- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 03-02-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 03:30 | Australia | Announcement of the RBA decision on the discount rate | 0.75% | 0.75% | |

| 03:30 | Australia | RBA Rate Statement | |||

| 09:30 | United Kingdom | PMI Construction | January | 44.4 | 46 |

| 10:00 | Eurozone | Producer Price Index, MoM | December | 0.2% | 0% |

| 10:00 | Eurozone | Producer Price Index (YoY) | December | -1.4% | -0.7% |

| 15:00 | U.S. | Factory Orders | December | -0.7% | 1.2% |

| 21:30 | Australia | AiG Performance of Construction Index | January | 38.9 | |

| 21:45 | New Zealand | Employment Change, q/q | Quarter IV | 0.2% | 0.3% |

| 21:45 | New Zealand | Unemployment Rate | Quarter IV | 4.2% | 4.2% |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 03:30 | Australia | Announcement of the RBA decision on the discount rate | 0.75% | 0.75% | |

| 03:30 | Australia | RBA Rate Statement | |||

| 09:30 | United Kingdom | PMI Construction | January | 44.4 | 46 |

| 10:00 | Eurozone | Producer Price Index, MoM | December | 0.2% | 0% |

| 10:00 | Eurozone | Producer Price Index (YoY) | December | -1.4% | -0.7% |

| 15:00 | U.S. | Factory Orders | December | -0.7% | 1.2% |

| 21:30 | Australia | AiG Performance of Construction Index | January | 38.9 | |

| 21:45 | New Zealand | Employment Change, q/q | Quarter IV | 0.2% | 0.3% |

| 21:45 | New Zealand | Unemployment Rate | Quarter IV | 4.2% | 4.2% |

James Knightley, the Chief International Economist at ING, notes that this ISM manufacturing index has jumped more than expected in January, rising to 50.9 from 47.8 in December, leaving the index at its strongest level since July.

"The gains were led by a hefty ten-point rise in the production component to 54.3 - the highest since last April - and a 4.4 point increase in new orders to 52.0. This is a very positive and welcome development, but as the chart below shows, the ISM continues to lag behind many of the closely followed regional surveys - maybe there will be more upside in the months ahead..."

"It seems likely that the Phase One trade deal with China has generated a positive lift for the sector by giving some certainty that there will be no-more tariffs, at least in the near term. Businesses, therefore, appear more willing to put plans into action, generating the uplift in orders and output."

"Despite this positive news for what has been a rather beleagured sector through 2019, we have to be cognisant of the risks. At the very least, the latest developments surrounding the coronavirus outbreak is likely to pose challenges for the sector. We know that production in China is being impacted and this could have adverse implications for US supply chains in coming months while there are worries about what it might mean for global demand in general, which could make manufacturers more cautious. The more the virus spreads, the more likely it starts to impact consumer and business behaviour, which implies downside risks for activity. As such, while today's report is very good news, we are nervous that the risks to activity in general, remain skewed to the downside with manufacturing looking particularly vulnerable."

FXStreet reports that the impact of coronavirus alongside future reductions on production makes analysts at TD Securities bet on crude’s upside backed on some technical indicators.

"The initial estimates of the impact on demand appear to have been far too low. Initial estimates ranged around an impact of 300k bpd, while the most recent suggest an impact up to three million barrels a day, or 20% of total Chinese consumption."

“Energy market participants are looking for 'peak coronavirus fear', as lower liquidity and a massive selling program across the complex helped prices overshoot.”

“Indeed, OPEC+ is mulling an emergency meeting which could curtail an additional 500k-1m bpd of production.”

“Mean-reversion indicators, which have performed smartly over the past 3m, are pointing in favor of the longs. (...) We argue that energy complex is trading somewhat cheap to the near-term outlook.”

Bloomberg reports, citing people familiar, that "Chinese officials are hoping the U.S. will agree to some flexibility on pledges, as Beijing tries to contain a health crisis that threatens to slow domestic growth".

The Commerce Department announced on Monday that construction spending fell 0.2 percent m-o-m in December after a revised 0.7 percent m-o-m gain in November (originally a 0.6 percent m-o-m advance). That was the first monthly drop in construction spending since June.

Economists had forecast construction spending increasing 0.5 percent m-o-m in December.

According to the report, spending on private construction edged down 0.1 percent m-o-m, while investment in public construction dropped 0.4 percent m-o-m.

For the full 2019, construction spending declined 0.3 percent, recording the first decrease since 2011.

A report from the Institute for Supply Management (ISM) showed on Monday the U.S. manufacturing sector's activity expands in January 2020.

The ISM's index of manufacturing activity came in at 50.9 percent last month, up 3.1 percentage points from the December 2019 reading of 47.8 percent (revised from 47.2). That marked the first growth in factory activity since July 2019 and beat economists' forecast for a 48.5 percent reading.

