- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 17-10-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 02:00 | China | Fixed Asset Investment | September | 5.5% | 5.4% |

| 02:00 | China | Industrial Production y/y | September | 4.4% | 5% |

| 02:00 | China | Retail Sales y/y | September | 7.5% | 7.8% |

| 02:00 | China | GDP y/y | Quarter III | 6.2% | 6.1% |

| 08:00 | Eurozone | Current account, unadjusted, bln | August | 29.8 | 17.6 |

| 14:00 | U.S. | Leading Indicators | September | 0.0% | 0.1% |

| 14:00 | U.S. | FOMC Member Esther George Speaks | |||

| 14:00 | U.S. | FOMC Member Kaplan Speak | |||

| 14:30 | U.S. | FOMC Member Kashkari Speaks | |||

| 15:30 | U.S. | FOMC Member Clarida Speaks | |||

| 17:00 | U.S. | Baker Hughes Oil Rig Count | October | 712 | |

| 18:30 | Canada | Gov Council Member Lane Speaks | |||

| 21:10 | U.S. | FOMC Member Kaplan Speak |

Major US stocks rose moderately as strong quarterly results from companies such as Netflix (NFLX) and Morgan Stanley (MS) encouraged investors. The mood was also supported by reports that the UK and the EU reached a preliminary agreement.

Netflix (NFLX) reported quarterly earnings of $ 1.09 per share, compared with an average analyst estimate of $ 1.05 per share. Revenues generally coincided with the market forecast. The company also reported that during the quarter the number of its subscribers increased by 6.77 million (+ 12% yoy), but warned that increased competition could have a negative impact on the growth rate of the number of subscribers in the last quarter of this year. NFLX shares jumped nearly 3%.

Morgan Stanley (MS) reported third-quarter earnings of $ 1.27 per share, $ 0.15 higher than the market average. The company's revenue also exceeded analysts' forecasts. MS CEO James Gorman said the quarter was strong despite the traditional decline in summer activity and volatile markets. MS shares about 2%.

However, IBM (IBM) reporting was a disappointment for the market. The company showed adjusted earnings of $ 2.68 per share, which was $ 0.02 higher than analysts. Nevertheless, the company's revenue was below the average forecast of analysts and showed a year-on-year decline for the fifth quarter in a row. IBM shares fell 5.4%.

Market participants also drew attention to several important macroeconomic reports. A Department of Commerce report showed US housing construction fell from more than a 12-year high in September, but single-family home construction rose for the fourth consecutive month. This suggests that the housing market is still supported by lower mortgage rates even in the face of a slowing economy. According to the report, US housing construction fell 9.4% to a seasonally adjusted annual rate of 1.256 million units last month, as construction in the unstable segment of multi-apartment buildings declined. At the same time, building permits fell 2.7% to 1.387 million in September.

Meanwhile, the US Department of Labor said that the number of applications for state unemployment benefits increased by only 4,000 to 214,000, seasonally adjusted for the week ending October 12. This suggests that the labor market continues to decline, despite the slowdown in employment and economic growth. Data for the previous week were unchanged. Economists predicted an increase in the number of applications by 215,000 over the past week.

Most DOW components completed trading in positive territory (20 out of 30). The biggest gainers were UnitedHealth Group Incorporated (UNH; + 2.84%). Outsiders were IBM shares (IBM; -5.39%).

All S&P sectors recorded an increase. The health sector grew the most (+ 1.0%)

At the time of closing:

Dow 27,026.16 +24.18 +0.09%

S&P 500 2,997.95 +8.26 +0.28%

Nasdaq 100 8,156.85 +32.67 +0.40%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 02:00 | China | Fixed Asset Investment | September | 5.5% | 5.4% |

| 02:00 | China | Industrial Production y/y | September | 4.4% | 5% |

| 02:00 | China | Retail Sales y/y | September | 7.5% | 7.8% |

| 02:00 | China | GDP y/y | Quarter III | 6.2% | 6.1% |

| 08:00 | Eurozone | Current account, unadjusted, bln | August | 29.8 | 17.6 |

| 14:00 | U.S. | Leading Indicators | September | 0.0% | 0.1% |

| 14:00 | U.S. | FOMC Member Esther George Speaks | |||

| 14:00 | U.S. | FOMC Member Kaplan Speak | |||

| 14:30 | U.S. | FOMC Member Kashkari Speaks | |||

| 15:30 | U.S. | FOMC Member Clarida Speaks | |||

| 17:00 | U.S. | Baker Hughes Oil Rig Count | October | 712 | |

| 18:30 | Canada | Gov Council Member Lane Speaks | |||

| 21:10 | U.S. | FOMC Member Kaplan Speak |

EIA’s report

reveals much-bigger-than-expected advance in U.S. crude oil inventories

The U.S. Energy

Information Administration (EIA) revealed on Wednesday that crude inventories

jumped by 9.281 million barrels in the week ended October 11. Economists had

forecast a gain of 3.000 million barrels.

