- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 05-09-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 05:00 | Japan | Leading Economic Index | July | 93.3 | |

| 05:00 | Japan | Coincident Index | July | 100.4 | |

| 06:00 | Germany | Industrial Production s.a. (MoM) | July | -1.5% | 0.3% |

| 06:45 | France | Trade Balance, bln | July | -5.2 | |

| 07:00 | Switzerland | Foreign Currency Reserves | August | 768 | |

| 07:30 | United Kingdom | Halifax house price index 3m Y/Y | August | 4.1% | 3.4% |

| 07:30 | United Kingdom | Halifax house price index | August | -0.2% | 0.2% |

| 09:00 | Eurozone | Employment Change | Quarter II | 0.3% | 0.2% |

| 09:00 | Eurozone | GDP (QoQ) | Quarter II | 0.4% | 0.2% |

| 09:00 | Eurozone | GDP (YoY) | Quarter II | 1.2% | 1.1% |

| 12:30 | U.S. | Manufacturing Payrolls | August | 16 | 8 |

| 12:30 | U.S. | Government Payrolls | August | 16 | |

| 12:30 | U.S. | Average workweek | August | 34.3 | 34.4 |

| 12:30 | U.S. | Average hourly earnings | August | 0.3% | 0.3% |

| 12:30 | U.S. | Labor Force Participation Rate | August | 63% | |

| 12:30 | U.S. | Private Nonfarm Payrolls | August | 148 | 150 |

| 12:30 | Canada | Unemployment rate | August | 5.7% | 5.7% |

| 12:30 | Canada | Employment | August | -24.2 | 15 |

| 12:30 | U.S. | Nonfarm Payrolls | August | 164 | 158 |

| 12:30 | U.S. | Unemployment Rate | August | 3.7% | 3.7% |

| 14:00 | Canada | Ivey Purchasing Managers Index | August | 54.2 | 53 |

| 16:30 | U.S. | Fed Chair Powell Speaks | |||

| 17:00 | U.S. | Baker Hughes Oil Rig Count | September | 742 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 05:00 | Japan | Leading Economic Index | July | 93.3 | |

| 05:00 | Japan | Coincident Index | July | 100.4 | |

| 06:00 | Germany | Industrial Production s.a. (MoM) | July | -1.5% | 0.3% |

| 06:45 | France | Trade Balance, bln | July | -5.2 | |

| 07:00 | Switzerland | Foreign Currency Reserves | August | 768 | |

| 07:30 | United Kingdom | Halifax house price index 3m Y/Y | August | 4.1% | 3.4% |

| 07:30 | United Kingdom | Halifax house price index | August | -0.2% | 0.2% |

| 09:00 | Eurozone | Employment Change | Quarter II | 0.3% | 0.2% |

| 09:00 | Eurozone | GDP (QoQ) | Quarter II | 0.4% | 0.2% |

| 09:00 | Eurozone | GDP (YoY) | Quarter II | 1.2% | 1.1% |

| 12:30 | U.S. | Manufacturing Payrolls | August | 16 | 8 |

| 12:30 | U.S. | Government Payrolls | August | 16 | |

| 12:30 | U.S. | Average workweek | August | 34.3 | 34.4 |

| 12:30 | U.S. | Average hourly earnings | August | 0.3% | 0.3% |

| 12:30 | U.S. | Labor Force Participation Rate | August | 63% | |

| 12:30 | U.S. | Private Nonfarm Payrolls | August | 148 | 150 |

| 12:30 | Canada | Unemployment rate | August | 5.7% | 5.7% |

| 12:30 | Canada | Employment | August | -24.2 | 15 |

| 12:30 | U.S. | Nonfarm Payrolls | August | 164 | 158 |

| 12:30 | U.S. | Unemployment Rate | August | 3.7% | 3.7% |

| 14:00 | Canada | Ivey Purchasing Managers Index | August | 54.2 | 53 |

| 16:30 | U.S. | Fed Chair Powell Speaks | |||

| 17:00 | U.S. | Baker Hughes Oil Rig Count | September | 742 |

EIA’s report

reveals bigger-than-expected decline in U.S. crude oil inventories

The U.S. Energy

Information Administration (EIA) revealed on Thursday that crude inventories decreased

by 4.771 million barrels in the week ended August 30. Economists had forecast a

drop of 2.000 million barrels.

