- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 13-02-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 04:30 | Japan | Tertiary Industry Index | December | 1.3% | |

| 07:00 | Germany | GDP (QoQ) | Quarter IV | 0.1% | 0.1% |

| 07:00 | Germany | GDP (YoY) | Quarter IV | 0.5% | 0.4% |

| 07:30 | Switzerland | Producer & Import Prices, y/y | January | -1.7% | |

| 10:00 | Eurozone | Employment Change | Quarter IV | 0.1% | 0.1% |

| 10:00 | Eurozone | Trade balance unadjusted | December | 20.7 | 21.4 |

| 10:00 | Eurozone | GDP (QoQ) | Quarter IV | 0.3% | 0.1% |

| 10:00 | Eurozone | GDP (YoY) | Quarter IV | 1.2% | 1% |

| 13:30 | U.S. | Import Price Index | January | 0.3% | -0.2% |

| 13:30 | U.S. | Retail Sales YoY | January | 5.8% | |

| 13:30 | U.S. | Retail sales excluding auto | January | 0.7% | 0.3% |

| 13:30 | U.S. | Retail sales | January | 0.3% | 0.3% |

| 14:15 | U.S. | Capacity Utilization | January | 77% | 76.8% |

| 14:15 | U.S. | Industrial Production YoY | January | -1% | |

| 14:15 | U.S. | Industrial Production (MoM) | January | -0.3% | -0.2% |

| 15:00 | U.S. | Reuters/Michigan Consumer Sentiment Index | February | 99.8 | 99.5 |

| 15:00 | U.S. | Business inventories | December | -0.2% | 0.1% |

| 16:45 | U.S. | FOMC Member Mester Speaks | |||

| 18:00 | U.S. | Baker Hughes Oil Rig Count | February | 676 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 04:30 | Japan | Tertiary Industry Index | December | 1.3% | |

| 07:00 | Germany | GDP (QoQ) | Quarter IV | 0.1% | 0.1% |

| 07:00 | Germany | GDP (YoY) | Quarter IV | 0.5% | 0.4% |

| 07:30 | Switzerland | Producer & Import Prices, y/y | January | -1.7% | |

| 10:00 | Eurozone | Employment Change | Quarter IV | 0.1% | 0.1% |

| 10:00 | Eurozone | Trade balance unadjusted | December | 20.7 | 21.4 |

| 10:00 | Eurozone | GDP (QoQ) | Quarter IV | 0.3% | 0.1% |

| 10:00 | Eurozone | GDP (YoY) | Quarter IV | 1.2% | 1% |

| 13:30 | U.S. | Import Price Index | January | 0.3% | -0.2% |

| 13:30 | U.S. | Retail Sales YoY | January | 5.8% | |

| 13:30 | U.S. | Retail sales excluding auto | January | 0.7% | 0.3% |

| 13:30 | U.S. | Retail sales | January | 0.3% | 0.3% |

| 14:15 | U.S. | Capacity Utilization | January | 77% | 76.8% |

| 14:15 | U.S. | Industrial Production YoY | January | -1% | |

| 14:15 | U.S. | Industrial Production (MoM) | January | -0.3% | -0.2% |

| 15:00 | U.S. | Reuters/Michigan Consumer Sentiment Index | February | 99.8 | 99.5 |

| 15:00 | U.S. | Business inventories | December | -0.2% | 0.1% |

| 16:45 | U.S. | FOMC Member Mester Speaks | |||

| 18:00 | U.S. | Baker Hughes Oil Rig Count | February | 676 |

According to ActionForex, analysts at TD Bank Financial Group note that U.S. consumer prices rose only 0.1% on the month in January, one tick lower than market expectations, and a deceleration from the 0.2% increase in December. Still, inflation ticked up to 2.5% on a year-on-year (y/y) basis, up from 2.3% in December.

"The energy index fell 0.7% (m/m) in January, driven lower by a 1.6% drop in gasoline prices. Despite January’s decline, energy prices have been a key inflationary force over the past year with prices up 6.2% versus a year ago."

"Food inflation continues to be subdued. The food index increased 0.2% in January, and on a y/y basis was up 1.7%."

"Core prices rose 0.2% (m/m), a tick up from December’s soft 0.1% increase, and in line with market expectations. The core inflation rate versus a year ago remained steady at 2.3% in January."

"Prices also rose for shelter (+0.4% m/m), medical care (+0.2% m/m), apparel (+0.7% m/m), recreation (+0.3% m/m), education (+0.3% m/m) and airline fares (+0.7% m/m)."

