- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 04-11-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:45 | China | Markit/Caixin Services PMI | October | 51.3 | |

| 03:30 | Australia | Announcement of the RBA decision on the discount rate | 0.75% | 0.75% | |

| 03:30 | Australia | RBA Rate Statement | |||

| 09:30 | United Kingdom | Purchasing Manager Index Services | October | 49.5 | 49.7 |

| 10:00 | Eurozone | Producer Price Index, MoM | September | -0.5% | 0.1% |

| 10:00 | Eurozone | Producer Price Index (YoY) | September | -0.8% | -1.2% |

| 13:30 | Canada | Trade balance, billions | September | -0.96 | -0.7 |

| 13:30 | U.S. | International Trade, bln | September | -54.9 | -52.5 |

| 14:45 | U.S. | Services PMI | October | 50.9 | 51 |

| 15:00 | U.S. | JOLTs Job Openings | September | 7.051 | |

| 15:00 | U.S. | ISM Non-Manufacturing | October | 52.6 | 53.4 |

| 17:40 | U.S. | FOMC Member Kaplan Speak | |||

| 21:45 | New Zealand | Employment Change, q/q | Quarter III | 0.8% | 0.3% |

| 21:45 | New Zealand | Unemployment Rate | Quarter III | 3.9% | 4.1% |

| 23:00 | U.S. | FOMC Member Kashkari Speaks | |||

| 23:50 | Japan | Monetary Policy Meeting Minutes |

Major US stocks rose moderately amid growing expectations for a deal between the US and China.

US Commerce Secretary Wilbur Ross said on Sunday that “in the very near future” US companies will be licensed to sell components of Chinese Huawei Technologies Co. Ross’s comments came after Washington and Beijing said Friday they had made progress in easing an economically disruptive trade war, and US officials said the deal could be signed this month.

The market was also supported by the fact that the ongoing corporate reporting season for the third quarter was stronger than expected. According to FactSet, out of the 360 companies in the S&P 500 index that have already reported, 75% showed excess profits for the last reporting period. After the close of the trading session, the publication of quarterly reports Uber (UBER) is expected. Analysts predict that according to the results of the reporting period, the company will show a loss of $ 0.54 per share for revenue of $ 3.685 billion.

Meanwhile, the data on production orders did not meet the expectations of economists. As the US Department of Commerce report showed, orders for manufactured goods fell 0.6% after falling 0.1% in August. Economists had predicted that orders would fall by 0.5% in September. At the same time, orders for capital goods not related to defense, with the exception of aircraft, which are considered as a measure of business equipment spending plans, fell by 0.6% instead of a decrease of 0.5%, which was reported last month. Deliveries of industrial goods fell 0.2% after falling 0.3% in August.

Most of the DOW components completed trading in positive territory (18 of 30). The biggest gainers were Chevron Corporation (CVX; + 4.69%). Outsider were the shares of The Procter & Gamble Company (PG; -3.75%).

Most S&P sectors recorded an increase. The largest growth was shown in the raw materials sector (+ 1.7%). The utilities sector declined more than the rest (-1.1%).

At the time of closing:

Dow 27,462.11 +114.75 +0.42%

S&P 500 3,078.27 +11.36 +0.37%

Nasdaq 100 8,433.20 +46.80 +0.56%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:45 | China | Markit/Caixin Services PMI | October | 51.3 | |

| 03:30 | Australia | Announcement of the RBA decision on the discount rate | 0.75% | 0.75% | |

| 03:30 | Australia | RBA Rate Statement | |||

| 09:30 | United Kingdom | Purchasing Manager Index Services | October | 49.5 | 49.7 |

| 10:00 | Eurozone | Producer Price Index, MoM | September | -0.5% | 0.1% |

| 10:00 | Eurozone | Producer Price Index (YoY) | September | -0.8% | -1.2% |

| 13:30 | Canada | Trade balance, billions | September | -0.96 | -0.7 |

| 13:30 | U.S. | International Trade, bln | September | -54.9 | -52.5 |

| 14:45 | U.S. | Services PMI | October | 50.9 | 51 |

| 15:00 | U.S. | JOLTs Job Openings | September | 7.051 | |

| 15:00 | U.S. | ISM Non-Manufacturing | October | 52.6 | 53.4 |

| 17:40 | U.S. | FOMC Member Kaplan Speak | |||

| 21:45 | New Zealand | Employment Change, q/q | Quarter III | 0.8% | 0.3% |

| 21:45 | New Zealand | Unemployment Rate | Quarter III | 3.9% | 4.1% |

| 23:00 | U.S. | FOMC Member Kashkari Speaks | |||

| 23:50 | Japan | Monetary Policy Meeting Minutes |

Analysts at Rabobank expect the RBA to re-embark on further easing next year, as the government's reaction to growing pressure to spend is set to have implications for monetary policy and the AUD over the medium-term.