At the same

time, gasoline stocks reduced by 2.396 million barrels, while analysts had

expected a decline of 1.750 million barrels. Distillate stocks fell by 2.538

million barrels, while analysts had forecast an increase of 0.400 million

barrels.

Meanwhile, oil

production in the U.S. decreased by 100,000 barrels a day to 12.400 million

barrels a day.

U.S. crude oil

imports averaged 6.9 million barrels per day last week, up by 976,000 barrels

per day from the previous week.

Richard Franulovich, the head of FX strategy at Westpac, notes that the Bank of Canada (BoC) struck a neutral bias for yet another meeting, defying expectations for an explicit easing bias.

- “Their statement conveyed a notably more squeamish tone, the bank downplaying the upside surprise in Q2 growth and noting that, “escalating trade conflicts and related uncertainty are taking a toll on the global and Canadian economies”.

- The absence of an explicit BoC easing bias and the USD’s less steady tone in the wake of the lousy August ISM will provide USD/CAD with some breathing room to explore lower levels near term. However, rates markets are not getting carried away and neither should USD/CAD. OIS markets are still pricing in more than 80% chance of a BoC rate cut by their December 2019 meeting.

- US survey data underscore risks of a weaker Canadian growth path into year’s end. USD/CAD has room down to 1.3100- 1.3150 but the underlying choppy uptrend from Q4 2017 remains intact.”

The U.S.

Commerce Department reported on Thursday that the value of new factory orders

rose 1.4 percent m-o-m in July, following a revised 0.5 percent increase in June

(originally a 0.6 percent m-o-m gain). That was the largest monthly increase in

industrial orders since August of 2018.

Economists had

forecast a 1.0 percent m-o-m advance.

According to

the report, orders for transportation equipment surged 7.0 percent m-o-m in July

after growing 4.1 percent m-o-m in June. There were also gains in orders for

computers and electronic products, and electrical equipment, appliances and

components. Meanwhile, machinery orders dropped 0.8 m-o-m after rising 1.7

percent m-o-m in June.

Total factory

orders excluding transportation, a volatile part of the overall reading, rose

0.3 percent m-o-m in July (compared to a 0.1 percent m-o-m drop in June), while

orders for nondefense capital goods excluding aircraft, a measure of business

spending plans, increased 0.2 percent m-o-m (compared to a 0.9 percent m-o-m

climb in June). The report also showed that shipments of core capital goods fell

0.6 percent m-o-m in July, following a flat m-o-m performance in June.

In y-o-y terms,

factory orders increased 0.4 percent in July.

The Institute

for Supply Management (ISM) reported on Thursday its non-manufacturing index

(NMI) came in at 56.4 in August, which was 2.7 percentage points higher than the

July reading of 53.7 percent. The August reading pointed to the fastest expansion in the services sector since May.

Economists

forecast the index to increase to 54.0 last month. A reading above 50 signals

expansion, while a reading below 50 indicates contraction.

The 16 non-manufacturing industries reported growth last month, the ISM said, adding that respondents remain concerned about tariffs and geopolitical uncertainty but are mostly positive about business conditions.

According to

the report, the ISM’s non-manufacturing business activity measure rose to 61.5 percent,

8.4 percentage points higher than the July reading of 53.1 percent. That

reflected growth for the 121st consecutive month, at a faster rate in July. The new orders gauge increased to 60.3 percent, 6.2 percentage points higher than

the reading of 54.1 percent in July. The Prices Index advanced 1.7 percentage

points from the July reading of 56.5 percent to 58.2 percent, indicating that

prices increased in August for the 27th consecutive month. Meanwhile, the

employment indicator fell 3.1 percentage points in August to 53.1 percent from

the July reading of 56.2 percent.