At the same

time, gasoline stocks declined by 2.562 million barrels, while analysts had

expected a drop of 1.500 million barrels. Distillate stocks reduced by 3.823

million barrels, while analysts had forecast a decrease of 2.500 million

barrels.

Meanwhile, oil

production in the U.S. was unchanged at 12.600 million barrels a day.

U.S. crude oil

imports averaged 6.3 million barrels per day last week, up by 70,000 barrels

per day from the previous week.

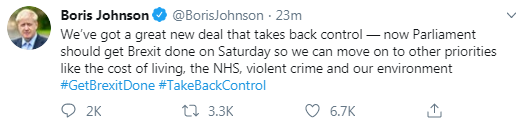

Analysts at Danske Bank note that, after the UK and EU27 reached a new Brexit deal today, the next uncertainty is whether PM Boris Johnson can get it over the finish line when the deal is put to a "meaningful vote" on Saturday.

- “The DUP has rejected supporting the deal, so it will be very very difficult for Johnson to get a majority in the House of Commons (which would have been difficult even assuming the DUP was on board). We still doubt the pro-Brexit Labour MPs will vote in favour of a deal, which is harder than that put forward by Theresa May. Some of the moderate Conservatives, who Boris Johnson expelled from the party last month, have also hinted they will reject the deal. Our base case remains another extension followed by a snap election.

- In our view, it is natural to ask why Johnson has reached an agreement with the EU knowing it will be difficult to get it through Parliament. We believe there are two reasons. First, it some MPs may get cold feet when the actual voting takes place. One way of addressing this is asking EU leaders to state they will reject another extension, i.e. stating it is 'this deal or no deal'. Second, Prime Minister Johnson and his team probably think with his new Brexit deal he will stand stronger against Jeremy Corbyn in a potential election campaign, as the Brexit deal is cleaner than that of Theresa May. In the event he won the election, he could pass the Brexit deal without the need of the DUP.

- Despite Prime Minister Johnson's deal being unlikely to pass Parliament on Saturday, we believe the tail risk of a no-deal Brexit even after a potential election has diminished further. This also partly explains the positive risk rally we have seen on the renewed Brexit optimism. While we previously feared a Johnson victory in a snap election would lead us to a no-deal Brexit, this is no longer the case. In our opinion, it is difficult to see a path to a no-deal Brexit now.”

Nathan Janzen, the senior economist at the Royal Bank of Canada (RBC), notes that Canada’s headline manufacturing sales rose 0.8% in August while volume sales increased 0.6%.

- “The bounce-back in August manufacturing sales (from a 1.3% drop the prior month) was largely as-expected. Transitory summer motor vehicle assembly shutdowns weighed on output in July and a resumption of activity contributed to an increase in August. Still, sales were also up 0.7% excluding the motor vehicle.

- Controlling for price-effects, sale volumes were up 0.6% from July, and 1.1% ahead of year-ago levels. That is admittedly an uninspiring growth rate. But it still leaves the manufacturing sector looking relatively resilient given sharper deterioration in the industrial sectors of global peers – most significantly for Canada, in the United States – alongside escalating global trade tensions.”

- Adds lots of momentum to complete US-China agreement

- Phase-one of U.S.-China trade includes lowering of nontariff barriers on agriculture, not just purchases

- Now is the moment for us to get Brexit done

- Deal means UK will leave the EU on Oct 31

Statistics

Canada released its Monthly Survey of Manufacturing on Thursday, which showed

that the Canadian manufacturing sales rose 0.8 percent m-o-m in August to

CAD57.58 billion, following an unrevised 1.3 percent m-o-m decrease in July.

Economists had

anticipated a gain of 0.6 percent m-o-m for August.

According to

the survey, sales increased in 11 of 21 industries, representing 62.9 percent

of total manufacturing sales. The transportation equipment (+2.8 percent m-o-m)

and fabricated metal (+3.6 percent m-o-m) industries were mainly responsible

for the advance in August. At the same time, the petroleum and coal product

industry posted the largest drop (+1.7 percent m-o-m).

Overall, sales

of non-durable goods edged down 0.1 percent m-o-m in August, while sales of

durable goods rose 1.6 percent m-o-m.

The Federal

Reserve reported on Thursday that the U.S. industrial production fell 0.4 m-o-m

in September, following a revised 0.8 percent m-o-m advance in August

(originally a 0.6 percent m-o-m increase).

