- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 15-07-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | RBA Meeting's Minutes | |||

| 08:30 | United Kingdom | Average earnings ex bonuses, 3 m/y | May | 3.4% | 3.5% |

| 08:30 | United Kingdom | Average Earnings, 3m/y | May | 3.1% | 3.1% |

| 08:30 | United Kingdom | ILO Unemployment Rate | May | 3.8% | 3.8% |

| 08:30 | United Kingdom | Claimant count | June | 23.2 | 18.9 |

| 09:00 | Eurozone | ZEW Economic Sentiment | July | -20.2 | -20.9 |

| 09:00 | Germany | ZEW Survey - Economic Sentiment | July | -21.1 | -20.0 |

| 09:00 | Eurozone | Trade balance unadjusted | May | 15.7 | |

| 12:00 | United Kingdom | BOE Gov Mark Carney Speaks | |||

| 12:15 | U.S. | FOMC Member Bostic Speaks | |||

| 12:15 | U.S. | FOMC Member Bowman Speaks | |||

| 12:30 | Canada | Foreign Securities Purchases | May | -12.8 | |

| 12:30 | U.S. | Import Price Index | June | -0.3% | -0.5% |

| 12:30 | U.S. | Retail Sales YoY | June | 2.9% | |

| 12:30 | U.S. | Retail sales excluding auto | June | 0.5% | 0.3% |

| 12:30 | U.S. | Retail sales | June | 0.5% | 0.3% |

| 13:15 | U.S. | Capacity Utilization | June | 78.1% | 78.2% |

| 13:15 | U.S. | Industrial Production (MoM) | June | 0.4% | 0.2% |

| 13:15 | U.S. | Industrial Production YoY | June | 2% | |

| 14:00 | U.S. | Business inventories | May | 0.5% | 0.3% |

| 14:00 | U.S. | NAHB Housing Market Index | July | 64 | 64 |

| 14:05 | U.S. | FOMC Member Bostic Speaks | |||

| 16:20 | U.S. | FOMC Member Kaplan Speak | |||

| 17:00 | U.S. | Fed Chair Powell Speaks | |||

| 19:30 | U.S. | FOMC Member Charles Evans Speaks | |||

| 20:00 | U.S. | Total Net TIC Flows | May | -7.8 | |

| 20:00 | U.S. | Net Long-term TIC Flows | May | 46.9 | 32.3 |

Major US stock indices rose, but only slightly, as investors were cautious at the beginning of the corporate reporting season.

Citigroup Inc. (C) published quarterly results that exceeded expectations today before the market opened, giving an unofficial start to the corporate reporting season for the second quarter. The company reported quarterly earnings of $ 1.95 per share, which was above the average forecast ($ 1.80). The bank’s revenue also exceeded expectations. However, analysts say, the main reason for the strong reporting is the income received from the initial public offering (IPO) of the Tradeweb bond trading platform.

Other major US financial institutions will report later this week: JPMorgan Chase & Co. (JPM), Goldman Sachs Group Inc. (GS) and Wells Fargo & Co. (WFC) will report tomorrow, Bank of America Corp. (BAC) - on Wednesday, Morgan Stanley (MS) - on Thursday.

In addition to banks, this week their quarterly results will also be announced by such companies as Johnson & Johnson (JNJ), IBM (IBM), Netflix (NFLX), UnitedHealth (UNH), Microsoft (MSFT), American Express (AXP) and others.

Market participants expect reports and forecasts of companies to assess how deeply the impact of the protracted trade dispute between the United States and China on corporate profits. According to Refinitiv IBES, analysts predict that the profits of the S & P 500 companies will show a 0.4% decline in y / y in the second quarter, which will be the first quarterly decline in three years.

Most of the components of DOW recorded an increase (19 of 30). The growth leader was Dow Inc. (DOW; + 2.21%). JPMorgan Chase & Co. shares turned out to be an outsider. (JPM; -1.44%).

Most sectors of the S & P finished trading in positive territory. The sector of conglomerates grew the most (+ 0.5%). The largest decline was shown by the base materials sector (-0.5%).

