- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- US Treasury yields plummet as inflation surprises, Fed dovish bets grow

US Treasury yields plummet as inflation surprises, Fed dovish bets grow

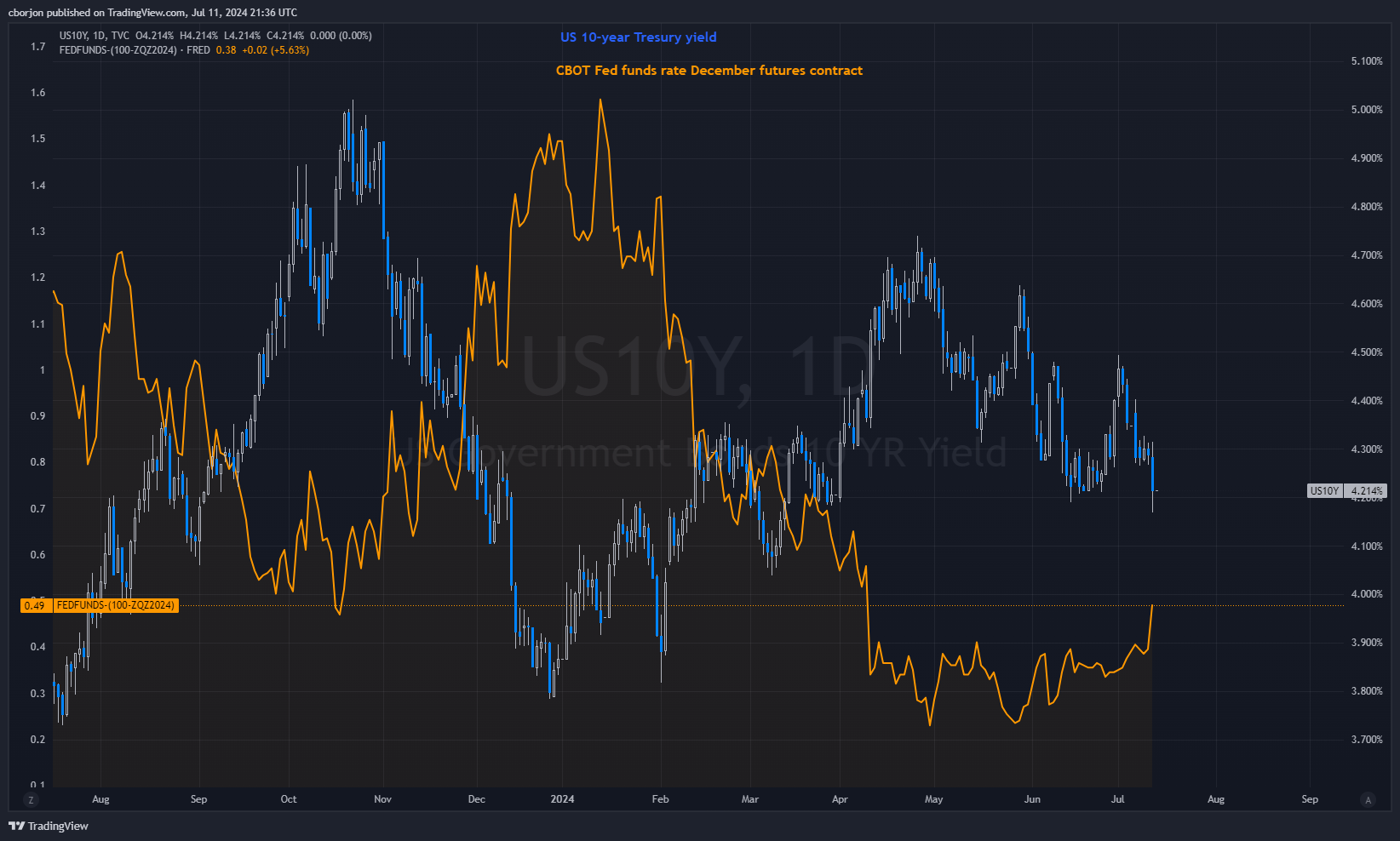

- US 10-year Treasury yield drops to 4.214% following unexpected -0.1% MoM contraction in June CPI.

- Core CPI increases by just 0.1% MoM, bolstering predictions for Fed rate cuts beginning September 2024.

- Gold exceeds $2,400 and Silver ascends past $31.00 as traders forecast 49 bps of easing by December 2024.

US Treasury bond yields tanked on Thursday after the US Bureau of Labor Statistics (BLS) revealed a surprise fall in inflation before Wall Street opened. This reinforced speculation that the Federal Reserve could start lowering interest rates in 2024, and according to data, traders target September as the first cut.

US CPI drop boosts Gold and Silver prices amid strengthening rate cut bets

The Consumer Price Index (CPI) for June contracted by -0.1% Month over Month, below estimates of a 0.1% increase. Underlying inflation, as measured by Core CPI, rose by 0.1% Month over Month, also beneath the consensus and May’s data.

Annual readings were also lower, as CPI fell from 3.3% to 3%, while core inflation dipped from 3.4% to 3.3%.

Other data showed the labor market remains robust as Initial Jobless Claims for the week ending July 6 came in better than expected at 222K, below the consensus of 236K and the previous reading of 239K. This highlights the labor market's strength, though data released during the day reaffirmed a Goldilocks scenario.

After the data, the odds of a September Fed rate cut have increased to 84%, up from 72% on Wednesday, via the CME FedWatch Tool,

The US 10-year Treasury bond yield plunged seven and a half basis points to 4.214%, though it hit its lowest level since March earlier at 4.168%. This pushed Gold prices above $2,400 and Silver above $31.00 a troy ounce, each.

Data from the Chicago Board of Trade (CBOT) shows that traders expect 49 basis points (bps) of easing, according to December’s 2024 fed funds rate futures contract.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.