- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 13-12-2019

Analysts at Wells Fargo note that data released today showed that retail sales in the U.S. rose 0.2% in November, below expectations

- “This is not the report we needed for our upbeat holiday sales forecast to be accurate. November Retail sales were mixed, but for the most part disappointing. The headline increase was just 0.2%, well short of the 0.5% expectation, although the prior month’s figures were revised higher, which softened the blow. Auto sales rose 0.5%, the second straight monthly increase. But when you strip away autos and gas, retail sales were flat on the month despite the consensus-expectation of a 0.4% gain.

- Remember that Thanksgiving came late this year. So late that the number of days between Thanksgiving and Christmas cannot be any less. On that basis, it stands to reason that this year, in particular, December will be the more critical month. Cyber Monday did not arrive until December 2.

- Last December retail sales posted the largest one-month decline since the recession. For our holiday sales measure, it was the largest one-month plunge ever recorded. Those low base effects alone set this December up for a considerable year-over-year gain. We do acknowledge there is some downside around this forecast, but even if holiday sales are flat in December, we are poised for a 4.4% gain in 2019 holiday sales.”

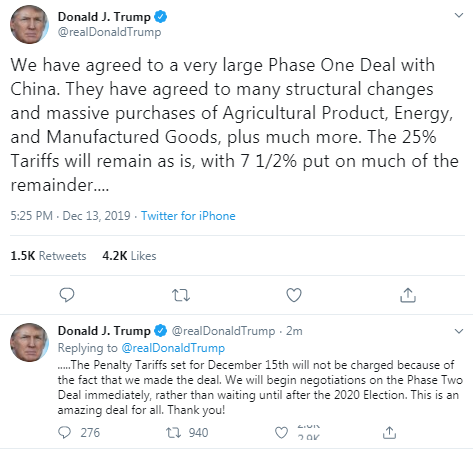

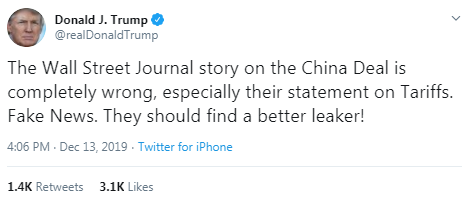

United States and China Reach Phase One Trade Agreement

12/13/2019

Washington, DC – The United States and China have reached an historic and enforceable agreement on a Phase One trade deal that requires structural reforms and other changes to China’s economic and trade regime in the areas of intellectual property, technology transfer, agriculture, financial services, and currency and foreign exchange. The Phase One agreement also includes a commitment by China that it will make substantial additional purchases of U.S. goods and services in the coming years. Importantly, the agreement establishes a strong dispute resolution system that ensures prompt and effective implementation and enforcement. The United States has agreed to modify its Section 301 tariff actions in a significant way.

“President Trump has focused on concluding a Phase One agreement that achieves meaningful, fully-enforceable structural changes and begins rebalancing the U.S.-China trade relationship. This unprecedented agreement accomplishes those very significant goals and would not have been possible without the President’s strong leadership,” said United States Trade Representative Robert Lighthizer.

“Today’s announcement of a Phase One agreement with China is another significant step forward in advancing President Trump’s economic agenda. Thanks to the President’s leadership, this landmark agreement marks critical progress toward a more balanced trade relationship and a more level playing field for American workers and companies,” said Secretary of the Treasury Steven Mnuchin.

The United States first imposed tariffs on imports from China based on the findings of the Section 301 investigation on China’s acts, policies, and practices related to technology transfer, intellectual property, and innovation. The United States will be maintaining 25 percent tariffs on approximately $250 billion of Chinese imports, along with 7.5 percent tariffs on approximately $120 billion of Chinese imports.

- Says first phase of trade negotiations achieved major progress

- An agreement has been reached on text

- U.S. will follow up on promise to cancel tariffs on a phased basis

- Deal to protect Chinese firms' legal interests in dealing in U.S.

