- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 11-12-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 | Australia | Consumer Inflation Expectation | December | 4% | 3.5% |

| 00:30 | Australia | RBA Bulletin | |||

| 06:45 | Switzerland | SECO Economic Forecasts | |||

| 07:00 | Germany | CPI, m/m | November | 0.1% | -0.8% |

| 07:00 | Germany | CPI, y/y | November | 1.1% | 1.1% |

| 07:30 | Switzerland | Producer & Import Prices, y/y | November | -2.4% | -2.2% |

| 07:45 | France | CPI, y/y | November | 0.8% | 1.0% |

| 07:45 | France | CPI, m/m | November | 0% | 0.1% |

| 08:30 | Switzerland | SNB Press Conference | |||

| 08:30 | Switzerland | SNB Interest Rate Decision | -0.75% | -0.75% | |

| 10:00 | Eurozone | Industrial Production (YoY) | October | -1.7% | -2.3% |

| 10:00 | Eurozone | Industrial production, (MoM) | October | 0.1% | -0.5% |

| 12:45 | Eurozone | ECB Interest Rate Decision | 0% | 0% | |

| 13:30 | U.S. | Continuing Jobless Claims | 1693 | 1678 | |

| 13:30 | Canada | New Housing Price Index, YoY | October | -0.1% | |

| 13:30 | Canada | New Housing Price Index, MoM | October | 0.2% | |

| 13:30 | U.S. | Initial Jobless Claims | 203 | 213 | |

| 13:30 | U.S. | PPI excluding food and energy, m/m | November | 0.3% | 0.2% |

| 13:30 | U.S. | PPI excluding food and energy, Y/Y | November | 1.6% | 1.6% |

| 13:30 | U.S. | PPI, y/y | November | 1.1% | 1.2% |

| 13:30 | U.S. | PPI, m/m | November | 0.4% | 0.2% |

| 13:30 | Eurozone | ECB Press Conference | |||

| 17:30 | Canada | BOC Gov Stephen Poloz Speaks | |||

| 21:30 | New Zealand | Business NZ PMI | November | 52.6 | 49.8 |

| 23:50 | Japan | BoJ Tankan. Non-Manufacturing Index | Quarter IV | 21 | 16 |

| 23:50 | Japan | BoJ Tankan. Manufacturing Index | Quarter IV | 5 | 2 |

The main US stock indexes rose slightly, which was facilitated by the results of the Fed meeting and the increase in the conglomerate sector.

The Federal Reserve System left interest rates unchanged and signaled that it did not plan to raise them in the near future. Fed officials in their accompanying statement continued to be optimistic about the economy. "The Committee considered that the current monetary policy is adequate to maintain a steady growth in economic activity," while there are favorable conditions for employment and price stability, the statement said. As a sign of a little more confidence in their position, managers excluded from the statement the phrase that “the uncertainty of prospects remains”, which they used in October. The statement still points to moderate inflationary pressures and the situation in the global economy as risks that should be monitored. New Fed forecasts have shown that, according to most executives, rates are low enough to spur economic growth. They expect rates to remain unchanged until the end of 2020 if the economic outlook does not change.

The focus was also on US data. A Labor Department report showed that the consumer price index rose 0.3% last month, as households paid more for gas. The consumer price index rose 0.4% in October. In the 12 months to November, the consumer price index rose 2.1% after rising 1.8% in October. Economists had forecast a consumer price index growth of 0.2% per month and an increase of 2.0% year on year. Excluding volatile food and energy components, the consumer price index rose 0.2%, which corresponds to an increase in October. In the 12 months to November, the base consumer price index rose 2.3% after a similar increase in October.

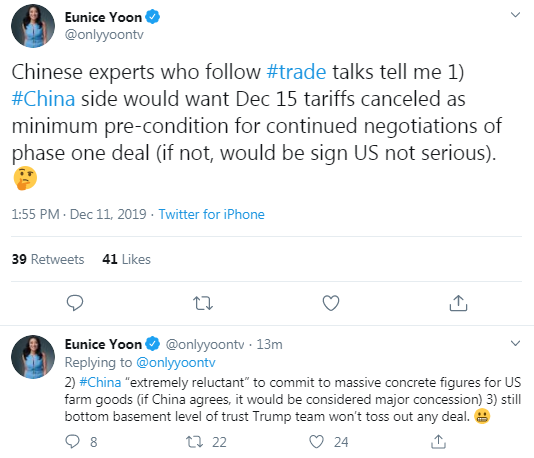

Investors also continued to closely monitor developments on the trade front, hoping to receive clear signals that the US and China had reached a trade agreement that could cancel or lower current tariff levels. On Sunday, Washington should introduce new tariffs on Chinese imports, including phones and toys.

