- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 13-06-2024

- GBP/USD loses traction around 1.2760 in Friday’s early Asian session amid the stronger US Dollar.

- The Fed's revised projections have boosted the US dollar broadly despite the weaker US May PPI data.

- Traders increased their bets on the BoE’s rate cut as the UK economy stagnated in April.

The GBP/USD pair edges lower near 1.2760 after three consecutive sessions of gain during the early Asian session on Friday. The recovery of the USD Index (DXY) above the 105.00 barrier weighs on the major pair. Later on Friday, the preliminary US Michigan Consumer Sentiment report is due, followed by a speech by Federal Reserve (Fed) Bank of Chicago President Austan Goolsbee.

The US Fed signaled that it will cut its key interest rate just once by 25 basis points (bps) toward the end of 2024 despite inflation easing, according to the dot plot. The Fed's revised projections have lifted the Greenback across the board and created a headwind for GBP/USD despite the weaker-than-expected US economic data released on Thursday.

The US Producer Price Index (PPI) rose 2.2% YoY in May, compared to the 2.3% increase in April (revised from 2.2%), below the market expectation of 2.5%, according to the US Bureau of Labor Statistics on Thursday. The core PPI figure climbed 2.3% YoY in May, below the estimation and previous reading of 2.4%. On a monthly basis, the PPI declined 0.2% in May, while the core PPI remained unchanged at 0%.

Additionally, the weekly Initial Jobless Claims for the week ending June 6 increased by 242K from the previous week's reading of 229K. This figure came in above the market consensus of 225K.

The growing speculation that the Bank of England (BoE) to start cutting interest rates in the August or September meeting exerts some selling pressure on the Pound Sterling (GBP). Traders raised their bets on the BoE’s rate cut due to the stagnant UK monthly Gross Domestic Product (GDP) number for April. "While we are seeing some tentative signs of cooling in the labour market, service sector inflation remains persistently high, and it is likely the MPC would want to wait until the next set of forecasts and a few more data points before it embarks on its first rate cut," said KPMG chief UK economist, Yael Selfin.

- The Bank of Japan is largely expected to keep its policy rate unchanged.

- Markets’ attention will be on a potential hawkish message by Governor Kazuo Ueda.

- Further announcements could be around JGB purchases.

The Bank of Japan (BoJ) is expected to maintain its short-term rate target between 0% and 0.1% on Friday, June 14, after concluding its two-day monetary policy review meeting for June.

The decision will be announced at 3:00 GMT on Friday. It is worth recalling that, in March, the BoJ raised the interest rate for the first time in 17 years, ending the negative interest rate policy that had been in place since 2016.

What can we expect from the BoJ interest rate decision?

With a steady policy widely expected at this gathering, market participants will keep their attention on the probable changes in the policy statement for fresh hints on the timing of the bank’s next rate increase.

So far, money markets see around 16 bps of hiking in October and nearly 22 bps at the December 19 meeting, according to Reuters.

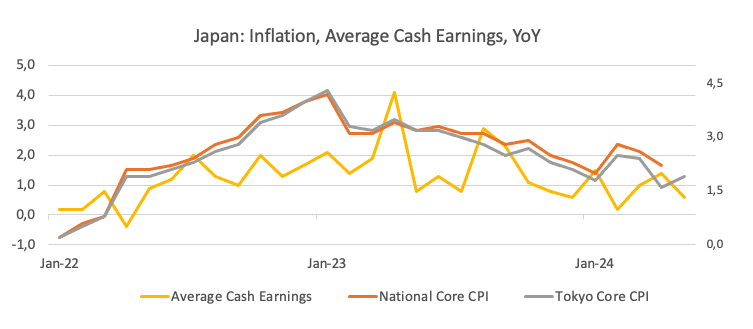

Data released on Wednesday revealed that Japan's wholesale inflation surged in May at the fastest annual rate in nine months. This indicates that the weak Yen is driving up the cost of raw material imports, thereby exerting upward pressure on prices.

This development complicates the central bank’s decision on the timing of raising interest rates, as price increases driven by cost pressures might reduce consumption, undermining the possibility of achieving the demand-driven inflation the BoJ aims for before further scaling back its stimulus measures.

Also pouring cold water over expectations of extra rate hikes, the National Core CPI approached the bank’s target in April (2.2% YoY), while the Tokyo Core CPI navigated below the inflation goal for the second month in a row in May (1.9% YoY).

Last week, Governor Ueda stated that it would be appropriate to scale back the central bank's bond-buying as it progresses towards ending its extensive monetary stimulus. Ueda also emphasized that the BoJ will proceed "cautiously" in deciding the timing and extent of short-term interest rate increases "to avoid making any significant errors."

In addition, board member Toyoaki Nakamura also argued last week that the central bank should not raise interest rates solely to slow the Yen's decline. He explained that attempting to address the weak Yen through interest rate adjustments would negatively impact the economy, as higher borrowing costs would dampen demand.

Analysts at TD Securities comment: “We expect the BoJ to keep the policy balance rate unchanged at 0% and announce a reduction of their JGB monthly purchases to likely around JPY5tn/mth”

How could the Bank of Japan interest rate decision affect USD/JPY?

A hawkish surprise by the BoJ could certainly give the Japanese Yen fresh legs and, therefore, sponsor a knee-jerk drop in USD/JPY. The opposite is likely to happen if the central bank disappoints expectations and signals that the next rate hike is still some time away or that the focus remains on achieving the bank’s inflation target before a move higher on rates.

A glimpse at the broader picture shows Fed-BoJ policy divergence remains at center stage. Following the cautious hold by the Federal Reserve (Fed) at its June 12 event and prospects of just one interest rate cut this year (most likely in December), a sustainable move lower in spot does not appear as the most favourable scenario for the time being.

Looking at the techs surrounding USD/JPY, Senior Analyst at FXStreet.com Pablo Piovano suggests that “further advances are expected to target the weekly high of 157.71 recorded on May 29, followed by the 2024 top of 160.20 from April 29.”

On the downside, “the June low of 154.52 (June 4) emerges as the initial target, ahead of the weekly low of 153.60 reached on May 16 and the provisional 100-day SMA at 152.55”, Pablo adds.

Economic Indicator

BoJ Interest Rate Decision

The Bank of Japan (BoJ) announces its interest rate decision after each of the Bank’s eight scheduled annual meetings. Generally, if the BoJ is hawkish about the inflationary outlook of the economy and raises interest rates it is bullish for the Japanese Yen (JPY). Likewise, if the BoJ has a dovish view on the Japanese economy and keeps interest rates unchanged, or cuts them, it is usually bearish for JPY.

Read more.Last release: Fri Apr 26, 2024 03:20

Frequency: Irregular

Actual: 0%

Consensus: 0%

Previous: 0%

Source: Bank of Japan

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan has embarked in an ultra-loose monetary policy since 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds.

The Bank’s massive stimulus has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy of holding down rates has led to a widening differential with other currencies, dragging down the value of the Yen.

