- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-07-2019

Iris Pang, the economist for Greater China at ING, notes that between January to June 2019, mechanical and electronic products made up around 55% to 60% of China’s exports, which means the tech war will hurt China’s export significantly.

- "Post the G20 meeting, Huawei’s CEO said, “very little has materially changed as Chinese tech firms still face quite a few problems in doing business with the US even with the changed US policies” and we tend to agree. But nowadays technology usually has dual-use, which means it can be used both by the military and ordinary people. So, in our view, this apparent relaxation is nothing more than a political gambit.

- This may also explain why China hasn’t yet increased US agricultural produce imports. This month alone, soybean imports fell by 15%MoM, which implies that China is still yet to import more agricultural products from the US. Moreover, there are other countries blocking Chinese companies from engaging in the 5G infrastructure set up, so we expect this tech war to continue for a while.

- But all of this means that technology products and parts export from China will diminish after this wave of front running (tariff avoiding) activities."

- Says labor markets seem quite vibrant, drawing in more people

- Fed is still debating what for employment means in current economy

- We should tolerate inflation both above and below 2%

- Currently considers US economy has very solid fundamentals

- Consumer still very strong

- Business investment weaker than expected

- Sees growth for 2019 around 2% which is close to what he regards as sustainable trend

- Business investment has been weaker despite fiscal aid

- Nervous about under running inflation objective

- A couple of rate cuts could lift inflation by 2021

- Framework is adequate as long as policymakers are going to actively push for inflation of 2% to assure target is met symmetrically

- Fed has a lot of inflation-fighting credibility, with expectations firmly anchored

U.S. stock-index futures rose modestly on Friday, signaling a possible extension of this week’s strong run, boosted by Federal Reserve Chairman Jerome Powell’s dovish remarks, which raised bets of an interest rate cut later this month.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,685.90 | +42.37 | +0.20% |

Hang Seng | 28,471.62 | +39.82 | +0.14% |

Shanghai | 2,930.55 | +12.79 | +0.44% |

S&P/ASX | 6,696.50 | -19.60 | -0.29% |

FTSE | 7,517.10 | +7.28 | +0.10% |

CAC | 5,577.00 | +25.05 | +0.45% |

DAX | 12,340.24 | +8.12 | +0.07% |

Crude oil | $60.23 | +0.07% | |

Gold | $1,407.80 | +0.08% |

ING notes that Cina's credit grew at an exceptionally fast pace in June mainly due to financing for infrastructure projects. However, the implication is that if there were no fiscal stimulus, the economy would be deteriorating.

Total financing increased by CNY2.26 trillion in June, with yuan loans increasing by CNY1.66 trillion.

Credit growth was exceptionally strong and this worries us. It means the Chinese economy needs a lot of funds to keep infrastructure investment growing at a level that can maintain GDP growth above 6% at a time when manufacturing PMIs and export growth are negative.

There will still be big funding needs in China in 2H19, as we expect infrastructure projects to double from 2 trillion yuan to 4 trillion yuan.

These projects will raise funds from local government special bonds (net issuance of these bonds amounted to 1.19 trillion yuan), but at a later stage, when there are manufacturing activities from these projects, there will be sizeable demand for loans from manufacturers.

The central bank is expected to divert targeted liquidity to smaller manufacturers. We therefore expect two targeted RRR (required reserve ratio) cuts, one in 3Q and one in 4Q, each at 0.5 percentage points.

If the economy needs further credit, we expect these targeted measures could become broad-based, although this is not as likely as targeted RRR cuts.

