- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 07-06-2024

- Kiwi's grip loosens against the Yen on Friday, moving towards the 20-day SMA.

- The cross cruises through a consolidation phase while the stance of the bear is strengthening.

- Defense around the 20-day SMA starts showing signs of weakness, hinting at potential declines.

On Friday, the NZD/JPY pair faced selling pressure, with the cross declining towards the 20-day Simple Moving Average (SMA) at 95.70. It appears that the consolidation phase might have tightened its grip around the pair, restricting the buyers' ability to keep the cross afloat.

The Relative Strength Index (RSI) for NZD/JPY on the daily chart currently stands at 53, reflecting a decrease from the previous session's RSI value of 62. The RSI's movement towards the neutral zone, away from the oversold or overbought regions, hints at a moderation in buying pressure. Meanwhile, the Moving Average Convergence Divergence (MACD) has started to print rising red bars, indicating a growing selling momentum and reinforcing the possibility of extended consolidation or even possible declines.

NZD/JPY daily chart

The cross's decline towards 20-day SMA coupled with strengthening selling pressure could potentially disrupt buyers' defense of the mentioned support. Despite the recent jump from around 91.00 to 96.00 since early May, it seems that consolidation has started to reign, marking a pause in the uptrend as gains are consolidated.

- Daily chart indicators reveal a neutral period for the pair; RSI stands at 49, showcasing no strong directional bias.

- Signs of a bearish takeover are emerging, suggesting possible short-term bearish pressure or further consolidation.

- The pair now interacts with the important 20-day SMA at 103.90, which currently serves as resistance to recover.

During the last trading sessions of this week, the AUD/JPY pair is maneuvering around the 103.00 level. This is indicative of an ongoing consolidation period following the impressive rally since early May.

Shifting the attention to the daily Relative Strength Index (RSI) analysis, the index is sitting at 49. When compared to the previous readings, a clear decline suggests that the pair has entered a bearish momentum in the short term. Moreover, the Moving Average Convergence Divergence (MACD) has started printing flat red bars, signaling that the market is experiencing steady selling activity.

AUD/JPY daily chart

Should the pair suffer further losses, the 100 and 200-day SMAs are readily available as buffering units. These averages are situated at about 99.80 and 97.98, respectively. Conversely, any attempt by the bulls to push the pair above the aforementioned 20-day SMA and further to the 105.00 level will be met with resistance. If these resistance barriers remain unbroken, the AUD/JPY pair might extend its consolidation phase.

- EUR/USD tumbled into 1.0800 once again, trimming the week’s earlier gains.

- US NFP figures came in much higher than expected.

- ECB rate cut unlikely to be chased by a follow-up rate trim.

EUR/USD tumbled sharply on Friday, receding after US Nonfarm Payrolls climbed well above forecasts and European Central Bank (ECB) President Lagarde warned that a follow-up rate cut to June’s quarter-point rate trim may not be on the cards as many investors hope.

US Nonfarm Payrolls added 272K net new jobs in May, well above the 185K forecast while th previous month saw only a slight downside revision to 165K from the initial print of 175K. US Average Hourly Earnings also outpaced expectations as wages grew at a firmer pace than investors had anticipated, growing at a MoM rate of 0.4% versus the forecast uptick to 0.3% from 0.2%.

The US Unemployment Rate ticked higher to 4.0%, but a still-tight US labor market and rising wages threw a large wrench into broad-market rate cut hopes to wrap up the trading week. According to the CME’s FedWatch Tool, rate traders are pricing in 51% odds of no rate cut at all in September, down steeply from 70% odds of at least a quarter-point trim on September 8 that was priced in prior to Friday’s NFP print.

ECB's Lagarde: Still a long way to go on defeating inflation

Despite the ECB delivering a much-sought after rate cut this week, ECB President Christine Lagarde tamped down expectations for a follow-up rate cut in July, noting that progress on inflation has been a choppy affair, and the ECB will need to see firmer progress on disinflation before committing to further rate cuts. A hawkish, or rather, not-dovish showing from the head of the ECB hobbled Euro bulls hoping for a late-session rebound to wrap up the trading week.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Last release: Fri Jun 07, 2024 12:30

Frequency: Monthly

Actual: 272K

Consensus: 185K

Previous: 175K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

EUR/USD technical outlook

Friday’s steep tumble has forced the Fiber back into familiar technical congestion, knocking the pair down nearly a full percent peak-to-trough on the day. The pair has fallen from 1.0900 to the 1.0800 handle, with the pair backsliding into the 200-day Exponential Moving Average (EMA).

Bidders will be looking for a technical rebound off of key technical levels next week, but a near-term collapse into a declining trendline setup might see bids slip further towards 1.0750 before buyers can hit the brakes and take another run at the topside.

EUR/USD hourly chart

EUR/USD daily chart

- The daily RSI records a balanced reading at 50, while the MACD bears a bearish crossover.

- The pair stabilize near the 20-day SMA, with buyers trying to avoid losses beneath it.

- The underlying bullish trend remains intact, guarded by the 100- and 200-day SMAs.

In Friday's session, the EUR/JPY pair is seen consolidating after a significant upward wave which took it near multi-year highs around 171.00, oscillating around the crucial 169.00 level. The stabilization at this junction is particularly corroborated by the proximity to the 20-day Simple Moving Average (SMA) near 169.60 which despite falling beneath, the cross will try to defend it as it serves as a strong support.

The Relative Strength Index (RSI) on the daily chart reads a steady 53 now, reflecting balanced market sentiment between the buyers and the sellers. This neutral RSI implies that the market participants are currently eagle-eyeing further direction before making a move. The daily Moving Average Convergence Divergence (MACD) has recently registered a bearish crossover- an occurrence when the MACD line dived under the signal line. This crossover potentially signals ensuing short-term bearish pressure, opening up possibilities of a tempo correction or further consolidation before resuming the upward march.

EUR/JPY daily chart

However, the broader bullish trend in the EUR/JPY remains unaffected. The support formed by the 100- and 200-day Simple Moving Averages (SMAs) at around 164.00 and 161.00, respectively, form a major bastion against long-drawn bearish movements. Therefore, while recent sessions brought some hope to bear, these movements should be treated as corrective rather than any structural changes in the trend.

European Central Bank President Christine Lagarde noted on Friday that despite recent progress, the ECB still has plenty of work ahead of it. According to the head of the ECB, President Lagarde noted that follow-up rate cuts to this week's reference rate trim may not be forthcoming as soon as investors had hoped.

Key highlights

The path to 2% won't be entirely smooth ride.

There's still a long way to go until inflation is defeated.

We've made major progress, but the inflation fight is not over.

The ECB still needs to have a foot on the brake for a while.

The ECB still needs vigilance, commitment, perseverance.

- USD/JPY climbs above 156.50 as buyers push prices above Ichimoku Cloud.