- "Last month a Guardian Essential poll indicated that 56% of respondents would argue that the Morrison government should stimulate the economy rather than prioritize its long-promised budget surplus.

- Despite accommodative monetary policy conditions, like most other G10 economies Australia has seen very little wage inflation in recent years. The prevalence of soft wage inflation has led the RBA to conclude that Australia is not yet at full employment.

- The RBA has had the benefit of having avoided the use of unconventional policies to date. This has allowed it the luxury of assessing the impact on policies such as quantitative easing from a strong vantage point."

Analysts at ING think that the encouraging news flow on the U.S.-China trade relations front has not yet left its mark on AUD and NZD positioning, with the two currencies still the biggest speculative shorts in the G10 space.

- “The kiwi dollar even saw a marginal increase in net shorts, that now pile up to -56% of open interest.

- The NZD outperformance in the past few days, mostly triggered by a significant re-pricing in Reserve Bank of New Zealand rate expectations (OIS implied probability of a November cut is now only 50%, from 100% two weeks ago), has likely been aided by some position-squaring effect. In turn, we would expect to start seeing some correction in the NZD positioning gauge in the next CFTC report.

- This week’s Reserve Bank of Australia policy announcement may be pivotal for both antipodean currencies: should it turn out to be a positive catalyst for the currencies, their extensive net short positioning suggests good potential for short-term rallies.”

The U.S.

Commerce Department reported on Thursday that the value of new factory orders fell

0.6 percent m-o-m in September, following an unrevised 0.2 percent m-o-m decrease

in August. That was the largest monthly drop in industrial orders since May.

Economists had

forecast a 0.5 percent m-o-m decline.

According to

the report, orders for transportation equipment declined 2.8 percent m-o-m in September

after growing 0.2 percent m-o-m in August. Orders for computers and electronic

products fell 1.2 percent m-o-m, while orders for electrical equipment,

appliances and components increased 0.7 percent m-o-m and machinery orders went

up 0.2 percent m-o-m.

Total factory

orders excluding transportation, a volatile part of the overall reading, edged

down 0.1 percent m-o-m in September (compared to a downwardly revised 0.2

percent m-o-m fall in August), while orders for nondefense capital goods

excluding aircraft, a measure of business spending plans, decreased 0.6 percent

m-o-m (compared to a 0.5 percent m-o-m decline in August). The report also

showed that shipments of core capital goods plunged 0.7 percent m-o-m in September,

the same as previously reported.

In y-o-y terms,

factory orders decreased 0.3 percent in September.

Analysts at TD Securities are expecting Canada’s labour market to continue its hot streak with the creation of other 25k jobs in October, which should allow the unemployment rate to slip back to the post-crisis low of 5.4%.

- “With over 130k jobs created in the last two months, we would typically look for some giveback but expect hiring for the federal election to offset any weakness. Public administration employment has risen by 32k on average during the month of the last three federal elections, although a 21k increase in PA employment over the last four months suggests we could see more modest gains this cycle due to wider usage of early voting.

- Looking past the election-related hiring we expect a modest unwind of recent gains, with health care and education expected to give back a portion of the 70k jobs created over the last two months. We also expect a slight improvement in earnings which should push wage growth to 4.4% y/y on muted base effects.”

Krishen Rangasamy, an analyst at National Bank Financial (NBF), believes that while minority governments tend to be short-lived, that does not necessarily mean Canada is set for policy gridlock and a quick return to the polls.

- “With the balance of power resting in the hands of the New Democratic Party, whose platform intersects with that of his own Liberal party, Prime Minister Trudeau is likely to find support for some of his proposed policies.

- We have accordingly raised our 2020 growth forecast by two ticks to 1.8%. The output gap, which is estimated by the Bank of Canada to remain open through 2021, could be eliminated sooner if, as we expect, fiscal stimulus is deployed by the new federal parliament.”

