- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 03-03-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Gross Domestic Product (QoQ) | Quarter IV | 0.4% | 0.4% |

| 00:30 | Australia | Gross Domestic Product (YoY) | Quarter IV | 1.7% | 2% |

| 01:45 | China | Markit/Caixin Services PMI | February | 51.8 | |

| 07:00 | Germany | Retail sales, real adjusted | January | -3.3% | 1% |

| 07:00 | Germany | Retail sales, real unadjusted, y/y | January | 0.8% | 1.5% |

| 07:30 | Switzerland | Consumer Price Index (MoM) | February | -0.2% | 0.2% |

| 07:30 | Switzerland | Consumer Price Index (YoY) | February | 0.2% | 0.1% |

| 08:50 | France | Services PMI | February | 51 | 52.6 |

| 08:55 | Germany | Services PMI | February | 54.2 | 53.3 |

| 09:00 | Eurozone | Services PMI | February | 52.5 | 52.8 |

| 09:30 | United Kingdom | Purchasing Manager Index Services | February | 53.9 | 53.3 |

| 10:00 | Eurozone | Retail Sales (YoY) | January | 1.3% | 1.1% |

| 10:00 | Eurozone | Retail Sales (MoM) | January | -1.6% | 0.6% |

| 13:15 | U.S. | ADP Employment Report | February | 291 | 191 |

| 13:30 | Canada | Labor Productivity | Quarter IV | 0.2% | 0.1% |

| 14:45 | U.S. | Services PMI | February | 53.4 | 49.4 |

| 15:00 | U.S. | ISM Non-Manufacturing | February | 55.5 | 54.9 |

| 15:00 | Canada | Bank of Canada Rate | 1.75% | 1.75% | |

| 15:30 | U.S. | Crude Oil Inventories | February | 0.452 | 3.333 |

| 18:30 | Germany | German Buba President Weidmann Speaks | |||

| 19:00 | U.S. | Fed's Beige Book | |||

| 22:00 | U.S. | FOMC Member James Bullard Speaks |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Gross Domestic Product (QoQ) | Quarter IV | 0.4% | 0.4% |

| 00:30 | Australia | Gross Domestic Product (YoY) | Quarter IV | 1.7% | 2% |

| 01:45 | China | Markit/Caixin Services PMI | February | 51.8 | |

| 07:00 | Germany | Retail sales, real adjusted | January | -3.3% | 1% |

| 07:00 | Germany | Retail sales, real unadjusted, y/y | January | 0.8% | 1.5% |

| 07:30 | Switzerland | Consumer Price Index (MoM) | February | -0.2% | 0.2% |

| 07:30 | Switzerland | Consumer Price Index (YoY) | February | 0.2% | 0.1% |

| 08:50 | France | Services PMI | February | 51 | 52.6 |

| 08:55 | Germany | Services PMI | February | 54.2 | 53.3 |

| 09:00 | Eurozone | Services PMI | February | 52.5 | 52.8 |

| 09:30 | United Kingdom | Purchasing Manager Index Services | February | 53.9 | 53.3 |

| 10:00 | Eurozone | Retail Sales (YoY) | January | 1.3% | 1.1% |

| 10:00 | Eurozone | Retail Sales (MoM) | January | -1.6% | 0.6% |

| 13:15 | U.S. | ADP Employment Report | February | 291 | 191 |

| 13:30 | Canada | Labor Productivity | Quarter IV | 0.2% | 0.1% |

| 14:45 | U.S. | Services PMI | February | 53.4 | 49.4 |

| 15:00 | U.S. | ISM Non-Manufacturing | February | 55.5 | 54.9 |

| 15:00 | Canada | Bank of Canada Rate | 1.75% | 1.75% | |

| 15:30 | U.S. | Crude Oil Inventories | February | 0.452 | 3.333 |

| 18:30 | Germany | German Buba President Weidmann Speaks | |||

| 19:00 | U.S. | Fed's Beige Book | |||

| 22:00 | U.S. | FOMC Member James Bullard Speaks |

- Outbreak has prompted significant moves in financial markets

- Household spending has been key driver of economic growth in past year

- We're beginning to hear about impacts on supply chains

- Overall impacts are highly uncertain

- FOMC judged that risks had changed materially

- In the weeks and months ahead we will continue to closely monitor developments and will act appropriately to support economy

- Over the course of the last couple weeks, we've seen a broader virus spread

- We saw a risk to the outlook for the economy

- I don't think anyone knows how long it will take, but I fully expect we will return to solid growth and a solid labor growth

- The ultimate solutions will come from others

- We're in active discussions with other central bank leaders around the world, they're doing what makes sense in their situations

In its statement, the Federal Reserve said: "The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by 1/2 percentage point, to 1 to 1‑1/4 percent. The Committee is closely monitoring developments and their implications for the economic outlook and will use its tools and act as appropriate to support the economy."

