- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 28-02-2011

USD/JPY holds around Y81.80 in a thin market after stalling out atop Y81.98. Bids remain around the Y81.60 area. Offers remain at Y82.00/10 and seem unlikely to be tested this afternoon.

GBP/USD holds around $1.6254, a bit lower mid-morning highs around $1.6275. Support comes at $1.6240. Flows are very light, cable still restrained by offers at $1.6280 and $1.6300.

Stocks are stuck near session lows. Leadership is now lacking after trade had seen broad-based support in the early going.

Tech is the largest sector by market weight, but that weight has hampered broader action, due to the sector's 0.3% loss. Every other sector is still in positive territory; utilities are up the most as they sport a 0.9% gain.

Selling has intensified in recent trade. That pressure has taken the stock market down to a fresh session low. The Volatility Index is still down for the day. It was last quoted with a 1% loss.

Retailers have had a relatively rough session. The group is down 0.3%. Amazon.com (AMZN 172.35, -4.89) has been a heavy drag on the group, following news that its shares were downgraded by analysts at UBS. Shares of AMZN are at a three-week low.

Weakness in AMZN has also weighed on the Nasdaq, which recently slipped into the red to trade with a narrow loss. Semiconductor stocks, collectively down 1.4%, have also adversely affected the tech-rich Nasdaq.

EUR/USD weakened to $1.3780 area after triggering stops below $1.3790. CitiFX analysts looking at the pair and eyeing the 4hr candlestick chart, seeing evidence of a "bearish shooting star" that could have negative technical implications, though the neckline is still a distant $1.3428.

On Monday the dollar fell to its lowest since November on bets Federal Reserve Chairman Ben S. Bernanke will signal to Congress the central bank plans to maintain economic stimulus.

The euro rose against the dollar on speculation European Central Bank President Jean-Claude Trichet may indicate this week a readiness to increase borrowing costs.

“The euro more so than any other currency has been driven by fiscal policy divergence as of late,” said Mark McCormick, a currency strategist at Brown Brothers Harriman & Co. “Anything that is the status-quo from Bernanke is probably favorable for the euro. Currencies will be volatile this week trading off rhetoric.”

U.S. consumer spending rose less than forecast in January, accelerating 0.2%, data from the Commerce Department showed today. Another report showed European inflation stayed above the ECB’s 2% target for a second month in January.

An ECB governing council member, Mario Draghi, said on Feb. 26 that inflation pressures are forcing policy makers to focus more closely on the timing of future interest-rate increases.

The ECB, which has kept its key interest rate at 1% since May 2009, will hold its next policy meeting on March 3.

Bernanke is scheduled to deliver the Fed’s semiannual report on monetary policy tomorrow to the Senate Banking Committee and is due to testify to the House Financial Services Committee the following day. The Fed has kept its benchmark interest rate at zero to 0.25% since December 2008.

Crude oil for April delivery rose as much 2.1% to $99.96 a barrel in New York before trading at $97.88. It rose last week to $103.41, the highest level since September 2008.

Canada’s dollar reached a three-year high versus the greenback after a government report showed the nation’s economy grew at a 3.3% annual pace in the fourth quarter, more than economists forecast.

The currency was headed for a 2.7% rally this month before tomorrow’s meeting of the Bank of Canada, which has expressed concern that its strength may stall growth.

The benchmark 10-year Note has spent most of the session trading near the neutral line. That has left its yield to trade only a couple of basis points above 3.40%.

Meanwhile, the Dollar Index is down 0.5%.

USD/CAD currently holds around $0.9729, a bit higher the February 28 2008 low around C$0.9712. Beyond that, larger support is found around C$0.9055/60 the life-time low (130-year low of C$0.9059) seen November 7, 2007. Andy Chaveriat, chief technical analyst at BNP Paribas, says a "sustained decisive break below C$0.9700 is expected soon, opening scope to the initial C$0.9670 medium-term swing target and potentially C$0.9350." He says to "sell rallies."

EUR/USD weakens to $1.3810 ahead with flows said not overly special. Earlier noted bids at $1.3820/25 area now absorbed, better interest seen at $1.3800 with stops in place sub $1.3790 should euro losses extend.

Ian Shepherdson of High Frequency Economics says the "Chicago PMI rise to 71.2 (from 68.8 and compared to median at 68.0) was the highest reading since July 1988. "The rise in the headline is reflected in the orders and production components, though employment dropped," he says. While the job component disappointed (-4.3 in Feb), it comes after a 5.6 pt rise in Jan.

