- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- FXS Fed Sentiment Index drops to neutral territory as blackout period starts

FXS Fed Sentiment Index drops to neutral territory as blackout period starts

The Federal Reserve (Fed) will conduct its two-day monetary policy meeting next week and announce its decisions on March 19. Until then, the Fed will be in the blackout period, during which policymakers and officials will not be allowed to comment on the policy outlook.

According to the CME FedWatch Tool, markets virtually see no chance of a 25 basis points (bps) rate cut next week. The probability of a rate reduction in May currently stands at around 40%.

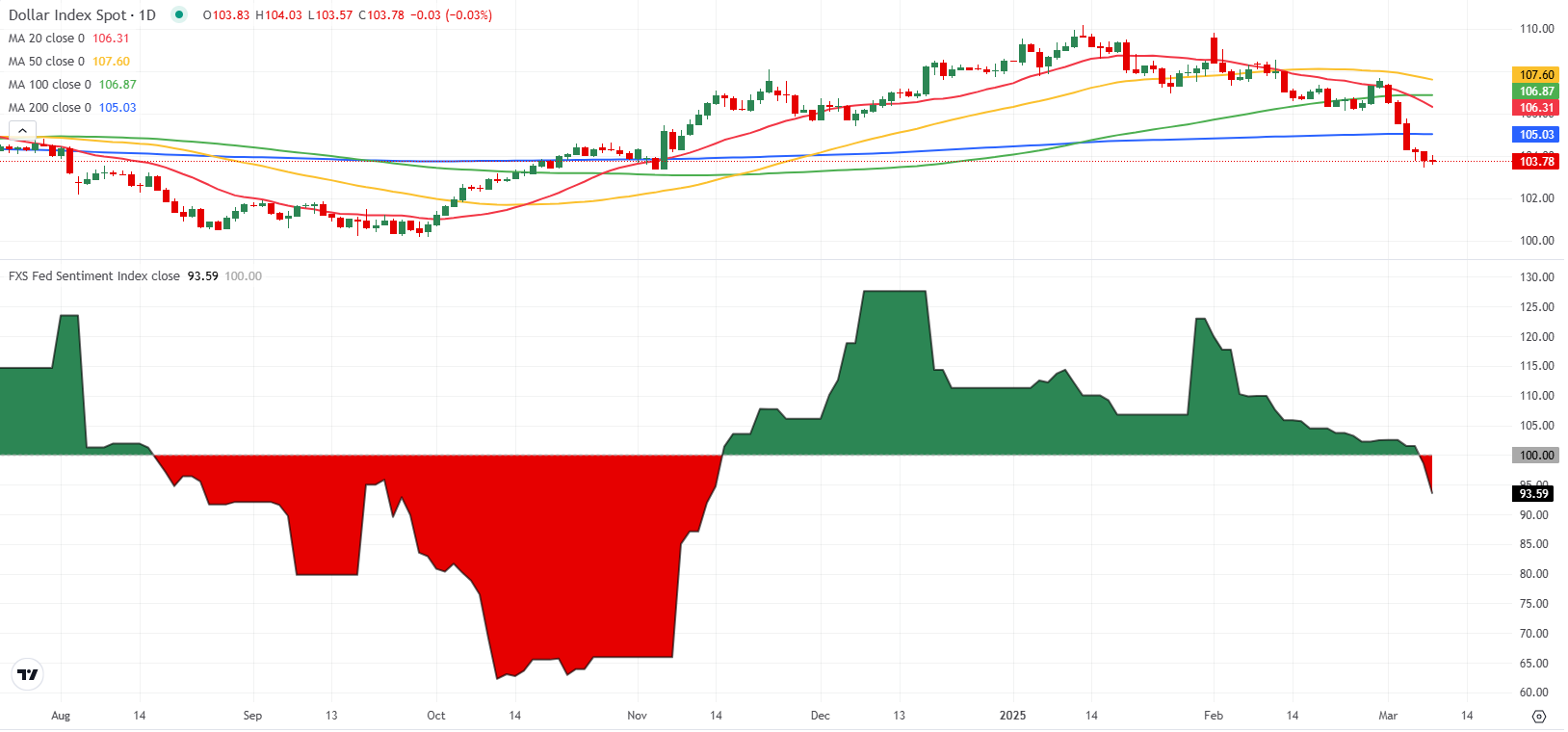

In the meantime, FXStreet (FXS) Fed Sentiment Index stays in the neutral territory, slightly below 100. Following the January meeting, the Fed left policy settings unchanged, as widely anticipated. The policy statement, however, adopted a cautious tone regarding further policy easing in the near future, citing the uncertainty surrounding the impact of policy changes. In turn, the FXS Fed Sentiment Index climbed above 120.

Comments from Fed officials following the January meeting, however, caused the FXS Fed Sentiment Index to turn south.

In his last public appearance before the beginning of the blackout period, Fed Chairman Jerome Powell noted that the policy is not on a preset course. "We can maintain policy restraint for longer if inflation progress stalls or ease if labor market unexpectedly weakens or inflation falls more than expected," Powell noted. On a more dovish note, San Francisco Fed President Mary Daly said that the elevated uncertainty about the economy and policies could weigh on demand. She further argued that they should be careful and deliberate with monetary policy.

Meanwhile, the US Dollar (USD) has been struggling to stay resilient against its rivals. Disappointing macroeconomic data releases, combined with US President Donald Trump's tariffs, revived fears over an economic downturn in the US and weighed heavily on the USD. The USD Index, which tracks the USD's performance against a basket of six major currencies, was last seen losing about 3.5% since the beginning of March, after falling nearly 1% in February.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.