Sean Callow, an analyst at Westpac, notes that after all the headlines on U.S.-China trade and Hong Kong, CNY and CNH are almost dead flat over the week.

- “7.20 to the dollar seems to be the new strong resistance, with USD/CNH falling about 40-50 pips short on Monday and Tuesday (<0.01%) and USD/CNY rolling over ahead of 7.19.

- Of course, the Asian currency rally mid-week on the HK government’s formal withdrawal of the extradition bill and confirmation of the resumption of US-China trade talks helped USD/China pull back. But even before then and despite US tariffs proceeding on Sunday on previously exempt imported Chinese goods, the daily USD/CNY fixings were firmly on the low side, much further below the spot close than we have seen for most of this year.

- So the yuan is not being weaponized – in fact the opposite seems to be occurring. Whether this costs the PBoC much in FX reserves remains to be seen – the guidance may largely suffice to limit capital outflows.”

Sean Callow, an analyst at Westpac, thinks that considerable bad news is arguably priced into USD/JPY but multi-week risks remain below 105.

- “The US and China proceeded with new tariffs on each other’s imports and wires reported that President Trump had to be talked out of doubling tariffs. But as the week progressed the risk mood improved on the Hong Kong backdown over the extradition bill and confirmation of US-China trade talks in early October, with lower-level talks during September.

- This left USD/JPY near the top of the past month’s ranges, though 107.00 could yet be a bridge too far. US yields are barely higher, with US data not supportive. Most dramatic was the slump in the ISM manufacturing index to below 50 but other releases have been little better, with the Atlanta Fed GDPNow estimate for Q3 down to 1.47% saar.

- This should keep markets preparing for -25bp from the Fed on 18 Sep and a clearly dovish tone. The BoJ and MoF meanwhile have not indicated any policy change is looming.”

U.S. stock-index futures rose solidly on Thursday, boosted by reports the United States and China agreed to hold high-level talks in October, raising hopes of a de-escalation in a trade war that has bruised global economic growth.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,085.94 | +436.80 | +2.12% |

Hang Seng | 26,515.53 | -7.70 | -0.03% |

Shanghai | 2,985.86 | +28.45 | +0.96% |

S&P/ASX | 6,613.20 | +60.20 | +0.92% |

FTSE | 7,256.78 | -54.48 | -0.75% |

CAC | 5,594.22 | +62.15 | +1.12% |

DAX | 12,129.80 | +104.76 | +0.87% |

Crude oil | $56.39 | +0.23% | |

Gold | $1,544.50 | -1.02% |

Chidu Narayanan, an economist at Standard Chartered, notes that Australia’s GDP growth slowed to a post-GFC low of 1.4% y/y in Q2 on slowing consumption and declining investment.

- “While the trade surplus rose to an all-time high on elevated iron ore prices, we expect this source of support to fade substantially in H2 as exports decline from current highs.

- Household consumption, which contributes c.55% of growth, is likely to edge lower in H2 on deteriorating labour-market conditions, subdued wage growth, declining consumer confidence and a soft property-market outlook. While government spending should take up some of the slack, we expect it to be insufficient to boost growth to trend levels. To reflect these headwinds, we lower our GDP growth forecasts for 2019 and 2020 to 1.7% (from 2.1%) and 2.2% (from 2.5%), respectively. We also revise down our inflation forecasts for both years, to 1.7% (from 2.0%) and 2.1% (from 2.2%).

- We expect labour-market conditions to deteriorate sharply over the next few months as declining construction activity leads to significant job losses. We expect the unemployment rate to rise above 5.5%; this will weigh further on household consumption.

- We expect two more 25bps rate cuts from the Reserve Bank of Australia (RBA) in Q4 as growth slows further. However, we see them coming only in November and December given the RBA’s reluctance to cut rates.”

