- Análisis

- Noticias y herramientas

- Noticias del mercado

Noticias de mercados

A continuación, lo que necesitas saber el jueves 20 de marzo:

El Dólar estadounidense (USD) encuentra dificultades para superar a sus rivales el jueves mientras los mercados digieren los anuncios de política de la Reserva Federal (Fed). El Banco de Inglaterra (BoE) publicará la decisión sobre la tasa de interés más tarde en la sesión y el calendario económico de EE.UU. incluirá los datos semanales de Solicitudes Iniciales de Subsidio por Desempleo, junto con las cifras de Viviendas Existentes para febrero.

Dólar estadounidense PRECIO Esta semana

La tabla inferior muestra el porcentaje de cambio del Dólar estadounidense (USD) frente a las principales monedas esta semana. Dólar estadounidense fue la divisa más débil frente al Franco suizo.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.06% | -0.31% | -0.19% | -0.24% | 0.23% | -0.39% | -0.91% | |

| EUR | 0.06% | -0.37% | -0.52% | -0.17% | 0.16% | -0.34% | -0.88% | |

| GBP | 0.31% | 0.37% | 0.15% | -0.01% | 0.51% | 0.02% | -0.58% | |

| JPY | 0.19% | 0.52% | -0.15% | -0.03% | 0.22% | -0.14% | -0.85% | |

| CAD | 0.24% | 0.17% | 0.01% | 0.03% | 0.27% | -0.15% | -1.22% | |

| AUD | -0.23% | -0.16% | -0.51% | -0.22% | -0.27% | -0.47% | -1.02% | |

| NZD | 0.39% | 0.34% | -0.02% | 0.14% | 0.15% | 0.47% | -0.54% | |

| CHF | 0.91% | 0.88% | 0.58% | 0.85% | 1.22% | 1.02% | 0.54% |

El mapa de calor muestra los cambios porcentuales de las principales monedas. La moneda base se selecciona desde la columna de la izquierda, mientras que la moneda de cotización se selecciona en la fila superior. Por ejemplo, si elige el Dólar estadounidense de la columna de la izquierda y se mueve a lo largo de la línea horizontal hasta el Yen japonés, el cambio porcentual que se muestra en el cuadro representará el USD (base)/JPY (cotización).

La Fed mantuvo la tasa de interés sin cambios en 4.25%-4.5% tras la reunión de marzo, como se anticipaba ampliamente. El Resumen de Proyecciones Económicas revisado mostró que los responsables de políticas aún proyectan una reducción total de 50 puntos básicos (bps) en las tasas en 2025. La previsión de crecimiento del Producto Interior Bruto (PIB) para este año se revisó a la baja a 1.7% desde el 2.1% en el SEP de diciembre. En la rueda de prensa posterior a la reunión, el presidente de la Fed, Powell, reiteró que no tendrán prisa por realizar recortes de tasas, añadiendo que pueden mantener la restricción de políticas por más tiempo si la economía se mantiene fuerte. El índice del USD no logró realizar un movimiento decisivo en ninguna dirección tras el evento de la Fed y cerró ligeramente al alza el miércoles. A primera hora del jueves, el índice se mueve lateralmente alrededor de 103.50.

La Oficina de Estadísticas Nacionales del Reino Unido informó el jueves que la Tasa de Desempleo de la OIT se mantuvo estable en 4.4% en los tres meses hasta enero, como se esperaba. En este período, el Cambio en el Empleo aumentó en 144.000. El GBP/USD cotiza ligeramente a la baja en el día por debajo de 1.3000 tras el informe de empleo del Reino Unido. Más tarde en el día, se anticipa ampliamente que el BoE mantenga sus configuraciones de política. No habrá rueda de prensa tras la publicación de la decisión sobre las tasas. Por lo tanto, es probable que los inversores presten mucha atención a la división de votos.

El Banco Nacional Suizo (SNB) también anunciará decisiones de política el jueves, y se espera que reduzca la tasa de política en 25 bps a 0.25%. Tras una caída de dos días, el USD/CHF encontró soporte y cerró prácticamente sin cambios el miércoles. El par fluctúa en un canal relativamente estrecho por encima de 0.8750 en la mañana europea.

El EUR/USD perdió alrededor del 0.4% el miércoles y rompió una racha de tres días de ganancias. El par lucha por ganar tracción y cotiza por debajo de 1.0900 al comenzar la sesión europea. La presidenta del Banco Central Europeo (BCE), Christine Lagarde, pronunciará un discurso ante el Parlamento Europeo el jueves.

Después de probar 150.00 el miércoles, el USD/JPY revirtió su dirección y terminó el día en rojo. El par continúa bajando y cotiza por debajo de 148.50 el jueves.

El Oro cerró ligeramente al alza el miércoles y tocó un nuevo máximo histórico por encima de 3.050$ en la sesión asiática del jueves antes de entrar en una fase de consolidación por debajo de este nivel.

BoE FAQs

El Banco de Inglaterra (BoE) decide la política monetaria del Reino Unido. Su principal objetivo es lograr la estabilidad de los precios, es decir, una tasa de inflación constante del 2%. Su instrumento para lograrlo es el ajuste de las tasas básicos de préstamo. El BoE fija el tipo al que presta a los bancos comerciales y al que los bancos se prestan entre sí, determinando el nivel de los tipos de interés en la economía en general. Esto también influye en el valor de la Libra esterlina (GBP).

Cuando la inflación supera el objetivo del Banco de Inglaterra, éste responde subiendo los tipos de interés, lo que encarece el acceso al crédito para los ciudadanos y las empresas. Esto es positivo para la Libra esterlina, ya que unos tipos de interés más altos hacen del Reino Unido un lugar más atractivo para que los inversores mundiales inviertan su dinero. Cuando la inflación cae por debajo del objetivo, es señal de que el crecimiento económico se está ralentizando, y el Banco de Inglaterra considerará la posibilidad de bajar los tipos de interés para abaratar el crédito con la esperanza de que las empresas pidan prestado para invertir en proyectos que generen crecimiento, lo que es negativo para la Libra esterlina.

En situaciones extremas, el Banco de Inglaterra puede aplicar una política denominada Quantitative Easing (QE). El QE es el proceso por el cual el BoE aumenta sustancialmente el flujo de crédito en un sistema financiero atascado. El QE es una política de último recurso cuando la bajada de los tipos de interés no logra el resultado necesario. El proceso de QE implica que el Banco de Inglaterra imprima dinero para comprar activos, normalmente bonos del Estado o bonos corporativos con calificación AAA, de bancos y otras instituciones financieras. El QE suele traducirse en un debilitamiento de la Libra esterlina.

El endurecimiento cuantitativo (QT) es el reverso del QE, y se aplica cuando la economía se está fortaleciendo y la inflación empieza a subir. Mientras que en el QE el Banco de Inglaterra (BoE) compra bonos del Estado y de empresas a las instituciones financieras para animarlas a conceder préstamos, en el QT el BoE deja de comprar más bonos y deja de reinvertir el principal que vence de los bonos que ya posee. Suele ser positivo para la Libra esterlina.

- El EUR/GBP cotiza en un tono más firme alrededor de 0.8390 en las primeras horas de la sesión europea del jueves.

- La tasa de desempleo del Reino Unido se mantuvo estable en el 4.4% en los tres meses hasta enero; el cambio en el número de solicitantes fue de 44.2K en febrero.

- Se espera que el BoE mantenga las tasas de interés en 4.5% el jueves.

- El parlamento alemán aprueba el histórico aumento del gasto de Merz.

El cruce EUR/GBP se mantiene en terreno positivo cerca de 0.8390 durante las primeras horas de negociación europea del jueves. La Libra esterlina (GBP) se debilita frente al Euro (EUR) tras el informe de empleo del Reino Unido. La atención se centrará en la decisión sobre la tasa de interés del Banco de Inglaterra (BoE), sin cambios en la tasa esperados.

Los datos publicados por la Oficina de Estadísticas Nacionales del Reino Unido el jueves mostraron que la tasa de desempleo de la OIT del país subió al 4.4% en los tres meses hasta enero. Esta cifra estuvo en línea con las expectativas del 4.4% durante el período informado. Mientras tanto, el cambio en el número de solicitantes aumentó en 44.200 en febrero frente a 2.800 anterior, por debajo de la cifra estimada de 7.900. La Libra se mantiene débil en una reacción inmediata al informe de empleo del Reino Unido.

Se espera que el BoE mantenga las tasas de interés sin cambios el jueves y se adhiera a su mantra de movimientos graduales en medio de la elevada incertidumbre económica. Los mercados anticipan que el banco central del Reino Unido mantendrá su tasa de interés de referencia en 4.5%, con el próximo recorte probablemente en mayo, seguido de más reducciones en agosto y noviembre, según la mayoría de los economistas encuestados por Reuters la semana pasada.

En el frente del Euro, el parlamento alemán aprobó planes para un masivo aumento del gasto el martes. Este desarrollo positivo podría proporcionar cierto apoyo a la moneda compartida, ya que el plan proporcionaría al canciller en espera un ingreso inesperado de cientos de miles de millones de euros para impulsar la inversión tras dos años de contracción en la economía más grande de Europa.

Libra esterlina FAQs

La Libra esterlina (GBP) es la moneda más antigua del mundo (886 d. C.) y la moneda oficial del Reino Unido. Es la cuarta unidad de cambio de divisas (FX) más comercializada en el mundo, representando el 12% de todas las transacciones, con un promedio de 630 mil millones de $ al día, según datos de 2022. Sus pares comerciales clave son GBP/USD, que representa el 11% de FX, GBP/JPY (3%) y EUR/GBP (2%). La Libra esterlina es emitida por el Banco de Inglaterra (BoE).