A weaker Yen and the spike in global energy prices have led to an increase in Japanese inflation, which has exceeded the BoJ’s 2% target. Still, the Bank judges that the sustainable and stable achievement of the 2% target has not yet come in sight, so any sudden change in the current policy looks unlikely.

- USD/CHF holds near 0.8939, minimal losses despite weaker US producer inflation data.

- Technical outlook: Pair remains neutral to upward biased, consolidating around the 200-DMA at 0.8896.

- Key levels: Support at 0.8800 and 0.8729; resistance at June 11 high of 0.8993 and 50-DMA at 0.9069.

The USD/CHF was subdued on Thursday, yet minimal losses of 0.06% were printed following the release of the softer US producer inflation report. The Greenback’s losses were capped by the Federal Reserve’s decision to hold rates and project one rate cut, as the disinflation process had stalled. The pair trades at 0.8939 at the time of writing.

USD/CHF Price Analysis: Technical outlook

The daily chart portrays the pair as neutral to upward biased, yet it remains consolidated at around the 200-day moving average (DMA) at 0.8896.

Momentum favors sellers, but they take a respite as they push the USD/CHF below the 200-DMA. Once cleared, the next support would be the 0.8800 figure, followed by the March 8 cycle low of 0.8729.

Conversely. If USD/CHF pushes back above the June 11 high of 0.8993, that would exacerbate a rally past the 0.9000 figure. The next resistance level would be the 50-DMA at 0.9069.

USD/CHF Price Action – Daily Chart

New Zealand’s Business NZ Performance of Manufacturing Index (PMI) contracted to 47.2 in May from the previous reading of 48.9, according to Business NZ on Friday.

“PMI readings to date this year are consistent with falling manufacturing GDP. We anticipate next week’s Q1 GDP figures to include a contraction in the manufacturing component. The latest PMI indicators suggests Q2 will also be weak and potentially weaker than we already anticipate,” said BNZ’s Senior Economist Doug Steel.

Market reaction

At the press time, the NZD/USD pair was down 0.06% on the day to trade at 0.6165.

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Silver prices have fallen aggressively during the last six days, with losses of more than 7%.

- Momentum supports further downside as RSI turned bearish.

- Key support levels are seen at $28.74, followed by $26.40 and $26.02.

Silver prices registered losses of more than 2.40% on Thursday after the Federal Reserve held rates unchanged and hinted that they would likely cut once instead of the three foreseen in the March Summary of Economic Projections (SEP). At the time of writing, the XAG/USD trades at $28.95.

XAG/USD Price Analysis: Technical outlook

From a price action standpoint, the XAG/USD is neutral to upward biased. The downtrend is capped by the presence of the 50-day moving average (DMA) at around $28.74, which is seen as the first support level. The grey metal bounced from around three-week lows of $28.66 to current spot prices.

Momentum remains bearish, as the Relative Strength Index (RSI) depicts. Hence, if XAG/USD achieves a daily close below the 50-DMA, the Silver price could plunge to the next support level seen at the 100-DMA at $26.40, ahead of the May 2 low of $26.02.

On the other hand, if Silver buyers conquer $29.00, they must clear the $30.00 handle, if they would like to re-test the year-to-date (YTD) high of $32.51.

XAG/USD Price Action – Daily Chart

- The NZD/USD holds in consolidation after a sharp mid-May rise.

- Buyers struggle to breach the 0.6220 area.

- Indicators remain in positive territory on the daily chart, though momentum points downward.

The NZD/USD rose to a high of 0.6217 before stabilizing at 0.6170. The upward momentum of this pair has encountered resistance in the 0.6220 area, with attempts to breach this level remaining unsuccessful.

In the daily chart, the Relative Strength Index (RSI) stands at 56 but points down suggesting a slight decline in buying pressure. This decrease in the RSI is consistent with the presence of flat red bars on the Moving Average Convergence Divergence (MACD), reinforcing the ongoing consolidation pattern.

NZD/USD daily chart

NZD/USD continues to show strong signs of consolidation with its 20-day Simple Moving Average (SMA) forming the immediate support at 0.6140. Furthermore, the convergence of the 100 and 200-day SMAs in the 0.6050-0.6060 region continues to act as a robust support base for the pairing. This may serve as a trajectory for correction if a bearish trend emerges. Any movements below this point of convergence could be considered a sell signal.

- EUR/USD erases recent gains to fall back into technical weak zone.

- Euro under pressure as political turmoil shakes markets.

- Greenback bolstered by risk-off flows as US data misses the mark.

EUR/USD tumbled back into recent lows below 1.0750 on Thursday, paring away recent gains as confidence in the Euro (EUR) flounders on the back of EU political instability. A miss in US Producer Price Index (PPI) figures is steepening concerns of an economic slowdown in the US, sparking a hard curve in risk appetite heading into the week’s final trading sessions.

European parliamentary elections drove confidence in the Euro even lower as France dissolves parliament and heads into snap elections. French President Emmanuel Macron called for a short-notice presidential election after suffering a crushing defeat in EU parliament elections, and financial markets are tilting to the downside at the prospect of France’s President Macron getting replaced by the National Rally’s Marine Le Pen, a right-leaning conservative politician sweeping to popularity within France on a platform of steep tax cuts, lowering the retirement age, and stiff limits to immigration into France from both outside and within the EU.

Financial markets in Europe are increasingly uneasy about a Le Pen win in France, which would carry steep fiscal burdens at a time when European economic figures are broadly missing the mark but rate cuts from the European Central Bank (ECB) remain difficult to deliver with lopsided inflation still plaguing the Eurozone.

US Dollar flows spiked higher on Thursday after US PPI figures eased quicker than forecasts, and US Initial Jobless Claims flagged a faster-than-expected uptick in new unemployment claims. Markets are now pivoting to Friday’s University of Michigan Consumer Sentiment Index for June, which is forecast to rise to 72.0 from 69.1.

A smattering of talking points from several ECB policymakers are expected throughout Friday as finance ministers from across the European Union meet to kick off the next round of Eurogroup Meetings.

EUR/USD technical outlook

Thursday’s decline has sent EUR/USD back into recent lows as the pair struggles to hold onto chart territory north of 1.0750. Fiber bids were unable to dig in a foothold above the 200-hour Exponential Moving Average (EMA) at 1.0804 this week, and the pair heads into Friday’s trading sessions on the back foot.

EUR/USD has buckled underneath the weight of descending trendlines drawn from 2024’s peak bids near 1.1140. Downside pressure has been building since the pair declined from June’s early highs above 1.0900, and the Fiber is now trading back into the low side of the 200-day EMA at 1.0804.

EUR/USD hourly chart

EUR/USD daily chart

- The AUD/JPY pair is experiencing a decline as buyers take profits, causing it to hover around the 20-day SMA.

- In spite of the drop, the pair remains in consolidation, suggesting the possibility of a limited decline for the time being.

- If the bulls are successful in building support around the 20-day SMA, the next potential target lies within the 104.50-105.00 price range.