- Trade deal to boost confidence of global markets

- Both sides agree to complete last stages as possible including translation and legal review of deal as soon as possible

- Two sides agreed to negotiate on specific arrangement for a signing ceremony

- China has decided to cancel tariffs scheduled to take effect on Sunday

- China hopes U.S. to follow up on its promises

- China to import U.S. wheat, rice and corn within quotas

- Are talking about timing, place and details of signing deal

The Commerce

Department announced on Friday that business inventories rose 0.2 m-o-m in October,

following a revised 0.1 m-o-m drop in September (originally unchanged m-o-m).

That was in

line with economists’ forecast of a 0.1 percent m-o-m increase.

According to

the report, retail inventories increased 0.3 percent m-o-m, while stocks at

wholesalers and at manufacturers rose 0.1 percent m-o-m each.

In y-o-y terms,

business inventories climbed 3.1 percent in October.

Analysts at BNP Paribas note that in the Euro area, growth is sharply decelerating, with some countries like Italy and Germany now close to recession.

- “Extra EU trade is less dynamic, in line with fading external demand, in particular coming from EMEs.

- Inflation is expected to come-back near the 1pct level, as a consequence of falling oil prices.

- The ECB has consequently restarted its Asset Purchases Program (APP) and plan to buy EUR20bn per month (net) over an indefinite period of time. The depo rate was cut to -0.5% and will stay there for long.”

U.S. stock-index futures rose on Friday on hopes that the U.S. and China would reach an initial deal to end their trade war.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 24,023.10 | +598.29 | +2.55% |

Hang Seng | 27,687.76 | +693.62 | +2.57% |

Shanghai | 2,967.68 | +51.98 | +1.78% |

S&P/ASX | 6,739.70 | +30.90 | +0.46% |

FTSE | 7,414.42 | +140.95 | +1.94% |

CAC | 5,938.03 | +53.77 | +0.91% |

DAX | 13,338.10 | +116.46 | +0.88% |

Crude oil | $59.83 | +1.10% | |

Gold | $1,472.90 | +0.04% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 169.4 | 0.84(0.50%) | 2264 |

ALTRIA GROUP INC. | MO | 50.12 | 0.19(0.38%) | 10869 |

Amazon.com Inc., NASDAQ | AMZN | 1,765.90 | 5.57(0.32%) | 36012 |

American Express Co | AXP | 123.05 | 0.41(0.33%) | 6410 |

Apple Inc. | AAPL | 272.55 | 1.09(0.40%) | 315358 |

AT&T Inc | T | 38.44 | 0.09(0.23%) | 26379 |

Boeing Co | BA | 347 | 0.71(0.21%) | 22386 |

Caterpillar Inc | CAT | 147.7 | 0.92(0.63%) | 12721 |

Chevron Corp | CVX | 119.69 | 0.88(0.74%) | 3715 |

Cisco Systems Inc | CSCO | 45.9 | 0.23(0.50%) | 80323 |

Citigroup Inc., NYSE | C | 77.6 | 0.55(0.71%) | 26793 |

Deere & Company, NYSE | DE | 174.94 | 1.12(0.64%) | 3274 |

E. I. du Pont de Nemours and Co | DD | 66.69 | 0.50(0.76%) | 4435 |

Exxon Mobil Corp | XOM | 70.6 | 0.26(0.37%) | 24905 |

Facebook, Inc. | FB | 196.87 | 0.12(0.06%) | 132277 |

FedEx Corporation, NYSE | FDX | 165.13 | 0.24(0.15%) | 2772 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.2 | 0.14(1.07%) | 92095 |