El factor más importante que influye en el valor de la Libra esterlina es la política monetaria decidida por el Banco de Inglaterra. El Banco de Inglaterra basa sus decisiones en si ha logrado su objetivo principal de "estabilidad de precios": una tasa de inflación constante de alrededor del 2%. Su principal herramienta para lograrlo es el ajuste de los tipos de interés. Cuando la inflación es demasiado alta, el Banco de Inglaterra intentará controlarla subiendo los tipos de interés, lo que encarece el acceso al crédito para las personas y las empresas. Esto es generalmente positivo para la libra esterlina, ya que los tipos de interés más altos hacen del Reino Unido un lugar más atractivo para que los inversores globales inviertan su dinero. Cuando la inflación cae demasiado es una señal de que el crecimiento económico se está desacelerando. En este escenario, el Banco de Inglaterra considerará bajar los tipos de interés para abaratar el crédito, de modo que las empresas se endeudarán más para invertir en proyectos que generen crecimiento.

Los datos publicados miden la salud de la economía y pueden afectar el valor de la libra esterlina. Indicadores como el PIB, los PMI de manufactura y servicios y el empleo pueden influir en la dirección de la Libra esterlina.

Otro dato importante que se publica y afecta a la Libra esterlina es la balanza comercial. Este indicador mide la diferencia entre lo que un país gana con sus exportaciones y lo que gasta en importaciones durante un período determinado. Si un país produce productos de exportación muy demandados, su moneda se beneficiará exclusivamente de la demanda adicional creada por los compradores extranjeros que buscan comprar esos bienes. Por lo tanto, una balanza comercial neta positiva fortalece una moneda y viceversa en el caso de un saldo negativo

- La tasa de desempleo del Reino Unido se mantiene en 4.4% en los tres meses hasta enero.

- El cambio en el número de solicitantes en Gran Bretaña fue de 44.2K en enero.

- El GBP/USD se mantiene por debajo de 1.3000 tras los datos mixtos de empleo en el Reino Unido.

La tasa de desempleo ILO del Reino Unido se mantuvo sin cambios en 4.4% en los tres meses hasta enero, según datos publicados por la Oficina de Estadísticas Nacionales (ONS) el jueves. El consenso del mercado era de una lectura del 4.4% en el período informado.

Detalles adicionales del informe mostraron que el número de personas que solicitaban beneficios por desempleo aumentó en 44,2K en febrero, en comparación con un aumento de 2,8K en enero, faltando a la cifra esperada de 7,9K.

Los datos de Cambio de Empleo para enero se situaron en 144.000 frente a los 107.000 de diciembre.

Mientras tanto, las Ganancias Medias, excluyendo Bonificaciones, en el Reino Unido aumentaron un 5.9% en tres meses interanuales (3M interanual) en enero, frente a un crecimiento del 5.9% registrado anteriormente. Los mercados esperaban un resultado del 5.9%.

Otra medida de la inflación salarial, las Ganancias Medias, incluyendo Bonificaciones, avanzó un 5.8% en el mismo periodo tras acelerar a un 6.1% revisado en el trimestre que finalizó en diciembre. Los datos superaron la previsión del mercado del 5.9%.

Reacción del GBP/USD al informe de empleo del Reino Unido

GBP/USD se mantiene a la baja tras la publicación de los datos de empleo del Reino Unido. El par cotiza un 0.02% a la baja en el día en 1.2985, al momento de escribir.

(Esta historia fue corregida el 20 de marzo a las 07:09 GMT para decir que "Detalles adicionales del informe mostraron que el número de personas que solicitaban beneficios por desempleo aumentó en 44,2K en febrero, en comparación con un aumento de 2,8K en enero," no 22K)

Libra esterlina PRECIO Últimos 7 días

La tabla inferior muestra el porcentaje de cambio del Libra esterlina (GBP) frente a las principales monedas últimos 7 días. Libra esterlina fue la divisa más fuerte frente al Yen japonés.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.02% | -0.16% | 0.04% | -0.18% | -0.06% | -0.81% | -0.62% | |

| EUR | 0.02% | -0.14% | 0.06% | -0.17% | -0.04% | -0.77% | -0.60% | |

| GBP | 0.16% | 0.14% | 0.19% | -0.03% | 0.11% | -0.63% | -0.45% | |

| JPY | -0.04% | -0.06% | -0.19% | -0.26% | -0.11% | -0.86% | -0.65% | |

| CAD | 0.18% | 0.17% | 0.03% | 0.26% | 0.14% | -0.61% | -0.43% | |

| AUD | 0.06% | 0.04% | -0.11% | 0.11% | -0.14% | -0.73% | -0.50% | |

| NZD | 0.81% | 0.77% | 0.63% | 0.86% | 0.61% | 0.73% | 0.22% | |

| CHF | 0.62% | 0.60% | 0.45% | 0.65% | 0.43% | 0.50% | -0.22% |

El mapa de calor muestra los cambios porcentuales de las principales monedas. La moneda base se selecciona desde la columna de la izquierda, mientras que la moneda de cotización se selecciona en la fila superior. Por ejemplo, si elige el Libra esterlina de la columna de la izquierda y se mueve a lo largo de la línea horizontal hasta el Dólar estadounidense, el cambio porcentual que se muestra en el cuadro representará el GBP (base)/USD (cotización).

- Se espera que el Banco de Inglaterra mantenga su tasa de interés en 4.50%.

- Las cifras de inflación del Reino Unido se mantienen muy por encima del objetivo del BoE.

- El GBP/USD extiende su rally más allá de la barrera psicológica de 1.3000.

El Banco de Inglaterra (BoE) está listo para revelar su decisión de política monetaria el jueves, marcando la segunda reunión de 2025.

Las expectativas son altas entre los observadores del mercado de que el banco central mantendrá su tasa de referencia en 4.50%, tras una reducción de 25 puntos básicos el mes anterior.

Junto con la decisión, el BoE publicará las actas de la reunión, y el gobernador Andrew Bailey llevará a cabo una conferencia de prensa para aclarar los motivos detrás de la medida.

A menos que haya sorpresas en la decisión sobre la tasa de interés, todas las miradas se centrarán en la orientación futura del banco y en las perspectivas económicas.

Perspectivas económicas del Reino Unido: Inflación obstinada, crecimiento en declive

El Banco de Inglaterra (BoE) cumplió con las expectativas en febrero, realizando un recorte de tasas de línea dura respaldado unánimemente por los nueve miembros del Comité de Política Monetaria (MPC).

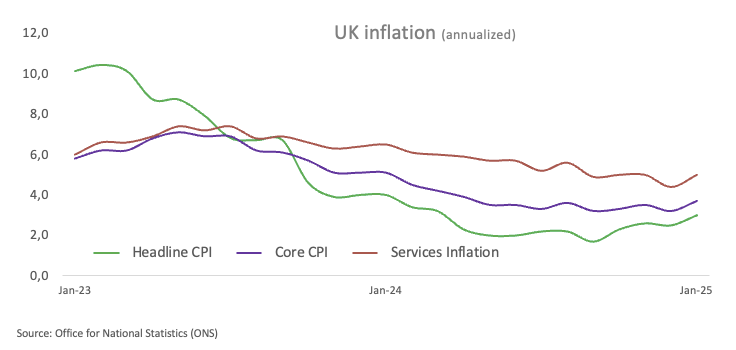

Mientras tanto, nuevos datos de la Oficina Nacional de Estadísticas (ONS) revelaron un aumento inesperado en la inflación general anual del Reino Unido, que subió al 3.0% en enero desde el 2.5% en diciembre. La inflación subyacente, que excluye los costos de alimentos y energía, también aumentó, alcanzando el 3.7% en los últimos 12 meses.

Además, las cifras de crecimiento pintaron un cuadro menos optimista. El Producto Interior Bruto (PIB) del Reino Unido se contrajo inesperadamente un 0.1% en enero. Además, los datos negativos de Producción Industrial y Manufacturera también contribuyeron a la imagen sombría, mientras que el PMI de Manufactura de S&P Global se mantuvo estancado en territorio de contracción durante el mismo mes.

Tras estas cifras desalentadoras, el mercado de swaps ahora prevé alrededor de 56 puntos básicos de alivio por parte del BoE hasta fin de año.

En la última reunión de política monetaria del BoE, el gobernador Andrew Bailey explicó que la incertidumbre económica global desempeñó un papel clave en la decisión de añadir la palabra "cuidadoso" a la orientación futura sobre las tasas de interés del banco.

En una conferencia de prensa, comentó que esta incertidumbre era "bidireccional", sugiriendo que podría obstaculizar el proceso de desinflación o, por el contrario, acelerarlo.

"Podría llevar a condiciones que, de hecho, hagan que el camino de la desinflación sea menos seguro", señaló Bailey, antes de añadir que "francamente también podría... llevar a condiciones que tengan el efecto opuesto y lleven a un camino más rápido para la desinflación".

¿Cómo impactará la decisión de tasas de interés del BoE al GBP/USD?

Como se mencionó anteriormente, los inversores anticipan ampliamente que el BoE mantendrá su tasa de interés sin cambios el jueves a las 12:00 GMT.

Con eso en mente, es probable que la Libra esterlina (GBP) se mantenga estable ante la decisión, pero podría mostrar alguna reacción a cómo votan los fijadores de tasas. Los inversores también prestarán especial atención a los comentarios del gobernador Andrew Bailey.

Antes del evento, el GBP/USD logró superar, aunque brevemente, la barrera psicológica de 1.3000, con el par siguiendo de cerca la dinámica del USD así como los desarrollos en la narrativa de tarifas de EE.UU.

Pablo Piovano, analista senior de FXStreet, señaló que el GBP/USD logró romper por encima del crítico obstáculo de 1.3000 a principios de la semana, enfrentando desde entonces cierta presión a la baja renovada.

"Una vez que Cable supere su máximo de 2025 de 1.3009 (establecido el 18 de marzo), podría embarcarse en una posible visita al máximo de noviembre de 2024 en 1.3047", añadió Piovano.