Most DOW components completed trading in the red (16 out of 30). Outsider turned out to be the shares of The Home Depot Inc. (HD; -1.91%). The biggest gainers were United Technologies Corporation (UTX; + 1.07%).

Most S&P sectors recorded an increase. The conglomerate sector grew the most (+ 0.9%). The real estate sector (-0.3%) and the financial sector (-0.1%) showed a decrease.

At the time of closing:

Dow 27,911.30 +29.58 +0.11%

S&P 500 3,141.63 +9.11 +0.29%

Nasdaq 100 8,654.05 +37.87 +0.44%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 | Australia | Consumer Inflation Expectation | December | 4% | 3.5% |

| 00:30 | Australia | RBA Bulletin | |||

| 06:45 | Switzerland | SECO Economic Forecasts | |||

| 07:00 | Germany | CPI, m/m | November | 0.1% | -0.8% |

| 07:00 | Germany | CPI, y/y | November | 1.1% | 1.1% |

| 07:30 | Switzerland | Producer & Import Prices, y/y | November | -2.4% | -2.2% |

| 07:45 | France | CPI, y/y | November | 0.8% | 1.0% |

| 07:45 | France | CPI, m/m | November | 0% | 0.1% |

| 08:30 | Switzerland | SNB Press Conference | |||

| 08:30 | Switzerland | SNB Interest Rate Decision | -0.75% | -0.75% | |

| 10:00 | Eurozone | Industrial Production (YoY) | October | -1.7% | -2.3% |

| 10:00 | Eurozone | Industrial production, (MoM) | October | 0.1% | -0.5% |

| 12:45 | Eurozone | ECB Interest Rate Decision | 0% | 0% | |

| 13:30 | U.S. | Continuing Jobless Claims | 1693 | 1678 | |

| 13:30 | Canada | New Housing Price Index, YoY | October | -0.1% | |

| 13:30 | Canada | New Housing Price Index, MoM | October | 0.2% | |

| 13:30 | U.S. | Initial Jobless Claims | 203 | 213 | |

| 13:30 | U.S. | PPI excluding food and energy, m/m | November | 0.3% | 0.2% |

| 13:30 | U.S. | PPI excluding food and energy, Y/Y | November | 1.6% | 1.6% |

| 13:30 | U.S. | PPI, y/y | November | 1.1% | 1.2% |

| 13:30 | U.S. | PPI, m/m | November | 0.4% | 0.2% |

| 13:30 | Eurozone | ECB Press Conference | |||

| 17:30 | Canada | BOC Gov Stephen Poloz Speaks | |||

| 21:30 | New Zealand | Business NZ PMI | November | 52.6 | 49.8 |

| 23:50 | Japan | BoJ Tankan. Non-Manufacturing Index | Quarter IV | 21 | 16 |

| 23:50 | Japan | BoJ Tankan. Manufacturing Index | Quarter IV | 5 | 2 |

Analysts at Wells Fargo note that higher energy and services prices pushed the Consumer Price Index up 0.3% in November.

- “The Consumer Price Index (CPI) rose 0.3% in November and is up 2.1% over the past year. That marks the strongest 12-month pace in a year, but hardly signals inflation is getting out of hand. Much of the pickup in the CPI over the past year has stemmed from a diminishing drag from energy prices after oil prices swooned last fall.

- We continue to see few signs of recent tariffs having a meaningful effect on inflation, with core goods inflation flat in November and weakening on a year-ago basis.

- Core CPI is up 2.3%. That is toward the top end of this cycle’s range, but is unlikely to move the FOMC away from its easing bias. FOMC Chair Powell has suggested higher inflation is the main criteria for the committee to reverse course again and raise rates. But the trend in core CPI has not strengthened meaningfully in recent months; on a three-month average annualized basis, the core has been rising at a 2.1% pace.

- The FOMC has been emphasizing symmetry around its inflation target since 2017. Even as the core PCE deflator looks poised to return to 2.0% within the first half of next year, we suspect it will need to push well above that for a time considering it has averaged just 1.6% this expansion. With slowing growth expected to keep a lid on inflation and longterm inflation expectations near historic lows, the Fed’s next move on interest rates is much more likely to be down than up.”

The U.S. Energy

Information Administration (EIA) revealed on Wednesday that crude inventories

increased by 0.822 million barrels in the week ended December 6. Economists had

forecast a drop of 2.763 million barrels.

At the same

time, gasoline stocks surged by 5.405 million barrels, while analysts had

expected an increase of 2.561 million barrels. Distillate stocks climbed by 4.118

million barrels, while analysts had forecast an advance of 1.950 million

barrels.