FXStreet reports that analysts at TD Securities now expect the ECB to announce limited stimulus measures targeting liquidity and tightened financial conditions next week, followed by a 10bps cut to the deposit rate in Q2 2020.

“Micro EUR liquidity measures which are fundamentally more effective tools to address the virus concern, could come as a disappointment for markets. This is already visible in today's rate price action. Nonetheless, the enhanced liquidity measures should come as a support for the credits spreads and vulnerable sectors. From a tactical perspective, we enter 5y swap spread tighteners at 38bps targeting 30bps and stop of 42bps.”

“The EUR has rallied sharply in recent days, but we think this mostly reflects short-covering driven by risk aversion rather than a positive reassessment of the region's fundamentals. Looking forward, we expect EURUSD to remain highly reactive to how policymakers eventually respond from here. The near-term outlook remains highly uncertain as there are many moving parts in the mix. Our base case argues for a bit more upside potential, but much depends on the precise policy mix and its sequencing. Further gains will depend, however, on a significant upward repricing of global growth prospects. In the absence of that, intensified risk aversion could see spot to fresh lows for the cycle.”

FXStreet reports that in light of the recent price action, FX Strategists at UOB Group believe USD/CNH could move to the 6.9400 region in the next weeks.

24-hour view: “We highlighted yesterday that ‘barring a move above 7.0000, USD is expected to weaken to 6.9575’. Our view was not wrong as USD subsequently dropped to 6.9538 before recovering. The combination of oversold conditions and waning momentum suggests limited downside risk for USD for today. USD is more likely to consolidate and trade sideways, expected to be between 6.9550 and 6.9790.”

Next 1-3 weeks: “We highlighted last Friday (28 Feb, spot at 7.0200) that ‘the risk of a deeper pullback would increase from here unless USD can move and stay above 7.0250 within these few days’. However, the sudden slump of -0.45% (NY close of 6.9780) came as a surprise. From here, the pull-back in USD could extend to 6.9400. The ‘strong resistance’ level has moved lower to 7.0150 from 7.0250.”

U.S. stock-index futures rose on Tuesday, as investors digested the official G-7 policy response to help mitigate the impact of the coronavirus.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 21,082.73 | -261.35 | -1.22% |

| Hang Seng | 26,284.82 | -6.86 | -0.03% |

| Shanghai | 2,992.90 | +21.97 | +0.74% |

| S&P/ASX | 6,435.70 | +44.20 | +0.69% |

| FTSE | 6,767.73 | +112.84 | +1.70% |

| CAC | 5,423.07 | +89.55 | +1.68% |

| DAX | 12,107.81 | +249.94 | +2.11% |

| Crude oil | $47.96 | | +2.59% |

| Gold | $1,605.90 | | +0.70% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 153.05 | 0.03(0.02%) | 20711 |

| ALTRIA GROUP INC. | MO | 42.2 | 0.13(0.31%) | 15054 |

| Amazon.com Inc., NASDAQ | AMZN | 1,958.56 | 4.61(0.24%) | 111748 |

| American Express Co | AXP | 114.64 | 0.77(0.68%) | 22199 |

| AMERICAN INTERNATIONAL GROUP | AIG | 42.75 | -0.10(-0.23%) | 408 |

| Apple Inc. | AAPL | 300.5 | 1.69(0.57%) | 1687725 |

| AT&T Inc | T | 37.25 | 0.07(0.19%) | 75397 |

| Boeing Co | BA | 291.29 | 2.02(0.70%) | 58011 |

| Caterpillar Inc | CAT | 126.49 | -1.11(-0.87%) | 20429 |

| Chevron Corp | CVX | 96.05 | -0.54(-0.56%) | 26563 |

| Cisco Systems Inc | CSCO | 40.94 | -0.23(-0.56%) | 112309 |

| Citigroup Inc., NYSE | C | 67.4 | -0.19(-0.28%) | 42174 |

| Deere & Company, NYSE | DE | 163.5 | -0.42(-0.26%) | 3285 |

| E. I. du Pont de Nemours and Co | DD | 45 | 0.05(0.11%) | 2748 |

| Exxon Mobil Corp | XOM | 54.22 | 0.34(0.63%) | 115280 |

| Facebook, Inc. | FB | 195.5 | -0.94(-0.48%) | 291647 |

| FedEx Corporation, NYSE | FDX | 139.5 | -0.25(-0.18%) | 9465 |

| Ford Motor Co. | F | 7.22 | 0.02(0.28%) | 153677 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.55 | 0.05(0.48%) | 28852 |