Economists had

forecast industrial production would edge down 0.1 percent m-o-m in September.

According to

the report, the manufacturing production decreased 0.5 percent m-o-m, due to a

strike at General Motors (GM), U.S. major manufacturer of motor vehicles. Excluding

motor vehicles and parts, the overall index and the manufacturing index each declined

0.2 percent m-o-m. Meanwhile, mining production dropped 1.3 percent m-o-m,

while utilities output grew 1.4 percent m-o-m.

Capacity

utilization for the industrial sector decreased 0.4 percentage point m-o-m in

September to 77.5 percent. That was 0.2 percentage point below economists’

forecast and 2.3 percentage points below its long-run (1972-2018) average.

In y-o-y terms,

the industrial output dropped 0.1 percent in September, following an unrevised

0.4 percent gain in the prior month.

For the third

quarter, industrial production increased 1.2 percent y-o-y, following declines

of about 2 percent y-o-y in both the first and the second quarters.

U.S. stock-index futures rose on Thursday, as reports that Britain struck a preliminary deal with the EU helped to remove some investor uncertainty amid heightened concerns about the health of the global economy, while solid earnings from Netflix (NFLX) and Morgan Stanley (MS) affirmed a strong start to Q3 reporting season.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 22,451.86 | -21.06 | -0.09% |

Hang Seng | 26,848.49 | +184.21 | +0.69% |

Shanghai | 2,977.33 | -1.38 | -0.05% |

S&P/ASX | 6,684.70 | -51.80 | -0.77% |

FTSE | 7,235.43 | +67.48 | +0.94% |

CAC | 5,700.14 | +3.24 | +0.06% |

DAX | 12,719.45 | +49.34 | +0.39% |

Crude oil | $52.98 | -0.71% | |

Gold | $1,493.10 | -0.06% |

The Commerce

Department reported on Thursday the building permits issued for privately owned

housing units dropped by 2.7percent m-o-m in September to a seasonally adjusted

annual pace of 1.387 million, while housing starts fell by 9.4 percent m-o-m to

an annual rate of 1.256 million.

Economists had

forecast housing starts dropping to a pace of 1.320 million units last month

and building permits falling to a pace of 1.350 million units.

Data for August

was revised to show homebuilding growing to a pace of 1.386 million units,

instead of decreasing at a rate of 1.364 million units as previously reported.

According to

the report, permits for single-family homes, the largest segment of the market,

increased 0.8 percent m-o-m at 882,000 in September (the highest level since

February 2018), while approvals for the multi-family homes segment declined 8.2

percent m-o-m to a 505,000 unit-rate.

In the

meantime, groundbreaking on single-family homes rose 0.3 percent m-o-m to a

rate of 918,000 units in September (the highest level since January), while

housing starts for the multi-family tumbled 28.2 percent m-o-m to a 338,000 -unit

pace.

(company / ticker / price / change ($/%) / volume)

ALCOA INC. | AA | 20.18 | 1.02(5.32%) | 30631 |

ALTRIA GROUP INC. | MO | 43.89 | 0.38(0.87%) | 10589 |

Amazon.com Inc., NASDAQ | AMZN | 1,797.00 | 19.57(1.10%) | 30474 |

American Express Co | AXP | 118.29 | 0.88(0.75%) | 3991 |

Apple Inc. | AAPL | 235.58 | 1.21(0.52%) | 161684 |

AT&T Inc | T | 37.85 | 0.06(0.16%) | 12350 |

Boeing Co | BA | 372.6 | 0.17(0.05%) | 4656 |

Caterpillar Inc | CAT | 131 | 0.81(0.62%) | 9349 |

Chevron Corp | CVX | 115.5 | 0.39(0.34%) | 585 |

Cisco Systems Inc | CSCO | 46.95 | 0.16(0.34%) | 12310 |

Citigroup Inc., NYSE | C | 69.85 | 0.35(0.50%) | 46247 |

Exxon Mobil Corp | XOM | 68.62 | 0.39(0.57%) | 29939 |

Facebook, Inc. | FB | 190.88 | 1.33(0.70%) | 35646 |

FedEx Corporation, NYSE | FDX | 151.25 | 0.48(0.32%) | 268 |

Ford Motor Co. | F | 9.14 | 0.07(0.77%) | 30154 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.69 | 0.19(2.00%) | 615 |

