- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 11-07-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 03:00 | China | Trade Balance, bln | June | 41.66 | 44.65 |

| 04:30 | Japan | Industrial Production (YoY) | May | -1.1% | -1.8% |

| 04:30 | Japan | Industrial Production (MoM) | May | 0.6% | 2.3% |

| 08:00 | United Kingdom | MPC Member Vlieghe Speaks | |||

| 09:00 | Eurozone | Industrial Production (YoY) | May | -0.4% | -1.6% |

| 09:00 | Eurozone | Industrial production, (MoM) | May | -0.5% | 0.2% |

| 12:30 | U.S. | PPI excluding food and energy, m/m | June | 0.2% | 0.2% |

| 12:30 | U.S. | PPI excluding food and energy, Y/Y | June | 2.3% | 2.2% |

| 12:30 | U.S. | PPI, m/m | June | 0.1% | 0% |

| 12:30 | U.S. | PPI, y/y | June | 1.8% | 1.6% |

| 17:00 | U.S. | Baker Hughes Oil Rig Count | July | 788 |

Major US stock indices have predominantly increased, helped by a rise in prices for individual health sector stocks, as well as the technology segment and expectations of lower interest rates, which have intensified after the report of the Fed Chairman Jerome Powell.

Shares of medical insurers Cigna Corp (CI) and UnitedHealth Group Inc. (UNH) jumped 8.88% and 5.37%, respectively, while McKesson Corp. (MCK) rose 1.87% after the Trump administration abandoned plans to exclude drug discounts from its Medicare health insurance plans. However, the shares of drug manufacturers Merck & Co Inc. (MRK) and Pfizer (PFE) fell by 4.62% and 2.64%, respectively.

Powell’s “dovish” statements also supported the stock market, which again appeared in the US Congress with its semi-annual monetary policy report.

The inflation data for June was also in focus. The report of the Ministry of Labor showed that the consumer price index in June rose by 0.1%, which corresponds to a slight increase in May. Economists had expected consumer prices to remain unchanged. Excluding food and energy prices, basic consumer prices rose 0.3% in June, after rising 0.1% for four consecutive months. Monthly increase in base prices was the highest in 1.5 years. It was expected that core inflation will grow by 0.2%. In the 12 months to June, the base consumer price index rose 2.1% after rising 2.0% in May. The fact that core inflation showed a sharp rise in June did not have a strong effect on expectations of a Fed rate cut this month. According to the FedWatch CME Group tool, traders take into account in quotes the 100% probability of interest rate cuts at the end of July.

Most of the components of DOW recorded an increase (19 of 30). The growth leader was UnitedHealth Group Inc. (UNH; + 5.37%). Outsider were shares of Merck & Co Inc. (MRK; -4.62%).

Most sectors of the S & P finished trading in positive territory. The service sector grew the most (+ 0.2%). The largest decline was shown by the health sector (-0.4%).

At the time of closing:

Dow 27,088.08 +227.88 +0.85%

S & P 500 2,999.91 +6.84 +0.23%

Nasdaq 100 8,196.04 -6.49 -0.08%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 03:00 | China | Trade Balance, bln | June | 41.66 | 44.65 |

| 04:30 | Japan | Industrial Production (YoY) | May | -1.1% | -1.8% |

| 04:30 | Japan | Industrial Production (MoM) | May | 0.6% | 2.3% |

| 08:00 | United Kingdom | MPC Member Vlieghe Speaks | |||

| 09:00 | Eurozone | Industrial Production (YoY) | May | -0.4% | -1.6% |

| 09:00 | Eurozone | Industrial production, (MoM) | May | -0.5% | 0.2% |

| 12:30 | U.S. | PPI excluding food and energy, m/m | June | 0.2% | 0.2% |

| 12:30 | U.S. | PPI excluding food and energy, Y/Y | June | 2.3% | 2.2% |

| 12:30 | U.S. | PPI, m/m | June | 0.1% | 0% |

| 12:30 | U.S. | PPI, y/y | June | 1.8% | 1.6% |

| 17:00 | U.S. | Baker Hughes Oil Rig Count | July | 788 |

- Trade disputes are inserting uncertainty into global supply chains

- Trade concerns weigh on U.S. economic outlook

- Relationship between inflation and unemployment has become weaker

- The natural rate of employment is lower than we thought

- Policy has not been as accommodative as we thought

- U.S. economy in a very good place but uncertainties weigh

- We've signaled that we are open to more accommodation

- U.S. consumer part of economy is intact

- Worried by some weakness in business sector, tied to softness and global manufacturing