A reading above 50 percent indicates expansion, while a reading below 50 percent indicates contraction.

According to the report, the New Orders Index stood at 52.0 percent, a surge of 4.4 percentage point from the December reading, while the Production Index registered 54.3 percent, up 9.5 percentage points compared to the seasonally adjusted December reading, the Employment Index recorded 6.6 percent, a 1.4-percentage point increase from the seasonally adjusted December reading and the Backlog of Orders Index posted 45.7 percent, up 2.4 percentage points compared to the December reading. At the same time, the Supplier Deliveries Index registered 52.9 percent, a 1.7-percentage point drop from the December reading, and the Inventories Index recorded 48.8 percent, a decrease of 0.4 percentage point from the seasonally adjusted December reading. Elsewhere, the Prices Index showed a 1.6-percentage point climb to 53.3 percent in January.

Timothy R. Fiore, Chair of the ISM Manufacturing Business Survey Committee said, "The past relationship between the PMI and the overall economy indicates that the PMI for January (50.9 percent) corresponds to a 2.4-percent increase in real gross domestic product (GDP) on an annualized basis."

FXStreet reports that analysts at TD Securities offered a brief preview of important Canadian macro releases scheduled through the course of this week.

“ Markets will remain focused on coronavirus developments, especially with the central bank calendar shifting into a lower gear. Top-tier event risk is provided by Friday's employment reports, with TD below consensus for jobs in both Canada and the US. We will also receive ISM Manufacturing for January alongside Markit Manufacturing PMI in Canada, while Wednesday's international trade report will round out the data calendar. Lastly, Senior Deputy Governor Wilkins will speak about Central Banking in a Slow-Growth World on Wednesday, although we do not expect much focus on the near-term policy outlook.”

“TD looks for the international merchandise trade deficit to narrow to a modest $100m in December, down from $1.1bn in the prior month, owing to a sharp increase in nominal energy exports. Crude oil prices rose by ~5% m/m in December, which alongside a pickup in real energy shipments should provide the driving force for total exports with motor vehicles exports expected to see little change. Elsewhere, CN Rail's return to normal operations should provide a modest tailwind after labour disruptions weighed on rail traffic during the month of November. On the other side of the ledger, we expect a more muted performance for imports owing to soft domestic demand and a poor reading on advance US exports.”

“The Canadian labour market is expected to begin 2020 on a subdued note, with employment forecast to rise by 10k in January on the heels of a (downwardly revised) 27k increase for December. Even though the Bank's Business Outlook Survey showed solid hiring intentions in Q4, the balance of opinion for small businesses has started to deteriorate. Job growth of 10k is consistent with the current six-month trend (12k) and we look for full-time positions to lead the advance given the persistence of labour shortages. More subdued job growth alongside an expected rebound in the labour force (-21k in Dec) will put upward pressure on the unemployment rate, which we expect to rise to 5.7%, while base-effects should result in a deceleration in wage growth to 3.6% y/y.”

FXStreet reports that analysts at TD Securities expect the RBA to keep rates on hold at its upcoming meeting on Tuesday as domestic fundamentals have turned more positive since late last year.

“Tuesday's RBA meeting is a key focus for G10 FX markets in the early part of the week. We are looking for an on-hold decision and think the same is likely at their March meeting. Previously, we had anticipated the RBA cutting the cash rate next month. This view was based predominantly on domestic fundamentals, but the tone of data turned more positive since late last year.”

“AUD has come under significant selling pressure in recent weeks. These declines have seen AUDUSD push below the 0.67 mark in recent days — a push below the October trough at 0.6671 would see the pair at its lowest level since the aftermath of the Global Financial Crisis. Our expectation for a dovish hold this week could certainly see AUDUSD test this low. Beyond that, however, we think the AUD has a lot of bad news in its price. That said, we prefer to be careful and selective in leaning against the market's pervasive AUD bearishness.”

“With the viral outbreak still yet to peak, we think it is probably too early to fade the market's risk-off bias entirely. Instead, we choose to express a more nuanced AUD outlook against currencies where we think the market has mispriced underlying risks. As we note above, sterling stands out here. GBPAUD longs look particularly stretched on our HFFV metrics while the technical backdrop has deteriorated substantially. In line with this, we are entering a short GBPAUD position as our Trade of the Week.”

