- Analytics

- News and Tools

- Market News

- GBP price action after UK election likely to be asymmetric - ING

GBP price action after UK election likely to be asymmetric - ING

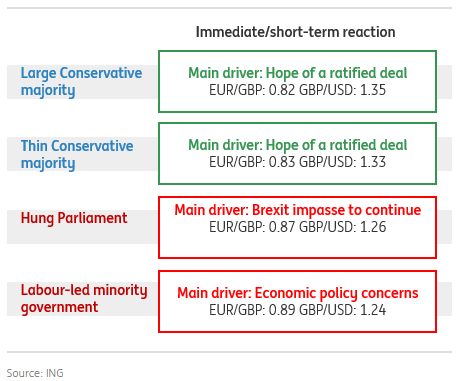

Analysts at ING suggest that GBP price action after the election will be asymmetric; less pronounced gains on a market-friendly outcome vs more meaningful losses on a non-market friendly outcome.

- "A large Conservative party majority would be perceived as an expected market-friendly outcome and lead to additional sterling gains. A Conservative Party majority of say 30-40 plus would be more positive as it would reduce potential uncertainty around a possible extent of the transition period. EUR/GBP to reach 0.82 and GBP/USD 1.35.

- A smaller Conservative majority would initially lead to GBP gains, too (to 0.83), yet the scale of GBP strength is likely to be marginally more limited. While the Withdrawal Agreement would very likely be passed by the end-January 2020, the question of a hard Brexit might return around mid-year if eurosceptics in the European Research Group oppose an extension to the transition period beyond the end of 2020 (which would, in turn, suggest there is no Conservative Party majority for an extension). Still, as this is an issue for 2020, it is unlikely to prevent initial GBP gains.

- A hung parliament would lead to a full pricing out of the GBP Brexit resolution premium (which is currently worth more than 2% based on our estimates), a rebuilding of sterling speculative shorts and GBP/USD likely dropping to 1.26 (and EUR/GBP rising 0.8700 this week).

- An outcome consistent with a fragile Labour-led minority government would, in our view, be the most negative of the most probable election outcomes. This reflects (a) the market not pricing such a scenario; (b) initial market concerns about nationalization and fiscal concerns (i.e. a material rise in borrowing needs as implied by the Labour manifesto). While the prospects of a second referendum could eventually help to stabilize GBP (as well as lower the probability that Labour policies would be introduced in full under a minority Labour-led government) the initial reaction would likely be GBP negative."

Scenario analysis for GBP post-election price action

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.