Meanwhile, oil

production in the U.S. declined by 100,000 barrels a day to 12.800 million

barrels a day.

U.S. crude oil

imports averaged 6.9 million barrels per day last week, up by 899,000 barrels

per day from the previous week.

Fitch Ratings says it does not expect a 'no-deal' Brexit to lead to downgrades for the roughly 90 EU27 Structured Finance (SF) transactions that continue to have swaps with UK counterparties.

- "A no-deal Brexit is still possible and the general election in the UK tomorrow may not lead to clarity on whether it will be avoided at the end of either January 2020 or any transition period.

- Swaps with UK counterparties would not become void following Brexit and counterparties should continue to perform under the existing contracts, which, in the case of SF transactions, are rarely amended post-closing. However, if UK counterparties lack the necessary contingency national licences to amend contracts following certain 'lifecycle' events in the event of a no-deal Brexit, the contract may need to be novated to an EU27 counterparty. The contingency arrangements are still evolving and must be reviewed individually on a trade and country basis, as the scope of measures varies across jurisdictions.

- Many counterparties have already novated or effected a Part VII transfer of their swaps to new or existing EU27 entities that are part of the same banking group. Should swaps that are essential for the operation of an SF transaction not be novated ahead of or shortly after a no-deal Brexit, SF rating downgrades could occur if an amendment is needed and if novation to an EU27 entity does not occur to make this possible."

Analysts at TD Securities note that U.S. headline inflation surprised to the upside at 0.3% m/m (0.258% unrounded) in November, lifting the annual rate to 2.1% from 1.8%.

- "Looking into the details, core goods inflation was flat m/m in November following two negative prints in September and October. A still-firm 0.6% m/m gain in used vehicles and a stabilization in apparel prices (0.1% m/m) contributed to the core goods category.

- On the other hand, core services inflation recovered to 0.3% after the slight drop to 0.2% in October (Figure 2). Shelter prices advanced a firm 0.3% on the back of 0.3% and 0.2% m/m increases in rents and OER and a 1.1% rise in other lodging. Medical care services inflation, while slowing versus October, remained strong at 0.4% m/m, as hospital services printed 0.3% in November.

- Although inflation has been a factor in the Fed's reasoning behind its easier stance this year, we don't see this month's CPI reading changing the calculus for the Fed in the near-term. Core PCE inflation remains below target and inflation expectations continue to hover below the historical levels associated with price stability. We expect the Fed to keep rates on hold in the near term, but to ease further in 2020 as economic growth continues to moderate."

James Knightley, the Chief International Economist at ING, provides his 2020 Fed view.

- "Given ongoing trade uncertainty, weak external demand and the strong dollar we are comfortable to be on the softer side of market expectations for GDP growth (1.4% versus 1.8% for 2020 GDP) and bond yields (targeting 1.4% in 1H20). Political uncertainty surrounding next year’s election could also see businesses taking a more cautious approach on expansion plans, with an emphasis on “wait and see”.

- With inflation looking benign the Fed has the flexibility to respond and so we continue to see the potential for two 25bp rate cuts in 1H20."

U.S. stock-index futures rose slightly on Wednesday, as investors awaited the Federal Reserve’s latest decision on monetary policy (19:00 GMT), while keeping an eye on U.S.-China trade front.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 23,391.86 | -18.33 | -0.08 |

Hang Seng | 26,645.43 | +208.81 | +0.79% |

Shanghai | 2,924.42 | +7.10 | +0.24% |

S&P/ASX | 6,752.60 | +45.70 | +0.68% |

FTSE | 7,204.22 | -9.54 | -0.13% |

CAC | 5,848.34 | +0.31 | +0.01% |

DAX | 13,123.47 | +52.75 | +0.40% |

Crude oil | $59.08 | -0.27% | |

Gold | $1,471.30 | +0.22% |

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC. | MO | 50 | -0.05(-0.10%) | 1130 |

Amazon.com Inc., NASDAQ | AMZN | 1,742.90 | 3.69(0.21%) | 5403 |

Apple Inc. | AAPL | 269.65 | 1.17(0.44%) | 94568 |

AT&T Inc | T | 38.13 | 0.07(0.18%) | 25749 |

Boeing Co | BA | 345.47 | -2.43(-0.70%) | 78427 |

Chevron Corp | CVX | 117.3 | -0.59(-0.50%) | 2889 |

Cisco Systems Inc | CSCO | 44.25 | 0.15(0.34%) | 2685 |

Citigroup Inc., NYSE | C | 75.8 | 0.02(0.03%) | 1580 |

Exxon Mobil Corp | XOM | 68.88 | -0.18(-0.26%) | 9942 |

Facebook, Inc. | FB | 201.3 | 0.43(0.21%) | 13159 |

Ford Motor Co. | F | 9.06 | -0.01(-0.11%) | 10361 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.48 | 0.20(1.63%) | 125982 |