- Eurozone may face the long period of anemic growth and inflation

- Projects GDP growth of 1.3% and inflation at 1.3% 2019

- Sees rising risks for Eurozone economy, especially trade tensions, impact of Brexit, Italy's debt woes

- EUROs real exchange rate as slightly undervalued, urges Germany, other trade surplus states to invest more

- ECB's intention to maintain ample accommodation for longer is vital

- ECB should short maturity of new TLTROs, offer less generous pricing terms than on TLTRO II to avoid banks increasing their sovereign exposure

- Says possible tiered deposit rate would have very small impact on aggregate bank profitability and questionable impact on credit conditions

- direct costs of negative rates are likely to outweigh by their positive indirect effects on aggregate demand and bank profitability

- if further accommodation required, ECB should consider new asset purchase program anchored by P and possibly broaden to larger set of assets

- ECB may have only limited room to cut interest rates

- further credit easing measures could be considered, including new cheaper liquidity facilities for banks

- Says risks are tilted a bit more to the downside

- Markets will adjusted rates end up not suggesting a need for a cut

- Businesses are not cutting back on spending but they are not leaning forward

- Consumer companies he talks to do not see demand weakening

- If needed, rate Cuts would stimulate economy in many Ways

- Sees a low likelihood of strong price hikes in the economy

- There are not that many tariffs in the U.S. economy

- Businesses are starting to think U.S. tariffs on China may be long-term

- U.S. labor market is tight

- He is focused on economic data, not the markets

- The Fed will discuss what to do with balance sheet if they decide to change rates

- Hopes and expects that President Trump will not remove Fed Chairman Powell

Elliot Clarke, the senior economist at Westpac, suggests that the minutes of the June FOMC meeting and Chair Powell’s Semiannual Monetary Policy Report to Congress provided support for the view that the July meeting will see a federal funds rate cut, and that further easing will follow in due course.

“From the June meeting minutes, “Although nearly all members agreed to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent at this meeting, they generally agreed that risks and uncertainties surrounding the economic outlook had intensified and many judged that additional policy accommodation would be warranted if they continued to weigh on the economic outlook”.

From “if they continued to weigh”, it is clear that a further deterioration in conditions is not necessary to justify a cut. Instead, the threshold is simply that current uncertainties persist.

From Chair Powell’s appearance before Congress, this seems a near certainty ahead of the July meeting, with the global cross-currents seen as numerous and largely open-ended in nature.

In Chair Powell’s view, “uncertainties about the outlook have [actually] increased in recent months. In particular, economic momentum appears to have slowed in some major foreign economies… [and] a number of government policy issues have yet to be resolved, including trade developments, the federal debt ceiling, and Brexit”.

To be clear, policy easing is not warranted merely because these uncertainties exist, but rather as there is clear evidence they are affecting the US economy, particularly business investment.”

- Could examine how to limit sub-zero impact

Statistics

Canada reported on Thursday the New Housing Price Index (NHPI) edged down 0.1

percent m-o-m in May, after remaining unchanged for three straight months.

Economists had

forecast the NHPI to increase 0.1 percent m-o-m in May.

According to

the report, builders in 16 of the 27 census metropolitan areas (CMAs) surveyed

reported flat or lower prices in April. Saskatoon (-0.5 percent m-o-m) and

Victoria (-0.4 percent m-o-m) posted the largest declines due primary to

deteriorating market conditions. At the same time, Charlottetown (+1.0 percent

m-o-m) registered the biggest price increase in May, with the rise attributed

to higher construction costs.

In y-o-y terms,

NHPI was unchanged in May after a 0.1 percent advance in the previous month.