U.S. stock-index futures rose on Monday, pointing to a rebound in the U.S. stock market after a sharp decline in the previous session, as China took steps to protect its economy from the impact of the coronavirus epidemic.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,971.94 | -233.24 | -1.01% |

| Hang Seng | 26,356.98 | +44.35 | +0.17% |

| Shanghai | 2,746.61 | -229.92 | -7.72% |

| S&P/ASX | 6,923.30 | -93.90 | -1.34% |

| FTSE | 7,322.40 | +36.39 | +0.50% |

| CAC | 5,831.69 | +25.35 | +0.44% |

| DAX | 13,019.25 | +37.28 | +0.29% |

| Crude oil | $51.58 | | +0.04% |

| Gold | $1,582.10 | | -0.37% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 162 | -0.51(-0.31%) | 5358 |

| ALCOA INC. | AA | 14.1 | -0.19(-1.33%) | 158311 |

| ALTRIA GROUP INC. | MO | 48.25 | 0.25(0.52%) | 12217 |

| Amazon.com Inc., NASDAQ | AMZN | 2,076.15 | 205.47(10.98%) | 516906 |

| Apple Inc. | AAPL | 321.85 | -2.02(-0.62%) | 310387 |

| AT&T Inc | T | 37.3 | -0.13(-0.35%) | 10687 |

| Boeing Co | BA | 323.2 | -0.10(-0.03%) | 6509 |

| Caterpillar Inc | CAT | 135.45 | 0.08(0.06%) | 199752 |

| Chevron Corp | CVX | 109.3 | -2.10(-1.89%) | 392739 |

| Cisco Systems Inc | CSCO | 46.77 | -0.47(-0.99%) | 29751 |

| Citigroup Inc., NYSE | C | 76.37 | -0.55(-0.72%) | 7797 |

| Deere & Company, NYSE | DE | 160.1 | -1.01(-0.63%) | 598 |

| E. I. du Pont de Nemours and Co | DD | 52.38 | -0.34(-0.64%) | 10672 |

| Exxon Mobil Corp | XOM | 63.1 | -1.69(-2.61%) | 1126431 |

| Facebook, Inc. | FB | 208.5 | -1.03(-0.49%) | 145051 |

| FedEx Corporation, NYSE | FDX | 147.25 | -1.01(-0.68%) | 1760 |

| Ford Motor Co. | F | 8.79 | -0.05(-0.57%) | 84869 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.15 | -0.17(-1.50%) | 40217 |

| General Electric Co | GE | 12.73 | 0.00(0.00%) | 235217 |

| General Motors Company, NYSE | GM | 33.18 | -0.15(-0.45%) | 4314 |

| Goldman Sachs | GS | 241 | -3.13(-1.28%) | 6285 |

| Google Inc. | GOOG | 1,466.04 | 10.20(0.70%) | 12726 |

| Home Depot Inc | HD | 232.01 | -0.78(-0.34%) | 1494 |

| HONEYWELL INTERNATIONAL INC. | HON | 175.95 | -2.39(-1.34%) | 11555 |

| Intel Corp | INTC | 65.72 | -0.75(-1.13%) | 84004 |

| International Business Machines Co... | IBM | 142.25 | 5.48(4.01%) | 105056 |

| Johnson & Johnson | JNJ | 149.9 | -0.46(-0.31%) | 2336 |

| JPMorgan Chase and Co | JPM | 134.92 | -0.97(-0.71%) | 9593 |

| McDonald's Corp | MCD | 215.5 | -0.68(-0.31%) | 2874 |

| Merck & Co Inc | MRK | 86.37 | -0.13(-0.15%) | 968 |

| Microsoft Corp | MSFT | 172.1 | -0.68(-0.39%) | 148951 |

| Nike | NKE | 98 | -0.19(-0.19%) | 7087 |

| Pfizer Inc | PFE | 36.92 | -0.15(-0.40%) | 13972 |

| Procter & Gamble Co | PG | 126.23 | 0.28(0.22%) | 2993 |

| Starbucks Corporation, NASDAQ | SBUX | 85.44 | -0.40(-0.47%) | 15397 |

| Tesla Motors, Inc., NASDAQ | TSLA | 641.43 | 0.62(0.10%) | 209440 |

| The Coca-Cola Co | KO | 58.92 | 0.06(0.10%) | 8294 |

| Twitter, Inc., NYSE | TWTR | 33.15 | -0.07(-0.21%) | 11426 |

| Verizon Communications Inc | VZ | 59.1 | -0.26(-0.44%) | 10389 |

| Visa | V | 202.22 | -5.99(-2.88%) | 102617 |

| Wal-Mart Stores Inc | WMT | 116 | -0.58(-0.50%) | 3914 |

| Walt Disney Co | DIS | 138.4 | 0.59(0.43%) | 59693 |

| Yandex N.V., NASDAQ | YNDX | 45.33 | -0.57(-1.24%) | 9471 |

FXStreet reports that Lee Sue Ann, Economist at UOB Group, sees the RBA sticking to the current monetary stance at the upcoming meeting.

“We think the combination of the latest 4Q19 inflation report as well as the stronger-than-expected labour market data for December, will be sufficient to keep the RBA on hold in February. That said, there are headwinds from the bushfires, drought, and downturn in residential construction activity, as well as the ongoing coronavirus. As such, we are not ruling out further policy stimulus, both monetary and fiscal.”

