Novosti centralne banke Kanade

Novosti banaka

-

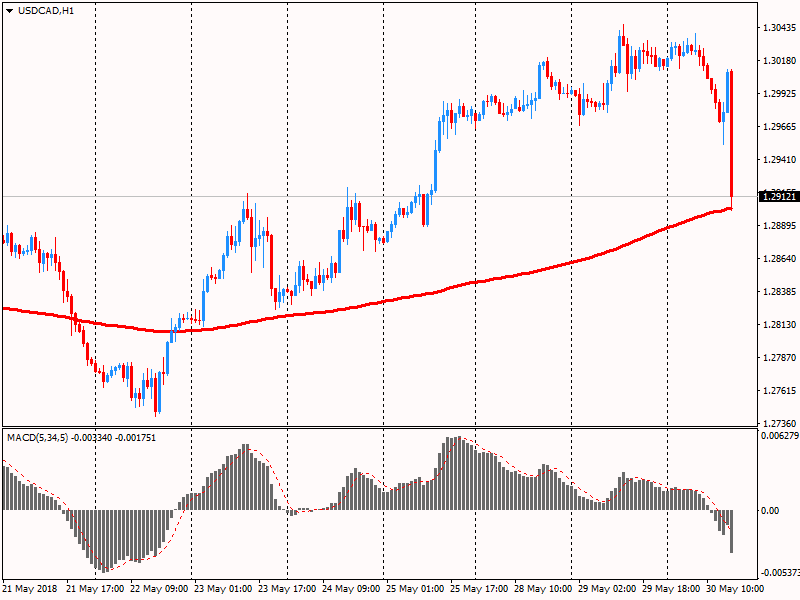

30 мај 2018, 14:12The Canadian dollar rose sharply against the US dollar after the Bank of Canada signaled higher interest rates. USD / CAD lost about 130 points, having updated three-day lows, and is currently trading at C $ 1.2890

-

30 мај 2018, 14:09BoC: higher interest rates will be warranted to keep inflation near target

-

Canada Q1 economic activity 'a little stronger' than projected

-

Core measures of inflation near 2%, reflect economy close to potential

-

Data suggest some upside to U.S. economic outlook

-

Trade policy uncertainty dampening global investment

-

Stresses developing in some emerging market economies

-

Will continue to assess economy's sensitivity to rate rises

-

Recent data supports BoC's outlook for 2% growth in H1

-

-

30 мај 2018, 14:02The Bank of Canada today maintained its target for the overnight rate at 1¼ per cent

"The Bank of Canada today maintained its target for the overnight rate at 1¼ per cent. The Bank Rate is correspondingly 1½ per cent and the deposit rate is 1 per cent.

Global economic activity remains broadly on track with the Bank's April Monetary Policy Report (MPR) forecast. Recent data point to some upside to the outlook for the US economy. At the same time, ongoing uncertainty about trade policies is dampening global business investment and stresses are developing in some emerging market economies. Global oil prices have been higher than assumed in April, in part reflecting geopolitical developments.

Inflation in Canada has been close to the 2 per cent target and will likely be a bit higher in the near term than forecast in April, largely because of recent increases in gasoline prices. Core measures of inflation remain near 2 per cent, consistent with an economy operating close to potential. As usual, the Bank will look through the transitory impact of fluctuations in gasoline prices.

In Canada, economic data since the April MPR have, on balance, supported the Bank's outlook for growth around 2 per cent in the first half of 2018. Activity in the first quarter appears to have been a little stronger than projected. Exports of goods were more robust than forecast, and data on imports of machinery and equipment suggest continued recovery in investment. Housing resale activity has remained soft into the second quarter, as the housing market continues to adjust to new mortgage guidelines and higher borrowing rates. Going forward, solid labour income growth supports the expectation that housing activity will pick up and consumption will continue to contribute importantly to growth in 2018".

-

25 мај 2016, 14:44Bank of Canada keeps its interest rate unchanged at 0.50% in May

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%, noting that the current monetary policy was still appropriate. This decision was expected by analysts.

The BoC noted that the Canadian economic growth in the first quarter was in line with the BoC's forecasts, adding that the growth in the second quarter would be weaker than previously expected due to wildfires in Alberta. According to the central bank, the economy was expected to rebound in the third quarter due to higher oil prices.

The central bank also said that business investment and intentions remained disappointing.

According to the central bank, inflation was evolving as anticipated by the BoC, and rose due to higher oil prices.

Risks around the inflation are roughly balanced, the central bank said.

The BoC added that household vulnerabilities increased.

-

9 мај 2016, 08:35Bank of Canada Deputy Governor Lawrence Schembri: central banks could contribute to the financial stability

The Bank of Canada (BoC) Deputy Governor Lawrence Schembri said in a speech on Friday that central banks could contribute to the financial stability.

"So although central banks don't themselves have a broad set of instruments to mitigate financial vulnerabilities, they do have that system-wide view, which they can and do use to promote financial stability by making public their analyses of financial vulnerabilities and risks and making recommendations for preventive policy actions," he said.

