- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 15-08-2024

- EUR/USD pitched lower despite Thursday’s improved risk appetite.

- US Retail Sales climbed much higher than expected.

- US data to dominate the remainder of the trading week with consumer sentiment.

EUR/USD took a dive back below the 1.1000 handle on Thursday despite a broad-market recovery in investor sentiment. US Retail Sales growth lurched to an 18-month high of 1.0% MoM in July, well above the forecast 0.3% and entirely engulfing the previous month’s -0.2% contraction. Improving economic health indicators are helping to stave off recent concerns of a potential recession within the US.

However, not all is rosy in financial markets post-Retail Sales. According to the CME’s FedWatch Tool, rate markets are now pricing in just 25% odds of a 50 bps double cut from the Federal Reserve (Fed) in September, down significantly from last week’s peak bets of 70% odds. Rate traders have still fully priced in a September rate trim as a done deal, with 75% odds of at least 25 basis points off of the top on September 18.

US data will take center stage for Fiber traders on Friday, where the University of Michigan’s Consumer Sentiment Survey Index is expected to show an improvement in consumer economic expectations, with the figure forecast to tick up to 66.9 from an eight-month low of 66.4.

Economic Indicator

Michigan Consumer Sentiment Index

The Michigan Consumer Sentiment Index, released on a monthly basis by the University of Michigan, is a survey gauging sentiment among consumers in the United States. The questions cover three broad areas: personal finances, business conditions and buying conditions. The data shows a picture of whether or not consumers are willing to spend money, a key factor as consumer spending is a major driver of the US economy. The University of Michigan survey has proven to be an accurate indicator of the future course of the US economy. The survey publishes a preliminary, mid-month reading and a final print at the end of the month. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Aug 16, 2024 14:00 (Prel)

Frequency: Monthly

Consensus: 66.9

Previous: 66.4

Source: University of Michigan

Consumer exuberance can translate into greater spending and faster economic growth, implying a stronger labor market and a potential pick-up in inflation, helping turn the Fed hawkish. This survey’s popularity among analysts (mentioned more frequently than CB Consumer Confidence) is justified because the data here includes interviews conducted up to a day or two before the official release, making it a timely measure of consumer mood, but foremost because it gauges consumer attitudes on financial and income situations. Actual figures beating consensus tend to be USD bullish.

EUR/USD price forecast

EUR/USD snapped a recent winning streak, tumbling back below the 1.1000 major handle on Friday. Bulls appear set to run out of gas and near-term momentum threatens to drag the Fiber back into a rough descending channel that has plagued the pair through 2024.

Bidders will be looking for technical support from a rising pattern of higher lows on daily candlesticks, but EUR/USD remains poised for a quick snap back toward the 200-day Exponential Moving Average (EMA) at 1.0826.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- GBP/USD halts downside turnaround, finds another green day.

- UK GDP and industrial activity meet or beat expectations, US Retail Sales surge.

- UK Retail Sales and US Consumer Sentiment on the docket for Friday.

GBP/USD found the gas pedal on Thursday after a steeper-than-expected recovery in US Retail Sales pushed Cable back into the high end. Market sentiment rebounded on the day after fears of a possible US recession were cooled by US data beating expectations, and the Pound Sterling caught additional bullish momentum from UK Gross Domestic Product (GDP) growth meet expectations and UK Manufacturing Production handily exceeding forecasts in July.

Coming up on Friday, UK Retail Sales are expected to rebound from a recent downswing. MoM Retail Sales in July are forecast to rise to 0.5% after the previous month’s -1.2% contraction, with the YoY figure expected to surge to 1.4% from the previous -0.2% contraction. On the US side, the University of Michigan’s Consumer Sentiment Survey Index is expected to show an improvement in consumer economic expectations, with the figure forecast to tick up to 66.9 from an eight-month low of 66.4.

Economic Indicator

Retail Sales (MoM)

The Retail Sales data, released by the US Census Bureau on a monthly basis, measures the value in total receipts of retail and food stores in the United States. Monthly percent changes reflect the rate of changes in such sales. A stratified random sampling method is used to select approximately 4,800 retail and food services firms whose sales are then weighted and benchmarked to represent the complete universe of over three million retail and food services firms across the country. The data is adjusted for seasonal variations as well as holiday and trading-day differences, but not for price changes. Retail Sales data is widely followed as an indicator of consumer spending, which is a major driver of the US economy. Generally, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Thu Aug 15, 2024 12:30

Frequency: Monthly

Actual: 1%

Consensus: 0.3%

Previous: 0%

Source: US Census Bureau

Retail Sales data published by the US Census Bureau is a leading indicator that gives important information about consumer spending, which has a significant impact on the GDP. Although strong sales figures are likely to boost the USD, external factors, such as weather conditions, could distort the data and paint a misleading picture. In addition to the headline data, changes in the Retail Sales Control Group could trigger a market reaction as it is used to prepare the estimates of Personal Consumption Expenditures for most goods.

GBP/USD technical outlook

Cable’s bullish recovery on Thursday gave the pair the help it needed to remain on the high side of the 50-day Exponential Moving Average (EMA) 1.2787. GBP/USD caught a technical bounce after hitting the 1.2800 handle early Thursday, but bulls ran out of steam just before they could chalk in a fresh two-week high. Intraday price action is churning just north of 1.2850.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- Gold price trades flat around $2,455 in Friday’s early Asian session.