- Resistance at June 4 high (156.48), 157.00, April 26 high (158.44), and YTD high (160.32).

- Supports at Senkou Span A and B (155.52/45), 50-DMA (154.98), and Ichimoku Cloud base (153.40/50).

The USD/JPY registered modest gains of 0.66% on Friday after a stronger-than-expected US employment report, which decreased the chances that the US Federal Reserve could ease policy during the year. Therefore, the pair trades at 156.64 after bouncing off lows of 155.12.

USD/JPY Price Analysis: Technical outlook

From a daily chart perspective, the USD/JPY continues to remain consolidated, slightly tilted to the upside. The pair climbed above the Ichimoku Cloud (Kumo), an indication of buyers' strength.

Momentum turned bullish, yet the pair could see an increase in volatility due to threats of intervention by Japanese authorities.

Once the USD/JPY cleared the June 4 high of 156.48, that could sponsor a leg-up toward 157.00. On further strength, the next supply zone would be the April 26 high of 158.44, followed by the year-to-date (YTD) high of 160.32.

Conversely, if USD/JPY tumbles below 156.00, the first support would be the confluence of the Senkou Span A and B at around 155.52/45, before testing the 50-day moving average (DMA) at 154.98. A breach of the latter will expose the bottom of the Ichimoku Cloud (Kumo) at around 153.40/50.

USD/JPY Price Action – Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.82% | 0.53% | 0.67% | 0.62% | 1.27% | 1.47% | 0.81% | |

| EUR | -0.82% | -0.27% | -0.14% | -0.19% | 0.46% | 0.72% | 0.01% | |

| GBP | -0.53% | 0.27% | 0.14% | 0.08% | 0.74% | 0.99% | 0.27% | |

| JPY | -0.67% | 0.14% | -0.14% | -0.05% | 0.59% | 0.81% | 0.15% | |

| CAD | -0.62% | 0.19% | -0.08% | 0.05% | 0.65% | 0.92% | 0.19% | |

| AUD | -1.27% | -0.46% | -0.74% | -0.59% | -0.65% | 0.25% | -0.48% | |

| NZD | -1.47% | -0.72% | -0.99% | -0.81% | -0.92% | -0.25% | -0.71% | |

| CHF | -0.81% | -0.01% | -0.27% | -0.15% | -0.19% | 0.48% | 0.71% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

- Gold falls to multi-week low after US labor market data exceeds expectations.

- China’s People’s Bank halts 18-month Gold buying spree, exerts downward pressure on XAU/USD.

- US Treasury yields surge with the 10-year yield up to 4.43%, bolstering the Greenback and pushing Gold’s price lower.

- Traders eye US inflation data and Fed policy meeting next week.

Gold prices plummeted to a four-week low after the US Bureau of Labor Statistics (BLS) revealed that the labor market remained strong, and China halted its purchase of the golden metal. Therefore, with the XAU/USD trading at $2,295, the non-yielding metal dropped by more than 3%.

The latest US Nonfarm Payrolls report for May revealed the labor market added more people to the workforce, smashing estimates. Despite that, the same report revealed an uptick in the Unemployment Rate, while Average Hourly Earnings witnessed a slight increase.

After the data release, XAU/USD extended its fall, which began during Friday’s Asian session. News that the People’s Bank of China paused its 18-month bullion buying spree weighed on the precious metal.

“Holdings of the precious metal by the PBOC held steady at 72.80 million troy ounces for May,” according to MarketWatch.

So far, Gold has traveled from $2,387 to $2,304 and is about to fall beneath the $2,300 mark. In the meantime, US Treasury bond yields are skyrocketing, with the 10-year bond yield climbing 14 basis points to 4.43%, underpinning the Greenback.

The DXY, an index of the US Dollar against six other currencies, increased 0.79% to 104.91.

Market participants turn to next week's US inflation data and the Federal Reserve’s (Fed) monetary policy meeting. The US Consumer Price Index (CPI) is expected to remain steady, but a reacceleration could trigger further losses for the golden metal.

Daily digest market movers: Gold price on the defensive after strong US jobs report

- US Bureau of Labor Statistics reported that May's Nonfarm Payrolls increased by 272,000, surpassing the forecast of 185,000 and April’s figure of 165,000.

- The Unemployment Rate jumped from 3.9% to 4%, while Average Hourly Earnings increased by 4.1% YoY, up from the previous 4%.

- A stronger-than-expected US NFP report sparked speculation that the Fed will keep rates higher for longer.

- After the data release, the December 2024 CBOT fed funds rate futures contract expects 27 basis points (bps) of easing, 12 bps less than on Thursday.

- Odds for a Fed rate cut in September were lowered from 55% to 47%.

Technical analysis: Gold price collapses below $2,300

Gold prices retreat sharply and appear to form a Head-and-Shoulders chart pattern, which could lower the price of the yellow metal. Momentum has shifted bearish due to the Relative Strength Index (RSI) piercing below the 50-midline, indicating that sellers are in charge.

Therefore, further Gold weakness and sellers could push the spot price below $2,300. Once cleared, the next stop would be the May 3 low of $2,277, followed by the March 21 high of $2,222. Further losses lie beneath, with buyers’ next line of defense at around the $2,200 figure.

Conversely, if Gold buyers lift prices above $2,350, look for a consolidation in the $2,350-$2,380 area.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- In Friday's session, the USD/CHF recovered surging above the 0.8965 mark.

- Strong Nonfarm Payroll data from the US propelled the USD across the board.

- US Treasury yields increased while the odds of a cut in September by the Fed slightly declined.

The USD/CHF pair is seeing a boost after updated Nonfarm Payroll (NFP) figures from the US were released on Friday, surpassing market expectations. As market bets on the Federal Reserve may turn more hawkish, the divergences with the Swiss National Bank (SNB) might favor the USD.

The newly reported NFP for May expanded to 272K up from 165K (April's revised reading), blowing market estimations of 185K. Strong data such as this has led to a decrease in the odds of a Fed rate cut happening in September. The Unemployment Rate in the US also rose to 4% from the previous 3.9%, with a small decline in the Labor Force Participation Rate, ticking down to 62.5% from the former 62.7%. Concurrently, the Average Hourly Earnings experienced a growth of 4.1% YoY from the revised 4% in April indicating a rise in wage inflation.

Following the release of the data, US Treasury yields spiked with the 2,5 and 10-year rates soaring to 4.80%, 4.44%, and 4.41% making the USD gain interest.

On the other hand, the SNB embarked on an easing cycle in its March meeting, reducing rates by 25 bps to reach 1.5%. As of now, the market predicts 55% odds for another rate cut happening in the upcoming meeting scheduled for June 20.

