- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP price action after UK election likely to be asymmetric - ING

GBP price action after UK election likely to be asymmetric - ING

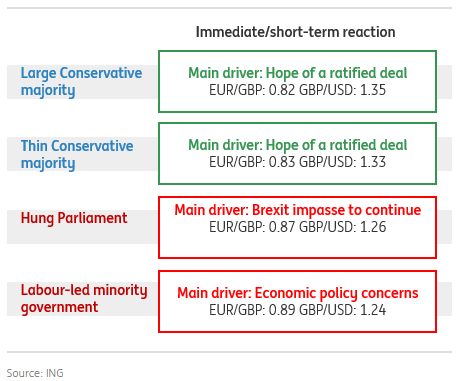

Analysts at ING suggest that GBP price action after the election will be asymmetric; less pronounced gains on a market-friendly outcome vs more meaningful losses on a non-market friendly outcome.

- "A large Conservative party majority would be perceived as an expected market-friendly outcome and lead to additional sterling gains. A Conservative Party majority of say 30-40 plus would be more positive as it would reduce potential uncertainty around a possible extent of the transition period. EUR/GBP to reach 0.82 and GBP/USD 1.35.

- A smaller Conservative majority would initially lead to GBP gains, too (to 0.83), yet the scale of GBP strength is likely to be marginally more limited. While the Withdrawal Agreement would very likely be passed by the end-January 2020, the question of a hard Brexit might return around mid-year if eurosceptics in the European Research Group oppose an extension to the transition period beyond the end of 2020 (which would, in turn, suggest there is no Conservative Party majority for an extension). Still, as this is an issue for 2020, it is unlikely to prevent initial GBP gains.

- A hung parliament would lead to a full pricing out of the GBP Brexit resolution premium (which is currently worth more than 2% based on our estimates), a rebuilding of sterling speculative shorts and GBP/USD likely dropping to 1.26 (and EUR/GBP rising 0.8700 this week).

- An outcome consistent with a fragile Labour-led minority government would, in our view, be the most negative of the most probable election outcomes. This reflects (a) the market not pricing such a scenario; (b) initial market concerns about nationalization and fiscal concerns (i.e. a material rise in borrowing needs as implied by the Labour manifesto). While the prospects of a second referendum could eventually help to stabilize GBP (as well as lower the probability that Labour policies would be introduced in full under a minority Labour-led government) the initial reaction would likely be GBP negative."

Scenario analysis for GBP post-election price action

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.