- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/CAD accelerates correction after UK inflation data miss

GBP/CAD accelerates correction after UK inflation data miss

- GBP/CAD extends its correction to fresh lows following lower-than-expected UK inflation data.

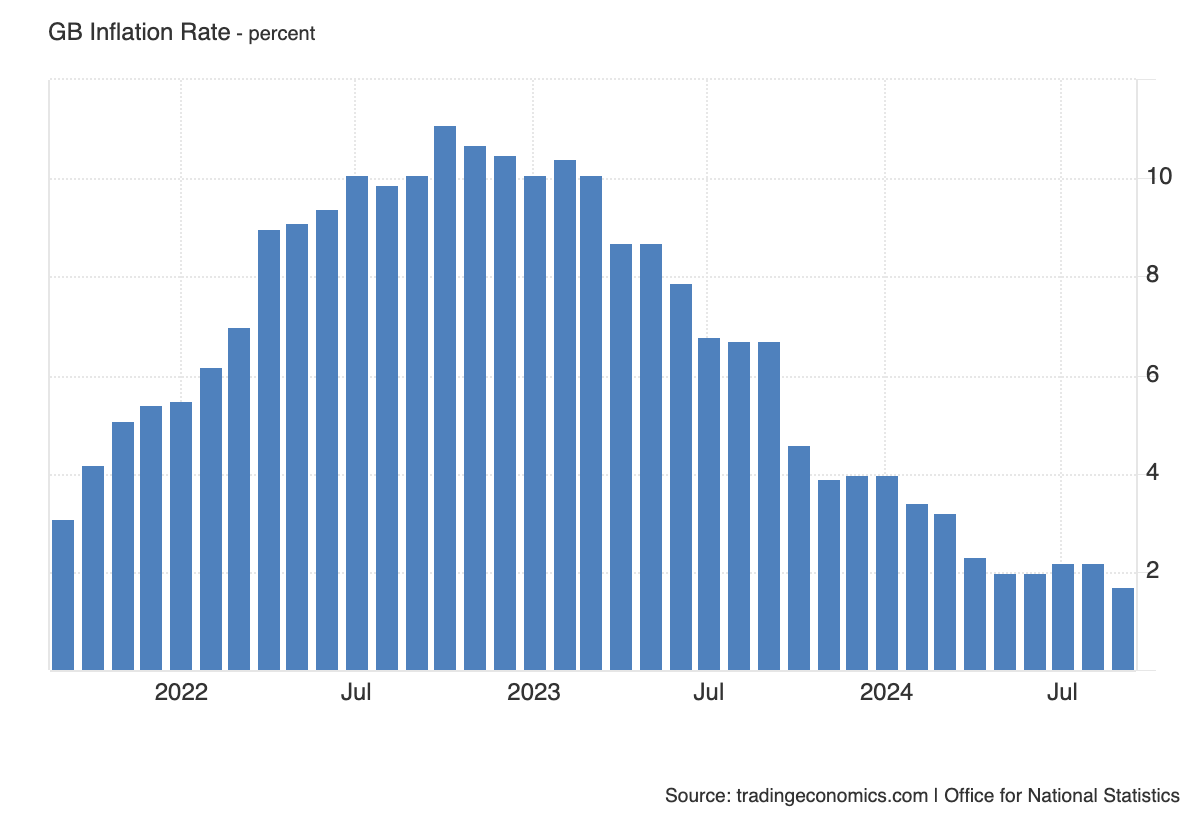

- The 1.7% rise in prices in September falls below the BoE’s 2.0% target.

- It increases the probability the BoE will cut interest rates decreasing foreign capital inflows and demand for Sterling.

GBP/CAD rolls over on Wednesday and declines almost half a percent to the mid 1.7900s. The fall is caused by the release of lower-than-expected inflation data from the UK – which showed headline inflation falling to 1.7% – as this put downside pressure on the Pound Sterling (GBP).

Cooler inflation increases the likelihood that the Bank of England (BoE) will cut interest rates, and lower interest rates are negative for Sterling as they reduce foreign capital inflows.

Before the release it was unclear whether the BoE would go ahead with an interest rate cut at their next meeting in November, mainly due to stubbornly high services inflation, however, Wednesday’s figures increase the odds the bank will go ahead with a 25 basis point (bps) (0.25%) rate cut.

Wednesday’s data showed that both core and services sector inflation cooled in September, falling to 3.2% and 4.9% respectively. Core fell from 3.6% in August and was below the 3.4% expected; services fell from 5.5% in August, reaching its lowest level since May 2022.

Bailey vindicated

Last week the Pound depreciated after the Governor of the BoE, Andrew Bailey said the bank should get more “activist” and “aggressive” about cutting interest rates which, at 5.0%, are one of the highest amongst western developed countries.

Although the BoE’s Chief Economist Huw Pill calmed markets on the day after Bailey’s speech – saying the bank should still act with caution when it came to lower interest rates, September’s data suggests Bailey was accurate in his assessment. After all, headline inflation has now fallen well below the BoE’s 2.0% target.

GBP/CAD Daily Chart

Downside for GBP/CAD may be limited, however, given similarly weak inflation data from Canada.

Data out on Tuesday, for example, showed that the Canadian headline Consumer Price Index (CPI) declined to 1.6% annually in September, from 2.0% in August, and below estimates of 1.8%. This, in turn, suggests the Bank of Canada (BoC) will cut interest rates again (after three consecutive 25 bps cuts already) at its next meeting on October 23.

The fall in Canadian inflation was mainly caused by a 10.7% decline in gasoline prices in September, and also affected related sectors such as transportation (down 1.5%). It marked the second month that headline inflation has fallen below the bank’s 2.0% target. Lower Crude Oil prices were responsible for the decline in gasoline prices. Oil also happens to be Canada’s largest export commodity. This, in turn, undermines the Canadian Dollar (CAD) and is a bullish factor for the GBP/CAD pair.

Trump says he would rip up free trade agreement with neighbors

The Canadian Dollar could be facing headwinds after comments by former president Donald Trump, in which he said that he would pursue a radical “America First” if elected in November.

In an interview with Bloomberg News, Trump said he would act to stop cheap Chinese cars from flooding the US market via carmakers nearshoring in Mexico as this was killing the US auto industry. Mexico has a free trade agreement with the US and Canada (USMCA), however, Trump suggested he would rip this up if he were made President. There is a risk Trump could also extend the trade war to the north and place heavy tariffs on Canadian goods, although the US does rely on Canadian Oil, suggesting it could be spared the same treatment as Mexico.

Trump’s comments carried all the more bite because he is now the favorite to win the election according to betting websites. OddsChecker puts his chances at 58% to Vice-President Kamala Harris’s 42%. Trump is still lagging in the polls however, which show Harris leading with 48.5% versus Trump’s 46.1%, according to website FiveThirtyEight.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.