to continue.

- AUD/USD recovers from 0.6400 amid improved market sentiment.

- The Aussie Employment data will guide market expectations for RBA rate cuts.

- It is forecasted that Australian employers hired mere 7.2K workers in March.

The AUD/USD pair finds a cushion near the round-level support of 0.6400 in Wednesday’s early American session. A three-day losing spell in the Aussie asset has concluded for now as investors expect that nations other than the United States are also facing stubborn inflation issues.

The Consumer Price Index (CPI) data for the United Kingdom and the New Zealand economies released in Wednesday’s session indicated that the last mile for inflation to return to the 2% target is bumpy. UK’s inflation softened slower than estimated in March while NZ inflation grew as expected in the first quarter of 2024.

This has forced traders to reprice their expectations for initial rate cuts. For the Bank of England (BoE) and the Reserve Bank of New Zealand (RBNZ), investors are now expecting that they will pivot to rate cuts from the November meeting instead of September.

Meanwhile, the market sentiment has improved. Considering bullish overnight futures, the S&P 500 is expected to open on a positive note. 10-year US Treasury yields fall slightly to 4.64% after refreshing a five-month high at 4.7%. The US Dollar Index (DXY) turns sideways after printing a fresh five-month high at 106.40. The US Dollar holds strength as Federal Reserve (Fed) Chair Jerome Powell leaned for keeping interest rates higher for a longer period as inflation data for March was not encouraging.

On the Australian Dollar front, investors await the Employment data for March, which will be published on Thursday. The Unemployment Rate is forecasted to have increased to 3.9% from 3.7% in February. In the same period, Australian employers are estimated to have hired 7.2K workers, significantly lower from 116.5K. Weak employment numbers would lift expectations for rate cuts by the Reserve Bank of Australia (RBA).

European Central Bank (ECB) Executive Board member Piero Cipollone said on Wednesday that they are seeing some signs of economic recovery in the Euro area, citing the latest PMI data.

Cipollone said that they expect inflation to resume on its path toward 2% next year and reach the target in 2025.

"If the incoming data in June and July confirm that confidence about the target improves, it will be appropriate to remove some restrictive measures imposed in 2023," he added, per Reuters, but noted that the impact of the Middle East conflict on energy costs is a major risk.

Market reaction

These comments don't seem to be having a significant impact on the Euro's performance against its rivals. At the time of press, EUR/USD was up 0.22% on the day at 1.0640.

- USD/CHF is trending higher within a rising channel.

- The trend is expected to continue to the next set of targets.

- A break below the lower channel line would be required to signal a reversal.

USD/CHF is rallying in an ascending channel on the daily chart. It is in a short and medium-term uptrend which is expected to continue higher given the old adage that the “trend is your friend.”

USD/CHF Daily Chart

USD/CHF has been consolidating over the past few days in the lower 0.9100s but it will probably eventually break higher in accordance with the dominant uptrend. A break above the 0.9152 April highs would confirm more upside.

The next target to the upside comes in at around 0.9173 where some major moving averages converge on higher time-frame charts.

Following that, the next upside target would be located at 0.9240 the level of previous major swing highs made in October 2023.

The Relative Strength Index (RSI) is not overbought any longer, suggesting scope for further upside.

A decisive break below the lower boundary of the channel, currently at roughly 0.9020, would reverse the outlook and bring into question the direction of the intermediate trend.

A decisive break would be one characterized by a breach with a longer-than-average red candlestick or three consecutive red candlesticks.

"Achieving inflation target has been a bumpy ride, it was always going to be and that last mile is the hardest work,"Bank of England (BoE) Monetary Policy Committee (MPC) member Megan Greene said on Wednesday.

"We're closer to target than we were just a few months ago, so the news has been encouraging," Greene added and noted that she is worried about what an energy price shock and other supply side shocks might do to inflation expectations.

Market reaction

GBP/USD showed no reaction to these comments and the pair was last seen rising 0.25% on the day at 1.2457.

- EUR/GBP declines after the release of higher-than-expected UK inflation data suggests UK interest rates could stay high.

- “This is not what the BoE wants to see,” says TD Securities analyst.

- Eurozone inflation data comes out in line with expectations, lifting the Euro amid dovish market expectations.