General Electric Co | GE | 11.54 | 0.10(0.88%) | 425731 |

General Motors Company, NYSE | GM | 36.28 | 0.18(0.50%) | 18961 |

Goldman Sachs | GS | 227.4 | 1.35(0.60%) | 17991 |

Google Inc. | GOOG | 1,352.32 | 2.05(0.15%) | 4171 |

Hewlett-Packard Co. | HPQ | 20.45 | 0.02(0.10%) | 215 |

Home Depot Inc | HD | 213.15 | 1.11(0.52%) | 19607 |

Intel Corp | INTC | 57.9 | 0.35(0.61%) | 59609 |

International Business Machines Co... | IBM | 135.88 | 0.56(0.41%) | 1093 |

Johnson & Johnson | JNJ | 141.45 | 0.11(0.08%) | 1545 |

JPMorgan Chase and Co | JPM | 138.6 | 0.58(0.42%) | 46932 |

McDonald's Corp | MCD | 196.52 | 0.21(0.11%) | 2571 |

Merck & Co Inc | MRK | 89.27 | 0.31(0.35%) | 1883 |

Microsoft Corp | MSFT | 153.42 | 0.18(0.12%) | 97424 |

Nike | NKE | 98.09 | 0.37(0.38%) | 5349 |

Pfizer Inc | PFE | 38.6 | 0.06(0.16%) | 10057 |

Procter & Gamble Co | PG | 125.14 | 0.57(0.46%) | 1122 |

Starbucks Corporation, NASDAQ | SBUX | 88.53 | 0.32(0.36%) | 7268 |

Tesla Motors, Inc., NASDAQ | TSLA | 361.85 | 2.17(0.60%) | 80139 |

The Coca-Cola Co | KO | 54.26 | 0.12(0.22%) | 663 |

Twitter, Inc., NYSE | TWTR | 30.4 | 0.10(0.33%) | 21967 |

United Technologies Corp | UTX | 150 | 0.59(0.39%) | 234 |

UnitedHealth Group Inc | UNH | 285.3 | 1.69(0.60%) | 9170 |

Verizon Communications Inc | VZ | 61.27 | 0.10(0.16%) | 2233 |

Visa | V | 183.3 | 0.66(0.36%) | 8579 |

Wal-Mart Stores Inc | WMT | 120.02 | 0.26(0.22%) | 6913 |

Walt Disney Co | DIS | 147.53 | 0.65(0.44%) | 43292 |

Yandex N.V., NASDAQ | YNDX | 41.79 | 0.04(0.10%) | 901 |

The Labor

Department reported on Friday the import-price index, measuring the cost of

goods ranging from Canadian oil to Chinese electronics, rose 0.2 percent m-o-m

in November, following an unrevised 0.5 percent m-o-m drop in October.

Economists had expected prices to advance 0.2 percent m-o-m last month.

According to

the report, the November gain was driven by higher fuel prices (+2.6 percent

m-o-m), which more than offset lower nonfuel prices (-0.1 percent m-o-m).

Over the

12-month period ended in November, import prices dropped 1.3 percent, weighed

down by a decline in nonfuel prices (-1.4 percent), which, however, was partially

offset by a gain in fuel prices (+0.8 percent).

Meanwhile, the

price index for U.S. exports also increased 0.2 percent m-o-m in November,

following an unrevised 0.1 percent m-o-m fall in the previous month.

Higher

agricultural prices (+2.2 percent m-o-m) led the November increase, while prices

for nonagricultural exports were unchanged.

Over the past

12 months, the price index for exports dropped 1.3 percent, weighed down by

lower prices for nonagricultural exports (-1.6 percent), while agricultural

prices surged (+2.5 percent).

The Commerce

Department announced on Friday the sales at U.S. retailers rose 0.2 percent

m-o-m in November, following a revised 0.4 percent m-o-m advance in October

(originally a 0.3 percent m-o-m gain), helped by increased motor vehicle

purchases and higher gasoline prices.

Economists had

expected total sales would increase 0.5 percent m-o-m in November.

Excluding auto,

retail sales edged up 0.1 percent m-o-m in November after a revised 0.3 percent

m-o-m increase in the previous month (originally a 0.2 percent m-o-m advance),

missing economists’ forecast for a 0.4 percent m-o-m gain.

