- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 02-03-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 | Australia | MI Inflation Gauge, m/m | February | 0.3% | |

| 00:30 | Australia | Building Permits, m/m | January | -0.2% | 1% |

| 00:30 | Australia | Current Account, bln | Quarter IV | 7.86 | 2.3 |

| 03:30 | Australia | RBA Rate Statement | |||

| 03:30 | Australia | Announcement of the RBA decision on the discount rate | 0.75% | 0.75% | |

| 05:00 | Japan | Consumer Confidence | February | 39.1 | 40.6 |

| 06:45 | Switzerland | Gross Domestic Product (YoY) | Quarter IV | 1.1% | 1.3% |

| 06:45 | Switzerland | Gross Domestic Product (QoQ) | Quarter IV | 0.4% | 0.2% |

| 09:30 | United Kingdom | PMI Construction | February | 48.4 | 48.4 |

| 10:00 | Eurozone | Producer Price Index (YoY) | January | -0.7% | -0.5% |

| 10:00 | Eurozone | Producer Price Index, MoM | January | 0% | 0.5% |

| 10:00 | Eurozone | Harmonized CPI, Y/Y | February | 1.4% | 1.2% |

| 10:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | February | 1.1% | 1.2% |

| 10:00 | Eurozone | Unemployment Rate | January | 7.4% | 7.4% |

| 19:50 | U.S. | FOMC Member Mester Speaks | |||

| 21:30 | Australia | AiG Performance of Construction Index | February | 41.3 | |

| 21:45 | New Zealand | Building Permits, m/m | January | 9.9% | -0.9% |

| 23:00 | U.S. | Total Vehicle Sales, mln | February | 16.8 | |

| 23:30 | U.S. | FOMC Member Charles Evans Speaks |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 | Australia | MI Inflation Gauge, m/m | February | 0.3% | |

| 00:30 | Australia | Building Permits, m/m | January | -0.2% | 1% |

| 00:30 | Australia | Current Account, bln | Quarter IV | 7.86 | 2.3 |

| 03:30 | Australia | RBA Rate Statement | |||

| 03:30 | Australia | Announcement of the RBA decision on the discount rate | 0.75% | 0.75% | |

| 05:00 | Japan | Consumer Confidence | February | 39.1 | 40.6 |

| 06:45 | Switzerland | Gross Domestic Product (YoY) | Quarter IV | 1.1% | 1.3% |

| 06:45 | Switzerland | Gross Domestic Product (QoQ) | Quarter IV | 0.4% | 0.2% |

| 09:30 | United Kingdom | PMI Construction | February | 48.4 | 48.4 |

| 10:00 | Eurozone | Producer Price Index (YoY) | January | -0.7% | -0.5% |

| 10:00 | Eurozone | Producer Price Index, MoM | January | 0% | 0.5% |

| 10:00 | Eurozone | Harmonized CPI, Y/Y | February | 1.4% | 1.2% |

| 10:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | February | 1.1% | 1.2% |

| 10:00 | Eurozone | Unemployment Rate | January | 7.4% | 7.4% |

| 19:50 | U.S. | FOMC Member Mester Speaks | |||

| 21:30 | Australia | AiG Performance of Construction Index | February | 41.3 | |

| 21:45 | New Zealand | Building Permits, m/m | January | 9.9% | -0.9% |

| 23:00 | U.S. | Total Vehicle Sales, mln | February | 16.8 | |

| 23:30 | U.S. | FOMC Member Charles Evans Speaks |

According to sources, the goal may be reviewed again in April.

The Commerce Department announced on Monday that construction spending climbed 1.8 percent m-o-m in January 2020 after a revised 0.2 percent m-o-m gain in December 2019 (originally a 0.2 percent m-o-m drop). This was the biggest monthly advance in construction spending since February 2018.

Economists had forecast construction spending increasing 0.7 percent m-o-m in January.

According to the report, spending on private construction surged 1.5 percent m-o-m, while investment in public construction jumped 2.6 percent m-o-m, the most since April 2018.

On a y-o-y basis, construction spending rose 6.8 percent in January, the highest annual increase since February 2017.

A report from the Institute for Supply Management (ISM) showed on Monday the U.S. manufacturing sector's activity grew at a slower pace in February compared to a month ago.