U.S. stock-index futures surged on Monday amid increased optimism around a potential U.S.-China trade deal.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 22,850.77 | -76.27 | -0.33% |

Hang Seng | 27,547.30 | +446.54 | +1.65% |

Shanghai | 2,975.49 | +17.29 | +0.58% |

S&P/ASX | 6,686.90 | +17.80 | +0.27% |

FTSE | 7,382.28 | +79.86 | +1.09% |

CAC | 5,827.41 | +65.52 | +1.14% |

DAX | 13,152.67 | +191.62 | +1.48% |

Crude oil | $56.77 | +1.00% | |

Gold | $1,513.30 | +0.13% |

Analysts at TD Securities are expecting Canada’s trade deficit to narrow to $600m in September from $960m on account of a pullback in import activity, partially offset by softer exports.

- “The UAW strike and resulting lockouts in the Canadian auto sector will weigh modestly on motor vehicle exports; US workers did not walk off the job until September 16th, and Canadian factories were able to operate for a few days before a parts shortage took hold. However, export volumes should see a more modest decline owing to a 0.1% decline in factory prices."

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 171.29 | 1.20(0.71%) | 4866 |

ALCOA INC. | AA | 22.15 | 0.28(1.28%) | 4281 |

ALTRIA GROUP INC. | MO | 45.24 | 0.18(0.40%) | 19015 |

Amazon.com Inc., NASDAQ | AMZN | 1,803.94 | 12.50(0.70%) | 29572 |

American Express Co | AXP | 119.5 | 0.36(0.30%) | 289 |

Apple Inc. | AAPL | 257.78 | 1.96(0.77%) | 357721 |

AT&T Inc | T | 39.14 | 0.19(0.49%) | 45135 |

Boeing Co | BA | 345.75 | 0.56(0.16%) | 20982 |

Caterpillar Inc | CAT | 145.4 | 0.91(0.63%) | 25904 |

Chevron Corp | CVX | 117.23 | 1.02(0.88%) | 8076 |

Cisco Systems Inc | CSCO | 47.36 | 0.33(0.70%) | 14338 |

Citigroup Inc., NYSE | C | 74.9 | 1.06(1.44%) | 78951 |

Deere & Company, NYSE | DE | 177.08 | 0.97(0.55%) | 612 |

E. I. du Pont de Nemours and Co | DD | 70 | 0.36(0.52%) | 6694 |

Exxon Mobil Corp | XOM | 70.34 | 0.74(1.06%) | 32166 |

Facebook, Inc. | FB | 194.87 | 1.25(0.65%) | 111730 |

FedEx Corporation, NYSE | FDX | 158.96 | 2.44(1.56%) | 6472 |

Ford Motor Co. | F | 8.97 | 0.08(0.90%) | 170836 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.7 | 0.18(1.71%) | 35645 |