General Electric Co | GE | 8.94 | 0.04(0.45%) | 101352 |

General Motors Company, NYSE | GM | 37 | 0.35(0.96%) | 4388 |

Goldman Sachs | GS | 208.05 | 0.63(0.30%) | 1290 |

Google Inc. | GOOG | 1,251.00 | 7.36(0.59%) | 1587 |

HONEYWELL INTERNATIONAL INC. | HON | 164.5 | 0.87(0.53%) | 13189 |

Intel Corp | INTC | 52.82 | 0.38(0.72%) | 12848 |

International Business Machines Co... | IBM | 133.39 | -8.72(-6.14%) | 201557 |

International Paper Company | IP | 41.95 | 0.06(0.14%) | 712 |

Johnson & Johnson | JNJ | 135.97 | 0.80(0.59%) | 10215 |

JPMorgan Chase and Co | JPM | 120.29 | 0.61(0.51%) | 10404 |

McDonald's Corp | MCD | 209.2 | 0.90(0.43%) | 1860 |

Merck & Co Inc | MRK | 84.5 | 0.05(0.06%) | 615 |

Microsoft Corp | MSFT | 141.15 | 0.74(0.53%) | 149679 |

Nike | NKE | 95.17 | 0.29(0.31%) | 1476 |

Pfizer Inc | PFE | 36.5 | 0.16(0.44%) | 1599 |

Procter & Gamble Co | PG | 117.26 | 0.48(0.41%) | 3145 |

Starbucks Corporation, NASDAQ | SBUX | 86.65 | -0.06(-0.07%) | 3705 |

Tesla Motors, Inc., NASDAQ | TSLA | 262.36 | 2.61(1.00%) | 65329 |

The Coca-Cola Co | KO | 53.69 | 0.20(0.37%) | 7126 |

Travelers Companies Inc | TRV | 142.35 | -0.22(-0.15%) | 301 |

Twitter, Inc., NYSE | TWTR | 40.18 | 0.27(0.68%) | 11090 |

UnitedHealth Group Inc | UNH | 238.57 | 1.58(0.67%) | 2394 |

Visa | V | 178.55 | 0.68(0.38%) | 9323 |

Walt Disney Co | DIS | 132.25 | 1.39(1.06%) | 18884 |

Yandex N.V., NASDAQ | YNDX | 30.25 | 0.05(0.17%) | 109515 |

Pfizer (PFE) resumed with a Neutral at BofA/Merrill; target $37

Merck (MRK) resumed with a Neutral at BofA/Merrill; target $90

Travelers (TRV) initiated with an Underperform at Evercore ISI; target $128

U.S. weekly

jobless claims increase less than forecast

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment benefits rose modestly last week, suggesting the labor market

continues to tighten despite slowing hiring and economic growth.

According to

the report, the initial claims for unemployment benefits increased by 4,000 to

a seasonally adjusted 214,000 for the week ended October 12.

Economists had

expected 215,000 new claims last week.

Claims for the

prior week were remained unchanged at 210,000.

Meanwhile, the

four-week moving average of claims increased by 1,000 to 214,750 last week.

Imre Speizer, an analyst at Westpac, note the NZD/USD has been stuck in a 0.6250-0.6350 range during the past two weeks, but over that period the USD has weakened but NZD/USD has struggled to rally.

- “We suspect the looming RBNZ decision on 13 Nov is keeping the bulls at bay. RBNZ Dep. Gov. Bascand yesterday gave the strongest hint yet that it will probably cut then. At 100% priced, with a follow-up cut 80% priced, it does seem aggressive.”

Analysts at TD Securities are expecting Canada’s manufacturing sales to rise by 1.0% in August (market: 0.7%) on a rebound in primary metals and partial rebound in motor vehicles.

- “A pickup in US activity bodes well for broader manufacturing conditions. Volumes should see a more modest increase but should nonetheless contribute positively to industry-level GDP.”

Morgan Stanley (MS) reported Q3 FY 2019 earnings of $1.27 per share (versus $1.17 in Q3 FY 2018), beating analysts’ consensus estimate of $1.12.

The company’s quarterly revenues amounted to $10.032 bln (+1.6% y/y), beating analysts’ consensus estimate of $9.627 bln.

MS rose to $44.69 (+4.44%) in pre-market trading.

Honeywell (HON) reported Q3 FY 2019 earnings of $2.08 per share (versus $1.90 in Q3 FY 2018), beating analysts’ consensus estimate of $2.01.

The company’s quarterly revenues amounted to $9.086 bln (-15.6% y/y), generally in line with analysts’ consensus estimate of $9.122 bln.

The company also raised guidance for FY 2019, projecting EPS of $7.90-8.15 (compared to its prior guidance of $7.80-8.10 and analysts’ consensus estimate of $7.99) and revenues of $36.5-37.2 bln (compared to its prior guidance of $36-36.9 bln and analysts’ consensus estimate of $36.85 bln).

HON rose to $164.00 (+0.23%) in pre-market trading.