In Thursday's session, the AUD/JPY pair witnessed a dip towards 104.00 as buyers cashed in their profits, which saw the pair soaring above the 20-day Simple Moving Average (SMA). The 20-day SMA, which previously acted as a point of resistance, seems to be the new focus point for building support in order to lessen further losses. Nevertheless, the persistent consolidation phase suggests a lack of momentum for a steady rise.

The daily Relative Strength Index (RSI) of the AUDJPY now stands at 54, a decrease from the previous session's score of 57, indicating a slight downward trend and implying that the previous upward momentum may be losing steam. In contrast, the Moving Average Convergence Divergence (MACD) is exhibiting stationary red bars, indicative of a stabilizing momentum.

AUD/JPY daily chart

In conclusion, the AUD/JPY pair appears to be in a consolidation phase, despite a drop this Thursday as trading hovers around the 20-day SMA. The possible range of 102.00-103.00 for the upcoming sessions may denote the continuation of side-ways trading as bulls seem to be consolidating from the May rally which had lifted the pair near 105.00. Nonetheless, the reduction in selling momentum could represent a gearing up by the bulls for the next upward swing, potentially retesting the 104.50-105.00 area.

In conclusion, the AUD/JPY pair appears to be in a consolidation phase, despite a drop this Thursday as trading hovers around the 20-day SMA. The possible range of 102.00-103.00 for the upcoming sessions may denote the continuation of side-ways trading as bulls seem to be consolidating from the May rally which had lifted the pair near 105.00. Nonetheless, the reduction in selling momentum could represent a gearing up by the bulls for the next upward swing, potentially retesting the 104.50-105.00 area.

- EUR/GBP heads for 0.8400 as Euro gets forced lower by political turmoil.

- Economic figures from the EU continue to disappoint.

- A rate cut from the ECB has widened the rate differential.

EUR/GBP saw a sharp downside push on Thursday, driving the pair to a nearly two-year low near the 0.8400 handle as political and economic uncertainty weigh on the Euro (EUR). Economic data has broadly missed forecasts in both the UK and the European economic zone, but a recent rate cut from the European Central Bank (ECB) has widened the Euro’s rate differential against other major currencies.

Pan-European Industrial Production contracted -0.1% MoM in April, missing the forecast 0.2% and the previous month was revised to 0.5% from 0.6%. YoY Industrial Production alos declined by a steeper-than-expected -3.0% compared to the forecast -1.9% and the previous period’s revised -1.2%.

European Parliamentary elections swung in favor of center-right and right-leaning parties across the European Union, sparking uncertainty in European financial markets. France has been driven to snap elections that could see President Emmanuel Macron get unseated by Deputy of the French National Assembly (FNA) Marine Le Pen. Le Pen’s political rise is shaking stability in financial markets as Le Pen's National Rally party's platform of steep tax cuts and lowering of the retirement age threatens to introduce financial instability in echoes of Lizz Truss’s brief stint as the Prime Minister of the UK.

UK data remains limited this week, leaving GBP traders to wait for next week’s latest UK Consumer Price Index (CPI) inflation print. The Bank of England (BoE) also delivers its latest rate call later next week. The BoE last voted 7-to-2 to keep interest rates on hold at 5.25%.

EUR/GBP technical outlook

EUR/GBP’s backslide on Thursday marks a fresh 22-month low for the pair, sending bids tumbling towards the 0.8400 handle. Bearish flows have dragged the pair into further declines after the EUR/GBP through technical support at 0.8500, and bulls are having a difficult time hitting the brakes.

EUR/GBP is accelerating towards the downside away from the 200-day Exponential Moving Average (EMA) at 0.8581. The pair is down 3% from 2024’s opening bids, and major resistance is priced in even further down at 0.8300.

EUR/GBP daily chart

- EUR/JPY buying pressure fades after consolidating around 168-170 for almost one month.

- Momentum supports sellers, with potential targets seen at 167.47 and 165.92.

- Upside is limited, yet a breach of 170.00, could pave the way to test the year-to-date (YTD) high of 171.58.

The EUR/JPY seesawed within a 180-pip range on Thursday yet is posting losses of 0.45% after hitting a daily high of 170.13. At the time of writing, the pair exchanged hands at 168.60, below its opening price.

EUR/JPY Price Analysis: Technical outlook

After peaking at around 170.00, the EUR/JPY has consolidated below the latter, yet it cannot drop below the Ichimoku Cloud (Kumo), which would accelerate the downtrend.

The Relative Strength Index (RSI) shows sellers gather momentum after the RSI punches below the 50-line. This suggests the EUR/JPY would be subject to further losses.

If EUR/JPY falls below the 50-day moving average (DMA) of 167.47, that could exacerbate a dip inside the Kumo, an indication of the acceleration of the downtrend. The next support would be the bottom of the Kumo at 165.92, followed by the 100-DMA at 164.78.

EUR/JPY Price Action – Daily Chart

- Kiwi shows signs of fatigue against the Yen, after reaching highest level since June 2007 on Thursday.

- Indicators on the daily chart suggest potential further consolidation, with trading confined between 95.00 and 97.00.

- A retest of the 97.00 level is possible, but a breach is unlikely as buyers consolidate gains from the significant ascent in May.

On Thursday, the NZD/JPY pair exhibited signs of fatigue, following its advancement to the multi-year highs logged earlier in the week. Clearly, the technical landscape suggests an extension of the consolidation phase, potentially keeping the pair's upside movements capped below the psychological 97.00 level.

The daily Relative Strength Index (RSI) for NZD/JPY has slightly retreated to 59, indicative of a waning in the bullish momentum. The Moving Average Convergence Divergence (MACD) continues to print flat red bars, further endorsing the perspective of ongoing consolidation.

NZD/JPY daily chart

The continuous presence of buyers above the 20-day Simple Moving Average (SMA) indicates their effort to sustain the bullish push. Yet, the recent exhaustion signal demonstrated by the daily technical indicators supports the market's need to consolidate following the significant surge recorded in May. The upcoming trading sessions might see the pair oscillate between the 95.00 level, serving as support, and the 97.00 level, acting as resistance, as the pair looks to stabilize after recent gains.

The continuous presence of buyers above the 20-day Simple Moving Average (SMA) indicates their effort to sustain the bullish push. Yet, the recent exhaustion signal demonstrated by the daily technical indicators supports the market's need to consolidate following the significant surge recorded in May. The upcoming trading sessions might see the pair oscillate between the 95.00 level, serving as support, and the 97.00 level, acting as resistance, as the pair looks to stabilize after recent gains.

The longer-term SMAs established around 90.00 - 92.00 safeguard the overall bullish complexion of the pair.

- USD/JPY edges up slightly despite falling US Treasury yields.

- Technical outlook: Buyers in control, targeting 157.00 and potentially April's high of 158.44.

- Downside risks are seen below 156.00, followed by 155.72 and further targets at 154.00 and 153.35/40.

The USD/JPY recovered some ground during the North American session yet is virtually unchanged, up by a minimal 0.08%, weighed by a fall in US Treasury bond yields. US economic data from the United States (US) shows that inflation is getting lower, yet the Federal Reserve remains skeptical that the battle against higher prices isn’t finished. The pair trades at 156.87 at the time of writing.