Walmart (WMT) target raised to $125 from $115 at Morgan Stanley

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 162.39 | 2.32(1.45%) | 5363 |

ALCOA INC. | AA | 18.5 | 0.22(1.20%) | 3274 |

ALTRIA GROUP INC. | MO | 44.5 | 0.20(0.45%) | 8955 |

Amazon.com Inc., NASDAQ | AMZN | 1,817.75 | 17.13(0.95%) | 26798 |

American Express Co | AXP | 119.71 | 1.31(1.11%) | 1011 |

Apple Inc. | AAPL | 211.6 | 2.41(1.15%) | 206494 |

AT&T Inc | T | 35.88 | 0.16(0.45%) | 11938 |

Boeing Co | BA | 359.4 | 2.87(0.81%) | 10579 |

Caterpillar Inc | CAT | 120.83 | 1.73(1.45%) | 5182 |

Chevron Corp | CVX | 117.4 | 0.15(0.13%) | 1738 |

Cisco Systems Inc | CSCO | 48.16 | 0.84(1.78%) | 23481 |

Citigroup Inc., NYSE | C | 65.6 | 1.32(2.05%) | 32317 |

E. I. du Pont de Nemours and Co | DD | 69.4 | 0.92(1.34%) | 1027 |

Exxon Mobil Corp | XOM | 69.91 | 0.62(0.89%) | 4627 |

Facebook, Inc. | FB | 189.12 | 1.98(1.06%) | 81039 |

FedEx Corporation, NYSE | FDX | 161 | 1.94(1.22%) | 1887 |

Ford Motor Co. | F | 9.29 | 0.09(0.98%) | 81472 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.47 | 0.18(1.94%) | 55846 |

General Electric Co | GE | 8.96 | 0.16(1.82%) | 302408 |

General Motors Company, NYSE | GM | 38.5 | 0.64(1.69%) | 10082 |

Goldman Sachs | GS | 204.7 | 2.97(1.47%) | 9256 |

Google Inc. | GOOG | 1,194.80 | 13.39(1.13%) | 3036 |

Hewlett-Packard Co. | HPQ | 18.58 | 0.22(1.20%) | 13650 |

Home Depot Inc | HD | 226.02 | 1.87(0.83%) | 8593 |

Intel Corp | INTC | 49.89 | 0.97(1.98%) | 89006 |

International Business Machines Co... | IBM | 137.6 | 1.28(0.94%) | 4555 |

International Paper Company | IP | 38.72 | 0.06(0.16%) | 120 |

Johnson & Johnson | JNJ | 129.38 | 0.52(0.40%) | 4798 |

JPMorgan Chase and Co | JPM | 111.61 | 1.74(1.58%) | 13535 |

McDonald's Corp | MCD | 219.34 | 0.84(0.38%) | 3448 |

Merck & Co Inc | MRK | 86.38 | 0.33(0.38%) | 8500 |

Microsoft Corp | MSFT | 139.4 | 1.77(1.29%) | 118954 |

Nike | NKE | 87.25 | 0.90(1.04%) | 4540 |

Pfizer Inc | PFE | 36.01 | 0.18(0.50%) | 10356 |

Procter & Gamble Co | PG | 123.28 | 0.07(0.06%) | 5366 |

Starbucks Corporation, NASDAQ | SBUX | 96.6 | 0.49(0.51%) | 10196 |

Tesla Motors, Inc., NASDAQ | TSLA | 222.55 | 1.87(0.85%) | 56599 |

The Coca-Cola Co | KO | 55.81 | 0.04(0.07%) | 13151 |

Twitter, Inc., NYSE | TWTR | 43.77 | 0.41(0.95%) | 108418 |

United Technologies Corp | UTX | 132.5 | 1.45(1.11%) | 1430 |

UnitedHealth Group Inc | UNH | 228 | 1.27(0.56%) | 4146 |

Verizon Communications Inc | VZ | 58.42 | 0.24(0.41%) | 3035 |

Visa | V | 183.65 | 1.88(1.03%) | 15706 |

Wal-Mart Stores Inc | WMT | 116.76 | 0.85(0.73%) | 8167 |

Walt Disney Co | DIS | 138.85 | 0.96(0.70%) | 8315 |

Yandex N.V., NASDAQ | YNDX | 38.02 | 0.06(0.16%) | 7558 |

General Electric (GE) initiated with an Equal-Weight at Morgan Stanley; target $10

Lyft (LYFT) initiated with a Buy at Deutsche Bank; target $70

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment benefits increased slightly last week, suggesting little impact on

the labor market from ongoing trade tensions.