"A la baja, la SMA de 200 días en 1.2795 sirve como la red de seguridad inicial, respaldada por la transitoria SMA de 100 días en 1.2621 y el mínimo semanal de 1.2558 (28 de febrero). Si la presión de venta se acelera, el par podría caer hacia la SMA de 55 días en 1.2552, seguida de un soporte más profundo en el mínimo de febrero de 1.2248 (3 de febrero) y el mínimo de 2025 en 1.2099 (13 de enero)", concluyó Piovano.

Indicador económico

Decisión de tipos de interés del BoE

El Banco de Inglaterra fija la tasa de interés interbancaria. Esta tasa de interés afecta a un rango de tipos de interés fijados por los bancos comerciales, sociedades de construcción y otras instituciones hacia sus propios ahorradores y prestatarios. También tiende a afectar el precio de activos financieros, tales como bonos, acciones y los tipos de cambio, los cuales afectan al consumidor y a la demanda de negocios en una variedad de formas.

Leer más.Próxima publicación: jue mar 20, 2025 12:00

Frecuencia: Irregular

Estimado: 4.5%

Previo: 4.5%

Fuente: Bank of England

Rendimientos de bonos del estado de Reino Unido FAQs

Los rendimientos de los bonos del estado británicos miden la rentabilidad anual que puede esperar un inversor de sus bonos o Gilts. Al igual que otros bonos, los Gilts pagan intereses a sus tenedores a intervalos regulares, el "cupón", seguido del valor total del bono al vencimiento. El cupón es fijo, pero el rendimiento varía, ya que tiene en cuenta los cambios en el precio del bono. Por ejemplo, un Gilt con un valor de 100 libras esterlinas podría tener un cupón del 5,0%. Si el precio del Gilt cayera a 98 libras, el cupón seguiría siendo del 5,0%, pero el rendimiento del Gilt aumentaría al 5,102% para reflejar la caída del precio.

Muchos factores influyen en los rendimientos de los bonos del estado, pero los principales son los tipos de interés, la solidez de la economía británica, la liquidez del mercado de bonos y el valor de la Libra esterlina. El aumento de la inflación generalmente debilitará los precios de los bonos del estado y conducirá a mayores rendimientos de los mismos porque los bonos son inversiones a largo plazo susceptibles a la inflación, que erosiona su valor. Los tipos de interés más altos afectan los rendimientos de los bonos del estado existentes porque los nuevos bonos del estado tendrán un cupón más alto y atractivo. La liquidez puede ser un riesgo cuando hay una falta de compradores o vendedores debido al pánico o la preferencia por activos más riesgosos.

Probablemente el factor más importante que influye en el nivel de los rendimientos de los bonos del estado son los tipos de interés, que fija el Banco de Inglaterra para garantizar la estabilidad de los precios. Unos tipos de interés más altos aumentarán los rendimientos y reducirán el precio de los bonos, porque los nuevos bonos del estado emitidos tendrán un cupón más alto y más atractivo, lo que reducirá la demanda de los bonos más antiguos, que experimentarán una correspondiente caída de precio.

La inflación es un factor clave que afecta los rendimientos de los títulos de deuda pública, ya que afecta el valor del capital que recibe el tenedor al final del plazo, así como el valor relativo de los reembolsos. Una mayor inflación deteriora el valor de los títulos de deuda pública con el tiempo, lo que se refleja en un mayor rendimiento (menor precio). Lo opuesto ocurre con una menor inflación. En casos excepcionales de deflación, un título de deuda pública puede subir de precio, lo que se representa por un rendimiento negativo.

Los tenedores extranjeros de Gilts están expuestos al riesgo cambiario, ya que los Gilts están denominados en libras esterlinas. Si la moneda se fortalece, los inversores obtendrán un mayor rendimiento y viceversa si se debilita. Además, los rendimientos de los Gilts están altamente correlacionados con la Libra esterlina. Esto se debe a que los rendimientos son un reflejo de las tasas de interés y las expectativas de tasas de interés, un factor clave de la Libra esterlina. Las tasas de interés más altas aumentan el cupón de los Gilts recién emitidos, atrayendo a más inversores globales. Dado que están cotizados en Libras esterlinas, esto aumenta la demanda de libras.

- El Índice del Dólar estadounidense recupera algo de terreno perdido y se acerca a 103.50 en la sesión europea temprana del jueves.

- El DXY mantiene la perspectiva negativa por debajo de la EMA de 100 días con un indicador RSI bajista.

- El primer objetivo a la baja a vigilar es 103.20; la barrera inmediata al alza se sitúa en 104.10.

El Índice del Dólar estadounidense (DXY), un índice del valor del Dólar estadounidense (USD) medido frente a una cesta de seis divisas mundiales, cotiza en territorio positivo cerca de 103.50 durante la sesión europea temprana del jueves.

Sin embargo, el potencial alcista del DXY podría estar limitado ya que la Reserva Federal (Fed) indicó que es probable que se produzcan recortes en las tasas de interés más adelante este año. Además, los funcionarios de la Fed redujeron su pronóstico de crecimiento económico y revisaron al alza tanto su proyección de inflación como sus estimaciones de desempleo.

Según el gráfico diario, la perspectiva bajista del DXY se mantiene intacta, con el índice sosteniéndose por debajo de la media móvil exponencial (EMA) clave de 100 días. Un mayor descenso parece favorable ya que el índice de fuerza relativa (RSI) de 14 días se sitúa por debajo de la línea media cerca de 31.75.

El nivel de soporte inicial para el índice USD se encuentra en 103.20, el mínimo del 18 de marzo. Un comercio sostenido por debajo del nivel mencionado podría exponer 101.88, el límite inferior de la Banda de Bollinger. Una ruptura de este nivel podría ver una caída a 100.53, el mínimo del 28 de agosto de 2024.

Por otro lado, el máximo del 14 de marzo en 104.10 actúa como un nivel de resistencia inmediata para el DXY. El filtro adicional al alza a vigilar es 105.45, el máximo del 6 de noviembre de 2024. La barrera clave al alza se sitúa en 106.00, representando la EMA de 100 días y el nivel psicológico.

Gráfico diario del Índice del Dólar (DXY)

Dólar estadounidense FAQs

El Dólar estadounidense (USD) es la moneda oficial de los Estados Unidos de América, y la moneda "de facto" de un número significativo de otros países donde se encuentra en circulación junto con los billetes locales. Según datos de 2022, es la divisa más negociada del mundo, con más del 88% de todas las operaciones mundiales de cambio de divisas, lo que equivale a una media de 6.6 billones de dólares en transacciones diarias. Tras la Segunda Guerra Mundial, el USD tomó el relevo de la libra esterlina como moneda de reserva mundial.

El factor individual más importante que influye en el valor del Dólar estadounidense es la política monetaria, que está determinada por la Reserva Federal (Fed). La Fed tiene dos mandatos: lograr la estabilidad de precios (controlar la inflación) y fomentar el pleno empleo. Su principal herramienta para lograr estos dos objetivos es ajustar las tasas de interés. Cuando los precios suben demasiado deprisa y la inflación supera el objetivo del 2% fijado por la Fed, ésta sube los tipos, lo que favorece la cotización del dólar. Cuando la Inflación cae por debajo del 2% o la tasa de desempleo es demasiado alta, la Fed puede bajar las tasas de interés, lo que pesa sobre el Dólar.

En situaciones extremas, la Reserva Federal también puede imprimir más dólares y promulgar la flexibilización cuantitativa (QE). La QE es el proceso mediante el cual la Fed aumenta sustancialmente el flujo de crédito en un sistema financiero atascado. Se trata de una medida de política no convencional que se utiliza cuando el crédito se ha agotado porque los bancos no se prestan entre sí (por miedo al impago de las contrapartes). Es el último recurso cuando es poco probable que una simple bajada de las tasas de interés logre el resultado necesario. Fue el arma elegida por la Fed para combatir la contracción del crédito que se produjo durante la Gran Crisis Financiera de 2008. Consiste en que la Fed imprima más dólares y los utilice para comprar bonos del gobierno estadounidense, principalmente de instituciones financieras. El QE suele conducir a un debilitamiento del Dólar estadounidense.

El endurecimiento cuantitativo (QT) es el proceso inverso por el que la Reserva Federal deja de comprar bonos a las instituciones financieras y no reinvierte el capital de los valores en cartera que vencen en nuevas compras. Suele ser positivo para el dólar estadounidense.

- El EUR/USD continúa cayendo antes del discurso de la presidenta del BCE, Christine Lagarde, en el Parlamento Europeo en Bruselas.

- El Dólar estadounidense luchó mientras los rendimientos de EE.UU. se debilitaron, tras la reafirmación de la Fed de su perspectiva de dos recortes de tasas en 2025.

- El plan económico propuesto por Alemania, destinado a estimular el crecimiento y aumentar el gasto en defensa, podría contribuir al aumento de la inflación y a una expansión económica más amplia.

El EUR/USD pierde terreno por segundo día consecutivo, cotizando alrededor de 1.0900 durante las horas asiáticas del jueves. Sin embargo, el par se fortaleció a medida que el Dólar estadounidense (USD) permaneció bajo presión, afectado por la caída de los rendimientos después de que la Reserva Federal (Fed) reafirmara su perspectiva de dos recortes de tasas más adelante este año. Sin embargo, la incertidumbre en torno a las políticas arancelarias del presidente estadounidense Donald Trump añade una capa de precaución.

Mientras tanto, los bonos del Tesoro de EE.UU. ganaron tracción tras la decisión de la Fed de ralentizar el ritmo de endurecimiento cuantitativo, citando preocupaciones sobre la reducción de la liquidez y los riesgos potenciales relacionados con los límites de la deuda gubernamental.

El Índice del Dólar estadounidense (DXY), que rastrea el USD frente a seis divisas principales, se mantiene cerca de 103.40, mientras que los rendimientos de los bonos del Tesoro de EE.UU. continúan cayendo. El rendimiento a 2 años se sitúa en 3.97%, y el rendimiento a 10 años en 4.24%.