The ISM's index of manufacturing activity came in at 50.1 percent last month, down 0.8 percentage point from the January reading of 50.9 percent. That was below economists' forecast for a 50.5 percent reading.

A reading above 50 percent indicates expansion, while a reading below 50 percent indicates contraction.

According to the report, the New Orders Index stood at 49.8 percent, a decline of 2.2 percentage points from the January reading and the Production Index registered 50.3 percent, down 4 percentage points compared to the January reading. Meanwhile, the Employment Index recorded 46.9 percent, an advance of 0.3 percentage point from the January reading, the Backlog of Orders Index posted 50.3 percent, a gain of 4.6 percentage points compared to the January reading and the Supplier Deliveries Index registered 57.3 percent, up 4.4 percentage points from the January reading. Elsewhere, the Prices Index showed a fall of 7.4 percentage points to 45.9 percent in February from January.

Timothy R. Fiore, Chair of the ISM Manufacturing Business Survey Committee said, "The past relationship between the PMI and the overall economy indicates that the PMI for February (50.1 percent) corresponds to a 2.1-percent increase in real gross domestic product (GDP) on an annualized basis."

FXStreet notes that the market's focus will be centered around Wednesday's Bank of Canada (BoC) decision and Friday's Labour Force Survey. The global macro narrative surrounding the coronavirus is clearly in the driver's seat and will dominate the volatility this week, strategists at TD Securities brief.

“Our call for the Bank to keep rates unchanged is under review amid ongoing market turmoil tied to COVID-19. Markets are fully priced for a 25bp cut but only a minority (9/27) of forecasters look for the Bank to follow through with easing.”

“We look for the labour market to add 12k jobs in February following two months of >25k job growth. We look for services to drive overall job growth, led by a rebound in health care.”

“Elsewhere, modest job growth figures should see the unemployment rate edge higher to 5.6% (from 5.54%) while we see wage growth cooling to 3.9% owing to a combination of base-effects and some moderation from the 1.0% m/m increase in January.”

- ECB needs to be very vigilant

- Euro economy is not in recession and jobs are still being created

- If there is a risk of recession, we must do everything possible

- Impact of virus can lower ECB's growth projections

- V-shaped recovery "not the only possible scenario"

FXStreet notes that for economies such as the US and the UK, there is still only a limited amount of evidence highlighting the impact of the coronavirus compared with Asia. In Europe, the Italian and German economies may be most directly affected by the coronavirus, economists at Rabobank inform.

“Apple’s CEO on Friday indicated that the company may not be feeling the effects of the coronavirus for much longer. However, the market is skeptical of this given that the closure of the factory of one of its suppliers in S.Korea over the weekend.”

“In the UK, the ‘just in time’ nature of supply chains is also likely creating issues for companies. This morning’s release of the final UK manufacturing PMI for February was revised down slightly from the initial estimate with IHS Markit stating that the outbreak led to material delivery delays, rising input costs and increased pressures on stocks of purchases.

“While Germany’s trade links with China opens its to supply disruption, Italy’s industrial North has been impacted by lockdowns.”

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 150.05 | 0.81(0.54%) | 42963 |

