- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 08-10-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 06:00 | Japan | Prelim Machine Tool Orders, y/y | September | -37.1% | |

| 08:00 | Eurozone | Eurogroup Meetings | |||

| 14:00 | U.S. | Wholesale Inventories | August | 0.2% | 0.4% |

| 14:00 | U.S. | JOLTs Job Openings | August | 7.217 | 7.191 |

| 14:30 | U.S. | Crude Oil Inventories | October | 3.104 | |

| 15:00 | U.S. | FOMC Member Esther George Speaks | |||

| 15:00 | U.S. | Fed Chair Powell Speaks | |||

| 18:00 | U.S. | FOMC meeting minutes | |||

| 21:45 | New Zealand | Food Prices Index, y/y | September | 2.1% | |

| 23:50 | Japan | Core Machinery Orders, y/y | August | 0.3% | -10.8% |

| 23:50 | Japan | Core Machinery Orders | August | -6.6% | -2.5% |

Major US stock indices fell significantly, as investor optimism about the upcoming trade negotiations between the US and China faded.

The Chinese newspaper South China Morning Post (SCMP) reported that the Chinese authorities have weakened their hopes of resolving a trade dispute ahead of negotiations with the United States. The publication notes that Chinese Deputy Prime Minister Liu He, who will lead the country's trade delegation, will not have the title of “special envoy,” which means that he did not receive any specific instructions from Chinese President Xi Jinping. Moreover, according to SCMP, the Chinese delegation may return home from negotiations one day earlier than planned. Summit trade talks between US and China should begin on Thursday. However, another Global Times publication in China said that China “sincerely” hopes to close a deal with the United States.

A negative reaction was also caused by the message that the US government has expanded its trade "black list" to include several leading Chinese companies specializing in artificial intelligence technologies, punishing Beijing for discrimination against predominantly Muslim ethnic minorities. Investors fear that China may react sharply to this decision, which could hurt the chances of a breakthrough in negotiations later this week. In addition, Bloomberg reported that the White House is seeking to limit US state pension fund investments in Chinese stocks.

Market participants also analyzed data on producer prices for September. According to a report by the US Department of Labor, producer price index (PPI) for final demand in September fell 0.3% after rising 0.1% in August. Over the 12 months to September, PPI grew by 1.4%, which is the smallest increase since November 2016, after rising by 1.8% in August. Economists predicted that PPI would rise by 0.1% in September and increase by 1.8% year on year. At the same time, excluding the volatile components of food, energy and trade services, producer prices did not change last month after a jump of 0.4% in August. The so-called basic PPI rose 1.7% in the 12 months to September after rising 1.9% in August.

Almost all DOW components completed trading in the red (29 of 30). Outsiders were shares of Cisco Systems (CSCO; -2.90%). Only shares of Walmart Inc. went up (WMT; + 0.31%).

All S&P sectors recorded a decline. The largest decline was shown by the technology sector (-1.7%).

At the time of closing:

Dow 26,164.04 -313.98 -1.19%

S&P 500 2,893.06 -45.73 -1.56%

Nasdaq 100 7,823.78 -132.52 -1.67%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 06:00 | Japan | Prelim Machine Tool Orders, y/y | September | -37.1% | |

| 08:00 | Eurozone | Eurogroup Meetings | |||

| 14:00 | U.S. | Wholesale Inventories | August | 0.2% | 0.4% |

| 14:00 | U.S. | JOLTs Job Openings | August | 7.217 | 7.191 |

| 14:30 | U.S. | Crude Oil Inventories | October | 3.104 | |

| 15:00 | U.S. | FOMC Member Esther George Speaks | |||

| 15:00 | U.S. | Fed Chair Powell Speaks | |||

| 18:00 | U.S. | FOMC meeting minutes | |||

| 21:45 | New Zealand | Food Prices Index, y/y | September | 2.1% | |

| 23:50 | Japan | Core Machinery Orders, y/y | August | 0.3% | -10.8% |

| 23:50 | Japan | Core Machinery Orders | August | -6.6% | -2.5% |

Jane Foley, the senior FX strategist at Rabobank, notes that the latest RBA interest rate cut has added more urgency to the debate about whether or not the RBA should embark on policies such as Quantitative Easing if further policy stimulus is required in the coming months.