USD/JPY Price Analysis: Technical outlook

From a technical standpoint, the USD/JPY climbs steadily, with buyers remaining in charge, as depicted by the Relative Strength Index (RSI). Momentum shows that bulls are losing steam, yet the RSI remains bullish.

If USD/JPY climbs past 157.00, that could pave the way for further gains, with buyers targeting April 26 high of 158.44. Further upside is seen above 159.00, like the year-to-date (YTD) high of 160.32.

Conversely, if USD/JPY slides beneath the Tenkan-Sen at 156.0, the next stop would be June 12 low of 155.72. A breach of the latter and the pair could tumble toward the 154.00 figure, before testing the Ichimoku Cloud (Kumo) low of 153.35/40.

USD/JPY Price Action – Daily Chart

- GBP/JPY hit a new 16-year peak of 201.32 on Thursday.

- JPY traders are buckling down ahead of the BoJ’s latest rate call.

- Sterling markets are shrugging off misses in UK data.

GBP/JPY tested into a fresh 16-year high above 201.00 on Thursday, tipping into 201.32 before falling back into the previous day’s range as Guppy traders jostle for position ahead of the Bank of Japan’s (BoJ) latest rate call and Monetary Policy Statement. The BoJ’s latest rate statement is due early on Friday, and Sterling traders will be looking ahead to next week’s latest UK Consumer Price Index (CPI) inflation update.

UK data has broadly missed the mark this week, with an unexpected surge in unemployment claims and a sharper-than-forecast contraction in industrial activity. However, GBP traders have broadly shrugged off the bleaker economic outlook for the UK to bolster the Guppy as Japan’s hypereasy monetary policy stance keeps the Yen unsupported against its major currency peers.

The BoJ is broadly expected to hold rates at 0% early Friday, and investors aren’t expecting much movement from the Japanese central bank in the way of tightening monetary policy. The economic calendar remains thin on the UK side, leaving GBP traders to sit and wait for next Wednesday’s CPI inflation print, followed by Thursday’s rate call from the Bank of England (BoE). The BoE last voted 7-to-2 to keep interest rates steady at 5.25%, with only two Monetary Policy Committee (MPC) members voting for a rate cut.

GBP/JPY technical outlook

GBP/JPY peaked at a fresh 16-year high of 201.32 early Thursday before quickly pulling back to the 200-hour Exponential Moving Average (EMA) at 199.89. The pair is still tilted firmly into bullish territory, but downside pulses are keeping the pair in a choppy rising consolidation pattern.

The Guppy closed five of the last six trading days in the green, and is showing signs of bullish exhaustion. The pair could be poised for a fresh drop to the 50-day EMA at 196.56, though GBP/JPY remains deep in bull country, trading above the 200-day EMA at 188.91.

GBP/JPY hourly chart

GBP/JPY daily chart

The US Dollar managed to regain balance and reverse the post-CPI pullback on Thursday along with investors’ assessment of a potential one interest rate cut by the Fed at some point by year-end and declining US yields across the curve. The BoJ is expected to keep rates on hold.

Here is what you need to know on Friday, June 14:

The USD Index (DXY) regained its uptrend and reclaimed the area beyond the 105.00 barrier, despite US yields continuing to trend lower. On June 14, the preliminary Michigan Consumer Sentiment gauge is due, seconded by the speech by the Fed’s Goolsbee (Chicago).

EUR/USD sharply reversed Wednesday’s bullish attempt and traded at shouting distance from monthly lows near 1.0720. The Balance of Trade results are expected in the euro zone on June 14, along with the speech by the ECB’s Lagarde.

GBP/USD made a U-turn after three consecutive sessions of gains in response to the marked rebound in the Greenback. The UK calendar is empty on June 14.

USD/JPY maintained cautious trade near the 157.00 region, up modestly for the day ahead of the key BoJ meeting. In fact, the BoJ’s interest rate decision takes centre stage on June 14, seconded by final Industrial Production, and the Tertiary Industry Index.

AUD/USD came under pressure following gains in the US Dollar, partially fading Wednesday’s strong advance. The publication of Consumer Inflation Expectations will be unveiled o June 14 followed by the Consumer Confidence Index tracked by Westpac.

WTI prices traded within a narrow range around the $78.00 mark per barrel, as traders digested recent US crude oil inventories report and inflation data.

Gold corrected sharply lower after three sessions in a row of gains on the back of the strong dollar and expectations of just one interest rate cut by the Fed this year. Silver sold off to four-week lows, breaking below the $29.00 mark per ounce amidst a generalized bearish tone in the commodity complex.

- Gold retreats on its way toward $2,300 after hitting a daily high of $2,326.

- Fed's revised projections show just one rate cut in 2024, a headwind for XAU/USD prices.

- Lower producer prices and higher unemployment claims boost USD, 10-year Treasury yield drops to 4.242%.

Gold prices retreated during the North American session on Thursday after hitting a daily high of $2,326. The Federal Reserve (Fed) projects just one interest rate cut instead of the three proposed since December’s 2023 Summary of Economic Projections (SEP), aka the dot plot. In the meantime, mixed US economic data boosted the Greenback to the detriment of the golden metal.

The XAU/USD spot trades at $2,303, down almost 1%. US data from the Bureau of Labor Statistics (BLS) showed lower prices paid by producers, while the number of Americans applying for unemployment benefits exceeded estimates and the previous reading.

Although the figures suggest that the Fed could set the stage to lower interest rates, Fed officials estimate just 25 basis points (bps) of easing toward the end of 2024, according to the dot plot.

Despite that, according to data from the Chicago Board of Trade, market participants are eyeing 39 basis points of easing via December’s 2024 fed funds rate contract.

The US 10-year Treasury note yield dropped seven bps from 4.310% to 4.242%, usually a tailwind for the non-yielding metal that is feeling China’s Gold buying pause.

News that the People’s Bank of China paused its 18-month bullion buying spree weighed on the precious metal. PBOC holdings held steady at 72.80 million troy ounces of Gold in May.

On Wednesday, Fed Chair Jerome Powell stated that they are less confident about inflation than previously "in order to cut." He added, "If jobs are to weaken unexpectedly, the Fed is ready to respond." When asked about the US CPI report, Powell mentioned that it is just one and emphasized the need to see the deflation process evolving toward the Fed’s goal.

Daily digest market movers: Gold price tumbles after softer US data

- US Dollar Index (DXY) increased by 0.49% to 105.20, a headwind for Gold prices.

- US Producer Price Index (PPI) in May dipped from 0.5% to -0.2%, below estimates of 0.1% expansion.

- Core PPI in May was unchanged at 0%, below forecasts of a 0.3% expansion and beneath April’s 0.5%.

- Initial Jobless Claims for the week ending June 6 rose by 242K, above the consensus of 225K and the previous week's reading of 229K.

- Despite US CPI report showing disinflation process continuing, Fed Chair Jerome Powell commented that they remain “less confident” about the progress on inflation.

- Even though the latest US CPI and PPI reports were weaker than expected, the latest NFIB Small Business Optimism Index survey for May showed that businesses are struggling with higher prices and access to cheap financing.

