- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD reclaims 1.0900 as Greenback plummets on rising Fed rate cut hopes

EUR/USD reclaims 1.0900 as Greenback plummets on rising Fed rate cut hopes

- EUR/USD climbed into a five-week peak amid broad-market Greenback selling.

- US PPI inflation rose faster than expected in June, but investors pin hopes on rate cuts.

- ECB rate cut looms ahead next week, US Retail Sales due next Tuesday.

Broad-market hopes for an accelerated pace of rate cuts from the US Federal Reserve (Fed) reached a fever pitch on Friday despite a notable upswing in US Producer Price Index (PPI) wholesale inflation. The Fiber extended into a third straight week of gains as investor risk appetite gets pinned to the ceiling.

Forecasting the Coming Week: Fed rate cut bets and the ECB should rule the sentiment

June’s core Producer Price Index (PPI) for wholesale inflation in the US rose to 3.0% YoY, surpassing the expected 2.5%. The previous period's figure was adjusted upward to 2.6% from the initial 2.3%. Despite the notable increase in producer-level inflation, market focus has shifted to the earlier decrease in Consumer Price Index (CPI) inflation, raising expectations for a rate cut.

The CME's FedWatch tool indicates a significant likelihood of a quarter-point rate cut at the Federal Open Market Committee's (FOMC) meeting on September 18. Rate traders are currently factoring in at least three rate cuts by 2024, more than the one or two cuts projected by the Fed by December.

Economic Indicator

Producer Price Index ex Food & Energy (YoY)

The Producer Price Index ex Food & energy released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Those volatile products such as food and energy are excluded in order to capture an accurate calculation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.Last release: Fri Jul 12, 2024 12:30

Frequency: Monthly

Actual: 3%

Consensus: 2.5%

Previous: 2.3%

Source: US Bureau of Labor Statistics

In other US economic data released on Friday, the University of Michigan's Consumer Sentiment Index survey dropped to a seven-month low of 66.0, falling short of the expected increase to 68.5. This reflects increasing discouragement among US consumers about the economic outlook. Additionally, the University of Michigan's 5-year Consumer Inflation Expectations decreased slightly in July to 2.9% from the previous 3.0%. Long-term consumer inflation expectations remain significantly higher than the Fed's target annual inflation rate of 2.0%

US Retail Sales figures are on the docket for next Tuesday, and Euro traders will be buckling down for the wait to next week’s latest rate call from the European Central Bank (ECB), slated for early next Thursday. The ECB recently delivered a quarter-point rate trim in early June, but odds of a follow-up cut are looking unlikely, and markets are broadly forecasting a cautious hold in July.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.62% | -1.35% | -1.74% | -0.07% | -0.50% | 0.31% | -0.19% | |

| EUR | 0.62% | -0.53% | -0.81% | 0.89% | 0.28% | 1.30% | 0.77% | |

| GBP | 1.35% | 0.53% | -0.33% | 1.44% | 0.81% | 1.79% | 1.30% | |

| JPY | 1.74% | 0.81% | 0.33% | 1.71% | 1.29% | 2.26% | 1.64% | |

| CAD | 0.07% | -0.89% | -1.44% | -1.71% | -0.46% | 0.37% | -0.08% | |

| AUD | 0.50% | -0.28% | -0.81% | -1.29% | 0.46% | 0.98% | 0.49% | |

| NZD | -0.31% | -1.30% | -1.79% | -2.26% | -0.37% | -0.98% | -0.48% | |

| CHF | 0.19% | -0.77% | -1.30% | -1.64% | 0.08% | -0.49% | 0.48% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