- “The RBA have the advantage of being able to study the impact and the side-effects of the QE used by other central banks in the aftermath of the global financial crisis.

- Given the headwinds connected with the global economic slowdown and given our view that tensions between the US and China will persist for some time, we do expect further policy stimulus from the RBA this cycle. That said, we also expect the pressure on the Australian government to relax fiscal policy to heighten. We look for further downside potential in AUD/USD towards 0.65 on a 9 to 12 mth view.

- Even before the RBA has touched QE, there are worries about the potential impact on the housing market in Australia with the country already close to the top of global rankings of household debt.

- It is likely that the RBA would like to avoid QE if possible. However, with short term rates at an all term low, it seems increasingly likely that unconventional methods could be used – though any effort by the government to relax fiscal policy will reduce the pressure on the RBA.

- The AUD is particularly sensitive to the outlook for the Chinese economy given strong trade links and to the outlook for global growth given its commodity links. While AUD/USD will continue to respond to China-linked headlines, we continue to expect a downside bias to dominate.”

- Says Germany sees economic weakness but no recession yet

Analysts at National Bank Financial (NBF) see, in the U.S., the release of September’s CPI data to attract the most attention this week.

- “A larger-than-seasonal drop in gasoline prices in the month may translate into just a modest increase in headline prices (+0.1% m/m), a development that would allow the annual rate to rise one tick to 1.8%. Core inflation, meanwhile, should have continued to be supported by the services sector, rising 0.2% on a monthly basis. As a result, the 12-month rate should stay put at 2.4%.”

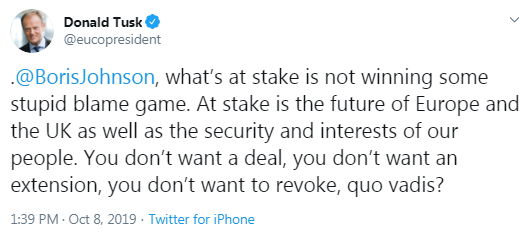

Petr Krpata, an FX strategist at ING, confirms that the extension of Article 50 and early election by late November/early December remains the firm's base case.

- "The extension may well last longer than three months to provide sufficient time for the new government to engage with the EU.

- Early elections will be sterling negative in our view given that (a) Prime Minister Boris Johnson will likely run on a ticket of a divisive stance against the EU to fend off the Brexit Party; and (b) the non-negligible likelihood of the Conservative Party gaining a majority and subsequent increased odds of a hard Brexit. This would translate into a build-up of sterling risk premia, which are currently narrow (as per above).

- We expect GBP/USD to fall below the 1.20 level (also helped by the lower EUR/USD) and EUR/GBP to re-test the 0.93 level.

- Note that the increased odds of hard Brexit should also limit the upside to EUR/USD and be negative for the European FX segment as a whole (be it G10 currencies or Central and Eastern European FX)."

Josh Nye, the senior economist at Royal Bank of Canada (RBC), notes that Canada's housing starts were above consensus at 221,000 annualized units in September with six-month trend remaining close to a cycle high.

- “Canada’s housing sector is back on the front foot with resales picking up as the year progresses and homebuilding activity clearly displaying some momentum. The latest permit data (247,000 in August) points to further strength ahead. After slowing throughout 2018 and early this year, the six-month trend in housing starts has reversed course, picking up to a near-cycle-high 223,500 annualized units.

- Ontario, the Prairies and Atlantic Canada are on the rebound while the trend in BC and Quebec remains strong despite slower starts in the last month or two.

- Across Canada, multi-unit starts remain the key driver of activity.”