General Electric Co | GE | 10.42 | 0.04(0.39%) | 318849 |

General Motors Company, NYSE | GM | 38.4 | 0.43(1.13%) | 9163 |

Goldman Sachs | GS | 220 | 2.61(1.20%) | 6178 |

Google Inc. | GOOG | 1,280.25 | 6.51(0.51%) | 4323 |

Hewlett-Packard Co. | HPQ | 17.87 | 0.09(0.51%) | 4156 |

Home Depot Inc | HD | 239 | 1.66(0.70%) | 1563 |

HONEYWELL INTERNATIONAL INC. | HON | 176.6 | 0.48(0.27%) | 128 |

Intel Corp | INTC | 56.91 | 0.40(0.71%) | 37111 |

International Business Machines Co... | IBM | 136.32 | 0.79(0.58%) | 5711 |

International Paper Company | IP | 43.74 | -0.22(-0.50%) | 214 |

Johnson & Johnson | JNJ | 131.83 | 0.63(0.48%) | 2100 |

JPMorgan Chase and Co | JPM | 129.3 | 1.50(1.17%) | 43515 |

McDonald's Corp | MCD | 190.74 | -3.20(-1.65%) | 334784 |

Merck & Co Inc | MRK | 85.38 | 0.44(0.52%) | 4396 |

Microsoft Corp | MSFT | 144.56 | 0.84(0.58%) | 120177 |

Nike | NKE | 90 | 0.82(0.92%) | 5462 |

Pfizer Inc | PFE | 38.61 | 0.22(0.57%) | 28491 |

Procter & Gamble Co | PG | 124.26 | 0.39(0.31%) | 3447 |

Starbucks Corporation, NASDAQ | SBUX | 83.33 | 0.12(0.14%) | 14895 |

Tesla Motors, Inc., NASDAQ | TSLA | 314.81 | 1.50(0.48%) | 43348 |

The Coca-Cola Co | KO | 54 | 0.10(0.19%) | 6335 |

Twitter, Inc., NYSE | TWTR | 29.81 | 0.19(0.64%) | 157927 |

United Technologies Corp | UTX | 146.11 | -0.57(-0.39%) | 2073 |

UnitedHealth Group Inc | UNH | 252.95 | 0.74(0.29%) | 1093 |

Verizon Communications Inc | VZ | 60.06 | -0.31(-0.51%) | 25786 |

Visa | V | 182.17 | 1.24(0.69%) | 9757 |

Wal-Mart Stores Inc | WMT | 118.38 | 0.76(0.65%) | 6783 |

Walt Disney Co | DIS | 134.25 | 1.50(1.13%) | 34589 |

Verizon (VZ) downgraded to Neutral from Buy at Nomura; target lowered to $65

- Balance of risks towards downside right now

- Until wage growth picks up we're not going to be at maximum employment

- Monetary policy has been too tight during U.S. economic recovery

- Fed should err on the side of more accommodation

- Fed should not raise rates prematurely

- U.S. not immune to China and Europe slowdown

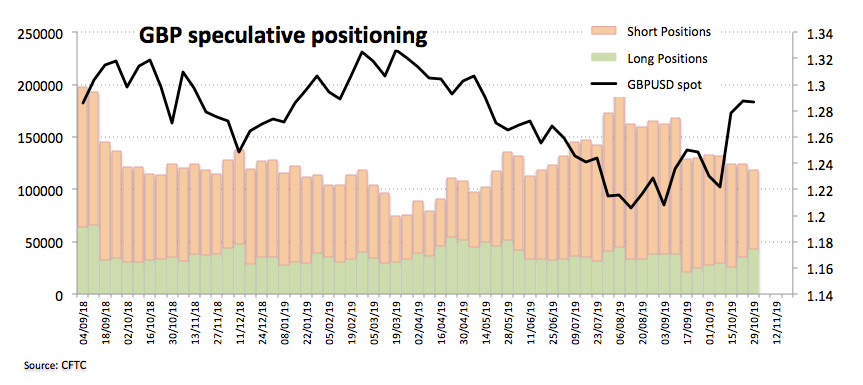

Analysts at Rabobank note that the latest CFTC Commitment of Traders Report showed that USD net longs slipped for a fourth consecutive week.

- “Net EUR short positions increased moderately. The previous week they had dropped sharply to their lowest levels since early September.

- Net short GBP positions dropped back for a seventh consecutive week and are now at their lowest level since May.

- JPY net positions held in negative ground for a third consecutive week.

- CHF net shorts remain broadly stable. Despite its safe-haven status, signs that the SNB is prepared to intervene in the FX market have distorted demand for the CHF.

- CAD net long positions surged again last week. Robust jobs data strengthened the case for steady rates from the BoC going forward.

- AUD net shorts fell for a second consecutive week. The AUD’s role as a proxy for confidence in China suggests that US/China trade talks are providing direction.”

Analysts at the Royal Bank of Scotland (RBS) note that the preliminary estimate of euro area inflation for October at 0.7% y/y matched market expectations and remained lower than that of September (0.8% y/y).

- “Core CPI at 1.1% outperformed both expectations and the previous month’s reading of 1.0%. Out of the main components of inflation, a rise in services and consumables was offset by a fall in energy prices. But despite a substantial amount of monetary stimulus headline inflation remains stubbornly lower than the ECB’s target of 2%.”

The CFTC Positioning Report for the week ended on October 29 reveales the following:

- Investors continued to trim gross shorts in the Sterling and pushed net shorts to the lowest level since late May on the back of persistent weakness in the Greenback, rising hopes on a final deal after another extension of the Brexit deadline and steady support for the Tory Party ahead of the December 12 elections.