USD/CHF technical analysis

Technically speaking, the pair has recuperated to a more favorable stance, pushing indicators out of the oversold regions. The Relative Strength Index (RSI) now hovers near 50, signaling a more balanced market, and the Moving Average Convergence Divergence (MACD) is reporting smaller red bars. There's a clear sign of the pair regaining positions above the reformed 100 and 200-day SMA barriers, bolstering the short-term bullish outlook. The 200-day SMA also adds additional reinforcement to defend against losses.

USD/CHF daily chart

- Dow Jones grinds into the middle as investors shrug off declining rate cut bets.

- The US added 272K net new jobs in May.

- US wages also climbed faster than expected, crumpling September rate cut hopes.

The Dow Jones Industrial Average (DJIA) shrugged off a forecast-thumping Nonfarm Payrolls (NFP) print on Friday, climbing into a brief 0.2% gain through the US market session before slumping back to the day’s opening bids after a reactionary tumble to better-than-expected jobs additions in May.

US Nonfarm Payrolls delivered its third-best monthly net job gains on Friday, adding 272K new employment positions in May, well above the forecast 185K. The figure handily beat the previous month’s figure, which was revised slightly lower to 165K from 175K.

US Average Hourly Earnings also climbed faster than expected, showing wages increased 0.4% MoM versus the forecast 0.3% and the previous 0.2%. Meanwhile, the US Unemployment Rate also ticked up to its highest level since February 2022, printing at 4.0% versus the expected hold at 3.9%.

With the US economy continuing to outperform investor expectations, broad-market hopes for Federal Reserve (Fed) rate cuts continue to get battered. According to the CME’s FedWatch Tool, rate traders are now pricing in barely 51% odds of a at least a quarter-point rate trim from the Fed on September 8, down significantly from the 70% odds that were priced in until just before Friday’s NFP print.

Dow Jones news

After some initial post-NFP jitters, the DJIA is recovering firmly on Friday. Two-thirds of the major index’s constituent securities are in the green on the day, with gains being led by 3M Co. (MMM), which is up around 3% in Friday’s trading. 3M’s stock was recently upgraded to a “buy” by Bank of America analysts, prompting investors to do just that. 3M crossed over $100 per share on Friday, and is up nearly 12% for the year.

On the low side, Unitedhealth Group Inc. (UNH) fell -1.8% on Friday, falling to $493.00 per share. UNH is down around -6.25% from mid-May’s peak near $525.00 per share, and Friday’s share prices are shedding further weight following the announcement of a shareholder lawsuit against the company for alleged losses stemming from securities fraud committed by the healthcare company between March 2022 and February 2024.

Dow Jones technical outlook

The Dow Jones tested the 39,000.00 handle in an intraday recovery on Friday, but fell back to the day’s opening range near 38,880.00. The index is holding steady after recent recovery bids from a near-term low at the 38,000.00 level, but Friday is shaping up to be another soft day to round out the trading week.

The Dow Jones continues to waffle after falling from record all-time highs above 40,000.00, and still remains down -3% from record peaks in May. A firm demand zone is priced in between 38,000.00 and 37,500.00, and the major equity index is still trading deep into bull country above the 200-day Exponential Moving Average (EMA) at 37,299.82.

Dow Jones five minute chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- Canadian Dollar tumbles -0.6% against US Dollar on Friday.

- Canada added more jobs than expected but is eclipsed by US NFP.

- Bumper job additions and rising wages crimp rate cut hopes.

The Canadian Dollar (CAD) is giving a mixed performance on Friday, climbing against the majority of its major currency peers but backsliding against the US Dollar (USD). The CAD shed six-tenths of a percent against the Greenback after a bumper US Nonfarm Payrolls (NFP) sent the USD broadly higher as investor hopes for a September rate cut from the Federal Reserve (Fed) wither on the vine.

Canada added more jobs than expected in May, but the figure was still well below previous figures, limiting the CAD’s upside momentum. Hourly wages also gained ground in both Canada and the US, while the US Unemployment Rate ticked higher in a cautionary note to Friday’s otherwise clean beat of market forecasts.

Daily digest market movers: Fresh job additions crimp rate cut bets

- US NFP added 272K net new jobs in May, clobbering the 185K forecast though the previous month’s print was revised lower to 165K from 175K.

- The US Unemployment Rate ticked higher to 4.0% in May, a 28-month high.

- US Average Hourly Earnings rose 0.4% MoM in May, above the forecast 0.3% and doubling the previous 0.2%.

- Canada’s Net Change in Employment rose to 26.7K in May, above the 22.5K forecast but still well below the previous month’s 90.4K.

- According to the CME’s FedWatch Tool, investor hopes for a September rate cut from the Fed were knocked firmly back by US data on Friday. Rate traders are pricing in only a 55% chance of at least a quarter-point cut from the Fed on September 8, down from over 70% before the US NFP print.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.76% | 0.50% | 0.66% | 0.59% | 1.18% | 1.39% | 0.79% | |

| EUR | -0.76% | -0.24% | -0.14% | -0.17% | 0.42% | 0.69% | 0.01% | |

| GBP | -0.50% | 0.24% | 0.12% | 0.07% | 0.67% | 0.93% | 0.25% | |

| JPY | -0.66% | 0.14% | -0.12% | -0.05% | 0.53% | 0.76% | 0.14% | |

| CAD | -0.59% | 0.17% | -0.07% | 0.05% | 0.59% | 0.87% | 0.18% | |

| AUD | -1.18% | -0.42% | -0.67% | -0.53% | -0.59% | 0.26% | -0.42% | |

| NZD | -1.39% | -0.69% | -0.93% | -0.76% | -0.87% | -0.26% | -0.66% | |

| CHF | -0.79% | -0.01% | -0.25% | -0.14% | -0.18% | 0.42% | 0.66% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Technical analysis: Canadian Dollar grinds out some gains as US Dollar soars

The Canadian Dollar (CAD) tumbled six-tenths of one percent against the Greenback on Friday, but otherwise stuck to its guns. The CAD rose three-quarters of one percent against the New Zealand Dollar (NZD) and six-tenths of one percent against the Australian Dollar (AUD). The CAD is also in the green within a fifth of a percent against the Euro (EUR) and the Swiss Franc (CHF).

USD/CAD shot to fresh near-term highs above 1.3750 on Friday, bumping into the ceiling of recent consolidation patterns. The pair is set to continue grinding sideways in the medium-term as buying power in the US Dollar evaporates at familiar technical highs.

Daily candlesticks show the pair on pace to see its strongest close in over a month, and bumping into its highest bids since early May. Consolidation remains the name of the game in the long-term, though USD/CAD continues to grind out chart paper north of the 200-day Exponential Moving Average (EMA).

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- Mexican Peso collapsed to 18.40 against USD after AMLO's remarks on judicial and transparency reforms.

- AMLO’s comments on judicial reform and dissolution of autonomous bodies spur investor concerns.

- Mexico’s headline inflation rises for third month, while core inflation declines for 16th consecutive month.

- Strong US employment data boosts speculation of prolonged higher Fed rates.