Chevron (CVX) target lowered to $127 from $134 at Cowen

Exxon Mobil (XOM) target lowered to $70 from $75 at Cowen

Verizon (VZ) downgraded to Neutral from Outperform at Credit Suisse; target $65

NIKE (NKE) upgraded to Buy from Neutral at UBS; target $136

NIKE (NKE) added to the "Analyst Focus List" at J.P. Morgan Chase

FXStreet reports that according to Piotr Matys, Senior Emerging Markets FX Strategist at Rabobank, the big sell-off in China after the local markets reopened following the extended Lunar New Year holidays had limited impact on the CEEMEA currencies as it was widely anticipated.

“We remain of the view that it is too early to abandon a cautious approach towards risky EM assets as there is no sufficient evidence yet (despite various measures being implemented) that the deadly virus has been contained. The death toll now exceeds 360 and total confirmed cases of infection have risen sharply to almost 17,400. It is worth noting that the coronavirus is spreading much faster than the SARS outbreak in 2003. The Philippines confirmed the first dead from the virus outside China. Tension between the US and China may resurface after Beijing accused Washington for “overreacting” to the outbreak.”

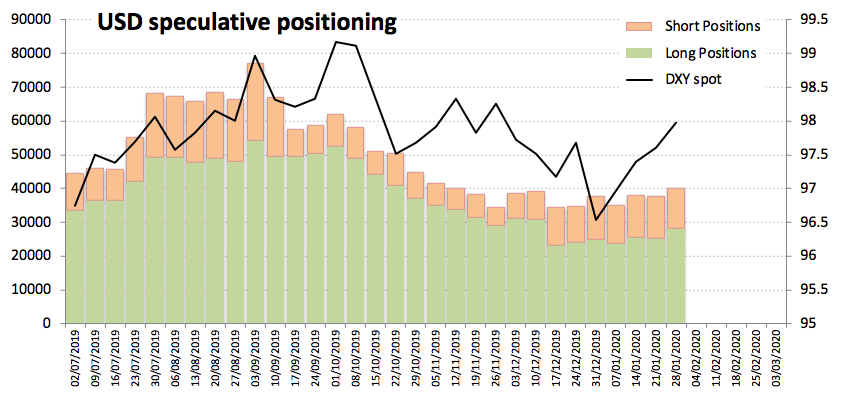

The FXStreet provides the main highlights of the CFTC Positioning Report for the week ended on January 28th:

"Speculators added longs to the already positive positions in the dollar, taking the net longs to the highest level since December 17th. Traders appear to have positioned for a hawkish message from the Federal Reserve at its last meeting (following the cut-off date), particularly after positive results in the US docket.

Crude oil net longs retreated to the lowest level since early December 2019. Oversupply concerns and demand fears stemming from the Chinese coronavirus continued to take a toll on traders' sentiment for yet another week.

Net shorts in the VIX (aka "the panic index") receded to levels last seen in mid-September 2019, as concerns over the Wuhan coronavirus kept weighing on prospects of global growth.

Gross longs in the sterling dropped for the third consecutive week, taking net longs to 3-week lows around 17.7K contracts. The likeliness of an interest rate cut by the BoE seems to have prompted some cautiousness among investors."

According to the report, China's officials are evaluating whether a 6% target for the country's economic growth in 2020 should be lowered as a part of a broader review of how the government's plans will be impacted by the new coronavirus outbreak.

The sources add that officials are also considering more measures to bolster the economy, although final decisions on the above matters have not been made.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 08:30 | Switzerland | Manufacturing PMI | January | 48.8 | 50.3 | 47.8 |

| 08:50 | France | Manufacturing PMI | January | 50.4 | 51.0 | 51.1 |

| 08:55 | Germany | Manufacturing PMI | January | 43.7 | 45.2 | 45.3 |

| 09:00 | Eurozone | Manufacturing PMI | January | 46.3 | 47.8 | 47.9 |

| 09:30 | United Kingdom | Purchasing Manager Index Manufacturing | January | 47.5 | 49.8 | 50 |

GBP fell against other major currencies in the European session on Monday after the UK's PM Boris Johnson in his speech about future trade relationship with the EU laid out tough terms for post-Brexit talks with the block. He stated that there is no need for the trade agreement to involve accepting EU rules on competition policy, subsidies, social protection, the environment, or anything similar. He also added the UK wants a free trade agreement, similar to Canada's. However, the EU's chief Brexit negotiator Michel Barnier, who spoke shortly before the UK's PM, stressed that both sides must agree on a level playing field and the EU does not want the UK's divergence from the block's rules to result in unfair competition.