"There are some interesting trends beneath the surface on inflation, but from a high level January’s data indicated that overall inflation pressures remain well contained. Core CPI inflation of just above 2% implies core PCE inflation of roughly 2%, pretty close to the Fed’s desired level. The uptick in core inflation pressures is more reassuring that inflation pressures aren’t cooling further, than a warning of an imminent break out in price pressures."

"This should give the Fed reassurance as they wait and assess the impact of past rate cuts and the risks to global economic growth from the novel coronavirus outbreak in China."

Julien Manceaux, ING’s Senior Economist for France, notes that the country's unemployment rate declined in the fourth quarter, to 8.1% from 8.5%.

"In metropolitan France, unemployment fell to 7.9% from 8.2%. Unemployment reached 8.5% on average in 2019, its lowest level since 2008. Most categories of the unemployed population declined last year, which was unique for the last decade: figures show a fall of 121k in the unemployed population (which now stands at just under 3.3 million, down from nearly 3.5 million in February 2016). Half of the decline since 2016 has occurred over the last five quarters and the trend is slowly accelerating; in December, the unemployed population fell at the fastest rate since 2008 (-3.5% over the year) and this is only for full-time unemployment. Other categories - such as the 2.2 million people employed on very short-term contracts or working only a few days a month - recorded the first decline in unemployment last year since 2008, indicating that the labour market recovery is deepening. Unemployment among 50+ workers even dropped to 5.8% at the end of 2019."

"In 2020, we expect the positive trend in the labour market to continue in the first half of the year and support domestic demand. Nevertheless, 2020 is still expected to end with a slightly higher unemployment rate, close to 8.5% (8.2% for Metropolitan France). President Macron's commitment was to reduce it to 7% in 2022. While we expect the unemployment rate to continue declining in the first half of 2020, the slowdown in eurozone activity and the relative weakness of private consumption in France should cap these improvements in the second half of the year before giving way to further improvements in 2021. It is still too soon to say that the 7% target of 2022 is out of reach, but to do so, the recovery would need to be stronger than expected from next year on."

U.S. stock-index futures fell on Thursday, as a reported spike in coronavirus cases raised concerns over the virus' impact on the economic activity and sent investors scurrying to safe-haven assets.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 23,827.73 | -33.48 | -0.14% |

| Hang Seng | 27,730.00 | -93.66 | -0.34% |

| Shanghai | 2,906.07 | -20.83 | -0.71% |

| S&P/ASX | 7,103.20 | +15.00 | +0.21% |

| FTSE | 7,416.72 | -117.65 | -1.56% |

| CAC | 6,059.33 | -45.40 | -0.74% |

| DAX | 13,691.14 | -58.64 | -0.43% |

| Crude oil | $51.42 | | +0.49% |

| Gold | $1,577.00 | | +0.34% |

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 161.7 | -0.63(-0.39%) | 6661 |

| ALCOA INC. | AA | 15.54 | -0.22(-1.40%) | 5644 |

| ALTRIA GROUP INC. | MO | 45.18 | -0.22(-0.48%) | 3147 |

| Amazon.com Inc., NASDAQ | AMZN | 2,144.85 | -15.15(-0.70%) | 59576 |

| AMERICAN INTERNATIONAL GROUP | AIG | 55.4 | 1.12(2.06%) | 11670 |

| Apple Inc. | AAPL | 323.95 | -3.25(-0.99%) | 546125 |

| AT&T Inc | T | 37.95 | -0.09(-0.24%) | 25807 |

| Boeing Co | BA | 344.2 | -1.20(-0.35%) | 33783 |

| Caterpillar Inc | CAT | 140.08 | 0.49(0.35%) | 29693 |

| Chevron Corp | CVX | 111.42 | -0.62(-0.55%) | 10189 |

| Cisco Systems Inc | CSCO | 47.27 | -2.66(-5.33%) | 225558 |

| Citigroup Inc., NYSE | C | 78.85 | -0.48(-0.61%) | 7390 |

| E. I. du Pont de Nemours and Co | DD | 53 | -0.55(-1.03%) | 1018 |

| Exxon Mobil Corp | XOM | 60.86 | -0.41(-0.67%) | 32498 |

| Facebook, Inc. | FB | 209.45 | -1.31(-0.62%) | 58307 |

| FedEx Corporation, NYSE | FDX | 156.75 | -1.76(-1.11%) | 839 |

| Ford Motor Co. | F | 8.2 | -0.04(-0.49%) | 113288 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.58 | -0.09(-0.71%) | 69575 |