U.S. stock-index futures fell on Tuesday as investor optimism around the upcoming trade talks between the U.S. and China diminished.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,587.78 | +212.53 | +0.99% |

Hang Seng | 25,893.40 | +72.37 | +0.28% |

Shanghai | 2,913.57 | +8.38 | +0.29% |

S&P/ASX | 6,593.40 | +29.80 | +0.45% |

FTSE | 7,181.79 | -16.09 | -0.22% |

CAC | 5,473.42 | -48.19 | -0.87% |

DAX | 11,980.12 | -117.31 | -0.97% |

Crude oil | $52.09 | -1.25% | |

Gold | $1,509.30 | +0.33% |

Statistics

Canada announced on Tuesday that the value of building permits issued by the

Canadian municipalities rose 6.1 percent m-o-m in August, following a revised

3.2 percent m-o-m advance in July (originally a 3.0 percent m-o-m increase).

Economists had

forecast a 1.0 percent drop in August from the previous month.

According to

the report, the value of residential permits surged 11.7 percent m-o-m in

August, as permits for multi-family dwellings climbed by 18.8 percent m-o-m, and

single-family permits rose by 3.2 percent m-o-m.

At the same

time, the value of non-residential building permits dropped by 2.7 percent

m-o-m in August, due to declines in institutional (-10.7 percent m-o-m) and

commercial (-5.9 percent m-o-m) permits, which however were partially offset by

a jump in industrial permits (+18.9 percent m-o-m).

In y-o-y terms,

building permits rose 11.1 percent in August.

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 151.75 | -1.77(-1.15%) | 5445 |

ALCOA INC. | AA | 19.05 | -0.20(-1.04%) | 5652 |

ALTRIA GROUP INC. | MO | 41.85 | -0.32(-0.76%) | 5820 |

Amazon.com Inc., NASDAQ | AMZN | 1,718.18 | -14.48(-0.84%) | 22052 |

American Express Co | AXP | 113 | -0.65(-0.57%) | 1134 |

Apple Inc. | AAPL | 225.5 | -1.56(-0.69%) | 214891 |

AT&T Inc | T | 37.58 | -0.08(-0.21%) | 30109 |

Boeing Co | BA | 371.2 | -5.34(-1.42%) | 20111 |

Caterpillar Inc | CAT | 118.5 | -1.75(-1.46%) | 6511 |

Chevron Corp | CVX | 112.3 | -0.96(-0.85%) | 1820 |

Cisco Systems Inc | CSCO | 47.53 | -0.24(-0.50%) | 8475 |

Citigroup Inc., NYSE | C | 67.36 | -0.79(-1.16%) | 4351 |

Exxon Mobil Corp | XOM | 67.41 | -0.61(-0.90%) | 16031 |

Facebook, Inc. | FB | 178.22 | -1.46(-0.81%) | 23644 |

FedEx Corporation, NYSE | FDX | 141 | -1.09(-0.77%) | 3213 |

Ford Motor Co. | F | 8.64 | -0.04(-0.46%) | 15861 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 8.68 | -0.08(-0.91%) | 24168 |

