- Analytics

- Market analysis

- Market Opinions

- Hungarian Forint HUF Ready for a New Move?

Hungarian Forint HUF Ready for a New Move?

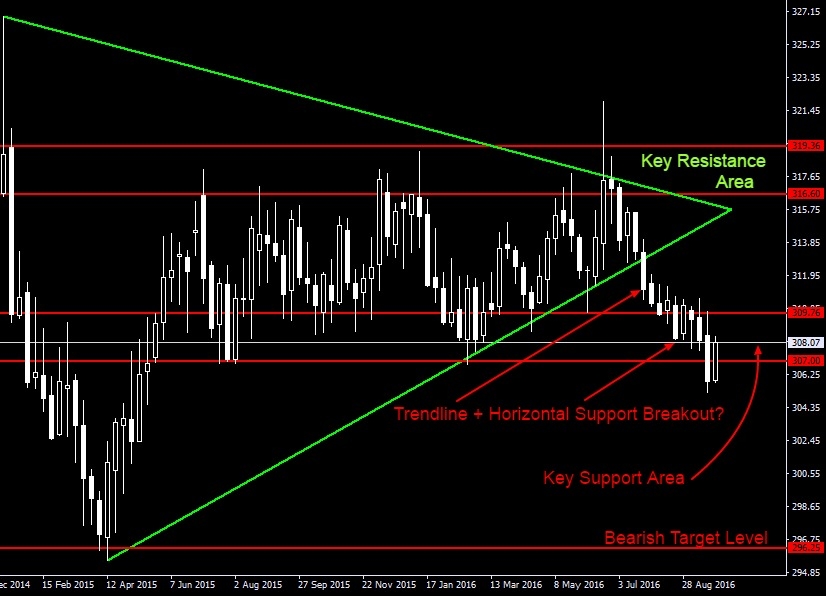

Since the beginning of 2014, with the rare exceptions of some brief spikes, the Hungarian currency has ranged between 295 and 320 HUF per Euro.

Compared to the steady drop of the Forint of 2008-2009, the recent 3 year-period 2014-2016 can be considered one of relative stability. HUF is technically still in a bearish uptrend compared to the EUR and USD, however there are signs that a possible correction could be showing its first signs.

The purpose of the series of reports starting today is to have a close technical look at the Forint, view it from several angles and see whether some of these moves could become great profit opportunities for TeleTrade traders and investors.

We will start with a longer-term perspective:

To confirm the bearish breakout, the Forint will have to make it back below 305 and remain offered there, while the 307-310 area will remain a ceiling, rejecting retests in short-term. In this case we can expect the HUF to reach the 296-295 key support area within 2-3 months.

On the other hand, if the pair climbs back above 310 and turns this key level into a support then the current situation will probably be confirmed as a failed breakout.

This view is purely technical - of course for a setup to be confirmed fundamental factors must always be taken into account.

In our next posts we will zoom into the smaller charts and check what short-term scenarios are setting up on the pair.

Until then, happy pipping!

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.