Meanwhile, the market participants ignored the release of UK final manufacturing PMI for January, which showed the activity in the UK's manufacturing improved more than initially estimated. The IHS Markit/CIPS reported the UK Purchasing Managers' Index (PMI) rose to a nine-month high of 50.0 in January, compared to a preliminary estimate of 49.8 and December's reading of 47.5 (a reading above 50 percent indicates expansion, while a reading below 50 percent indicates contraction). That was the highest reading since last April and pointed to the stabilization in the sector following eight straight months of contraction. According to the report, new orders and business confidence demonstrated mild recoveries, and production volumes stabilized as the levels of political uncertainty reduced following the general election. In addition, the level of employment was broadly unchanged during January, halting a nine-month sequence of job losses.

EUR traded mixed against its major rivals (it rose against GBP, but fell against most of the rest), despite the fact the latest data from IHS Markit revealed the Eurozone final manufacturing PMI for January was revised higher to 47.9 in January from a preliminary estimate of 47.8. That represented an improvement from December's reading of 46.3 and pointed to the slowest contraction in factory activity in nine months. According to the report, falls in output, new orders and purchasing slowed, while the pace of job losses remained marked.

Elsewhere, the safe-haven JPY and CHF traded little changed against their major rivals amid lingering fears about the spreading of coronavirus in China, while CNH remained under pressure.

FXStreet reports that analysts at TD Securities (TDS) outlined Monday's key focus areas and also offered a brief preview of the release of the US ISM Manufacturing PMI for January, scheduled during the early North-American session.

“The market's focus will remain divided between the ongoing uncertainty regarding the coronavirus and domestic fundamentals. Decent economic data could put upward pressure on rates, but if uncertainty over the virus maintains a risk-off tone, Treasury yields could continue to drift lower. The market has now increased 2020 rate cut pricing to 46bp from 29bp last week — helping to steepen the curve sharply.”

“We expect the manufacturing ISM index to be lifted back toward 50 in January by more positive sentiment following the Phase One trade deal. We expect that lift to offset negative news on Boeing. Even at 50, our forecast is relatively weak in an absolute sense, but it would be up from 47.8 in December (and 47.2 in the original report). Most of the regional manufacturing surveys that have been reported for January have signaled improvement, with the Chicago survey the main exception.”

“Along with the ISM report, construction spending data for Dec will be reported. BEA officials appear to have assumed about a 0.3% m/m rise in construction spending in the advance Q4 GDP report. Lastly, look for the release of the Fed's Senior Loan Officer Opinion Survey (SLOOS) for Q1.”

- EU and UK must agree on level playing field

- EU offer is conditional on open, fair competition

- UK financial services will no longer have passporting rights

- Free trade agreement must include deal on fisheries

- We will not engage in cutthroat race to the bottom on trade

- We are not undermining EU standards

- We will not insist the EU does everything we do as a price of free trade

February 3

After the Close:

Alphabet (GOOG). Consensus EPS $12.76, Consensus Revenues $46872.80 mln

February 4

After the Close:

Ford Motor (F). Consensus EPS $0.17, Consensus Revenues $36548.31 mln

Snap (SNAP). Consensus EPS $0.01, Consensus Revenues $561.63 mln

Walt Disney (DIS). Consensus EPS $1.46, Consensus Revenues $20831.83 mln

February 5

Before the Open:

General Motors (GM). Consensus EPS $0.01, Consensus Revenues $31530.19 mln

Merck (MRK). Consensus EPS $1.15, Consensus Revenues $11705.27 mln

United Micro (UMC). Consensus EPS $0.22, Consensus Revenues $41010.39 mln

After the Close:

Qualcomm (QCOM). Consensus EPS $0.86, Consensus Revenues $4852.65 mln

February 6

Before the Open:

Fiat Chrysler (FCAU). Consensus EPS $0.93, Consensus Revenues $28852.06 mln

Twitter (TWTR). Consensus EPS $0.27, Consensus Revenues $995.05 mln

Tyson Foods (TSN). Consensus EPS $1.67, Consensus Revenues $11085.54 mln

After the Close:

Uber (UBER). Consensus EPS -$0.52, Consensus Revenues $4045.37 mln

FXStreet reports that in opinion of FX Strategists at UOB Group, further upside momentum in USD/CNH could extend to the 7.04 zone.

24-hour view: "Expectation for USD to trade sideways last Friday was incorrect as it soared to a high of 7.0068 before ending the day on a firm note at 7.0028. Upward momentum picked up and USD could advance to 7.0280. For today, the major 7.0400 level could be just out of reach. Support is at 7.0000 followed by 6.9800."

Next 1-3 weeks: "Our latest narrative from Tuesday (28 Jan, spot at 6.9780) remains unchanged wherein USD 'could extend its gains to 7.0400'. However, after yesterday's price action, the odds for such a move have diminished somewhat but only a breach of 6.9350 (no change in 'strong support' level) would indicate the current USD strength has run its course."