At the time of closing:

Dow 27,358.82 +26.79 +0.10%

S & P 500 3,014.28 +0.51 +0.02%

Nasdaq 100 8,258.18 +14.04 +0.17%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | RBA Meeting's Minutes | |||

| 08:30 | United Kingdom | Average earnings ex bonuses, 3 m/y | May | 3.4% | 3.5% |

| 08:30 | United Kingdom | Average Earnings, 3m/y | May | 3.1% | 3.1% |

| 08:30 | United Kingdom | ILO Unemployment Rate | May | 3.8% | 3.8% |

| 08:30 | United Kingdom | Claimant count | June | 23.2 | 18.9 |

| 09:00 | Eurozone | ZEW Economic Sentiment | July | -20.2 | -20.9 |

| 09:00 | Germany | ZEW Survey - Economic Sentiment | July | -21.1 | -20.0 |

| 09:00 | Eurozone | Trade balance unadjusted | May | 15.7 | |

| 12:00 | United Kingdom | BOE Gov Mark Carney Speaks | |||

| 12:15 | U.S. | FOMC Member Bostic Speaks | |||

| 12:15 | U.S. | FOMC Member Bowman Speaks | |||

| 12:30 | Canada | Foreign Securities Purchases | May | -12.8 | |

| 12:30 | U.S. | Import Price Index | June | -0.3% | -0.5% |

| 12:30 | U.S. | Retail Sales YoY | June | 2.9% | |

| 12:30 | U.S. | Retail sales excluding auto | June | 0.5% | 0.3% |

| 12:30 | U.S. | Retail sales | June | 0.5% | 0.3% |

| 13:15 | U.S. | Capacity Utilization | June | 78.1% | 78.2% |

| 13:15 | U.S. | Industrial Production (MoM) | June | 0.4% | 0.2% |

| 13:15 | U.S. | Industrial Production YoY | June | 2% | |

| 14:00 | U.S. | Business inventories | May | 0.5% | 0.3% |

| 14:00 | U.S. | NAHB Housing Market Index | July | 64 | 64 |

| 14:05 | U.S. | FOMC Member Bostic Speaks | |||

| 16:20 | U.S. | FOMC Member Kaplan Speak | |||

| 17:00 | U.S. | Fed Chair Powell Speaks | |||

| 19:30 | U.S. | FOMC Member Charles Evans Speaks | |||

| 20:00 | U.S. | Total Net TIC Flows | May | -7.8 | |

| 20:00 | U.S. | Net Long-term TIC Flows | May | 46.9 | 32.3 |

Iris Pang, the economist for Greater China at ING, notes that China's retail sales boomed by 9.8% YoY in June from 8.6% YoY. However, the details tell a different story, she added.

- "There are signs that Chinese consumers have become more cautious about spending on leisure trips, signaling that consumers are potentially concerned about their job security and wage growth. Consumer items typically bought on overseas' leisure trips have been bought domestically. For example, cosmetics, usually bought in duty-free shop in airports, grew 22.5% YoY in China compared to 13.2% YoY YTD. The current account shows that outbound tourism spending fell 8.7% year-on-year in 1Q19. Another example is that in Hong Kong, retail sales fell 1.3% YoY in May and have shrunk for four months in a row. We expect retail sales in China will continue to grow at a good rate even that growth is coming for all the wrong reasons.

- Another reason for the jump in retail sales in June was that China's car dealers cut prices, which boosted car sales 17.2% YoY after sales growth of just 1.2% YoY YTD. But the price cutting promotion can't last for more than a quarter. And together with shrinking production (by 16.8%YoY in June), corporate earnings of car dealers and car producers will suffer."

Analysts at TD Securities are expecting China’s headline inflation to decelerate to 2.1% y/y in June, with prices down 0.2% from May.

- “Lower gasoline prices will provide the main driver for the monthly print; gasoline prices fell by 8% for the month as a whole, which should shave 0.3pp off the headline print in June. Elsewhere, food prices should see modest gains following the recent strength in producer prices, however, 3.5% is likely to mark the peak for food price inflation since FX passthrough from a stronger Canadian dollar should start to provide some relief in the coming months.