El miércoles, como se esperaba, la Reserva Federal mantuvo la tasa de fondos federales sin cambios en 4.25%–4.5% durante su reunión de marzo. El presidente de la Fed, Jerome Powell, señaló: "Las condiciones del mercado laboral son sólidas, y la inflación se ha acercado a nuestro objetivo a largo plazo del 2%, aunque sigue siendo algo elevada."

En Europa, los líderes alemanes aprobaron un plan de reestructuración de la deuda propuesto por el probable canciller Friedrich Merz el martes. El plan tiene como objetivo estimular el crecimiento económico y aumentar el gasto en defensa. Los participantes del mercado anticipan que un cambio respecto al conservadurismo fiscal de larga data de Alemania podría impulsar la inflación y la expansión económica, lo que llevaría al Banco Central Europeo (BCE) a reevaluar su política monetaria actual.

Los operadores probablemente observarán a la presidenta del BCE, Christine Lagarde, el jueves, quien está programada para ofrecer una declaración introductoria sobre Asuntos Económicos y Monetarios (ECON) en el Parlamento Europeo en Bruselas, Bélgica.

Euro PRECIO Hoy

La tabla inferior muestra el porcentaje de cambio del Euro (EUR) frente a las principales monedas hoy. Euro fue la divisa más débil frente al Yen japonés.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.07% | 0.08% | -0.19% | 0.06% | 0.28% | 0.47% | -0.05% | |

| EUR | -0.07% | 0.00% | -0.24% | -0.01% | 0.20% | 0.40% | -0.12% | |

| GBP | -0.08% | -0.00% | -0.25% | -0.06% | 0.20% | 0.39% | -0.14% | |

| JPY | 0.19% | 0.24% | 0.25% | 0.24% | 0.46% | 0.63% | 0.18% | |

| CAD | -0.06% | 0.01% | 0.06% | -0.24% | 0.23% | 0.41% | -0.15% | |

| AUD | -0.28% | -0.20% | -0.20% | -0.46% | -0.23% | 0.20% | -0.35% | |

| NZD | -0.47% | -0.40% | -0.39% | -0.63% | -0.41% | -0.20% | -0.56% | |

| CHF | 0.05% | 0.12% | 0.14% | -0.18% | 0.15% | 0.35% | 0.56% |

El mapa de calor muestra los cambios porcentuales de las principales monedas. La moneda base se selecciona desde la columna de la izquierda, mientras que la moneda de cotización se selecciona en la fila superior. Por ejemplo, si elige el Euro de la columna de la izquierda y se mueve a lo largo de la línea horizontal hasta el Dólar estadounidense, el cambio porcentual que se muestra en el cuadro representará el EUR (base)/USD (cotización).

Las expiraciones de opciones FX para el 20 de marzo, corte en Nueva York a las 10:00 hora del Este a través de DTCC se pueden encontrar a continuación.

EUR/USD: montos en EUR

- 1.0800 1.6b

- 1.0860 834m

- 1.0875 1.6b

- 1.0900 2.7b

- 1.0910 1.5b

GBP/USD: montos en GBP

- 1.3000 452m

USD/JPY: montos en USD

- 150.00 813m

- 150.70 905m

USD/CHF: montos en USD

- 0.8800 419m

AUD/USD: montos en AUD

- 0.6400 1b

- 0.6405 639m

USD/CAD: montos en USD

- 1.4125 485m

- 1.4500 731m

NZD/USD: montos en NZD

- 0.5670 1.5b

EUR/GBP: montos en EUR

- 0.8400 655m

- El GBP/JPY amplía el retroceso del día anterior desde la proximidad de un máximo de más de dos meses.

- Las apuestas por una subida de tasas del BoJ y la búsqueda de seguridad apuntalan al JPY, ejerciendo cierta presión.

- Una configuración técnica mixta justifica la cautela de los alcistas antes de la decisión de política del BoE.

El cruce GBP/JPY atrae a vendedores por segundo día consecutivo el jueves y amplía la caída de esta semana desde la proximidad de la marca psicológica de 195.00, o un máximo de más de dos meses. Los precios al contado se debilitan aún más por debajo de la cifra redonda de 193.00 durante la sesión asiática y parecen vulnerables a caer más en medio de un Yen japonés (JPY) en general más fuerte.

Las expectativas de que un fuerte crecimiento salarial podría impulsar el gasto del consumidor y contribuir al aumento de la inflación dan al Banco de Japón (BoJ) margen para seguir subiendo las tasas de interés. Aparte de esto, la incertidumbre sobre las políticas comerciales del presidente estadounidense Donald Trump y los riesgos geopolíticos apuntalan al JPY como refugio seguro, lo que, a su vez, se observa ejerciendo presión sobre el cruce GBP/JPY. La Libra esterlina (GBP), por otro lado, lucha por ganar tracción mientras los operadores optan por esperar la decisión del Banco de Inglaterra (BoE).

Desde una perspectiva técnica, el precio al contado a principios de esta semana luchó por encontrar aceptación por encima de la muy importante media móvil simple (SMA) de 200 días y la posterior caída podría verse como un desencadenante clave para los operadores bajistas. Dicho esto, los osciladores en el gráfico diario aún se mantienen en territorio positivo. Además, la reciente ruptura a través de la resistencia horizontal de 192.50 justifica cierta cautela antes de posicionarse para cualquier movimiento de depreciación adicional de cara al riesgo del evento clave del banco central.

Mientras tanto, el mencionado punto de resistencia podría proteger el lado negativo inmediato, por debajo del cual el cruce GBP/JPY podría acelerar la caída hacia la marca de 192.00 en ruta hacia la zona de soporte de 191.35-191.30. Algunas ventas de continuación tienen el potencial de arrastrar los precios al contado por debajo de la cifra redonda de 191.00, hacia el siguiente soporte relevante cerca del área de 190.45-190.40 en ruta hacia la marca psicológica de 190.00 y la región de 189.70-189.65.

Por otro lado, cualquier movimiento positivo podría ahora enfrentar resistencia cerca de la marca de cifra redonda de 194.00 antes de la SMA de 200 días, actualmente situada alrededor de la región de 194.30. Esto es seguido por la región de 194.90, o un máximo de varios meses alcanzado a principios de esta semana, que si se supera de manera decisiva debería allanar el camino para ganancias adicionales. El cruce GBP/JPY podría entonces subir a la marca de 196.00 en ruta hacia la zona horizontal de 196.40 antes de intentar recuperar la cifra redonda de 197.00 por primera vez desde enero.

GBP/JPY gráfico diario

Indicador económico

Decisión de tipos de interés del BoE

El Banco de Inglaterra fija la tasa de interés interbancaria. Esta tasa de interés afecta a un rango de tipos de interés fijados por los bancos comerciales, sociedades de construcción y otras instituciones hacia sus propios ahorradores y prestatarios. También tiende a afectar el precio de activos financieros, tales como bonos, acciones y los tipos de cambio, los cuales afectan al consumidor y a la demanda de negocios en una variedad de formas.

Leer más.Próxima publicación: jue mar 20, 2025 12:00

Frecuencia: Irregular

Estimado: 4.5%

Previo: 4.5%

Fuente: Bank of England

- El USD/CHF se debilita a alrededor de 0.8760 en la sesión asiática del jueves.

- La Fed mantuvo su tasa de interés de referencia a un día en el rango del 4.25%-4.50%.

- Se espera que el SNB recorte las tasas en 25 puntos básicos en su reunión de marzo el jueves.

El par USD/CHF atrae a algunos vendedores cerca de 0.8760 durante las horas de negociación asiáticas del jueves. El Dólar se desliza a la baja después de que la Reserva Federal (Fed) indicó que es probable que se produzcan recortes de tasas de interés más adelante este año, a pesar del alto grado de incertidumbre en torno a las políticas arancelarias de EE.UU. Más tarde el jueves, la decisión sobre la tasa de interés del Banco Nacional Suizo (SNB) estará en el centro de atención.

El miércoles, la Fed mantuvo las tasas de interés sin cambios en un rango de 4.25% a 4.5% en su reunión de marzo, como se esperaba ampliamente. El banco central de EE.UU. señaló que recortará las tasas dos veces más este año, de acuerdo con su proyección anterior de diciembre.

Sin embargo, los funcionarios de la Fed redujeron su pronóstico de crecimiento económico y revisaron al alza tanto su proyección de inflación como sus estimaciones de desempleo. Esto, a su vez, pesa sobre el USD frente al Franco suizo (CHF). Los operadores ahora están descontando casi 66 puntos básicos (bps) de recortes de tasas este año por parte de la Fed, aproximadamente dos reducciones de 25 bps cada una, con un recorte en julio completamente descontado, según los datos de LSEG.

En el frente suizo, los mercados esperan que el SNB reduzca su tasa de interés de referencia en 25 bps hasta el 0.25% en su reunión de política el jueves. La decisión sigue a una reducción de 50 bps en diciembre y se produce en medio de una inflación contenida, un CHF fuerte y una perspectiva económica global incierta. No obstante, las preocupaciones sobre la fortaleza del CHF persisten, y el banco central suizo podría intentar aliviar esta presión recortando las tasas de interés y tal vez interviniendo en el mercado de divisas.

Franco suizo FAQs

El Franco suizo (CHF) es la moneda oficial de Suiza. Se encuentra entre las diez monedas más negociadas a nivel mundial, alcanzando volúmenes que superan con creces el tamaño de la economía suiza. Su valor está determinado por el sentimiento general del mercado, la salud económica del país o las medidas adoptadas por el Banco Nacional Suizo (SNB), entre otros factores. Entre 2011 y 2015, el Franco suizo estuvo vinculado al Euro (EUR). La vinculación se eliminó abruptamente, lo que resultó en un aumento de más del 20% en el valor del franco, lo que provocó una turbulencia en los mercados. Aunque la vinculación ya no está en vigor, la suerte del franco suizo tiende a estar altamente correlacionada con la del euro debido a la alta dependencia de la economía suiza de la vecina eurozona.