FXStreet reports that FX Strategists at UOB Group remain bearish on AUD/USD, although a move below 0.6670 appears unlikely for the time being.

24-hour view: "We highlighted last Friday that AUD "could dip below 0.6700 but last year's low at 0.6670 is not expected to come into the picture". AUD subsequently dropped to 0.6683 before ending the day on a soft note at 0.6686. Conditions remain severely oversold but it is too early to expect a recovery. AUD is more likely to lick its wounds and consolidate at these lower levels. Expected range for today, 0.6675/0.6715."

Next 1-3 weeks: "For now, we are holding on to our view from Tuesday (28 Jan, spot at 0.6760) wherein while AUD could continue to weaken, severely oversold conditions suggest last year low at 0.6670 may not come into the picture. That said, AUD is not out of the woods just yet and only a move above 0.6780 ('strong resistance' level previously at 0.6810) would indicate the current weakness has stabilized."

FXStreet reports that economists at Standard Chartered Bank offered a brief review of Monday's release of Chinese Manufacturing PMI, which eased 0.2ppt to 50.0 in January from 50.2 in December.

"Domestic demand showed signs of recovery. While the new export orders sub-index fell below 50, the new orders PMI picked up 0.2ppt to 51.4. Non-manufacturing PMI rebounded 0.6ppt to 54.1 on a recovery in construction activity. However, officials noted that the survey was conducted before 20 January, suggesting the result does not fully reflect the impact of the coronavirus outbreak."

"Export growth likely eased and import growth may have contracted in January partly on seasonality and normalisation after front-loading activity in December ahead of the Lunar New Year holidays. The signing of the phase one trade deal likely supported imports. The coronavirus outbreak is unlikely to have affected trade activity given the new year holidays started earlier this year on 24 January."

FXStreet reports that analysts at Danske bank provided a brief highlight of Monday's trade set-up and also offered a preview of important releases.

"The coronavirus will continue to attract market attention. As the number of new cases appears to be levelling off, the focus is turning to the economic impact of the virus. The US 3m10s curve has inverted again, highlighting that investors think risks are increasing that the US will fall into a recession (investors are pricing in more than a 50% probability of a recession, according to our model based on US yields)."

"In the US, focus is on ISM manufacturing. The effect of the coronavirus on countries and value chains outside China will likely take some time to materialise and in light of strong regional PMIs, we look for an increase in the ISM manufacturing to 48.2 from 47.2. Boeing's decision to halt production of 737 MAX is a downside risk, however."

"The UK has now formally left the EU and the negotiations on the future relationship will soon begin. Today, PM Boris Johnson will hold a speech outlining his objectives followed by a speech by EU chief negotiator Michel Barnier discussing EU's objectives."

According to the report from IHS Markit/CIPS, the start of 2020 saw the performance of the UK manufacturing sector steady following the downturn experienced through much of last year. Reduced levels of political uncertainty following the general election led to mild recoveries in new orders and business confidence and a stabilisation of production volumes. Overseas demand remained a constraint, however, as new export orders fell for the third straight month.

The seasonally adjusted Manufacturing PMI rose to a nine-month high of 50.0 in January, identical to its no-change mark and above December's reading of 47.5. The PMI last posted a reading above its neutral 50.0 level in April 2019.

Output rose in the consumer and intermediate goods sectors, as manufacturers in these industries scaled up production in response to improved inflows of new business. In contrast, the downturn in the investment goods sector continued, with output and new work intakes declining sharply (albeit to lesser extents than before the turn of the year).

The trend in new export business continued to weigh on the UK manufacturing sector in January. Companies cited weak economic growth in key markets - especially within Europe - as the main factor underlying the latest decline in new export orders. Signs of stabilisation in the manufacturing sector at the start of 2020 filtered through to trends in hiring and business confidence. The level of employment was broadly unchanged during January, halting a nine month sequence of job losses. Optimism improved to an eight-month high, with 47% of manufacturers forecasting that output would expand over the year ahead. Improved confidence reflected reduced political uncertainty, higher demand, an expected recovery in export volumes and planned new product launches.

According to the report from IHS Markit, operating conditions in the euro area manufacturing economy continued to weaken at the start of the year, but at a noticeably slower rate.

After accounting for seasonal factors, the Eurozone Manufacturing PMI registered 47.9, slightly better than the earlier flash reading and above December's 46.3. Economists had expected an increase to 47.8. Although the index has now recorded below the crucial 50.0 no change mark for 12 months in succession, the latest reading was the highest since April 2019.

Market groups data signalled that the consumer goods category remained the strongest-performing during January, registering marginal growth for a second successive month. In contrast, the intermediate and investment goods sectors both continued to contract, although rates of decline weakened in each instance.