The EUR/GBP edges lower a fraction on Wednesday to trade at about the 0.8540 level, after the release of macroeconomic data from both the UK and Eurozone.

In the UK, inflation rose slightly higher than expected in March, according to data from the Office of National Statistics (ONS), on Wednesday. The Consumer Price Index (CPI) in March rose 3.2% year-on-year when a 3.1% rise had been expected. That said it was below the 3.6% of the previous month.

Core CPI rose 4.2% versus the 4.1% expected reading but was also lower than the previous month. The same was true of the Retail Price Index (RPI) whilst the Producer Price Index showed results either inline with expectations or slightly below them.

The data gave a lift to the Pound Sterling, perhaps because it reduces the probabilities that the Bank of England (BoE) will be able to start reducing interest rates.

“Overall, this is not what the BoE wants to see, in particular after the stronger than expected wage numbers out yesterday," said analysts at TD Securities, responding to the data.

It means the BoE may need to keep interest rates higher for longer in order to combat stickier-than-expected inflation. Higher interest rates tend to appreciate a currency as they lead to higher foreign capital inflows.

EUR/GBP recovered some lost ground following the release of the final estimate for the March Eurozone Harmonized Index of Consumer Prices (HICP), on Wednesday.

The data showed no change from the flash reading, which showed a 2.4% YoY rise in HICP and 2.9% in core HICP. Both readings were still below the 2.6% and 3.1% readings respectively for February.

The Euro (EUR) may have been lifted because market expectations had overall declined in relation to Eurozone inflation. Recent dovish comments from European Central Bank (ECB) officials, have suggested an increasing willingness to cut interest rates because of falling inflation and stuttering growth, and this could have been responsible for the lower outlook.

ECB President Christine Lagarde, for example, said on Tuesday that the ECB will cut rates soon, bar a surprise, and that the ECB was keeping a close eye on Oil prices due to Middle East tensions.

Analysts at TD Securities think that the Bank of Canada (BoC) remains on track to start lowering the policy rate before the Federal Reserve (Fed) following the latest inflation data.

Third consecutive miss for headline CPI weighed on CAD

"Headline CPI edged higher to 2.9% y/y in March, in line with the market consensus, but details were considerably softer with further progress across the Bank of Canada's preferred measures of core inflation and inflation breadth. CPI-trim/median edged lower to 2.95% y/y on average, as another 0.1% m/m increase saw 3m core inflation rates fall to just 1.3%."

"Today's report provides the Bank of Canada with some additional evidence that recent inflation progress was sustained through March, but we would note the ex. food/energy aggregate saw a much stronger performance, and there is still the risk that recent progress is unwound in April. We do not think today's report is enough to lock in a June cut and still think July is the more likely start to the BoC's easing cycle, but today's report will add to the risk of an earlier move."

"The third consecutive miss for headline CPI weighed on CAD and leaves the Bank of Canada on track to start cutting comfortably before the Fed."

Analysts at BBH share their near-term outlook for the US Dollar Index (DXY).

Chair Powell and other Fed officials have taken a more hawkish turn

"The dollar rally is taking a breather. DXY is trading lower for the first time since last Monday near 106.165 after making a new cycle yesterday near 106.517. It remains on track to test the November 1 high near 107.113."

"The euro is trading higher near $1.0645 but the clean break below $1.0755 sets up a test of the November 1 low near $1.0515. Elsewhere, sterling is trading higher near $1.2465 after higher-than-expected CPI data. USD/JPY is trading lower near 154.60 after making a new cycle high near 154.80 yesterday."

"The dollar rally should continue as recent data confirm persistent inflation and robust growth in the U.S. In turn, Chair Powell and other Fed officials have taken a more hawkish turn. This should keep upward pressure on U.S. yields, and this is what the Fed wants in lieu of another hike. We believe that while market easing expectations have adjusted violently after CPI and now Powell, there is still room to go. When the market finally capitulates on the Fed, the dollar should gain further."

- The US Dollar consolidates ahead of a very light day in the economic calendar.

- Markets digest Fed Chairman Powell hawkish remarks.

- The US Dollar Index trades deep into the 106.00 area though, although a small pullback could be at hand.