El Franco suizo (CHF) se considera un activo de refugio seguro, o una moneda que los inversores tienden a comprar en épocas de tensión en los mercados. Esto se debe a la percepción que se tiene de Suiza en el mundo: una economía estable, un sector exportador fuerte, grandes reservas del banco central o una postura política de larga data hacia la neutralidad en los conflictos globales hacen que la moneda del país sea una buena opción para los inversores que huyen de los riesgos. Es probable que los tiempos turbulentos fortalezcan el valor del CHF frente a otras monedas que se consideran más riesgosas para invertir.

El Banco Nacional Suizo (BNS) se reúne cuatro veces al año (una vez cada trimestre, menos que otros bancos centrales importantes) para decidir sobre la política monetaria. El banco aspira a una tasa de inflación anual inferior al 2%. Cuando la inflación supera el objetivo o se prevé que lo superará en el futuro previsible, el banco intentará controlar el crecimiento de los precios elevando su tipo de referencia. Los tipos de interés más altos suelen ser positivos para el Franco suizo (CHF), ya que conducen a mayores rendimientos, lo que hace que el país sea un lugar más atractivo para los inversores. Por el contrario, los tipos de interés más bajos tienden a debilitar el CHF.

Los datos macroeconómicos publicados en Suiza son fundamentales para evaluar el estado de la economía y pueden afectar la valoración del Franco suizo (CHF). La economía suiza es estable en términos generales, pero cualquier cambio repentino en el crecimiento económico, la inflación, la cuenta corriente o las reservas de divisas del banco central tienen el potencial de desencadenar movimientos en el CHF. En general, un alto crecimiento económico, un bajo desempleo y un alto nivel de confianza son buenos para el CHF. Por el contrario, si los datos económicos apuntan a un debilitamiento del impulso, es probable que el CHF se deprecie.

Como economía pequeña y abierta, Suiza depende en gran medida de la salud de las economías vecinas de la Eurozona. La Unión Europea en su conjunto es el principal socio económico de Suiza y un aliado político clave, por lo que la estabilidad de la política macroeconómica y monetaria en la eurozona es esencial para Suiza y, por ende, para el Franco suizo (CHF). Con tal dependencia, algunos modelos sugieren que la correlación entre la suerte del euro (EUR) y el Franco suizo es superior al 90%, o casi perfecta.

Los precios del Oro subieron en India el jueves, según datos recopilados por FXStreet.

El precio del Oro se situó en 8.472,91 rupias indias (INR) por gramo, un aumento en comparación con las 8.452,50 INR que costaba el miércoles.

El precio del Oro aumentó a 98.821,50 INR por tola desde los 98.588,26 INR por tola del día anterior.

| Unidad de medida | Precio del Oro en INR |

|---|---|

| 1 Gramo | 8.472,91 |

| 10 Gramos | 84.724,63 |

| Tola | 98.821,50 |

| Onza Troy | 263.538,00 |

Qué mueve el mercado hoy: El precio del oro sigue atrayendo flujos de refugio seguro en medio de nervios comerciales y riesgos geopolíticos

-

Los mercados de acciones asiáticos siguen las ganancias de la noche en Wall Street, impulsados por la decisión de la Reserva Federal de mantener las tasas de interés sin cambios y mantener su pronóstico de recortes de tasas para el año. Como se esperaba, el banco central de EE.UU. mantuvo las tasas de interés estables por segunda reunión consecutiva y señaló que entregaría dos recortes de 25 puntos básicos para finales de este año.

-

Además, el presidente de EE.UU., Donald Trump, y el presidente ruso, Vladimir Putin, acordaron el martes una pausa inmediata en los ataques contra la infraestructura energética en la guerra de Ucrania. Además, el presidente ucraniano, Volodymyr Zelenskiy, y Trump también acordaron trabajar juntos para poner fin a la prolongada guerra entre Rusia y Ucrania, lo que aumentó aún más la confianza de los inversores.

-

Mientras tanto, los funcionarios de la Fed recortaron su pronóstico de crecimiento para el año en medio de la creciente incertidumbre sobre el impacto de las agresivas políticas comerciales de la administración Trump en la actividad económica. Trump impuso un arancel del 25% sobre el acero y el aluminio desde febrero y ha amenazado con imponer aranceles recíprocos y sectoriales, alimentando preocupaciones sobre una guerra comercial global.

-

Los operadores ahora ven más de un 65% de probabilidad de que la Fed reanude su ciclo de recortes de tasas en la reunión de política de junio. Esto, a su vez, no ayuda al Dólar estadounidense a registrar ninguna recuperación significativa desde un mínimo de varios meses alcanzado a principios de esta semana y debería prestar cierto apoyo al precio del Oro sin rendimiento en medio del riesgo de una mayor escalada de tensiones en Oriente Medio.

-

El ejército israelí dijo que lanzó una incursión terrestre limitada en Gaza, un día después de un bombardeo aéreo de la franja que rompió el alto el fuego de dos meses con Hamás. Además, el primer ministro israelí, Benjamin Netanyahu, advirtió sobre una feroz expansión de la guerra, lo que debería seguir respaldando al metal precioso de refugio seguro y limitar cualquier deslizamiento correctivo.

-

Los operadores ahora esperan las últimas actualizaciones de política monetaria del Banco de Inglaterra y del Banco Nacional Suizo. Más tarde, durante la sesión norteamericana, la agenda económica de EE.UU. – que incluye las habituales solicitudes iniciales semanales de subsidio por desempleo, el índice manufacturero de la Fed de Filadelfia y los datos de ventas de viviendas existentes – podría generar oportunidades a corto plazo alrededor del XAU/USD.

FXStreet calcula los precios del Oro en India adaptando los precios internacionales (USD/INR) a la moneda local y las unidades de medida. Los precios se actualizan diariamente según las tasas del mercado tomadas en el momento de la publicación. Los precios son solo de referencia y las tasas locales podrían divergir ligeramente.

Oro FAQs

El Oro ha desempeñado un papel fundamental en la historia de la humanidad, ya que se ha utilizado ampliamente como depósito de valor y medio de intercambio. En la actualidad, aparte de su brillo y su uso para joyería, el metal precioso se considera un activo refugio, lo que significa que se considera una buena inversión en tiempos turbulentos. El Oro también se considera una cobertura contra la inflación y la depreciación de las divisas, ya que no depende de ningún emisor o gobierno concreto.

Los bancos centrales son los mayores tenedores de Oro. En su objetivo de respaldar sus divisas en tiempos turbulentos, los bancos centrales tienden a diversificar sus reservas y a comprar Oro para mejorar la percepción de fortaleza de la economía y de la divisa. Unas reservas de Oro elevadas pueden ser una fuente de confianza para la solvencia de un país. Los bancos centrales añadieron 1.136 toneladas de Oro por valor de unos 70.000 millones de dólares a sus reservas en 2022, según datos del Consejo Mundial del Oro. Se trata de la mayor compra anual desde que existen registros. Los bancos centrales de economías emergentes como China, India y Turquía están aumentando rápidamente sus reservas de Oro.

El Oro tiene una correlación inversa con el Dólar estadounidense y los bonos del Tesoro de EE.UU., que son los principales activos de reserva y refugio. Cuando el Dólar se deprecia, el precio del Oro tiende a subir, lo que permite a los inversores y a los bancos centrales diversificar sus activos en tiempos turbulentos. El Oro también está inversamente correlacionado con los activos de riesgo. Un repunte en el mercado bursátil tiende a debilitar el precio del Oro, mientras que las ventas masivas en los mercados de mayor riesgo tienden a favorecer al metal precioso.

El precio del Oro puede moverse debido a una amplia gama de factores. La inestabilidad geopolítica o el temor a una recesión profunda pueden hacer que el precio del Oro suba rápidamente debido a su condición de activo refugio. Como activo sin rendimiento, el precio del Oro tiende a subir cuando bajan los tipos de interés, mientras que el encarecimiento del dinero suele lastrar al metal amarillo. Aun así, la mayoría de los movimientos dependen de cómo se comporte el Dólar estadounidense (USD), ya que el activo se cotiza en dólares (XAU/USD). Un Dólar fuerte tiende a mantener controlado el precio del Oro, mientras que un Dólar más débil probablemente empuje al alza los precios del Oro.

(Se utilizó una herramienta de automatización para crear esta publicación.)

- El precio del Oro alcanza un nuevo máximo histórico a medida que una combinación de factores sigue impulsando la demanda de refugio seguro.

- La perspectiva dovish de la Fed mantiene a los alcistas del USD a la defensiva y respalda aún más al XAU/USD.

- Condiciones ligeramente sobrecompradas y un tono de riesgo positivo actúan como un viento en contra para el metal precioso.

El precio del Oro (XAU/USD) entra en una fase de consolidación alcista tras tocar un nuevo pico histórico durante la sesión asiática del jueves. Los alcistas ahora parecen reacios a abrir nuevas posiciones en medio de condiciones ligeramente sobrecompradas y un tono de riesgo positivo, lo que tiende a socavar al metal precioso de refugio seguro. Sin embargo, cualquier caída correctiva significativa aún parece elusiva a raíz de la creciente incertidumbre sobre las políticas comerciales del presidente estadounidense Donald Trump y su impacto en la economía global.

Aparte de esto, el riesgo geopolítico y las expectativas dovish de la Reserva Federal (Fed) deberían actuar como un viento de cola para el precio del Oro sin rendimiento. Mientras tanto, el Dólar estadounidense (USD) lucha por ganar tracción significativa y languidece cerca de su nivel más bajo desde octubre alcanzado a principios de esta semana en medio de las expectativas de que la Fed reanudará pronto su ciclo de recortes de tasas. Esto podría contribuir aún más a limitar la baja para la mercancía y justifica la cautela antes de confirmar un máximo a corto plazo para el lingote.

