- Analytics

- Market analysis

- Market Opinions

- The British Pound's Moves Now Have Very Interesting Parallels with 2017

The British Pound's Moves Now Have Very Interesting Parallels with 2017

The upcoming week may be busy for the British Pound. A set of U.K. labour market statistics is due to be issued on Tuesday, including the data about employment changes and jobless rates for December 2019, plus wages growth dynamics. Inflation data will be coming out on Wednesday, while the retail sales and the industrial trends orders, which will be released by the Confederation of British Industry (CBI), plus the Purchasing Managers' Index (PMI) will complete this everyday information stream from the United Kingdom.

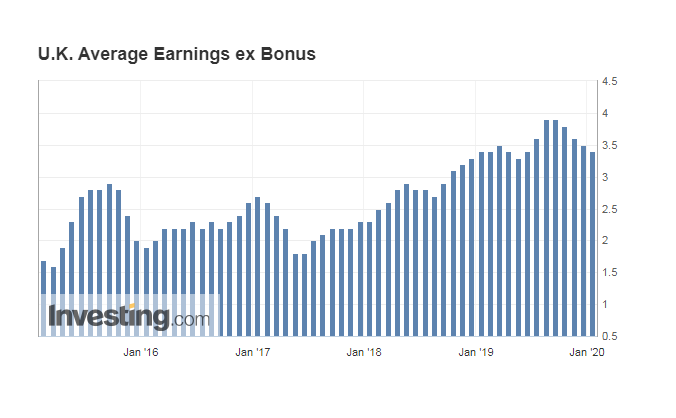

The latest labour report on January 21, 2020 represented a remarkable +208,000 three-month surplus in the number of employed workers. But the average figures were almost near to zero since June, so it is now expected that any number higher than +100,000 would be interpreted by the market as a favourable background for the British economy, which is just emerging from a Brexit period which was linked to uncertainty. The consensus by the Bloomberg pole estimates for this Tuesday's release to be about 110,000. The unemployment rate is expected to remain at around 3.8% or 3.9% - that is the lowest levels since 1975 - but then if the U.K. average earnings (ex Bonus) is considered, it came down step by step from +3.9% growth in September 2019 (that was a ten-year maximum) to 3.4% growth only in January 2020.

Pic 1. U.K. Average Earnings ex Bonus

Source: Investing.com

That is why many investors may pay special attention to the average earnings data, and any more positive numbers in wages could wake up hopes for the Bank of England's moving away from its present policy of too low interest rates. In this scenario, some limited purchases of the GBP/USD before the end of the week may be trigger with possible targets at 1.32 and even higher, whereas a further decline in the average earnings pace could send the Cable lower to test the depth of the 1.28-1.29 technical area again.

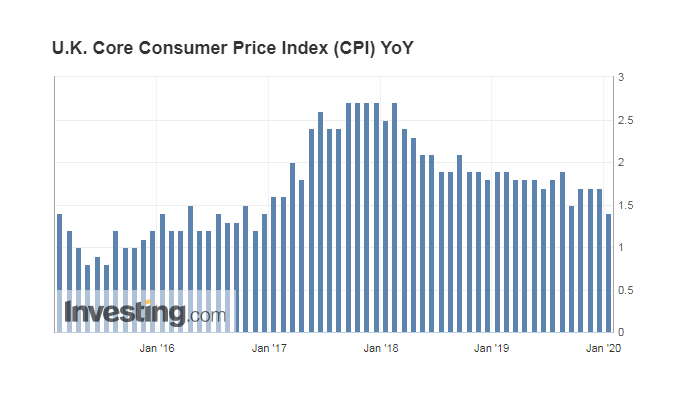

Any effect of Tuesday's labour market report could be multiplied or cancelled by Wednesday's inflation figures, which include the several varieties of the Consumer Price index (CPI), the Producer Price Index (PPI) and the Retail Price Index (RPI). All the details of these indexes could be essential for the market.

Pic 2. U.K. Core Consumer Price Index (CPI) in a year-to-year basis

Source: Investing.com

The most interesting aspect about how the Pound is moving at the moment may be the parallel between the nature of the British Pound movements since November 2019 and the second half of 2017. The sharp rise of GBP/USD from 1.2800 to 1.3650 in August to September 2017, with a comeback to 1.30 and a three-month technical consolidation after this, and a subsequent price growth to the 1.43-1.44 area in the beginning of 2018, is seen to be similar to the Cable's jump to 1.35 in December 2019, with a similar comeback below 1.30 before the end of the year, followed by a 1.5-month technical consolidation which continues until now.

Each time the GBP/USD edged lower to 1.28-1.29 in January and February of 2020, it quickly popped up again above the 1.30 mark and remained nearly unchanged overall. Very similar fundamental reasons were seen to be behind for the movements in 2017 and in 2019, when the Pound first was underestimated and then appreciated again on positive Brexit situation developments. The people inside the UK and investors in 2017 expected a possible happy-end with the UK-EU deal from the government of Theresa May, which did not happened. Despite this, the Cable uptrend ultimately prevailed until mid-April, 2018 with a strong technical support area near 1.30.

The same pattern with the support area of around 1.27-1.30 may form a good technical base for the next move up given the positive opportunities from Boris Johnson's deal, for some limited period of time at least. The upcoming statistics this week may trigger the Pound's strengthening after positive indications that the market received from last week's GDP release. If the expected statistical reports this week flags more negative data then even the possibility of such an upward movement will remain ink on paper. The disappointing economic development in the UK may send the Pound under crossfire from all sides.

Disclaimer:

Analysis and opinions provided herein are intended solely for informational and educational purposes and don't represent a recommendation or investment advice by TeleTrade.

Indiscriminate reliance on illustrative or informational materials may lead to losses.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.