Analysts at TD Securities are expecting the U.S. industrial production to slow from its solid 0.6% m/m jump in August to 0.2% in September, largely reflecting fading manufacturing output and despite an expected rebound in growth for the utilities sector.

- “We project a flat print for manufacturing, as less supportive global demand and continued trade uncertainty continues to drag production lower. In addition, the month-long strike by GM workers is a clear risk to the downside for activity in September.

- Separately, the market expects the Philly Fed manufacturing index to post its third consecutive decline in October to 8.0, from 12.0 before. Note that largely positive signals from the Philly Fed's ISM-adjusted index in recent months have notably deviated from the decline in the more widely followed ISM manufacturing index.”

- Says China is to strictly protect intellectual property

- U.S. and China should resolve issues via dialogue

Netflix (NFLX) reported Q3 FY 2019 earnings of $1.09 per share (versus $0.89 in Q3 FY 2018), beating analysts’ consensus estimate of $1.05.

The company’s quarterly revenues amounted to $5.245 bln (+31.2% y/y), generally in line with analysts’ consensus estimate of $5.248 bln.

The company also issued downside guidance for Q4 FY 2019, projecting EPS of $0.51 versus analysts’ consensus estimate of $0.85 and revenues of $5.442 bln versus analysts’ consensus estimate of $5.51 bln.

NFLX rose to $309.40 (+8.08%) in pre-market trading.

IBM (IBM) reported Q3 FY 2019 earnings of $2.68 per share (versus $3.42 in Q3 FY 2018), beating analysts’ consensus estimate of $2.66.

The company’s quarterly revenues amounted to $18.028 bln (-3.9% y/y), missing analysts’ consensus estimate of $18.286 bln.

The company also reaffirmed FY 2019 EPS guidance of $12.80 versus analysts’ consensus estimate of $12.81.

IBM fell to $135.16 (-4.89%) in pre-market trading.

Analysts at ANZ note the New Zealand economy has a little less wind in her sails and it’s now been confirmed in the hard data, and the view from the crow’s nest is that there’s a little more softening to come.

- "While it’s our expectation that growth will stabilize and begin to recover gradually in early 2020, this is contingent on a couple of key economic drivers holding steady as the swell continues to pick up. And with the RBNZ expected to use up all of its conventional fuel just keeping the ship on course, we’re only one storm away from being blown into the uncharted territory of unconventional monetary policy.

- Let’s hope the Government can see the darkening clouds on the horizon and is readying its fleet to lend a hand if the SOS goes from monetary policy needing friends to New Zealanders’ wellbeing needing a lifebuoy.

- The RBNZ’s surprise 50bp cut in August was a major talking point for the market over the quarter. Meanwhile, the Federal Reserve maintained an easing bias, and cut its policy rate by a further 25bp and the RBA, too, felt the need to ease policy, with its latest cut reigniting talks of unconventional monetary policy on both sides of the Tasman. NZ yields hit fresh lows as the global data pulse deteriorated, with the September 2025 inflation-indexed bond becoming the first NZD-denominated asset to yield a negative interest rate.

- We expect the slowdown in global and domestic activity to continue to weigh on the NZD over coming quarters, and expect the global easing cycle to continue to drag yields lower.”

FX Strategists at UOB Group say USD/JPY is seen pushing further north of the 109.00 handle in the next weeks.

- "24-hour view: Expectation for USD to “edge above 109.00” did not materialize as it traded in a surprisingly subdued manner between 108.55 and 108.86. Momentum indicators are neutral and USD is likely to continue to trade sideways, expected to be between 108.00 and 108.50.

- Next 1-3 weeks: We highlighted on Monday (14 Oct, spot at 108.35) that “while the advance appears to be running ahead of itself, the risk is for further USD strength to 109.00”. USD soared to 108.89 yesterday (15 Oct) before ending the day on a solid note at 108.84. The positive outlook is still clearly intact and if USD were to break above 109.00, the next level to focus on is at the August’s peak near 109.30. In view of the overbought conditions, USD could ill afford to dither as a consolidation at these elevated levels would quickly increase the risk of a short-term top. On the downside, a break of 108.10 (‘strong support’ level previously at 107.50) would indicate the current upward pressure has eased."

Researchers at Danske Bank note that, according to some UK political analysts, DUP repeated last night that "gaps remain" explaining why no agreement was reached late last night.

- “Without DUP's support to PM Johnson's Brexit deal, it seems very difficult for PM Johnson to get his deal over the finish line. However, as Sky News explains in this video on Twitter , it may be difficult even if DUP supports the deal (320 MPs are needed for a majority).