There was a broad-based rise in national PMI figures during January, with all eight countries covered recording higher readings compared to December.

Euro area manufacturing production and new order levels both continued to decline at the start of 2020, although in each case at weaker rates than at the end of 2019. The rate of decline in new work was, however, the slowest for over a year, helped in part by only a marginal reduction in new export sales. Eurozone manufacturers also continued to make cuts to their purchasing activity, although in line with trends for output and new orders, the fall in purchasing activity was the weakest in 11 months. Latest data showed that input costs fell for an eighth month in succession and afforded manufacturers further room to cut their own charges. January's survey signalled another fall in output prices, maintaining a trend that has been evident since last July.

Looking ahead to the next 12 months, confidence about the future jumped at the start of 2020 to its highest level since August 2018.

FXStreet reports that the recent bounce has motivated the pair to shift its focus to the key 200-day SMA in the 1.1130 region, noted Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank.

"EUR/USD last week sold off towards and recovered just ahead of the 1.0981 29th November low. The market is probing the 55 day ma at 1.1096 and attention has reverted to the 200 day ma at 1.1127 and directly above here lies the 1.1171 55 week ma, the 1.1208 one year down channel and the 1.1240 recent high. These remain the break up point to the 200 week ma at 1.1355, which continues to represent a critical break up point."

FXStreet reports that senior Economist at UOB Group Alvin Liew noted the US economy faces diminished risks of entering into a technical recession during the current year.

"The US released its prelim 4Q GDP growth which came in at 2.1% q/q SAAR in 3Q (the same pace of expansion in 3Q but slightly better than Bloomberg median estimate) thanks to a surprisingly strong contribution from net exports, continued improvement in residential investment & government spending. And while consumer spending remained positive, its 4Q growth was a marked slowdown from the preceding two quarters."

"The main drags on GDP continued to be a slump in business investments and a bigger extraction from private inventories."

"For the full year, the US economy grew by 2.3% in 2019, slower than the 2.9% recorded in 2018 and further away from the 3% growth pledged by US President Trump."

"Taking stock of several key factors (including faltering consumer spending, trade uncertainties continuing to hamper business investments, constrained housing growth and the latest coronavirus uncertainty), we expect US growth to slow further to 1.5% in 2020 (from 2.3% in 2019 and below the US potential growth of 2.0%)."

"We factor in a negative quarter in 1Q 2020 (-0.4% q/q SAAR), but the subsequent quarters will resume q/q growth. This implies we see a lower risk of a technical recession (i.e. 2 consecutive quarters of sequential q/q declines) in 2020 but have not ruled it out. It is important to remember that we are still in the midst of the longest US economic expansion on record (128 months as of Jan 2020) and even if we do get a technical recession in 2020, it will likely be mild."

eFXdata reports that Credit Suisse discusses USD/CAD technical outlook and maintains a bullish bias in the near-term.

"Although further short-term weakness should be allowed for here, we remain biased higher within the range...Resistance initially seen at the 78.6% retracement at 1.3250, which is likely to cap the market in our view, particularly with next resistance just above at the 2019 September downtrend at 1.3282, which is likely to prove an equally tough barrier. Removal this zone though would suggest further medium-term strength, with the next resistance then seen at the 1.3325 high," CS notes.

Support moves initially to 1.3155, then 1.3139 and 1.3119, removal of which would ease the immediate upside bias. Beneath here, we see a move back to 1.3036/26, which remains seen as a tough floor," CS adds.

FXStreet reports that the FX Strategists at TD Securities offer their expectations on the upcoming Reserve Bank of Australia's (RBA) monetary policy decision and the Statement on Monetary Policy (SoMP) due later this week.

"TD and consensus expect the RBA to keep the cash rate on hold at 0.75% at tomorrow's Board meeting. OIS is placing ~25% chance of a cut to 0.5%. We expect the Bank to retain an easing bias and cut next in Apr.

Q3 Private consumption growth was weak, RBA Nov'19 SoMP consumption f/c's appear too high and bus investment f/c's appear ambitious. Expect the RBA to downgrade Dec'20 GDP to 2.5-2.6%/y. Does the Bank retain its Dec'21 GDP 3.1%/y f/c?

The Statement is unlikely to shed light completely on these f/c's. Accordingly, the Gov's speech on Wed titled 'The Year Ahead' is likely to take on greater significance ahead of the Fri 7th Feb SoMP release.

RBA Feb cut odds overdone on virus. Add to paid Feb'20 OIS at 0.69%, DV01 A$50k. US$0.6670 HUGE level."