The Mexican Peso sank to a new eight-month low against the Greenback on Friday after Mexican President Andres Manuel Lopez Obrador's (AMLO) comments rattled investors who continued to sell Pesos amid an uncertain outlook. The USD/MXN trades at 18.35, gaining some 2.0% after hitting a multi-month high of 18.39.

In his usual morning press conference, Mexican President AMLO insisted on presenting a judicial reform and another that involves the dissolution of autonomous bodies, like the INAI, the government’s transparency body.

AMLO emphasized his radical rhetoric and stated, “The judicial power is hijacked, the service is taken over by a minority of those at the top. I have already said it here, and they know it very well. It is even shameful, but there are ministers who are like employees of large corporations,” according to El Financiero.

Consequently, the USD/MXN jumped from around 17.95 toward the multi-month high of 18.39 on AMLO’s remarks. Traders should be aware that the Mexican Peso will be extremely sensitive and volatile amid political uncertainty.

Aside from political comments, Mexico’s headline inflation rose for the third straight month, exerting pressure on the Bank of Mexico (Banxico). Nevertheless, underlying inflation, which excludes volatile items and provides a clear view of prices, dropped for the sixteenth consecutive month.

Across the border, the latest US employment report fueled speculation that the Federal Reserve (Fed) would keep rates “higher for longer,” with figures crushing estimates.

Following the data, US Treasury bond yields jumped more than ten basis points (bps), with the 10-year benchmark note rising to 4.414%, up 12.5 bps, and underpinning the Greenback. The US Dollar Index (DXY), which tracks the performance of the American currency against six others, rose 0.74% to 104.86.

Data-wise, Mexican Auto Exports increased in May but less than in April, signaling the economy is feeling the impact of higher borrowing costs set by Banxico.

Daily digest market movers: Mexican Peso landslide continues on investors’ fears

- On Thursday, Morena’s leader at the Congress, Ignacio Mier, commented that they will submit the proposals to the newly established Congress in September.

- Some of the most important proposals include a reform of the Supreme Court, which proposes that the Supreme Court's ministers be elected by popular vote; electoral reform, which seeks to have INE councilors elected by popular vote and reduce multi-membership; and reform of autonomous bodies, which entails the dissolution of INAI, the transparency body.

- Mexico’s Consumer Price Index (CPI) in May was 4.69% YoY, up from 4.65% in April, while core CPI dipped from 4.37% to 4.21%.

- Although this fuels speculations of another Banxico rate cut in June, a further depreciation of the Mexican Peso could prevent the Mexican Central Bank from easing policy.

- Morgan Stanley noted that if Mexico’s upcoming government and Congress adopted an unorthodox agenda, it would undermine Mexican institutions and be bearish for the Mexican Peso, which could weaken to 19.20.

- US Bureau of Labor Statistics (BLS) revealed that May’s Nonfarm Payrolls increased by 272,000, exceeding forecasts of 185,000 and April’s 165,000.

- US Unemployment Rate jumped from 3.9% to 4%, while Average Hourly Earnings (AHE) rose by 4.1% YoY, up from 4%.

- Contrary to Thursday’s expectations that the Fed might cut rates by 39 bps toward the end of the year. However, the latest US jobs report witnessed a fall to just 29 bps of easing, according to the December 2024 CBOT fed funds future rate contract.

Technical analysis: Mexican Peso depreciates sharply as USD/MXN surges above 18.20

From a technical standpoint, the USD/MXN remains bullish and might extend its gains if the pair achieves a fifth daily close above a four-year-old downslope resistance trendline drawn from all-time highs (ATH) at around $25.77, which was broken on Monday. That could be the last nail in the coffin for the Mexican Peso's strength.

The USD/MXN's next resistance would be the October 6 high of 18.48, which could open the door to challenging the psychological 19.00 figure. Once that level is breached, on March 20, 2023, a high of 19.23 would follow. If all those levels are surpassed, the exotic pair could hit 20.00, and reach a new 18-month high.

On the other hand, sellers need to push the USD/MXN back below the April 19 high of 18.15 if they would like to keep the pair within the 18.00-18.15 trading range.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- USD maintains its momentum, rising by more than 0.70% on Friday.

- US Nonfarm Payrolls exceeded market expectations in May, showing a robust recovery in the labor market.

- September odds fall for a Fed rate cut as positive economic signals abound.

On Friday, the US Dollar Index (DXY) expanded its winning streak following stronger-than-forecasted labor market data. The Nonfarm Payrolls, combined with an increase in wage inflation, outline a robust, resilient economy that may justify the delay of rate cuts by the Federal Reserve (Fed).

Attention now turns to future Fed meetings, with the market eyeing any shift in the monetary policy stance following the positive labor data. The odds for cuts for June and July remain low after the strong employment data, falling to around 50% for September.

Daily digest market movers: DXY strengthens, backed by solid economic results

- The Nonfarm Payrolls for May surged 272K, surpassing market projections of 185K and demonstrating substantial growth from April's revised figure of 165K.

- Unemployment Rate slightly crept higher to 4% from 3.9%.

- Wage inflation data, as indicated by the percentage change in Average Hourly Earnings, increased to 4.1% on a yearly basis, bouncing from the revised 4% in April.

- Meanwhile, Treasury yields followed the upward trajectory with the 2, 5 and 10-year rates climbing more than 2% to 4.85%, 4.44%, and 4.41%, respectively.

DXY technical analysis: A bullish reversal sets up as the index recovers key levels

A turnaround in the DXY index's fortune is becoming more apparent as it jumps above the key Simple Moving Averages (SMAs) of 20,100 and 200-days. The Relative Strength Index (RSI) shifted back above 50, signaling a return to bullish momentum, while the Moving Average Convergence Divergence (MACD) continues to print lower red bars, suggesting that buying interest is picking up.

For a sustained bullish outlook, the DXY bulls need to maintain the critical resistance level at 104.40, regained after the strong jobs data.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