According to

the report, the initial claims for unemployment benefits rose by 1,000 to a

seasonally adjusted 217,000 for the week ended August 31.

Economists had

expected 215,000 new claims last week.

Claims for the

prior week were revised upwardly to 216,000 from the initial estimate of 215,000.

Meanwhile, the

four-week moving average of claims increased 1,500 to 216,250 last week.

The employment

report prepared by Automatic Data Processing Inc. (ADP) and Moody's Analytics

showed on Thursday the U.S. private employers added 195,000 jobs in August. That

was the biggest increase since April.

Economists had

expected a gain of 149,000.

The increase

for July was revised down to 142,000 from the originally reported 156,000.

“In August we

saw a rebound in private-sector employment,” said Ahu Yildirmaz, vice president

and cohead of the ADP Research Institute. “This is the first time in the last

12 months that we have seen balanced job growth across small, medium and

large-sized companies.”

Meanwhile, Mark

Zandi, chief economist of Moody’s Analytics, said, “Businesses are holding firm

on their payrolls despite the slowing economy. Hiring has moderated, but

layoffs remain low. As long as this continues recession will remain at bay.”

Tim Riddell, an analyst at Westpac, notes that the ECB president-elect Lagarde’s presentation to the EU Parliament indicated that she will continue Draghi’s policies and will also push for fiscal expansion within the region.

- “Draghi’s indication of a concerted stimulus package at the ECB’s Sep appeared to be affirmed by ECB Governing Council members Lane and Rehn, but more hawkish members Knot, Weidmann and Lautenschlaeger have recently highlighted potentially deep divisions over further ECB stimulus.

- Data into next week’s ECB meeting and the ability of Draghi to gain support for a swansong stimulus will be critical for both the handover to Lagarde and EUR.

- Recent declines in global sentiment, expectations of ECB easing and veiled threats over US-EU trade have seen EUR/USD breach 1.10 support. If ECB credibility is affirmed, a new 1.08-1.12 range could develop.”

- China is fully capable, confident to deal with any difficulties

- China's economy faces increasing downward pressure

- China will increase lending to small and private firms

- Will improve monetary policy transmission mechanism

Analysts at TD Securities note that the German factory orders were down 2.7% m/m in July, dropping twice as much as expected.

- “The details showed shipments also down -1.0% during the month, and haven't posted a m/m gain since January. As as result we've downgraded our German IP forecast for tomorrow morning, and now look for a -1.0% m/m decline (mkt +0.4%).”

Analysts at TD Securities believe the release of the ADP report should give us the first look at employment data for August, with the consensus expecting a 148k print, somewhat below the 156k registered in July.

- “The ISM non-manufacturing index is expected to advance modestly to 54.0 in August following two consecutive declines that have led the index to 53.7 — the lowest since 2016. This would come on the heels of a sharply lower ISM manufacturing print for August and would suggest the services sector remains largely healthy despite the worsening outlook for the industrial sector.”

Goldman Sachs' Chief Financial Officer (CFO) Stephen Scherr told CNBC in an interview held in Frankfurt on Thursday that Germany's economy is in the “early days of a slowdown”.

“We are in the early days of a slowdown. I think that, you know, many of us and many economists can point to particular issues, whether it’s the automotive sector or the China trade issue that weigh on the German economy”, Scherr said.