- US July Retail Sales beat expectations, rising 1.0% MoM; Initials Jobless Claims fell 7K to 227K last week.

- The escalating geopolitical risks in the Middle East might cap the Gold’s downside.

Gold price (XAU/USD) flat lines near $2,455 during the early Asian session on Friday. The yellow metal seesaws between gains and losses amid the consolidation of the US Dollar (USD). Traders will focus on the preliminary of the US Michigan Consumer Sentiment Index for August, along with the Building Permits and Housing Starts.

Following the release of encouraging employment-related data and strong retail sales, speculative interest in the world's biggest economy decreased, easing fears about a potential recession. However, traders still see the US Federal Reserve (Fed) start easing the policy in September. According to the CME FedWatch Tool, the markets are now pricing in a nearly 80% chance of a September rate cut and expect 200 basis points (bps) of reduction in the next 12 months, though that will depend on incoming data.

Data released by the US Census Bureau on Thursday showed that Retail Sales in the United States rose by 1.0% MoM in July, compared to a decline of 0.2% in June. This figure surpassed the estimation of a 0.3 increase. Meanwhile, the Initial Jobless Claims for the week ending August 10 arrived at 227K, better than the expectation of 235K and down from the previous week of 234K. The recent stronger job data and upbeat Retail Sales have strengthened the USD broadly and weighed on the precious metal.

Nonetheless, the elevated geopolitical risks in the Middle East might provide some support to Gold price, a traditional safe-haven asset. Gaza’s Health Ministry says more than 40,000 Palestinians have been killed in Israeli attacks since October 7, with many more buried under rubble and threatened by illness, according to local news source Aljazeera.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- NZD/USD slides lower by 0.25% on Thursday, extending its losing streak.

- Selling pressure gains pace as the RSI and MACD indicate a potential reversal.

- Pair continues trading in the 20-day and 200-day SMA channels.

In Thursday's session, the NZD/USD pair declined to 0.5985, extending its losing streak to two consecutive sessions. The pair has been trading within a narrow range between the 200-day Simple Moving Average (SMA) and the 20-day SMA which are serving as support and resistances.

On the daily chart, the Relative Strength Index (RSI) is currently around 49, but points down while the MACD is showing decreasing green bars, signaling decreasing bullish momentum. This suggests that the selling pressure is increasing and a potential reversal could be on the horizon.

NZD/USD daily chart

On the daily chart, the NZD/USD pair is facing immediate support at 0.5980. A break below this level could open the door for a deeper correction towards 0.5960 and 0.5930 (20-day SMA). On the upside, resistance lies at 0.6000, 0.6040(100-day SMA) and 0.6100 (200-day SMA). Traders should monitor any brakes above or below the mentioned SMAs as they could trigger sharp movements.

- The Canadian Dollar churned at the mercy of market flows on Thursday.

- Canada reported another, albeit slower, contraction in Wholesale Sales in June.

- Uptick in US Retail Sales pin Greenback lower, but CAD unable to capitalize.

The Canadian Dollar (CAD) was at the mercy of overall market flows on Thursday, rising against the day’s weaker currencies but giving up further ground as the Greenback softens. US markets tilted into a risk-on stance after US Retail Sales jumped in July, helping the market’s overall mood but trimming bets of a double rate cut from the Federal Reserve (Fed) in September.

Canada reported another miss in Wholesale Sales in June, reporting another contraction in large-scale business inventory acquisitions. However, the figure was less than the previous MoM contraction, but the data which runs two months behind the curve, is too late for CAD traders to do anything with.

Daily digest market movers: CAD gives up further ground to Greenback despite risk-on sentiment

- Canadian Wholesale Sales contracted again in June, falling by -0.6% MoM compared to the previous -1.2% decline.

- Despite the low-impact nature of the data, CAD still found a way to ease back against the softening US Dollar.

- US Retail Sales surged to 1.0% in July, the indicator’s highest print since February of 2023.

- The jump in US Retail Sales, a firm indication of good economic health, prompted a broad recovery in risk appetite, sending the Greenback lower.

- Not all is rosy: markets are shrugging off a -0.6% contraction in US Industrial Production in July, the indicator’s worst print since November of 2023.

- Rate markets have pared back bets of a 50 bps double cut from the Fed in September to less than 25%, but they still see 76% odds of at least a quarter-point rate trim.

- Friday’s University of Michigan Consumer Sentiment Index will give one last data point for investors trying to nail down rate cut bets. The index of survey responses is expected to tick higher to 66.9 from 66.4.

Canadian Dollar price forecast: Further losses on the horizon as CAD goes limp

The Canadian Dollar (CAD) broadly followed global market flows, giving a mixed performance overall but shedding a little over one-tenth of one percent against the US Dollar. USD/CAD bids rose back into contention with the 50-day Exponential Moving Average (EMA) at 1.3730, but bidders remain unable to muscle the pair back into fresh positive territory above 1.3750.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- AUD/USD shows an increase on Thursday, climbing to 0.6630.

- The RBA maintains its hawkish position, potentially balancing the downside.

- The rising Australian Unemployment Rate could affect the Aussie's performance.

The AUD/USD pair experienced an increase of 0.45% during Thursday's session, settling near 0.6630. Despite the rise in Australia's Unemployment Rate in July, strong labor market figures from the country can potentially support the AUD. In addition, the hawkish stance of the Reserve Bank of Australia (RBA) also has a significant impact on the stability of the Aussie.