| General Electric Co | GE | 13.1 | -0.06(-0.46%) | 143902 |

| General Motors Company, NYSE | GM | 35.15 | -0.34(-0.96%) | 12514 |

| Goldman Sachs | GS | 238.52 | -0.13(-0.06%) | 3787 |

| Google Inc. | GOOG | 1,510.00 | -8.27(-0.54%) | 6809 |

| Hewlett-Packard Co. | HPQ | 22.28 | -0.20(-0.89%) | 2844 |

| Home Depot Inc | HD | 240 | -1.59(-0.66%) | 914 |

| Intel Corp | INTC | 67.01 | -0.45(-0.67%) | 73657 |

| International Business Machines Co... | IBM | 154.5 | -0.81(-0.52%) | 4272 |

| International Paper Company | IP | 44 | -0.50(-1.12%) | 338 |

| Johnson & Johnson | JNJ | 150.25 | -0.84(-0.56%) | 2933 |

| JPMorgan Chase and Co | JPM | 137.11 | -0.89(-0.64%) | 9991 |

| McDonald's Corp | MCD | 216.74 | -0.72(-0.33%) | 1342 |

| Merck & Co Inc | MRK | 82.99 | -0.26(-0.31%) | 23933 |

| Microsoft Corp | MSFT | 183.49 | -1.22(-0.66%) | 246432 |

| Nike | NKE | 102.29 | -0.71(-0.69%) | 11240 |

| Pfizer Inc | PFE | 37.69 | -0.05(-0.13%) | 11908 |

| Procter & Gamble Co | PG | 123.35 | -0.10(-0.08%) | 2055 |

| Starbucks Corporation, NASDAQ | SBUX | 88.1 | -0.47(-0.53%) | 22957 |

| Tesla Motors, Inc., NASDAQ | TSLA | 735.82 | -31.47(-4.10%) | 718850 |

| The Coca-Cola Co | KO | 59.28 | -0.13(-0.22%) | 11661 |

| Travelers Companies Inc | TRV | 135.21 | -0.50(-0.37%) | 363 |

| Twitter, Inc., NYSE | TWTR | 36.49 | -0.30(-0.82%) | 71415 |

| UnitedHealth Group Inc | UNH | 300 | -3.48(-1.15%) | 2189 |

| Verizon Communications Inc | VZ | 58.24 | 0.01(0.02%) | 5545 |

| Visa | V | 206.32 | -0.82(-0.40%) | 20537 |

| Wal-Mart Stores Inc | WMT | 115.59 | -0.26(-0.22%) | 4503 |

| Walt Disney Co | DIS | 141 | -0.85(-0.60%) | 18610 |

| Yandex N.V., NASDAQ | YNDX | 48.2 | -0.35(-0.72%) | 5197 |

The data from the Labor Department revealed on Thursday the number of applications for unemployment benefits rose slightly last week, indicating the labor market remains strong.

According to the report, the initial claims for unemployment benefits increased by 2,000 to a seasonally adjusted 205,000 for the week ended February 8.

Economists had expected 210,000 new claims last week.

Claims for the prior week were revised upwardly to 203,000 from the initial estimate of 202,000.

Meanwhile, the four-week moving average of claims remained unchanged at 212,000 last week.

Caterpillar (CAT) upgraded to Buy from Neutral at Goldman; target raised to $168

The Labor Department announced on Thursday the U.S. consumer price index (CPI) edged up 0.1 percent m-o-m in January 2020 after an unrevised 0.2 percent m-o-m gain in the previous month.

Over the last 12 months, the CPI climbed 2.5 percent y-o-y last month, following an unrevised 2.3 percent m-o-m jump in the 12 months through December 2019. That was the highest annual inflation since October 2018.

Economists had forecast the CPI to increase 0.2 percent m-o-m and 2.4 percent y-o-y in the 12-month period.

According to the report, the index for shelter (+0.4 percent m-o-m) accounted for the largest part of the January gain in the seasonally adjusted all items index, with the indexes for food (+0.2 percent m-o-m) and for medical care services (+0.3 percent m-o-m) also rising. These advances more than offset a decrease in the gasoline index (-1.6 percent m-o-m).

Meanwhile, the core CPI excluding volatile food and fuel costs rose 0.2 percent m-o-m in January, following a 0.1 percent m-o-m advance in the previous month.