- We also see scope for a pullback in telecom prices after new "unlimited" data plans were introduced by major service providers in early June. Looking past the headline, exclusion based core measures (ie. ex-food and energy) should hold stable given the large drag from energy prices while the Bank of Canada's preferred core measures are likely to edge lower to 2.0% y/y on average.”

- Says he doesn't always sense urgency from market participants to shift language in contracts away from USD Libor

- Industry can't wait on Libor shift

- Libor is a leading risk to financial stability

- We are now at a critical polit in the timeline

- Consumer products are a critical area where industry needs to focus because it's going to be challenging

U.S. stock-index futures rose on Monday, as better-than-expected quarterly results of Citigroup (C) provided an upbeat start to the U.S. corporate earnings season.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | - | - | - |

Hang Seng | 28,554.88 | +83.26 | +0.29% |

Shanghai | 2,942.19 | +11.64 | +0.40% |

S&P/ASX | 6,653.00 | -43.50 | -0.65% |

FTSE | 7,538.22 | +32.25 | +0.43% |

CAC | 5,583.83 | +10.97 | +0.20% |

DAX | 12,384.77 | +61.45 | +0.50% |

Crude oil | $60.46 | +0.42% | |

Gold | $1,413.40 | +0.08% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 173.75 | 0.41(0.24%) | 2029 |

ALTRIA GROUP INC. | MO | 49.62 | 0.12(0.24%) | 6254 |

Amazon.com Inc., NASDAQ | AMZN | 2,022.00 | 11.00(0.55%) | 32344 |

American Express Co | AXP | 128 | 0.04(0.03%) | 1522 |

AMERICAN INTERNATIONAL GROUP | AIG | 56.2 | -0.07(-0.12%) | 2431 |

Apple Inc. | AAPL | 204 | 0.70(0.34%) | 44738 |

AT&T Inc | T | 33.74 | 0.09(0.27%) | 12344 |

Boeing Co | BA | 360.3 | -5.03(-1.38%) | 63711 |

Caterpillar Inc | CAT | 138.89 | 0.53(0.38%) | 3013 |

Cisco Systems Inc | CSCO | 58.06 | 0.11(0.19%) | 9150 |

Citigroup Inc., NYSE | C | 72.53 | 0.76(1.06%) | 645797 |

Deere & Company, NYSE | DE | 167.18 | 1.81(1.09%) | 6507 |

Exxon Mobil Corp | XOM | 77.72 | 0.09(0.12%) | 1727 |

Facebook, Inc. | FB | 204.4 | -0.47(-0.23%) | 110453 |

FedEx Corporation, NYSE | FDX | 167.48 | 0.01(0.01%) | 4148 |

Ford Motor Co. | F | 10.45 | -0.04(-0.38%) | 65923 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.13 | 0.11(1.00%) | 15935 |