General Electric Co | GE | 8.49 | -0.07(-0.82%) | 90316 |

General Motors Company, NYSE | GM | 34.52 | -0.23(-0.66%) | 3042 |

Goldman Sachs | GS | 198 | -2.40(-1.20%) | 3776 |

Google Inc. | GOOG | 1,200.96 | -6.72(-0.56%) | 1457 |

Hewlett-Packard Co. | HPQ | 16.6 | -0.20(-1.19%) | 3923 |

Home Depot Inc | HD | 225.3 | -1.44(-0.64%) | 11044 |

HONEYWELL INTERNATIONAL INC. | HON | 162.05 | -1.13(-0.69%) | 518 |

Intel Corp | INTC | 50.28 | -0.34(-0.67%) | 21453 |

International Business Machines Co... | IBM | 141.19 | -0.09(-0.06%) | 2533 |

International Paper Company | IP | 38.62 | -0.50(-1.28%) | 3166 |

Johnson & Johnson | JNJ | 132.31 | -0.85(-0.64%) | 1341 |

JPMorgan Chase and Co | JPM | 113.25 | -1.12(-0.98%) | 6420 |

McDonald's Corp | MCD | 211.6 | -0.32(-0.15%) | 2561 |

Merck & Co Inc | MRK | 84 | -0.39(-0.46%) | 451 |

Microsoft Corp | MSFT | 137.3 | 0.18(0.13%) | 124376 |

Nike | NKE | 91.62 | -1.55(-1.66%) | 42848 |

Pfizer Inc | PFE | 35.7 | -0.13(-0.36%) | 1377 |

Procter & Gamble Co | PG | 122.7 | -0.14(-0.11%) | 1820 |

Starbucks Corporation, NASDAQ | SBUX | 85.5 | -0.35(-0.41%) | 4685 |

Tesla Motors, Inc., NASDAQ | TSLA | 236.1 | -1.62(-0.68%) | 31438 |

The Coca-Cola Co | KO | 53.75 | -0.12(-0.22%) | 1512 |

Twitter, Inc., NYSE | TWTR | 40.55 | -0.25(-0.61%) | 7272 |

United Technologies Corp | UTX | 131.77 | -0.92(-0.69%) | 736 |

Verizon Communications Inc | VZ | 60.23 | -0.02(-0.03%) | 4524 |

Visa | V | 175.33 | 0.43(0.25%) | 8830 |

Wal-Mart Stores Inc | WMT | 116.81 | -0.42(-0.36%) | 2983 |

Walt Disney Co | DIS | 130.37 | -0.53(-0.40%) | 7762 |

Yandex N.V., NASDAQ | YNDX | 34.93 | -0.35(-0.99%) | 500 |

The Labor

Department reported on Tuesday the U.S. producer-price index (PPI) fell 0.3

percent m-o-m in September, following a gain of 0.1 percent m-o-m August. That was

the largest decline in producer prices since January.

For the 12

months through September, the PPI rose 1.4 percent after a 1.8 percent advance

in the previous month. That marked the smallest gain in PPI since November 2016.

Economists had

forecast the headline PPI would increase 0.1 percent m-o-m and 1.8 percent over

the past 12 months.

According to

the report, the September decline in final demand prices reflected a 0.2

percent m-o-m decrease in prices for final demand services and a 0.4 percent

m-o-m drop in prices for final demand goods.

Excluding

volatile prices for food and energy, the PPI dropped 0.3 percent m-o-m and rose

2.0 percent over 12 months. Economists had forecast gains of 0.2 percent m-o-m

and 2.3 percent y-o-y, respectively.

The Canada

Mortgage and Housing Corp. (CMHC) reported on Tuesday the seasonally adjusted

annual rate of housing starts was at 221,202 units in September, down 2.5

percent from an upwardly revised 226,871 units in August (originally 226,639

units).

Economists had

forecast an annual pace of 214,500 for September.

According to

the report, urban starts dropped by 2.4 percent m-o-m last month to 208,503 units,

as single-detached urban starts tumbled by 9.2 percent m-o-m to 48,761 units,

while multiple urban starts decreased by 0.2 percent m-o-m to 159,742 units. At

the same time, rural starts were estimated at a seasonally adjusted annual rate

of 12,699 units.

Analysts at TD Securities note that German industrial production rebounded by 0.3% m/m in August.

“It was better than the contraction consensus was looking for but not as strong of a rebound as the shipments data was suggesting, even with the positive revisions to July. Given the early indicators are pointing to a further mild contraction in the September data, this does not change the picture for the ECB.”

FX strategists at UOB Group suggest that probable visit to the 106.30 region in USD/JPY appears to be running out of steam as of late.

- "24-hour view: The sudden overnight surge in USD that touched 107.45 was not expected. While the rapid rise appears to be running ahead of itself, there is room for USD to test the strong 107.50 resistance. For today, the prospect for a clear break of this level is not high (next resistance is at 107.75). Support is at 107.00 but only a move below 106.70 would indicate the current upward pressure has eased.

- Next 1-3 weeks: The sudden surge in USD yesterday (NY close of 107.28, +0.32%) came as a surprise. While our 107.50 ‘key resistance’ is still intact (overnight high of 107.45), downward pressure has been dented and the odds for further USD weakness to 106.35 have diminished (we have expected USD to trade with a downside bias towards 106.35 since last Thursday, 03 Oct, spot at 107.15). In order to rejuvenate the flagging downward momentum, USD has to move and stay below 106.70 within these 1 to 2 days or a break of 107.50 would suggest that USD has moved into a sideway-trading phase."