| ALCOA INC. | AA | 13.85 | -0.02(-0.14%) | 5377 |

| ALTRIA GROUP INC. | MO | 40.4 | 0.03(0.07%) | 21213 |

| Amazon.com Inc., NASDAQ | AMZN | 1,882.00 | -1.75(-0.09%) | 110171 |

| American Express Co | AXP | 109.3 | -0.63(-0.57%) | 21513 |

| AMERICAN INTERNATIONAL GROUP | AIG | 41.4 | -0.76(-1.80%) | 6071 |

| Apple Inc. | AAPL | 276.4 | 3.04(1.11%) | 1175923 |

| AT&T Inc | T | 35.33 | 0.11(0.33%) | 102680 |

| Boeing Co | BA | 275.65 | 0.54(0.20%) | 74314 |

| Caterpillar Inc | CAT | 123 | -1.24(-1.00%) | 12670 |

| Chevron Corp | CVX | 92.51 | -0.83(-0.89%) | 14571 |

| Cisco Systems Inc | CSCO | 39.54 | -0.39(-0.98%) | 97146 |

| Citigroup Inc., NYSE | C | 62.54 | -0.92(-1.45%) | 61196 |

| Deere & Company, NYSE | DE | 157.2 | 0.72(0.46%) | 5379 |

| E. I. du Pont de Nemours and Co | DD | 42.5 | -0.40(-0.93%) | 10340 |

| Exxon Mobil Corp | XOM | 51.23 | -0.21(-0.41%) | 124429 |

| Facebook, Inc. | FB | 191.5 | -0.97(-0.50%) | 167945 |

| FedEx Corporation, NYSE | FDX | 140.56 | -0.61(-0.43%) | 5493 |

| Ford Motor Co. | F | 6.96 | -0.00(-0.00%) | 143843 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.93 | -0.03(-0.30%) | 54524 |

| General Electric Co | GE | 10.96 | 0.08(0.74%) | 2288384 |

| General Motors Company, NYSE | GM | 30.2 | -0.30(-0.98%) | 32593 |

| Goldman Sachs | GS | 197.42 | -3.35(-1.67%) | 17423 |

| Google Inc. | GOOG | 1,336.50 | -2.83(-0.21%) | 26181 |

| Home Depot Inc | HD | 216 | -1.84(-0.84%) | 17176 |

| HONEYWELL INTERNATIONAL INC. | HON | 161.4 | -0.77(-0.47%) | 655 |

| Intel Corp | INTC | 55 | -0.52(-0.94%) | 146489 |

| International Business Machines Co... | IBM | 129.49 | -0.66(-0.51%) | 24053 |

| Johnson & Johnson | JNJ | 133.89 | -0.59(-0.44%) | 15279 |

| JPMorgan Chase and Co | JPM | 114.55 | -1.56(-1.34%) | 82152 |

| McDonald's Corp | MCD | 191.75 | -2.42(-1.25%) | 15267 |

| Merck & Co Inc | MRK | 76 | -0.56(-0.73%) | 10887 |

| Microsoft Corp | MSFT | 161.6 | -0.41(-0.25%) | 613827 |

| Nike | NKE | 87.79 | -1.59(-1.78%) | 19137 |

| Procter & Gamble Co | PG | 112.46 | -0.77(-0.68%) | 16902 |

| Starbucks Corporation, NASDAQ | SBUX | 77.25 | -1.18(-1.50%) | 53886 |

| Tesla Motors, Inc., NASDAQ | TSLA | 689.16 | 21.17(3.17%) | 789333 |

| The Coca-Cola Co | KO | 53.48 | -0.01(-0.02%) | 39395 |

| Travelers Companies Inc | TRV | 118.6 | -1.21(-1.01%) | 3611 |

| Twitter, Inc., NYSE | TWTR | 35.6 | 2.40(7.23%) | 536417 |

| United Technologies Corp | UTX | 132 | 1.41(1.08%) | 8185 |

| UnitedHealth Group Inc | UNH | 256.3 | 1.34(0.53%) | 20504 |

| Verizon Communications Inc | VZ | 54.9 | 0.74(1.37%) | 59830 |

| Visa | V | 181.2 | -0.56(-0.31%) | 69600 |

| Wal-Mart Stores Inc | WMT | 106.88 | -0.80(-0.74%) | 12977 |

| Walt Disney Co | DIS | 116.75 | -0.90(-0.77%) | 99313 |

| Yandex N.V., NASDAQ | YNDX | 39.65 | -0.96(-2.36%) | 44043 |

Apple (AAPL) upgraded to Outperform from Perform at Oppenheimer; target $320

Verizon (VZ) upgraded to Outperform from Market Perform at Cowen; target $61

JPMorgan Chase (JPM) upgraded to Overweight from Neutral at Piper Sandler; target $149

Micron (MU) upgraded to Neutral from Underperform at Robert W. Baird; target raised to $55

Lyft (LYFT) upgraded to Hold from Sell at The Benchmark Company

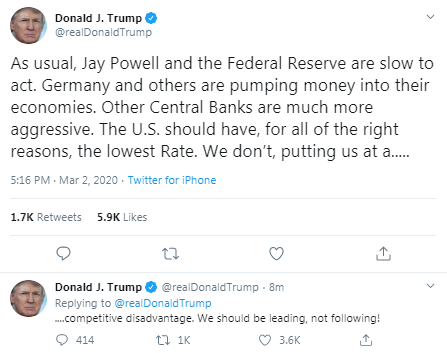

FXStreet notes that panic selling has ceded a bit, reflecting the hope of mobilization by policymakers. The Fed recently pointed to a willingness to act, with TD Securities experts now expecting a Fed cut in March and April.