| General Electric Co | GE | 11.35 | 0.14(1.25%) | 779021 |

| General Motors Company, NYSE | GM | 31.43 | 0.01(0.03%) | 18465 |

| Goldman Sachs | GS | 208.89 | -0.58(-0.28%) | 25622 |

| Google Inc. | GOOG | 1,384.28 | -4.83(-0.35%) | 18409 |

| Hewlett-Packard Co. | HPQ | 21.94 | 0.08(0.37%) | 26220 |

| Home Depot Inc | HD | 229.91 | -0.03(-0.01%) | 23633 |

| HONEYWELL INTERNATIONAL INC. | HON | 165.48 | 1.24(0.76%) | 2513 |

| Intel Corp | INTC | 57.33 | -0.85(-1.46%) | 141924 |

| International Business Machines Co... | IBM | 133.51 | -0.79(-0.59%) | 18531 |

| International Paper Company | IP | 38.3 | 0.07(0.18%) | 4375 |

| Johnson & Johnson | JNJ | 139.8 | -0.22(-0.16%) | 23580 |

| JPMorgan Chase and Co | JPM | 121.3 | -0.22(-0.18%) | 35948 |

| McDonald's Corp | MCD | 201 | -1.55(-0.77%) | 17249 |

| Merck & Co Inc | MRK | 81.39 | 0.02(0.02%) | 27977 |

| Microsoft Corp | MSFT | 173.45 | 0.66(0.38%) | 1056878 |

| Nike | NKE | 91.91 | -0.77(-0.83%) | 23765 |

| Pfizer Inc | PFE | 35.15 | 0.27(0.77%) | 265079 |

| Procter & Gamble Co | PG | 119 | -0.56(-0.47%) | 17469 |

| Starbucks Corporation, NASDAQ | SBUX | 81.67 | -0.71(-0.86%) | 20917 |

| Tesla Motors, Inc., NASDAQ | TSLA | 799.98 | 56.36(7.58%) | 1430600 |

| The Coca-Cola Co | KO | 56.1 | 0.18(0.32%) | 63593 |

| Travelers Companies Inc | TRV | 126.4 | -1.28(-1.00%) | 10331 |

| Twitter, Inc., NYSE | TWTR | 35.9 | 0.08(0.22%) | 120765 |

| United Technologies Corp | UTX | 133 | -1.07(-0.80%) | 42112 |

| UnitedHealth Group Inc | UNH | 268.5 | -4.61(-1.69%) | 17358 |

| Visa | V | 193.75 | 1.42(0.74%) | 88870 |

| Wal-Mart Stores Inc | WMT | 115 | -0.88(-0.76%) | 16933 |

| Walt Disney Co | DIS | 121.6 | 1.62(1.35%) | 124849 |

| Yandex N.V., NASDAQ | YNDX | 41.56 | 0.65(1.59%) | 42702 |

Uber (UBER) target lowered to $54 from $56 at Needham

Advanced Micro (AMD) upgraded to Overweight from Neutral at Piper Sandler; target raised to $56

American Express (AXP) upgraded to Buy from Hold at DZ Bank

Tesla (TSLA) upgraded to Mkt Outperform from Mkt Perform at JMP Securities; target $1060

- G7 agreed to monitor coronavirus situation very closely

FXStreet reports that Andrew Kelvin, Chief Canada Strategist at TD Securities (TDS) offered a brief preview of the upcoming Bank of Canada monetary policy decision on Wednesday, wherein the central bank is expected to cut interest rates by 25 bps.

“With other G7 central banks making unspecified promises of support, financial markets are now fully primed for widespread monetary stimulus. In Canada's case, markets have now fully priced in a rate cut for March, and with recent developments we believe that the cost of disappointing the market would be unpalatably high for the BoC. Although their preference may be to wait until they have a full forecast in hand to act, we now believe that the BoC will cut rates by 25 bps at tomorrow's meeting.”

“We don't expect to see much in the way of forward guidance given the volatile backdrop. Data dependence will remain the bank's lodestar going forward, as they will tie the March rate cut to expected reductions in global growth. We also expect they will cut by 25 bps in April, but the Bank won't want to signal anything until they have a better sense of COVID-19's growth implications and potential fiscal measures.”