Qué mueve el mercado hoy: El precio del oro sigue atrayendo flujos de refugio seguro en medio de nervios comerciales y riesgos geopolíticos

- Los mercados de acciones asiáticos siguen las ganancias nocturnas en Wall Street, impulsados por la decisión de la Reserva Federal de mantener las tasas de interés sin cambios y mantener su pronóstico de recortes de tasas para el año. Como se esperaba ampliamente, el banco central de EE.UU. mantuvo las tasas de interés estables por segunda reunión consecutiva y señaló que entregaría dos recortes de 25 puntos básicos para finales de este año.

- Sumado a esto, el presidente estadounidense Donald Trump y el presidente ruso Vladimir Putin acordaron el martes una pausa inmediata en los ataques contra la infraestructura energética en la guerra de Ucrania. Además, el presidente ucraniano Volodymyr Zelenskiy y Trump también acordaron trabajar juntos para poner fin a la prolongada guerra entre Rusia y Ucrania, lo que aumentó aún más la confianza de los inversores.

- Mientras tanto, los funcionarios de la Fed recortaron su pronóstico de crecimiento para el año en medio de la creciente incertidumbre sobre el impacto de las agresivas políticas comerciales de la administración Trump en la actividad económica. Trump impuso un arancel del 25% sobre el acero y el aluminio desde febrero y ha amenazado con imponer aranceles recíprocos y sectoriales, alimentando preocupaciones sobre una guerra comercial global.

- Los operadores ahora ven más de un 65% de probabilidad de que la Fed reanude su ciclo de recortes de tasas en la reunión de política de junio. Esto, a su vez, no ayuda al Dólar estadounidense a registrar ninguna recuperación significativa desde un mínimo de varios meses alcanzado a principios de esta semana y debería prestar algo de apoyo al precio del Oro sin rendimiento en medio del riesgo de una mayor escalada de tensiones en Oriente Medio.

- El ejército israelí dijo que lanzó una incursión terrestre limitada en Gaza, un día después de un bombardeo aéreo de la franja que rompió el alto el fuego de dos meses con Hamás. Además, el primer ministro israelí Benjamin Netanyahu advirtió sobre una feroz expansión de la guerra, lo que debería seguir respaldando al metal precioso de refugio seguro y limitar cualquier caída correctiva.

- Los operadores ahora esperan las últimas actualizaciones de política monetaria del Banco de Inglaterra y del Banco Nacional Suizo. Más tarde, durante la sesión norteamericana, la agenda económica de EE.UU. – que incluye las habituales solicitudes iniciales semanales de subsidio por desempleo, el índice manufacturero de la Fed de Filadelfia y los datos de ventas de viviendas existentes – podría generar oportunidades a corto plazo en torno al XAU/USD.

El precio del Oro necesita consolidarse antes del próximo movimiento al alza en medio de condiciones ligeramente sobrecompradas en el gráfico diario

El Índice de Fuerza Relativa (RSI) diario se mantiene por encima de 70, mostrando condiciones de sobrecompra y reteniendo a los alcistas de abrir nuevas posiciones. Por lo tanto, será prudente esperar alguna consolidación a corto plazo o un retroceso modesto antes de que los operadores comiencen a posicionarse para una extensión de la tendencia alcista bien establecida que se ha observado durante los últimos tres meses aproximadamente. Dicho esto, la reciente ruptura a través de la barrera psicológica de los 3.000$ y el posterior movimiento al alza sugieren que el camino de menor resistencia para el precio del Oro sigue siendo al alza.

Mientras tanto, cualquier caída correctiva significativa probablemente atraerá a algunos compradores en niveles alrededor de 3.023$-3.022$. Esto debería ayudar a limitar la baja cerca de la marca de 3.000$, que ahora debería actuar como un punto clave para los operadores a corto plazo. Una ruptura convincente por debajo de este último podría provocar algunas ventas técnicas y arrastrar el precio del Oro hacia el soporte intermedio de 2.980$-2.978$ en ruta hacia la región de 2.956$. La trayectoria descendente podría extenderse aún más hacia el soporte de 2.930$ antes de que el XAU/USD caiga a la marca de 2.900$ y al mínimo de la semana pasada, alrededor de la zona de 2.880$.

Oro FAQs

El Oro ha desempeñado un papel fundamental en la historia de la humanidad, ya que se ha utilizado ampliamente como depósito de valor y medio de intercambio. En la actualidad, aparte de su brillo y su uso para joyería, el metal precioso se considera un activo refugio, lo que significa que se considera una buena inversión en tiempos turbulentos. El Oro también se considera una cobertura contra la inflación y la depreciación de las divisas, ya que no depende de ningún emisor o gobierno concreto.

Los bancos centrales son los mayores tenedores de Oro. En su objetivo de respaldar sus divisas en tiempos turbulentos, los bancos centrales tienden a diversificar sus reservas y a comprar Oro para mejorar la percepción de fortaleza de la economía y de la divisa. Unas reservas de Oro elevadas pueden ser una fuente de confianza para la solvencia de un país. Los bancos centrales añadieron 1.136 toneladas de Oro por valor de unos 70.000 millones de dólares a sus reservas en 2022, según datos del Consejo Mundial del Oro. Se trata de la mayor compra anual desde que existen registros. Los bancos centrales de economías emergentes como China, India y Turquía están aumentando rápidamente sus reservas de Oro.

El Oro tiene una correlación inversa con el Dólar estadounidense y los bonos del Tesoro de EE.UU., que son los principales activos de reserva y refugio. Cuando el Dólar se deprecia, el precio del Oro tiende a subir, lo que permite a los inversores y a los bancos centrales diversificar sus activos en tiempos turbulentos. El Oro también está inversamente correlacionado con los activos de riesgo. Un repunte en el mercado bursátil tiende a debilitar el precio del Oro, mientras que las ventas masivas en los mercados de mayor riesgo tienden a favorecer al metal precioso.

El precio del Oro puede moverse debido a una amplia gama de factores. La inestabilidad geopolítica o el temor a una recesión profunda pueden hacer que el precio del Oro suba rápidamente debido a su condición de activo refugio. Como activo sin rendimiento, el precio del Oro tiende a subir cuando bajan los tipos de interés, mientras que el encarecimiento del dinero suele lastrar al metal amarillo. Aun así, la mayoría de los movimientos dependen de cómo se comporte el Dólar estadounidense (USD), ya que el activo se cotiza en dólares (XAU/USD). Un Dólar fuerte tiende a mantener controlado el precio del Oro, mientras que un Dólar más débil probablemente empuje al alza los precios del Oro.

- El GBP/USD puede apuntar a la resistencia inmediata en el máximo de cinco meses de 1.3048.

- El RSI de 14 días indica una situación de sobrecompra y una posible corrección a la baja.

- El soporte principal aparece en una EMA de 9 días de 1.2955.

El par GBP/USD se mantiene en territorio positivo por cuarta sesión consecutiva, cotizando alrededor de 1.3010 durante las horas asiáticas del jueves. El análisis técnico del gráfico diario indica un sesgo alcista continuo, con el par moviéndose hacia arriba dentro de un patrón de canal ascendente.

El Índice de Fuerza Relativa (RSI) de 14 días está ligeramente por encima de 70, señalando un fuerte impulso alcista pero también sugiriendo que el par GBP/USD está sobrecomprado, lo que podría llevar a una corrección a la baja.

Además, el par GBP/USD continúa cotizando por encima de la media móvil exponencial (EMA) de 9 días, reforzando una fuerte dinámica de precios a corto plazo y confirmando la tendencia alcista en curso.

Al alza, el par GBP/USD puede desafiar la resistencia principal en el máximo de cinco meses de 1.3048, registrado el 6 de noviembre, seguido por el límite superior del canal ascendente cerca de 1.3090.

Es probable que el par GBP/USD encuentre soporte inmediato en la EMA de 9 días de 1.2954. Una ruptura por debajo de este nivel podría debilitar el impulso de precios a corto plazo, llevando potencialmente al par hacia el límite inferior del canal ascendente cerca de 1.2770, seguido por la EMA de 50 días en 1.2705.

GBP/USD: Gráfico Diario

Libra esterlina PRECIO Hoy

La tabla inferior muestra el porcentaje de cambio del Libra esterlina (GBP) frente a las principales monedas hoy. Libra esterlina fue la divisa más fuerte frente al Dólar neozelandés.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.06% | -0.02% | -0.21% | -0.01% | 0.20% | 0.33% | -0.19% | |

| EUR | 0.06% | 0.03% | -0.13% | 0.05% | 0.26% | 0.39% | -0.14% | |

| GBP | 0.02% | -0.03% | -0.17% | 0.00% | 0.23% | 0.36% | -0.16% | |

| JPY | 0.21% | 0.13% | 0.17% | 0.18% | 0.39% | 0.51% | 0.08% | |

| CAD | 0.00% | -0.05% | -0.00% | -0.18% | 0.21% | 0.36% | -0.18% | |

| AUD | -0.20% | -0.26% | -0.23% | -0.39% | -0.21% | 0.14% | -0.39% | |

| NZD | -0.33% | -0.39% | -0.36% | -0.51% | -0.36% | -0.14% | -0.55% | |

| CHF | 0.19% | 0.14% | 0.16% | -0.08% | 0.18% | 0.39% | 0.55% |

El mapa de calor muestra los cambios porcentuales de las principales monedas. La moneda base se selecciona desde la columna de la izquierda, mientras que la moneda de cotización se selecciona en la fila superior. Por ejemplo, si elige el Libra esterlina de la columna de la izquierda y se mueve a lo largo de la línea horizontal hasta el Dólar estadounidense, el cambio porcentual que se muestra en el cuadro representará el GBP (base)/USD (cotización).

- El precio de la Plata enfrentó vientos en contra ya que la Fed mantuvo la tasa de fondos federales en 4.25%–4.5% el miércoles

- La Plata, un activo sin rendimiento, puede haber encontrado soporte a medida que los rendimientos de los bonos del Tesoro de EE.UU. disminuyeron.

