- Analytics

- Market analysis

- Technical Analysis

- SP500 Posts Bullish Pin Bar

SP500 Posts Bullish Pin Bar

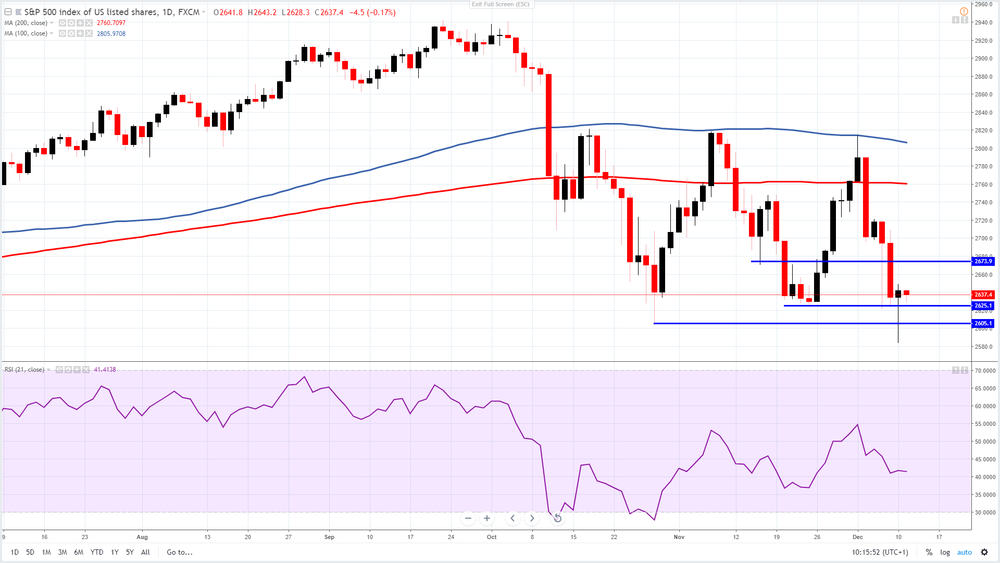

Yesterday’s session started with another selling pressure, but bulls managed to save the day and push the price sharply higher as the index rose around 40 points from daily lows to close slightly higher on the day. It was consolidating on Tuesday and was down briefly, trading at around 2,635 USD during the London session.

Monday’s daily candle looks like a big bullish pin bar, which is a reversal pattern. This candle could suggest that bears lost control of the market and retreated, which could mean further bullish behaviour is likely over the next few days, if this pattern is confirmed. The price needs to rise above 2,650 USD to confirm this candle.

The next target could be at 2,650 USD and then probably at 2,675 USD.

On the other hand, should the bullish breakout fail to materialise, the support now stands at around 2,625 USD and if not held, the price could decline back to 2,608 USD, where October lows are seen.

Disclaimer:

Analysis and opinions provided herein are intended solely for informational and educational purposes and don't represent a recommendation or an investment advice by TeleTrade. Indiscriminate reliance on illustrative or informational materials may lead to losses.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.