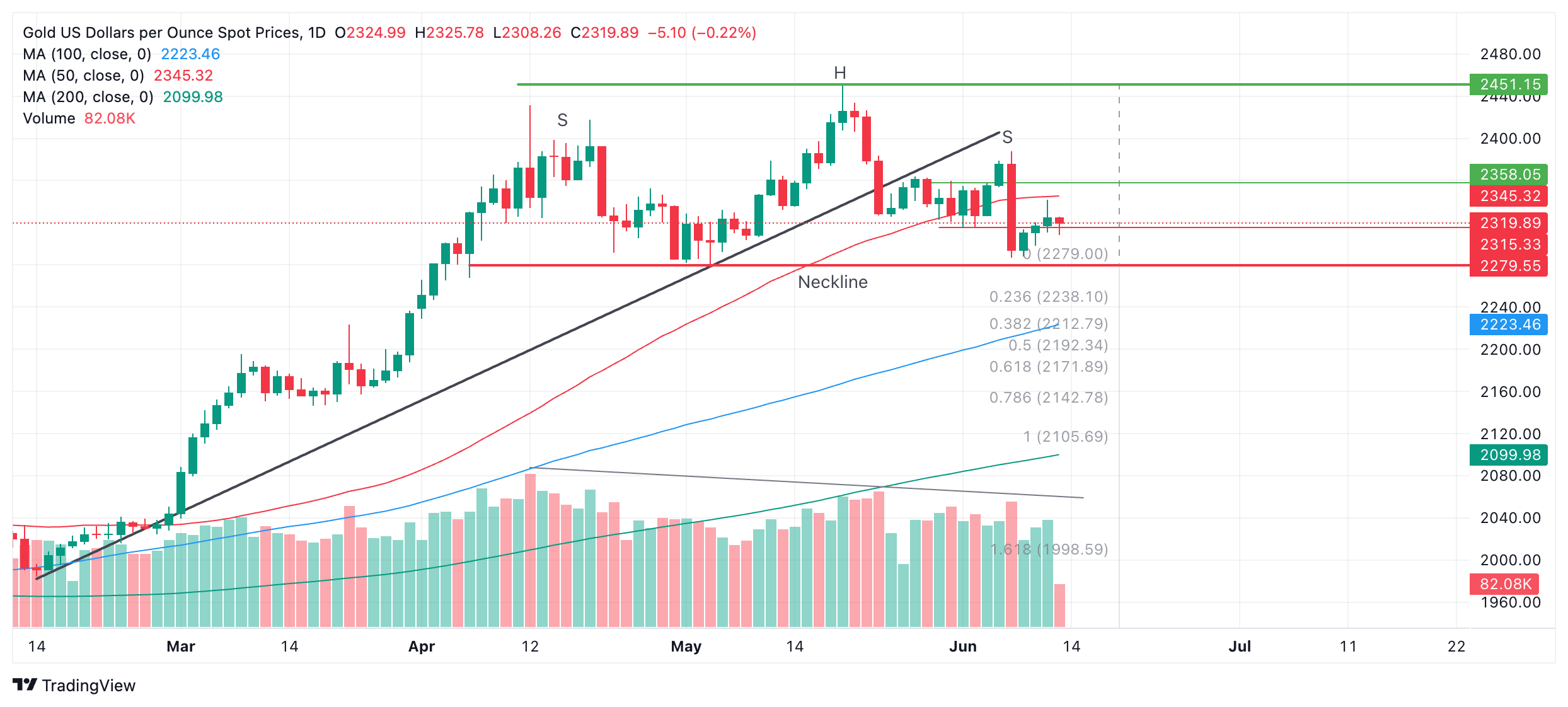

Technical analysis: Gold price sellers regain control as prices are headed toward $2,300

The Gold price remains neutral to downwardly biased as the Head-and-Shoulders chart pattern remains in place, hinting that the non-yielding metal price is set for further losses. Momentum as measured by the Relative Strength Index (RSI) shows that sellers are in charge, an indication that once XAU/USD’s price drops below $2,300, lower prices lie ahead.

Gold’s first support would be $2,300. Once cleared the next stop would be the May 3 low of $2,277, followed by the March 21 high of $2,222. Further losses lie beneath, as sellers would eye the Head-and-Shoulders chart pattern objective at around $2,170 to $2,160.

On the flipside, if XAU/USD soars past the June 7 cycle high of $2.387, that paves the way to test the $2,400 figure.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- AUD/USD experiences an extended decline following release of labor market figures from Australia during Asian session.

- Federal Reserve's projection of higher interest rates continues to favor USD.

- Despite clearing some losses, US Treasury yields remain down by more than 2%.

The Australian Dollar (AUD) fell further against the US Dollar (USD) on Thursday despite strong labor market data from Australia reported earlier in the session. The US seems to be enjoying demand thanks to the interest rate revisions, which saw the Federal Reserve (Fed) governors forecasting fewer rate cuts this year. In addition, the Greenback kept its strength despite soft inflation figures reported during the European session.

The Australian economy shows some signs of weakness, but the stubbornly high inflation is prompting the Reserve Bank of Australia to delay cuts, which may limit the downside.

Daily digest market movers: Australian Dollar maintains selling bias despite positive employment numbers

- Australian Bureau of Statistics (ABS) released employment data showing a drop in Australia’s Unemployment Rate to 4.0% in May, meeting expectations. This figure marked a slight improvement from the previous rate of 4.1%.

- Australian Employment Change increased to 39.7K in May from 38.5K in April, surpassing the forecast of 30.0K.

- Participation rate increased slightly to 66.8% in May, up from 66.7% in April. There was a significant increase in Full-Time Employment, while Part-Time Employment decreased.

- On the US side, the US Bureau of Labor Statistics revealed on Thursday that the Producer Price Index (PPI) for final demand in the US rose 2.2% on a yearly basis in May, indicating looser inflationary pressure than expected.

- On the negative side, weekly Initial Jobless Claims came in higher than expected.

Technical analysis: AUD/USD sellers gather momentum, positive outlook remains

The Relative Strength Index (RSI) remains above 50 but points downwards, suggesting that bullish momentum might be losing steam. Meanwhile, the Moving Average Convergence Divergence (MACD) shows steady red bars indicating stable selling pressure.

However, the short-term outlook remains positive as the pair sustains its position above the 20-day Simple Moving Average (SMA) at 0.6640. If lost, the 100 and 200-day SMAs offer themselves as barriers around the 0.6560 area.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- Mexican Peso counterattacks, snapping two days of losses.

- Banxico Governor Victoria Rodriguez Ceja assures intervention if Peso exhibits “atypical behavior or extreme volatility.”

- Greenback weakens against Peso despite Fed's unchanged rates and revised projections with US economic data showing mixed signals.

The Mexican Peso recovered some ground on Thursday and appreciated 0.93% following a verbal intervention by the Bank of Mexico (Banxico). Governor Victoria Rodriguez Ceja commented that the Bank is ready to step in if the Peso shows “atypical behavior or extreme volatility.” The USD/MXN trades at 18.56, around two-day lows.