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 169.3 | 0.26(0.15%) | 1245 |

ALTRIA GROUP INC. | MO | 50 | 0.74(1.50%) | 35173 |

Amazon.com Inc., NASDAQ | AMZN | 2,009.72 | 8.65(0.43%) | 31834 |

American Express Co | AXP | 127.5 | 0.22(0.17%) | 502 |

Apple Inc. | AAPL | 202.25 | 0.50(0.25%) | 76785 |

Boeing Co | BA | 359.5 | 0.50(0.14%) | 4790 |

Caterpillar Inc | CAT | 134.15 | 0.19(0.14%) | 430 |

Chevron Corp | CVX | 125.68 | 0.25(0.20%) | 629 |

Cisco Systems Inc | CSCO | 57.47 | 0.17(0.30%) | 2280 |

Citigroup Inc., NYSE | C | 71.85 | 0.24(0.34%) | 10150 |

Exxon Mobil Corp | XOM | 77.56 | -0.01(-0.01%) | 972 |

Facebook, Inc. | FB | 199.99 | -1.24(-0.62%) | 105658 |

FedEx Corporation, NYSE | FDX | 164.7 | 2.10(1.29%) | 5610 |

Ford Motor Co. | F | 10.27 | 0.08(0.78%) | 316199 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.04 | -0.01(-0.09%) | 7395 |

General Electric Co | GE | 10.16 | 0.05(0.49%) | 1025138 |

General Motors Company, NYSE | GM | 38.54 | 0.11(0.29%) | 5201 |

Goldman Sachs | GS | 212.58 | 1.23(0.58%) | 8659 |

Hewlett-Packard Co. | HPQ | 21.05 | 0.20(0.96%) | 57869 |

Home Depot Inc | HD | 214.51 | 0.47(0.22%) | 890 |

Intel Corp | INTC | 48.84 | 0.24(0.49%) | 27878 |

Johnson & Johnson | JNJ | 140.49 | 0.38(0.27%) | 1306 |

JPMorgan Chase and Co | JPM | 114.38 | 0.28(0.25%) | 11470 |

McDonald's Corp | MCD | 213.2 | 0.51(0.24%) | 4807 |

Merck & Co Inc | MRK | 81.2 | 0.20(0.25%) | 7246 |

Microsoft Corp | MSFT | 138.95 | 0.55(0.40%) | 59197 |

Pfizer Inc | PFE | 43.05 | 0.07(0.16%) | 2957 |

Procter & Gamble Co | PG | 114.66 | 0.28(0.24%) | 1153 |

Starbucks Corporation, NASDAQ | SBUX | 89.39 | 0.32(0.36%) | 1337 |

Tesla Motors, Inc., NASDAQ | TSLA | 239.6 | 1.00(0.42%) | 20836 |

The Coca-Cola Co | KO | 52.15 | 0.11(0.21%) | 836 |

Twitter, Inc., NYSE | TWTR | 37.39 | 0.18(0.48%) | 27470 |

United Technologies Corp | UTX | 131.6 | 0.26(0.20%) | 200 |

UnitedHealth Group Inc | UNH | 262 | 0.84(0.32%) | 4806 |

Verizon Communications Inc | VZ | 57.02 | 0.10(0.18%) | 443 |

Visa | V | 181.44 | 0.70(0.39%) | 10138 |

Wal-Mart Stores Inc | WMT | 114.28 | 0.36(0.32%) | 2258 |

Walt Disney Co | DIS | 143.7 | 0.14(0.10%) | 8109 |

Yandex N.V., NASDAQ | YNDX | 40.03 | 0.06(0.15%) | 10565 |

3M (MMM) target lowered to $182 from $201 at UBS; Neutral

Altria (MO) upgraded to Buy from Neutral at Goldman; target $59

Morgan Stanley (MS) upgraded to Buy from Neutral at Citigroup; target raised to $52

The Labor

Department reported on Friday the U.S. producer-price index (PPI) edged up 0.1

percent m-o-m in June, the same increase as in May.

For the 12

months through June, the PPI rose 1.7 percent, following a 1.8 percent gain in

the previous month. That was the smallest 12-month rise since a 1.7-percent

advance in January 2017.

Economists had

forecast the headline PPI would be flat m-o-m last month and would increase 1.6

percent over the past 12 months.

According to

the report, the June rise in final demand prices is attributable to a

0.4-percent m-o-m advance in the index for final demand services, while prices

for final demand goods declined 0.4 percent m-o-m.

Excluding

volatile prices for food and energy, the PPI rose 0.2 percent m-o-m and 2.3

percent over 12 months. Economists had forecast gains of 0.2 percent m-o-m and

2.2 percent y-o-y, respectively.