In the 12 months through January, the core CPI surged 2.3 percent, the same pace as in the 12 months ending December.

Economists had forecast the core CPI to rise 0.2 percent m-o-m and 2.2 percent y-o-y last month.

FXStreet reports that analysts at TD Securities (TDS) offered a brief preview of Thursday's important US macro data – the latest consumer inflation figures for January.

“The Jan CPI report will lead the data calendar in the US on Thursday. Headline CPI was probably held down by a decline in gasoline prices; our 0.1% forecast is below the 0.2% consensus. Even so, the 12-month change probably rose 0.1 points to 2.4%. In contrast, we expect the 12-month change in core prices to fall 0.1 points to 2.2%, even with a 0.2% m/m rise, although it is a close call between 2.2% and 2.3%. Net net, the trend still looks tame.”

“Global rates see a strong rally as markets continue to sift through the potential fallout from COVID-19. If CPI overshoots, markets are likely to look past the print for the most part as the Fed has indicated they are comfortable letting CPI run on the hotter side — but a downside surprise could trigger a decent rally in fixed income markets.”

“Separately, we expect initial jobless claims to print a steady 215k for the week of Feb 8, near the 4-week trend and somewhat above consensus expectations (210k). Also of note, the Shelton and Waller Fed nomination hearings will commence in the Senate at 10am.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 07:00 | Germany | CPI, y/y | January | 1.5% | 1.7% | 1.7% |

| 07:00 | Germany | CPI, m/m | January | 0.5% | -0.6% | -0.6% |

| 10:00 | Eurozone | EU Economic Forecasts |

GBP rose against most other major currencies in the European session on Thursday, following media reports that Sajid Javid had resigned as the head of the UK’s finance ministry as Prime Minister Boris Johnson began reshaping his cabinet.

According to the reports, Javid was offered the chance to remain the UK's top finance official on the condition that he fires all of his advisors. But he said no and opted to resign himself.

The decision was a surprise for the markets as it came just a few weeks before Javid was due to present Britain’s budget in March. At the same time, it raised hopes that his replacement would pave the way for a more expansionary budget next month.

Rishi Sunak is being reported to replace Javid.

Sajid Javid has served as UK Chancellor of the Exchequer since July 2019, when Boris Johnson was first appointed prime minister

Alibaba (BABA) reported Q3 FY 2020 earnings of RMB18.19 per share (versus RMB12.19 per share in Q3 FY 2019), beating analysts' consensus estimate of RMB15.70 per share.

The company's quarterly revenues amounted to RMB161.456 bln (+37.7% y/y), beating analysts' consensus estimate of RMB156.002 bln.

BABA rose to $224.59 (+0.12%) in pre-market trading.

Applied Materials (AMAT) reported Q1 FY 2020 earnings of $0.98 per share (versus $0.81 per share in Q1 FY 2019), beating analysts' consensus estimate of $0.93 per share.

The company's quarterly revenues amounted to $4.162 bln (+10.9% y/y), beating analysts' consensus estimate of $4.113 bln.

The company also issued upside guidance for Q2 FY 2020, projecting EPS of $0.98-1.10 versus analysts' consensus estimate of $0.92 and revenues of $4.14-4.54 bln versus analysts' consensus estimate of $4.06 bln.

AMAT rose to $66.80 (+2.19%) in pre-market trading.

FXStreet reports that in the opinion of FX Strategists at UOB Group, USD/CNH is expected to remain side-lined for the time being.

24-hour view: “We highlighted yesterday that “further USD weakness is not ruled out” but added, “a breach of 6.9500 would come as a surprise”. USD subsequently dropped to 6.9575 before rebounding quickly. Downward pressure has more or less dissipated and the current movement is viewed as part of a consolidation phase. In other words, USD is expected to trade sideways for today, likely between 6.9650 and 6.9980.”

Next 1-3 weeks: “USD traded in a relatively choppy manner over the past few days as it gave up most of its gains from late last week over the past couple of days. For now, we continue to hold the same form last Thursday (06 Feb, spot at 6.9780) wherein USD is expected to trade within a broad 6.9500/7.0230 range.”

Cisco (CSCO) reported Q2 FY 2020 earnings of $0.77 per share (versus $0.73 per share in Q2 FY 2019), beating analysts' consensus estimate of $0.76 per share.

The company's quarterly revenues amounted to $12.000 bln (-3.6% y/y), roughly in line with analysts' consensus estimate of $11.982 bln.