- On the other hand, USD net longs dropped to the lowest level since August 20 as investors kept favouring the risk-associated complex ahead of the FOMC meeting.

- By the same token, JPY net shorts climbed to the highest level since June 11 against the backdrop of the broad-based sell-off in safe havens. The positive developments from the US-China trade front as of late have been fuelling the investors’ preference for riskier assets.

David Mann, the global chief economist at Standard Chartered, expects only positive news on U.S.-China trade through the next 12 months.

- “Of all the factors that we can think of to help Donald Trump’s re-election prospects, avoiding a 2020 recession is high on the list. We assume that he would want a strong story to tell on the 2020 campaign trail about China, rather than being in the truce phase that currently prevails. This story could either be a "great deal" or a worsening trade war that would risk weakening the economy further. We see more reasons for Trump to take the less risky option of a "great deal".

- Fiscal policy will barely support US growth in 2020, in our view. Monetary policy has already been loosening; we forecast another 25bps cut in December 2019. Trump’s main "direct controllable" is trade policy. If a series of positive surprises on trade are delivered between now and the November 2020 elections, he could spin this as a "victory" in the trade war – something that was a major component of Trump’s presidential campaign platform in 2016. A plausible scenario could be for a quid pro quo on tariff reductions in return for China to push the Chinese yuan (CNY) stronger, a reversal of what was seen since 2018.”

Analysts at Rabobank are expecting the Bank of England (BoE) to leave the policy rate unchanged at 0.75% on Thursday 7 November.

- “This is also the consensus view and GBP OIS implies virtually no chance of a move in either direction at this week’s meeting.

- Whilst the OIS market is –on balance– still looking for a rate cut in the first half of 2020, the implied probabilities have closely tracked those of a no-deal Brexit.

- The immediate threat of a no-deal Brexit has been averted, but the uncertainty prevails. The UK is heading for a Christmas election, and even Johnson’s Brexit-deal leaves open a wide range of future possible trading relationships, including no trade agreement at all.

- Business investment has been in the doldrums for almost two years, while cracks have also started to become visible in the labour market. There is a good chance that sustained weakness on this front tilts the balance within the MPC. We now expect two rate cuts in 2020.”

FX Strategists at UOB Group suggested that NZD/USD could attempt a move to the 0.6480/0.6500 area in the next weeks.

- "24-hour view: We highlighted last Friday, “barring a move below 0.6390, NZD could advance further even though the major 0.6450 level is likely out of reach for today”. NZD subsequently dipped to 0.6404 before surging briefly above 0.6450 (high of 0.6456). The advance is running ahead of itself and further sustained NZD strength is not expected for today. NZD is more likely to consolidate its gains and trade sideways at these higher levels, expected to- be within a 0.6410/0.6450 range.

- Next 1-3 weeks: We highlighted last Friday (01 Nov, spot at 0.6410) that “the odds for a break of the September’s peak of 0.6450 have increased”. NZD subsequently rose to 0.6456 before retreating quickly. While overbought shorter-term conditions could lead to 1 to 2 days of consolidation first, the outlook for NZD is still positive and a test of the strong 0.6480/0.6500 resistance would not be surprising. On the downside, only a break of 0.6390 (‘strong support’ level was at 0.6370) would suggest our view is wrong."

There is no promise “fatigue” about China’s efforts to open its economy to foreign businesses, the government said on Monday on the eve of week-long import fair, after the European Union said China needed to make rapid and substantial improvements.

The EU, China’s largest trading partner, said last week ahead of the Shanghai fair that there was a risk of “promise fatigue”, urging China to show “more ambition and genuine effort towards rebalancing and a level playing field”.

China has long been dogged by allegations of unfair trade practices, from forced tech transfers to protectionist market entry policies. The country has been criticized for making promises to open its market and not delivering on them.

Speaking at a daily news briefing, Chinese Foreign Ministry spokesman, Geng Shuang, said China was pleased to note the EU’s statement mentioned how European companies’ sales had benefited from the fair last year, the first of its kind in the country.

European firms will be well-represented this year, too, and are sure to come away well satisfied, Geng said. When it comes to China’s commitment to reform and opening up, China has always stuck to its word, he said.