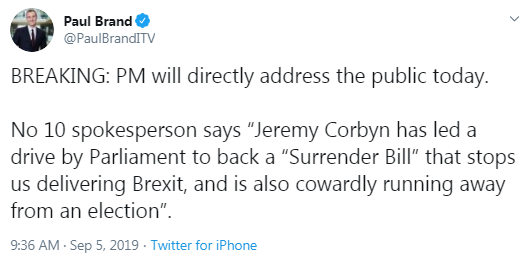

- Does not agree with Barnier's assessment of Brexit talks

- To continue talks again on Friday

- Says PM Johnson wants an election before EU Council meeting

Sean Callow, an analyst at Westpac, suggests that for Australia, the record A$20bn trade surplus helped GDP avoid a zero or even negative result.

- It was stunning to see Australia report its first current account surplus since 1975, around 1% of GDP, with the trade surplus 4% of GDP.

- Beyond that though, there wasn’t much to cheer. Growth over the year of 1.4% was the weakest since 2009 and slower than population growth. The growth drivers are a concern too, with private demand contracting – see chart. Business investment is falling, construction is yet to recover and consumer spending is up just 1.4%yr.

- We can at least hope for better consumption data once the targeted tax cuts reach household bank accounts. And infrastructure activity should also pick up, as the RBA noted in its statement this week. It predicted growth would “strengthen gradually to be around trend over the next couple of years.

- But this implies no real progress on lowering Australia’s unemployment rate and what the RBA terms the “trade and technology disputes” remain a major headwind, even if today brought a glimmer of hope as the US and China at least confirmed high-level trade talks in early October.

- The RBA’s wary optimism, GDP data and more positive headlines on US-China trade helped AUD lead the G10 over the past week. It would be surprising if it can keep top spot in the week ahead.”

- Negotiations with David Frost are a waste of time

- Barnier told EU 27 that Johnson is undermining Ireland's position on backstop

- Barnier told EU 27 that UK risks crashing out without a deal by accident or by default

- UK idea for a Brexit deal is a "heroic" assumption

- Hard to see any Brexit deal passing in UK parliament currently

- UK idea that EU 27 will eventually cave in is wrong

- Ireland has maintained stance that cannot replace backstop with vague, non-binding and unclear commitments from the UK

Petr Krpata, the cChief EMEA FX and IR strategist at ING, notes the pound has benefited from the mix of (a) the UK Parliament legislating against no deal Brexit by the 31 Oct deadline and (b) stretched short positioning.

- "Still with early elections looming (it now seems just a question of timing – i.e. before or after the October deadline), we expect GBP strength to be short-lived and the pound to soon re-start a weakening trend given the election uncertainty and non-negligible risk of a no-deal Brexit should the Conservative party under PM Boris Johnson win a Parliamentary majority. Indeed, recall the GBP price action earlier in the year, when GBP strengthened first on the hopes of the Article 50 extension (as is happening now) but eventually depreciated meaningfully as UK politics became even more fragmented and the risk of a no-deal Brexit rose. We look for a similar roadmap this time around."

Karen Jones, an analyst at Commerzbank, notes that GBP/USD’s recent slide into 35-month lows was accompanied by a large divergence of the daily RSI.

- “It also has not closed below 1.2000 and we have seen as sizeable bounce higher. Rallies will need to overcome the 55-day ma at 1.2343 – this protects the June high at 1.2784. Below 1.1958 (3rd September low) lies the 1.1491 3rd October low (according to CQG).

- Only a rise above the June high at 1.2784 would indicate that a bottom is being formed (not favoured).”

Carsten Brzeski, a chief economist at ING Germany, notes that industrial new orders dropped by 2.7% month-on-month in July from +2.7% MoM in June.

- "Industrial orders data has been highly volatile in recent months with bulk orders often blurring the picture. Excluding bulk orders, July industrial orders would have been up by 0.5% MoM. Still, the trend of industrial orders is anything but encouraging. Since the start of the year, industrial orders have dropped by an average of 1% MoM every month. Looking at the July data, both domestic and foreign orders dropped. Foreign orders from outside the eurozone fell by a dramatic 6.7% MoM, showing once again Germany’s exposure and sensitivity to the ongoing trade conflicts and increasing global uncertainty.