- If so, the question is whether the 19 pro-Brexit Labour MPs who want Brexit to get done and the 20 Conservative rebels will vote for the deal or not. Some pro-Brexit Labour MPs are having a hard time supporting Johnson's proposal, which is a harder version of Brexit than Theresa May's deal was (which they rejected).

- Some of the Conservative rebels have already hinted they will vote against the deal. Jennifer Rankin from The Guardian has a Twitter thread explaining what the Johnson-Varadkar-Barnier compromise looks like.”

- Saturday vote in parliament will be a meaningful vote

- New Brexit arrangement is the best way through for the UK

- PM Johnson has support of Cabinet for the deal

FX Strategists at UOB Group suggest the GBP/USD should meet the next key hurdle at the 1.30 neighborhood.

- "24-hour view: We highlighted yesterday that GBP “could move above 1.2800 but odds for a sustained rise beyond 1.2850 are not high”. However, GBP surged to a high of 1.2877 before retreating quickly. While the current rally is overbought, it is too early to expect a sustained pullback. There is still room for further GBP strength but the pace of any advance is likely to be slower. From here, barring a move below 1.2740 (minor support at 1.2780), GBP could edge higher but a sustained break of 1.2920 appears unlikely.

- Next 1-3 weeks: GBP continues with its stupendous rally as the 1.2850 level indicated just yesterday (16 Oct, spot at 1.2765) was quickly exceeded (overnight high 1.2877). As the next resistance of note is some distance away at 1.3000, the current impulsive momentum could continue to carry GBP higher in the coming days. Support is at 1.2740 but only a break of 1.2630 (‘strong support’ was at 1.2530 yesterday) would indicate the current rally in GBP has run its course."

- European Commission President Juncker and UK Prime Minister Johnson to present it at the EU summit

- Deal allows legal certainty where Brexit created uncertainties

- Deal includes legally operative solution in Withdrawal Agreement to avoid hard border in Ireland

- Northern Ireland will remain aligned to a limited set of EU rules, notably related to goods

- Johnson's deal is worse than May's

- Best way to sort Brexit is to have a second referendum

Richard Franulovich, head of FX strategy at Westpac, suggests that further near term follow through DXY weakness (97.0-97.5) would not surprise.

“The DXY and USTs have so far shed only a fraction of 2019’s safe haven gains. But we are not getting carried away and stick with a positive 1-3m DXY outlook. Negative tail risk scenarios have eased but the underlying state of the global economy is still poor and the trade war détente is unlikely to yield breakthroughs on contentious structural topics like IP theft and state subsidies. Soft Sep retail sales warns business sector weakness may be bleeding into the hitherto resilient consumer, bolstering the case for an Oct Fed cut. The USD impact will be minimal though, with 84% priced in.”

British lenders expect business loans will dry up in the next few months at the fastest rate since the financial crisis, according to a Bank of England survey on Thursday that augured badly for investment as Brexit nears.

The BoE's gauge of expectations for the availability of loans to businesses over the next three months fell to -13.5% in the third quarter from -5.8% in the second quarter, its lowest level since early 2008.

Banks and building societies expected the availability of mortgages to increase slightly in late 2019, the survey showed.

Nick Kounis, head of financial markets research at ABN AMRO, suggests that one of the few areas of strength in the eurozone has been the labour market as the employment was up by 1.2% yoy in Q2, down from its peak growth rates, but still healthy.

“Unemployment continues to drop. It was down to 7.4% in August from 7.5% in July, and down around 0.6 percentage points over the last year. Unfortunately, the labour market is a lagging indicator and the sharp slowdown in the economy is likely to become increasingly visible. Indeed, a number of good leading indicators of the labour market suggest a more significant slowdown is imminent. The employment index of the composite PMI fell to 51.4 in September, from 51.7 in August and compared to a level of 55.2 a year ago. It is consistent with job growth slowing to around 0.6% yoy in the next few months. Meanwhile, temporary employment is pointing to a sharper deterioration in labour market prospects over the next year. Temporary employment leads overall employment as it is the easiest and quickest way to adjust staff levels on the both the way up and the way down. Temporary employment has slowed sharply over the last year (in Q2 it contracted by 2% yoy) and it points to a sharp slowdown in total employment growth over the next year, as well as a significant rise in unemployment. This will make the slowdown in the eurozone economy more protracted than the ECB and consensus expects, in our view.”

According to first estimates from Eurostat, in August 2019 compared with July 2019, seasonally adjusted production in the construction sector decreased by 0.5% in the euro area (EA19) and by 0.2% in the EU28. In July 2019, production in construction decreased by 0.2% in the euro area and increased by 0.5% in the EU28. In August 2019 compared with August 2018, production in construction increased by 1.2% in the euro area and by 1.9% in the EU28.