Relying on the mixed Australian economic outlook and increasing inflation, the RBA's consistent hawkish position has led the markets to predict only 25 bps of easing for 2024.

Daily digest market movers: Aussie sees improvement and shrugs off soft Unemployment figures

- Thursday saw an upbeat day for the AUD/USD pair, even in the face of a rising Unemployment Rate from 4.1% to 4.2%, according to the Australian Bureau of Statistics (ABS).

- Despite this, the strong performance of the Australian Employment Change and Full-Time Employment results, which both surpassed expectations, helped support the AUD.

- Meanwhile, the RBA continues to maintain its hawkish stance, and it all points out that it may be the last among the G10 central banks to implement interest rate cuts.

- On the contrary, the Federal Reserve (Fed) seems poised to facilitate easing in the foreseeable future, a disparity that can potentially benefit the AUD/USD pair in the months to come.

AUD/USD technical outlook: AUD/USD traders exhibit resilience, outlook remains hopeful

On the technical side, the AUD/USD pair reflects a degree of volatility with the Relative Strength Index (RSI) wavering around 54, indicating a primarily neutral momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) prints flat green bars, contributing to the neutral to bullish outlook.

Key support levels are detected at 0.6560 and 0.6500, whereas resistance appears near the 0.6640 and 0.6600 regions. The latter represents the 100 and 200-day Simple Moving Average (SMA) convergence, which is acting as strong support in recent sessions.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

What you need to take care of on Friday, August 16:

The US Dollar seesawed between gains and losses, ending the day mixed across the FX board after United States (US) data brought relief. Speculative interest dropped concerns about a potential recession in the world’s largest economy following the release of healthy employment-related figures and upbeat Retail Sales. Other figures were not that encouraging but fell short of reviving concerns or affecting the odds for a September interest rate cut.

Stocks made the most out of it, as Wall Street extended its rally to fresh weekly highs, with the three major indexes holding on to substantial gains at the end of the day.

The Euro lost the 1.1000 mark versus the US Dollar and settled around 1.0970, while GBP/USD managed to end the day at around 1.2860, as Sterling Pound found support in local data. The UK Q2 Gross Domestic Product (GDP) showed the economy grew 0.6% in the three months to June as expected. Additionally, Manufacturing Production rose 1.1% MoM in June, surpassing expectations.

Safe-haven CHF and JPY edged lower vs the US Dollar, but commodity-linked currencies such as the AUD and the CAD held within familiar levels as stocks’ rally partially offset USD strength.

Gold managed to trim intraday losses and recovered the $2,450 mark ahead of the US close.

Friday will bring speeches from major central bank Governors. Reserve Bank of Australia (RBA) Michele Bullock is due to testify before Congress alongside other policymakers, while Reserve Bank of New Zealand (RBNZ) Adrian Orr is due to speak about monetary policy at an event hosted by the Wellington Chamber of Commerce.

Later in the day, the United Kingdom (UK) will release July Retail Sales, while the United States (US) will publish the preliminary estimate of the August Michigan Consumer Sentiment Index and the Michigan Consumer Inflation Expectations for the same month.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.31% | -0.26% | 1.13% | 0.07% | -0.21% | 0.25% | 0.71% | |

| EUR | -0.31% | -0.58% | 0.80% | -0.25% | -0.61% | -0.23% | 0.40% | |

| GBP | 0.26% | 0.58% | 1.40% | 0.34% | -0.03% | 0.36% | 1.08% | |

| JPY | -1.13% | -0.80% | -1.40% | -1.07% | -1.35% | -1.02% | -0.32% | |

| CAD | -0.07% | 0.25% | -0.34% | 1.07% | -0.28% | 0.02% | 0.74% | |

| AUD | 0.21% | 0.61% | 0.03% | 1.35% | 0.28% | 0.37% | 1.09% | |

| NZD | -0.25% | 0.23% | -0.36% | 1.02% | -0.02% | -0.37% | 0.72% | |

| CHF | -0.71% | -0.40% | -1.08% | 0.32% | -0.74% | -1.09% | -0.72% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

- GBP/USD traded back above 1.2860 after US Retail Sales data beat.

- Improving economic data releases ease market fears of US recession.

- UK GDP met expectations, and manufacturing improved more than expected.

GBP/USD recovered back into the high side on Thursday after a bullish tilt in UK data prints coupled with better-than-expected US Retail Sales figures helped to improve overall market sentiment and keep the Greenback pinned on the low side.

US Retail Sales growth lurched to an 18-month high of 1.0% MoM in July, well above the forecast 0.3% and entirely engulfing the previous month’s -0.2% contraction. Improving economic health indicators are helping to stave off recent concerns of a potential recession within the US. However, rate markets got cold water thrown on recent bets of a double cut from the Federal Reserve (Fed) in September.

On the UK side, Gross Domestic Product (GDP) figures for the second quarter printed exactly as expected, rising 0.6% QOQ and 0.9% YoY. Annualized GDP growth figures rebounded from the previous print of 0.3%, and UK Manufacturing Production swelled by 1.1% MoM in June, well above the forecast 0.1% and recovering from the previous month’s revised 0.3%.

GBP/USD price forecast

Cable’s bullish recovery on Thursday gave the pair the help it needed to remain on the high side of the 50-day Exponential Moving Average (EMA) 1.2787. GBP/USD caught a technical bounce after hitting the 1.2800 handle early Thursday, but bulls ran out of steam just before they could chalk in a fresh two-week high. Intraday price action is churning just north of 1.2850.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- USD steadies amid strong economic data releases.