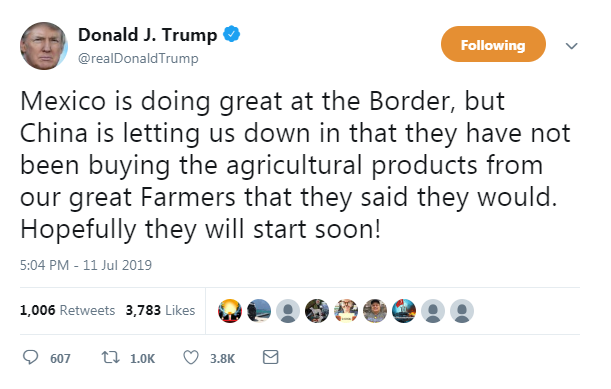

- U.S. expects China to be buying US farm products

- It does look like the Fed will cut rates

- There is no intention to remove Fed Chair Powell

U.S. stock-index futures rose slightly on Thursday, as inflation report revealed the U.S. underlying consumer prices increased by the most in nearly 1-1/2 years in June, dimming hopes for an aggressive interest cut by the Federal Reserve this month.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,643.53 | +110.05 | +0.51% |

Hang Seng | 28,431.80 | +227.11 | +0.81% |

Shanghai | 2,917.76 | +2.46 | +0.08% |

S&P/ASX | 6,716.10 | +26.30 | +0.39% |

FTSE | 7,520.24 | -10.45 | -0.14% |

CAC | 5,573.48 | +5.89 | +0.11% |

DAX | 12,356.43 | -16.98 | -0.14% |

Crude oil | $60.58 | +0.25% | |

Gold | $1,417.80 | +0,38% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 166 | 0.30(0.18%) | 392 |

ALCOA INC. | AA | 22.15 | -0.46(-2.03%) | 29565 |

ALTRIA GROUP INC. | MO | 48.95 | -0.05(-0.10%) | 2535 |

Amazon.com Inc., NASDAQ | AMZN | 2,026.01 | 8.60(0.43%) | 72886 |

American Express Co | AXP | 127.5 | 0.61(0.48%) | 3285 |

Apple Inc. | AAPL | 203.99 | 0.76(0.37%) | 138258 |

AT&T Inc | T | 33.85 | 0.09(0.27%) | 21773 |

Boeing Co | BA | 352.94 | 0.64(0.18%) | 13735 |

Caterpillar Inc | CAT | 133.31 | 0.67(0.51%) | 4730 |

Cisco Systems Inc | CSCO | 57.25 | 0.12(0.21%) | 14499 |

Citigroup Inc., NYSE | C | 71.32 | 0.19(0.27%) | 2209 |

Exxon Mobil Corp | XOM | 77.81 | 0.30(0.39%) | 2570 |

Facebook, Inc. | FB | 203.18 | 0.45(0.22%) | 80905 |

FedEx Corporation, NYSE | FDX | 160.2 | 0.21(0.13%) | 1072 |

Ford Motor Co. | F | 10.13 | 0.02(0.20%) | 24984 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.1 | 0.15(1.37%) | 24536 |