General Electric Co | GE | 10.26 | -0.11(-1.06%) | 277017 |

General Motors Company, NYSE | GM | 39.28 | 0.07(0.18%) | 2587 |

Goldman Sachs | GS | 215.43 | 1.49(0.70%) | 24754 |

Google Inc. | GOOG | 1,146.00 | 1.10(0.10%) | 3255 |

Home Depot Inc | HD | 219 | 0.77(0.35%) | 6119 |

Intel Corp | INTC | 50.09 | 0.17(0.34%) | 26616 |

International Business Machines Co... | IBM | 143.14 | 0.40(0.28%) | 1793 |

International Paper Company | IP | 41.6 | -1.17(-2.74%) | 7381 |

Johnson & Johnson | JNJ | 134.62 | 0.32(0.24%) | 40642 |

JPMorgan Chase and Co | JPM | 116.16 | 0.86(0.75%) | 80199 |

Merck & Co Inc | MRK | 80 | 0.27(0.34%) | 3518 |

Microsoft Corp | MSFT | 139.47 | 0.57(0.41%) | 302764 |

Nike | NKE | 89.22 | 0.10(0.11%) | 248 |

Pfizer Inc | PFE | 42.42 | 0.02(0.05%) | 3819 |

Procter & Gamble Co | PG | 114.81 | -0.18(-0.16%) | 1713 |

Starbucks Corporation, NASDAQ | SBUX | 89.85 | 0.08(0.09%) | 946 |

Tesla Motors, Inc., NASDAQ | TSLA | 248.62 | 3.54(1.44%) | 119744 |

The Coca-Cola Co | KO | 52.28 | 0.16(0.31%) | 644 |

Travelers Companies Inc | TRV | 153.37 | -0.02(-0.01%) | 251 |

Twitter, Inc., NYSE | TWTR | 37.91 | 0.07(0.19%) | 40480 |

United Technologies Corp | UTX | 134 | 0.28(0.21%) | 978 |

UnitedHealth Group Inc | UNH | 266.2 | 0.30(0.11%) | 1992 |

Verizon Communications Inc | VZ | 57.3 | 0.11(0.19%) | 5270 |

Visa | V | 181 | 0.67(0.37%) | 9971 |

Wal-Mart Stores Inc | WMT | 114.82 | 0.22(0.19%) | 2853 |

Walt Disney Co | DIS | 145.3 | 0.42(0.29%) | 10063 |

Yandex N.V., NASDAQ | YNDX | 40.88 | 0.55(1.36%) | 7127 |

The report from

the New York Federal Reserve showed on Monday that manufacturing activity in

the New York region rebounded modestly in July.

According to

the survey, NY Fed Empire State manufacturing index came in at 4.30 this month

compared to an unrevised -8.60 in June. That marked the headline indicator climbed

out of the negative territory.

Economists had

expected the index to come in at 2.0.

Anything below

zero signals contraction.

According to

the report, the new orders index rose, but remained negative at -1.5., indicating

a decline in orders, and the shipments index moved slightly lower to 7.2,

pointing to a small advance in shipments. Meanwhile, unfilled orders dropped for

a second consecutive month, delivery times were somewhat shorter, and

inventories reduced. The index for a number of employees slid further, dropping

six points to -9.6 (its lowest level in nearly three years), pointing to a

decline in employment levels. On the price front, input price increases

continued to moderate somewhat, while the pace of selling price gains remained

modest.

McDonald's (MCD) target raised to $230 at Telsey Advisory Group

General Electric (GE) downgraded to Neutral from Buy at UBS; target lowered to $11.50

Int'l Paper (IP) downgraded to Underweight from Sector Weight at KeyBanc Capital Markets; target $38

July 15

Before the Open:

Citigroup (C). Consensus EPS $1.80, Consensus Revenues $18486.01 mln

July 16

Before the Open:

Goldman Sachs (GS). Consensus EPS $5.03, Consensus Revenues $8879.07 mln

Johnson & Johnson (JNJ). Consensus EPS $2.43, Consensus Revenues $20388.34 mln

JPMorgan Chase (JPM). Consensus EPS $2.49, Consensus Revenues $28524.81 mln

Wells Fargo (WFC). Consensus EPS $1.16, Consensus Revenues $20948.94 mln

July 17

Before the Open:

Bank of America (BAC). Consensus EPS $0.71, Consensus Revenues $23129.97 mln

After the Close:

Alcoa (AA). Consensus EPS $0.01, Consensus Revenues $2768.66 mln

eBay (EBAY). Consensus EPS $0.62, Consensus Revenues $2673.71 mln

IBM (IBM). Consensus EPS $3.09, Consensus Revenues $19177.19 mln

Netflix (NFLX). Consensus EPS $0.55, Consensus Revenues $4934.49 mln

July 18

Before the Open:

Honeywell (HON). Consensus EPS $2.08, Consensus Revenues $9375.75 mln

Morgan Stanley (MS). Consensus EPS $1.16, Consensus Revenues $10021.29 mln

UnitedHealth (UNH). Consensus EPS $3.46, Consensus Revenues $60602.21 mln

After the Close:

Microsoft (MSFT). Consensus EPS $1.21, Consensus Revenues $32775.09 mln

July 19

Before the Open:

