- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Pound Sterling hovers around monthly highs with UK-US PM, Jackson Hole in focus

Pound Sterling hovers around monthly highs with UK-US PM, Jackson Hole in focus

- The Pound Sterling rises to a fresh monthly high near 1.3000 against the US Dollar ahead of key economic data for both the UK and the US.

- Fed Chairman Powell may signal in Jackson Hole whether the central bank will cut interest rates by 25 or 50 basis points (bps) in September.

- BoE’s Governor Bailey could uncover uncertainty over subsequent interest-rate cuts.

The Pound Sterling (GBP) posts a fresh monthly high near the psychological resistance of 1.3000 against the US Dollar (USD) in Tuesday’s London session. The GBP/USD pair demonstrates sheer strength as the outlook of the US Dollar is bleak amid firm speculation that the Federal Reserve (Fed) will start reducing interest rates in September.

The US Dollar Index (DXY) – which tracks the Greenback’s value against six major currencies – edges higher to near 102.00, but it remains close to a fresh more-than-seven-month low.

Sluggishness in the United States (US) economic data of July suggested that the economy is not overheated anymore. The labor market has cooled down, and inflationary pressures remain on track to return to the desired rate of 2%.

This week, the major triggers for the US Dollar will be the release of the Federal Open Market Committee (FOMC) minutes and Fed Chair Jerome Powell’s commentary at the Jackson Hole (JH) Symposium, which are scheduled for Wednesday and August 22-24, respectively. Investors will look through the FOMC minutes and the JH Symposium to know whether the Fed will pivot to policy normalization aggressively or gradually.

A Reuters poll carried out between August 14 and 19 shows that 54% of the respondents think that the Fed will cut interest rates in each of its remaining meetings this year.

On the economic data front, investors await the US preliminary S&P Global PMI data for August, which will be published on Thursday. The flash Composite PMI is estimated to come in at 53.7, down from the prior release of 54.3, suggesting that the economy expanded at a slower pace.

Daily digest market movers: Pound Sterling gains on expectations of BoE’s gradual rate-cut approach

- The Pound Sterling exhibits a strong performance against its major peers in the European trading hours on Tuesday. The British currency trades firm on expectations that the policy-easing cycle from the Bank of England (BoE) will be slower than that of other central banks.

- Despite a sharp slowdown in price pressures in the UK’s service sector, a closely watched inflation gauge by BoE policymakers, the drop is still insufficient to compel officials to cut interest rates aggressively. Services inflation decelerated to 5.2% in July from 5.7% in June. However, easing services inflation has opened doors for BoE sequential interest rate cuts. Currently, markets have attached a 37% probability of such action, Reuters reported.

- For meaningful cues on the interest-rate path, investors will focus on the BoE Governor Andrew Bailey’s speech at the JH Symposium on Friday. Investors will keenly focus on what he says about the wage growth outlook and how far inflationary pressures could increase if they reaccelerate.

- Before Bailey’s speech, investors will look at the UK preliminary S&P PMI data for August, which will be published on Thursday. Economists expect the flash Manufacturing PMI to steady at 52.1, while activity in the service sector is seen improving to 52.8 from the prior release of 52.5.

Technical Analysis: Pound Sterling aims to surpass 1.3000

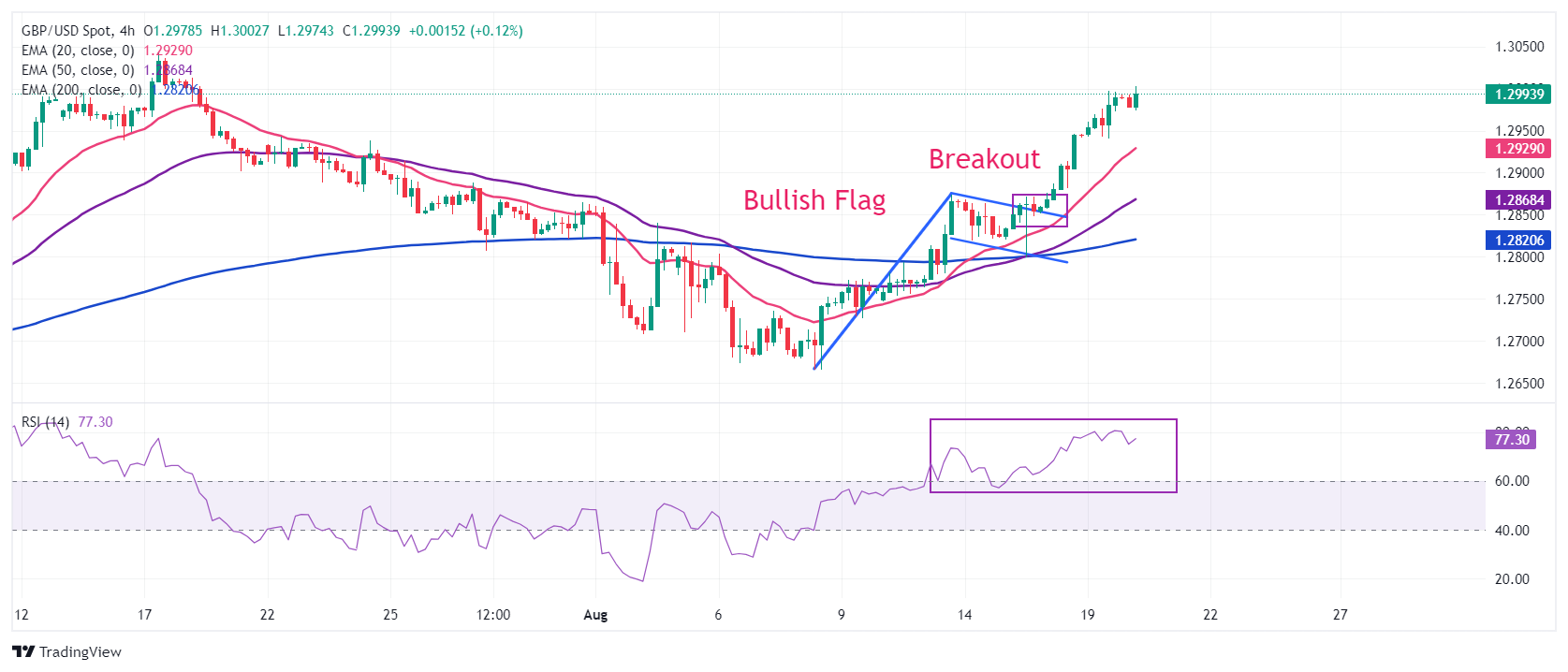

The Pound Sterling continues its winning spell for the fourth trading session on Thursday. The GBP/USD pair gains to near 1.3000 after a Bullish Flag breakout in the 4-hour timeframe. The Bullish Flag formation is characterized by lower volume in which inventory is transferred from retail participants to institutional investors. A decisive breakout of the Flag pattern results in the continuation of the ongoing trend, which in this case is up.

All short-to-long term Exponential Moving Averages (EMAs) are sloping higher, suggesting the uptrend is well supported.

The 14-period Relative Strength Index (RSI) oscillates in the bullish range of 60.00-80.00, suggesting a strong upside momentum.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.