- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 16-05-2013

European stocks were little changed, after the benchmark Stoxx Europe 600 Index yesterday extended its highest level since June 2008.

National benchmark indexes retreated in 12 of the 18 western-European markets. The U.K.'s FTSE 100 Index slipped 0.1 percent, Germany's DAX Index added 0.1 percent, while France's CAC 40 lost 0.1 percent.

Zurich Insurance lost 3.3 percent to 261.30 Swiss francs after Switzerland's biggest insurer reported a 7 percent decline in first-quarter net income to $1.06 billion. That missed the $1.14 billion average estimate in a Bloomberg survey.

Suedzucker tumbled 6.7 percent to 27.34 euros after Europe's largest sugar producer forecast that full-year operating profit will fall "significantly" to about 825 million euros.

Vivendi SA dropped 2.7 percent to 15.30 euros after Activision Blizzard Inc. (ATVI) was said to have shelved a plan to buy back shares held by its French parent amid a disagreement on price. The world's largest video-game publisher planned to buy at least part of Vivendi's stake as recently as last month, people with knowledge of the talks said. Vivendi, which has a 61 percent Activision holding valued at more than $10 billion, is still exploring how to extract cash from its stake, including a possible dividend recapitalization, one of the people said.

3i Group Plc lost 4.8 percent to 345.8 pence after the U.K.'s largest publicly traded private-equity firm reported a net value of its assets of 311 pence a share for the full year. That missed the 315 pence to 325 pence estimate of Iain Scouller, an analyst at Oriel Securities Ltd. in London who rates the stock a sell. The shares have still surged 59 percent so far this year.

Richemont jumped 7.6 percent to 88.80 francs after the owner of the Cartier brand reported full-year net income of 2.01 billion euros ($2.58 billion), beating analyst estimates for 1.96 billion euros. The company also proposed a dividend of 1 franc, topping forecasts.

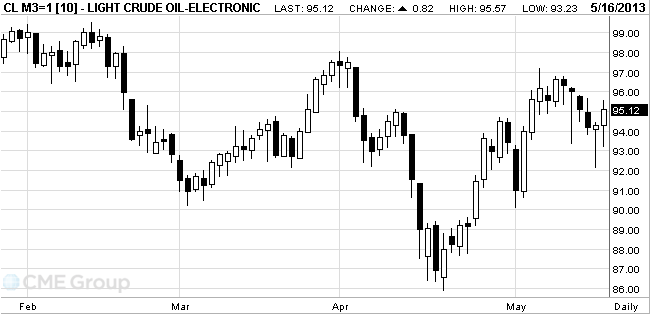

West Texas

Intermediate crude rose on speculation that central banks will bolster stimulus

after more Americans than projected filed applications for unemployment

benefits and

Futures

climbed as much as 1.2 percent as Labor Department figures showed that jobless

claims exceeded all forecasts in a Bloomberg survey of economists. The

WTI oil for

June delivery rose $1.12, or 1.2 percent, to $95.42 a barrel at 11:15 a.m. on

the New York Mercantile Exchange. Prices dropped as much as $1.07 before the

release of the U.S. figures at 8:30 a.m. in Washington. The volume of all

contracts traded was 54 percent above the 100-day average for the time of day.

Brent crude

for June settlement, which expires today, advanced 37 cents, or 0.4 percent, to

$104.05 a barrel on the London-based ICE Futures Europe exchange. The more

actively traded July futures increased 65 cents, or 0.6 percent, to $104.15 a

barrel. Volume for all contracts was 25 percent greater than the 100-day

average.

Gold prices fell on Thursday to its lowest

level in almost a month amid fears of collapse and the Fed's bond

purchases to reduce the volume of metal in the Investment Fund ETF

to a minimum since 2009.

Gold prices may fall to show the sixth day in

a row and record the worst performance since March

2009.

"The recent strengthening of the U.S. dollar

eroded gold's appeal for financial investment," - said the head of

ANZ Global Markets Research Tim Riddell. Strengthening U.S.

currency makes commodities denominated in it more expensive for

holders of other currencies.