- Retail Sales from July came in strong as well as weekly Jobless Claims.

- Markets continue confident outlook about a September cut by the Fed.

The US Dollar (USD), measured by the US Dollar Index (DXY), consolidated and rose toward the 102.90 level during Thursday's trading session. This was influenced by strong data reported by the US, but steady dovish bets continue to limit the USD upside.

The US economy is persisting above the trend, suggesting that the market may once again be leaning too heavily into firm easing.

Daily digest market movers: USD steadies as Retail Sales and Jobless Claims beat expectations

- Retail Sales rose 1% MoM to $709.7 billion in July, according to the US Census Bureau. This figure surpassed the expected 0.3% increase and compensated for the 0.2% dip in June.

- Retail Sales ex Autos also rose noticeably by 0.4%, beating the expected 0.1%.

- In addition, Initial Jobless Claims for the week ending August 10 came in at 227K, better than the expected 235K and down from the previous week's revised figure of 234K.

- According to the CME FedWatch Tool, odds now point to an 80% chance of a rate cut in September, and markets remain overconfident of 200 bps of easing in the next 12 months though that will depend on incoming data.

DXY technical outlook: Bias remains bearish but showing signs of stabilization

DXY's technical outlook remains bearish, despite some indications of stabilization. The index is positioned below the 20, 100 and 200-day Simple Moving Averages (SMAs), confirming the established bearish bias. Momentum-based indicators such as the Relative Strength Index (RSI) is now hovering around 40, showing signs of stability despite persisting selling pressure.

The Moving Average Convergence Divergence (MACD) also demonstrates red bars that have stabilized deep in the negative region. Though there is a notable shift in momentum, the overall technical narrative does not project a significant bullish rebound just yet.

Support Levels: 102.40, 102.20, 102.00 Resistance Levels: 103.00, 103.50, 104.00

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- The Dow Jones climbed 475 points on Thursday after upbeat US data print.

- US Retail Sales surged to 18-month high in July.

- Upbeat US data sloughs off recession fears, but tempers rate cut bets.

The Dow Jones Industrial Average (DJIA) gained 475 points on Thursday, climbing around 1.25% on the day as equities tipped into the bullish side after US Retail Sales surged well above forecasts. Markets are shedding recent fears of a recession in the US economy, bolstering risk appetite and sending indexes broadly higher.

However, not all is rosy in financial markets post-Retail Sales. According to the CME’s FedWatch Tool, rate markets are now pricing in just 25% odds of a 50 bps double cut from the Federal Reserve (Fed) in September, down significantly from last week’s peak bets of 70% odds. Rate traders have still fully priced in a September rate trim as a done deal, with 75% odds of at least 25 basis points off of the top on September 18.

Dow Jones news

The Dow Jones is broadly higher on Thursday, with all but four of the index’s listed securities testing into the green for the day. Only four stocks on the board are seeing red, with losses being led by Verizon Communications Inc. (VZ) which fell -1.87% to $40.13 per share.

The DJIA is getting dragged higher by firm gains from key listed companies, including Cisco Systems Inc. (CSCO) and Walmart Inc. (WMT). Cisco Systems is extending into a second day of gains after a solid earnings beat this week, rising 7.1% on Thursday to $48.67 per share. Walmart is seeing an earnings beat of its own on Thursday, climbing 6.5% to $73.14 per share after broadly beating growth forecasts.

Read more:

Walmart earnings and guidance impress, helping lead Dow Jones higher

Cisco earnings surprise Wall Street with fiscal Q4 earnings beat

Dow Jones price forecast

Thursday’s upswing puts the Dow Jones to close in the green for a third straight day, climbing even higher above the 40,000.00 handle after a recent plunge into near-term leans below 38,500.00. Price action is trading north of the 50-day Exponential Moving Average (EMA) as bulls return to the fold in force, and bidding continues to drive prices back towards all-time highs above 41,250.00 set in July.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- The Mexican Peso reclaimed higher ground against the US Dollar on Thursday.

- The Greenback sold off after Retail Sales surged in the US.

- Markets still see a September Fed rate cut, but strong Retail Sales shed slowdown fears.

The Mexican Peso (MXN) climbed three-quarters of a percent against the US Dollar (USD) on Thursday after the Greenback broadly softened. US Retail Sales firmly eclipsed forecasts, causing investors to shrug off recent economic slowdown concerns. Rate markets pulled back on their bets of a double cut from the Federal Reserve (Fed) in September.

Mexico’s central bank (Banxico) is holding firm in its recent decision to cut interest rates from 11% to 10.75%, even as headline inflation figures rose to 5.57% in July. Citing a long-run slide in core inflation metrics and a broader slowdown looming over Mexico’s domestic economy, Banxico Deputy Governor Omar Mejia noted during an interview on Thursday that:

... a cut with a degree of restriction wasn’t just adequate, but opportune and efficient; to consider just one data point on the margin would mean renouncing a fair amount of information that... we must incorporate into our decisions.

Banxico’s measure of core inflation slowed to 4.05% in July, down from the previous month’s 4.13%. The Mexican central bank expects core inflation to reach its 3% target sometime in Q4 2025.

Daily digest market movers: Peso bolstered by risk-on sentiment crowding the bracket

- US Retail Sales surged to 1.0% in July, the indicator’s highest print since February of 2023.