GBP/USD holds near session highs on $1.6251 amid EUR/GBP declines under earlier lows at stg0.8513. Cable offers remain in place up to $1.6260, a break to expose the 2011 high at $1.6279 (Feb3). Further offers seen into $1.6280. Above here and further option barrier ahead of $1.6300. Support $1.6220/10, stops on a break of $1.6190.

U.S. stock futures were higher early Monday, after a government report showed a larger-than-expected increase in personal income. But investors keep a wary eye on ongoing tensions in Libya.

U.S. stocks closed solidly higher Friday, but fears about Libya and the oil market translated into the worst week for stocks since November.

Despite the recent volatility, stocks are off to a strong start his year. The major indexes are all up nearly 5% so far in 2011.

Economy: A report from the Commerce Department showed that personal income jumped 1%, while spending by individuals rose 0.2% in January.

Economists were looking for personal incomes to rise 0.3%, and the personal spending figure was expected to go up 0.4%.

Later Monday morning, the Chicago purchasing managers index will be released, followed by pending home sales from the National Association of Realtors.

The Chicago PMI is expected to decline slightly to 67.5 from last month's 68.8, and pending home sales are expected to fall 3.2%.

World markets:

Oil for April delivery slipped 34 cents to $98.22 a barrel.

Gold futures for April delivery rose $4.70 to $1,414.10 an ounce.

The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.42% from 3.59% late Friday.

Auction house Sotheby's (BID) will report after the market close.

EUR/USD

Offers: $1.3850, $1.3860/65, $1.3885/900, $1.3950

Bids: $1.3800, $1.3780, $1.3750/40

EUR/JPY

Offers: Y113.40/45, Y114.00, Y114.50, Y115.00

Bids: Y112.40, Y112.00, Y111.70

Broke below the C$0.9750 area of a barrier strike in the wake of the upbeat GDP data with momentum carrying the pair to C$0.9742 area as a few stops were flushed. Targets now in the area of C$0.9710/20 area of Feb 2007 lows.

The euro rose against the majority of its most-traded peers before a policy decision by the European Central Bank this week, at which President Jean-Claude Trichet may signal a readiness to increase borrowing costs. Bernanke may say that the Fed will keep rates near zero when he testifies to the Senate Banking Committee tomorrow.

“As long as the Fed retains its stance, the interest-rate differentials will move against the dollar,” said Neil Jones, head of European hedge fund sales at Mizuho Corporate Bank Ltd. in London. “There’s a lot of bullish sentiment that Trichet will move to a more hawkish stance and discuss removing the stimulus. That’s one of the key reasons for euro strength.”

The euro maintained gains versus the dollar after a report showed inflation stayed above the ECB’s 2% target for a second month in January. Euro-region consumer prices rose 2.3 percent from a year earlier, the fastest since October 2008, the European Union’s statistics office said today.

EUR/USD: tested Friday peaks around $1.3830/40.

GBP/USD: from $1.6070 gained up to $1.6240.

USD/JPY: traded within Y81.60-Y81.95 range.

US data starts at 1330GMT with the ISM-NY Business Index Personal Income & Expenditures data and the PCE Price Index. Personal income is expected to rise 0.4% in January, as payrolls rose only 36,000 and the workweek fell to 34.2 hours, offset by a 0.4% jump in hourly earnings. PCE is expected to rise 0.4%, as retail sales were up 0.3%, both including and excluding auto sales. The core PCE price index is expected to rise 0.2%.

US data continues at 1430GMT with the weekly MNI Capital Goods Index. Then, at 1445GMT, the Chicago PMI is expected to fall to a reading of 68.0 in February. Other regional data already released have suggested modest expansion. Further US data includes the 1500GMT release of NAR Pending Home Sales as well as the weekly MNI Retail Trade Index

and Dallas Fed Manufacturing Outlook Survey both at 1530GMT.

- Economy definitely looks brighter than it did;

- Don't want to pile up any more QE than want to;

- Sees QE2 ending a little 'shy' of where planned;

- Sees Fed then pausing to take stock.

Cross getting pulled up further by some attraction of euro-dollar barrier interest at $1.3850. Pair has just posted a fresh high of Y113.31 ahead of resistance seen at Y113.40/45. A break here seen opening up to the Y114.24 high of Feb 21.

Reported stops between $1.6225/35 targeted and triggered as rate moves up to $1.6242. Resistance seen placed between $1.6250/60, a break above to expose 2011 high at $1.6279 (Feb 3). Offers noted to $1.6280.