American Express (AXP). Consensus EPS $2.02, Consensus Revenues $10826.68 mln

- Central banks must be kept independence

- Central bank independence has improved stability

- Facebook's Libra currency could become channel for laundering

- Trade deal can be done with U.S., but it won't be rapid

- Banks in UK have prepared for Brexit

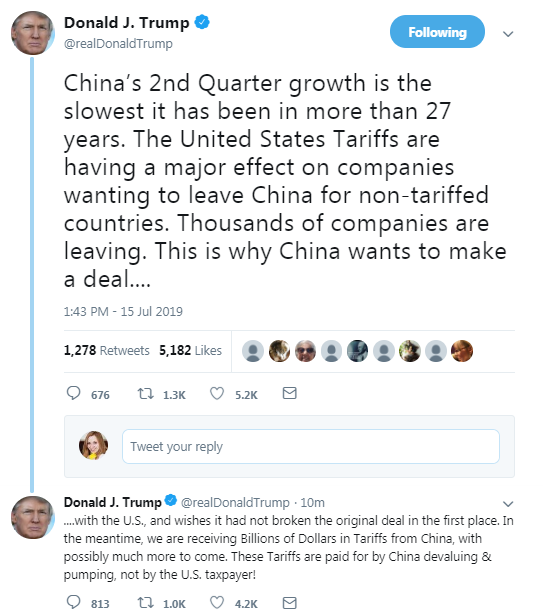

Nordea Markets' analysts note that China's GDP growth slowed to 6.2% in Q2 2019 amongst high uncertainty around the trade war.

- “The uncertainty around the trade war and thus also regarding Chinese domestic economic development remains high. Although presidents Trump and Xi agreed to restart the trade negotiations at their bilateral meeting at the end of June, it seems that all key questions are still without a solution. Thus, we do not expect a deal to materialize any time soon and believe the uncertainty surrounding the trade war will persist into the second half of 2019. Regarding the domestic economy, official numbers continue to show robust growth. While growth is supported by domestic consumption, negative impacts of the trade war will weigh on the growth outlook going forward.”

- China’s GDP growth slowed to 6.2% in Q2 2019. In quarterly terms, GDP increased by 1.6%, which was in line with our forecast. The monthly indicators show that consumption-driven growth has remained robust, but outlook uncertainty persists.

- The main risk factor for the outlook is still the trade war between China and the US.

- USD/CNY is receiving some support from the dovish Fed, but lingering trade worries and limited impact from stimulus measures keep strengthening in check.”

Francesco Pesole, the FX Strategist at ING, believes that the release of the 2Q inflation at 23:45 GMT will be pivotal in directing the market uncertainty when it comes to the monetary policy outlook.

- "The Reserve Bank of New Zealand cut rates in May and is broadly expected to cut again by the end of the year (22 basis points is currently in the price). Market expectations for today’s release are for an advance in the year-on-year headline CPI from 1.5% to 1.7%. Unless the print shows a more marked increase towards the 2.0% inflation target mid-point, we suspect that New Zealand rates may remain depressed. This should assist a gradual decline in NZD/USD, which may revert to the below-0.670 area today."

Analysts at TD Securities are expecting that the NY Empire manufacturing index is to bounce back into positive territory in July, following the massive decline in June to -8.6 from 17.8 before.

- “The improvement would likely reflect some easing on trade worries that affected manufacturing sentiment in June (US-Mexico standoff and fallout in US-China talks pre-G20).”

TD Securities' analysts note that China’s Q2 GDP came in at 6.2% y/y, following a 6.4% increase in the previous quarter, matching TD’s and market expectations.

- “Accompanying comments by NBS sounded downbeat, noting external uncertainties and downward pressures. However, higher frequency data for June released at the same time looked far better, with industrial production up 6.3% y/y (market 5.2% y/y), retail sales up 9.8% y/y (market 8.5%) and fixed assets investment up 5.8% YTD y/y (market 5.5%).

- Although growth has slowed to its weakest in many years, this was well flagged in advance and the data is backward looking in any case. The other data released today, as well as new loans and aggregate financing released last week, suggest less urgency for fresh stimulus though we still expect more targeted easing.”