Meanwhile,

closely watched core retail sales, which exclude automobiles, gasoline,

building materials and food services, and are used in GDP calculations, inched

up 0.1 percent m-o-m in November after an unrevised 0.3 percent m-o-m rise in October.

In y-o-y terms,

the U.S. retail sales surged 3.3 percent in November, following a 3.2 climb in

the previous month.

Oracle (ORCL) reported Q2 FY 2020 earnings of $0.90 per share (versus $0.80 in Q2 FY 2019), beating analysts’ consensus estimate of $0.89.

The company’s quarterly revenues amounted to $9.615 bln (-0.4% y/y), generally in line with analysts’ consensus estimate of $9.653 bln.

ORCL fell to $55.18 (-2.28%) in pre-market trading.

- We have 11 months to negotiate a trade deal with Britain

- We will have to prioritize put focus on issues that are cliff edge if they are not done

- There will be sequencing, emphasis on certain things and talks

- Will not conclude trade deal with Britain at any cost, it has to be a balanced agreement

- We have a deadline until start of July 2022 decide if transition; for Britain should be extended

Broadcom (AVGO) reported Q4 FY 2019 earnings of $5.39 per share (versus $5.85 in Q4 FY 2018), beating analysts’ consensus estimate of $5.35.

The company’s quarterly revenues amounted to $5.776 bln (+6.1% y/y), generally in line with analysts’ consensus estimate of $5.735 bln.

The company also issued upside guidance for FY 2020, projecting revenues of 24.50-25.50 bln vs. analysts’ consensus estimate of $23.99 bln.

AVGO fell to $320.90 (-2.10%) in pre-market trading.

Costco (COST) reported Q1 FY 2020 earnings of $1.73 per share (versus $1.67 in Q1 FY 2019), beating analysts’ consensus estimate of $1.72.

The company’s quarterly revenues amounted to $37.040 bln (+5.6% y/y), slightly missing analysts’ consensus estimate of $37.395 bln.

COST closed Thursday's trading session at $297.34 (+0.69%).

Analysts at ING note that starting with the outlook for near-term Brexit risks, the outright Tory victory amounts to a reduction in tail risks.

- "As our UK economist has highlighted, the Withdrawal Agreement ratification is now a near-certainty. The large Tory majority means Johnson’s cabinet will not be in the thrall of Eurosceptic MPs when it comes to making decisions about a possible extension of the transition period beyond 2020, or about the future relationship with the EU.

- This we feel, was already the widespread assumption in the market before the election. Consequently, we see little room for the feel-good factor to last longer than a few days. As we have highlighted previously, the focus in the first half of next year will quickly turn to the challenge of negotiating a trade deal in a very short amount of time.

- The upcoming deadlines still justify a degree of safe-haven premium baked into Gilt yields in our view. What is interesting when compared to other markets is that Gilt investors seem to have taken a more cautious view than for example GBP FX. The 10Y Gilt-Bund spread has only reverted to its 2019 average level post-election result despite the UK stepping from the brink of a no-deal Brexit in the near-term. We think this is correct but still leaves room for a move lower in rates.

- Brexit aside, a key factor that should keep GBP rates in check is the Tory party's fiscally prudent stance, particularly compared to other parties. Despite pledges for higher spending, the Tory manifesto also promised to keep debt on a downward path. More importantly, perhaps was the conspicuous absence of grand investment plans of the sort that would stoke both a rise in borrowing and a step-change in inflation expectations. That said, with a large chunk of Johnson’s new-found majority coming from traditional Labour seats, the government may well feel the need to maintain a more expansive fiscal policy (with higher borrowing and revised fiscal rules) with half an eye on the next election in five years’ time.

- This brings us to the last element capping GBP rates: inflation. The trade-weighted Sterling strength since the summer should keep inflation expectations in check. In spite of the improvement in global risk sentiment, we see little need for long-dated Gilts to price much inflation risk.

