- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/JPY Price Analysis: Rises steadily as buyers eye crucial 162.00 mark

USD/JPY Price Analysis: Rises steadily as buyers eye crucial 162.00 mark

- USD/JPY climbs 0.14%, rebounding from a low of 160.77.

- Resistance levels: 161.95 (July 3 high), 162.00, 164.87 (Nov 1986 high).

- Support levels: 161.00, 160.35 (Tenkan-Sen), 159.30 (Senkou Span A), 158.25 (Kijun-Sen).

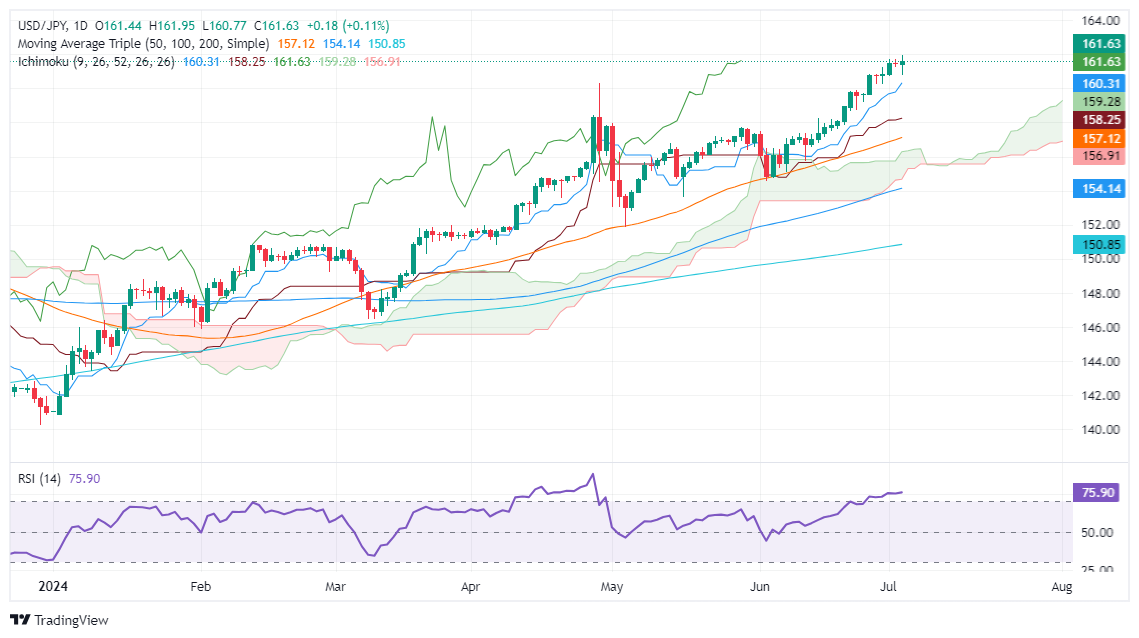

The USD/JPY pair finished Wednesday's session with minuscule gains of 0.14% after dipping to a daily low of 160.77, sponsored by traders increasing bets that the Federal Reserve might cut rates in 2024, following dismal data revealed during the day. At the time of writing, the major trades at 161.62.

USD/JPY Price Analysis: Technical outlook

The uptrend remains intact in the USD/JPY pair amid increasing risks that Japanese authorities or the Bank of Japan could intervene in the FX markets. The major continues to advance steadily and trades at multi-year highs, with buyers eyeing a test of the 162.00 psychological level.

Momentum remains on the buyers' side, as depicted by the Relative Strength Index (RSI), which has turned overbought, but it doesn’t show signs of aiming lower. That said, the path of least resistance is skewed to the upside.

Resistance lies at the July 3 high of 161.95. Once cleared, the next stop would be 162.00, ahead of the challenging November 1986 high of 164.87. On further USD/JPY weakness, the first support would be 161.00, immediately followed by the Tenkan-Sen at 160.35. A breach of the latter can exacerbate a pullback toward the Senkou Span A at 159.30, followed by the Kijun-Sen at 158.25.

USD/JPY Price Action – Daily Chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.