- PM Johnson told cabinet there was no doubt that Benn act has had an impact on Brexit talks

- PM repeated Merkel the EU must compromise if there is to be a deal

- PM is expected to continue to engage with the EU leaders in order to find a way through to a Brexit deal

Analysts at TD Securities are expecting the Canadian housing starts to trend higher to a 230k pace in September from 226k in August, above the market consensus for a more subdued 220k.

“A rebound in multi-unit construction, which has fallen by nearly 13% over the last two months, should provide the main driver for the headline print following steady gains in the resale market. August building permits will be released shortly afterward with the market looking for a 1.2% increase.”

Analysts at TD Securities note the Fed Chair Powell will deliver remarks at the annual NABE Conference at 2:30 pm EST, which will be closely scrutinized for clues regarding the path forward for rates.

- “The topic of Powell's discussion will be "Data Dependence in an Evolving Economy". The market is now priced in for an October cut on the heels of deteriorating data and will be looking for confirmation by the Fed Chair.

- Separately, the market expects producer prices to advance 0.1% m/m, keeping the annual rate unchanged at 1.8% for a second consecutive month in September. Similarly, excluding food and energy, producer prices should have remained unchanged at 2.3% y/y on the back of a stronger 0.2% m/m gain.”

Analysts at National Bank Financial (NBF) see September’s labour force survey to draw the most attention for Canada this week.

- “No less than 304K jobs were added in the country in the first eight months of the year, the best tally since 2002. Adding to the good news, most of the positions created over that period were full-time (230K) and in the private sector (237K). That pace is unsustainable in the context of growing labour shortages in several provinces and we suspect we’ll see a sharp moderation in coming months, starting with a -15K print on Friday.

- The unemployment rate, meanwhile, could rise one tick to 5.8%, assuming the participation rate stays put at 65.8%.”

- UK Brexit negotiator Frost is still to hold talks with EC on Tuesday, despite reports that a Brexit deal was now "essentially impossible"

Analysts at ANZ note that the positioning data for the week ending 1 October 2019 revealed that both funds and asset managers remained in dollar buying mode even as USD has weakened since the CFTC cut-off date.

- “Looking forward, we expect USD positioning to continue to exhibit volatility owing to multiple factors at play: US-China trade headlines, ongoing political developments in the US, and market expectation of the Fed’s monetary policy path.

- Funds and asset managers both reverted to selling EUR, as the currency weakened further on worse than expected economic and inflation data. However, both continued with their offsetting positons on GBP; while funds sold, asset managers bought. Both were also overall sellers of safe-haven currencies (JPY and CHF), perhaps owing to continued optimism over the upcoming US-China trade talks.

- Commodity currencies saw overall buying by funds led by AUD. However, asset managers were combined net sellers, selling AUD while buying CAD and NZD. In the EMFX space, funds only bought BRL while asset managers bought MXN while selling BRL.”

The National Federation of Independent Business (NFIB) reported on Tuesday the Small Business Optimism Index decreased by 1.3 points to 101.8 in September, following a 1.6-point decline in August.

According to the report, the September decline in the headline index was mainly attributable to a further deterioration in the perceived environment for expansion and expected business conditions. Twenty-two percent of respondents said it was a good time to expand, down 4 points from August, while a net 9 percent expect better business conditions, down 3 points. In addition, net 17 percent of business owners said they plan to create new jobs, down 3 points from August. Meanwhile, current job creation, capital spending, and inventory investment, all were consistent with solid, but slower growth. Overall, seven of 10 index components declined and three were unchanged.

“As small business owners continue to invest, expand, and try to hire, they’re doing so with less gusto than they did earlier in the year, thanks to the mixed signals they’re receiving from policymakers and politicians,” said NFIB President and CEO Juanita D. Duggan. “All indications are that owners are eager to do more, but they’re uncertain about what the future holds and can’t find workers to fill the jobs they have open.”

Aline Schuiling, senior economist at ABN AMRO, points out that the volume of orders received by Germany’s industrial sector continued to decline in August.