EUR/USD $1.3660, $1.3675, $1.3720, $1.3800, $1.3825, $1.3850

USD/JPY Y82.00, Y82.10, Y83.20, Y83.25

EUR/JPY Y112.40, Y114.50, Y114.75

AUD/JPY Y82.50

AUD/USD $1.0080, $1.0060

Data:

05:00 Japan Housing Starts, y/y +2.7%

05:00 Japan Construction Orders, y/y -10.7%

Canada’s currency climbed to its strongest level in almost three years against its U.S. counterpart as crude oil, the nation’s biggest export, had its biggest weekly gain since 2009.

The loonie, as the Canadian currency is known for the image of the aquatic bird on the C$1 coin, was poised for a 2.4 percent monthly increase versus the U.S. dollar before the Bank of Canada’s meeting next week.

New Zealand’s dollar strengthened for a third day against the greenback as gains in Asian stocks revived demand for higher-yielding currencies.

Australia’s currency weakened earlier after Wen said yesterday that China set an annual economic expansion target of 7 percent for the 12th 5-year plan period, which covers 2011 through 2015. The target was 7.5 percent for the period from 2006 through 2010, with actual growth surpassing that each year.

EUR/USD: the pair shown high in the field of $1.3780 then decreased.

GBP/USD: the pair bargained within the limits of $1.6070-$ 1.6160.

USD/JPY: the pair bargained within the limits of Y81.60-Y81.75.

Core-European data for Monday starts at 0700GMT with German import prices for January and ends at 1000GMT with the EMU flash HICP data for February.

US: UK data is limited to the January Land Registry House Price data, which is due at 1100GMT.

US data starts at 1330GMT with the ISM-NY Business Index Personal Income & Expenditures data and the PCE Price Index. Personal income is expected to rise 0.4% in January, as payrolls rose only 36,000 and the workweek fell to 34.2 hours, offset by a 0.4% jump in hourly earnings. PCE is expected to rise 0.4%, as retail sales were up 0.3%, both including and excluding auto sales. The core PCE price index is expected to rise 0.2%.

US data continues at 1430GMT with the weekly MNI Capital Goods Index. Then, at 1445GMT, the Chicago PMI is expected to fall to a reading of 68.0 in February. Other regional data already released have suggested modest expansion. Further US data includes the 1500GMT release of NAR Pending Home Sales as well as the weekly MNI Retail Trade Index

and Dallas Fed Manufacturing Outlook Survey both at 1530GMT.

On Monday the yen and the dollar strengthened against most of their major counterparts as concern that unrest in the Middle East will spread boosted demand for safer assets.Japan’s currency rose from a three-month low against the euro as stocks fell in Europe and Asia. Libyan leader Muammar Qaddafi’s son Saif said the country may have a civil war.

The euro dropped after German Chancellor Angela Merkel’s Christian Democratic Union suffered an election defeat in the country’s richest state, fuelling concern that European Union attempts to deal with the sovereign debt crisis will be derailed.

On Tuesday the Swiss franc rose against all of its 16 most-traded counterparts as violence in Libya boosted demand for the currency as a refuge.

The euro pared its drop versus the dollar after Yves Mersch, a European Central Bank council member, said the ECB may toughen its stance on inflation as soon as next week.

On Wednesday the euro climbed to an almost three-week high versus the greenback.

The pound gained versus the dollar as minutes of the Bank of England’s Feb. 10 meeting showed an additional policy maker backed an increase in rates.

On Thursday the Swiss franc climbed to a record against the dollar and the yen strengthened to an almost three- week high as the uprising in Libya drove oil to a 29-month high, spurring demand for the safest assets.

On Friday the yen gained against the dollar for an eighth day, the longest winning streak this year, after data showed the U.S. economy grew more slowly than first estimated in the fourth quarter.

U.S. gross domestic product expanded in the fourth quarter at a 2.8% annual pace, compared with an earlier estimate of 3.2%, Commerce Department figures showed today in Washington. The forecast in a survey of economists was for a 3.3% increase. GDP grew 2.6% in the third quarter. The franc retreated from a record high versus the greenback and the Australian and New Zealand dollars strengthened against most major peers as investors sought higher-yielding assets such as equities. New Zealand’s dollar also rose after Standard & Poor’s said the earthquake in Christchurch would have no immediate effect on the nation’s credit rating.

The dollar pared its loss against the yen after U.S. consumer confidence rose more than forecast this month, according to the Thomson Reuters/University of Michigan sentiment index, increasing to 77.5 from 74.2 last month.