- Despite the near-term positive of a ‘no deal’ Brexit being avoided in January, we think uncertainty surrounding the transition period will continue to keep a lid on investment during 2020. While it is still early days, this ongoing weakness will maintain pressure on the jobs market – which is already showing signs of faltering. That means the bar to Bank of England tightening, at least in the first half of 2020, is set relatively low. But barring a significant jobs market deterioration, we aren’t currently expecting rate cuts from the BoE either."

Morten Lund, an analyst at Nordea Markets, notes that GBP has rallied on the back of the election result, sending EUR/GBP lower to levels around 0.829.

- “Given our expectations of a divorce deal being ratified before 31 January 2020, we expect the GBP to be somewhat underpinned the next month or so. Hereafter, however, we see clear downside risk for the GBP, as focus then switches to the phase two negotiations concerning the more important and probably also more difficult future trade relationship.

- Furthermore, we do not think the economy will see a big investment boom after a potential divorce deal has been ratified, with key figures continuing to be sluggish. As such, our view on the sterling is more in line with the option market, which is clearly positioned for downside GBP risk in 2020.”

Analysts at TD Securities note that in the UK, Boris Johnson's Conservative party won a surprisingly robust majority in yesterday's general election, taking 364 of 650 seats (with 1 seat remaining to be counted), giving him roughly an 80-seat majority in the House of Commons.

- “Johnson will now reportedly push ahead with the first vote of the Withdrawal Agreement Bill next Friday 20 Dec as the government prepares for the UK to leave the EU on 31 Jan 2020. He should then be able to get any trade deal he negotiates with the EU through Parliament with this large a majority as well. This should minimize risks of a No-Deal Brexit at the end of 2020.”

- Say policy is accommodative and attentive

Analysts at BNP Paribas, notes that the U.S. economy, especially in the manufacturing sector, has shown some signs of weakness recently, prompting the U.S. Federal Reserve to cut rates preventively.

- “The materialization of US “trade war” through tariffs increases on worth $300bn of imports is likely to weigh on firms' profitability, then activity.

- The inverted yields curve is a bearish signal. It could be followed by sizeable downward adjustments in highly leveraged sectors such as energy and IT.

- As a consequence, the monetary policy would continue to ease.”

- Aims to cut financing costs for smaller firms by 50 bps next year

Morten Lund, analyst at Nordea Markets, points out that Tories secured a solid absolute majority at yesterday’s election in the UK which should pave the way for a ratified divorce deal in January.

“Uncertainty will linger due to following trade negotiations, keeping the BoE on hold and making the GBP vulnerable. In line with polls and our expectations, the Conservatives and Boris Johnson secured an absolute majority at yesterday’s election. The majority is estimated to be at the upper range of projections at 78 seats, ie 364 seats out of 650, and thereby much bigger than the 28-majority suggested by the otherwise much-trusted YouGov poll (the only poll to predict the Tories losing their majority in the 2017 general election). Labour, on the other hand, had a disastrous election. Compared to the 2017 general election, the party lost 59 seats and now only has a total of 203 MPs in the House of Commons. Labour leader Jeremy Corbyn has consequently decided to resign, although he will continue in the short-term until a new leader is elected. The SNP had a solid election gaining 13 seats which increases the pressure for a new Scottish independence referendum (although the Tory win should still rule out a vote in 2020/2021). On the other hand, Liberal Democrats lost 1 seat and furthermore did not get their Leader, Jo Swinson, elected. The election results should have a clear impact on the Brexit end-game. All the Conservatives MPs have pledged to vote for BoJo’s divorce deal and given the large majority, there is even room for several MPs to potentially rebel. Therefore, we stick to our base case since April that the divorce deal will be ratified in 2020, and that that the UK will therefore leave the EU by 31 January. We give this scenario a 90% probability, while a no-deal scenario has around 10% probability.”