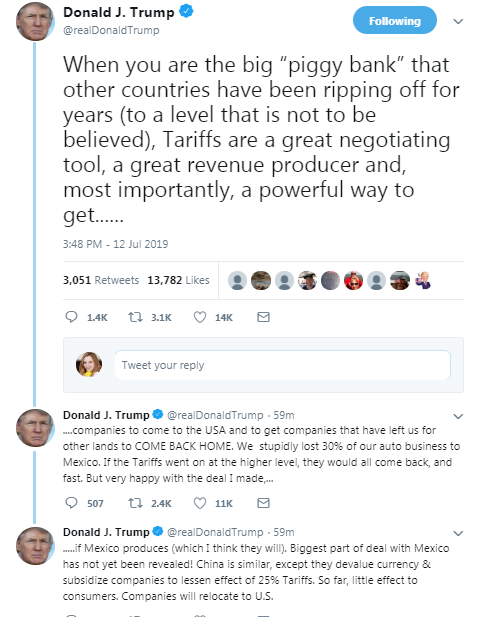

- Notes that trade talks are "going great"

- Says Trump and Lighthizer will take the lead on China trade negotiations

- Lighthizer and Mnuchin will travel to Beijing in the near future

- Thinks investors should ignore comments from the Chinese press regarding the talks

TD Securities' analysts note that China’s June trade data revealed a -1.3% y/y fall in exports (market 1.4%), and a -7.3% y/y fall in imports (market -4.6%).

- “The trade balance was bigger than expected at USD40.98bn (market USD45.0bn). The trade surplus with the US rose to USD29.92bn, with total trade with the US down -13.5% y/y. Both exports and imports reflect a combination of weakening Chinese and global trade and activity.

- Some of the weakness in trade had been flagged by very weak trade across Asia, in particular Korea. The imports fall will be taken as a clear sign that Chinese growth momentum is waning and that need for further stimulus is growing. This will likely be confirmed next Monday, with a slowing in GDP to around 6.2% y/y likely in Q2.”

Nick Kounis, head of financial markets research at ABN AMRO, notes that the account of the ECB’s June monetary policy meeting, which was pre-Sintra, suggested that the majority of the Governing Council stands firmly behind the President.

- “The account notes that ‘there was broad agreement that, in the light of the heightened uncertainty, which was likely to extend further into the future, the Governing Council needed to be ready and prepared to ease the monetary policy stance further by adjusting all of its instruments, as appropriate, to achieve its price stability objective.

- Potential measures to be considered included the possibility of further extending and strengthening the Governing Council’s forward guidance, resuming net asset purchases and decreasing policy rates’. There seemed to be particular concern about the inflation outlook. In particular, although inflation was projected to rise in coming years it ‘was still projected to reach only 1.6% in 2021, which was seen to remain some distance away from the Governing Council’s inflation aim’. Against this background it was important to prepare for ‘adverse contingencies’.

- At the July meeting we think the Governing Council will decide to change its forward guidance on policy rates to explicitly hint at the possibility of rate cuts. In particular, it could say it expects the key ECB interest rates ‘to remain at their present levels or lower …’.

- In September, we expect a 10bp cut in policy rates as well as a clear signal that the ECB is investigating the design of a new asset purchase programme. By December, we expect the ECB to announce a EUR 630bn QE package, to be implemented for 9 months from January 2020 at a pace of EUR 70bn per month. The second 10bp rate reduction will follow in Q1 of next year.”

ANZ's analysts believe that the Australian employment growth will stall in June as most of the leading indicators suggest a sharp slowing in employment growth is due.

“An unwind of election-related employment is likely to impact the June report.

Looking beyond the June report, the ANZ Labour Market Indicator points to the unemployment rate holding around 5.2-5.3% in the second half the year. We don’t think the RBA can make progress toward an unemployment rate of 4.5% or lower without giving the economy additional stimulus.

Some reports suggested the consumer and business confidence data this week was disappointingly soft. We are inclined to be cautious in interpreting the numbers this way. Equally, though, we don’t think ANZ Job Ads was as strong as the gain in June suggested.