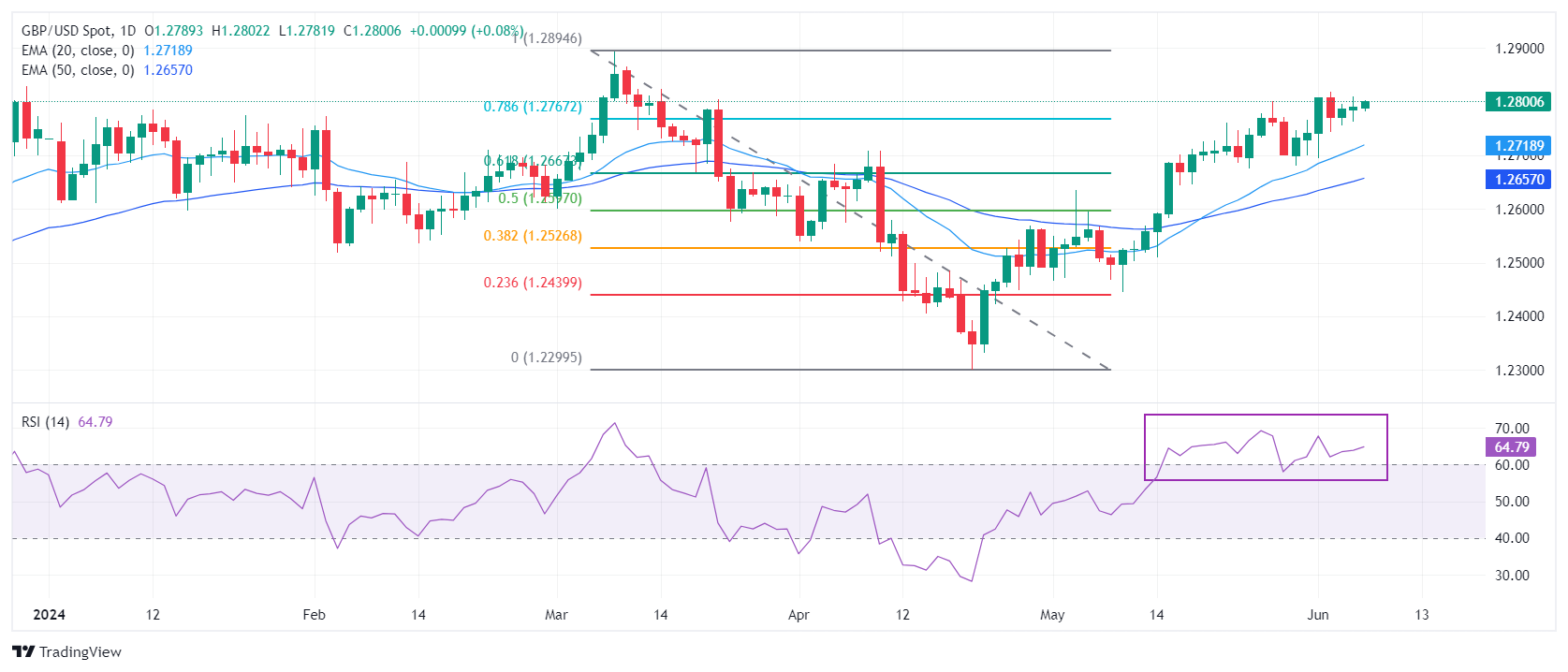

- GBP/USD pukes following stellar US NFP data report.

- The pair trades at around weekly lows, sellers eye 1.2694.

- Near-term momentum favors sellers, as RSI accelerates toward the 50-midline.

The British Pound plunged against the US Dollar after the US Bureau of Labor Statistics (BLS) revealed the US jobs market remains hotter than expected, exceeding the consensus estimates, boosting the Greenback. Therefore, the pair tumbled near the week's lows, with the GBP/USD trading at 1.2722, down 0.53%, at the time of writing.

GBP/USD Price Analysis: Technical outlook

From a technical perspective, the GBP/USD failed to clear strong resistance at the confluence of technical indicators, and sudden US Dollar strength dragged the spot prices below the low of the three-day range of 1.2740.

Momentum has shifted in sellers’ favor in the near term, with the Relative Strength Index (RSI) diving from around 64 to 54.26, about to enter bearish territory.

That said, the first support for GBP/USD would be the 1.2700 figure, followed by last Friday’s low of 1.2694. Further losses are seen beneath at 1.2680, the May 30 low, immediately followed by the May 24 cycle low of 1.2674.

Conversely, if buyers reclaim 1.2740, that could pave the way to keep the pair range-bound at around 1.2750-1.2800.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.67% | 0.47% | 0.80% | 0.43% | 1.10% | 1.28% | 0.87% | |

| EUR | -0.67% | -0.18% | 0.14% | -0.24% | 0.43% | 0.66% | 0.20% | |

| GBP | -0.47% | 0.18% | 0.32% | -0.06% | 0.62% | 0.84% | 0.38% | |

| JPY | -0.80% | -0.14% | -0.32% | -0.37% | 0.29% | 0.48% | 0.08% | |

| CAD | -0.43% | 0.24% | 0.06% | 0.37% | 0.67% | 0.91% | 0.44% | |

| AUD | -1.10% | -0.43% | -0.62% | -0.29% | -0.67% | 0.22% | -0.25% | |

| NZD | -1.28% | -0.66% | -0.84% | -0.48% | -0.91% | -0.22% | -0.45% | |

| CHF | -0.87% | -0.20% | -0.38% | -0.08% | -0.44% | 0.25% | 0.45% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

- USD/CAD is attempting to break out of a triangle price pattern and push higher.

- A decisive breakout would reaffirm 2024’s uptrend and begin a new more bullish phase.

USD/CAD is pushing up against the upper borderline of a large symmetrical triangle price pattern, threatening to break out to the upside.

USD/CAD Daily Chart

A decisive breakout from the triangle would activate the initial upside target for the pattern at 1.3869, the 0.618 Fibonacci extrapolation of the height of the triangle from the breakout point higher.

A decisive break would be one accompanied by a long green daily candlestick that broke clearly through the level and closed near its high or three green candlesticks in a row that broke through the level.

USD/CAD has broadly-speaking been in an uptrend since the start of 2024. During that time it has risen from the 1.31s to the current 1.37s. Given that “the trend is your friend” the odds favor a continuation of the bull trend.

Since April USD/CAD has been trading sideways in a narrowing range like a triangle. This is a type of continuation pattern. The probabilities favor price breaking out to the upside in line with the prior trend. The pattern has also completed five internal waves which is the minimum requirement for a triangle.

The breakout, when it happens, is likely to be quite volatile. Traders should be warned that false breakouts are quite common. For more confidence a move above 1.3762 (May 8 high) should be used as confirmation.

A decisive breakdown from the triangle would reverse the trend and suggest a move down to an initial target at around 1.3483.

- Silver price drops vertically below $30.00 as US yields soar after upbeat US NFP report for May.

- Both job and wage growth beat estimates.

- Pause in PBoC’s gold-buying also weighed on the Silver price.

Silver price (XAG/USD) plummets below the psychological support of $30.00 in Friday’s New York session. The white metal plunges after the United States Nonfarm Payrolls (NFP) report May showed that labor demand remains robust and the wage growth momentum was stronger than expected.

Fresh payrolls came in higher at 272K than expectations of 185K and the prior release of 165K. Average Hourly Earnings rose strongly by 0.4% from the estimates of 0.3% and the former release of 0.2% on a month-on-month basis. Average Hourly Earnings data is a measure of wage inflation, which directs households’ spendings. Annual wage inflation measure grew by 4.1%, beats the estimate of 3.9% and April’s read of 4.0%.