- The development of industrial orders is a painful illustration of the downward trend of German industry over the last 1 ½ years. While industrial orders dropped by a monthly average of 0.4% MoM last year, the pace of the downswing actually accelerated this year with industrial orders having dropped by 1% MoM on average. What initially only looked like an order book deflation at high levels has become an industrial slump. Interestingly, this downward trend is not only driven by weaker foreign demand on the back of trade conflicts and increased uncertainty. Since the start of the year, domestic orders have actually dropped more than foreign orders, suggesting that global woes have reached the domestic economy.

- Today’s data is the first hard data for the third quarter and it doesn't bode well at all. While tomorrow’s industrial production data could bring some relief and latest confidence indicators still point to weak but positive growth, the combination of shrinking order books and high inventories suggests that the industrial slump will not be over any time soon."

ANZ analysts note that Australia’s monthly trade balance continued to show strength, coming in at a AUD7,268m surplus in July.

- “Underlying this was a 2.9% m/m increase in imports, offset to some extent by a 0.6% m/m gain for exports.

- Resource exports grew, up 0.9% m/m in July. However, excluding gold, resources were down 3.6% m/m. The decline was largely driven by coal exports, which declined 9.4% for the month. Rural goods and manufacturing exports declined 1.1% and 1.4% respectively.

- Capital goods imports were down 1.4% m/m, reflecting weakness in civil aircraft imports, which fell 35.8% in July, continuing the 45.8% m/m decline in June. Intermediate goods imports were up 5.1% m/m, led by fuel imports, which increased 13.7% m/m. The pick-up in imports likely reflects the recovery in oil prices in July after the lows in June. Consumption goods imports were up 4.5% m/m after falling 5.1% in June. Car imports, which rose 14.3% m/m, were a significant contributor.”

Analysts at TD Securities note that in the UK, MPs approved a bill mandating an Article 50 extension should they not agree to a deal by 19 October, and also rebuffed Boris Johnson's attempt to trigger a 15-October election.

- “The Extension Bill heads to the House of Lords now for a final few days of showdown there. In a procedural tactic by the government, aimed at ambushing the bill, an amendment requiring Theresa May’s deal to be put to a vote yet again was also passed.”

FX Strategists at UOB Group suggest the corrective recovery in AUD/USD has scope to move near the 0.6830 area.

- "24-hour view: Our view yesterday was AUD “could advance further but expect strong resistance at 0.6800”. The expectation was not wrong as AUD touched 0.6801 before settling just below the high (closed at 0.6797). While the strong advance over the past two days appears to be ‘tiring’, there is room for AUD to edge higher from here. That said, a break of the solid 0.6825 resistance is unlikely. Support is at 0.6780 followed by 0.6760.

- Next 1-3 weeks: We detected the weakened underlying tone… and cautioned that “only a NY closing below 0.6690 would suggest AUD could move to 0.6640”. AUD subsequently touched 0.6688 before soaring to end the day sharply higher at 0.6763 (+0.69%). The strong gain (largest 1-day rise in 3 weeks) coupled with the bounce from the strong 0.6690 level suggest AUD could be trying to form a bottom. That said, it is too early to expect a sustained up-move. For now, we view the price action as a ‘corrective rebound’ but there appears to be ample scope for AUD to test the strong 0.6825 resistance. Looking forward, if AUD were to register a NY close above 0.6850, it would indicate that last month’s low of 0.6678 is a more significant bottom than currently expected."

- Says trade call with U.S. this morning went very well

- Hopes that U.S. would stop putting pressure on Chinese companies

- Reiterates that they firmly oppose escalation in the trade war

- Says it will strive to achieve real progress during October trade talks

Analysts at TD Securities note that Australia’s trade surplus for July staged a small drop to A$7.268b from A$7.977b in June, the outcome essentially in line with expectations.

- “Exports rose 1%, thanks to a +0.5% rise in service exports, offsetting partially some of the declines in iron ore exports -0.8% and 9% drop in coal exports.

- Import values rose 2.9%/m, driven in part by higher consumption goods. The first print for the 3rd quarter suggests net trade should add to Q3 GDP but is unlikely to exceed the 0.6% pt contribution to Q2 GDP seen earlier this week.”

