- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Canada CPI expected to rise 1.8% in September, bolstering BoC to further ease policy

Canada CPI expected to rise 1.8% in September, bolstering BoC to further ease policy

- The Canadian Consumer Price Index is expected to rise 1.8% YoY in September.

- The Bank of Canada has reduced its policy rate by 75 bps so far this year.

- The Canadian Dollar has been losing considerable ground in October.

Statistics Canada is set to release its latest inflation data tracked by the Consumer Price Index (CPI) for the month of September on Tuesday. Forecasts suggest that the headline CPI could have risen 1.8% year-over-year (YoY) last month.

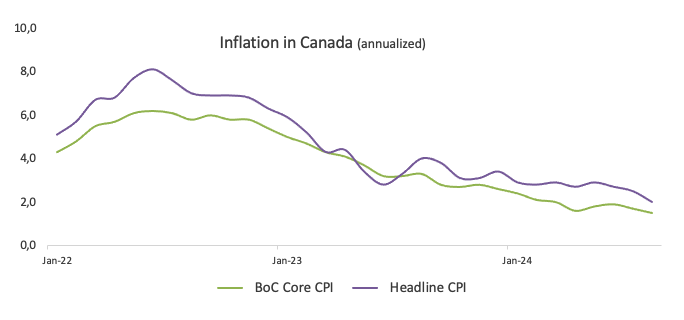

Alongside the headline data, the Bank of Canada (BoC) will release its core CPI, which excludes more volatile components such as food and energy. In August, the core CPI showed a 0.1% monthly decrease and a 1.5% rise from a year earlier. Meanwhile, the headline CPI climbed by 2.0% over the last twelve months — the lowest level since February 2021 — and dropped by 0.2% compared to the previous month.

These inflation figures are being closely monitored for their potential impact on the Canadian Dollar (CAD), especially in light of the BoC's current easing cycle. It is worth recalling that the BoC has reduced its policy rate by 25 basis points at its June, July, and September meetings so far this year, taking the reference interest rate to 4.25%.

In the FX world, the Canadian Dollar has depreciated in the last nine consecutive days, sending USD/CAD to the 1.3800 zone for the first time since early August.

What can we expect from Canada’s inflation rate?

Analysts appear divided regarding the path of price pressures in Canada in September, though they agree that domestic headline prices will fall below the Bank of Canada's target for the time being. Banning an outsized surprise, the underlying disinflationary trend is likely to prompt the BoC to maintain its course regarding the easing cycle that started in June.

After the BoC's rate cut on September 4, Governor Tiff Macklem stated that a 25 bps reduction was appropriate, although he added that BoC officials discussed different scenarios, including slowing the pace of rate reductions and even a 50 basis point cut.

Regarding inflation, Macklem suggested that further rate cuts are likely, citing the Bank of Canada's progress in reducing inflation towards its 2% target. In an interview in Toronto on September 24, Macklem emphasized the importance of maintaining inflation near the midpoint of the 1%–3% control range, stating, "We need to stick the landing." He also highlighted the need for ongoing moderation in core inflation, which, he noted, remains slightly above 2%.

In light of the upcoming release, analysts at TD Securities noted, “We look for CPI to dip to 1.9% on a large drag from gasoline, offset by a stabilization in core goods and strength in travel components. Our forecast would see Q3 CPI undershoot BoC projections from July, but with softer oil prices helping to drive that move and a modest pickup for the BoC's core measures in Sept, we do not believe this would justify a move to 50bp cuts.”

When is the Canada CPI data due, and how could it affect USD/CAD?

Canada will release its September CPI data on Tuesday at 12:30 GMT, and the Canadian Dollar's response will hinge only on any significant surprise in the figures. Absent a major deviation from expectations, the data is unlikely to influence the Bank of Canada's rate outlook.

USD/CAD has kicked off the month with a marked upward bias, reaching two-month highs around 1.3800 on Monday. The monthly advance has so far been on the back of a strong rebound in the US Dollar (USD), which has been keeping the broad risk-linked currencies on the back foot.

Pablo Piovano, Senior Analyst at FXStreet, points out that the continuation of the recovery could well see USD/CAD challenging its 2024 top of 1.3946 (August 5), just ahead of the 1.4000 milestone, an area last visited in May 2020.

“In the opposite direction, there are provisional contention levels at the 100-day and 55-day SMAs of 1.3655 and 1.3618, respectively, prior to the more relevant 200-day SMA at 1.3612. A break below this level could trigger further weakness, potentially targeting the next support at the September bottom of 1.3418 (September 25), ahead of the weekly low of 1.3358 (January 31)”, Pablo adds.

Economic Indicator

BoC Consumer Price Index Core (MoM)

The BoC Consumer Price Index Core, released by the Bank of Canada (BoC) on a monthly basis, represents changes in prices for Canadian consumers by comparing the cost of a fixed basket of goods and services. It is considered a measure of underlying inflation as it excludes eight of the most-volatile components: fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation and tobacco products. The MoM figure compares the prices of goods in the reference month to the previous month. Generally, a high reading is seen as bullish for the Canadian Dollar (CAD), while a low reading is seen as bearish.

Read more.Next release: Tue Oct 15, 2024 12:30

Frequency: Monthly

Consensus: -

Previous: -0.1%

Source: Statistics Canada

Bank of Canada FAQs

The Bank of Canada (BoC), based in Ottawa, is the institution that sets interest rates and manages monetary policy for Canada. It does so at eight scheduled meetings a year and ad hoc emergency meetings that are held as required. The BoC primary mandate is to maintain price stability, which means keeping inflation at between 1-3%. Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Canadian Dollar (CAD) and vice versa. Other tools used include quantitative easing and tightening.

In extreme situations, the Bank of Canada can enact a policy tool called Quantitative Easing. QE is the process by which the BoC prints Canadian Dollars for the purpose of buying assets – usually government or corporate bonds – from financial institutions. QE usually results in a weaker CAD. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The Bank of Canada used the measure during the Great Financial Crisis of 2009-11 when credit froze after banks lost faith in each other’s ability to repay debts.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Bank of Canada purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the BoC stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Canadian Dollar.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.