The decline in gold exchange-traded fund - ETF

- shows that investors switch from gold to stocks. Thus, the volume

of metal in the largest gold ETF-oriented world - SPDR Gold Trust -

has decreased by 0.43 per cent to 1,047 tonnes on Wednesday - the

lowest level since March 2009.

Financial market participants also fear that

the U.S. Federal Reserve may decide to curtail loose monetary

policy, which is why investing in gold to protect against inflation

could lose meaning.

The cost of the June gold futures on COMEX today dropped to 1368.00 dollars an ounce.

EUR/USD $1.2810, $1.2875, $1.2900, $1.2920, $1.2940, $1.2950, $1.2990

USD/JPY Y102.00, Y102.50, Y102.70

USD/CHF Chf0.9500

EUR/CHF Chf1.2250, Chf1.2375, Chf1.2400

AUD/USD $0.9850, $0.9900, $1.0000

EUR/AUD A$1.3000

AUD/JPY Y100.95

U.S.

stock futures are mixed as more Americans than projected filed

applications for jobless benefits last week and starts of new homes

fell in April.

Shares of Wal-Mart Stores Inc. (WMT) fell after the world's largest retailer forecast second-quarter profit that was less than analysts estimated.

Shares of Cisco Systems Inc. surged more then 10% after reporting fiscal third-quarter profit that topped estimates.Global Stocks:

Nikkei 15,037.24 -58.79 -0.39%

Hang Seng 23,082.68 +38.44 +0.17%

Shanghai Composite 2,251.81 +27.01 +1.21%

FTSE 6,698.66 +5.11 +0.08%

CAC 3,964.77 -17.46 -0.44%

DAX 8,358.08 -4.34 -0.05%

Crude oil $94.74 -0.47%

Gold $1377.50 -1.34%

Upgrades:

Downgrades:

Other:

Apple (AAPL) initiated at Neutral at Susquehanna

eBay (EBAY) initiated at Buy at Lazard

Amazon.com (AMZN) initiated at Buy at Lazard

Cisco Systems (CSCO) reiterated at Outperform at Oppenheimer, target raised from $24 to $27

Cisco Systems (CSCO) reiterated at Buy at Wunderlich, target raised from $24 to $26

Data

02:00 New Zealand Annual Budget Release 2013

04:30 Japan Industrial Production (MoM) (Finally) March +0.2% +0.2% +0.9%

04:30 Japan Industrial Production (YoY) (Finally) March -7.3% -6.7%

06:45 France Non-Farm Payrolls (Preliminary) Quarter I -0.3% -0.3% -0.1%

09:00 Eurozone Trade Balance s.a. March 12.0 11.8 18.7

09:00 Eurozone Harmonized CPI April +1.2% -0.1% -0.1%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) April +1.2% +1.2% +1.2%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y April +1.5% +1.0% +1.1%

The euro exchange rate fluctuates against the dollar, approaching the maximum values of the session. Note that the latest data published by Statistics Eurostat, the trade surplus Eurozone has increased markedly in March, being at the same time by more than two times higher than in the previous month. We also add that this was the highest value since records began in 1999, which was due to a sharp increase in exports and decrease imports. According to experts, the high export figures give some hope that the eurozone may soon return to growth after a prolonged reduction, and suggests that the decline recorded in the first quarter, was associated with a very weak domestic demand. According to the report, the unadjusted trade surplus rose in March to a level of 22.9 billion euros, compared with 10.1 billion euros in February. Recall that in March 2012 the surplus was 6.9 billion euros. In addition, it was reported that the seasonally adjusted surplus in merchandise trade rose to the level of 18.7 billion euros, compared with a surplus of 12.7 billion euros in the previous month, which was revised up from 12 billion euro. According to experts, the surplus was $ 11.8 billion. In addition, the data showed that the volume of exports of the euro zone rose to a seasonally adjusted 2.8 per cent compared with February. At the same time, the volume of imports fell by 1 percent. Note that a further report, which was submitted to Eurostat showed that the annualized rate of inflation in the euro area declined in April to 1.2 percent from 1.7 percent in March. On a monthly basis, inflation declined to 0.1 percent, in line with economists' forecasts. Core inflation, which excludes prices of energy, food, alcohol and tobacco, fell to 1 percent from 1.5 percent a month earlier. In the EU27, the annual inflation rate was 1.4 percent, down from 1.9 percent in March. The lowest rates were observed in Greece, Latvia and Sweden, while Romania showed the highest values.