“The Fed has more room to cut than most and, in turn, could reduce the costs of USD selling. Our global growth framework shows the USD is trading at a 1.5% discount.”

“A mix of renewed Fed easing and a rising political premium could cement the recent highs, kick-starting a marginal push lower. As this tug of war persists, we expect more volatility in currencies.”

“Sander's ascent in the polls has dovetailed with a peaking USD, leaving much attention on Super Tuesday. It's a dynamic cocktail mix for markets with global growth pulling the USD in one direction and politics and policymakers pushing it the other way. The latter will likely win out ahead of the March Fed meeting.”

- The front line of the response to coronavirus should be fiscal policy

- Virus adds a new layer to uncertainty to global, euro area growth prospects

- ECB remains vigilant and will closely monitor all incoming data

- ECB stands ready to adjust all its instruments as appropriate, to ensure inflation moves towards its aim in a sustained manner

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 08:30 | Switzerland | Manufacturing PMI | February | 47.8 | 48.1 | 49.5 |

| 08:50 | France | Manufacturing PMI | February | 51.1 | 49.7 | 49.8 |

| 08:55 | Germany | Manufacturing PMI | February | 45.3 | 47.8 | 48 |

| 09:00 | Eurozone | Manufacturing PMI | February | 47.9 | 49.1 | 49.2 |

| 09:30 | United Kingdom | Mortgage Approvals | January | 67.93 | 67.9 | 70.89 |

| 09:30 | United Kingdom | Consumer credit, mln | January | 1.337 | 1.1 | 1.23 |

| 09:30 | United Kingdom | Net Lending to Individuals, bln | January | 5.7 | 5.2 | |

| 09:30 | United Kingdom | Purchasing Manager Index Manufacturing | February | 50 | 51.8 | 51.7 |

GBP fell against its major rivals in the European session on Monday as persistent concerns about fast-spreading coronavirus continued to weigh on the investors' sentiment.

According to the latest information, the global coronavirus death toll passed 3,000 with more than 88,000 people infected. In the UK, the total number of confirmed coronavirus cases amounted to 36.

The Organisation for Economic Cooperation and Development (OECD) warned that the coronavirus outbreak could cut global economic growth in half. The organization lowered its projection of global GDP growth for 2020 to 2.4% from 2.9% it forecast before the outbreak took hold, but noted that a “longer lasting and more intensive coronavirus outbreak” could slash growth to 1.5 percent.

The Bank of England (BoE) stated on Monday that it is working with international partners and the UK's finance ministry to ensure "all necessary steps are taken" to offset the economic hit from coronavirus.

Market participants also received final data on UK manufacturing Purchasing Managers' Index (PMI) and mortgage approvals.

The latest survey from IHS Markit revealed the UK's manufacturing sector grew at the fastest pace in ten months in February, due to a continued recovery in domestic demand amid reduced political uncertainty. The IHS Markit/CIPS UK manufacturing PMI increased to 51.7 in February from 50.0 in January. However, this was below the earlier flash estimate of 51.9. The PMI posted above the 50.0-neutral mark for the first time in ten months and pointed to the biggest gain in factory activity since April of 2019.

Meanwhile, a report from the Bank of England (BoE) showed that mortgage approvals for house purchases rose to the highest level in nearly four years in January. According to the report, mortgage approvals increased to 70,888 in January from upwardly revised 67,930 in December. This was the highest level since February 2016 and above economists' forecast of 67,900. At the same time, consumer credit increased GBP 1.23 billion in January, following an upwardly revised GBP 1.34 billion advance in the previous month and above economists' forecast of GBP 1.10 billion. The annual rate of growth in consumer credit remained unchanged at 6.1 percent in January.

Investors are also fretting about post-Brexit trade talks, set to begin today, and whether the UK's budget, planned to be delivered on March 11, will include much more spending, which many market participants say is necessary to boost the country's economy.