General Electric Co | GE | 10.99 | -0.02(-0.18%) | 21778 |

General Motors Company, NYSE | GM | 35.21 | 0.10(0.28%) | 1032 |

Goldman Sachs | GS | 222.5 | 0.62(0.28%) | 502 |

Google Inc. | GOOG | 1,349.69 | 5.03(0.37%) | 1167 |

Hewlett-Packard Co. | HPQ | 20.01 | -0.19(-0.94%) | 6226 |

Home Depot Inc | HD | 211.88 | -4.02(-1.86%) | 69661 |

Intel Corp | INTC | 56.61 | 0.02(0.04%) | 1816 |

International Business Machines Co... | IBM | 134.37 | 0.46(0.34%) | 649 |

Johnson & Johnson | JNJ | 140.22 | 0.23(0.16%) | 526 |

JPMorgan Chase and Co | JPM | 134 | -0.50(-0.37%) | 9246 |

McDonald's Corp | MCD | 195.34 | 0.39(0.20%) | 822 |

Merck & Co Inc | MRK | 89.5 | 0.40(0.45%) | 801 |

Microsoft Corp | MSFT | 151.6 | 0.47(0.31%) | 25756 |

Pfizer Inc | PFE | 38.59 | 0.11(0.29%) | 4153 |

Starbucks Corporation, NASDAQ | SBUX | 86.2 | 0.16(0.19%) | 913 |

Tesla Motors, Inc., NASDAQ | TSLA | 352.7 | 3.86(1.11%) | 83556 |

The Coca-Cola Co | KO | 53.9 | 0.13(0.24%) | 1745 |

Twitter, Inc., NYSE | TWTR | 29.93 | 0.09(0.30%) | 30529 |

UnitedHealth Group Inc | UNH | 280 | 0.48(0.17%) | 406 |

Verizon Communications Inc | VZ | 61.3 | 0.07(0.11%) | 746 |

Visa | V | 182.92 | 0.66(0.36%) | 6001 |

Wal-Mart Stores Inc | WMT | 119.41 | 0.27(0.23%) | 1327 |

Walt Disney Co | DIS | 147 | 0.90(0.62%) | 15236 |

Yandex N.V., NASDAQ | YNDX | 40.58 | 0.13(0.31%) | 1000 |

Walgreens Boots Alliance (WBA) downgraded to Equal-Weight at Wells Fargo; target lowered to $61

The Labor

Department announced on Wednesday the U.S. consumer price index (CPI) rose 0.3

percent m-o-m in November after an unrevised 0.4 percent m-o-m gain in the

previous month.

Over the last

12 months, the CPI rose 2.1 percent y-o-y last month, following an unrevised 1.8

percent m-o-m climb in the 12 months through October. That was the highest annual

inflation since November 2018.

Economists had

forecast the CPI to increase 0.2 percent m-o-m and 2.0 percent y-o-y in the

12-month period.

According to

the report, gains in the shelter (+0.3 percent m-o-m) and energy (+0.8 percent

m-o-m) indexes were major factors in the seasonally adjusted monthly increase

of the all items index. Advances in the indexes for medical care (+0.3 percent

m-o-m), for recreation (+0.4 percent m-o-m), and for food (+0.1 percent m-o-m) also

contributed to the overall rise.

Meanwhile, the

core CPI excluding volatile food and fuel costs advanced 0.2 percent m-o-m in November,

the same pace as in the previous month.

In the 12

months through November, the core CPI rose 2.3 percent, the same pace as in the

12 months ending October.

Economists had

forecast the core CPI to rise 0.2 percent m-o-m and 2.3 percent y-o-y last

month.

Ned Rumpeltin, the European Head of FX Strategy at TD Securities, notes the UK's political landscape remains fluid ahead of Thursday's crucial election.

- “Sterling has given up some of its recent gains overnight after a key poll showed the Conservative's lead was starting to shrink. A hung Parliament would mean the UK's political chaos would continue, but even a diminished Tory majority means a still-cloudy future. We think cable would have plenty of room to fall if the Conservatives stumble at the ballot box.

- The post-poll dip back below 1.32 overnight suggests we have edged back from that a bit. Despite this, however, we think there is still quite a bit of scope for disappointment if the market's primary expectation is disappointed.