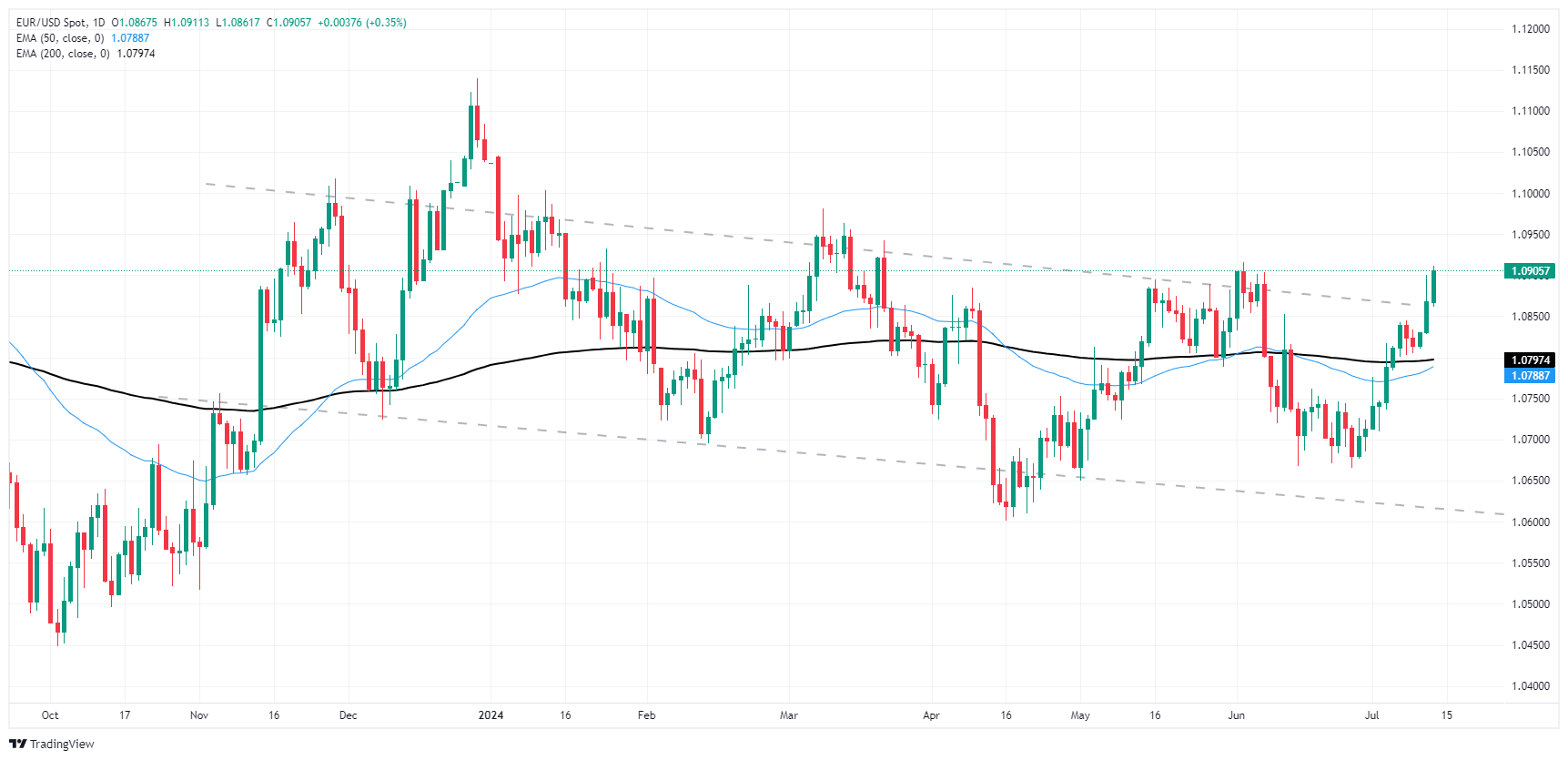

EUR/USD technical outlook

EUR/USD has chalked in a third straight week of gains, closing Friday a hair above the 1.0900 handle. The pair has risen 2.3% from late June’s swing low into 1.0666, and intraday price action is poised for a clash with technical resistance from June’s early peaks near 1.0920.

Fiber broken out of the topside of a rough descending channel on daily candlesticks. Despite closing in the green for all but two of the last twelve consecutive trading days, bullish momentum is poised to run out of gas and could see a bearish pullback to the 200-day Exponential Moving Average (EMA) at 1.0797.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.