All up we don’t think this week’s data provided the ‘smoking gun’ the RBA seems to need to ease as soon as next month. A weak employment report and soft CPI data may provide the impetus.”

Bert Colijn, the senior economist at ING, notes that Eurozone’s industrial output bounced back by 0.9% in May after a weak start to the year.

- “The May data surprised somewhat on the upside, mainly due to a strong performance in France and some recovery in Germany and Italy. The growth was broad-based, with only production in intermediate goods declining on the month, while consumer goods production grew at above 2% for both durable and nondurable goods production.

- Still, industrial production is a very volatile indicator and after the poor April data, industry also needs to have grown at a decent pace in June in order for a contraction to be averted over the whole of 2Q.

- For the ECB, this rounds out a batch of data that will have brought mixed feelings about the state of the eurozone economy. It seems likely that growth will have slowed significantly in 2Q, making 1Q a positive exception more than the rule when looking at the recent growth path.”

- Says ECB will continue to assess measures at its disposal in the coming weeks

- Bank of Italy projects Italian GDP growth this year at 0.1%

In view of ANZ analysts, the gloom hanging over China’s economy is unlikely to go away soon due to challenges on both domestic and external fronts.

“With key economic indicators posting downside surprises over the past few months, we expect China’s Q2 GDP to test a historic low of 6.2%, when the data is released next Monday, 15 July. Although domestic demand could have given a boost to economic activities such as infrastructure investment, there aren’t yet signs of a robust recovery despite the fund-raising efforts of local governments via bond issuance. Consumer demand has also been a concern as automobile sales have slumped by more than 17% y/y in the past two months. To stabilise growth, the People’s Bank of China (PBoC) will maintain an accommodative bias for the rest of the year, in our view. We expect the central bank to trim the 7-day reverse repo rate by 5bps, as well as shave 100bps from the reserve requirement ratio (RRR). We also expect the 10Y CGB yield to breach the 3.00% mark in the next few months.”

Surging U.S. oil output will outpace sluggish global demand and lead to a large stocks build around the world in the next nine months, the International Energy Agency (IEA) said on Friday.

"Market tightness is not an issue for the time being and any rebalancing seems to have moved further into the future," the IEA said in its monthly report.

"Clearly, this presents a major challenge to those who have taken on the task of market management," it added, referring to the OPEC and producer allies such as Russia.

The demand for OPEC crude oil in early 2020 could fall to only 28 million bpd, it added, with non-OPEC expansion in 2020 rising by 2.1 million bpd -- a full 2 million bpd of which is expected to come from the United States. At current OPEC output levels of 30 million bpd, the IEA predicted that global oil stocks could rise by 136 million barrels by the end of the first quarter of 2020.

According to estimates from Eurostat, in May 2019 compared with April 2019, seasonally adjusted industrial production rose by 0.9% in the euro area (EA19) and by 0.8% in the EU28. Economists had expected a 0.2% increase of industrial production. In April 2019, industrial production fell by 0.4% in the euro area and by 0.6% in the EU28.

In May 2019 compared with May 2018, industrial production decreased by 0.5% in the euro area and increased by 0.4% in the EU28.

In the euro area in May 2019, compared with April 2019, production of non-durable consumer goods rose by 2.7%, durable consumer goods by 2.3%, capital goods by 1.3% and energy by 0.7%, while production of intermediate goods fell by 0.2%. In the EU28, production of capital goods rose by 1.9%, durable consumer goods by 1.7%, non-durable consumer goods by 1.5% and energy by 1.3%, while production of intermediate goods fell by 0.1%.

The Bank of England might need to cut interest rates almost all the way down to zero in the event of a no-deal Brexit and it is not clear how long it would take for them to rise again, BOE member Gertjan Vlieghe said.

Vlieghe dedicated most of his speech to arguing that the BoE should make a major change to its forecasting process and follow other central banks by setting out its best collective guess about how borrowing costs might change.

"On balance I think it is more likely that I would move to cut Bank Rate towards the effective lower bound of close to 0% in the event of a no-deal scenario," Vlieghe said.