Bank of America Global Research flags a scope for USD/JPY upside through Q1 of next year on the back of strong M&A flow.

"We have estimated the average interval between an M&A announcement and completion to be about four months. December is also a seasonally strong month for M&A by Japanese corporates. It suggests Japan's outward M&A would provide support for USD/JPY through announcement impacts and flow into 1Q20. In fact, USD/JPY reversed its downtrend during Tokyo trading hours in August and has grinded higher, partly owning to M&A flow, in our view. Longer term, increased foreign exposure may lift volatility in the FX and equity markets around turns in the business cycle," BofA adds.

Survey data from the Bank of England showed that britons' inflation expectations for the next 12 months and the year after eased in November.

Median expectations of the rate of inflation over the coming year fell to 3.1 percent from 3.3 percent in August, the quarterly Bank of England/TNS Inflation Attitudes Survey revealed.

Expected inflation for the twelve months after that eased to 2.9 percent from 3.0 percent in August.

Longer term inflation expectations, which is for five years' time, climbed to 3.6 percent from 3.1 percent.

The survey was undertaken between November 1 and November 5.

Markets stateside could be in for a “significant correction” if the Democrats make a clean sweep in next year’s U.S. elections, according to one Goldman Sachs analyst.

A “unified Democratic result” where the party secures the presidency as well as both chambers of Congress would make the partial or full rescinding of tax cuts passed in 2017 “highly likely,” said Timothy Moe, co-head of macro research in Asia at Goldman Sachs.

“If that was to happen, then you would lower 2021 S&P 500 earnings potentially by about 12% if you have a full (rescinding) of the tax cut,” Moe told CNBC. “That, in turn, could lead to a significant correction in the U.S. markets.”

“I think that’s a risk that the markets will play with next year and could possibly price partly in, especially if we come into the year having had very strong gains with the S&P up about 26% year to date,” he said.

Looking ahead through 2020, Moe said the market is “likely to have some challenges”.

Credit ratings agency Moody's said on Friday that Brexit uncertainty was likely to return despite British Prime Minister Boris Johnson's comprehensive victory in Thursday's national election.

"Today's result of a Conservative majority means that Brexit is likely to occur quite quickly," Sarah Carlson, Moody's lead UK sovereign analyst, said.

"However, Brexit-related uncertainty is unlikely to abate for more than a few months, given the relatively short transition period to which the Prime Minister is currently committed."

The results of British elections are "positive" in the short term as they eliminate uncertainty regarding Britain's exit process from the European Union, the European Central Bank's Vice-president Luis de Guindos said.

Guindos also said that the slowdown in the euro area had bottomed out amid signs of stabilisation in the bloc's economy as the scenario of a disorderly Brexit or a trade war between China and the U.S. had not materialised.

De Guindos made those comments a day after Christine Lagarde struck a more upbeat tone on the economy in her first news conference as head of the ECB and as Prime Minister Boris Johnson won a resounding election victory.

"The Fed thinks it has everything under control," Philip Marey, Rabobank's senior US strategist, wrote in a note to clients.

But the same forecasting model that led Rabobank to correctly pinpoint the end of the Fed's recent rate hiking cycle is now signaling that the central bank will need to "cut rates all the way back to zero before the end of 2020," Marey said.

"The three insurance cuts [this year] will not be enough to prevent the economy from sliding into a recession," he wrote. "While the Fed is still convinced that they have made a mid-cycle adjustment, we think that it is more likely that we are late in the cycle."

Rabobank predicts the Fed will keep rates steady at the current range of 1.5% to 1.75% until April. That's when the firm anticipates that the Fed will launch the first of six-straight "recession" cuts.

Markets are pricing in just a 15% chance that the Fed will cut rates more than once in 2020, according to the CME FedWatch Tool. Investors are signaling there in no chance of rates dropping to zero.

The European Union hopes for a quick British parliament vote on Britain’s withdrawal from the bloc and clarity on London’s plans following Prime Minister Boris Johnson’s triumph in elections, the head of the European Council said on Friday.