- The jump in US Retail Sales, a firm indication of good economic health, prompted a broad recovery in risk appetite, sending the Greenback lower.

- Not all is rosy: markets are shrugging off a -0.6% contraction in US Industrial Production in July, the indicator’s worst print since November of 2023.

- Rate markets have pared back bets of a 50 bps double cut from the Fed in September to less than 25%, but they still see 76% odds of at least a quarter-point rate trim.

- Friday’s University of Michigan Consumer Sentiment Index will give one last data point for investors trying to nail down rate cut bets. The index of survey responses is expected to tick higher to 66.9 from 66.4.

Mexican Peso price forecast: Easing Greenback gives Peso room to move

The Mexican Peso chalked in a third straight gain on Thursday as the US Dollar moved out of the way to allow a Peso recovery. USD/MXN has eased below 18.80 for the first time since the beginning of August and is headed toward the 50-day Exponential Moving Average (EMA) near 18.33 as long as current trends hold.

The MXN is on pace to gain ground against the Greenback for all but one of the last seven consecutive trading days. However, USD/MXN is easing down from a very high perch after the pair ran up the charts over 23% from 2024’s lows to tap a 22-month high above 20.00 in early August.

USD/MXN daily chart

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- EUR/GBP fell to 0.8540, testing a key support level.

- The pair declined despite mixed UK GDP reported during the European sessions.

- The softish economic outlook favors additional cuts from the BoE.

Thursday saw the EUR/GBP pair fall to 0.8540, after mixed Gross Domestic Product (GDP) data from the UK. This comes after Wednesday's movements when the strength of the Pound was suppressed by disappointing UK inflation data.

The UK reported its Q2 Gross Domestic Product (GDP) data, showing a quarterly growth rate of 0.6%, down from 0.7% in Q1. The annual growth rate was 0.9%, an increase from 0.3% in Q1, as expected. Private consumption grew by a weaker-than-anticipated 0.2% quarter-on-quarter, but this was partially balanced by stronger government spending, which increased by 1.4% quarter-on-quarter.

Business investment and net exports negatively impacted growth. Monthly data for June, released simultaneously, indicated a slowdown as the quarter ended: GDP remained unchanged month-on-month, industrial production rose by 0.8%, services decreased by 0.1%, and construction increased by 0.5%. Overall, current data suggests the Bank of England will likely continue cutting rates to support the economy.

EUR/GBP technical analysis

The EUR/GBP shows a mixed trend in recent sessions, with the Relative Strength Index (RSI) moving from mid to high 50s. This suggests a generally bullish or neutral sentiment among traders but with the index now pointing down, it may hint that the sellers are coming. This is backed by the Moving Average Convergence Divergence (MACD) which is showing decreasing red bars, signaling a possible shift towards a bearish sentiment. The volume over the past week has been stable, pointing towards decent liquidity in the pair.

Traders should monitor the 0.8540-0.8590 range as a breakout might fuel sharp movements.

EUR/GBP daily chart

Markets expect CTAs to continue covering shorts in Platinum markets this session, but the balance of risks for CTA positioning has now notably shifted to the downside, TDS senior commodity strategist Daniel Ghali notes.

Balance of risks for CTA positioning turns to the downside

“Barring continued strength in prices, we expect CTAs to return to the offer with large-scale selling activity expected over the coming week, even in a flat tape. And, a big downtape could spark massive CTA selling activity totaling up to -50% of the algos' max size.”

“While there are still some scenarios for the coming week that could result in continued buying activity from algorithmic trend followers, the set-up for flows is already pointing to extreme downside asymmetry.”

We expect notable CTA buying activity in Copper markets this session to set the stage for subsequent buying exhaustion, TDS senior commodity strategist Daniel Ghali notes.

CTA buying activity in Copper to slow down

“CTA trend followers will now be tapped out without a substantial rally propelling Copper prices back towards the $9,800/t mark. The set-up for flows is already asymmetrically tilted to the downside, but we estimate that only a big downtape could spark large-scale selling activity over the coming week.”

“The set-up in Aluminium markets remains more favorable should the complex continue to rally, with continued CTA buying activity expected in an uptape. That being said, the set-up for algo flows in aluminium is now symmetric.”

The Turkish lira (TRY) was hardly changed yesterday despite headlines that the central bank (CBT) had added to its liquidity management toolset by buying up liras at one of the locally operated money markets. This was CBT’s first purchase at this specific money market. The effort to sterilise excess liquidity is consistent with MPC guidance that CBT would seek additional liquidity sterilisation steps when appropriate, with the presumed aim of supporting the currency and ensuring pass-through of monetary tightening to bank lending rates, Commerzbank’s FX strategist Tatha Ghose notes.

Policymakers may be forced into harder measures

“The non-response of the lira exchange rate to liquidity tightening measures in recent months must mean that: either such factors are secondary and ineffective because the exchange rate is currently stronger than its fundamental fair-value, and is gradually finding its way to such value; or that other currency-negative factors are popping up around the same time, which is neutralising the liquidity tightening.”

“If we exclude the abrupt weakening following last year’s election, and calculate only over the subsequent, relatively-stable period, the pace of depreciation still works out to an annualised 26%. If this pace were to continue, then in a year’s time, USD/TRY could trade at 45.30. We assume that policymakers would, by then, be forced into harder measures, paradigm shifts, reforms, or more monetary tightening.”