- As a result, sterling's recent gains leave it vulnerable to a meaningful correction if anything less than a full Tory sweep is the result this week. If we do get an unstable Conservative majority, we would not be surprised to see cable push lower to test the 1.2985/1.3015 breakout zone. This may not provide sufficient support, however. We would not be surprised to see a deeper correction toward 1.2880 ahead of 1.2820/25 by early next week. Beyond this, sterling may settle down and establish new trading ranges into year-end with leadership reverting to the USD leg overall.”

Sees non-OPEC supply rising by 2.17 mln bpd in 2020, unchanged from previous forecast

Leaves forecast for 2020 global Oil demand growth unchanged at 1.08 mln bpd or 1%

Points to 2020 supply deficit of 30,000 bpd if OPEC keeps production at November’s rate, down from 70,000 bpd surplus in previous estimate

Says November oil output fell by 193,000 bpd m-o-m to 29.55 mln bpd as Saudi Arabia cuts supply

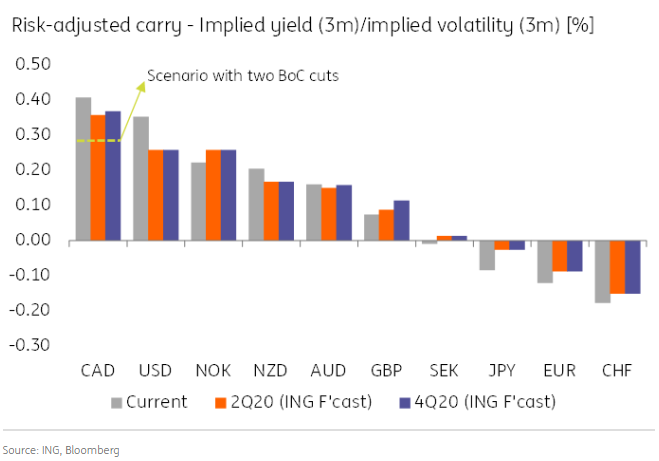

Analysts at ING note the Canadian dollar has been facing the hurdles of grim data flows and subsequently increased bets on BoC easing.

"However, CAD is up 3% versus the dollar YTD, mostly thanks to the supportive rate environment in Canada. While we expect the BoC to deliver a cut in the next few months, we do not see this as ultimately denting CAD’s rate advantage.

The figure above shows how – according to our forecasts – CAD is bound to retain the best risk-adjusted carry in the G10 space, even in a scenario with one or two BoC cuts. A stabilization in risk sentiment should allow, in our view, commodity currencies to outperform in 2020 and we expect CAD to lead the pack as it should be able to cash in on its attractive carry.

On the external side, our commodities team is looking at more OPEC+ cuts in 2020, which should put a floor under oil prices. The long-awaited ratification of the USMCA may also add to the relative positives for CAD. All these factors lead us to believe that USD/CAD will be able to move below 1.30 in the first half of 2020, despite the prospect of BoC easing. We see the pair at 1.25 in 4Q20."

Bill Diviney, Senior Economist at ABN AMRO provided a brief insight into the upcoming UK general election on Thursday, wherein PM Boris Johnson's Conservative Party is expected to win a majority.

- “The UK goes to the polls in a general election on Thursday, and we should have a good idea of the outcome on Friday morning. The latest opinion polls still show the Conservatives with a comfortable lead, with the Britain Elects poll of polls moving from 11.2pt lead at the start of the campaign to a 9.7pt lead as of today. Individual polls range from a 6-15 point lead. Should the ultimate outcome be closer to the lower end of that range, we could yet end up with a hung parliament.

- But regional polling suggests that, while both main parties have gained at the expense of smaller parties during the campaign, the ‘Remain’ vote is much more split between Labour and Liberal Democrats than the ‘Leave’ vote is split between Conservatives and the Brexit Party (whose support has collapsed). This will make it easier for the Conservatives to get a majority, and the political betting odds on Boris Johnson remaining Prime Minister have increased from a 72% implied probability at the start of the campaign to 80% as of today, according to PredictIt.”

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. rose 3.8 percent in the week ended December 6, following a 9.2

percent plunge in the previous week.

According to

the report, refinance applications surged 8.7 percent, while applications to

purchase a home fell 0.4 percent

Meanwhile, the

average fixed 30-year mortgage rate edged up to 3.98 percent from 3.97 percent.

“The 30-year

fixed mortgage rate remained under 4% for the fourth straight week, and rates

for FHA loans declined close to their lowest level of the year,” noted Joel

Kan, MBA’s associate vice president of economic and industry forecasting. “The

decrease in FHA rates led to a 27% jump in refinance applications for those

loans, and their share of refinance activity - at 14% - was the highest since

2016.”

“The November

jobs data showed increased payroll gains and low unemployment, which means conditions

remain favorable for steady purchase growth in the coming months,” added Kan.