- Important for ECB to remain alert, monitor situation

- There's no imminent need to act, but we're ready to step in when and where necessary

- Panic and overreaction could cost us a lot

- We are closely monitoring the spread of the coronavirus disease 2019 and its impact on markets and economic conditions

- We reaffirm our commitment to use all appropriate tools to achieve strong, sustainable growth and safeguard against downside risks

- G7 central banks will continue to fulfill their mandates, thus supporting price stability and economic growth while maintaining the resilience of the financial system

- We stand ready to cooperate further on timely and effective measures

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 09:30 | United Kingdom | PMI Construction | February | 48.4 | 48.8 | 52.6 |

| 10:00 | Eurozone | Producer Price Index (YoY) | January | -0.6% | -0.5% | -0.5% |

| 10:00 | Eurozone | Producer Price Index, MoM | January | 0.1% | 0.5% | 0.4% |

| 10:00 | Eurozone | Harmonized CPI, Y/Y | February | 1.4% | 1.2% | 1.2% |

| 10:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | February | 1.1% | 1.2% | 1.2% |

| 10:00 | Eurozone | Unemployment Rate | January | 7.4% | 7.4% | 7.4% |

GBP strengthened against USD and EUR in the European session on Tuesday as post-Brexit trade talks with the European Union (EU) began, while expectations of a BoE rate cut increased.

The first round of talks between Britain and the EU's executive arm, the European Commission kicked off on Monday and will last until Thursday. This round is the first of several, which are to take place before an EU-UK summit in June. Half a trillion euros worth of annual trade and close security ties are at stake. The UK's chancellor Rishi Sunak urged the EU to honour a June deadline for granting market access rights.

The EU said it was ready to give Britain beneficial access to its single market of 450 million consumers in exchange for guarantees that London would prevent dumping. But the UK's Prime Minister Boris Johnson has stated that Britain wants a relationship with Europe based on friendly cooperation between sovereign equals and will not be bound by EU rules or the jurisdiction of its top court.

Deepening concerns over the spread of coronavirus and the economic damage it could cause raised expectations that the world's central banks would cut their interest rates to limit the fallout, including possibly through coordinated action. The G7 finance ministers and central bank governors stated today that they are ready "to take actions, including fiscal measures where appropriate, to aid in the response to the virus and support the economy during this phase" and "to cooperate further on timely and effective measures".

The Bank of England's (BoE) governor Mark Carney told the UK's MPs on Tuesday he expected a “powerful and timely” global response to the economic hit from coronavirus. He added that the BoE stood ready to act.

Money markets see a more than 80% chance of a 25 basis point cut by the BoE on March 26. Meanwhile, two cuts are priced in by end-2020.

Market participants also received data from IHS Markit, which revealed that the UK's construction sector grew for the first time since April 2019 despite severe weather conditions in February. The IHS Markit/CIPS construction Purchasing Managers' Index (PMI) increased to 52.6 in February from 48.4 in January, signaling that the overall rate of construction output growth was the fastest for 14 months. The latest survey also pointed to the sharpest rise in new orders since December 2015.

FXStreet reports that FX Strategists at UOB Group note that while further pullbacks are not ruled out, USD/JPY is seen attempting to consolidate in the short-term horizon.

24-hour view: “USD opened on a weak note yesterday but rebounded strongly and rapidly. Downward momentum has eased and the current movement is viewed as a consolidation phase. While USD is likely to trade sideways for today, the immediate bias is for it to probe to the top of the expected 107.80/109.20 range first.”

Next 1-3 weeks: “We expected ‘further USD weakness’ last Friday (28 Feb, spot at 109.50) but clearly did not anticipate the outsized plunge that led to a low of 107.49. Such large 1-day decline (the -1.38% drop last Friday is the largest in 33 months) is rare and while further weakness is not ruled out, the odds for a sustained drop below 106.30 are not high. Meanwhile, USD could continue to trade in a choppy manner over the next few days and only a move back above 110.00 (‘strong resistance’ level was at 110.45 last Friday) would indicate the current weakness has stabilized.”

FXStreet reports that in the opinion of FX Strategists at UOB Group, a probable drop in Cable to the 1.2700 neighbourhood seems to have lost some traction as of late.

24-hour view: “GBP traded between 1.2740 and 1.2850 yesterday, close to our expected sideway-trading range of 1.2735/1.2855. The movement is still viewed as a consolidation phase even though the slightly weakened underlying tone suggests GBP is likely to trade at a lower range of 1.2720/1.2820.”