General Electric Co | GE | 10.22 | 0.02(0.20%) | 21738 |

Goldman Sachs | GS | 206.01 | 0.04(0.02%) | 1546 |

Google Inc. | GOOG | 1,146.99 | 6.51(0.57%) | 2763 |

Home Depot Inc | HD | 211.93 | 1.18(0.56%) | 7068 |

Intel Corp | INTC | 48.26 | 0.05(0.10%) | 43882 |

International Business Machines Co... | IBM | 140.7 | 0.23(0.16%) | 1382 |

International Paper Company | IP | 42.5 | -0.65(-1.51%) | 6919 |

Johnson & Johnson | JNJ | 141.8 | 0.59(0.42%) | 1735 |

JPMorgan Chase and Co | JPM | 113.58 | 0.56(0.50%) | 2238 |

McDonald's Corp | MCD | 213.55 | 0.55(0.26%) | 3359 |

Merck & Co Inc | MRK | 85 | 0.18(0.21%) | 1209 |

Microsoft Corp | MSFT | 138.15 | 0.30(0.22%) | 85024 |

Nike | NKE | 87.9 | 0.46(0.53%) | 3601 |

Pfizer Inc | PFE | 43.71 | -0.35(-0.79%) | 31921 |

Procter & Gamble Co | PG | 114.16 | 0.41(0.36%) | 1635 |

Starbucks Corporation, NASDAQ | SBUX | 88.7 | 0.32(0.36%) | 4844 |

Tesla Motors, Inc., NASDAQ | TSLA | 238.5 | -0.42(-0.18%) | 49534 |

The Coca-Cola Co | KO | 51.86 | 0.04(0.08%) | 1931 |

Twitter, Inc., NYSE | TWTR | 37.58 | 0.11(0.29%) | 37848 |

UnitedHealth Group Inc | UNH | 255.19 | 7.71(3.12%) | 79817 |

Verizon Communications Inc | VZ | 57.11 | 0.11(0.19%) | 733 |

Visa | V | 180.19 | 0.88(0.49%) | 16303 |

Wal-Mart Stores Inc | WMT | 113.35 | 0.37(0.33%) | 2955 |

Walt Disney Co | DIS | 143.88 | 0.34(0.24%) | 12986 |

Yandex N.V., NASDAQ | YNDX | 39.87 | 0.05(0.13%) | 450 |

Home Depot (HD) initiated with a Buy at Goldman; target $235

Microsoft (MSFT) initiated with an Outperform at Cowen; target $150

Walmart (WMT) initiated with a Buy at Goldman; target $123

Alcoa (AA) downgraded to Hold from Buy at Deutsche Bank; target lowered to $23

Int'l Paper (IP) downgraded to Neutral from Buy at Citigroup

Freeport-McMoRan (FCX) upgraded to Buy from Hold at Deutsche Bank; target raised to $13.50

The Labor

Department announced on Thursday the U.S. consumer price index (CPI) edged up

0.1 percent m-o-m in June, the same pace as in the previous month.

Over the last

12 months, the CPI rose 1.6 percent y-o-y last month, following a 1.8 percent

m-o-m advance in the 12 months through May. It was the lowest rate since

February.

Economists had

forecast the CPI to increase 0.2 percent m-o-m and 1.6 percent y-o-y in the

12-month period.

According to

the report, gains in the

indexes for shelter, apparel, and used cars and trucks more than offset

declines in energy indexes, while the food index was unchanged m-o-m.

Meanwhile, the

core CPI excluding volatile food and fuel costs rose 0.3 percent m-o-m in June,

following a 0.1 percent m-o-m uptick in the previous month. This represented the largest monthly increase in core CPI since January 2018.

In the 12

months through June, the core CPI rose 2.1 percent after a 2.0 percent increase

for the 12 months ending May.

Economists had

forecast the core CPI to rise 0.2 percent m-o-m and 2.0 percent y-o-y last

month.

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment benefits fell more than expected last week, pointing to sustained

labor market strength.

According to

the report, the initial claims for unemployment benefits decreased 13,000 to a

seasonally adjusted 209,000 for the week ended July 6.

Economists had

expected 223,000 new claims last week.

Claims for the

prior week were revised upwardly to 222,000 from the initial estimate of 221,000.

Meanwhile, the

four-week moving average of claims decreased by 3,250 to 219,250 last week.

Delta Air Lines (DAL) reported Q2 FY 2019 earnings of $2.35 per share (versus $1.77 in Q2 FY 2018), beating analysts’ consensus of $2.28.

The company’s quarterly revenues amounted to $12.536 bln (+6.5% y/y), generally in line with analysts’ consensus estimate of $12.487 bln.

The company also issued in-line guidance for Q3 FY 2019, projecting EPS of $2.10-2.40 (versus analysts’ consensus estimate of $2.16) and revenue growth of 1.5-3.5%.

It also raised its FY 2019 EPS guidance to $6.75-7.25 from $6-7 (versus analysts’ consensus estimate of $6.98) and revenue growth guidance to 6-7% from 4-6%.

DAL rose to $60.70 (+2.07%) in pre-market trading.

FX strategists at UOB Group suggest that USD/JPY is likely to trade within a rangebound theme in the near term.

- "24-hour view: While we noted yesterday that “upward momentum is not strong”, the manner of which USD plunged from the Asian hours high of 108.98 was clearly not expected. The decline is accompanied by relatively strong downward momentum and USD could test the 108.00 support. For today, a move below 107.75 is unlikely. On the upside, 108.65 is likely strong enough to cap any intraday recovery (minor resistance is at 108.45).

- Next 1-3 weeks: Our view from yesterday (10 Jul, spot at 108.90) wherein USD is expected to move to 109.30 was proven wrong quickly as it plummeted after touching a 5-week high of 108.98. The rapid drop took out the 108.35 "key support" (overnight low of 108.33). From here, USD is deemed to have moved into a sideways-trading phase and is likely to trade within a relatively broad range of 107.50 and 108.95."