November 4

After the Close:

Uber (UBER). Consensus EPS -$0.54, Consensus Revenues $3684.92 mln

November 5

Before the Open:

Allergan (AGN). Consensus EPS $4.20, Consensus Revenues $3880.65 mln

Arconic (ARNC). Consensus EPS $0.52, Consensus Revenues $3586.48 mln

November 6

Before the Open:

Barrick (GOLD). Consensus EPS $0.12, Consensus Revenues $2703.35 mln

After the Close:

Baidu (BIDU). Consensus EPS $1.17, Consensus Revenues $3894.77 mln

November 7

After the Close:

Walt Disney (DIS). Consensus EPS $0.97, Consensus Revenues $19011.12 mln

Despite a potential move to 0.8700 and above, extra losses remain well on the cards in the European cross, noted Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank.

“EUR/GBP is consolidating sideways – the correction higher has proved to be very tepid indeed and the market remains on the defensive. There remains scope very near term for a move into the .8705/.8790 band (current intraday Elliott wave counts) ahead of further losses. Below .8571 we would allow for the slide to extend to the .8465 2019 low. We note the TD support at .8485. Initial resistance is .8786 the mid September low. Key resistance is the 55 day ma at .8853 and the October high at .9022. While capped here a negative bias is entrenched”.

A Chinese official said breakthroughs have been made in negotiations for an Asia-wide trade pact that would be the world's biggest trade deal, though he said consultations with India are still going on.

An announcement on the deal would be made later in the day by leaders attending the Association of Southeast Asian Nations (ASEAN) summit in Bangkok, said Chinese Vice Foreign Minister Le Yucheng.

Host country Thailand had said earlier that the deal would be ready to sign in 2020.

Le said there were a "few outstanding issues that will be completed by this year" and added that "whenever India is ready they are welcomed to come on board".

The envisioned bloc includes the 10 ASEAN members plus China, South Korea, Japan, India, Australia and New Zealand.

In view of Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, Cable is still expected to test the key 1.3000 area.

“GBP/USD last week recovered from near term support offered by the 1.2784 25th June high. This leaves the market well placed to tackle psychological resistance at 1.3000. Directly above here we have the 200 week ma at 1.3131 and the 1.3187 May high and these remain our short term targets. The 200 day ma at 1.2710 guards 1.2582. For now, provided dips lower hold over 1.2582 (20th September high), an immediate upside bias is maintained. The 1.3187 May high guards the 1.3382 2019 high. Below 1.2582 lies the 1.2382 17th July low and the 1.2348 uptrend. The uptrend guards 1.2196/94”.

According to the report from IHS Markit/CIPS, October data pointed to a sustained decline in UK construction output, with overall volumes of work falling for the sixth consecutive month. The latest survey also revealed a sharp drop in new work, although the rate of contraction was the slowest for three months. Meanwhile, construction companies continued to reduce their workforce numbers in October, which was linked to weak order books and concerns about their near term business outlook.

At 44.2 in October, the headline seasonally adjusted UK Construction Total Activity Index registered below the crucial 50.0 no-change threshold. The latest reading was up from 43.3 during the previous month, but still close to the ten-year low seen in June (43.1).

Construction companies noted that client demand remained subdued in response to domestic political uncertainty and the economic backdrop. In some cases, survey respondents noted that unusually wet weather in October had acted as an additional headwind to construction output. Lower volumes of work were recorded across all three broad categories of activity.

New orders dropped for the seventh month in a row during October, but the rate of decline was the least marked since July. Softer demand conditions and a lack of new work to replace completed projects resulted in another fall in staffing levels across the construction sector.

Meanwhile, business optimism towards the year-ahead outlook for construction work remained among the weakest seen since 2012. Some construction firms noted that contract awards related to large scale civil engineering projects had the potential to boost workloads in the next 12 months, although political uncertainty continued to cloud the outlook.

According to the report from IHS Markit, the euro area manufacturing sector continued to contract during October. After accounting for usual seasonal influences, the IHS Markit Eurozone Manufacturing PMI recorded 45.9 in October. Although up from September’s 45.7 and the earlier flash reading, the index remained well below the 50.0 no-change mark to indicate a rate of contraction that was the second sharpest in the past seven years. All three market groups covered by the survey once again recorded a deterioration in operating conditions on the previous month. Investment goods and intermediate goods producers both registered marked contractions, compared to consumer goods where the rate of deterioration remained marginal.