Strong payrolls and wage growth data prompt the need to maintain a restrictive interest rate framework by the Federal Reserve (Fed) for a longer period, which is a favourable situation for yields on interest-bearing assets and the US Dollar. 10-year US Treasury yields rally 4.43%, up by 3.5% from Thursday’s close. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, jumps to 104.80. Higher yields on interest-bearing assets increase the opportunity cost of holding an investment in non-yielding assets, such as Silver.

The white metal was already under pressure as People’s Bank of China’s (PBoC) gold reserves report for May showed that their 18-month long Gold buying spell paused for a while. The report showed that gold reserves were unchanged at 72.80 million fine troy oz.

Silver technical analysis

Selling pressure in the Silver price indicates that it could deliver a breakdown of the Head and Shoulder chart pattern formed on a four-hour timeframe. The neckline of the above-mentioned chart pattern appears to be around $29.00. A decisive break below the same would result in a bearish reversal.

Spot prices have dropped below the 50-period Exponential Moving Average (EMA) near $30.50, suggesting that the near-term outlook turns bearish.

The 14-period Relative Strength Index (RSI) has slipped below 40.00. A sustained move below the same will push the momentum towards the downside.

Silver four-hour chart

- USD/JPY shoots over half a percent higher following higher-than-expected US payrolls data for May.

- The data also showed a greater-than-experienced increase in wages although unemployment unexpectedly rose.

- The data contrasts with Japanese real wages which fell for the 25th straight month in April.

USD/JPY spikes higher by over half a percent in the minutes following the release of US Nonfarm Payrolls (NFP) data, on Friday. USD/JPY trades in the upper 156s after the US Dollar (USD) strengthens as a result of the better-than-expected results.

US Nonfarm Payrolls showed the number of employed people in the US rose by 272K in May when 185K had been expected, according to data from the US Bureau of Statistics (BLS). The result was higher than the April figure which was revised down to 165K.

USD/JPY Daily Chart

The BLS report showed a rise in Average Hourly Earnings of 4.1% YoY, beating estimates of 3.9% and higher than the revised-up 4.0% in April.

The report showed the Unemployment Rate rose to 4.0%, however, when 3.9% had been forecast from 3.9% previously.

The data overall suggests the US labor market is in better shape than had previously been thought, especially given the lower-than-expected JOLTS Job Openings and ADP payrolls data earlier in the week. The higher-than-expected wage inflation indicates the possibility headline and core inflation might rise as workers spend their increased wages. Higher general inflation could deter the US Federal Reserve (Fed) from lowering interest rates. Prior to the NFP release, the probability of the Fed cutting interest rates in September was roughly 67% – after the NFPs it had fallen to 53%.

Maintaining high interest rates is positive for USD/JPY as it strengthens the US Dollar. A higher interest rate attracts greater inflows of foreign capital, increasing demand for the currency.

USD/JPY further propelled by contrast with Japanese wage data

USD/JPY’s strong move up following the NFP data may be exaggerated because it follows two negative minor US employment reports earlier in the week (JOLTS and ADP) and because of the contrast with similar data from Japan.

Real wages in Japan declined for the 25th straight month in April, as domestic inflation continued to outpace wage growth. The data makes it harder for the Bank of Japan (BoJ) to normalize its monetary policy. The BoJ is the only major central bank still undertaking quantitative easing (QE) and has had to keep interest rates in an ultra-low 0.0% - 0.1% range. This has led to a stark devaluation in the Yen to levels which raise concern among policymakers as they are hampering business activity.

That said, USD/JPY lost ground earlier in the week amid rumors the BoJ was planning to reduce the bond purchases it makes as part of its QE programme. If the BoJ cuts bond purchases it would put upward pressure on Japanese bond yields which are highly correlated to the JPY. It remains to be seen, however, whether the rumors materialize.

USD/JPY upside may be capped by direct intervention from the Japanese authorities to buy the Yen in the FX markets. On Tuesday, Deputy Governor of the BoJ Ryozo Himino repeated concerns about how a weak JPY was negatively impacting the economy and the BoJ needed to be “very vigilant” regarding its effects. His comments suggested the BoJ might be preparing for another direct intervention in Forex markets to prop up JPY (negative for USD/JPY).

According to Himino the weak Yen pushes up inflation, but in a negative way. Although it increases the price of imported goods, continued stagnant wages mean consumers are increasingly being priced out of the market. Himino said he would prefer inflation to come from higher wages, not a weak currency, as this would lead to a more dynamic economy.

- Natural Gas price trades above $2.85 and is set to close the week in green.

- Egypt has issued a bigger than expected tender for more than 15 LNG cargoes.

- The US Dollar Index flirts with a break below 104.00 ahead of the US Employment Report for May.

Natural Gas price (XNG/USD) trades marginally higher above $2.85 on Friday, extending this week’s positive move, with markets ignoring that the Norwegian Gas is flowing again in full volume towards Europe and the UK. Instead, traders are more focused on the surprise tender from Egypt, which exceeded expectations. Initially, the assumption was that Egypt would only issue a tender for less than 10 Liquefied Natural Gas (LNG) cargoes, though the final data on Thursday showed the tender for more than 15 LNG cargoes, according to Reuters.

Meanwhile, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, hovers around 104.00 ahead of the US Employment Report for May, with the Nonfarm Payrolls (NFP) number, Unemployment Rate and the Average Hourly Earnings for the month. Volatility is set to pick up, should the Nonfarm Payrolls number miss expectations, with consensus views titled to a higher number than the previous month. In case of a big miss in the US employment data and a sell-off in the DXY, the Natural Gas price could extend its positive move on Friday.

Natural Gas is trading at $2.87 per MMBtu at the time of writing.

Natural Gas news and market movers: Egypt is buying up

- Reuters reported on Friday that Egypt has released tender details for at least 15 LNG cargoes with deliveries to cover summer demand.

- Taiwan has signed a three-decade-long agreement with Qatar to buy LNG to fill the gap for its missing Nuclear and Coal energy, which is being phased out.

- Bloomberg reports that Gazprom CEO Alexey Miller and Turkey’s Energy Minister Alparslan Bayraktar have discussed further plans for an international Gas hub during a meeting in St. Petersburg.

Natural Gas Technical Analysis: A bounce that keeps going

Natural Gas trades higher again after a perfect technical bounce earlier this week against the 200-day Simple Moving Average (SMA) at $2.53. From here on out, the question is whether that bounce is strong enough to head to $3.08 on the upside. Meanwhile, the CME FedWatch Tool suggests a 68% chance that the Federal Reserve’s (Fed) interest rate will be lower than the current level in September, which might boost Gas prices in the idea that an interest rate cut would be good for demand.

On the upside, the $3.00 marker as a big figure was tested in May and remains a first element to watch out for on the upside. The pivotal level near $3.07 ( March 6, 2023, high) remains key as prices failed to post a daily close above it. Further up, the fresh year-to-date high at $3.16 is the level to beat.