- Las tasas de arrendamiento de Plata han aumentado debido a la reducción de las reservas en Londres.

El precio de la Plata (XAG/USD) mantiene ganancias tras una sesión anterior de pérdidas, cotizando alrededor de 33.80$ por onza troy durante las horas asiáticas del jueves. Sin embargo, el metal sin rendimiento enfrenta presión tras la decisión de tasas de interés de la Reserva Federal (Fed).

Como se esperaba ampliamente, la Fed mantuvo la tasa de fondos federales en 4.25%–4.5% durante su reunión de marzo, pero reafirmó su perspectiva de dos recortes de tasas más adelante este año. Esta postura se alinea con las previsiones de un crecimiento del PIB más lento y un aumento del desempleo, contrarrestando las preocupaciones sobre el aumento de la inflación en Estados Unidos (EE.UU.), potencialmente impulsada por los agresivos aranceles impuestos por el presidente Donald Trump.

La Plata, un activo sin rendimiento, puede haber encontrado soporte a medida que los rendimientos de los bonos del Tesoro de EE.UU. disminuyeron, con el rendimiento a 2 años en 3.97% y el rendimiento a 10 años en 4.24%. Mientras tanto, los bonos ganaron tracción tras la decisión de la Fed de desacelerar el ritmo de endurecimiento cuantitativo, citando preocupaciones sobre la reducción de la liquidez y los riesgos potenciales relacionados con los límites de la deuda gubernamental.

Las tasas de arrendamiento de Plata han aumentado debido a la reducción de las reservas, particularmente en Londres, ya que la Plata fluye hacia EE.UU. para capitalizar precios más altos. Los bancos y comerciantes arriendan Plata para asegurar liquidez a corto plazo para necesidades comerciales u operativas.

Este cambio ha ampliado las brechas de precios entre los principales mercados, con la Plata al contado aumentando un 17% este año, superando a otras materias primas. Además, las transferencias físicas de Plata desde Canadá y México están restringidas por aranceles, lo que agrava aún más la oferta. Los crecientes temores de un "apretón de plata" podrían interrumpir el comercio durante meses.

Plata FAQs

La Plata es un metal precioso altamente negociado entre los inversores. Históricamente, se ha utilizado como un refugio de valor y un medio de intercambio. Aunque es menos popular que el Oro, los operadores pueden recurrir a la Plata para diversificar su portafolio de inversiones, por su valor intrínseco o como una posible cobertura durante períodos de alta inflación. Los inversores pueden comprar Plata física, en monedas o en lingotes, o negociarla a través de vehículos como los Fondos Cotizados en Bolsa, que siguen su precio en los mercados internacionales.

Los precios de la Plata pueden moverse debido a una amplia gama de factores. La inestabilidad geopolítica o los temores de una recesión profunda pueden hacer que el precio de la Plata se dispare debido a su estatus de refugio seguro, aunque en menor medida que el del Oro. Como activo sin rendimiento, la Plata tiende a subir con tasas de interés más bajas. Sus movimientos también dependen de cómo se comporte el Dólar estadounidense (USD), ya que el activo se cotiza en dólares (XAG/USD). Un Dólar fuerte tiende a mantener el precio de la Plata a raya, mientras que un Dólar más débil probablemente impulse los precios al alza. Otros factores como la demanda de inversión, la oferta minera – la Plata es mucho más abundante que el Oro – y las tasas de reciclaje también pueden afectar los precios.

La Plata se utiliza ampliamente en la industria, particularmente en sectores como la electrónica o la energía solar, ya que tiene una de las conductividades eléctricas más altas de todos los metales, superando al Cobre y al Oro. Un aumento en la demanda puede incrementar los precios, mientras que una disminución tiende a reducirlos. Las dinámicas en las economías de EE.UU., China e India también pueden contribuir a las fluctuaciones de precios: para EE.UU. y particularmente China, sus grandes sectores industriales utilizan Plata en varios procesos; en India, la demanda de los consumidores por el metal precioso para joyería también juega un papel clave en la fijación de precios.

Los precios de la Plata tienden a seguir los movimientos del Oro. Cuando los precios del Oro suben, la Plata típicamente sigue el mismo camino, ya que su estatus como activos refugio es similar. La relación Oro/Plata, que muestra el número de onzas de Plata necesarias para igualar el valor de una onza de Oro, puede ayudar a determinar la valoración relativa entre ambos metales. Algunos inversores pueden considerar un ratio alto como un indicador de que la Plata está infravalorada, o que el Oro está sobrevalorado. Por el contrario, un ratio bajo podría sugerir que el Oro está infravalorado en relación con la Plata.

- El Yen japonés recibe soporte de las expectativas de subida de tasas del BoJ y del vuelo global hacia la seguridad.

- Los nervios comerciales y las crecientes tensiones geopolíticas continúan beneficiando a los activos de refugio seguro.

- Las expectativas divergentes entre el BoJ y la Fed también ejercen presión a la baja sobre el par USD/JPY.

El Yen japonés (JPY) atrae compradores por segundo día consecutivo y se fortalece a un nuevo máximo semanal frente a su contraparte estadounidense durante la sesión asiática del jueves. Las expectativas de que un fuerte crecimiento salarial podría impulsar el gasto del consumidor y contribuir a la inflación creciente dan al Banco de Japón (BoJ) margen para seguir subiendo las tasas de interés. Esto llevó a la reciente y pronunciada reducción del diferencial de tasas entre Japón y otros países, lo que continúa apoyando al JPY de menor rendimiento.

Aparte de esto, la incertidumbre sobre las políticas comerciales del presidente estadounidense Donald Trump y su impacto en la economía global, junto con los riesgos geopolíticos y la crisis política turca, impulsan algunos flujos hacia el JPY como refugio seguro. El Dólar estadounidense (USD), por otro lado, lucha por ganar tracción significativa en medio de una mayor incertidumbre económica debido a los aranceles comerciales del presidente Donald Trump. Esto, a su vez, ejerce presión sobre el par USD/JPY y contribuye a la caída intradía.

El Yen japonés está respaldado por las expectativas de un BoJ de línea dura y la persistente demanda de refugio seguro

- El Banco de Japón decidió mantener su tasa de política clave sin cambios al final de una reunión de revisión de dos días el miércoles y señaló que la incertidumbre en torno a la economía de Japón y los precios sigue siendo alta.

- En la rueda de prensa posterior a la reunión, el gobernador del BoJ, Kazuo Ueda, dijo que el banco central quiere llevar a cabo políticas antes de que sea demasiado tarde y que alcanzar un objetivo de inflación del 2% es importante para la credibilidad a largo plazo.

- La Reserva Federal, como se anticipaba ampliamente, también mantuvo las tasas de interés estables por segunda reunión consecutiva y señaló que es probable que entregue dos recortes de 25 puntos básicos para finales de este año.

- Mientras tanto, los responsables de políticas recortaron su pronóstico de crecimiento para el año en medio de la creciente incertidumbre sobre el impacto de las agresivas políticas comerciales del presidente Donald Trump en la actividad económica.

- Además, la Fed elevó su proyección de inflación. Sin embargo, los operadores aún ven más de un 65% de probabilidad de que el banco central de EE.UU. reanude su ciclo de recortes de tasas en la reunión de política de junio.

- El presidente ucraniano Volodymyr Zelenskiy y Trump acordaron trabajar juntos para poner fin a la guerra entre Rusia y Ucrania. Sin embargo, el presidente ruso Vladimir Putin rechazó un propuesto alto el fuego completo de 30 días.

- El ejército israelí dijo que lanzó una incursión terrestre limitada en Gaza, un día después de un bombardeo aéreo de la franja que rompió el alto el fuego de dos meses con Hamas.

- El primer ministro israelí Benjamin Netanyahu advirtió sobre una feroz expansión de la guerra, aumentando el riesgo de una mayor escalada de las tensiones en Medio Oriente y beneficiando a los activos de refugio seguro, incluido el Yen japonés.

El USD/JPY parece vulnerable a debilitarse aún más y apunta a probar el próximo soporte relevante en 147.75

Desde una perspectiva técnica, el fracaso de la noche anterior para encontrar aceptación por encima de la marca psicológica de 150.00 y la posterior caída sugiere que el reciente rebote desde un mínimo de varios meses se ha quedado sin impulso. Además, los osciladores negativos en el gráfico diario apoyan las perspectivas de un movimiento de depreciación adicional para el par USD/JPY. Por lo tanto, alguna debilidad de continuación por debajo de la marca de 148.00, hacia el siguiente soporte relevante cerca del soporte horizontal de 147.75, parece una posibilidad distinta. La trayectoria a la baja podría extenderse aún más hacia la región de 147.30 en ruta hacia el nivel redondo de 147.00 y el área de 146.55-146.50, o el nivel más bajo desde principios de octubre alcanzado a principios de este mes.

Por el contrario, cualquier intento de recuperación podría ahora enfrentar un obstáculo inmediato cerca del máximo de la sesión asiática, justo antes de la marca de 149.00. Esto es seguido por la zona de oferta de 149.25-149.30, por encima de la cual el par USD/JPY podría apuntar a recuperar la marca de 150.00. Alguna compra de continuación más allá del máximo de la noche anterior, alrededor de la región de 150.15, podría provocar un repunte de cobertura de cortos y elevar los precios al contado hacia la barrera intermedia de 150.60 en ruta hacia la marca de 151.00 y el pico mensual, alrededor de la región de 151.30.

Yen japonés FAQs

El Yen japonés (JPY) es una de las divisas más negociadas del mundo. Su valor viene determinado en líneas generales por la marcha de la economía japonesa, pero más concretamente por la política del Banco de Japón, el diferencial entre los rendimientos de los bonos japoneses y estadounidenses o el sentimiento de riesgo entre los operadores, entre otros factores.