The company also issues in-line guidance for Q3 FY 2020, projecting EPS of $0.79-0.81 versus analysts' consensus estimate of $0.80 and revenues of decline 1.5-3.5% y/y to $12.50-12.76 bln versus analysts' consensus estimate of $12.62 bln.

CSCO fell to $47.50 (-4.87%) in pre-market trading.

FXStreet reports that Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, noted occasional bullish attempts in Cable are expected to meet initial hurdle in the 1.3060 region.

“GBP/USD is seeing a mild recovery from 1.2872 and it is possible that this was the end of an ‘a-b-c’ correction. Rallies will find initial resistance at the 55 day ma at 1.3059 and the near term resistance line at 1.3129 and will need to regain this to alleviate downside pressure. Failure at 1.2872 (recent low) would put the 55 week ma at 1.2799 and the 200 day moving average at 1.2690 back on the plate.”

FXStreet reports that FX Strategists at UOB Group believe USD/JPY could still attempt a test of the 110.30 region in the next weeks.

24-hour view: "Instead of trading sideways, USD popped to a high of 110.13 before easing off. For today, last month's peak at 110.28 is unlikely to come into the picture. USD could ease from here but nay weakness is likely limited to 109.65. Resistance is at 110.10 followed by 110.30."

Next 1-3 weeks: "USD edged above 110.00 yesterday and touched 110.13. While upward momentum has not improved by much, the firm underlying tone suggests USD could edge upwards and test the top of our expected 109.20/110.30 sideway-trading range (narrowed from 109.00/110.30). As highlighted on Tuesday (11 Feb, spot at 109.75), the top of the range at 110.30 appears to be more vulnerable but USD has to register a NY closing above this level or the next resistance at 110.65 is unlikely to come into the picture. Overall, the current mild upward pressure could improve further as long as USD does not move below the bottom of the expected range at 109.30."

FXStreet reports that in the view of the analysts at Westpac, the near-term volatility in commodities, in light of the China coronavirus outbreak, will be replaced by medium-term fundamentals by end 2020.

"The coronavirus is having a mixed impact on commodities. Mostly it is downwards, with falling crude oil and iron ore prices. Chinese mining production has also been impacted, leading to rising coal prices.

These price movements will reverse as the disease is contained and Chinese activity returns to normal. Beyond that, while the government's policy response to the slowdown presents upside risk, we still expect iron ore and coal prices to soften into end 2020 as supply conditions improve.

China dominates commodity demand in the 21st century, altering the way commodity markets behave. But this shift has had other dimensions - changing supply arrangements (China is also a major producer of many commodities) and the introduction of new pricing arrangements (there was no spot iron ore market in 2003) making direct comparisons to the SARS event of 2003 difficult.

Commodity prices should hold around current levels until Chinese activity and demand recovers heading into the second half. There is still, however, a high degree of uncertainty surrounding near term supply and demand conditions."

-

Raises German GDP forecast to 1.1% for 2020, 2021 (previously 1.0%)

-

Cuts French 2020 GDP forecast to 1.1% (previously 1.3%), keeps 2021 forecast at 1.2%

-

The European economy continued to weather external headwinds in the second half of 2019 thanks to the strength of domestic drivers.

-

Growth in the euro area turned out better than expected in the third

-

quarter but disappointed at the end of the year.

-

Leading indicators suggest that manufacturing output may stabilise in the months to come, although an upturn is not yet on the cards.

-

However, with hints of a bottoming out in global trade flows, and as the dampening impact of domestic inventory adjustment fades, a trough may have been reached.

-

With continued real income gains, a supportive policy mix and a construction sector buoyed by low borrowing costs, the European economy is well placed to navigate the challenging external environment, high trade policy uncertainty and dampening structural factors.

-

This is, however, a fragile equilibrium, which could be easily derailed by unforeseen events.

-

Overall, the European economy remains on a path of steady and moderate growth.

-

Over the next two years, annual GDP growth in the euro area is expected to settle at 1.2%, the same as in 2019.

-

The outlook for 2020 and 2021 is unchanged since the autumn, as more positive developments are counterbalanced by negative events elsewhere.

-

On the back of supportive monetary policy, slightly higher oil price assumptions and some upward momentum in underlying price pressures, euro area headline inflation has been revised slightly upwards, to 1.3% in 2020 and 1.4% in 2021.

FXStreet reports that further upside in NZD/USD should be seen as corrective and unlikely to challenge the resistance at 0.6525, according to FX Strategists at UOB Group.