- We are seeing the materialization of downside risks

- It is still too soon to measure impact of coronavirus outbreak on economy

- "V-shaped recovery" forecast presented a couple of weeks ago cannot be taken for granted; this expectation is "optimistic"

- We will assess requests for fiscal flexibility under EU rules due to coronavirus outbreak

FXStreet reports that according to economists at Westpac Institutional Bank AUD/USD, as a proxy for global risk sentiment and also for China’s growth outlook, will continue to be buffeted by COVID-19 concerns.

“Record short real money positions should mean two-way price action, but we prefer to sell into any rallies above 0.6600.”

“Fragile industrial commodities and the China travel ban threaten each of Australia’s top five exports (coal, iron ore, LNG, education, tourism), pointing to a collapse in the trade surplus starting in the February data.”

“The extent and timing of likely RBA easing is a swing factor near term but the impact on Australia’s economy will be muted. We see multi-day/week risks to 0.6350/0.6400, our existing 0.66 target by end-June requiring a sharp rebound in Chinese growth.”

FXStreet notes that the sharp drop in China’s manufacturing PMI in February reinforces the view of analysts at ANZ Research that the normalisation in economic activity will be delayed, as reflected in high-frequency growth trackers.

“There has been a huge contraction in both demand and supply, as reflected in the steep declines of sub-30 seen in sub-indices such as production, new orders, and new export orders to 27.8, 29.3 and 28.7, respectively.”

“We see the economy contracting by 2% in Q1 on a sequential basis and revise down our forecast of Q1 GDP to +2% y/y (previously 3.2−4.0%).”

“Chances of a v-shaped rebound are low. We cut our forecast for 2020 to 4.1%. The government has targeted aid to affected sectors and enterprises, rather than using stimulus.”

- There is a positive trend in areas outside of Hubei, but strict prevention and control measures must be maintained

- Will work hard to promote the research and tests of drugs and vaccines

- Cities with high population mobility like Beijing must control channels

- The rest of China should adjust emergency response level according to situation

- Hubei must also start agricultural production in an orderly manner

FXStreet reports that as analysts at Danske Bank argued in their latest Fed monitor, based on almost all metrics, one should expect the Fed to soon intervene. This was exactly what happened last Friday in the Fed chair Powell's extraordinary press statement, which opened the door for Fed action.

"Based on Fed chair Powell's statement and the current situation, we change our Fed call and now expect the Fed to cut its target range by 25bp in March and again in April."

"A third cut in June may be necessary depending on how the coronavirus develops. We also think one should not disregard the possibility that the Fed will cut by 50bp in March if the current risk sell-off continues."

"Despite Fed chair Powell's statement, the Fed still seems behind the curve compared with current market pricing, as investors are pricing in more than a full 25bp cut in March."

FXStreet reports that Australian Interbank futures are now placing > 100% chance the RBA cuts 25bps tomorrow but analysts at TD Securities see little reason for the Reserve Bank of Australia (RBA) to cut tomorrow. AUD/USD trades at 0.6545.

"If there is no co-ordinated policy action, we see little reason for the RBA to cut the cash rate tomorrow. We believe the RBA can afford to wait for more information before it acts."

"The RBA runs the risk that cuts may not help the economy - tourist and foreign student numbers are unlikely to jump in response to rate cuts."

"With the monetary policy transmission mechanism having diminished, we believe the RBA and Government are more likely to achieve a greater impact via alternative targeted measures such as providing support for small firms via a special lending facility or more far-reaching fiscal stimulus."

-

The coronavirus (COVID-19) outbreak has already brought considerable human suffering and major economic disruption.

-

Output contractions in China are being felt around the world, reflecting the key and rising role China has in global supply chains, travel and commodity markets. Subsequent outbreaks in other economies are having similar effects, albeit on a smaller scale.

-

Growth prospects remain highly uncertain.

-

On the assumption that the epidemic peaks in China in the first quarter of 2020 and outbreaks in other countries prove mild and contained, global growth could be lowered by around ½ percentage point this year relative to that expected in the November 2019 Economic Outlook.

-

Accordingly, annual global GDP growth is projected to drop to 2.4% in 2020 as a whole, from an already weak 2.9% in 2019, with growth possibly even being negative in the first quarter of 2020.

-

Prospects for China have been revised markedly, with growth slipping below 5% this year, before recovering to over 6% in 2021, as output returns gradually to the levels projected before the outbreak.