“Total orders fell by 0.6% mom after they dropped by 2.1% in July. The weakness was concentrated in domestic orders (-2.6% mom in August), while foreign orders increased (orders from the eurozone rose by 1.5% mom and from non-eurozone countries by 0.4%). The monthly orders data is very volatile and the more stable 3 month-over-3 month growth rate shows that the weakness in orders is actually broadbased, across both geographies (domestic, eurozone and non-eurozone) and main product groups (consumer goods, capital goods and intermediate goods). All in all, the orders data confirm the weak picture already painted by the most recent manufacturing PMI and the Ifo industrial business climate indicator, which each fell in August and September, suggesting that the contraction in Germany’s industrial sector will continue in the second half of the year.”

The Swiss National Bank will cut interest rates early next year, pushed into action by a further round of easing by other central banks, according to UBS Group AG.

It expects both the European Central Bank and the Federal Reserve to “react to recession risks” with more rate cuts. “That should force the SNB to cut rates in the spring, which is why there shouldn’t be a stronger appreciation of the franc in the next twelve months,” UBS economist Alessandro Bee wrote in a note to clients.

Along with Denmark, Switzerland has the lowest policy benchmark of any central bank. Although euro-area officials cut rates in September, that package disappointed markets and the SNB didn’t follow suit with a cut of its own.

However, the Swiss institution increased the amount banks can exempt from its deposit charge of 75 basis points, shielding banks from side effects and paving the way for a rate reduction.

Martin Enlund, analyst at Nordea Markets, suggests that US growth expectations have been falling in relative terms since the start of the summer and if this trend continues, it could weaken the USD at some point.

“Looking at empirical evidence, however, we argue that US growth expectations need to converge with the rest of the world before any significant weakening occurs – right now, relative growth expectations are still consistent with a USD that will strengthen 5% on an annualised basis. It is also striking is how Euro-area (EA) data has generally kept disappointing. A weaker EUR, record-low bond yields and accelerating monetary growth have so far failed to stabilise activity growth. Instead, the most recent PMI for manufacturing was the weakest since 2012, and there are sadly more and more signs that weakness in the manufacturing sector has started to spill over into the more employment-heavy service sector. Even as US growth estimates are lowered, we argue that the country is still outperforming well enough to keep the USD firm.”

Productivity in Britain contracted at the fastest annual pace in five years during the second quarter, according to official data that underline a persistent weak spot in the economy.

Office for National Statistics said, output per hour worked fell 0.5% year-on-year in the April to June period after stagnating in the first three months of 2019, the biggest drop since the second quarter of 2014. It fell 0.2% quarter-on-quarter, extending a 0.5% quarterly drop seen in early 2019.

Both services and manufacturing saw a fall in labour productivity growth of 0.8% and 1.9% respectively, compared with the same quarter in the previous year.

There was no growth in output per job in Quarter 2 (Apr to June) 2019 compared with the same quarter in the previous year, as both gross value added (GVA) and the number of jobs grew by 1.3% over the same period.

Japan's output of crude steel in the October-December quarter is forecast to fall 0.1% from a year earlier as trade tensions and uncertainty over China's economy curb exports, the Ministry of Economy, Trade and Industry (METI) said.

Crude steel output is estimated at 25.69 million tonnes versus 25.70 million tonnes a year earlier, the ministry said. Output has fallen year on year for five quarters.

Output in the current quarter is expected to rise 0.8% from the previous quarter.

Demand for steel products, including those for exports, is forecast to fall 2.9% year on year to 22.92 million tonnes, the ministry said, citing an industry survey.

Exports, which typically account for about 40% of Japanese steel production, are predicted to drop 1.4%.

Robert Carnell, chief economist at ING, points out that China’s Caixin manufacturing PMI for September rose from 50.4 to 51.4, a surprisingly strong reading.

“Indeed, on a trend basis, the Caixin index has been on an erratic uptrend since its trough in January this year, when it dropped to 48.3. It now suggests that the more export focussed private sector firms that constitute the bulk of this survey are actually seeing activity increase. Even the export orders index, which remains in negative territory, seems to indicate that things are not falling as fast as they were. It is less clear that the Caixin services indicator, which is released today, will be similarly affected by such stimulus. Consensus sees the index virtually flat at 52.0 (52.1 in August). That seems a reasonable guess. Though this survey is far more erratic and almost anything seems possible. If I had to guess, I would say that this survey should converge on its manufacturing counterpart, though the correlation between the two seems virtually nonexistent (0.09 since the beginning of 2017). A modest uptick today would not seem totally outlandish. But the scope for two-way surprise is high.