"At the same time that central banks are enhancing their efforts to promote financial stability, they must maintain their focus on monetary policy to achieve price and macroeconomic stability. These are necessary conditions for financial stability," Schembri added.

The BoC deputy governor noted that the central bank would introduce a framework for stress tests that would incorporate different sectors of the financial system.

-

26 април 2016, 15:04Bank of Canada Governor Stephen Poloz: the global economy is recovering

The Bank of Canada (BoC) Governor Stephen Poloz said in a speech on Tuesday that the global economy was recovering.

"The global economy can continue to recover, even if global trade growth remains lower than its pre-crisis levels," he said.

Poloz pointed out that a slowdown in the global trade did not signal a recession.

"The weakness in trade we've seen is not a warning of an impending recession. Rather, I see it as a sign that trade has reached a new balance point in the global economy," the BoC governor noted.

Regarding the central bank's monetary policy, Poloz said that the central bank would continue to work on building a positive economic environment for investors, firms and consumers.

-

19 април 2016, 15:46Bank of Canada Governor Stephen Poloz: the recent economic data was encouraging but also quite variable

The Bank of Canada (BoC) Governor Stephen Poloz said before the House of Commons Standing Committee on Finance on Tuesday that the recent economic data was encouraging but also quite variable.

He noted that there was no evidence of higher investment.

"We have not yet seen concrete evidence of higher investment and strong firm creation. These are some of the ingredients needed for a return to natural, self-sustaining growth with inflation sustainably on target," Poloz said.

The BoC governor also said that the Canadian economy was hit by a drop in oil prices.

-

13 април 2016, 14:53Bank of Canada keeps its interest rate unchanged at 0.50% in April

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%, noting that the current monetary policy was appropriate. This decision was expected by analysts.

The BoC upgraded its growth forecast for to 1.7% from 1.4%. The economy is expected to expand 2.3% in 2017 and 2.0% in 2018.

The BoC noted that the Canadian economic growth in the first quarter was unexpectedly strong due to temporary factors, adding that it will reverse in the second quarter.

The central bank also said that the labour market continued to improve, household spending continued to expand moderately, while business investment was shrinking.

According to the central bank, inflation was evolving as anticipated by the BoC, and was expected to decline further.

Risks around the inflation are roughly balanced, the central bank said.

The BoC added that financial vulnerabilities continued to edge higher.

-

4 април 2016, 08:23Bank of Canada’s Business Outlook Survey: business sentiment improves but remains subdued overall

The Bank of Canada (BoC) released its Spring Business Outlook Survey on Friday. The BoC's survey showed that business sentiment in Canada improved but remained subdued overall. The improvement of the sentiment was driven by foreign demand, according to the survey.

Expectations for future sales growth remained positive, supported by U.S. demand, the BoC said.

Investment and hiring intentions rose but remained modest, so BoC Business Outlook Survey.

-

31 март 2016, 08:42Bank of Canada Deputy Governor Lynn Patterson: the Canadian economy will need more than two years to recover

Bank of Canada (BoC) Deputy Governor Lynn Patterson said in a speech on Wednesday that the Canadian economy would need more than two years to recover from low commodity prices.

"Our best guess is that the full adjustment will take longer than two years, our normal forecast horizon," she said.

Patterson noted that households would likely restrain their spending and the consumption growth was expected to be lower due to lower real incomes.

-

9 март 2016, 15:13Bank of Canada keeps its interest rate unchanged at 0.50% in March

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%, noting that the current monetary policy was appropriate. This decision was expected by analysts.

The BoC said that financial market volatility seemed to dissipate, while the downside risks remained.

The BoC noted that the Canadian economic growth was better than expected in the fourth quarter. Employment improved, the central bank added.

According to the central bank, inflation was evolving broadly as anticipated.

Risks around the inflation are roughly balanced, the central bank said.

The BoC added that "vulnerabilities in the household sector continue to edge higher".

-

20 јануар 2016, 15:17Bank of Canada keeps its interest rate unchanged at 0.50% in January

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%, noting that the current monetary policy is appropriate. This decision was expected by analysts.

The BoC expects the Canadian economy to expand 1.4% in 2016 and 2.4% in 2017.

Inflation is expected to rise to about 2% by early 2017 once the effect of low oil prices will dissipate.

According to the central bank, low prices for oil and other commodities weighed on the Canadian economy.

The BoC noted that the Canadian labour market remains resilient.

Risks around the inflation are roughly balanced, the central bank said.

The BoC added that "vulnerabilities in the household sector continue to edge higher".

-

11 јануар 2016, 16:19Bank of Canada’s Business Outlook Survey: business sentiment deteriorated on low commodity prices

The Bank of Canada (BoC) released its Winter Business Outlook Survey today. The BoC's survey showed that business sentiment deteriorated on low commodity prices.

Exporters benefited from strong U.S. demand and the weak Canadian dollar, the BoC said.

Investment and hiring intentions dropped to their lowest levels since 2009, so BoC Business Outlook Survey.

Sve informacije koje nalaze na web sajtu imaju isključivo informativni karakter i nisu osnova za donošenje odluka o investiranju. Pročitajte naš kompletan dokument Upozorenje o rizicima .

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.

.gif)

.gif)