“The latest SONAR survey reportedly shows that an increasing fraction of the electorate wants early elections. And they want this because of dissatisfaction with the economy. While respondents cite a weak economy and high inflation as urgent problems, the reality is that the economy would have to get a lot worse if inflation were to be truly controlled. There has been some base-effect driven superficial disinflation so far, but not much more.”

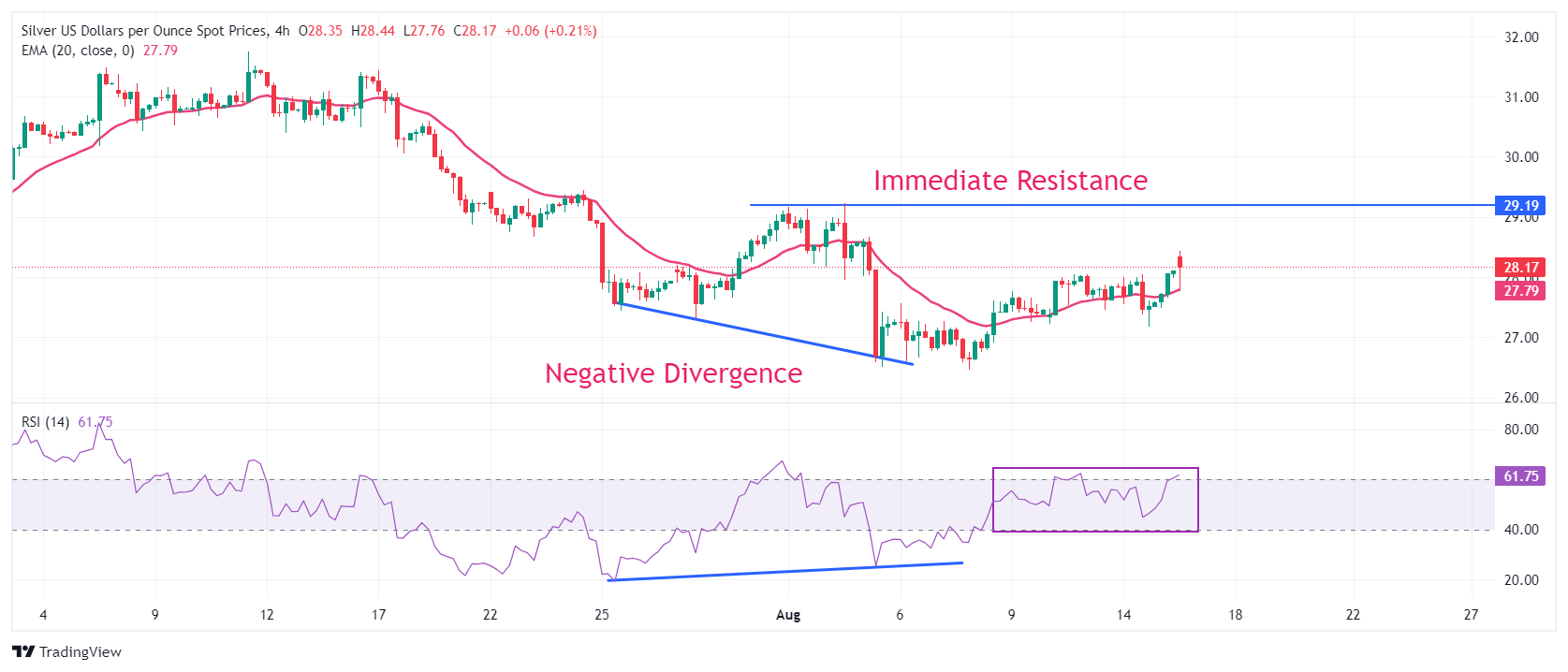

- Silver price drops from intraday high of $28.44 after resilient US Retail Sales data for July.

- Back-to-back decline in US jobless claims suggest that labor market conditions are not as worse as it was anticipated.

- Strong US Retail Sales have prompted a strong recovery in the US Dollar and bond yields.

Silver price (XAG/USD) gives up some of its intraday gains in Thursday’s New York session after the release of the resilient United States (US) Retail Sales data for July and lower-than-expected number of individuals claiming jobless benefits for the first time in the week ending August 9.

The white metal struggles to hold the crucial support of $28.00 as upbeat US data has boosted the US Dollar (USD) and bond yields. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, bounces back above 103.00. 10-year US Treasury yields soar to near 3.96%. Higher yields on interest-bearing assets weigh on non-yielding assets, such as Silver, by increasing the opportunity cost of holding investment in them.

The Retail Sales, a key measure of consumer spending, returned to expansion and rose at a robust pace of 1% from the estimates of 0.3%. Meanwhile, Initial Jobless Claims came in in lower at 227K than estimates of 235K and the prior release of 234K, upwardly revised from 233K. This is the second consecutive time when number of jobless claims have come in lower than expectations, suggesting that labor market conditions are not as bad as they were indicated by the Nonfarm Payrolls (NFP) data for July.

Meanwhile, the near-term outlook of the Silver price remains firm as investors remain confident that the Federal Reserve (Fed) will begin reducing interest rates from the September meeting. However, upbeat data have dashed hopes the Fed will adopt an aggressive policy-easing stance.

