- Analytics

- Market analysis

- Market Opinions

- Technical analysis for USDJPY Probable Bearish Sentiment

Technical analysis for USDJPY Probable Bearish Sentiment

Technical analysis for USDJPY Probable Bearish Sentiment

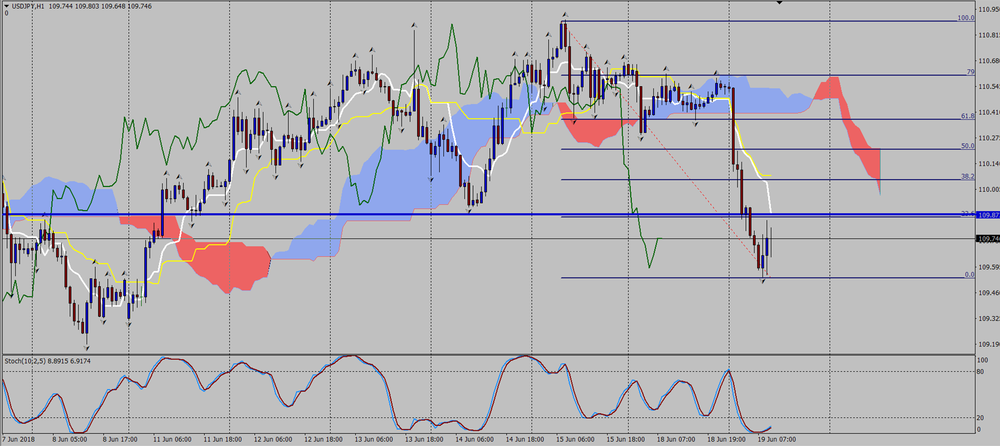

• On 18/6/18 the price reached the level 2 times 110.610 which was the Fibonacci level of 79% and reverse.

Based on the technical analysis we can see that the price is creating lower lows and lower highs, failing to recover.

On 18/6/18 the price reached the level 110.610 2 times which was the Fibonacci level of 70% and reverse.

If we examine the Ichimoku system, we can see that the price also respects the Kumo cloud by not be able to penetrate it which is at the same level 79% of Fibonacci.

It is notable here that we have a valid kumo break out signal as well on the bear side.

The price is below the cloud, the Tekan sen and kijun sen seem to be in a bear formation and the Chikou span is below the price.

Those clues giving us the confidence we need to confirm that the kumo breakout signal is valid

USDJPY 1H Chart

Disclaimer: Materials, analysis, and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the Author does not represent and should not be construed as a statement or an investment advice made by TeleTrade. All Indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

Risk Warning: Investment services are provided by TeleTrade-DJ International Consulting Ltd, a Cyprus Investment Firm under Reg. number HE272810 operating in accordance with MiFID, under license 158/11 by the Cyprus Securities and Exchange Commission. Trading in leveraged derivative financial instruments carries a high level of risk and may not be suitable for all investors. Past performance is not a reliable indicator of future results. Indiscriminate reliance on informational or historical materials may lead to losses

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.