Charles Michel, who chairs EU summits, congratulated Johnson and also said the EU was ready to negotiate a free-trade agreement with Britain but called on London to work in good faith.

“We expect, as soon as possible, a the vote by the British Parliament ... It’s important to have clarity, as soon as possible,” Michel told reporters as he arrived for a second day of an EU leaders summit. “We are ready,” he said of trade talks.

In view of Danske Bank analysts, today's economic highlight is the release of US retail sales for November.

“Private consumption has been strong in the US despite the weakness in manufacturing and there is nothing to suggest it should end now although retail sales are very volatile/noisy on a monthly basis. Today, markets will look out for official confirmation of a phase one trade deal between the US and China ahead of the planned 15 December tariff rate hike. Markets expect the Central Bank of Russia to cut rates from 6.50% to 6.25% today. The announcement is at 11:30 CET.”

In its monthly economic assessment report, Germany’s central bank slashed the German growth forecasts for 2020.

Sees German GDP at +0.5% in 2019 versus +0.6% in June forecast.

Sees German GDP at 0.6% In 2020 versus 1.2% In June forecast.

Sees German GDP at 1.4% In 2021 versus 1.3% In June forecast.

According to Axel Rudolph, analyst at Commerzbank, EUR/USD has not only broken through the five month downtrend line at 1.1105 but also risen above the 200 day moving average at 1.1154 to its current December high at 1.1200.

“Next up are the 55 week moving average at 1.1212 and the August peak at 1.1249. Further up meanders the 200 week moving average at 1.1358 which remains in focus for the weeks to come. It represents a critical break point on the topside from a medium term perspective. Support comes in at the 200 day moving average at 1.1154 and also at the 1.1116 December 4 as well as the 1.1097 November 21 highs. Further support is seen at the December 6 low at 1.1040. Failure at 1.0981 would target the 78.6% Fibonacci retracement at 1.0943. This is seen as the last defence for the 1.0879 October low. If revisited, we would look for signs of reversal from there.”

Japanese big manufacturers’ business mood sank to a near seven year low in the fourth quarter, a closely watched central bank survey showed, as the U.S.-China trade war and soft global demand weighed on the export-reliant economy.

Companies expect conditions to remain unchanged or even worsen three months ahead, the Bank of Japan’s “tankan” quarterly survey showed, suggesting that the fallout from the trade conflict could hurt broader sectors of the economy.

But there were some bright signs. Non-manufacturers’ sentiment appeared to weather the hit from October’s sales tax hike with companies maintaining robust capital expenditure plans, reinforcing market expectations the BOJ will hold off on expanding stimulus at next week’s rate review.

The headline index for big manufacturers’ sentiment stood at 0 in December, down from 5 in September and worse than a median market forecast of 2. It marked the fourth straight quarter of decline and hit the lowest reading since March 2013. Underscoring the pain from the trade war, an index gauging big automakers’ sentiment turned negative for the first time in more than three years.

A sales tax hike that rolled out in October weighed on Japan’s service sector, with the index for big non-manufacturers sliding to 20 from 21 in September. But the reading exceeded a estimate of 16.

As reported by the Federal Statistical Office (Destatis), the selling prices in wholesale trade fell by 2.5% in November 2019 from the corresponding month of the preceding year. This has been the strongest price decrease compared to the previous year since May 2016 (-2.8%). In October 2019 and in September 2019 the annual rates of change had been -2.3% and -1.9%, respectively.

From October 2019 to November 2019 the index slightly fell by 0.1%.

The biggest impact on the overall development compared to the same month of the previous year was the 15.7% lower prices in the wholesale trade of petroleum products in November 2019. There were also sharp year-on-year price declines in the wholesale trade of waste and residual materials (-19.8 %), cereals, raw tobacco, seeds and animal feed (-11.1 %) and data processing equipment, peripheral equipment and software (-7.8 %). In contrast, prices for live animals (+23.7 %) and meat and meat products (+6.7 %) were higher at wholesale level than in November 2018.