Silver technical analysis

Silver price bounced back after a negative divergence formation on a four-hour timeframe, which shapes when the momentum oscillator refuses to make lower lows, while the asset continues that formation. The 14-period Relative Strength Index (RSI) rebounded from 24.00 without hitting downside below previous low of 20.00.

However, the above-mentioned formation would trigger if the white metal breaks above the immediate swing high plotted from the August 2 high of $29.23.

The asset stays above the 20-period Exponential Moving Average (EMA) near $27.80, suggesting that the near-term trend has leaned on the upside.

The 14-period RSI has bounced back to near 60.00 and a decisive break above the same will trigger the upside momentum.

Silver four-hour chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

The Pound Sterling (GBP) is a marginally better performer among the core majors so far today, with gains supported by further signs of a growth renaissance in the economy.

GBP set to rise towards 1.2900/50

“June GDP was unchanged in the month, as expected, while UK Q2 GDP rose 0.6% q/q, also in line with expectations. June Industrial Production rose a stronger than forecast 0.8% m/m. Manufacturing jumped 1.1%, well ahead of calls for a 0.2% gain. Firm growth trends will not stop the BoE from easing rates again in the next few months but the data tilt risks a little further against a September move.”

“Sterling’s rebound from the upper 1.26s has paused over the past couple of sessions but price patterns are still leaning bullish for the pound as spot consolidates gains. A bullish flag/wedge pattern may be developing on the intraday chart. Gains through 1.2865/75 in the next day or so should be the cue for the GBP rise to resume towards 1.2900/50.”

- USD/CAD rises to near 1.3740 as the US Dollar bounces back after upbeat US data.

- US Retail Sales rose strongly by 1% and Initial Jobless Claims came in lower than expectations.

- A sharp recovery in the Oil price continues to boost the Canadian Dollar.

The USD/CAD pair delivers a vertical upside move to near 1.3740 in Thursday’s New York session as the US Dollar (USD) recovers strongly. The US Dollar bounces back after the release of the stronger-than-expected United States (US) Retail Sales data for July and lower Initial Jobless Claims for the week ending August 9.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, jumps above 103.00. The US Retail Sales report showed that sales at retail stores rose at a robust pace of 1% due to strong demand for automobiles from the estimates of 0.3%. In June, Retail Sales contracted by 0.2%, downwardly revised from a flat performance.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.44% | 0.03% | 1.21% | -0.01% | -0.20% | 0.28% | 0.80% | |

| EUR | -0.44% | -0.41% | 0.74% | -0.44% | -0.72% | -0.32% | 0.35% | |

| GBP | -0.03% | 0.41% | 1.17% | -0.03% | -0.31% | 0.10% | 0.85% | |

| JPY | -1.21% | -0.74% | -1.17% | -1.21% | -1.41% | -1.05% | -0.32% | |

| CAD | 0.00% | 0.44% | 0.03% | 1.21% | -0.20% | 0.13% | 0.88% | |

| AUD | 0.20% | 0.72% | 0.31% | 1.41% | 0.20% | 0.39% | 1.15% | |

| NZD | -0.28% | 0.32% | -0.10% | 1.05% | -0.13% | -0.39% | 0.75% | |

| CHF | -0.80% | -0.35% | -0.85% | 0.32% | -0.88% | -1.15% | -0.75% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Retail Sales are a key measure of households’ spending that eventually propels consumer inflation. Higher value and volume of sales receipts at retail stores exhibits robust spending by individuals. Upbeat Retail Sales have dampened market speculation for the Federal Reserve (Fed) to deliver a 50-basis point (bps) interest-rate reduction in the September. However, firm market expectations for the Fed pivoting to policy-normalization in September remain intact.

Meanwhile, Individuals claiming jobless benefits for the first time came in lower at 227K than estimates of 235K and the prior release of 234K, upwardly revised from 233K.

On the Canadian Dollar (CAD) front, upbeat Oil prices continue to act as major cushion for the Lonnie. The Oil prices have recovered strongly after a two-day correction on expectations that rate cuts from the Fed will boost fuel consumption. It is worth noting that Canada is the leading exporter of Oil to the United States and higher Oil prices result in significant foreign inflows to the former.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Gold (XAU/USD) prices remain near all-time highs, but the associated narratives are stale, TDS senior commodity strategist Daniel Ghali notes.

Risk of a positioning washout is the highest of the year

“Macro fund positioning is statistically consistent with the aggressive 200bps of Fed cuts priced into rates markets over the coming twelve months. CTAs are sitting on their 'max long' position size, whereas the threshold for a deterioration in uptrend signals inches closer by the day.”

“Asian flows have notably deteriorated, following a short pause to the buyer's strike tied to a brief wave of buying activity associated with the change in Indian duties. Shanghai trader positioning remains near record levels, but is increasingly under pressure.”

“Several of the major cohorts in Gold markets are now facing buying exhaustion, whereas the narrative that propelled prices to these all-time highs now appears stale. The risk of a positioning washout is at its highest levels of the year.”

"It now appears the balance of risks on inflation and unemployment have shifted," St. Louis Federal Reserve President Alberto Musalem said on Thursday and added: "The time may be nearing when an adjustment to moderately restrictive policy may be appropriate."

Key takeaways

"Monetary policy is moderately restrictive."

"Absent further shocks, inflation seems to have returned back to path consistent with 2% over time."

"Services and shelter inflation remain a little sticky."

"More disinflation work to do."

"Labor market is no longer overheated."

"Signs of labor market cooling, but layoffs remain low."