24-hour view: "The rapid and outsized surge in NZD that hit a high of 0.6487 is running ahead of itself. Severely overbought conditions suggest further NZD strength is unlikely. For today, NZD is more likely to consolidate, expected to be between 0.6415 and 0.6465."

Next 1-3 weeks: "The weak phase in NZD that started in late January ended abruptly as NZD just surged above the 'strong resistance' level of 0.6640 at the time of writing. The low of 0.6378 from yesterday (11 Feb) is deemed as a short-term bottom and NZD is likely to trade above this level, at least for a week or so. That said, any advance is viewed as a correction for now and a break of the solid resistance level at 0.6525 is unlikely (on a shorter-term note, 0.6500 is already strong level)."

FXStreet reports that the downside momentum in Cable appears to have lost traction, noted FX Strategists at UOB Group.

24-hour view: "We expected GBP to 'edge higher and test the strong 1.2980 resistance'. GBP subsequently touched 1.2991 before easing off. The mild upward pressure has eased and for today, the bias is tilted to the downside. That said, any weakness is likely limited to a test of 1.2910 (a sustained decline below this level appears unlikely). Resistance is at 1.2975 followed by 1.2990."

Next 1-3 weeks: "We cautioned yesterday (12 Feb, spot at 1.2955) that 'rapid loss in downward momentum has decreased the risk of a break of 1.2850'. GBP subsequently breached the 'strong resistance' level of 1.2980 (high of 1.2991) and downward pressure has more or less dissipated. From here, GBP is expected to trade sideways between the two strong levels of 1.2850 and 1.3060. This sideway-trading phase could last for up to a week but looking forward, the prospect for a break of 1.2850 first is higher than a break of 1.3060."

-

Global oil demand has been hit hard by the novel coronavirus (Covid-19) and the widespread shutdown of China's economy.

-

Demand is now expected to fall by 435 kb/d y-o-y in 1Q20, the first quarterly contraction in more than 10 years.

-

We have cut our 2020 growth forecast by 365 kb/d to 825 kb/d, the lowest since 2011.

-

Lower-than-expected consumption in the OECD trimmed 2019 growth to 885 kb/d.

-

The coronavirus outbreak has also led us to revise down the outlook for global refinery runs.

-

Chinese crude throughputs for 1Q20 have been cut by 1.1 mb/d and are now expected to contract by 0.5 mb/d year-on-year. As a result, global runs are forecast to expand by just 0.7 mb/d in 2020.

-

Global oil supply slumped by 0.8 mb/d in January to 100.5 mb/d.

-

A blockade in Libya slashed production and the UAE saw output fall by 0.3 mb/d.

-

World oil output was largely unchanged on a year ago as lower supply from OPEC was offset by a 2.1 mb/d increase in non-OPEC production.

-

The call on OPEC crude plunges to 27.2 mb/d in 1Q20, which is 1.7 mb/d below the group's January production of 28.86 mb/d.

-

OECD industry stocks held largely steady in December at 2 915 mb as a build in product inventories more than offset lower crude holdings. Total oil stocks stood 26.4 mb above the five-year average and covered 61 days of forward demand.

-

Preliminary data for January show inventories building in the US and Japan while falling in Europe.

According to the January 2020 RICS UK Residential Market Survey, renewed optimism from buyers and sellers saw a continued pick-up in sales activity across the UK housing market, with both the number of agreed sales and new homes being listed for sale improving over the month.

At the national level, the number of homes being listed for sale increased in January, as a net balance +19% of respondents reported a rise, up from +11% in December. In addition to the increase in homes being put up for sale, January saw an increase in the number of people looking to buy as new buyer enquiries rose to a net balance of +23% from +19% in December. As well as this, agreed sales rose for a second month in a row (a net balance of +21%).

Looking ahead, respondents to the survey expect this refreshed optimism to continue with sales anticipated to rise across all UK regions, both in the near term and for the year to come.

Simon Rubinsohn, RICS Chief Economist, said: "The latest survey results point to a continued improvement in market sentiment over the month, building on a noticeable pick-up in the immediate aftermath of the General Election. The rise in new sales instructions coming onto the market is a noteworthy and much needed development, given the lack of fresh listings over the past few years had pushed stock levels to record lows. It remains to be seen how long this newfound market momentum is sustained for, and political uncertainty may resurface towards the end of the year. But, at this point in time, contributors are optimistic regarding the outlook for activity over the next twelve months."

FXStreet reports that the pair's upside momentum could still extend to the 0.9840 region, suggested Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank.