Francesco Pesole, the FX strategist at ING, sggests that EUR investors may take a wait-and-see attitude today ahead of the ZEW survey tomorrow and, most importantly, the inflation report on Wednesday.

- "Implied volatility on EUR/USD remains quite sluggish (1M vols below 5%) ahead of the European Central Bank meeting, signaling some reluctance in the market to see a major shift in policy stance just yet. EUR/USD may be trapped in a narrow range today, with the 1.1255 100-day moving average likely to be a solid support. As highlighted in the latest FX Talking, a dovish ECB may continue to keep EUR gains broadly capped ahead."

The world has become more economically exposed to China at a time when the Asian giant is increasingly relying on its own consumers to boost growth, according to a July report by consultancy McKinsey and Company.

The findings by McKinsey come as China is locked in a year-long tariff fight with the U.S. that has spilled into areas such as technology and security. Economists generally predicted that the Chinese economy — instead of the U.S. — will experience a larger hit from elevated tariffs partly due to the Asian country’s relatively heavier reliance on exports.

But the report by McKinsey found that consumption contributed to more than 60% of China’s growth during 11 out of 16 quarters — from January 2015 to December 2018. That means China’s economy has been reducing its reliance on trade as a source of growth. In fact, the study found that China’s net trade - the value of total exports minus that of imports - “actually made a negative contribution” to growth last year.

According to the analysts at TD Securities (TDS), New Zealand’s second quarter Consumer Price Index (CPI), due out on Tuesday at 2245 GMT, is seen rising across the time horizons.

“NZD TD forecasts Q2 inflation to rise by 0.5% in the June qtr lifting annual inflation to 1.6%. This is a touch below the RBNZ's 0.6%/q forecast. While higher oil prices in the qtr account for more than 60% of the increase in CPI in the qtr, food at 20% of the basket, imparts a mild downside bias. A print in line with RBNZ forecasts keeps an Aug rate cut in play.”

"We now expect the ECB to change its forward guidance on 25 July and follow up with two rate cuts of 10 bps each in September and December, and to introduce tiering...The hurdle facing a new QE program now seems much lower than just fours weeks ago, but we still do not consider QE a done deal just yet. We think QE will come if the Eurozone's growth and inflation outlook worsen, if downside risks related to trade policy and (geo-)political uncertainty materialise, or if the Fed eases policy by more than we currently anticipate." - UBS economists wrote in a note to their clients.

German industrial activity is sluggish and recent data point to slower growth in the service sector, the German Economy Ministry said, adding this suggested Europe's largest economy would experience a weak general economic trend in the second quarter.

"After what is shaping up to be a subdued development in the second quarter, the forces of economic upswing could become more prominent again if the external environment settles," the ministry said in its monthly report.

But it added that there were significant downside risks such as trade conflicts, Britain's expected departure from the European Union and geopolitical tensions.

According to Francesco Pesole, FX Strategist at ING, US banks and tech companies are scheduled to report earnings this week, which could inevitably test the prevailing risk-on mood and have an impact on the FX markets.

“Mixed Chinese data failed to set a clear tone for global market sentiment overnight. While GDP growth decelerated to multi-decade lows, retail sales, industrial production and fixed asset investment managed to beat estimates in June. Overall, it seems that more time is needed to fully assess the impact of trade wars on the Chinese economy and for now, markets can preserve the risk-on mood. This mood will inevitably be tested this week as the US corporate earnings season kicks in. Particular attention will be on major US banks today and tomorrow - along with some tech giants - with any surprise likely to reverberate in the FX market as well. Today’s calendar in the US includes the New York manufacturing survey, which should recover from the sharp drop in June. Some focus will also be on a speech by NY Fed President John Williams. We see limited market-moving potential from his comments and expect the dollar to stay broadly range-bound today.”

According to Michael Schumacher, global head of rate strategy and managing director at Wells Fargo Securities, investors may find themselves disappointed by the Fed’s next move.

Many expect the U.S. central bank to slash its benchmark interest rate at the next meeting in late July in response to weakening economic data domestically and around the globe. The CME’s FedWatch tool currently shows traders pricing in a 100% chance of a July cut.