The yen declined significantly against the dollar, even though the publication of better-than-expected data. Data released by the Japanese government show that qoq economy grew by 0.9% in the period from January to March, while year - by 3.5%, which is the best result among the G-7. This improvement is also the result of increasing the volume of private consumption (+0.9% in Q1 this year) versus 0.4% in the previous quarter, as well as personal expenses, which increased by 0.6%, slightly less than in the last quarter of 2012. In addition, the fall of the yen to boost exports, which marked an increase of 3.8% compared to -2.9% in the period October-December 2012.

Experts note that the result of the monetary incentive, launched by the Japanese Prime Minister Abe, as well as the Bank of Japan, also known as "Abenomika" were two quarters of economic growth. They also add that Abenomiki continued success depends on whether the Japanese government implements the planned steps. In January, the government announced a major expansion of the leniency program (10 trillion. Yen), the Central Bank raised its target mark on inflation to 2%. In April, the Bank announced a doubling of the size of the QE program to 270 bln. yen by the end of 2014, "and the next step will be the presentation of a new strategy for growth, planned for June.

EUR / USD: during the European session, the pair dropped to $ 1.2845, but then rose $ 1.2886

GBP / USD: during the European session, the pair dropped to $ 1.5195, after which rose to $ 1.5244

USD / JPY: during the European session, the pair rose to Y102.68

At 12:30 GMT Canada is to publish data on the volume of transactions with foreign securities in March. Also this time the U.S. will report the volume of building permits issued and the number of Housing Starts in April and present the consumer price index and core consumer price index for April. At 14:00 GMT the United States will Fed manufacturing index for May Philadelphia. At 22:45 GMT New Zealand will release the Producer Price Index and the Producer Price Index for Q1. At 23:50 GMT Japan will report on changes in the volume of mortgage lending in Q1 and the change in the volume of orders for machinery and equipment in March.

EUR/USD

Offers $1.2950, $1.2925/40, $1.2900/05

Bids $1.2825/20, $1.2800/790, $1.2775/70

GBP/USD

Offers $1.5330/35, $1.5295/300, $1.5265-80, $1.5250

Bids $1.5195, $1.5175/70, $1.5160/50, $1.5130/20, $1.5100-090

AUD/USD

Offers $0.9950, $0.9935/40, $0.9900, $0.9880, $0.9845/50

Bids $0.9800, $0.9750, $0.9720/10, $0.9700, $0.9650

EUR/JPY

Offers Y133.50, Y133.00, Y132.75/80, Y132.40/50, Y132.20

Bids Y131.40, Y131.20, Y131.10/00, Y130.80

USD/JPY

Offers Y103.50, Y103.05/10, Y102.90/95, Y102.75/80

Bids Y102.00, Y101.85/80, Y101.50, Y101.25

EUR/GBP

Offers stg0.8545/50, stg0.8530/35, stg0.8490-500

Bids stg0.8435/25, stg0.8410/00, stg0.8395

European stocks declined for the first time in three days, sending the Stoxx Europe 600 Index down from its highest level since June 2008. U.S. index futures were little changed, while Asian shares fell.

The Stoxx 600 lost 0.2 percent to 307.46 at 10:58 a.m. in London. The benchmark gauge has rallied 9.9 percent so far in 2013, its best start to a year since 1998, bolstered by central-bank monetary stimulus.

In the U.S., a report at 8:30 a.m. in Washington, may show housing starts dropped to a 970,000 annual rate in April, after jumping in March to a 1.04 million pace, according to the median.