"USD/CHF is struggling to maintain a break of the 55 day ma and recently charted a key day reversal. This suggests that this may be an 'a-b-c' correction after all. It is not clear - intraday Elliot wave counts are positive. Failure at current levels would place the market back in the range and re-target the .9613 January low and the September 2018 low at .9543."

"We are unable to rule out scope for near term strength to extend to .9841/44, the September and October lows and the 200 day ma at .9967.

FXStreet reports that in opinion of Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, the pair's decline is expected to face a solid support in the 1.0879/1.0763 band.

"EUR/USD remains under pressure and has eroded the October low at 1.0879. This, together with the 1.0814/78.6% retracement and the 1.0763 2000-2020 uptrend, represent a major band of support, that we look to hold."

"Intraday rallies are likely to halt around 1.0910/40."

"Resistance can now be seen between the November and January lows at 1.0981/92."

FXStreet reports that analysts at Westpac cited the Australian dollar's historical performances and key catalysts to justify its status as a global risk barometer. The report also anticipates the Aussie to recover during 2020 and 2021.

"After reaching a peak just above USD0.70 at the turn of the year, the weight of the world has come to bear on the Australian dollar. Currently, the pair sits at USD0.67, but this follows a number of days when the currency traded below that mark in early February as coronavirus concerns peaked.

Equity markets have, to date, brushed off this real economy shock, showing little concern for the potential cost to future profits, or perhaps simply expressing a belief that central banks will act to offset any downside.

The sustained move in commodities, however, franks the economic significance of the coronavirus.

The other key variable that determines the fair value for the Australian dollar is the interest rate differential between Australia and the US.

Our timing for the RBA meanwhile has them lowering rates in April (ahead of the US) and then again in August, down to 0.25%.

Our forecast for the Australian dollar to only rise a cent from June 2020 to December 2020 could be regarded as evidence that this is a benign risk. However, this forecast necessitates that the RBA provides additional stimulus as it moves to unconventional measures.

Looking forward to 2021, a combination of a benign global outlook and a sense of stability in commodity markets should aid the Australian dollar back above USD0.70.

The further we move into that year, the more monetary policy will have been seen to be effective, as Australian GDP growth tends back to trend on broad-based gains across household demand and business investment. A peak of USD0.72 is seen at the end of 2021".

eFXdata reports that Citi maintains a long AUD/NZD position after the hawkish RBNZ's stance at this week policy meeting.

"The RBNZ left is policy rate unchanged at 1.0% today as broadly expected. It was also largely in line with our expectation for today's meeting, but the overall massage was more hawkish than we thought," Citi notes.

"The optimism will likely be priced in at first, which we suspect could be followed by disappointments.

"As we indicated in "AUDNZD Long", we are more bullish on AUD compared to NZD, supposing bad news in Australia has been priced in already partly because of the bushfires which have forced the markets to discount pessimism. This view hasn't changed even after today's RBNZ and subsequent drop in AUDNZD," Citi adds.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:00 | Australia | Consumer Inflation Expectation | February | 4.7% | 4.3% | 4% |

| 00:15 | Australia | RBA's Governor Philip Lowe Speaks | ||||

| 00:15 | Canada | BOC Gov Stephen Poloz Speaks | ||||

| 07:00 | Germany | CPI, y/y | January | 1.5% | 1.7% | 1.7% |

| 07:00 | Germany | CPI, m/m | January | 0.5% | -0.6% | -0.6% |

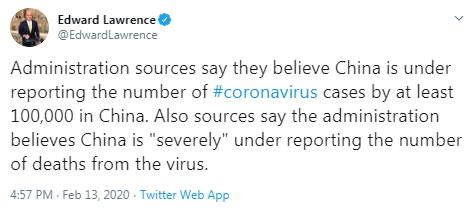

During today's Asian trading, the US dollar has changed slightly against the euro and declined against the yen amid growing demand for safe haven assets due to increased worries about the spread of a new coronavirus.

The ICE Dollar index, which shows the value of the US dollar against six major world currencies, fell by 0.08%.

In the Chinese province of Hubei, the epicenter of the spread of a new type of coronavirus, 242 cases of death from pneumonia caused by the infection were registered over the past day, and 14,840 new cases of infection, local medical authorities said.

In the administrative center of the province, the city of Wuhan, where the coronavirus began spreading in December last year, 216 people died, and 13,436 new patients were identified.