Analysts at TD Securities provide their view on the upcoming ECB monetary policy decision on Thursday and expect no change in interest rates.

- “Despite expected growth downgrades, we expect Ms. Lagarde to focus more on building consensus than on further easing, with the hope that the policy currently in place will be enough.

- We look for the EUR to react only mildly as policy continuity should be the main takeaway. Lagarde's style and tone is a wild card. Barring an early misstep there, the slight downgrades we see to growth may be offset upgrades to next year's inflation forecast. This should keep EURUSD confined to familiar ranges overall.

- With markets only pricing in 3-4bps in rates in 2020, we continue to favour receiving the front-end of the EUR curve expressed via Rec 2y1y EUR OIS.”

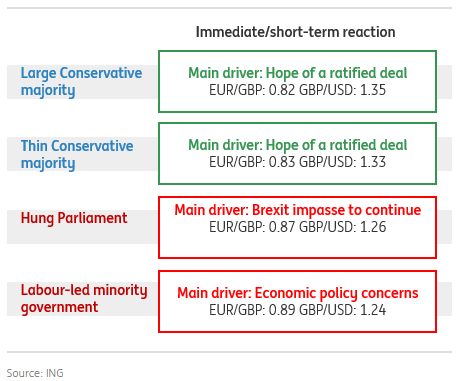

Analysts at ING suggest that GBP price action after the election will be asymmetric; less pronounced gains on a market-friendly outcome vs more meaningful losses on a non-market friendly outcome.

- "A large Conservative party majority would be perceived as an expected market-friendly outcome and lead to additional sterling gains. A Conservative Party majority of say 30-40 plus would be more positive as it would reduce potential uncertainty around a possible extent of the transition period. EUR/GBP to reach 0.82 and GBP/USD 1.35.

- A smaller Conservative majority would initially lead to GBP gains, too (to 0.83), yet the scale of GBP strength is likely to be marginally more limited. While the Withdrawal Agreement would very likely be passed by the end-January 2020, the question of a hard Brexit might return around mid-year if eurosceptics in the European Research Group oppose an extension to the transition period beyond the end of 2020 (which would, in turn, suggest there is no Conservative Party majority for an extension). Still, as this is an issue for 2020, it is unlikely to prevent initial GBP gains.

- A hung parliament would lead to a full pricing out of the GBP Brexit resolution premium (which is currently worth more than 2% based on our estimates), a rebuilding of sterling speculative shorts and GBP/USD likely dropping to 1.26 (and EUR/GBP rising 0.8700 this week).

- An outcome consistent with a fragile Labour-led minority government would, in our view, be the most negative of the most probable election outcomes. This reflects (a) the market not pricing such a scenario; (b) initial market concerns about nationalization and fiscal concerns (i.e. a material rise in borrowing needs as implied by the Labour manifesto). While the prospects of a second referendum could eventually help to stabilize GBP (as well as lower the probability that Labour policies would be introduced in full under a minority Labour-led government) the initial reaction would likely be GBP negative."

Scenario analysis for GBP post-election price action

- Overall 2020 outlook seems to be relatively bright

U.S. President Donald Trump will be the one to make the final decision on tariffs and the U.S.-China trade deal, White House trade adviser Peter Navarro said.

"Either way we're going to be in a great place ... The president loves them (the tariffs)," Navarro said in an interview with Fox Business Network.

"If we get a great deal, we'll be in a good place as well. But it will be the president's decision. It will come soon," Navarro added.

Germany will not scale back its investments even if tax revenues come in lower, the country's finance minister was quoted as saying by weekly newspaper Die Zeit on Wednesday.

"It would be wrong to reduce investment in an economic crisis," Olaf Scholz said, according to comments released by the newspaper.

"That's exactly what happened in the past. That will not happen with me," Scholz was quoted as saying.

China finance ministry will tighten controls on ownership transfers of state-owned financial institutions, a notice released on Wednesday said.

Effective Dec. 20, any capital increase or share sales of state-owned financial institutions that could cause the government to lose its controlling stake would need final approvals by local bureaus of the finance ministry and local governments, according to the notice.

Ahead of the highly anticipated FOMC decision, Mikael Olai Milhøj – Senior Analyst at Danske Bank – offered his take on the US central bank's near-term monetary policy outlook.

“The Fed has made two U-turns in 2019. At the beginning of the year, the Fed skipped its plan to raise rates further. Then, since July, the Fed has cut rates three times and the target range is currently 1.50-1.75%. At the latest meeting in October, the Federal Reserve changed its forward guidance and now believes the current stance of monetary policy is appropriate. On the back of the Fed’s new ‘wait-and-see’ approach, we recently changed our Fed call and now expect only one more cut in 3-6M (previously three more cuts). We keep a cut in our forecast profile, as we still believe the US economy is more fragile than the Fed believes and that the renewed trade optimism is unlikely to be enough to trigger a rebound in business investments yet.”

