- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/USD Price Analysis: Drops to two-week low, bears await break below 38.2% Fibo. level

GBP/USD Price Analysis: Drops to two-week low, bears await break below 38.2% Fibo. level

- GBP/USD remains under some selling pressure for the second straight day on Wednesday.

- A combination of factors lends support to the USD and drags spot prices to a two-week low.

- The technical setup warrants caution for bears and before positioning for additional losses.

The GBP/USD pair drifts lower for the second successive day – also marking the fourth day of a negative move in the previous five – and drops to a nearly two-week low during the Asian session on Wednesday. Spot prices currently trade just below the 1.2900 mark, down 0.15% for the day amid a modest US Dollar (USD), though any meaningful depreciating move seems elusive.

In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, climbed to a two-week high amid an uptick in the US Treasury bond yields. Apart from this, a softer risk tone further benefits the safe-haven buck, though bets for an imminent start of the Federal Reserve's (Fed) rate-cutting cycle in September cap gains. Apart from this, diminishing odds of an August rate cut by the Bank of England (BoE) should act as a tailwind for the British Pound (GBP) and the GBP/USD pair ahead of flash PMIs.

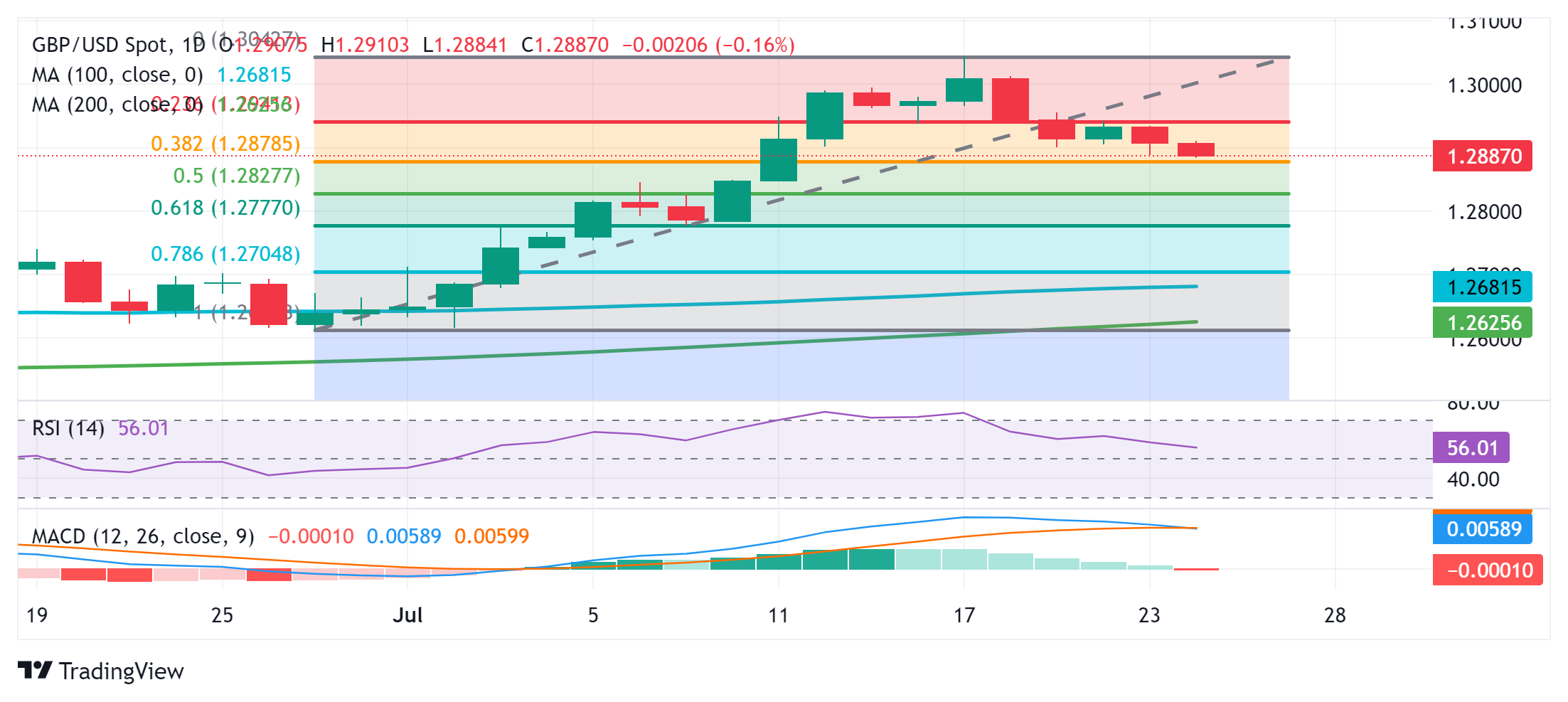

From a technical perspective, spot prices currently trade just above the 38.2% Fibonacci retracement level of the recent rally from the June monthly swing low. The said support is pegged near the 1.2880 region, below which a fresh bout of selling could drag the GBP/USD pair to the 1.2830-1.2835 area, or the 50% Fibo. level. The next relevant support is seen near the 1.2800 mark ahead of the 61.8% Fibo. level, around the 1.2780-1.2775 region. A convincing break below will be seen as a fresh trigger for bears and pave the way for deeper losses.

On the flip side, any positive beyond the 1.2900 mark is likely to attract fresh buyers and remain capped near the 1.2930-1.2940 resistance or the 23.6% Fibo. level support breakpoint. Some follow-through buying will suggest that the recent corrective slide has run its course and shift the bias back in favor of bulls. Given that oscillators on the daily chart are still holding in positive territory, the GBP/USD pair might then aim back to reclaim the 1.3000 psychological mark and retest the 1.3045 region, or the one-year peak touched last week.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.