Mexico’s economic docket remains absent for the rest of the week, with traders awaiting the release of Aggregate Demand, Private Spending, and Retail Sales data next week. However, the USD/MXN exchange rate continues to be driven by political uncertainty about the changes to the Mexican Constitution that threaten the state of law.

In the meantime, on Wednesday, Banxico’s Governor Victoria Rodriguez Ceja commented that the Mexican central bank remains attentive to the USD/MXN exchange rate and insisted that policymakers are not trying to defend a specific level.

Aside from this, the Greenback is on the back foot against the Mexican currency even though the US Federal Reserve (Fed) held rates unchanged and adjusted their projections for future monetary policy. Fed Chair Jerome Powell and the central bank’s governors estimate one interest rate cut in 2024 instead of the three projected by the dot plot since December 2023.

Meanwhile, US economic data showed that prices paid by producers in May were virtually unchanged compared to April, while the number of Americans filing for unemployment benefits exceeded estimates.

Daily digest market movers: Mexican Peso on defensive amidst political uncertainty

- In February 2024, AMLO put forward several proposals to the Mexican Congress. These include a Supreme Court reform that suggests electing Supreme Court ministers through popular vote; an electoral reform aimed at electing electoral commission councilors by popular vote and reducing multi-member representation; and a reform of autonomous bodies that proposes dissolving the transparency body.

- Mexican Peso depreciation could weigh on the Bank of Mexico's (Banxico) decision to ease policy on June 27 despite last month’s dip in core prices. Therefore, keeping interest rates higher could prompt deceleration in the economy and increase the odds of a possible recession.

- Morgan Stanley noted that if Mexico’s upcoming government and Congress adopted an unorthodox agenda, it would undermine Mexican institutions and be bearish for the Mexican Peso, which could weaken to 19.20.

- The US Department of Labor revealed that the Producer Price Index (PPI) in May was 2.2% YoY, below estimates of 2.5%, and a tenth below April’s 2.3%. Core PPI for the same month expanded 2.3% YoY, beneath the consensus and the previous reading of 2.4%.

- The latest US inflation report increased the odds for a Fed rate cut in September, according to the CME FedWatch Tool, from 46.7% to 60.5%.

- December’s 2024 fed funds futures contract hints that investors expect 38 basis points of rate cuts by the Fed through the end of the year.

Technical analysis: Mexican Peso advances as USD/MXN slides below 18.60

The USD/MXN uptrend remains intact despite retreating toward the 18.50s region, which could be seen as buyers taking a respite as the Relative Strength Index (RSI) turned overbought. Despite that, momentum favors further upside after the exotic pair cleared strong resistance levels, opening the door for higher spot prices.

The USD/MXN's next resistance would be the year-to-date high of 18.99, followed by the March 20, 2023, high of 19.23. A breach of the latter will sponsor an uptick to 19.50, ahead of the psychological 20.00 mark.

On the other hand, sellers must push the USD/MXN back below the April 19 high of 18.15 if they want to keep the pair within the 18.00-18.15 trading range.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Dow Jones backslides over 150 points on Thursday.

- Treasury yields and equities backslid after US PPI figures declined.

- US Initial Jobless Claims also rose faster than expected, sparking recession concerns.

The Dow Jones Industrial Average (DJIA) tumbled another 150-plus points on Thursday after US data hinted at a further contraction of the overall economy, briefly sparking risk-off bids into the US Dollar (USD) and forcing Treasury yields lower alongside equity indexes.

US Producer Price Index (PPI) inflation eased faster than expected in May, contracting -0.2% MoM compared to the forecast move lower to 0.1% from 0.5%. Annualized Core PPI also ticked down to 2.3% YoY, falling from the forecast steady print at 2.4%.

US Initial Jobless Claims also rose faster than expected for the week ended June 7, rising to 242K versus the forecast 225K and the previous 229K. Declining producer-level inflation and rising unemployment benefits seekers are exposing cracks in the US economy, reigniting fears of a possible recession looming ahead.

Investor sentiment is on the ropes on Thursday after the Federal Reserve (Fed) held rates on Wednesday and cautioned that the US central bank only expects to make a single rate cut in 2024, down from the three initially forecast in March. Risk-off flows are sapping strength out of equity indexes heading into the tail-end of the trading week, though momentum could flip back to the bullish side. According to the CME’s FedWatch Tool, rate traders are pricing in nearly-even odds of a first quarter-point rate trim in either September or November, with rate markets pricing in a 76% chance of a quarter-point rate cut on September 18.

Dow Jones news

Two-thirds of the Dow Jones index is underwater on Thursday, with losses being led by Salesforce Inc. (CRM) which declined -2.16% to $230.71 per share. On the high side, JPMorgan Chase & Co. (JPM) is recovering from a recent selloff, climbing 0.92% to $193.34 per share.

Dow Jones technical outlook

The Dow Jones is grappling with an intraday recovery from the day’s early lows near 38,393.00, as DJIA bidders try to force action back above the 38,600.00 level. US equities are grinding out a slow recovery from Thursday’s early declines, pulling back into the trading week’s range after setting a brief new low for the week.

The Dow Jones is on pace for a third consecutive down day, but price action continues to hold above a near-term demand zone below the 38,000.00 handle. The index remains down nearly 4% from all-time highs above 40,000.00, but is still decidedly bullish in 2024, up 2.3% from January’s opening bids.

Dow Jones five minute chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- Canadian Dollar sheds -0.20% against USD as price action rebounds.

- Canada remains absent from the economic calendar on Thursday.

- BoC Governor Macklem due to speak at event, policy comments expected.

The Canadian Dollar (CAD) pared back recent gains against the US Dollar (USD) on Thursday, shedding a quarter of a percent against the USD as market flows pull back to safety and bolster the Greenback. US economic data broadly printed worse than expected on Thursday, driving investors back into safe havens.

Canada brings strictly low-tier economic calendar events this week, leaving CAD flows at the mercy of broader market sentiment. However, Bank of Canada (BoC) Governor Tiff Macklem is scheduled to speak at an event later on Thursday, and CAD traders will be looking for any updates on the Canadian central bank’s policy stance.

Daily digest market movers: Greenback flows reverse bullish CAD momentum

- US data missed expectations across the board on Thursday, sparking moderate safe haven bids.

- US Initial Jobless Claims for the week ended June 7 jumped to 242K, above the forecast 225K and the previous week’s 229K.

- US Producer Price Index (PPI) in May contracted -0.2%, missing the forecast of 0.1% and declining further from the previous 0.5%.

- Core US PPI (PPI excluding volatile food and energy prices) ticked down to 2.3% YoY versus the forecast hold at 2.4%.