- Some ECB officials argued for more accommodative TLTRO terms

- Noted a drop in market-based inflation expectations

- There should be no room for complacency in the face of falling inflation expectations

- There was a broad agreement on need to change stance, demonstrate determination to act

- Central bank should put more emphasis on symmetry of inflation aim

- Care should be taken so this could not be seen as moving goalpost when it proved challenging to achieve it

- Potential measures include extending/strengthening forward guidance, resuming QE and cutting interest rates

- While policymakers should never ignore signals coming from financial markets, they should not focus on them too narrowly either

- The pessimism priced into bond markets today may not necessarily presage downward pressure on inflation tomorrow – at least not to the same extent

Analysts at TD Securities are expecting the U.S. headline CPI to slow a further two tenths to 1.6% y/y in June (flat m/m), on the back of a notable decline in energy prices.

- “Core inflation should remain steady at 2.0% y/y, reflecting a firm 0.2% m/m advance. We pencil in a 0.2% m/m increase in core services and a flat reading in core goods, which should help buoy core CPI overall.”

Analysts at Rabobank say that the vast majority of EM currencies benefited from Fed Chairman Powell’s dovish message during his testimony to Congress.

- “Led by the South African rand, the EM FX space appreciated against the US dollar after Powell cemented expectations for a rate cut later this month.

- We are not convinced that “the rally of everything” will prove sustainable as no amount of Fed easing will likely be sufficient to prevent global recession if trade tensions inevitably escalate again.

- However, we also fully acknowledge the powerful impact the prospect of easy money can have on risky assets over the short-term horizon and we have no intention to fight against it.”

- Notes that material risks of economic disruption remain from no-deal Brexit

- Says that Brexit preparedness has improved but some risks still remain

- If trade tensions rise it would hurt the global economy further amid vulnerability seen

Perceived likelihood of no-deal Brexit has risen

No-deal Brexit could cause material economic disruption

But UK banks could withstand a disorderly Brexit

Sees risks in high debt levels, corporate leverage

Mismatch in open-ended funds could pose systemic risks

Central bank will review how to address the issue of liquidity mismatch

A top strategist at J.P. Morgan Asset Management said that the Federal Reserve is “fundamentally making a mistake” with its anticipated rate cut at the end of the month.

David Kelly, the chief global strategist at J.P. Morgan Asset Management, said that he doesn’t think rate cuts will boost the U.S. economy and that the expected cut is in part due to political pressure from the Trump administration on Fed Chair Jerome Powell.

“Chairman Powell admits that really it is fiscal policy that has any possibility at all of stimulating the economy,/ Not, by the way, that you need to stimulate the economy when you’ve got a 3.7% unemployment rate” Kelly said.

President Trump has reportedly discussed attempting to remove Powell from his position. Powell reiterated on Wednesday that he intends to serve his entire term and said “my answer would be no ” to an attempt by Trump to fire him.

“I think they’re worried about independence. I think they’re worried about getting too criticized by the administration,” Kelly said.

According to analysts at ING, today’s calendar is likely to keep further EUR/USD upside limited after the euro posted the smallest gains among G10 currencies amid the US dollar's sell off in the past 24 hours.

“The key event is the release of the ECB June minutes, where any hint of a possible shift in forward guidance – possibly at the late July meeting – will keep a lid on the euro. Some further pressure may also come from remarks by the ECB’s Benoit Coeure (1115 GMT) should he reiterate his recent openness to another round of quantitative easing. The balance of risks for EUR/USD seems skewed to the downside and the pair may fall back below the 100-day moving average (1.1256) during the day.”

China and the United States can find a way to resolve their trade dispute if each other’s concerns are taken into consideration, the commerce ministry said.

Ministry spokesman Gao Feng also said during a weekly news briefing that China hopes the U.S. will remove sanctions on Huawei Technologies Co Ltd as soon as possible and clear a path for healthy bilateral relations.

“Trade teams from both sides, according to the consensus reached at Osaka by leaders from both countries, will restart economic and trade negotiations on the basis of equality and mutual respect,” said Gao.

“China believes that both sides can find a way to resolve the issue if each other’s reasonable concerns are taken into consideration through a dialogue of equals.”

Aila Mihr, senior analyst at Danske Bank, explains that Minutes from the June meeting revealed that the Fed was already leaning towards easing, as many FOMC members saw a stronger case for a cut.