In the euro area in August 2019, compared with July 2019, civil engineering fell by 1.3% and building construction by 0.2%. In the EU28, civil engineering fell by 1.2% while building construction increased by 0.1%.

In the euro area in August 2019, compared with August 2018, building construction increased by 1.6% and civil engineering by 0.9%. In the EU28, building construction rose by 2.2% and civil engineering by 1.4%.

According to the report from Office for National Statistics, the quantity bought was flat (0.0%) in September 2019 when compared with the previous month, following a fall of 0.3% in August 2019.

The year-on-year growth rate shows that the quantity bought in September 2019 increased by 3.1%, with growth across all sectors except department stores and household goods. Economists had expected a 3.2% increase.

Online sales as a proportion of all retailing was 19.1% in September 2019, compared with 19.5% reported in August 2019.

In the three months to September 2019, moderate growth in the quantity bought continued at 0.6% when compared with the previous three months, with all sectors within non-food stores reporting declines except “other stores”.

Bill Diviney, senior economist at ABN AMRO, notes that the US Retail sales came in weaker than expected at -0.3% MoM, while ‘core’ retail sales (ex-autos and gasoline) came in at 0.0% (ABN/consensus for both measures: +0.3%).

“Upward revisions to August sales comfortably offset this weakness, particularly the ex-autos/gas measure, which was revised up to 0.4% from 0.1%. Indeed, retail sales for the full quarter expanded at a robust 6.0% annualised pace, down only modestly from the 7.7% growth registered in Q2. This implies Q3 private consumption growth of 3.0-3.5%, down from 4.7% in Q2. Such growth rates are unsustainable, in our view, particularly given the slowdown in monthly average payrolls gains, which have fallen to +161k in the year to date, down from +223k in 2018. Looking ahead, we continue to expect the knock-on effects of a weaker manufacturing sector to drive a broader slowdown in the US, primarily via lower jobs growth. We expect payrolls growth to slow further over the coming months, with the monthly average perhaps dipping below +100k in 2020.”

There has been significant movement in negotiations on Britain’s departure from the European Union and a Brexit deal is still possible but that goal has not yet been reached, German Chancellor Angela Merkel said.

“There has been movement in recent days, significant movement ... so we are on a better path than before but, today I must say very clearly, we have not reached the goal yet,” Merkel told Germany’s Bundestag lower house of parliament.

“So I cannot say today how the European Council will end tomorrow,” she added ahead of a summit of European Union leaders. “But I can say that we will not allow hate and violence to flare up on the island of Ireland again.”

The Bank of England would probably take measures to stimulate bank lending in the event of a fresh downturn in the economy, and government fiscal policy could also play a role, BoE Governor Mark Carney said.

Carney said the British central bank would probably cut the countercyclical capital buffer that it sets for banks to zero, from 1% now, if the economy - which faces the prospect of a no-deal Brexit shock - took a hit.

"You certainly can paint scenarios, globally and then in the UK, where that may not be enough," Carney said when asked at an event at Harvard University about the monetary policy options available to the BoE with interest rates so low.

"And certainly you can paint scenarios where you want to do some of that, but you absolutely want to complement it by fiscal policy."

Carney said the world economy was close to a liquidity trap - when interest rates are low and savings rates are high, making monetary policy ineffective - which put the onus on governments to kick-start growth with their tax and spending policies.

According to analysts at TD Securities, there is nothing in the Australia’s September Employment report that serves as a trigger for the RBA to cut the cash rate next month.

“Even though the headline print of +14.7k was close enough to the market's +15k f/c, the internals were more positive - full time jobs rose +26.2k, more than offsetting the prior month's drop and the unemployment rate dipped from 5.3% to 5.2% (thanks to a drop in the participation rate from 66.2% to 66.1%). More importantly the underemployment rate dropped from 8.5% to 8.3% in turn driving the underutilisation rate from 13.8% to 13.5% implying less spare capacity. The RBA can breathe a sigh of relief that a near term rate cut is off the agenda but the broader trend remains for spare capacity to edge higher.”

World Bank President David Malpass said the development lender will likely again downgrade its global growth outlook amid uncertainty over falling trade and investment flows, but he stopped short of calling on the United States and China to resolve their trade war.

“As we look at the data today, we will probably be looking at a further downgrade from our June downgrade,” Malpass told reporters at the start of World Bank and International Monetary Fund annual meetings.

The World Bank in June cut its global growth forecast for 2019 by 0.3 percentage point to 2.6 percent, about the same level as 2016.

The IMF on Tuesday released a new forecast that showed global growth slipping to its lowest level since the 2008-2009 financial crisis, due largely to trade conflicts.

According to Karen Jones, analyst at Commerzbank, EUR/USD has eroded the 55 day ma at 1.1050 and reached the 38.2% retracement of the move down from July (1.1083).