- BoC Governor Macklem due to participate in a fireside chat at the Bank of International Settlements’ Innovation Hub Center in Toronto. CAD traders will be keeping an ear out for any statements about the BoC’s expectations of further rate cuts in the future.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.60% | 0.39% | 0.06% | 0.26% | 0.53% | 0.38% | -0.02% | |

| EUR | -0.60% | -0.20% | -0.52% | -0.34% | -0.07% | -0.22% | -0.61% | |

| GBP | -0.39% | 0.20% | -0.32% | -0.13% | 0.15% | -0.03% | -0.40% | |

| JPY | -0.06% | 0.52% | 0.32% | 0.19% | 0.47% | 0.28% | -0.08% | |

| CAD | -0.26% | 0.34% | 0.13% | -0.19% | 0.27% | 0.12% | -0.26% | |

| AUD | -0.53% | 0.07% | -0.15% | -0.47% | -0.27% | -0.17% | -0.55% | |

| NZD | -0.38% | 0.22% | 0.03% | -0.28% | -0.12% | 0.17% | -0.37% | |

| CHF | 0.02% | 0.61% | 0.40% | 0.08% | 0.26% | 0.55% | 0.37% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Technical analysis: CAD walks back gains against Greenback, but remains mixed overall

The Canadian Dollar (CAD) is mixed overall on Thursday, shedding weight against the US Dollar but gaining ground against the Euro (EUR). The CAD is down a third of a percent against the Swiss Franc (CHF), but gained three-tenths of one percent against the Euro, Thursday’s worst-performing major currency.

USD/CAD has risen above 1.3750 as the Greenback climbs over the CAD, dragging the pair higher but still falling on the short side of the week’s peak bids near 1.3790. Bidders are making a fresh push to try and recapture the 1.3800 handle, while short positions will accumulate in an attempt to drag USD/CAD back down to the 50-day Exponential Moving Average (EMA) at 1.3668.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- DXY rallies further following Federal Reserve's decision, trades above 105.00.

- US releases soft PPI figures from May and higher weekly Initial Jobless Claims.

- US Treasury yields continue to move down and may limit the upside.

On Thursday, the US Dollar Index (DXY) continued its positive momentum, extending its recovery into Thursday's session above 105.00. This followed Wednesday's Federal Reserve (Fed) decision and as markets digested fresh Producer Price Index (PPI) figures from May and weekly Initial Jobless Claims, which showcased weaker than anticipated inflation and higher unemployment benefit requests.

The Fed kept its economic activity revisions unchanged while upgrading the Personal Consumption Expenditures (PCE) forecasts. The US economy is currently showcasing mixed signs with preliminary evidence indicating softening inflation but with a resilient labor market, which seems to have made Fed officials project fewer rate cuts in 2024.

Daily digest market movers: DXY reacts to Fed decision, PPI data

- Federal Open Market Committee (FOMC) dot plot update on Wednesday shows just one rate cut for 2024 as the median outcome, down from the three rate cut expectation last March by Fed Officials.

- This adjusted the market's expectations, which priced in between one or two cuts this year, indicating a longer timeline for potential rate cuts.

- Producer Price Index (PPI) for final demand rose 2.2% on a yearly basis in May, below the market expectation of 2.5%.

- Annual core PPI rose by 2.3%, also below market expectations.

- Weekly Jobless Claims showed 242K in the week ending June 8, higher than initial estimates of 225K and last week's print of 229K.

DXY technical analysis: Bulls maintain control and recover SMAs

Following Wednesday’s session, indicators recovered to stand in positive terrain. The Relative Strength Index (RSI) is now above 50 midline, and the Moving Average Convergence Divergence (MACD) is printing green bars. In addition, the Index is now trending above its 20, 100, and 200-day Simple Moving Averages (SMA). This extends the bullish outlook for the US Dollar, following Wednesday’s sharp decline.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Banxico Governor Rodriguez Ceja attributes Peso volatility to external factors, not solely domestic political issues.

- USD/MXN surged from 16.91 to 18.99 after the June 2 election, with 10-year Mbono yield rising to 10.74%.

- Banxico may deploy a $30 billion hedging program to stabilize markets; USD/MXN currently retreats below 18.80, down 0.87%.

Bank of Mexico (Banxico) Governor Victoria Rodriguez Ceja commented on Wednesday that the central bank has the tools to intervene in the markets and restore market order after the Mexican Peso depreciated more than 9% following the June 2 election.

Banxico is ready to intervene following Peso's 9% depreciation post-election

Rodriguez Ceja said that volatility is mostly attributed to external factors and refrained from expressing that the USD/MXN exchange rate jumped due to Andres Manuel Lopez Obrador’s (AMLO) intentions to push a bill to make a judiciary reform and to reforms to disappear autonomous bodies, which bring certainty to investors.

She said volatility is due to “idiosyncratic factors” and global issues such as the Middle East war and the outlook for US interest rates.

After the elections, the USD/MXN rallied from 16.91 and hit a 14-month high of 18.99 on June 12. Additionally, the yield on the 10-year Mexican Bono (Mbono) jumped from 9.76% to 10.74% amid analysts’ comments on the lack of bids for Mexican debt.

Banxico Governor Rodriguez commented they could turn to a $30 billion hedging program aimed at stabilizing the markets and protecting banks from MXN losses, according to Bloomberg.

USD/MXN Reaction

On Thursday, the USD/MXN so far retreated below 18.80, with the emerging market appreciating some 0.87%. Still, upside risks remain unless the pair drops below the April 19 high of 18.15 after the Peso crashed to a new multi-month low.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Bank of Canada (BoC) Deputy Governor Sharon Kozicki noted on Thursday that the BoC is set to end its quantitative easing program and that future applications of QE will have a very high bar to pass before accessing additional monetary policy mechanisms.

Key highlights

- Unwinding of quantitative easing through quantitative tightening has gone smoothly.

- If inflation continues to ease, it is reasonable to expect further rate cuts. We are taking our interest rate decisions one meeting at a time.

- The bar for us to use QE again is very high.

- The BoC expects to end quantitative tightening at some point in 2025.

Industrial metals prices slide down from the late May highs amid China’s lowering demand, TDS analysts note.

Future Federal Reserve rate cuts can provide a boost for metals

“Industrial metals continue to trade weaker as prices recalibrate from the late May highs. Weaker US data driving interest rates lower can provide a marginal boost, but Chinese growth concerns are the bigger factor.”

“With few signs of physical tightness, and increasing inventory levels across the globe, Copper remains at risk given macro traders have already built an extremely bloated long position. As traders begin to lose patience with the fundamental narrative, we have seen early signs of money managers unwinding their large long positions.”

“With that said, Commodity Trading Advisors (CTAs) remain comfortable with their length, but the margin of safety grows smaller with the first selling trigger now sitting at $9,715/t.”

- GBP/USD snaps three days of gains, drops below 1.2800.

- The pair remains consolidated yet lacks the strength to rally towards the YTD high.

- Momentum favors sellers, but they must push GBP/USD below 1.2700.

The GBP/USD experienced a retreat early in the North American session, down by 0.23%. This was a continuation of a trend, as the major trades below 1.2800 at around 1.2769 were unable to achieve a daily close above 1.2800 for the ninth consecutive trading day.

GBP/USD Price Analysis: Technical outlook

Despite reaching a three-month high, the GBP/USD remains consolidated, with buyers unable to push the exchange rate above the 1.2800 figure to challenge the year-to-date (YTD) high of 1.2894.