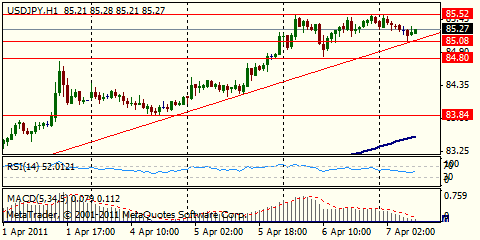

Resistance 3:Y83.50 (Feb 18 and 22 high)

Resistance 2:Y82.90 (Feb 23 high)

Resistance 1:Y82.10 (Feb 25 high)

Current price: Y81.60

Support 1:Y81.60 (session low, Feb 24 low)

Support 2:Y81.30 (support line from Dec 31)

Support 3:Y80.90 (Dec 31 low)

Comments: the pair remains under pressure. The nearest support - Y81,60. Below losses are possible to Y81.30. The nearest resistance - Y82.10. Above growth is possible to Y82.90.

Resistance 3: Chf0.9500 (50.0 % FIBO Chf0.9775-Chf0.9230, Feb 22 high)

Resistance 2: Chf0.9440 (38.2 % FIBO Chf0.9775-Chf0.9230)

Resistance 1: Chf0.9320 (Feb 25 high)

Current price: Chf0.9265

Support 1: Chf0.9230 (Feb 14 low)

Support 2: Chf0.9200 (psychological mark)

Support 3: Chf0.9100 (psychological mark)

Comments: the pair bargains in former frameworks. The nearest support - Chf0.9230. Below loss may extend to Chf0.9200. The nearest resistance-Chf0.9320. Above is located Chf0.9440.

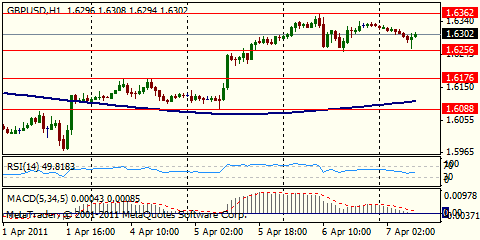

Resistance 3: $ 1.6280/00 (Jan 4-5 and Feb 3 high)

Resistance 2: $ 1.6260 (Feb 18, 21, 23 and 24 high)

Resistance 1: $ 1.6160 (Feb 25 high)

Current price: $1.6114

Support 1 : $1.6070 (session low)

Support 2 : $1.6030 (Feb 25 low)

Support 3 : $1.5960 (Feb 11 low)

Comments: the pair become stronger. The nearest resistance $1.6160. Above growth i possible to $1.6260. The nearest support $1.6070. Below is possible testings of around $1.6030.

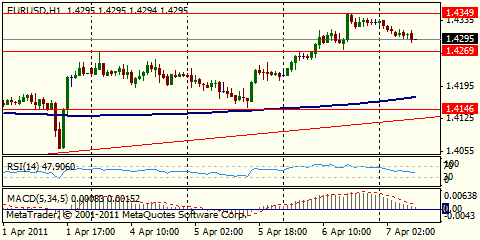

Resistance 3: $ 1.3860 (Feb 2 high)

Resistance 2: $ 1.3840 (Feb 25 high)

Resistance 1: $ 1.3760 (session high)

Current price: $1.3755

Support 1 : $1.3700/10 (session low, Feb 24 low)

Support 2 : $1.3660 (МА (200) for Н1)

Support 2 : $1.3640 (support line from Jan 10)

Comments: the pair bargains within the limits of $1.3700/10-$ 1.3740 (the nearest support/resistance accordingly). Above growth is possible to $1,3760. Below decrease is possible to $1.3660.

05:00 Japan Housing starts (January) Y/Y - 7.5%

05:00 Japan Construction orders (January) Y/Y - 13.1%

07:00 Germany Import prices (January) - 2.3%

07:00 Germany Import prices (January) Y/Y - 12.0%

07:00 Germany Import prices excluding oil (January) Y/Y - 8.1%

10:00 EU(17) Harmonized CPI (January) final - 0.6%

10:00 EU(17) Harmonized CPI (January) final Y/Y 2.4% 2.2%

10:00 EU(17) Harmonized CPI ex EFAT (January) Y/Y - 1.1%

13:30 USA Personal income (January) 0.3% 0.4%

13:30 USA Personal spending (January) 0.3% 0.7%

13:30 USA PCE price index ex food, energy (January) 0.1% 0.0%

13:30 USA PCE price index ex food, energy (January) Y/Y - 0.7%

14:45 USA Chicago PMI (February) 67.0 68.8

23:30 Japan Unemployment (January) - 4.9%

23:30 Japan Household spending (January) real Y/Y - -3.3%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.