-

The adverse impact on confidence, financial markets, the travel sector and disruption to supply chains contributes to the downward revisions in all G20 economies in 2020, particularly ones strongly interconnected to China, such as Japan, Korea and Australia.

-

Provided the effects of the virus outbreak fade as assumed, the impact on confidence and incomes of well-targeted policy actions in the most exposed economies could help global GDP growth recover to 3¼ per cent in 2021.

FXStreet reports that late Friday night, Fed Chair Powell responded to the substantial market sell-off in an extraordinary statement. The question is no longer whether the Fed will ease, but when and by how much. Analysts at Nordea expect an easing package in March.

"The equity sell-off prompted a response from Chair Powell who in a statement late Friday night said that 'The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy'."

"The Fed should deliver some easing in March. We think an easing package consisting of a 25 bp rate cut, strong easing forward guidance as well as a postponement of the otherwise announced liquidity tapering is on the cards. We see the risk as clearly tilted towards a bigger rate cut of 50 bp in March. If equities tank even more ahead of the FOMC March meeting, we would thus expect a 50 bp cut to materialise."

"The uncertainty around our forecast is high. On one hand, a rate cut of 50 bp in March followed by more cuts in the coming months cannot be ruled out if this turns out to be a US or even a global recession. On the other hand, Fed may opt for only one rate cut in March, if the coronavirus is soon contained and macro indicators suggest a V-shaped recovery."

"Lastly, bear in mind that we do not see the upcoming US Presidential election as a real barrier for a rate cut."

According to the report from IHS Markit/CIPS, growth of manufacturing output accelerated to a ten month high in February, as domestic demand continued to recover on the back of reduced political uncertainty. Supply chain disruptions were rapidly emerging, however, as the outbreak of COVID-19 led to sizeable raw material delivery delays, rising input costs and increased pressure on stocks of purchases.

The seasonally adjusted IHS Markit/CIPS PMI rose to 51.7 in February, up from 50.0 in January, but below the earlier flash estimate of 51.9. The PMI posted above the 50.0 neutral mark for the first time in ten months. Economists had expected an increase to 51.8.

Manufacturing output increased at the fastest pace since April 2019, as growth strengthened in both the consumer and intermediate goods sectors. In contrast, the downturn at investment goods producers continued. The main factor underlying output growth was improved intakes of new work. Business optimism also strengthened, hitting a ninemonth high, reflecting planned new investment, product launches, improved market conditions and a more settled political outlook.

Less positive news was provided by the trend in new export business, with overseas demand decreasing for the fourth successive month in February. Companies reported reduced new work intakes from Asia (especially China) due to the COVID-19 outbreak. There were also reports of efforts to re-route supply chains away from the UK (following Brexit) contributing to weaker demand from the EU.

According to the report from IHS Markit, operating conditions in the eurozone's manufacturing sector continued to worsen during February, but only marginally and at the weakest rate for the past year.

The IHS Markit Eurozone Manufacturing PMI, which is adjusted for seasonal factors, recorded 49.2 in February, up from January's 47.9 and slightly above the earlier flash reading. Economists had expected an increase to 49.1. Although the PMI has now recorded below the 50.0 no-change mark for 13 months in succession, February's reading marked not only a one-year high, but also a second successive monthly rise in the index. Latest data indicated that two market groups registered a deterioration in operating conditions in February. Investment goods producers registered

Euro area wide manufacturing production and new orders both remained inside negative territory during February, although rates of contraction were the weakest in nine and 15 months respectively. In contrast, export trade fell at a sharper rate to extend the current run of continuous contraction to just under a year-and-a-half.

On the jobs front, staff numbers were reduced for a tenth successive month. The rate of contraction was solid, albeit weaker than those seen around the turn of the year, as firms responded to reduced workloads by seeking to cut any excess capacity.

Finally, having reached a near one-and-a-half year high during January, business confidence was slightly lower in the latest survey period.

eFXdata reports that Credit Suisse discusses EURUSD technical outlook and sees a scope for further recovery within the medium-term downtrend.

"EURUSD has been floored as expected by the long-term potential uptrend from 2000 at 1.0778/51 and although the market remains in a clear medium term downtrend, we think the risks are likely that we see a reversal back higher within the shallow downtrend, very much in line with the previous immediately reversed breakdowns that we have seen during this shallow downtrend," CS notes.