"It is highly uncertain when I would want to reverse these interest rate cuts," he said, explaining it would depend on the economy recovering from its no-deal shock or a rise in inflation risks caused by a slump in the value of the pound.

On the other hand, if Britain can ease its way out of the EU with a deal, the BoE could raise rates to 1.0% in one year, 1.25% in two years and 1.75% in three years' time, he said. However, such increases would probably also depend on the global economy recovering from its slowdown.

According to Chris Turner, global head of strategy at ING, euro has failed to take advantage of a weak dollar environment.

“Here the dramatic narrowing in the BTP:Bund spread should be seen as a EUR positive – yet one of the reasons for the narrowing (QE2 from the ECB) is holding the EUR back. Nonetheless, if investors slowly turn against the dollar there aren’t that many liquid alternatives and the EUR should find some support. For today, the focus is on eurozone industrial production, which may have increased in May though we expect manufacturing to be weak in the second half of the year. Let’s see if EUR/USD can edge up to 1.1330 in thin summer markets.”

Final data from the statistical office INE showed that Spain's inflation eased as initially estimated in June to the lowest since late 2016.

Consumer price inflation halved to 0.4 percent from 0.8 percent in May. This was in line with the flash estimate and the lowest since September 2016, when the rate was 0.2 percent. Meanwhile, underlying inflation rose slightly to 0.9 percent from 0.7 percent a month ago.

Inflation, based on the harmonized index of consumer prices, slowed to 0.6 percent, as estimated, from 0.9 percent in May. On a monthly basis, consumer prices and harmonized prices fell 0.1 percent each. Both figures matched preliminary estimate.

1H 2019 trade surplus of ¥1.23 trillion

1H 2019 exports +6.1% y/y (in yuan terms)

1H 2019 imports +1.4% y/y (in yuan terms)

country's trade is facing a flurry of challenges and that the external environment remains complex.

1H trade conditions were resilient due to stable economy

China's economy is in a proper range so far this year

Trade is facing pressure but still has good outlook

China's 1H 2019 trade surplus to the US increased by 12% to ¥954.8 billion

1H exports to the US fell by 2.6% y/y (in yuan terms)

1H imports from the US fell by 25.7% y/y (in yuan terms)

Bank of America Merrill Lynch Global Research flags the risk of the US administration abandoning the 'strong USD policy.'

"We have noted President Trump's frequent comments against the strong USD in recent weeks. His statements about the USD are becoming more frequent and more targeted, and are combined with increasing attacks on other central banks for doing too much and the Fed for doing too little. We see a risk of further escalation of such USD rhetoric and even direct currency intervention, as the US economy is weakening and the USD is overvalued, which should put a ceiling on the USD for now. However, we also see a risk that the Trump administration may decide to abandon the "strong USD policy," which would not violate G20 commitments and could be a game changer. We do not believe the historically low FX vol is pricing such risks," BofAML argues.

Analysts at Societe Generale believe that the US dollar is likely to derive support from the Treasury yields, which will, in turn, help keep the sentiment around the USD/JPY buoyed.

“The decline in USD/JPY may be limited due to higher Treasury yields and US stocks, although gains are expected to face a hurdle above the 109.00 level. Short-term positions in USD/JPY appears to be neutral at the moment. Geopolitical tensions in the Middle East and any comments by Trump on the dollar itself or trade could be risk factors. USD/JPY to trade within a range of 108.00 to 109.00 in the next week and may head towards either 107.50 or 109.50 - although saying that markets will generally struggle to find a clear direction.”

Researchers at UOB Group assessed the recent dovish testimonies from Fed’s Jerome Powell.

“FOMC Chair Powell’s Congressional testimony was seen as very dovish, setting the stage for the Fed to cut rates as early as end of this month. Powell highlighted that trade uncertainties and concerns about global economy continue to weigh on the US and repeated that the Fed will act “as appropriate” to sustain US economic growth. He was willing to look past the strong US current data (like the Jun employment) and place more emphasis on the risk of an uncertain outlook. Powell’s most important concerns are cross currents of trade policy and slowing global growth while persistent low inflation is another factor. Following the very dovish Powell testimony, we have revised our Fed call and we now expect a Fed rate cut at the July FOMC (instead of Sep FOMC). This is seen as a pre-emptive “insurance” rate cut in view of the uncertain outlook despite robust current economic data. We do not think the Fed will deploy a “bazooka” 50bps rate cut since this is supposed to be the Fed taking out an insurance policy against an unknown future”.