The State

Secretariat for Economic Affairs (SECO) revealed on Thursday that Switzerland's

gross domestic product (GDP) rose 0.3 percent q-o-q in the second quarter of

2019, after a revised 0.4 percent q-o-q growth in the previous quarter (originally

a 0.6 percent q-o-q advance).

Economists had

forecast the Swiss economy would expand by 0.2 percent q-o-q.

According to

the report, private consumption rose by 0.3 percent q-o-q in the second

quarter, supported by expenditure for healthcare, housing and energy. Meanwhile,

government consumption edged up 0.1 percent q-o-q. Investment in construction registered

a marginal drop of 0.1 percent q-o-q, while investment in equipment recorded a

quite substantial decline of 1.0 percent. Exports of goods fell by 0.8 percent

q-o-q, while imports of goods and services also dropped by 0.6 percent q-o-q.

In y-o-y terms,

Swiss GDP grew by 0.2 percent in the second quarter, following a revised 1.0

percent advance in the first quarter (originally an increase of 1.7 percent).

This represented the weakest growth since a 0.4 percent contraction in the fourth quarter of 2009 and was well below economists’ forecasts for a 0.9

percent gain.

The Federal

Statistical Office’s (Destatis) report revealed that new orders in the German manufacturing sector decreased by 2.7 percent m-o-m in seasonally terms in July, following an upwardly revised 2.7 percent m-o-m advance in June (originally a 2.5 percent m-o-m gain). That was the biggest monthly decline in factory orders since February.

Economists had forecast

a drop of a 1.5 percent m-o-m.

According to

the report, domestic orders fell by 0.5 percent m-o-m in July. Meanwhile, foreign

orders declined by 4.2 percent m-o-m as a 0.3 percent m-o-m gain in new orders

from the euro area was more than offset by a 6.7 percent m-o-m tumble in new

orders from other countries.

New orders for

intermediate goods decreased by 2.2 percent m-o-m in July, while orders for

consumer goods dropped by 2.4 m-o-m and the orders for capital goods declined

by 3.0 percent m-o-m.

The Australian

Bureau of Statistics (ABS) announced on Thursday that Australia’s trade surplus

in seasonally adjusted terms narrowed to AUD7.268 billion in July from a

downwardly revised AUD7.977-billion surplus in June (initially a surplus of

AUD8.036 billion).

Economists had

expected a surplus of AUD7.400 billion.

According to

the report, the exports increased 0.6 m-o-m in July, after jumping 1.4 percent

m-o-m in June. Meanwhile, imports rose 2.9 percent m-o-m in July, following a

3.5 percent m-o-m drop in the prior month.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 60.14 | 3.81 |

| WTI | 55.81 | 3.85 |

| Silver | 19.56 | 1.66 |

| Gold | 1552.472 | 0.28 |

| Palladium | 1555.38 | 0.91 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 23.98 | 20649.14 | 0.12 |

| Hang Seng | 995.38 | 26523.23 | 3.9 |

| KOSPI | 22.84 | 1988.53 | 1.16 |

| ASX 200 | -20.4 | 6553 | -0.31 |

| FTSE 100 | 43.07 | 7311.26 | 0.59 |

| DAX | 114.18 | 12025.04 | 0.96 |

| Dow Jones | 237.45 | 26355.47 | 0.91 |

| S&P 500 | 31.51 | 2937.78 | 1.08 |

| NASDAQ Composite | 102.72 | 7976.88 | 1.3 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67949 | 0.6 |

| EURJPY | 117.357 | 0.98 |

| EURUSD | 1.10333 | 0.57 |

| GBPJPY | 130.271 | 1.79 |

| GBPUSD | 1.22494 | 1.39 |

| NZDUSD | 0.63553 | 0.45 |

| USDCAD | 1.32221 | -0.86 |

| USDCHF | 0.98053 | -0.62 |

| USDJPY | 106.351 | 0.41 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.