Against the backdrop of deteriorating order books, euro area manufacturers made further cuts to both their output and purchasing activity in October. Whilst rates of decline eased since September, they nonetheless remained historically marked. Firms also made notable inroads into their backlogs of work to extend the current period of contraction to 14 months.

On the price front, average input costs fell the most since March 2016 during October. Commodities such as copper and steel, plus plastics, were amongst the inputs reported to be down in price. Manufacturers responded by making downward adjustments to their own charges for a fourth month in a row.

Finally, economic and political uncertainties (such as Brexit and US trade policy) continued to weigh on sentiment during October. Although expectations were at their highest for three months, confidence remained historically low.

Bank of America Merrill Lynch Global Research discusses GBP outlook ahead of next month's UK elections.

"Are we finally heading for some closure on phase 1 of Brexit? Possibly but not certainly. The House of Common's last night authorised a 12 December UK general election. Assuming the legislation passes through the House of Lords today then we examine the economic impact of three scenarios for that election result:

1. Conservative Party majority and Brexit deal agreed.

2. Labour minority government and Brexit referendum.

3. Hung parliament, lack of clarity, no deal risks potentially return,

An unprecedented fourth general election in nine years provides a large body of evidence on how FX markets are likely to react pre and post the election. One unambiguous conclusion, and our preferred way to express a view on GBP is to expect higher volatility over the coming month in the run up to election day. We think GBPUSD could struggle to sustain a break above 1.30 in the run up to the election," BofAML adds.

The British election is likely to result in a hung parliament and the Brexit Party’s lawmakers could be kingmakers, leader Nigel Farage said on Monday.

“It is likely, it is likely that we are going to have a hung parliament next time around so actually if the Brexit Party get a reasonable amount of people in there they could exert a great influence,” Farage told ITV. “Mrs May was kept in power by 10 DUP MPs.”

Former Prime Minister Theresa May was dependent on Democratic Unionist Party lawmakers to govern after her failed bet on a snap election lost her party its majority.

Farage said he would hurt the opposition Labour Party “in the most extraordinary way”.

China’s Foreign Ministry said on Monday that President Xi Jinping and U.S. President Donald Trump have been in touch all along through various means, when asked when and where the two leaders might meet.

Ministry spokesman Geng Shuang made the comments at a daily news briefing in Beijing.

Trump on Friday suggested that he could sign a long-awaited trade agreement with China in the farm state of Iowa.

U.S. and Chinese negotiators have been racing to finalize a text of a ‘phase one’ agreement for Trump and Xi to sign this month, a process clouded by wrangling over U.S. demands for a timetable of Chinese purchases of U.S. farm products.

A critical date is Dec. 15, when new U.S. tariffs on Chinese imports such as laptops, toys and electronics are set to kick in. Both the United States and China have an interest in reaching a deal and averting those tariffs.

Treasury 10-year yields may surge while stocks grind higher over the next six months after the Federal Reserve’s third interest-rate cut, according to JPMorgan Chase & Co.

The market reaction to the Fed’s “insurance” rate cuts has been most akin to a similar path taken in the mid-1990s, JPMorgan strategists said.

“Assuming markets continue to follow the trajectory of the 1995 mid-cycle episode, this implies modest 5% or so upside for equities over the next six months, very big 100 basis point upside in the 10-year U.S. Treasury yield, steepening of the UST curve, and little change in the dollar or credit spreads,” strategists led by Nikolaos Panigirtzoglou wrote in a note.

The prediction comes with some big caveats, though. It assumes that the U.S. macro picture remains consistent with a mid-cycle adjustment, with resilience in employment and consumer confidence, as well as a rebound in manufacturing, JPMorgan said. It would also require a reversal of the pattern that has seen retail investors buy bond funds and sell equity funds at an unusually heavy level, and a re-steepening at the front end of the U.S. forward curve.

New Zealand said on Monday it has concluded a deal to upgrade its free trade agreement with China which has been under negotiations for years.

The upgraded agreement will make exporting to China easier and reduce compliance costs for New Zealand exports by millions of dollars each year, the trade ministry said in a statement.

The upgrade would ensure nearly all New Zealand's wood and paper trade to China will have preferential access over the next 10 years, it said.

“This ensures our upgraded free trade agreement will remain the best that China has with any country,” Prime Minister Jacinda Ardern said.

The upgrade also secures a commitment from Beijing to promote environmental protections and ensure that environmental standards are not used for trade protectionist purposes, it added.