As reported by the Federal Statistical Office (Destatis), the selling prices in wholesale trade increased by 0.3% in June 2019 from the corresponding month of the preceding year. In May 2019 and in April 2019 the annual rates of change had been +1.6% and +2.1%, respectively. From May 2019 to June 2019 the index fell by 0.5%. Economists had expected a 0.2% increase

The biggest influence on the overall development compared to the same month of the previous year in June 2019 was the price increase in wholesale of live animals (+13.6%) as well as cereals, raw tobacco, seeds and animal feed (+6.8%).

Compared with June 2018, prices for wholesale sales of meat and meat products (+5.0%) also increased at an above-average rate. In contrast, prices for waste and residual materials (-10.0%) and for computers, peripherals and software (-5.2%) at wholesale level were lower than in June 2018. Petroleum products were on average also below the level of the previous year ( -2.1%).

According to analysts at Danske Bank, market focus remains on the probability of forthcoming central bank easing.

“Today, our eyes will primarily be on Sweden and the Riksbank minutes. As the decision to leave the repo rate path was unanimous, it will be interesting to see how the board has interpreted and processed recent dovish signals from ECB and Fed. In the euro area, we get a further piece of the puzzle on where GDP growth will arrive in Q2 with the industrial production data for May . The April figures pointed to a weak start for the industrial sector into Q2 and country figures already released paint a mixed picture for May. We still think that the industrial sector will likely have returned as an outright drag on growth in Q2.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.1370 (1321)

$1.1350 (855)

$1.1327 (237)

Price at time of writing this review: $1.1269

Support levels (open interest**, contracts):

$1.1246 (3802)

$1.1216 (3291)

$1.1180 (2607)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 9 is 57309 contracts (according to data from July, 11) with the maximum number of contracts with strike price $1,1300 (3802);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2663 (504)

$1.2637 (430)

$1.2617 (320)

Price at time of writing this review: $1.2543

Support levels (open interest**, contracts):

$1.2501 (1299)

$1.2477 (1420)

$1.2447 (2396)

Comments:

- Overall open interest on the CALL options with the expiration date August, 9 is 14681 contracts, with the maximum number of contracts with strike price $1,3000 (2052);

- Overall open interest on the PUT options with the expiration date August, 9 is 15784 contracts, with the maximum number of contracts with strike price $1,2450 (2563);

- The ratio of PUT/CALL was 1.08 versus 1.03 from the previous trading day according to data from July, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 66.49 | 0.12 |

| WTI | 60.41 | 0.18 |

| Silver | 15.09 | -0.79 |

| Gold | 1403.717 | -1 |

| Palladium | 1559.49 | -1.69 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 110.05 | 21643.53 | 0.51 |

| Hang Seng | 227.11 | 28431.8 | 0.81 |

| KOSPI | 21.8 | 2080.58 | 1.06 |

| ASX 200 | 26.3 | 6716.1 | 0.39 |

| FTSE 100 | -20.87 | 7509.82 | -0.28 |

| DAX | -41.29 | 12332.12 | -0.33 |

| Dow Jones | 227.88 | 27088.08 | 0.85 |

| S&P 500 | 6.84 | 2999.91 | 0.23 |

| NASDAQ Composite | -6.49 | 8196.04 | -0.08 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.69716 | 0.16 |

| EURJPY | 122.074 | 0.06 |

| EURUSD | 1.12523 | 0 |

| GBPJPY | 135.858 | 0.21 |

| GBPUSD | 1.25224 | 0.13 |

| NZDUSD | 0.66589 | 0.19 |

| USDCAD | 1.30656 | -0.08 |

| USDCHF | 0.98973 | 0.08 |

| USDJPY | 108.475 | 0.07 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.