The data for the past day is very different from the data as of last Tuesday. On Tuesday, 94 people died in the province as a result of infection with the coronavirus, and the number of newly infected people was 1,638.

The provincial health Committee explains the sharp jump in the number of new cases and deaths with a new method of diagnosis.

The US Federal reserve will monitor economic data to assess the impact of the coronavirus, Federal reserve Chairman Jerome Powell said during a hearing before the Senate banking Committee on Wednesday. However, he expects that the impact of the disease will affect the statistical data in the near future.

Speaking to the House financial services Committee a day earlier, Powell said the spread of the coronavirus would have consequences for the Chinese economy in the first quarter of 2020 and possibly for the American economy. According to him, it is too early to draw conclusions about whether the epidemic will lead to sustainable and significant changes in the US economy.

According to the report from Federal Statistical Office (Destatis), the inflation rate in Germany, measured as the year-on-year change in the consumer price index, stood at 1.7% in January 2020. Destatis also reports that consumer prices decreased by 0.6% compared with December 2019.

The prices of goods (total) were up 2.0% in January 2020 from January 2019. There was a price increase especially for energy products (+3.4%) after their prices had fallen slightly in December 2019 (-0.1%). In January 2020, higher prices than a year earlier were recorded in particular for motor fuels (+5.2%) and electricity (+3.9%). The rise in food prices was also above average (+2.3%). Markedly higher prices were observed for meat (+6.2%) and fruit (+6.0%). As regards goods, there were considerable price rises also for newspapers and periodicals (+5.3%) and tobacco products (+4.4%).

Excluding energy prices, the rate of inflation would have been 1.5% in January 2020.

The prices of services (total) increased by 1.5% in January 2020 on January 2019. Higher prices for the services of car repair shops (+4.7%) and social facilities (+4.3%) should be mentioned here. Net rents exclusive of heating expenses, which are important as they account for large part of household final consumption expenditure, rose by 1.4%.

Compared with December 2019, the consumer price index fell by 0.6% in January 2020. This was due to seasonal price decreases for package holidays (-28.7%), clothing (-6.3%) and footwear (-4.0%) and to the fact that there has been a lower value added tax rate for long-distance rail tickets since 1 January 2020, which reduced the prices of long-distance train journeys by 10%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1013 (3334)

$1.0974 (1005)

$1.0943 (358)

Price at time of writing this review: $1.0870

Support levels (open interest**, contracts):

$1.0846 (3092)

$1.0818 (2766)

$1.0782 (1917)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 6 is 99443 contracts (according to data from February, 12) with the maximum number of contracts with strike price $1,1200 (6368);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3056 (2101)

$1.3030 (787)

$1.3010 (365)

Price at time of writing this review: $1.2949

Support levels (open interest**, contracts):

$1.2914 (1329)

$1.2890 (2061)

$1.2860 (2980)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 25957 contracts, with the maximum number of contracts with strike price $1,3050 (3841);

- Overall open interest on the PUT options with the expiration date March, 6 is 27792 contracts, with the maximum number of contracts with strike price $1,2800 (3661);

- The ratio of PUT/CALL was 1.07 versus 1.05 from the previous trading day according to data from February, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 56.14 | 3.71 |

| WTI | 51.58 | 3.41 |

| Silver | 17.45 | -0.96 |

| Gold | 1565.572 | -0.13 |

| Palladium | 2391.5 | 2.24 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 175.23 | 23861.21 | 0.74 |

| Hang Seng | 239.78 | 27823.66 | 0.87 |

| KOSPI | 15.26 | 2238.38 | 0.69 |

| ASX 200 | 32.9 | 7088.2 | 0.47 |

| FTSE 100 | 34.93 | 7534.37 | 0.47 |

| DAX | 121.94 | 13749.78 | 0.89 |

| CAC 40 | 49.97 | 6104.73 | 0.83 |

| Dow Jones | 275.08 | 29551.42 | 0.94 |

| S&P 500 | 21.7 | 3379.45 | 0.65 |

| NASDAQ Composite | 87.02 | 9725.96 | 0.9 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67362 | 0.35 |

| EURJPY | 119.696 | -0.12 |

| EURUSD | 1.08709 | -0.41 |

| GBPJPY | 142.649 | 0.31 |

| GBPUSD | 1.29557 | 0.02 |

| NZDUSD | 0.64618 | 0.94 |

| USDCAD | 1.32541 | -0.24 |

| USDCHF | 0.9783 | 0.27 |

| USDJPY | 110.102 | 0.3 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.