U.S. President Donald Trump congratulated British Prime Minister Boris Johnson on the latter's election win and said that Britain and the United States will now be free to strike a 'massive' new trade deal after Brexit.

"This deal has the potential to be far bigger and more lucrative than any deal that could be made with the E.U. Celebrate Boris," Trump said in a tweet early on Friday.

Breton added that a new phase to start in trade talks with UK.

ING analysts suggests that only a few predicted the scale of Boris Johnson and his Conservative Party’s victory in the UK general elections and is set to have a majority of nearly 80 in the House of Commons.

“For Brexit, this all means that Johnson’s deal will be ratified, most likely allowing the UK to leave the EU at the end of January. But more importantly, it could give the prime minister the political breathing room to ask for an extension to the transition period. This is the standstill phase where the UK’s trading relationship remains unchanged, where the government hopes to negotiate the terms of the future deal. But spanning just 11-months, this is unlikely to be long enough. An extension is an option, but the EU has signalled the UK will need to sign-up to budget payments beyond 2020 – and importantly that this needs to be agreed by the end of June. This would undoubtedly infuriate hardline pro-Brexit Conservative MPs, and until now the government has ruled out an extended transition. But with a sizable majority, this could change – an extension is probably more likely than not. If the government decides that there is merit in ending the transition period in 2020, there is really very little Parliament can do about it. MPs are unlikely to be able to seize control, as they did in March and September. Don’t forget a number of the moderate Conservative MPs that backed efforts to force an Article 50 extension in April and October stood down at this election.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.1242 (5340)

$1.1218 (2634)

$1.1202 (3769)

Price at time of writing this review: $1.1168

Support levels (open interest**, contracts):

$1.1143 (768)

$1.1117 (1747)

$1.1083 (4063)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 3 is 52253 contracts (according to data from December, 12) with the maximum number of contracts with strike price $1,1050 (5481);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3630 (1660)

$1.3588 (989)

$1.3548 (5666)

Price at time of writing this review: $1.3446

Support levels (open interest**, contracts):

$1.3015 (548)

$1.2986 (1043)

$1.2955 (573)

Comments:

- Overall open interest on the CALL options with the expiration date January, 3 is 22989 contracts, with the maximum number of contracts with strike price $1,3500 (5666);

- Overall open interest on the PUT options with the expiration date January, 3 is 26128 contracts, with the maximum number of contracts with strike price $1,2800 (2694);

- The ratio of PUT/CALL was 1.14 versus 0.88 from the previous trading day according to data from December, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 64.64 | 0.65 |

| WTI | 59.17 | 0.65 |

| Silver | 16.91 | 0.42 |

| Gold | 1469.285 | -0.37 |

| Palladium | 1939.07 | 1.49 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 32.95 | 23424.81 | 0.14 |

| Hang Seng | 348.71 | 26994.14 | 1.31 |

| KOSPI | 31.73 | 2137.35 | 1.51 |

| ASX 200 | -43.8 | 6708.8 | -0.65 |

| FTSE 100 | 57.22 | 7273.47 | 0.79 |

| DAX | 74.9 | 13221.64 | 0.57 |

| Dow Jones | 220.75 | 28132.05 | 0.79 |

| S&P 500 | 26.94 | 3168.57 | 0.86 |

| NASDAQ Composite | 63.27 | 8717.32 | 0.73 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.69091 | 0.47 |

| EURJPY | 121.663 | 0.71 |

| EURUSD | 1.1131 | 0.01 |

| GBPJPY | 143.993 | 0.54 |

| GBPUSD | 1.31736 | -0.16 |

| NZDUSD | 0.65973 | 0.2 |

| USDCAD | 1.31794 | 0.07 |

| USDCHF | 0.98454 | 0.19 |

| USDJPY | 109.296 | 0.7 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.