- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/TRY climbs to all-time highs near 34.0000 post-CBRT

USD/TRY climbs to all-time highs near 34.0000 post-CBRT

- The Turkish currency sinks to record lows vs. the US Dollar.

- The CBRT left its One-Week Repo Rate unchanged at 50.00%.

- The central bank said it will maintain its restrictive stance.

The Turkish lira weakens further and sends USD/TRY to fresh all-time highs in levels shy of the 34.0000 barrier on Tuesday.

The CBRT kept rates unchanged, as expected

USD/TRY extended its uptrend for yet another session on Tuesday, marking its fifth daily gain in a row so far.

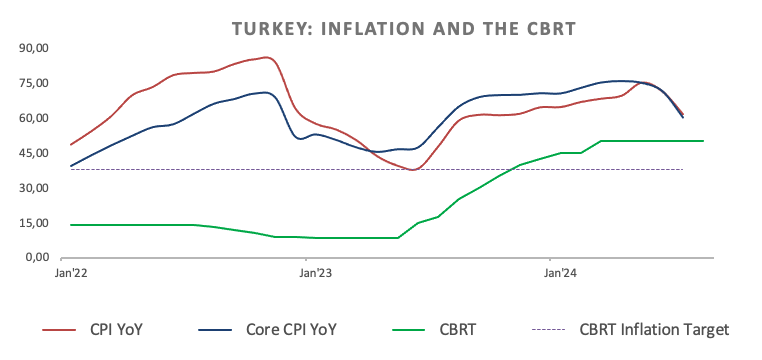

Extra losses in TRY accelerated after the Turkish central bank (CBRT) maintained its One-Week Repo Rate at 50.00% for the fifth month in a row at its meeting on Tuesday.

The bank indicated that the underlying trend of monthly inflation had edged up slightly in July but remained below its second-quarter average. It also reiterated its commitment to maintaining a tight monetary stance until it observes "a significant and sustained decline in the underlying trend of monthly inflation" and expectations align with the projected forecast range.

The statement also mentioned that the monetary policy stance would be tightened if a significant and persistent deterioration in inflation is anticipated.

It is worth mentioning that, since 2022, the pair only closed in negative territory in three months (November 2022, August 2023, and May 2024). During that period, the lira depreciated around 165% vs. the Greenback.

USD/TRY levels to watch

At the time of writing, USD/TRY is up by 0.49% to 33.8716 and faces the next barrier at the all-time peak of 33.8737 (August 20). On the downside, there is provisional support at the 55-day SMA of 32.9085, seconded by the weekly low of 32.7623 (July 26) and the July bottom of 32.4595 (July 3).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.