Next 1-3 weeks: “While we indicated last Friday that a ‘NY close below 1.2820 would suggest GBP is ready to embark of a sustained decline’, we were of the view ‘the prospect for such a scenario is low for now’. However, GBP sliced through 1.2820 and plunged to a 4-1/2 -month low of 1.2726 before snapping back up to end the day at 1.2821 (-0.48%). The break of 1.2820 has exposed the downside in GBP even though 1.2700 is a strong support and may not come into the picture so soon. To look at it another way, GBP could consolidate for a couple of days first before making a run for 1.2700. On the upside, only a move above 1.2900 (‘strong resistance’ level) would indicate that GBP is not ready to move lower just yet.”

- I will not make a decision before seeing the data

- Incoming data will influence my decision

- Global growth had appeared to be stabilising in January

- But situation is changing now, we will be reassessing our position

- We have a very tight labour market but this is not the only factor for inflation

- There is strong competition in the retail sector and declining business markups are weighing on inflation

- It's important to highlight that BoE is not in rush to raise interest rates

- Says he would currently not support an interest rate cut to help curb coronavirus effects on economy

- TLTROs will be under consideration next week

- Sees no urgency to move on TLTROs

- Says monetary policy actions are secondary to fiscal support

FXStreet reports that analysts at Nordea Markets offered a quick review of Tuesday's release of the flash version of the Eurozone CPI, which is estimated to have edged down to 1.2% YoY rate in February from 1.4% previous.

“Last week, German inflation came in at 1.7% y/y, just above consensus (1.6% y/y) and up from January’s 1.6% y/y. It was mainly driven by services and food prices. French inflation edged down slightly, to 1.6% y/y from 1.7% y/y in January. Higher prices for manufactured goods and services were offset by lower energy prices. Italian inflation also slowed due to lower energy prices, to 0.4% y/y.”

“Looking ahead, the recent drop in oil prices sets headline inflation to move down further in the coming months. We expect core inflation to pick up slowly. Inflation is however not the most important factor for the ECB right now. As Lagarde’s statement yesterday stressed, the ECB is closely monitoring developments concerning the coronavirus outbreak and activity indicators revealing its impact to decide on the policy course in the near term. We expect an emergency response from the ECB in March.”

CNBC reports that despite taking a beating last week as cases of the new coronavirus spread rapidly around the world, U.S. markets have yet to price in a full-scale pandemic and subsequent recession, a U.S. equity manager told.

Speaking to CNBC, Columbia Threadneedle EMEA Head of U.S. Equities Nadia Grant said that despite the volatility, her team had not yet seen enough to make any strategic plays on cheaper stocks.

She said the market is pricing in 0% earnings growth for 2020, "rightly so", with a return to around 8% in 2021.

"That's what the market is pricing in, that's what our base case scenario also is. But I do not think the markets are washed; I do not think markets have panicked, and so in terms of finding great ideas, we haven't had enough of a sell-off for that," Grant said.

She added that the worst-case scenario of the virus becoming a pandemic with a recessionary impact on the U.S. economy was "not priced in at all by the market right now."

Grant hypothesized that containment measures similar to those exercised in China, involving the widespread shutdown of manufacturing facilities, schools and businesses, could see Columbia Threadneedle analysts' worst-case scenario play out.

FX Strategists at UOB Group expect EUR/USD to attempt some consolidation ahead of a probable move to 1.1239.

24-hour view: "While our view for a higher EUR was correct, we underestimated the pace and extent of its rally as it surged to a high of 1.1185. The rapid and strong rise over the past few days is severely overbought and further sustained EUR strength is unlikely for today. EUR is more likely to consolidate and trade sideways at these elevated levels. Expected range for today, 1.1100/1.1190."

Next 1-3 weeks: "We indicated yesterday (02 Mar, spot at 1.1040) that that 'the rapid improvement in momentum suggests a move above 1.1096 would not be surprising and if EUR can register a NY closing above this level, it could continue to advance towards 1.1170'. The scenario was supposed to take a few days to evolve but EUR blast past 1.1096 and cracked 1.1170 with a few hours (overnight high of 1.1185). Now that 1.1170 is breached, the focus has shifted to the late December high of 1.1239. The prospect for a move to this level is not low but EUR is likely to take a breather and consolidate for a couple of days first before making a move towards 1.1239. On the downside, the 'strong support' level has moved higher to 1.1000 from yesterday's level of 1.0940."

According to a flash estimate from Eurostat, euro area annual inflation is expected to be 1.2% in February 2020, down from 1.4% in January. Meanwhile, the core figures arrived at +1.2% in February when compared to 1.2% expectations and +1.1% previous.

Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in February (2.2%, compared with 2.1% in January), followed by services (1.6%, compared with 1.5% in January), non-energy industrial goods (0.5%, compared with 0.3% in January) and energy (-0.3%, compared with 1.9% in January).

According to the report from Eurostat, the euro area (EA19) seasonally-adjusted unemployment rate was 7.4% in January 2020, stable compared with December 2019 and down from 7.8% in January 2019. This remains the lowest rate recorded in the euro area since May 2008. The EU27 unemployment rate was 6.6% in January 2020, stable compared with December 2019 and down from from 6.9% in January 2019. This is the lowest rate recorded in the EU27 since the start of the EU monthly unemployment series in January 2000.

Eurostat estimates that 14.086 million men and women in the EU27, of whom 12.179 million in the euro area, were unemployed in January 2020. Compared with December 2019, the number of persons unemployed increased by 16 000 in the EU27 and by 1 000 in the euro area. Compared with January 2019, unemployment fell by 746 000 in the EU27 and by 593 000 in the euro area.

In January 2020, 2.719 million young persons (under 25) were unemployed in the EU27, of whom 2.249 million were in the euro area. Compared with January 2019, youth unemployment decreased by 110 000 in the EU27 and by 75 000 in the euro area. In January 2020, the youth unemployment rate was 14.9% in the EU27 and 15.6% in the euro area, compared with 15.5% and 16.1% respectively in January 2019.

According to the report from IHS Markit/CIPS, UK construction companies signalled a return to business activity growth during February, following a nine-month period of declining workloads. The latest survey also pointed to the sharpest rise in new orders since December 2015. Anecdotal evidence mainly linked the recovery to a postelection improvement in business confidence and pent-up demand for new projects.

At 52.6 in February, up from 48.4 in January, the headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index registered above the 50.0 no-change value for the first time since April 2019. Moreover, the latest reading signalled that the overall rate of construction output growth was the fastest for 14 months.

Survey respondents noted that improved demand had translated into higher levels of business activity in February, particularly in the housing and commercial sub-sectors. There were some reports, however, that severe weather conditions had led to delays on site and acted as a brake on growth.

Residential activity remained the best-performing construction category. Latest data signalled the strongest expansion of house building activity since July 2018. Commercial work also returned to growth in February, with the sub-sector posting its fastest increase in business activity since November 2018. In contrast to the overall trend for construction output, civil engineering activity fell again during February. However, the rate of decline was only marginal and the least marked for 13 months.

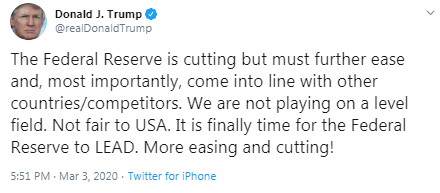

CNBC reports that President Donald Trump once again called on the Federal Reserve to deliver some major policy easing measures, after the Australian central bank cut rates to record lows and noted the impact of the coronavirus outbreak.

The Reserve Bank of Australia (RBA) said Tuesday that it was cutting its cash rate to 0.5% to mitigate the economic impact of the new coronavirus. Philip Lowe, the bank's governor, said that the epidemic was having a "significant" hit on the country's economy.

Within hours the U.S. president responded on Twitter, saying the U.S. central bank's chairman had "called it wrong from day one."

"Australia's Central Bank cut interest rates and stated it will most likely further ease in order to make up for China's coronavirus situation and slowdown...Other countries are doing the same thing, if not more so. Our Federal Reserve has us paying higher rates than many others, when we should be paying less," Trump said.

"Tough on our exporters and puts the USA at a competitive disadvantage. Must be the other way around. Should ease and cut rate big," he added.

FXStreet reports that Australia's economy expanded by 0.7% quarter-on-quarter in the fourth quarter despite weak private demand, as per economists at Australia and New Zealand (ANZ) banking group,

"After the release of key partial indicators this week, we expect GDP to have risen 0.7% q/q in Q4. This would see annual growth lift to 2.3%, consistent with the RBA's characterization of a "gentle turning point".

The 0.7% figure is a little stronger than our 0.5% q/q preliminary estimate released last Friday. The main new pieces of information since then are stronger than initial expected inventories, profits, and wages, only partly offset by slightly weaker government spending and net exports.

Private demand looks to have been very weak. We estimate another fall of 0.1% q/q, which would leave annual growth in negative territory at -0.5%. The mainstays of economic growth continue to be public demand and net exports".