Uno de los mandatos del Banco de Japón es el control de divisas, por lo que sus movimientos son clave para el Yen. El BoJ ha intervenido directamente en los mercados de divisas en ocasiones, generalmente para bajar el valor del Yen, aunque se abstiene de hacerlo a menudo debido a las preocupaciones políticas de sus principales socios comerciales. La actual política monetaria ultralaxa del BoJ, basada en estímulos masivos a la economía, ha provocado la depreciación del Yen frente a sus principales pares monetarios. Este proceso se ha exacerbado más recientemente debido a una creciente divergencia de políticas entre el Banco de Japón y otros bancos centrales principales, que han optado por aumentar bruscamente los tipos de interés para luchar contra niveles de inflación de décadas.

La postura del Banco de Japón de mantener una política monetaria ultralaxa ha provocado un aumento de la divergencia política con otros bancos centrales, en particular con la Reserva Federal estadounidense. Esto favorece la ampliación del diferencial entre los bonos estadounidenses y japoneses a 10 años, lo que favorece al Dólar frente al Yen.

El Yen japonés suele considerarse una inversión de refugio seguro. Esto significa que en tiempos de tensión en los mercados, los inversores son más propensos a poner su dinero en la moneda japonesa debido a su supuesta fiabilidad y estabilidad. En épocas turbulentas, es probable que el Yen se revalorice frente a otras divisas en las que se considera más arriesgado invertir.

- La Rupia india se debilita en la sesión asiática del jueves.

- Un rebote en los precios del petróleo y la postura de línea dura de la Fed arrastran al INR a la baja.

- Los inversores esperan los datos semanales de solicitudes iniciales de subsidio por desempleo de EE.UU., que se publicarán más tarde el jueves.

La Rupia india (INR) cotiza en terreno negativo el jueves. Un aumento en los precios del petróleo crudo en medio de las tensiones geopolíticas en curso en Oriente Medio pesa sobre la moneda local, ya que India es el tercer mayor consumidor de petróleo del mundo. Además, la postura más de línea dura de la Reserva Federal de EE.UU. (Fed) en su reunión de marzo el miércoles eleva al Dólar estadounidense (USD) y socava la moneda india.

Sin embargo, los últimos datos de la cuenta corriente de India, que mostraron un superávit en febrero, podrían ayudar a limitar las pérdidas del INR. El Banco de la Reserva de la India (RBI) ha estado "oportunamente" absorbiendo entradas de USD en las últimas sesiones, probablemente para reponer las reservas de divisas que se expandieron para apoyar al INR en los últimos meses, según informes. De cara al futuro, las solicitudes semanales iniciales de subsidio por desempleo de EE.UU. se publicarán más tarde el jueves, seguidas del índice manufacturero de la Fed de Filadelfia, las ventas de viviendas existentes y el índice adelantado CB.

La Rupia india sigue siendo frágil en medio de múltiples vientos en contra

- Las reservas de divisas de India han aumentado de 624.000 millones de dólares en enero a 654.000 millones de dólares a principios de marzo, aunque siguen siendo 50.000 millones de dólares por debajo de su pico en octubre.

- La Fed mantuvo las tasas estables en el rango del 4.25%-4.50% en la reunión de marzo el miércoles, como se anticipaba ampliamente.

- Los funcionarios de la Fed aún ven la posibilidad de reducir los costos de endeudamiento en medio punto porcentual para finales de este año debido al crecimiento económico lento y a una desaceleración de la inflación.

- El presidente de la Fed, Jerome Powell, destacó el alto grado de incertidumbre por los cambios significativos en la política del presidente de EE.UU., Donald Trump, añadiendo que los funcionarios de la Fed pueden esperar más claridad sobre el impacto de esas políticas en la economía antes de actuar.

- Powell declaró durante una conferencia de prensa: "Las condiciones del mercado laboral son sólidas, y la inflación se ha acercado a nuestro objetivo del 2% a largo plazo, aunque sigue siendo algo elevada."

USD/INR mantiene la vibra alcista a largo plazo

La Rupia india cotiza en un tono más débil en el día. A largo plazo, el par USD/INR mantiene su perspectiva constructiva en el marco diario. No obstante, a corto plazo, el par ha salido de un triángulo simétrico, mientras que el Índice de Fuerza Relativa (RSI) de 14 días se sitúa por debajo de la línea media cerca de 37.00, lo que sugiere que un mayor descenso parece favorable.

El nivel psicológico de 87.00 parece ser un obstáculo difícil de superar para el USD/INR. Una ruptura decisiva por encima de este nivel podría ver un repunte hacia 87.38, el máximo del 11 de marzo, en ruta hacia 87.53, el máximo del 28 de febrero.

A la baja, el nivel de soporte crucial se encuentra en 86.00, el nivel redondo y la EMA de 100 días. Una ruptura del nivel mencionado podría atraer a algunos vendedores y arrastrar al par a la baja hasta 85.60, el mínimo del 6 de enero.

Rupia india FAQs

La Rupia india (INR) es una de las monedas más sensibles a los factores externos. El precio del petróleo crudo (el país depende en gran medida del petróleo importado), el valor del Dólar estadounidense (la mayor parte del comercio se realiza en dólares estadounidenses) y el nivel de inversión extranjera son todos factores influyentes. La intervención directa del Banco de la Reserva de la India (RBI) en los mercados de divisas para mantener estable el tipo de cambio, así como el nivel de los tipos de interés fijados por el RBI, son otros factores importantes que influyen en la Rupia.

El Banco de la Reserva de la India (RBI) interviene activamente en los mercados de divisas para mantener un tipo de cambio estable y ayudar a facilitar el comercio. Además, el RBI intenta mantener la tasa de inflación en su objetivo del 4% ajustando las tasas de interés. Los tipos de interés más altos suelen fortalecer la Rupia. Esto se debe al papel del “carry trade”, en el que los inversores piden prestado en países con tasas de interés más bajas para colocar su dinero en países que ofrecen tasas de interés relativamente más altas y beneficiarse de la diferencia.

Los factores macroeconómicos que influyen en el valor de la Rupia incluyen la inflación, las tasas de interés, la tasa de crecimiento económico (PIB), la balanza comercial y las entradas de inversión extranjera. Una tasa de crecimiento más alta puede conducir a una mayor inversión en el extranjero, aumentando la demanda de la Rupia. Una balanza comercial menos negativa eventualmente conducirá a una Rupia más fuerte. Los tipos de interés más altos, especialmente los tipos reales (tipos de interés menos inflación) también son positivos para la Rupia. Un entorno de riesgo puede generar mayores entradas de inversión extranjera directa e indirecta (IED y FII), que también benefician a la Rupia.

Una inflación más alta, en particular si es comparativamente más alta que otros países, es generalmente negativa para la moneda, ya que refleja una devaluación a través del exceso de oferta. La inflación también aumenta el costo de las exportaciones, lo que lleva a que se vendan más rupias para comprar importaciones extranjeras, lo que es negativo para la Rupia india. Al mismo tiempo, una inflación más alta suele llevar al Banco de la Reserva de la India (RBI) a subir los tipos de interés y esto puede ser positivo para la Rupia, debido al aumento de la demanda de los inversores internacionales. El efecto contrario se aplica a una inflación más baja.

En su última publicación en la plataforma Truth Social, el presidente de EE.UU. Donald Trump instó a la Reserva Federal (Fed) a bajar las tasas de interés, ya que los aranceles están perjudicando la economía.

Citas clave

"La Fed estaría MUCHO mejor si RECORTARA TASAS a medida que los aranceles estadounidenses comienzan a transitar (¡aliviarse!) en la economía."

"Hagan lo correcto."

"¡El 2 de abril es el Día de la Liberación en América!!!"

Reacción del mercado

El Índice del Dólar estadounidense (DXY) pierde 0.11% en el día, cotizando cerca de 103.40, tras los comentarios de Trump.

Dólar estadounidense PRECIO Hoy

La tabla inferior muestra el porcentaje de cambio del Dólar estadounidense (USD) frente a las principales monedas hoy. Dólar estadounidense fue la divisa más débil frente al Yen japonés.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.09% | -0.03% | -0.31% | 0.03% | 0.28% | 0.37% | -0.19% | |

| EUR | 0.09% | 0.05% | -0.19% | 0.11% | 0.38% | 0.45% | -0.10% | |

| GBP | 0.03% | -0.05% | -0.25% | 0.05% | 0.32% | 0.41% | -0.15% | |

| JPY | 0.31% | 0.19% | 0.25% | 0.31% | 0.57% | 0.63% | 0.17% | |

| CAD | -0.03% | -0.11% | -0.05% | -0.31% | 0.26% | 0.34% | -0.22% | |

| AUD | -0.28% | -0.38% | -0.32% | -0.57% | -0.26% | 0.08% | -0.47% | |

| NZD | -0.37% | -0.45% | -0.41% | -0.63% | -0.34% | -0.08% | -0.58% | |

| CHF | 0.19% | 0.10% | 0.15% | -0.17% | 0.22% | 0.47% | 0.58% |

El mapa de calor muestra los cambios porcentuales de las principales monedas. La moneda base se selecciona desde la columna de la izquierda, mientras que la moneda de cotización se selecciona en la fila superior. Por ejemplo, si elige el Dólar estadounidense de la columna de la izquierda y se mueve a lo largo de la línea horizontal hasta el Yen japonés, el cambio porcentual que se muestra en el cuadro representará el USD (base)/JPY (cotización).

- El AUD/JPY pierde terreno ya que el cambio de empleo en Australia disminuyó en 52.8K en febrero, fallando en el aumento esperado de 30.0K.

- El PBOC mantuvo sus tasas preferenciales de préstamos (LPR) a un año y a cinco años en 3.10% y 3.60%, respectivamente.

- El Yen japonés se fortalece a medida que los operadores continúan considerando la posibilidad de un aumento de tasas por parte del BoJ en 2025.