On the downside, the 200-day Simple Moving Average (SMA) acts as the first support near $2.53. Should that support area fail to hold, the next target could be the pivotal level near $2.14, with interim support by the 55-day SMA near $2.25. Further down, the biggest support comes at $2.11 with the 100-day SMA.

Natural Gas: Daily Chart

Natural Gas FAQs

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

- WTI Oil is unfolding an up leg within a falling channel.

- It is close to meeting resistance from the upper channel boundary line and the 50 SMA.

- A reversal at this point would probably lead to an extension of the downtrend and the falling channel.

WTI Oil price (OIL) has been trending lower in a channel since the beginning of April. It is in a downtrend on the 4-hour Chart which is used to analyze the short-term trend (up to 6 weeks). Given that “the trend is your friend” this is expected to continue.

More recently, WTI Oil has started a counter-trend recovery rally back up within the falling channel and is now approaching the upper (green) boundary line at roughly $76.20. The 50 Simple Moving Average (SMA) is situated nearby at $76.33. These are likely to present tough obstacles to bulls. Assuming the channel keeps its integrity they may trigger a reversal back down within the channel.

WTI Oil 4-hour Chart

The Moving Average Convergence Divergence (MACD) indicator is in negative territory but rising, it suggests a little more upside is probably on the horizon before the next turn – probably to the aforementioned green channel line.

Key reversals in price as it moves up and down within the channel have corresponded quite reliably with the MACD crossing above and below its red signal line. If the synchronicity continues, it suggests that if price rises up to resistance from the upper channel line and then reverses down, it will be accompanied by a corresponding cross of the MACD below its signal line. Such a cross would provide supporting evidence to back up the idea of a reversal lower in line with the dominant downtrend, especially if it occurs when the MACD is above zero. A bearish candlestick reversal pattern or other similar reversal insignia would also add evidence.

If this scenario plays out, the next down leg of the channel could reach $72.46 (June 4 low) initially, followed by $71.43 (February 5 low) and then $70.70 (January 17 low).

The break above the channel line that occurred during the rally between May 24-29 was a bullish sign, however, and suggests an increased risk price could break above again.

- AUD/USD drops to near 0.6660 as investors are expected to make informed positions after the US NFP report for May.

- The Fed is expected to start reducing interest rates from September.

- Investors see the RBA holding interest rates steady by the year-end.

The AUD/USD pair falls back to 0.6660 while attempting to capture the round-level resistance of 0.6700 in Friday’s London session. The Aussie asset faces pressure as uncertainty ahead of the release of the United States Nonfarm Payrolls (NFP) report for May limits the upside in risk-perceived assets.

The market sentiment turns cautious as the US NFP report is expected to influence market expectations for the Federal Reserve (Fed) rate cuts. S&P 500 futures have turned negative after erasing entire overnight gains, indicating a decline in investors’ risk-appetite. The US Dollar Index (DXY) remains sideways near the crucial support of 104.00.

The US Employment report is expected to show that employers added 185K payrolls, higher than the prior release of 175K. The Unemployment Rate is estimated to have remained steady at 3.9%. Investors will also pay attention to the Average Hourly Earnings data, which gauges wage growth momentum. Annual Average Hourly Earnings are forecasted to have grown steadily by 3.9%. While monthly wage growth is estimated to have risen at a higher pace of 0.3% from the former release of 0.2%.

Upbeat payrolls and wage growth data would diminish hopes of the Fed lowering its interest rates from the current levels. The CME FedWatch tool shows that the Fed would choose the September meeting as the earliest point to start unwinding the restrictive interest rate stance. While soft figures would boost Fed rate-cut expectations for September.

Meanwhile, the Australian Dollar holds gains as the Reserve Bank of Australia (RBA) appears to list as those central banks that are not expected to deliver rate cuts this year. The expectations for RBA rate cuts waned after RBA Governor Michele Bullock delivered hawkish guidance on the interest rate outlook on Wednesday. Bullock indicated that the central bank is prepared to increase interest rates further if inflation doesn’t return to the target range of 1%-3%. Apart from the RBA, the Reserve Bank of New Zealand (RBNZ) is also expected to consider rolling back its tight interest-rate stance next year.

- The US Dollar trades mixed on Friday ahead of key US economic data.

- Markets are still digesting the interest rate cut from the ECB ahead of the US Employment Report.

- The US Dollar Index dips lower and already fell below 104.00 in the early Asian session.

The US Dollar (USD) edges lower on Friday but manages to hold above the 104.00 level ahead of the US Nonfarm Payrolls data for May. The Greenback struggles near weekly lows after the European Central Bank (ECB) delivered a 25 basis points interest rate cut on Thursday, setting the ECB rate on Deposit Facility to 3.75% from 4%. The fact that ECB’s officials gave no forward guidance on interest rates leaves markets feeling that it was a one-and-done, and dampens hopes for further easing.

On the economic front, besides the ECB revaluation, markets are on the lookout for the US Employment Report for May, with the Nonfarm Payrolls number, monthly wage growth and unemployment rate as three main drivers. The consensus for the Nonfarm Payrolls is an increase by 185,000 after the 175,000 seen in April. The range of views varies from 120,000 on the low end to 258,000 on the upside. Most significant market movements are expected should the number come below or above the lower and higher end of the range.

Daily digest market movers: Calm before the storm

- At 12:30 GMT, the US Employment Report for May will be released:

- Nonfarm Payrolls are expected to increase by 185,000 after the 175,000 additions in April.

- Monthly Average Hourly Earnings are expected to tick up to 0.3% in May from 02.% a month before.

- Yearly Average Hourly Earnings should remain stable at 3.9%.

- Unemployment Rate should remain unchanged at 3.9%.

- As always, a number that falls in line with expectations will not have a significant market impact, whereas a print below 120,000 or above 258,000 for the Nonfarm Payrolls figure will see a pickup in volatility.

- Equities are trading with minor losses in Asia and Europe, while US futures are gently heading into the green.

- According to the CME Fedwatch Tool, 30-day Fed Fund futures pricing data suggests a 31.8% chance of keeping rates unchanged in September, against a 55.7% chance of a 25 basis points (bps) rate cut and a 12.3% chance of an even 50 bps rate cut. For the upcoming meeting on June 12, markets are fully pricing that rates will remain at current levels.

- The benchmark 10-year US Treasury Note trades around 4.29%, near its fresh monthly low of 4.27% from Wednesday.

US Dollar Index Technical Analysis: NFP comes at a wrong time

The US Dollar Index (DXY) is flirting with a drop below the 104.00 handle. Some brief excursions below this level have already been made in the past few days, though for now, this area still sees ample amounts of buying interest. The question is how long those buyers will last, and should NFP come in under the weakest projection, something could snap.