Zurich Insurance lost 3.5 percent to 260.90 Swiss francs after Switzerland's biggest insurer reported a 7 percent decline in first-quarter net income to $1.06 billion. That missed the $1.14 billion average estimate. Chief Executive Officer Martin Senn said in a statement that the company is on track to meet its targets as all core businesses delivered "high-quality" operating performance.

Vivendi slid 2.5 percent to 15.32 euros after people with knowledge of the talks said Activision (ATVI) has halted discussions to buy back shares amid a disagreement on price. The world's largest video-game publisher planned to buy at least part of Vivendi's stake as recently as last month, said the people.

Vivendi, which has a 61 percent Activision holding valued at more than $10 billion, is still exploring how to extract cash from its stake, including a possible dividend recapitalization, one of the people said.

Suedzucker AG tumbled 8 percent to 26.97 euros, for the biggest decline on the Stoxx 600, after Europe's largest sugar producer forecast that full-year operating profit will fall "significantly" to about 825 million euros.

Richemont jumped 6.5 percent to 87.95 francs, its highest price since at least 1990, after the the owner of the Cartier brand reported full-year net income of 2.01 billion euros ($2.58 billion), beating analyst estimates for 1.96 billion euros. The company also proposed a dividend of 1 franc, topping forecasts.

FTSE 100 6,696.09 +2.54 +0.04%

CAC 40 3,966.9 -15.33 -0.38%

DAX 8,341.98 -20.44 -0.24%

EUR/USD

$1.2810, $1.2875, $1.2900, $1.2920, $1.2940, $1.2950,

$1.2990

USD/JPY Y102.00, Y102.50, Y102.70

USD/CHF Chf0.9500

EUR/CHF Chf1.2250, Chf1.2375, Chf1.2400

AUD/USD $0.9850, $0.9900, $1.0000

EUR/AUD A$1.3000

AUD/JPY Y100.95

Most

Asian stocks fell as a decline in Japanese banks after forecasting

lower earnings offset a report that Japan's economy expanded faster

than analysts estimated in the first quarter.

Nikkei 225 15,037.24 -58.79 -0.39%

S&P/ASX 200 5,165.7 -25.96 -0.50%

Shanghai Composite 2,245.43 +20.63 +0.93%

Mitsubishi UFJ Financial Group Inc. sank 2.9 percent, leading Japanese lenders lower.

Daewoo Shipbuilding & Marine Engineering Co., South Korea's third-biggest shipbuilder, fell 10 percent as first-quarter profit plunged.

Dai-ichi Life Insurance Co., Japan's second-largest life insurer, jumped 7.3 percent after projecting improved earnings and a stock split.

02:00 New Zealand Annual Budget Release

2013

04:30 Japan Industrial Production (MoM) (Finally) March +0.2% +0.2% +0.9%

04:30 Japan Industrial Production (YoY) (Finally) March -7.3% -6.7%

The euro slid toward a six-week low before a report that will probably confirm inflation in the 17-nation region was the slowest in three years. The euro-area's annual inflation rate dipped to 1.2 percent in April, the lowest since February 2010, from 1.7 percent a month earlier, the European Union's statistics office in Luxembourg is forecast to confirm today. The rate has been below the ECB's 2 percent ceiling since February.

Gross domestic product in the euro area contracted 0.2 percent last quarter, data showed yesterday. A Bloomberg News survey forecast a 0.1 percent decline. The German economy grew 0.1 percent, below the 0.3 percent economists forecast.

The common currency completed a five-day drop yesterday, the longest losing stretch in six months, on speculation the European Central Bank will ease policy after data showed the euro-area economy extended its recession to a record sixth quarter. ECB President Mario Draghi pledged on May 2 to ease policy again if needed following a cut in the benchmark to 0.5 percent.

The Dollar Index (DXY) was 0.3 percent from its highest level since July before Federal Reserve Bank of San Francisco President John Williams speaks. In the U.S., government data will probably show today initial jobless claims probably increased 7,000 to 330,000 in the week ended May 11, according to the median estimate of economists surveyed by Bloomberg. The 323,000 the previous week was the fewest since January.