Momentum has shifted, and sellers appear to gather traction, yet the Relative Strength Index (RSI) remains in bullish territory but is dropping towards the 50-midline. Once the RSI pierces the latter, that would be the green light to drive the GBP/USD lower.

Key support levels lie ahead, like the latest cycle low of 1.2687, the June 10 low. A breach of the latter will pave the way toward the confluence of the 100-day moving average (DMA) and the May 16 low of 1.2643 before challenging the 50-DMA at 1.2610.

GBP/USD Price Action – Daily Chart

- Silver posts another lower low as it continues its steady decline.

- The 50-day SMA, however, could provide an obstacle to further weakness.

- The RSI momentum indicator is converging bullishly with price.

Silver (XAG/USD) trades almost 2.0% lower on Thursday after the release of US factory-gate inflation data.

The precious metal has broken below $29.04 (June 11 low) and thereby posted a lower low at $28.85, the low of the day.

The sequence of lower lows and lower highs witnessed since the May highs suggests Silver is in a short-term downtrend, which given “the trend is your friend” is expected to extend.

Silver 4-hour Chart

A break below $28.85 (June 13 low) would confirm another lower low, continuing the bearish sequence.

There is a chance Silver could fall to an initial target at $28.21, the 0.618 Fibonacci ratio of the height of the range that unfolded in the second half of May, extrapolated lower. This is the usual method used by technical analysts for establishing targets after breakouts from ranges.

The 50-day Simple Moving Average (SMA) at $28.93, however, could provide a barrier to further downside.

That said, more bearishness could still see Silver reach as low as $27.19, the second target at the 100% extrapolation of the height of the range lower.

The Relative Strength Index (RSI) is showing bullish convergence with price since the June 4 low. Although price has gone on to make progressively lower lows, RSI has not. The non-correlation indicates a lack of bearish momentum and increases the risk of Silver making a pullback or a recovery.

It would take a close above $31.00 to bring the short-term downtrend into doubt. A move above the $31.55 lower high would suggest the possibility of a recovery to the range high at $32.51, and a reversal of the short-term trend too.

The latest Department of Energy (DOE) inventory statistics weighed on the crude Oil markets, but with that said, the energy complex has recovered from the post-OPEC+ sell-off, TD Securities analysts note.

Crude Oil market loses optimism

“The latest DOE inventory statistics, which showed larger inventory builds than expected, have sapped some of the recent optimism out of the crude oil market.”

“The energy complex has recovered nicely from the OPEC+ driven jolt lower. CTAs are now more likely buyers with uptrends reforming, and spreads have also shown major signs of recovery. Indeed, Commodity Trading Advisor (CTAs) may be back on the bid in WTI and Brent crude, if prices can reach north of $78.46/bbl and $82.77/bbl respectively.”

The Federal Reserve (Fed) appeared to have a hawkish tilt, but the details suggest otherwise, analysts at TD Securities suggest.

Most of the Fed officials look to ease later this year

"On the hawkish front the Fed penciled in only one cut for 2024, rather than the two the market was expecting. However, while the dots shifted higher across the 2024-25 policy horizon, the fed funds rate for 2026 sits at the same level that was projected in March when all is said and done (3.125%). The majority of Fed officials is looking for the start of the easing cycle later this year."

"Indeed, the FOMC appears to be only split around the number of cuts in 2024: 7 Fed officials penciled in one cut while 8 penciled in two cuts, the tiebreaker was the 4 Fed officials who are now looking for no cuts this year (up from only 2 in March)."

"Nonetheless, Gold (XAU/USD) markets gave back the early morning CPI gains, and will remain locked in on the data moving forward. On this front, this morning's PPI data also came in below expectations, which is once again providing a boost to the precious metals. With that said, Gold has eroded some margin of safety, with the first selling trigger now standing at $2,227/oz."

- AUD/USD finds cushion near 0.6650 after soft US PPI report for May boosts Fed rate-cut hopes for September.

- The Fed’s dot plot signaled only one rate cut this year.

- Australian Employment data for May beats estimates.

The AUD/USD pair finds support near 0.6650 in Thursday’s New York session. The Aussie asset bounces back as cooling United States consumer and producer inflation has prompted expectations of the Federal Reserve (Fed) to begin reducing interest rates from the September meeting.

The US PPI report for May showed that the monthly headline PPI contracted by 0.2% as gasoline prices slumped and the core reading was stagnant. Also, annual headline and core PPI decelerated to 2.2% and 2.3%, respectively, from their expectations.

The CME FedWatch tool shows that 30-day Fed Funds futures have priced in a 67.7% chance for rate cuts in September, up from 64.7% recorded on Wednesday. The tool also indicates that there will be two rate cuts this year against one projected in the Fed’s dot plot.

On Wednesday, the Fed’s dot plot showed that policymakers have scaled back projections for several rate cuts, one from their anticipated when they last met in March. Fed Chair Jerome Powell welcomed the soft inflation report but clarified that policymakers need more soft CPI reports to gain confidence that inflation is on course to return to the 2% target.

Meanwhile, market sentiment is positive regarding firm speculation about Fed rate cuts. The S&P 500 has opened slightly bullish. 10-year US Treasury yields have declined to 4.28%.

In Australia, stronger-than-expected Employment data for May has improved speculation that the Reserve Bank of Australia (RBA) will keep its Official Cash Rate (OCR) at its current levels for the entire year. In May, Australian employers hired 39.7K job-seekers, beating estimates of 30K and the prior release of 37.4K, downwardly revised from 38.5k. The Unemployment Rate declined to 4.0%, as expected, from 4.1% in April.

As expected, the Federal Reserve (Fed) kept monetary policy on hold again in its June meeting, reiterating that it will take longer to gain confidence that inflation is on its way back to 2%, says Rogier Quaedvlieg, Senior Economist at ABN AMRO.

Median number of cuts is reduced to a single one for 2024 in June

“The policy statement contained a minimal change, revising the ‘lack of further progress' on inflation to ‘modest progress (…),' following April PCE and May CPI inflation releases. A stronger revision was seen in the dot plot, which reduced the median number of cuts from three in March to a single one in June.”

“This meeting also saw the release of updated economic projections. Headline and core PCE inflation forecasts for 2024 rose to 2.8% for 2024, from 2.6% in March, and to 2.3% in 2025, from 2.2% in March. Median growth forecasts remain unchanged, while the unemployment rate in 2025 and 2026 was raised by 0.1 pp.”

“In the press conference, Fed's Chair Jerome Powell generally struck a more balanced tone compared to the relatively doveish performance in May. He reiterated the need for confidence that inflation will come down to 2%. Reflecting on inflation readings of this year, he noted that one has to be careful not to dismiss inflation readings one doesn't like, referring to the high readings in the first quarter.”

The US Dollar (USD) dropped a bit following the release of the softer-than-expected US CPI inflation report on Wednesday. At the same time, the report made the Japanese Yen (JPY) stronger against the USD for a short period of time, Rabobank analysts note.

Market sees little scope for a hawkish surprise from the BoJ