CNBC reports that global financial ministers and central bankers will hold a conference call on Tuesday to coordinate the financial and economic response to the coronavirus.

The teleconference call will be led by Treasury Secretary Steven Mnuchin and Federal Reserve Chairman Jerome Powell on Tuesday at 7 a.m ET, CNBC reported. Representatives of the Group of Seven industrialized nations will attend the call.

It will be a "coordinating call" for the financial and economic response to virus, according to a source.

A communique is scheduled for after the call, CNBC has learned.

Stocks rallied sharply on Monday on hopes that global central banks will take action soon to offset any impact from the deadly coronavirus, which has spread into the U.S.

FXStreet reports that macro strategists at Deutsche bank jot down the key events to watch out for this Super Tuesday.

"The data highlights will be the Euro Area CPI estimate for February, along with January's unemployment rate.

In addition, we'll also get the preliminary Italian unemployment rate for January and the UK's construction PMI for February.

From central banks, we'll hear from the ECB's Holzmann, along with the Fed's Mester and Evans.

Finally, Target will be releasing earnings."

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Australia | Building Permits, m/m | January | 3.9% | 1% | -15.3% |

| 00:30 | Australia | Current Account, bln | Quarter IV | 6.50 | 2.3 | 1 |

| 03:30 | Australia | RBA Rate Statement | ||||

| 03:30 | Australia | Announcement of the RBA decision on the discount rate | 0.75% | 0.75% | 0.5% | |

| 05:00 | Japan | Consumer Confidence | February | 39.1 | 40.6 | 38.4 |

| 06:45 | Switzerland | Gross Domestic Product (YoY) | Quarter IV | 1.1% | 1.3% | 1.5% |

| 06:45 | Switzerland | Gross Domestic Product (QoQ) | Quarter IV | 0.4% | 0.2% | 0.3% |

During today's Asian trading, the US dollar declined against the euro and yen amid heightened expectations that the Fed will significantly lower its interest rate to support the US economy in the face of the spread of the coronavirus.

Expectations of a Fed rate cut rose after Fed Chairman Jerome Powell said the Central Bank was "closely monitoring" the COVID-19 situation and would use its tools to support the economy.

Futures quotes for the Fed's benchmark interest rate suggest that by the end of March, the rate will be at 1.04%, according to CME Group data. This indicates the confidence of traders that the Fed will lower the rate by 0.5% at the meeting on March 17-18 - to 1-1. 25% per annum.

Deutsche Bank experts expect the rate to be reduced by 1 percentage point this year. A rate cut would reduce the advantage in US asset returns, given that the ECB and the Bank of Japan have much less room to cut rates further.

ECB President Christine Lagarde said yesterday that the Central Bank is ready to take "appropriate" measures if necessary to support the Eurozone economy, whose growth is being held back by the spread of the coronavirus.

The Australian dollar rose almost 0.2% against the US dollar following the Central Bank's rate cut. The Reserve Bank of Australia has lowered its key interest rate to support the country's economy in the face of the coronavirus epidemic. The rate was reduced by 0.25 percentage points to a record low 0.5% per annum, and RBA chief Philip Lowe said the Central Bank could continue easing policy.

eFXdata reports that ANZ Research flags a risk for a sharp drop in AUD/USD and NZD/USD on further negative implications from the COVID-19

"The path of COVID-19 remains both tragic and very uncertain, but the risks that infections in new countries escalate and that the recovery in global growth will be slower than expected are rising.

The AUD and NZD have traded in a relatively orderly fashion thus far, despite panic in other markets. For now, we think that this will remain the case, however, the distribution around that forecast is heavily skewed to the downside," ANZ notes.

"Should the news flow continue to evolve towards a global pandemic, we see a risk that the AUD tests USD0.58 and the NZD could fall to USD0.5," ANZ adds.

FXStreet reports that analysts at TD Securities (TDS) offer a sneak peek at what to expect from Tuesday's Eurozone Preliminary Inflation report.

"We expect the flash core euro area CPI for February to pick up a touch to 1.2% y/y (mkt: 1.2%), while the drop in crude oil prices should see headline HICP slip to 1.2% y/y (mkt: 1.2%).

This would leave inflation on track to come in a bit firmer than the ECB forecasted for Q1 in its December staff forecasts, and should be of some comfort after a long series of downside surprises."

-

Board decided to lower the cash rate by 25 basis points to 0.50 per cent.

-

The Board took this decision to support the economy as it responds to the global coronavirus outbreak.

-

The coronavirus has clouded the near-term outlook for the global economy and means that global growth in the first half of 2020 will be lower than earlier expected.