“Near term dips should ideally be contained by 1.0990 and given that that we view the 1.0879 recent low as an interim low, we look for recovery to initially the mid September high at 1.1110. A close above here would trigger another leg higher to the 200 day ma at 1.1211. Longer term the critical resistance to overcome is the top of the one year channel at 1.1396 and the 200 week ma at 1.1353. Below 1.0879 we have the January 2017 low at 1.0829 and the 78.6% Fibonacci retracement of the 2017-2018 advance at 1.0814.”

China will remove business restrictions on foreign banks, brokerages and fund management firms, a cabinet meeting chaired by Premier Li Keqiang said on Wednesday, state television reported.

But the move, which comes nearly 18 years after China joined the World Trade Organization (WTO), could have limited impact on the competitive landscape of an industry dominated by China’s state firms.

China has stepped up efforts to open its financial sector amid a festering trade war with the United States, with increased access to its financial sector among a host of demands from Washington.

Last week, China announced a firm timetable for opening its futures, brokerage and mutual fund sectors fully to foreign investors next year, as Beijing and Washington reached a tentative deal to resolve their trade dispute.

The cabinet did not elaborate on what effect the removal of the curbs would have. On Tuesday, the cabinet relaxed management rules for foreign insurers and banks, giving them easier access to China, and wider business scope.

China will also support local governments’ efforts to attract more foreign investment and allow foreign companies to be more flexible in choosing how they borrow funds from abroad, the cabinet said.

China will not allow forced technology transfers by foreign firms, it said.

Stabilizing foreign investment is part of Beijing’s policies to support the slowing economy that has been hit by the country’s trade war with the United States.

Analysts at TD Securities are looking for the US retail sales to post a -0.2% MoM decline in September (mkt -0.1%).

“While the heat wave in the second half of the month should support sales, some other survey measures showed extremely weak retail outcomes, and all three PMIs were below 50. So we think that we're more likely to see a negative print for sales. Brexit negotiations will continue this morning, with the best case scenario now looking like a deal, if done, will be discussed by EU leaders on Friday ahead of a vote in Parliament on Saturday. Full approval in the next few days is ambitious, and while not impossible, remains unlikely in our view. This means that the Benn Act comes into play this weekend, with PM Johnson mandated to write a letter to the EU, requesting an Article 50 extension, with the hopes a deal can still be done next week.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.1172 (3858)

$1.1152 (2875)

$1.1131 (596)

Price at time of writing this review: $1.1075

Support levels (open interest**, contracts):

$1.0979 (4017)

$1.0938 (3425)

$1.0893 (3386)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 8 is 69687 contracts (according to data from October, 16) with the maximum number of contracts with strike price $1,1000 (4017);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2997 (1609)

$1.2947 (1785)

$1.2924 (1113)

Price at time of writing this review: $1.2804

Support levels (open interest**, contracts):

$1.2618 (191)

$1.2518 (126)

$1.2441 (1245)

Comments:

- Overall open interest on the CALL options with the expiration date November, 8 is 33704 contracts, with the maximum number of contracts with strike price $1,3200 (3662);

- Overall open interest on the PUT options with the expiration date November, 8 is 20925 contracts, with the maximum number of contracts with strike price $1,2000 (1686);

- The ratio of PUT/CALL was 0.62 versus 0.60 from the previous trading day according to data from October, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 58.82 | 0.26 |

| WTI | 52.98 | 0.11 |

| Silver | 17.37 | -0.17 |

| Gold | 1489.414 | 0.57 |

| Palladium | 1765.54 | 1.9 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 265.71 | 22472.92 | 1.2 |

| Hang Seng | 160.35 | 26664.28 | 0.61 |

| KOSPI | 14.66 | 2082.83 | 0.71 |

| ASX 200 | 84.5 | 6736.5 | 1.27 |

| FTSE 100 | -43.69 | 7167.95 | -0.61 |

| DAX | 40.32 | 12670.11 | 0.32 |

| Dow Jones | -22.82 | 27001.98 | -0.08 |

| S&P 500 | -5.99 | 2989.69 | -0.2 |

| NASDAQ Composite | -24.53 | 8124.18 | -0.3 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67542 | 0.03 |

| EURJPY | 120.379 | 0.28 |

| EURUSD | 1.10724 | 0.38 |

| GBPJPY | 139.336 | 0.36 |

| GBPUSD | 1.28156 | 0.46 |

| NZDUSD | 0.62905 | -0.33 |

| USDCAD | 1.31995 | -0.02 |

| USDCHF | 0.99477 | -0.38 |

| USDJPY | 108.717 | -0.1 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.