“The testimony from Fed Chairman Powell all but confirmed that the next move from the Fed is an easing of monetary policy. During his hearing, Powell stressed that uncertainty since the June meeting continued to dim the outlook for the US economy and that trade war risks overshadow the healthy labour market. On the back of the dovish language, markets started to reprice the probability of a 50bp cut at the end of the month (now back up at 25%). We stick to our view of a 25bp cut at the July meeting.”

A widely expected interest rate cut by the U.S. Federal Reserve would give China more breathing room in shoring up its slowing economy, some analysts said.

Markets took Fed Chairman Jerome Powell’s comments during the first of a two-day Congressional testimony as affirming expectations for easier monetary policy in the U.S. T

A looser monetary policy environment would reduce pressure on China’s central bank to ease monetary policy..

“If the Fed does go ahead and cut rates, which I don’t think is a given ... it simply means the PBoC has a little breathing room to see if the policies it has implemented have an impact on the real economy,” Hannah Anderson, global market strategist at J.P. Morgan Asset Management, told.

The central bank will also face less pressure to allow the yuan to depreciate, making it easier to maintain a goal of keeping the exchange rate stable, she said, while higher Treasury prices would boost the paper value of the PBoC’s holdings, increasing confidence.

Some analysts expect if the Fed cuts rates, it will go so far as to prompt China’s central bank to take similar action.

“If (make that when) the Fed cuts rates then it’s quite likely the PBOC will follow suit,” Leland Miller, chief executive officer of China Beige Book, said.

“But a benchmark interest rate cut is almost purely a symbolic move that won’t affect most corporates,” Miller said. He noted that “only a small subset of (state-owned enterprises) pay the benchmark rate, and most of those firms don’t have to repay their loans anyway.”

OPEC+ is sticking with its production cuts deal.

Production is falling in Iran and Venezuela and risk of supply disruptions is rising in the Middle East.

Together these should see the oil market balance tightening in H2 2019.

US shale companies have been pulling back on drilling, could limit growth in output from shale in near term.

Slowing global economic growth will still see demand growing more than 1mb/d.

We believe the market's focus will soon shift from a focus on softer demand to looking at supply disruption risks. This should see prices back above USD70/bbl in H2 2019.

Danske Bank analysts point out that in the euro area, the ECB minutes from the June meeting are set to be released today and will be a key event for today.

“At the press conference, Draghi stressed that the governing council (GC) discussed several options at the meeting including a rate cut and a restart of QE. Draghi in his Sintra speech sent a strong signal to markets that more stimulus is coming. Hence, markets will look out for clues in the minutes on how ready the GC stands in announcing immediate steps already at the 25 July meeting. We still lean towards an announcement of an easing package coming in September. In the US, CPI inflation figures are in focus. We expect CPI core rose 0.2% m/m in June, which translates into an unchanged annual inflation rate at 2.0%.”

Bank of America Merrill Lynch discusses its call on the Fed monetary path in light of today's Fed Powell testimony before the Congress.

"Fed Chair Powell delivered a dovish testimony, hinting strongly at an upcoming cut. We now expect a 25bp cut at the upcoming meeting with a chance of a 50bp cut. We now expect a 25bp cut at the July 31st meeting followed by two more cuts at the next two meetings. We are sticking with our forecast of a cumulative 75bp of easing but we pulled forward the timing of the cuts. The Fed seems to be willing to dismiss the better data from the US and instead is focusing on the weaker global data. In other words, the Fed is taking out insurance with hopes of extending the recovery and ultimately gaining policy space," BofAML adds.

According to the report from Insee, in June 2019, the Consumer Prices Index (CPI) rose by 0.2% over a month, after +0.1% in May 2019. This increase, barely stronger than in the previous month, came from a rebound, over a month, in services prices (+0.5% after −0.2%), partly offset by a slight downturn in energy prices (−0.1% after +0.6%) and a slowdown in those of food (+0.1% after +0.7%). The prices of manufactured products were stable over a month, after +0.2% in May. Similarly, tobacco prices were unchanged in June after +0.3% in the previous month.

Seasonally adjusted, consumer prices rebounded to +0.3% over a month, after −0.1% in May.