-

Prior to the outbreak, there were signs that the slowdown in the global economy that started in 2018 was coming to an end.

-

It is too early to tell how persistent the effects of the coronavirus will be and at what point the global economy will return to an improving path.

-

Policy measures have been announced in several countries, including China, which will help support growth.

-

Inflation remains low almost everywhere and unemployment rates are at multi-decade lows in many countries.

-

Long-term government bond yields have fallen to record lows in many countries, including Australia.

-

The unemployment rate increased in January to 5.3 per cent and has been around 5¼ per cent since April last year.

-

Wages growth remains subdued and is not expected to pick up for some time.

-

A gradual lift in wages growth would be a welcome development and is needed for inflation to be sustainably within the 2-3 per cent target range.

According to the report from Federal Statistical Office, Switzerland's GDP rose by 0.3% in the 4th quarter of 2019, following 0.4% in the previous quarter. Economists had expected a 0.2% increase.

Exporting industries lost momentum, while growth was underpinned by the domestic economy. Switzerland thus mirrored the international development. GDP growth was 0.9% for 2019 as a whole. In manufacturing (−0.0%), value added stagnated following four quarters of above-average growth. International headwinds are continuing to hit cyclically sensitive sectors such as machinery and metals, which suffered further falls in turnover. Although the chemical and pharmaceutical industry bolstered overall economic growth, it could not quite repeat the fast pace of previous quarters. Exports of goods (−0.5%) fell slightly and imports of goods (−2.7 %) substantially. Investments in machinery and electrical equipment, which are more sensitive to the economic cycle, declined in step with the international development; overall, companies were hesitant to invest in their production capacities. Nevertheless, investment in equipment (+2.4%) rose thanks to investments in aircraft, which are generally highly volatile. Investment in construction (+0.4%) increased, as did value added in construction (+0.9%). Consumption expenditure by both private households (+0.4%) and the government (+0.5%) rose somewhat faster overall than in the previous quarter, driven not least by falling consumer prices. Domestic demand saw modest growth on the whole. This also benefited most service sectors.

The provisional real GDP growth rate for 2019 is 0.9% (2018: 2.8%), or 1.4% (2018: 2.3%) after adjusting for sporting events. The Swiss economy thus grew at a similarly modest pace as in the years 2015 and 2016.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1277 (4759)

$1.1242 (6257)

$1.1216 (3601)

Price at time of writing this review: $1.1145

Support levels (open interest**, contracts):

$1.1075 (3727)

$1.1035 (2761)

$1.0991 (3174)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 6 is 126552 contracts (according to data from March, 2) with the maximum number of contracts with strike price $1,1100 (6343);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3009 (2011)

$1.2962 (1123)

$1.2918 (506)

Price at time of writing this review: $1.2788

Support levels (open interest**, contracts):

$1.2734 (3323)

$1.2708 (2537)

$1.2674 (1046)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 27349 contracts, with the maximum number of contracts with strike price $1,3050 (3660);

- Overall open interest on the PUT options with the expiration date March, 6 is 28950 contracts, with the maximum number of contracts with strike price $1,2800 (3323);

- The ratio of PUT/CALL was 1.06 versus 1.09 from the previous trading day according to data from March, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 53.07 | 4.88 |

| WTI | 47.41 | 7.14 |

| Silver | 16.71 | 1.46 |

| Gold | 1589.599 | 0.49 |

| Palladium | 2523.88 | -1.19 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 201.12 | 21344.08 | 0.95 |

| Hang Seng | 161.75 | 26291.68 | 0.62 |

| KOSPI | 15.5 | 2002.51 | 0.78 |

| ASX 200 | -49.7 | 6391.5 | -0.77 |

| FTSE 100 | 74.28 | 6654.89 | 1.13 |

| DAX | -32.48 | 11857.87 | -0.27 |

| CAC 40 | 23.62 | 5333.52 | 0.44 |

| Dow Jones | 1293.96 | 26703.32 | 5.09 |

| S&P 500 | 136.01 | 3090.23 | 4.6 |

| NASDAQ Composite | 384.79 | 8952.17 | 4.49 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.65409 | 0.98 |

| EURJPY | 120.589 | 1.37 |

| EURUSD | 1.11305 | 0.81 |

| GBPJPY | 138.126 | 0.08 |

| GBPUSD | 1.27495 | -0.46 |

| NZDUSD | 0.62592 | 0.87 |

| USDCAD | 1.3324 | -0.82 |

| USDCHF | 0.95935 | -0.43 |

| USDJPY | 108.334 | 0.54 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.