"In contrast, a move below 1.0751 would suggest the medium term downtrend is accelerating, with the next support on a break below 1.0778/51 seen at 1.0682, a corrective price low, before a more prominent price low at 1.0569," CS adds.

eFXdata reports that Bank of America Global Research discusses its expectations for this week's RBA March policy meeting.

"Pressure on the Reserve Bank of Australia (RBA) to ease again is mounting due to the broader negative impact on growth from weaker services exports, consumption and investment. We now see 2020 growth at 2.0% having already lowered our forecast to 2.2% following the bushfire season. But we think the Bank will hold rates steady next week and we maintain the expectation of one more rate cut in 2020," BofA notes.

"We do not expect any additional cuts for a few reasons: (1) financial conditions are easing via the currency, (2) fiscal policy will become more expansionary and (3) there is a high hurdle to cut rates to the lower bound.

We question if the transmission of easier conditions will act to support activity as it has done in previous cycles considering services exports are affected and unlikely to fully recover this year," BofA adds.

CNBC reports that the Federal Reserve is likely to join other global central banks in cutting interest rates aggressively in response to the coronavirus scare, Goldman Sachs economists said.

With fears over a global slowdown intensifying, the Fed likely will announce a 50 basis point cut at its March meeting, if not sooner, the firm said. In all, Goldman sees the Fed cutting 100 basis points this year, which is an increase from just Friday, when it saw a cut of 75 basis points.

The call comes as the Goldman Sachs Analyst Index falling 7.4 points to 47 in February, which indicates economic contraction. Sales and orders fell into contraction, while output and material prices as well as wages and exports all pulled back though inventories increased. Respondents "cited the virus as a major headwind, and a few analysts noted that a prolonged outbreak could lead to supply chain disruptions in their industry," the firm said.

"Even relative to some of our new policy rate forecasts, we think the risk is on the downside, at least in terms of timing. Specifically, we see a high risk that the easing we expect over the next several weeks occurs in coordinated fashion, perhaps as early as the coming week," Jan Hatzius, Goldman's chief economist, said in a note.

The projection is in line with market pricing, which sees a likelihood that the Fed will cut at least 100 basis points, or 1 percentage point, by the end of 2020.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:00 | Belgium | UK-EU Trade Talks | ||||

| 00:30 | Australia | ANZ Job Advertisements (MoM) | February | 3.8% | -6.6% | 0.7% |

| 00:30 | Australia | Company Gross Profits QoQ | Quarter IV | -0.6% | -3.5% | -3.5% |

| 00:30 | Japan | Manufacturing PMI | February | 48.8 | 47.6 | 47.8 |

| 01:45 | China | Markit/Caixin Manufacturing PMI | February | 51.1 | 45.7 | 40.3 |

During today's Asian trading, the US dollar declined against the euro, but rose against the yen.

The head of the US Federal reserve Jerome Powell on Friday said that the fed is "closely monitoring" the situation with COVID-19. This has given investors some optimism that the fed will cut interest rates to support economic growth in the country.

Earlier, the President of the Federal reserve Bank of St. Louis, James Bullard, said that he would support a reduction in the interest rate if the situation with COVID-19 turns into a pandemic. At the same time, he does not see the need for a rate cut, since the economy is still supported by the easing of monetary policy taken last year. "A further rate cut is possible if the epidemic grows into a global pandemic, but this is not the baseline scenario at the moment," Bullard said.

Meanwhile, market participants are increasingly confident that the fed will have to make an emergency reduction in the cost of lending if the situation with the coronavirus worsens. According to CME Group data, traders on Friday estimated the probability of a 25 basis point rate cut in March at 72%. A week earlier, the chances of this were estimated at only 9%.

Medical authorities in the United States reported the first death in the country as a result of infection with the coronavirus - in the state of Washington. A second death was later recorded there. State Governor Jay inslee declared a state of emergency that directs all state agencies to " use all resources necessary to prepare for and respond to the outbreak."

The ICE Dollar index, which shows the value of the dollar against six major world currencies, fell by 0.22% compared to the previous day.

FXStreet reports that cable remains under pressure and risks extra retracements in the near-term, according to FX Strategists at UOB Group.