FX Strategists at UOB Group still view as possible a potential breakout of the key resistance around 1.10 in the next weeks.

24-hour view: “We highlighted yesterday EUR “could edge above the 1.1000 level” but held the view “the next resistance at 1.1025 is still unlikely to come into the picture”. EUR subsequently touched 1.1000 before easing off to end the day little changed at 1.0970 (-0.06%). The recent mild upward pressure appears to have dissipated and the downside risk has increased. From here, unless there is a clear break of 1.1000, EUR could edge lower to 1.0950. The next support at 1.0930 is a relatively strong level and is unlikely to yield”.

Next 1-3 weeks: “EUR tested the 1.1000 level for the third straight day (high of 1.1000) before easing off to close little changed at 1.0970 (-0.05%). The price action was not surprising as we indicated last Thursday (03 Oct, spot at 1.0960) that “the current movement is viewed as the early stages of a consolidation phase”. That said, as highlighted yesterday (07 Oct, spot at 1.0980), looking forward, the top of the expected 1.0890/1.1025 range appears to be more vulnerable”.

Chinese Vice Premier Liu He and top trade negotiator will be traveling to Washington for the next round of trade talks with the United States on Oct.10-11, China's commerce ministry said on Tuesday.

Liu will meet U.S. Trade Representative Robert Lighthizer and U.S. Treasury Secretary Steven Mnuchin, the ministry said in a brief statement.

Chinese Commerce Minister Zhong Shan, China's central bank Governor Yi Gang, and the National Development and Reform Commission's deputy head Ning Jizhe will also attend the trade talks, according to the statement.

Danske Bank analysts suggest that today is quiet in terms of economic data releases but the US NFIB small business optimism at 12:00 may attract some attention due to the recession fears.

“We have some Fed speeches today, not least Fed chair Powell at 20:30 CET. With investors pricing in a high probability of another cut later this month, the Fed probably needs to correct market pricing in case they are not going to deliver the cut. Consumer confidence on Friday and retail sales next week are going to be vital. Otherwise focus remains on politics. Look out for any political statements ahead of the US-China trade negotiations on Thursday-Friday, the Brexit negotiations which need to be concluded this week and the US-Turkey-Syria situation.”

Britain's budget deficit is likely to more than double to around 100 billion pounds if the country leaves the EU without a deal, quickly requiring a return to austerity, a leading think-tank said on Tuesday.

Britain is due to leave the EU on Oct. 31 and Prime Minister Boris Johnson has said he is determined to do so despite parliament ordering him to seek a delay if he cannot negotiate an acceptable transition agreement before then.

The Institute for Fiscal Studies predicted borrowing would rise to 92 billion pounds - equivalent to 4% of national income - by 2021/22 under a "relatively benign" no-deal Brexit scenario, in which there are no major delays at borders.

Even then, the economy would still enter recession in 2020, the IFS said in an annual assessment of the public finances.

If the government undertook enough fiscal stimulus to stop the economy contracting - roughly 23 billion pounds of extra spending in 2020 and 2021 - annual borrowing would peak at 102 billion pounds

"A no-deal Brexit would likely require a fiscal short-term stimulus followed by a swift return to austerity," IFS deputy director Carl Emmerson said.

In the longer term, a no-deal Brexit would mean less money to spend on public services - or higher tax rates - than staying in the EU or leaving with a deal, the IFS said.

Britain published a revised temporary tariff regime on Tuesday to come into force if it leaves the European Union without a deal, saying that 88% of total imports by value would be eligible for tariff free access.

Britain first published a temporary tariff regime in March prior to its original deadline to leave the bloc.

The revised plan, which lowers tariffs on trucks and applies tariffs to additional bioethanol and some clothing products, will last for up to 12 months and is designed to keep prices down for consumers while protecting the fortunes of domestic producers.