But what the stock market is pricing in with regards to Fed policy might be too aggressive, Schumacher told. “We think they’ll come in and do two moves, so 50 basis points total [worth of cuts]. The market’s priced for something like 65 or 70 basis points,” Schumacher said. “So, in our view, at least at Wells Fargo, we think the Fed is, in some strange way, going to disappoint the market by not [cutting] as much as it already anticipates.”

“Fed Chair Powell wants to cut,” Schumacher said, adding that the constructive U.S. consumer price data didn’t change the view of the chairman.

And, if the Fed decides to go through with a cut, U.S. 10-year Treasury yields could also see some counterintuitive moves, said the strategist, whose year-end target for the 10-year yield is 2.30%.

Justin Smirk, Senior Economist at Westpac Westpac forecast a 0.5% rise in the June quarter CPI lifting the annual pace to 1.5%yr from 1.3%yr.

“The June quarter tends to be a seasonally soft quarter with the ABS projecting a seasonal factor of +0.2ppt. The seasonally adjusted CPI is forecast to rise 0.7%. The trimmed mean is forecast to rise 0.33%qtr/1.5%yr and the weighted median is forecast to rise 0.30%qtr/1.1%yr. The average of the core inflation measures is forecast to print 0.31%qtr with the annual pace easing back to 1.3%yr from 1.4%yr. In June, we forecast that fresh fruit & vegetable prices drag food prices down 0.4%qtr. Housing costs are down slightly due to falling utilities and there is the usual seasonal fall in pharmaceuticals while car prices fall again. Auto fuel is forecast to make the single largest contribution rising 11%. Alcohol & tobacco rose modestly while clothing & footwear had a positive quarter. Health costs continue to rise solidly (as rising medical & hospital services more than offset falling pharmaceuticals) and there was an unseasonal gain in domestic holiday travel.

Spot remains on track to visit the 1.1323/48 band while underpinned by the 1.1181/76 band, suggested Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank.

“Last week EUR/USD reversed ahead of the March and mid-June lows at 1.1181/76 as expected. While this area underpins on a daily chart closing basis, the 200 day moving average and early June high at 1.1323/48 will remain in sight. This guards the more important 1.1394/1.1412 55 week ma and recent high. Above the 1.1412 June high we look for a test of the 1.1570 2019 high. Slightly longer term we target 1.1815/54, the highs from June and September 2018”.

Asking prices for British homes fell this month for the first time this year as buyers' confidence took a hit from the escalating uncertainty around Brexit, property website Rightmove said.

The average asking price for residential property advertised on Rightmove fell by 0.2% in July after a 0.3% rise in June. Compared with a year ago, prices were down 0.2%, Rightmove said.

"The housing market fundamentals remain largely sound in many parts of the country, but the current political climate means that the crucial ingredient of confidence has been impaired, and that is causing some potential buyers and sellers to hesitate," Rightmove director Miles Shipside said.

Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, sees the cross heading towards the 119.90 area in the near term.

“EUR/JPY is side lined just above the 2019 uptrend line at 121.37 and the 120.79 June low, near term rebounds remain tepid at best. It should eventually fail here and then head to the 119.91 78.6% Fibonacci retracement. This is the last defence for the 117.85 January spike low. Resistance is offered by the 123.34/75 May 21, June and current July highs. This resistance area maintains an overall negative bias and protects 125.52, the 78.6% retracement and the 200 day ma at 125.41”.

According to the report from the Federal Statistical Office (FSO), the Producer and Import Price Index fell in June 2019 by 0.5% compared with the previous month, reaching 101.7 points (December 2015 = 100). Economists had expected a 0.1% increase. The decline is due in particular to lower prices for petroleum products, petroleum and natural gas as well as basic metals and semi-finished metal products. Compared with June 2018, the price level of the whole range of domestic and imported products fell by 1.4%. Economists had expected a 0.9% decrease.

The decline in the producer price index compared with the previous month was mainly due to lower prices for petroleum products. Metals, metal semifinished products and scrap also became cheaper. On the other hand, rising prices were observed for wood products.