24-hour view: "The sudden and sharp plunge in GBP last Friday came as a surprise as it cracked several strong support levels with ease and hit a 4- 1/2 -month low of 1.2726 before rebounding. While further GBP weakness appears likely in the days ahead, the rapid short-term drop is running ahead of itself. From here, GBP is expected to consolidate and trade between 1.2735 and 1.2855."

Next 1-3 weeks: "While we indicated last Friday that a 'NY close below 1.2800 would suggest GBP is ready to embark of a sustained decline', we were of the view 'the prospect for such a scenario is low for now'. However, GBP sliced through 1.2820 and plunged to a 4-1/2 -month low of 1.2726 before snapping back up to end the day at 1.2821 (-0.48%). The break of 1.2820 has exposed the downside in GBP even though 1.2700 is a strong support and may not come into the picture so soon. To look at it another way, GBP could consolidate for a couple of days first before making a run for 1.2700. On the upside, only a move above 1.2900 ('strong resistance' level) would indicate that GBP is not ready to move lower just yet."

According to the report from Markit/Caixin, efforts to contain the recent outbreak of the coronavirus in mainland China weighed heavily on manufacturing sector performance in February. Production, new work and staffing levels all fell at the quickest rates since the survey began nearly 16 years ago as companies extended their usual Lunar New Year shutdowns to help stem the spread of the virus. Supply chains were also hit heavily, with average delivery times increasing at the quickest pace on record, leading firms to increase their use of current stocks. However, firms anticipate a recovery in production over the next year due to expectations that production will be ramped up once any coronavirus-related restrictions are lifted. Notably, the degree of positive sentiment was the strongest seen for five years.

At 40.3 in February, the headline seasonally adjusted PMI - a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy - fell from 51.1 at the start of the year to signal a renewed decline in the health of the sector. Furthermore, it was the lowest PMI reading since the survey began in April 2004.

Production fell sharply during February as many firms shutdown or were operating below capacity due to restrictions put in place in response to the coronavirus outbreak. The rate of contraction was the quickest on record, and ended a six-month period of rising output. The total amount of new work received by Chinese manufacturers also declined at the steepest rate since the survey began in early 2004.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1168 (4355)

$1.1128 (6530)

$1.1095 (4318)

Price at time of writing this review: $1.1047

Support levels (open interest**, contracts):

$1.0968 (3613)

$1.0933 (3683)

$1.0892 (3519)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 6 is 129286 contracts (according to data from February, 28) with the maximum number of contracts with strike price $1,1100 (6530);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3008 (1970)

$1.2963 (1090)

$1.2921 (489)

Price at time of writing this review: $1.2833

Support levels (open interest**, contracts):

$1.2762 (2751)

$1.2741 (3768)

$1.2712 (3224)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 28174 contracts, with the maximum number of contracts with strike price $1,3050 (3665);

- Overall open interest on the PUT options with the expiration date March, 6 is 30630 contracts, with the maximum number of contracts with strike price $1,2800 (3768);

- The ratio of PUT/CALL was 1.09 versus 1.07 from the previous trading day according to data from February, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 50.23 | -1.76 |

| WTI | 45.01 | -2.58 |

| Silver | 16.64 | -6.09 |

| Gold | 1584.502 | -3.59 |

| Palladium | 2589.89 | -9.16 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -805.27 | 21142.96 | -3.67 |

| Hang Seng | -648.69 | 26129.93 | -2.42 |

| KOSPI | -67.88 | 1987.01 | -3.3 |

| ASX 200 | -216.7 | 6441.2 | -3.25 |

| FTSE 100 | -215.79 | 6580.61 | -3.18 |

| DAX | -477.11 | 11890.35 | -3.86 |

| CAC 40 | -185.7 | 5309.9 | -3.38 |

| Dow Jones | -357.28 | 25409.36 | -1.39 |

| S&P 500 | -24.54 | 2954.22 | -0.82 |

| NASDAQ Composite | 0.89 | 8567.37 | 0.01 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.65045 | -0.96 |

| EURJPY | 119.172 | -1.18 |

| EURUSD | 1.1028 | 0.26 |

| GBPJPY | 138.539 | -1.94 |

| GBPUSD | 1.28208 | -0.5 |

| NZDUSD | 0.62446 | -0.96 |

| USDCAD | 1.33949 | 0.04 |

| USDCHF | 0.96521 | -0.28 |

| USDJPY | 108.051 | -1.44 |

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.