As Beijing and Washington return to the negotiating table looking to settle their trade dispute, experts say the Hong Kong protests could cast a “shadow” over discussions — even if the situation doesn’t directly affect the outcome of this week’s talks.

“If anything happened bad, I think that would be a very bad thing for the negotiation. I think politically it would be very tough,” U.S. President Donald Trump said of Hong Kong’s pro-democracy protests.

Hong Kong, a former British colony, returned to Chinese rule in 1997. Anti-government protests have rocked the city for over four months now. They first erupted over a now withdrawn extradition bill that would have allowed fugitives to be transferred to mainland China for trial.

“It will just irritate the Chinese that the two [situations] are being linked,” said Richard Harris, CEO of Hong Kong-based asset management firm Port Shelter Investment Management.

But if Beijing exercises any extreme measures in Hong Kong, then there will be potential talks of sanctions and restrictions, denting any progress that has been made, Harris told.

“There’s been strong reports, even this morning, that if there is major action by Chinese forces in Hong Kong, that it will certainly be included in terms of the trade deal — and you have to think that’s going to be the case,” he said.

Even if there’s no direct impact, Hong Kong’s months of unrest “will likely cast an uncomfortable shadow over the [trade] discussions,” said Nick Marro, global trade lead at The Economist Intelligence Unit.

According to provisional data of the Federal Statistical Office (Destatis), in August 2019, production in industry was up by 0.3% on the previous month on a price, seasonally and calendar adjusted basis. Economists had expected a 0.1% decrease. In July 2019, the corrected figure shows a decrease of 0.4% (primary -0.6%) from June 2019.

In August 2019, production in industry excluding energy and construction was up by 0.7%. Within industry, the production of intermediate goods increased by 1.0% and the production of capital goods by 1.1%. The production of consumer goods showed a decrease by 1.0%. Outside industry, energy production was down by 1.7% in August 2019 and the production in construction decreased by 1.5%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1108 (2872)

$1.1083 (2048)

$1.1064 (585)

Price at time of writing this review: $1.0974

Support levels (open interest**, contracts):

$1.0943 (3256)

$1.0912 (3292)

$1.0875 (3252)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 8 is 61843 contracts (according to data from October, 7) with the maximum number of contracts with strike price $1,0800 (3524);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2558 (857)

$1.2502 (117)

$1.2454 (168)

Price at time of writing this review: $1.2296

Support levels (open interest**, contracts):

$1.2239 (1170)

$1.2200 (588)

$1.2152 (648)

Comments:

- Overall open interest on the CALL options with the expiration date November, 8 is 31529 contracts, with the maximum number of contracts with strike price $1,3300 (3788);

- Overall open interest on the PUT options with the expiration date November, 8 is 18190 contracts, with the maximum number of contracts with strike price $1,2000 (1635);

- The ratio of PUT/CALL was 0.58 versus 0.55 from the previous trading day according to data from October, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 58.12 | 0.4 |

| WTI | 52.68 | 0.27 |

| Silver | 17.41 | -0.85 |

| Gold | 1493.197 | -0.93 |

| Palladium | 1660.13 | -0.24 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -34.95 | 21375.25 | -0.16 |

| KOSPI | 1.04 | 2021.73 | 0.05 |

| ASX 200 | 46.5 | 6563.6 | 0.71 |

| FTSE 100 | 42.5 | 7197.88 | 0.59 |

| DAX | 84.62 | 12097.43 | 0.7 |

| Dow Jones | -95.7 | 26478.02 | -0.36 |

| S&P 500 | -13.22 | 2938.79 | -0.45 |

| NASDAQ Composite | -26.18 | 7956.29 | -0.33 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67317 | -0.42 |

| EURJPY | 117.629 | 0.45 |

| EURUSD | 1.09702 | -0.08 |

| GBPJPY | 131.765 | 0.26 |

| GBPUSD | 1.22885 | -0.26 |

| NZDUSD | 0.62885 | -0.42 |

| USDCAD | 1.33074 | -0.1 |

| USDCHF | 0.99458 | 0.04 |

| USDJPY | 107.217 | 0.52 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.