The yen advanced after reports showed the nation's economy expanded more than forecast. Japan's economy expanded 0.9 percent in the first quarter, compared with the forecast for a 0.7 percent increase, a separate report showed.

The Australian dollar traded near an 11-month low after signs of slowdown in the global economy weighed on commodity prices, dimming the outlook for the South Pacific nation's exports.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.2865-90

GBP / USD: during the Asian session, the pair traded in the range of $ 1.5210-45

USD / JPY: during the Asian session, the pair traded in the range of Y101.95-30

Thursday sees another busy day on both sides of the Atlantic, with a solid mix of both data central bank speakers. The European data calendar gets underway at 0645GMT, with the release of the French April manufacturing investment survey, first quarter jobs creation data and first quarter employment data. At 0700FGMT, Spanish March industrial orders data are due for release. More eurozone data is expected at 0900GMT, with the release of the EMU April final HICP data and the March trade balance numbers. Eurozone CPI is seen at -0.1% on month and up 1.2% on year. At 1300GMT, ECB Executive Board member Peter Praet gives a keynote speech at the European Business Summit, in Brussels. Following on from Wednesday's data and BOE press conference, today is a relatively quiet data day in the UK, with just the April SMMT Auto Production Figures expected at 0830GMT. US CPI, weekly jobless claims and housing starts at 1230GMT, followed by Phila Fed at 1400GMT in focus.

Change % Change Last

GOLD 1,391.50 -33.00 -2.32%

OIL (WTI) 94.33 0.12 0.13%

Change % Change Last

Nikkei 225 15,096.03 +337.61 +2.29%

Hang Seng 23,039.76 +109.48 +0.48%

S&P/ASX 200 5,191.7 -29.29 -0.56%

Shanghai Composite 2,224.8 +7.79 +0.35%

FTSE 100 6,693.55 +7.49 +0.11%

CAC 40 3,982.23 +16.17 +0.41%

DAX 8,362.42 +23.31 +0.28%

DJIA 15,275.70 60.44 0.40%

S&P 500 1,658.78 8.44 0.51%

NASDAQ 3,471.62 9.01 0.26%

(pare/closed(00:00 GMT +02:00)/change,

%)

EUR/USD $1,2880 -0,40%

GBP/USD $1,5222 +0,02%

USD/CHF Chf0,9659 0,00%

USD/JPY Y102,27 +0,01%

EUR/JPY Y131,73 -0,39%

GBP/JPY Y155,65 +0,01%

AUD/USD $0,9887 -0,09%

NZD/USD $0,8232 +0,33%

USD/CAD C$1,0163 -0,18%

02:00 New Zealand Annual Budget Release

2013

04:30 Japan Industrial Production (MoM) (Finally) March +0.2% +0.2%

04:30 Japan Industrial Production (YoY) (Finally) March -7.3%

06:45 France Non-Farm Payrolls (Preliminary) Quarter I -0.3% -0.3%

09:00 Eurozone Trade Balance s.a. March 12.0 11.8

09:00 Eurozone Harmonized CPI April +1.2% -0.1%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) April +1.2% +1.2%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y April +1.5% +1.0%

12:30 Canada Foreign Securities Purchases March -6.31 5.36

12:30 U.S. Initial Jobless Claims May 323 332

12:30 U.S. Building Permits, mln April 0.902 0.940

12:30 U.S. Housing Starts, mln April 1.036 0.980

12:30 U.S. CPI, m/m April -0.2% -0.3%

12:30 U.S. CPI, Y/Y April +1.5% +1.3%

12:30 U.S. CPI excluding food and energy, m/m April +0.1% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y April +1.9% +1.8%

14:00 U.S. Philadelphia Fed Manufacturing Survey May 1.3 2.5

16:30 U.S. FOMC Member Raskin Speaks

22:00 New Zealand ANZ Job Advertisements (MoM) April +0.7%

22:45 New Zealand PPI Input (QoQ) Quarter I -0.3% +0.3%

22:45 New Zealand PPI Output (QoQ) Quarter I -0.1% 0.0%

23:50 Japan Core Machinery Orders March +7.5% +3.1%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.