On the upside, the DXY first faces a confluence resistance in the 200-day Simple Moving Average (SMA) and the 100-day SMA at 104.44. Further up, the pivotal level near 104.60 comes into play. For now, the topside can be seen around 105.00, with the 55-day SMA coinciding with this round number and the peak from recent weeks at 105.08.

On the downside, the 104.00 big figure looks to be holding. Once through there, another decline to 103.50 and even 103.00 are the levels to watch. With the Relative Strength Index (RSI) still not oversold, more downsides are still under consideration.

Nonfarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation. A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work. The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower. NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa. Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold. Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components. At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary. The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

- Silver price falls vertically to $30.50 after steady PBoC’s Gold reserves data.

- Investors should brace for more volatility ahead of the US NFP report for May.

- Growing speculation for Fed rate cuts in September has limited the US Dollar’s upside.

Silver price (XAG/USD) drops sharply to $30.50 in Friday’s European session. The white metal weakens due to multiple headwinds such as caution among investors ahead of the United States (US) Nonfarm Payrolls (NFP) data for May and unchanged China’s Gold reserves by May end from April.

The US NFP report will indicate labor market’s health of world’s largest nation, which will influence the Federal Reserve’s (Fed) interest rate outlook ahead of the policy meeting on Wednesday. According to the estimates, US employers added 185K payrolls, increased from 175K in April. Average Hourly Earnings, which is a measure of wage inflation grew by 0.3% in month from the 0.2% pace recorded for April. Annually, the wage inflation measure is estimated to have grown steadily by 3.9%.

Signs of strengthening labor market conditions would force traders to pare bets supporting rate cuts by the Fed in September, while soft figures will do the opposite.

The US Dollar Index (DXY) remains sideways around the crucial support of 104.00. This week, the USD Index remains on the backfoot as weak employment-oriented economic indicators boost expectations for Fed rate cuts in September.

Meanwhile, non-yielding assets have also come under pressure as an 18-month-long Gold buying spell by the People’s Bank of China (PBoC) appears to be concluded. The PBoC gold reserves by May end were steady at 72.80 million fine troy oz as seen in April’s report. High investment in non-yielding assets is considered optimal amid high inflation and economic uncertainty.

Silver technical analysis

Silver price declines after facing immense selling pressure above the 61.8% Fibonacci retracement (plotted from May 29 high at $32.30 to June 4 low near $29.40) at $31.20. Silver’s near-term outlook appears to be uncertain as spot prices have dropped below the 50-period Exponential Moving Average (EMA), which trades around $30.70.

The 14-period Relative Strength Index (RSI) has slipped below 40.00. A sustained move below the same will push the momentum towards the downside.

Silver hourly chart

- Gold price falls after data unveils PBoC reserves showed no change in May compared to April, ending 18-month buying spree.

- Central bank buying is considered a major driver of Gold price, according to World Gold Council.

- Short-term technical picture remains volatile as Gold whipsaws higher and then lower.

Gold (XAU/USD) is trading over one and a half percentage point lower in the $2,330s on Friday after the news that the People’s Bank of China (PBoC) suddenly halted its Gold purchases in May after an 18-month stretch of buying.

Gold price deflates after People’s Bank of China halts further buying

Gold is trending lower at the end of the week after the news that Gold reserves at the PBoC remained unchanged at 72.8 million troy ounces at the end of May, the exact same figure as at the end of April, according to official data from the PBoC on Friday.

The data follows strong buying in April that saw China Gold reserves at the PBoC hit an all-time high, accounting for 4.9% of total reserves, and following 18 consecutive months of growth.

Central bank buying, especially in Asia, is now a key driver of Gold price. It was probably behind the rally in 2024 which saw Gold reach a record high of $2,450 in May. According to the World Gold Council (WGC) unreported over-the-counter buying (i.e not through exchanges) by central banks was a significant driver of Gold’s strength.

“Looking at our Gold Return Attribution Model (GRAM), there was no single variable that stood out as a key driver in May,” says the WGC report for May. “Momentum and a weaker US Dollar were positive drivers but their impact was marginal. And while the unexplained component of the model shrank considerably in May, it was still the largest factor by far. As we have noted previously, we believe some of this can be attributed to strong over-the-counter buying, including central bank purchases which have been a notable contributor to recent Gold returns.”

Asian and emerging market country central banks have been hoarding Gold reserves as a hedge against the threat of devaluation of their own currencies, especially against the US Dollar (USD). The revision of interest-rate expectations by the Federal Reserve (Fed) in the spring led to a strengthening of USD, which increased the reserve-hoarding trend.

That said, a recent run of poor US data means investors are renewing bets the Fed will start cutting interest rates in September, with the probabilities at around 67%, according to the CME FedWatch tool, which bases its estimates on 30-day US Fed Fund Futures pricing data.

Additionally, at a global level, interest-rate expectations are falling. On Wednesday, the Bank of Canada (BoC) cut its overnight rate to 4.75% from 5.00% and the European Central Bank (ECB) followed the day after. The release of lower inflation data in Switzerland has now prompted speculation the Swiss National Bank (SNB) could also cut interest rates at its June 20 meeting following an earlier cut in March.

Technical Analysis: Gold breaks out of top of range, then dumps

Gold price has broken out of the top of a mini-range, stretching from roughly $2,315 to $2,358, but since reversed course and dumped. It has now fallen back inside the range.

XAU/USD 4-hour Chart

A break below the $2,315 range low would reactivate downside targets generated by the trendline break. The first target for the follow-through is at $2,303 – the 0.618 Fibonacci extrapolation of “a”. A stronger move down could even see Gold reach support at $2,279. The targets are calculated using the length of the move prior to the break as a guide.

On Thursday, Gold broke out of its mini-range and hit an initial target at $2,385, the 0.618 Fibonacci extrapolation of the height of the range from the breakout point higher, before reversing and crashing back down on Friday.

Despite the short-term weakness, the precious metal’s medium and long-term trends are still bullish, and the risk of a recovery remains high.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- EUR/USD trades back and forth near 1.0900 ahead of US NFP data for May.

- The US NFP will indicate whether labor market conditions have started normalizing.

- The ECB commenced its policy easing campaign but refrained from committing to a predefined interest-rate path.

EUR/USD trades sideways near 1.0900 in Friday’s European session. The major currency pair remains broadly steady as traders stay on the sidelines ahead of the United States Nonfarm Payrolls (NFP) data for May, which will be published at 12:30 GMT.

According to the estimates, US employers added 185K payrolls, lower than the 175K increase seen in April. The Unemployment Rate is estimated to have remained stable at 3.9%. Higher-than-expected payroll numbers would likely clear doubts about easing labor demand after recent employment-oriented indicators have suggested that the jobs market is loosening.

The JOLTS Job Openings data for April and ADP Employment Change for May came in weaker than expected. Also, Initial Jobless Claims for the week ending May 31 were higher than estimates, suggesting that some heat has been released from the labor market.