Lower prices compared with May 2019, the import price index recorded lower prices, especially for petroleum products, oil and natural gas, as well as metals and metal semifinished products. Price declines were also reflected in core and stone fruit, as well as products from the building carpentry and interior finishing works. However, cars became more expensive.

China's new home prices grew 0.6% month-on-month in June, slowing from a 0.7% uptick in May, official National Bureau of Statistics (NBS) data showed on Monday.

On a yearly basis, average new home prices in China's 70 major cities rose 10.3% in June, compared with a 10.7% gain in May.

A slew of government curbs and a slowing economy have weighed on the property market, but renewed fears that prices may heat up due to looser credit conditions have prompted policymakers to recently clamp down on speculative buying. Beijing has tightened the screws over property developers' financing channels while some local governments have also raised the bar for purchases to prevent speculation.

China released second-quarter figures on Monday showing that its economy slowed to 6.2% - the weakest rate in at least 27 years, as the country’s trade war with the U.S. took its toll.

From April to June, China’s economy grew 6.2% from a year ago, the country’s statistics bureau said. That was in line with the expectations and lower than the 6.4% y/y growth in the first quarter of 2019.

China’s statistics bureau said the economy faces a complex situation with increasing external uncertainties. The world’s second largest economy also faces new downward pressures and will try to ensure steady economic growth, the statistics bureau added.

For the first half of the year, China’s GDP grew 6.3% on-year, data from the statistics bureau showed.

“With the first half of the year registering a headline growth rate of 6.3% year-on-year, only a fall below 5.8% in the second half would prevent China attaining the official target of (at least) 6.0%. In our view, the Chinese government will not allow the quarterly growth to fall below 6.0%,” said ANZ economists.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1376 (1343)

$1.1358 (855)

$1.1338 (237)

Price at time of writing this review: $1.1271

Support levels (open interest**, contracts):

$1.1221 (3354)

$1.1183 (2679)

$1.1141 (3546)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 9 is 59453 contracts (according to data from July, 12) with the maximum number of contracts with strike price $1,1300 (3808);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2707 (1814)

$1.2681 (505)

$1.2645 (320)

Price at time of writing this review: $1.2565

Support levels (open interest**, contracts):

$1.2498 (1421)

$1.2463 (2397)

$1.2425 (2562)

Comments:

- Overall open interest on the CALL options with the expiration date August, 9 is 14801 contracts, with the maximum number of contracts with strike price $1,3000 (2052);

- Overall open interest on the PUT options with the expiration date August, 9 is 15782 contracts, with the maximum number of contracts with strike price $1,2450 (2562);

- The ratio of PUT/CALL was 1.07 versus 1.08 from the previous trading day according to data from July, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 66.57 | 0.08 |

| WTI | 60.37 | -0.08 |

| Silver | 15.2 | 0.66 |

| Gold | 1414.898 | 0.8 |

| Palladium | 1544.96 | -0.94 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 42.37 | 21685.9 | 0.2 |

| Hang Seng | 39.82 | 28471.62 | 0.14 |

| KOSPI | 6.08 | 2086.66 | 0.29 |

| ASX 200 | -19.6 | 6696.5 | -0.29 |

| FTSE 100 | -3.85 | 7505.97 | -0.05 |

| DAX | -8.8 | 12323.32 | -0.07 |

| CAC 40 | 20.91 | 5572.86 | 0.38 |

| Dow Jones | 243.95 | 27332.03 | 0.9 |

| S&P 500 | 13.86 | 3013.77 | 0.46 |

| NASDAQ Composite | 48.1 | 8244.14 | 0.59 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.70185 | 0.67 |

| EURJPY | 121.599 | -0.39 |

| EURUSD | 1.12697 | 0.16 |

| GBPJPY | 135.666 | -0.14 |

| GBPUSD | 1.25726 | 0.4 |

| NZDUSD | 0.66938 | 0.52 |

| USDCAD | 1.3026 | -0.3 |

| USDCHF | 0.98402 | -0.58 |

| USDJPY | 107.888 | -0.54 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.