According to Karen Jones, Analyst at Commerzbank, EUR/JPY’s upside attempts will continue to get sold into its 5-month downtrend, currently located at 120.86.

“EUR/JPY’s outlook remains negative while capped by its 5-month downtrend, currently at 120.86. This is reinforced by resistance at 121.45/48 - this is the location of the 200-day ma, the 50% Fibonacci retracement and the late October high. While capped here, attention remains on the 119.48 uptrend. This should hold the initial test, however, longer-term the risk has increased for a break lower. Failure here will target the 117.09 October low ahead of the 115.87 September low. Above the 200 day-ma lies the 123.34 July high.”

Parties in Italy’s ruling coalition have dropped demands for a veto on part of a planned reform of the EU’s bailout fund that could make it easier to secure agreement on restructuring public debt of countries seeking help from the fund.

Previously the parties had rejected so-called single limb collective action clauses that allow a single vote to be taken on restructuring bonds of countries seeking a bailout under the European Stability Mechanism (ESM).

A final version of a resolution by the anti-establishment 5 Star Movement and the center-left Democratic Party on Wednesday dropped demands for a veto on the single limb clause contained in a draft form of the resolution.

Analysts at Australia and New Zealand Banking Group (ANZ) have revised up their forecasts for the Kiwi dollar, in light of the recent streak of upbeat New Zealand’s fundamentals and government’s fiscal stimulus. ANZ now sees NZD/USD rising to 0.66 in Q1 2020.

“For the Kiwi dollar, the facts have changed rather quickly in the last couple of weeks, challenging our high conviction call of NZD weakness. Little has changed from a top-down perspective, however better data, a possible fiscal injection, and a more muted capital ask from the RBNZ have removed the catalysts we saw for near term weakness. As such we are revising our forecasts and taking out much of the weakness that we had previously anticipated in the NZD. This will have the biggest impact on our near-term bias for the AUD/NZD cross, and for how we think about the NZD/JPY in a better risk environment.”

Analysts at Danske Bank a brief preview of Wednesday's highly anticipated FOMC decision, wherein the US central bank is expected to leave interest rates unchanged.

“Today's main event is the Fed meeting. As most FOMC members have said they think the current stance of monetary policy is appropriate, the Fed is now on hold after three cuts in a row. Political uncertainty has declined, global growth has stabilised and US recession fears have eased after strong job reports lately. Most will look at the 'dots' for hints about what the Fed thinks about next year. Given the Fed has cut one more time than it thought in September, it will automatically be lowered but we think the Fed will signal it is on hold also next year. Markets are pricing in another cut during 2020.”

Karen Jones, an analyst at Commerzbank offers key technical levels for trading USD/CHF ahead of the key Fed decision.

“USD/CHF is eroding the .9844/41 September and October lows. We consider the market to be vulnerable as we note the confirmed sell signal on the DMI and it remains capped by the 55- and 200-day ma at .9925/44. Failure at .9830 would push key support at .9716/.9659 to the fore. This is the location of the January, June, mid- and late August lows. Below here sits the .9659 August low and the September 2018 low at .9543.”

Outlook for European banks has changed to negative from stable.

Weakening economic growth in much of the region will cause banks' loan quality and profitability to decline.

In UK, outlook for banks is also negative as Brexit-related uncertainty will weaken operating conditions and slow loan demand

Outlook for Euro-area banks is negative as economic slowdown, continued accommodative monetary policy will erode already weak profitability.

In CEE, economic growth will slow but it will still outperform the Euro area and foster business opportunities for banks.

In the Nordic countries, economic growth will slow but remain supportive.

If trade tensions escalate, between the US and China or US and EU, there would be a bigger deterioration in European banks.

Analysts at TD Securities note that the US inflation is likely to accelerate in November but it could possibly be the Fed Chair Powell’s comments that should support the US dollar later on Wednesday.

“We look for headline inflation to to tick up two tenths to 2.0% y/y in November (0.2% m/m), mostly reflecting a gain in prices in the ex-food and energy segment. In effect, core inflation should stay unchanged at 2.3% y/y on the back of a 0.2% m/m increase. Changes to the FOMC statement and dot-plot are well anticipated. Propensity to compel major FX shift is low at this time of year. Powell's tone in the press conference should diverge from a cautious ECB (the next day), and should modestly support the USD.”