Year on year, consumer prices gathered pace in June to +1.2% after +0.9% in May 2019. This rise in inflation resulted from a strong acceleration in services prices and, to a lesser extent, in those of food. Contrariwise, energy prices sharply slowed down. Those of manufactured products dropped by 0.7%, as in the previous month. Finally, tobacco prices rose by 9.0% year on year after +9.1% in May.

Year on year, core inflation rose by 0.9%, after +0.5% in May. The Harmonised Index of Consumer Prices (HICP) accelerated, over a month, to +0.3% in June, after +0.1% in May; year on year, it grew by 1.4%, after +1.1% in the previous month.

New Zealand’s ANZ Monthly Inflation Gauge was up 0.3% m/m in June, largely supported by insurance and housing-related price gains, notes the research team at ANZ.

“Annual inflation in the Gauge ticked up to 2.8% from 2.7%. But it’s increasingly looking like domestic inflationary pressures have peaked for now. For the June quarter, the Gauge is pointing to a soft 0.2% q/q rise in non-tradable inflation, which would be the lowest CPI non-tradable outturn since June 2017. The Gauge has come within 0.2%pts for 13 of the last 14 Stats NZ non-tradable inflation outturns.”

According to the report from Federal Statistical Office (Destatis), сonsumer prices in Germany rose 1.6% in June 2019 compared with June 2018. In May 2019, it had been +1.4%. Compared with May 2019, the consumer price index rose by 0.3% in June 2019. Destatis thus confirms its provisional overall results for the CPI. The provisional results of 27 June 2019 regarding the harmonised index of consumer prices (HICP) are corrected upwards by the final results.

Energy product prices rose 2.5% from June 2018 to June 2019. The increase in energy prices thus was smaller than in May 2019 (+4.2%).

The higher inflation rate in June 2019 was caused in particular by package holiday prices rising again (+6.1%; May 2019: -9.0%). Food prices rose below average (+1.2%) from June 2018 to June 2019. However, the price increase accelerated slightly on the previous month (May 2019: +0.9%). The prices of goods (total) were 1.5% higher in June 2019 than in the same month a year earlier. The prices of services rose more strongly year on year (+1.9%) in June 2019.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1369 (1215)

$1.1348 (855)

$1.1325 (237)

Price at time of writing this review: $1.1277

Support levels (open interest**, contracts):

$1.1244 (3287)

$1.1215 (3324)

$1.1179 (2705)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 9 is 54655 contracts (according to data from July, 10) with the maximum number of contracts with strike price $1,1500 (3620);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2655 (585)

$1.2627 (451)

$1.2604 (323)

Price at time of writing this review: $1.2533

Support levels (open interest**, contracts):

$1.2489 (1128)

$1.2467 (1417)

$1.2440 (2399)

Comments:

- Overall open interest on the CALL options with the expiration date August, 9 is 14498 contracts, with the maximum number of contracts with strike price $1,3000 (2052);

- Overall open interest on the PUT options with the expiration date August, 9 is 14921 contracts, with the maximum number of contracts with strike price $1,2450 (2563);

- The ratio of PUT/CALL was 1.03 versus 0.99 from the previous trading day according to data from July, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 66.34 | 3.04 |

| WTI | 60.24 | 3.13 |

| Silver | 15.21 | 0.86 |

| Gold | 1417.765 | 1.46 |

| Palladium | 1586.6 | 2.64 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -31.67 | 21533.48 | -0.15 |

| Hang Seng | 88.41 | 28204.69 | 0.31 |

| KOSPI | 6.75 | 2058.78 | 0.33 |

| ASX 200 | 24.1 | 6689.8 | 0.36 |

| FTSE 100 | -5.78 | 7530.69 | -0.08 |

| DAX | -63.14 | 12373.41 | -0.51 |

| Dow Jones | 76.71 | 26860.2 | 0.29 |

| S&P 500 | 13.44 | 2993.07 | 0.45 |

| NASDAQ Composite | 60.8 | 8202.53 | 0.75 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.69606 | 0.46 |

| EURJPY | 121.996 | 0.01 |

| EURUSD | 1.1252 | 0.4 |

| GBPJPY | 135.574 | -0.05 |

| GBPUSD | 1.25067 | 0.35 |

| NZDUSD | 0.66465 | 0.63 |

| USDCAD | 1.30757 | -0.39 |

| USDCHF | 0.98899 | -0.44 |

| USDJPY | 108.401 | -0.4 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.