New Zealand was the first developed country to sign a free trade agreement with China in 2008. It has been working with Beijing to upgrade the agreement for the last three years. China is New Zealand’s largest trading partner, with annual two-way trade recently exceeding NZ$32 billion.

Analysts at Danske Bank provide a brief preview of the key event risks due on the cards in the day ahead.

“Today, Christine Lagarde will give her first public speech in her role as ECB president, which markets will scrutinise for any hints on her stance on monetary policy. Final euro area PMI figures for October are also released. In Denmark, the central bank is scheduled to publish FX reserve figures for October. A new House of Commons speaker will be elected today. Later this week the Bank of England announces its interest rate decision as the UK general election campaign gets under way, while Chinese trade data will also be in focus.”

According to the report from SECO, сonsumer sentiment has worsened slightly. Consumers have proved less optimistic about both general economic development and the labour market than in previous quarters.

In November 2019, the consumer sentiment index stands at −10 points and is therefore below its long-term average (−5 points). Sentiment has worsened slightly in comparison with July’s survey (–8 points).

Expectations regarding general economic development have deteriorated significantly. The relevant sub-index (−20 points) has dropped below its long-term average (−9 points) for the first time in more than three years. According to the assessment of the respondents, the outlook for the labour market has clouded over, too. The index on anticipated unemployment (48 points) is close to its long-term average and has thus reached its highest level for over two years; however, job security is still assessed as above average.

Overall, these results point to weak economic development in the near future. By contrast, households’ budget situation has tended to ease slightly, although its level remains below average. In particular, the assessment of the financial situation in the last few months (–11 points; average: –6 points) has continued its positive development of recent quarters. Expectations regarding the financial situation in the next few months (–3 points; average: +2 points) have at least left the low point of mid-2019 behind them. In line with these figures, the likelihood of making major purchases has largely remained stable (–8 points; average: –6 points). Based on the current survey results, moderate growth in private consumer expenditure is to be expected, as in previous quarters.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1258 (3247)

$1.1223 (2876)

$1.1197 (3616)

Price at time of writing this review: $1.1168

Support levels (open interest**, contracts):

$1.1098 (3856)

$1.1049 (2452)

$1.1000 (3974)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 8 is 76475 contracts (according to data from November, 1) with the maximum number of contracts with strike price $1,1000 (3974);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3066 (686)

$1.3029 (1536)

$1.3000 (1683)

Price at time of writing this review: $1.2933

Support levels (open interest**, contracts):

$1.2872 (184)

$1.2834 (326)

$1.2791 (763)

Comments:

- Overall open interest on the CALL options with the expiration date November, 8 is 26155 contracts, with the maximum number of contracts with strike price $1,3400 (3252);

- Overall open interest on the PUT options with the expiration date November, 8 is 29733 contracts, with the maximum number of contracts with strike price $1,2100 (3166);

- The ratio of PUT/CALL was 1.14 versus 1.20 from the previous trading day according to data from November, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 60.52 | 2.09 |

| WTI | 55.26 | 2.18 |

| Silver | 18.07 | -0.06 |

| Gold | 1513.812 | 0.12 |

| Palladium | 1804.2 | 0.49 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -76.27 | 22850.77 | -0.33 |

| Hang Seng | 194.04 | 27100.76 | 0.72 |

| KOSPI | 16.72 | 2100.2 | 0.8 |

| ASX 200 | 5.7 | 6669.1 | 0.09 |

| FTSE 100 | 54.04 | 7302.42 | 0.75 |

| DAX | 94.26 | 12961.05 | 0.73 |

| CAC 40 | 32.03 | 5761.89 | 0.56 |

| Dow Jones | 301.13 | 27347.36 | 1.11 |

| S&P 500 | 29.35 | 3066.91 | 0.97 |

| NASDAQ Composite | 94.04 | 8386.4 | 1.13 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.69113 | 0.3 |

| EURJPY | 120.759 | 0.25 |

| EURUSD | 1.1164 | 0.12 |

| GBPJPY | 139.898 | 0.19 |

| GBPUSD | 1.29341 | 0.06 |

| NZDUSD | 0.64249 | 0.18 |

| USDCAD | 1.31393 | -0.18 |

| USDCHF | 0.98549 | -0.1 |

| USDJPY | 108.144 | 0.12 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.