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:00 | Australia | MI Inflation Gauge, m/m | January | 0.3% | 0.3% | |

| 00:30 | Australia | ANZ Job Advertisements (MoM) | January | -5.7% | 3.7% | 3.8% |

| 00:30 | Australia | Building Permits, m/m | December | 10.9% | -3% | -0.2% |

| 00:30 | Japan | Manufacturing PMI | January | 48.4 | 49.3 | 48.8 |

| 01:45 | China | Markit/Caixin Manufacturing PMI | January | 51.5 | 51.3 | 51.1 |

During today's Asian trading, the US dollar rose against the euro and the yen. Meanwhile, the Chinese yuan fell against the dollar on the first day of trading after a long holiday.

The people's Bank of China (PBOC) on Monday set the reference yuan rate at 6.9249 yuan per $1. The market rate of the Chinese national currency may deviate from the official reference value by no more than 2% in any of the parties during the day.

"The yuan's losses are much less weak compared to the Chinese stock indexes, which fell by 8%. This is impressive. The stability of the yuan was supported by liquidity injections by the Central Bank of China, " said INTL FCStone trader Minze Wu .

In addition, latest PMI data from the Caixin signalled the softest improvement in operating conditions across China's manufacturing sector for five months in January. Companies signalled slower increases in new orders and output, while payrolls fell for the first time since last October. The headline seasonally adjusted PMI - a composite indicator designed to provide a single figure snapshot of operating conditions in the manufacturing economy - edged down from 51.5 in December to 51.1 in January.

The pound fell against the US dollar, retreating from a high on January 7, as investors took profits after a recent rally and played down the news that the UK had left the European Union.

Latest PMI data from the Caixin signalled the softest improvement in operating conditions across China's manufacturing sector for five months in January. Companies signalled slower increases in new orders and output, while payrolls fell for the first time since last October. The latter was partly linked to attempts to reduce costs, as firms saw a solid increase in overall operating expenses at the start of the year. More cautious approaches were also taken in terms of purchasing activity and stocks of inputs and finished items, which all fell slightly in January. Factory gate prices rose only modestly, however, due to competitive market pressures. On a more positive note, an easing of China-US trade tensions helped to boost business confidence regarding the 12-month outlook for output. Notably, optimism about the year ahead rose to its highest level for 22 months.

The headline seasonally adjusted PMI - a composite indicator designed to provide a single figure snapshot of operating conditions in the manufacturing economy - edged down from 51.5 in December to 51.1 in January. Although remaining above the neutral 50.0 mark, the figure indicated only a marginal improvement in the health of the sector. Notably, the rate of improvement was the slowest recorded since the current upturn began in August 2019.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1207 (3662)

$1.1167 (2872)

$1.1138 (3895)

Price at time of writing this review: $1.1081

Support levels (open interest**, contracts):

$1.1044 (2940)

$1.0998 (2724)

$1.0949 (1281)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 7 is 67163 contracts (according to data from January, 31) with the maximum number of contracts with strike price $1,1150 (4453);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3404 (2301)

$1.3318 (3220)

$1.3256 (1373)

Price at time of writing this review: $1.3157

Support levels (open interest**, contracts):

$1.3090 (2383)

$1.3045 (1213)

$1.2998 (3299)

Comments:

- Overall open interest on the CALL options with the expiration date February, 7 is 25420 contracts, with the maximum number of contracts with strike price $1,3600 (3910);

- Overall open interest on the PUT options with the expiration date February, 7 is 21777 contracts, with the maximum number of contracts with strike price $1,3000 (3299);

- The ratio of PUT/CALL was 0.86 versus 0.86 from the previous trading day according to data from January, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 56.8 | -2.92 |

| WTI | 51.49 | -2.54 |

| Silver | 18.02 | 1.18 |

| Gold | 1588.772 | 0.94 |

| Palladium | 2273.89 | -0.87 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 227.43 | 23205.18 | 0.99 |

| Hang Seng | -136.5 | 26312.63 | -0.52 |

| KOSPI | -28.99 | 2119.01 | -1.35 |

| ASX 200 | 8.8 | 7017.2 | 0.13 |

| FTSE 100 | -95.95 | 7286.01 | -1.3 |

| DAX | -175.15 | 12981.97 | -1.33 |

| CAC 40 | -65.43 | 5806.34 | -1.11 |

| Dow Jones | -603.41 | 28256.03 | -2.09 |

| S&P 500 | -58.14 | 3225.52 | -1.77 |

| NASDAQ Composite | -147.99 | 9150.94 | -1.59 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.66857 | -0.53 |

| EURJPY | 120.204 | 0.02 |

| EURUSD | 1.10937 | 0.57 |

| GBPJPY | 143.1 | 0.35 |

| GBPUSD | 1.32074 | 0.9 |

| NZDUSD | 0.64627 | -0.41 |

| USDCAD | 1.32277 | 0.2 |

| USDCHF | 0.96327 | -0.63 |

| USDJPY | 108.344 | -0.55 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.