U.S. President Donald Trump will be the one to make the final decision on tariffs and the U.S.-China trade deal, White House trade adviser Peter Navarro said.

“Either way we’re going to be in a great place ... The president loves them (the tariffs),” Navarro said in an interview with Fox Business Network.

“If we get a great deal, we’ll be in a good place as well. But it will be the president’s decision. It will come soon,” Navarro added.

New Zealand cut its growth forecast for 2019/2020 and flagged a budget deficit on Wednesday, but announced a significant lift in capital spending to bolster the economy with a plan to invest more than $12 billion on infrastructure projects.

The Treasury department predicted a NZ$0.9 billion budget deficit in the current 2019/20 year in its half-year economic and fiscal update, down from the NZ$1.3 billion it had forecast in its May budget.

“A small deficit in the current year is not surprising, given the impacts global headwinds are having on confidence here,” Finance Minister Grant Robertson said.

Treasury also trimmed expected surpluses for 2021 and 2022 as economic growth slows amid heightened risks from factors such as the U.S.-China trade war and Brexit uncertainty.

The growth forecast for the current year was cut to 2.3% from the previously forecast 3.2%.

Robertson said that while the economy was expected to grow more slowly, New Zealand was still outperforming its peers. “The economy continues to grow, it continues to outpace most other economies,” he told.

Robertson also announced the government’s plan to spend NZ$12 billion on new infrastructure investment, which he said was the highest level of capital spending in more than 20 years.

The Asian Development Bank downgraded its Developing Asia's growth projections citing challenging global environment.

The lender said developing Asia will grow 5.2 percent in both 2019 and 2020. The projection for 2019 was lowered from 5.4 percent and that for next year from 5.5 percent.

Growth in developing Asia continues to moderate as domestic investment weakens under a more challenging external environment with slowing global trade and economic activity, protracted trade tensions between the United States and China, and a global downturn in electronics, the ADB noted.

Growth forecasts for East Asia were downgraded to 5.4 percent in 2019 and 5.2 percent in 2020 as China and the Republic of Korea endure continuing trade tensions and slowing domestic investment.

Given recent deceleration, China was expected to expand 6.1 percent in 2019 versus prior estimate of 6.2 percent, as domestic demand weakened and external headwinds stiffened.

Meanwhile, the projected growth rate in Central Asia as a whole was raised to 4.6 percent for 2019 from 4.4 percent in the Update and to 4.5 percent for 2020 from 4.3 percent.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1215 (2720)

$1.1196 (3768)

$1.1184 (867)

Price at time of writing this review: $1.1089

Support levels (open interest**, contracts):

$1.1036 (5425)

$1.0993 (3197)

$1.0946 (2722)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 3 is 49735 contracts (according to data from December, 10) with the maximum number of contracts with strike price $1,1050 (5415);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3346 (322)

$1.3321 (447)

$1.3302 (339)

Price at time of writing this review: $1.3139

Support levels (open interest**, contracts):

$1.3036 (968)

$1.3002 (109)

$1.2965 (479)

Comments:

- Overall open interest on the CALL options with the expiration date January, 3 is 21493 contracts, with the maximum number of contracts with strike price $1,3500 (5297);

- Overall open interest on the PUT options with the expiration date January, 3 is 18044 contracts, with the maximum number of contracts with strike price $1,2500 (2393);

- The ratio of PUT/CALL was 0.84 versus 0.84 from the previous trading day according to data from December, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 64.53 | 0.03 |

| WTI | 59.05 | 0.36 |

| Silver | 16.64 | 0.3 |

| Gold | 1464.24 | 0.18 |

| Palladium | 1895.85 | 0.82 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -20.51 | 23410.19 | -0.09 |

| Hang Seng | -58.11 | 26436.62 | -0.22 |

| KOSPI | 9.35 | 2098 | 0.45 |

| ASX 200 | -23.1 | 6706.9 | -0.34 |

| FTSE 100 | -20.14 | 7213.76 | -0.28 |

| DAX | -34.89 | 13070.72 | -0.27 |

| Dow Jones | -27.88 | 27881.72 | -0.1 |

| S&P 500 | -3.44 | 3132.52 | -0.11 |

| NASDAQ Composite | -5.65 | 8616.18 | -0.07 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.68098 | -0.17 |

| EURJPY | 120.621 | 0.44 |

| EURUSD | 1.10925 | 0.27 |

| GBPJPY | 143.053 | 0.28 |

| GBPUSD | 1.31545 | 0.1 |

| NZDUSD | 0.65429 | -0.03 |

| USDCAD | 1.32302 | -0.04 |

| USDCHF | 0.98431 | -0.34 |

| USDJPY | 108.737 | 0.17 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.