"Recent data have bolstered my confidence on inflation."

"Risks to both sides seem more balanced."

Market reaction

The US Dollar preserves its strength following these comments. At the time of press, the USD Index was up 0.5% on the day at 103.06.

This morning, China's National Bureau of Statistics released its monthly data report, which was generally uninspiring, Commerzbank’s FX Analyst Volkmar Baur notes.

China's weak economy argues for lower interest rates

“Although retail sales were slightly positive, the other data points remained weak. Investment in particular was much lower than most analysts had expected according to Bloomberg. In addition to the housing market, infrastructure investment seems to increasingly weigh on growth.”

“So, all in all it was not a good start for the Chinese economy in the third quarter. We expect an improvement in the interest rate differential between China and the US as a result of the interest rate cut cycle in the US to boost the CNY in the coming months.”

“However, the potential remains limited as China's weak economy also argues for lower interest rates.”

- AUD/USD lost its traction and declined toward 0.6600 on Thursday.

- Earlier in the day, the pair gathered bullish momentum on upbeat jobs data from Australia.

- Renewed US Dollar strength doesn't allow the pair to push higher.

After rising to a daily high above 0.6630 during the European trading hours on Thursday, AUD/USD reversed its direction and declined toward 0.6600, erasing its daily gains in the process.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.48% | 0.08% | 1.15% | 0.09% | -0.09% | 0.40% | 0.82% | |

| EUR | -0.48% | -0.42% | 0.64% | -0.39% | -0.66% | -0.25% | 0.33% | |

| GBP | -0.08% | 0.42% | 1.07% | 0.02% | -0.23% | 0.18% | 0.84% | |

| JPY | -1.15% | -0.64% | -1.07% | -1.07% | -1.25% | -0.88% | -0.24% | |

| CAD | -0.09% | 0.39% | -0.02% | 1.07% | -0.18% | 0.15% | 0.82% | |

| AUD | 0.09% | 0.66% | 0.23% | 1.25% | 0.18% | 0.40% | 1.07% | |

| NZD | -0.40% | 0.25% | -0.18% | 0.88% | -0.15% | -0.40% | 0.67% | |

| CHF | -0.82% | -0.33% | -0.84% | 0.24% | -0.82% | -1.07% | -0.67% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

During the Asian trading hours, the data from Australia showed that the Unemployment Rate ticked up to 4.2% in July from 4.1% in June. On a positive note, Employment Change in the same period came in at +58.2K, surpassing the market expectation of 20K by a wide margin. Additionally, the National Bureau of Statistics of China reported that Retail Sales grew by 2.7% on a yearly basis in July, up from the 2% increase recorded in June.

AUD/USD gathered bullish momentum following these data releases and continued to stretch higher in the first half of the day.

In the American session, upbeat macroeconomic data releases from the US provided a boost to the USD and forced AUD/USD to turn south.

The weekly Initial Jobless Claims in the US declined by 7,000 to 227,000 in the week ending August 10. Furthermore, Retail Sales rose by 1% to $709.7 billion in July. Both of those prints came in better than analysts' estimates.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- EUR/USD turned south and broke below 1.1000 in the American session.

- The US Dollar outperforms its rivals on easing concerns over an economic slowdown.

- Investors see a diminishing probability of a large Fed rate cut in September.

After touching its highest level in 2024 near 1.1050 on Wednesday, EUR/USD went into a consolidation phase during the European trading hours on Thursday. With the latest macroeconomic data releases from the US providing a boost to the USD, however, the pair lost its footing and slumped below 1.1000. At the time of press, the pair was down 0.55% on the day at 1.0955.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.54% | 0.19% | 1.22% | 0.12% | -0.01% | 0.46% | 0.98% | |

| EUR | -0.54% | -0.36% | 0.67% | -0.41% | -0.64% | -0.25% | 0.44% | |

| GBP | -0.19% | 0.36% | 1.05% | -0.05% | -0.27% | 0.12% | 0.90% | |

| JPY | -1.22% | -0.67% | -1.05% | -1.10% | -1.25% | -0.91% | -0.14% | |

| CAD | -0.12% | 0.41% | 0.05% | 1.10% | -0.14% | 0.17% | 0.96% | |

| AUD | 0.00% | 0.64% | 0.27% | 1.25% | 0.14% | 0.37% | 1.16% | |

| NZD | -0.46% | 0.25% | -0.12% | 0.91% | -0.17% | -0.37% | 0.78% | |

| CHF | -0.98% | -0.44% | -0.90% | 0.14% | -0.96% | -1.16% | -0.78% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The US Census Bureau reported on Thursday that Retail Sales rose by 1% to $709.7 billion in July. This print came in better than the market expectation for an increase of 0.3%.

Additionally, the number of first-time applications for unemployment benefits in the US declined by 7,000 to 227,000 in the week ending August 10, the US Department of Labor announced.

With the immediate market reaction, investors started to lean toward a 25 basis points Federal Rate (Fed) cut in September and US Treasury bond yields surged higher. As of writing, the benchmark 10-year US T-bond yield was up nearly 3% on the day at 3.95%. According to the CME FedWatch Tool, the probability of the Fed opting for a 50 bps rate reduction at the next meeting now sits around 20%, down from about 50% seen earlier in the week.

The US economic calendar will not feature any other high-impact data releases on Thursday. Nevertheless, investors will pay close attention to comments from Fed policymakers later in the American session.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.